Global Anticoagulant Reversal Drugs Market By Product (Vitamin K Antagonists, Prothrombin Complex Concentrates (PCC), Fresh Frozen Plasma (FFP), Protamine Sulfate, Idarucizumab, Andexanet Alfa and Others), By Indication (Bleeding, Perioperative/Pre Surgical Reversal and Supratherapeutic Drug Levels), By Route of Administration (Intravenous, Subcutaneous and Oral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171923

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Indication Analysis

- Route of Administration Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

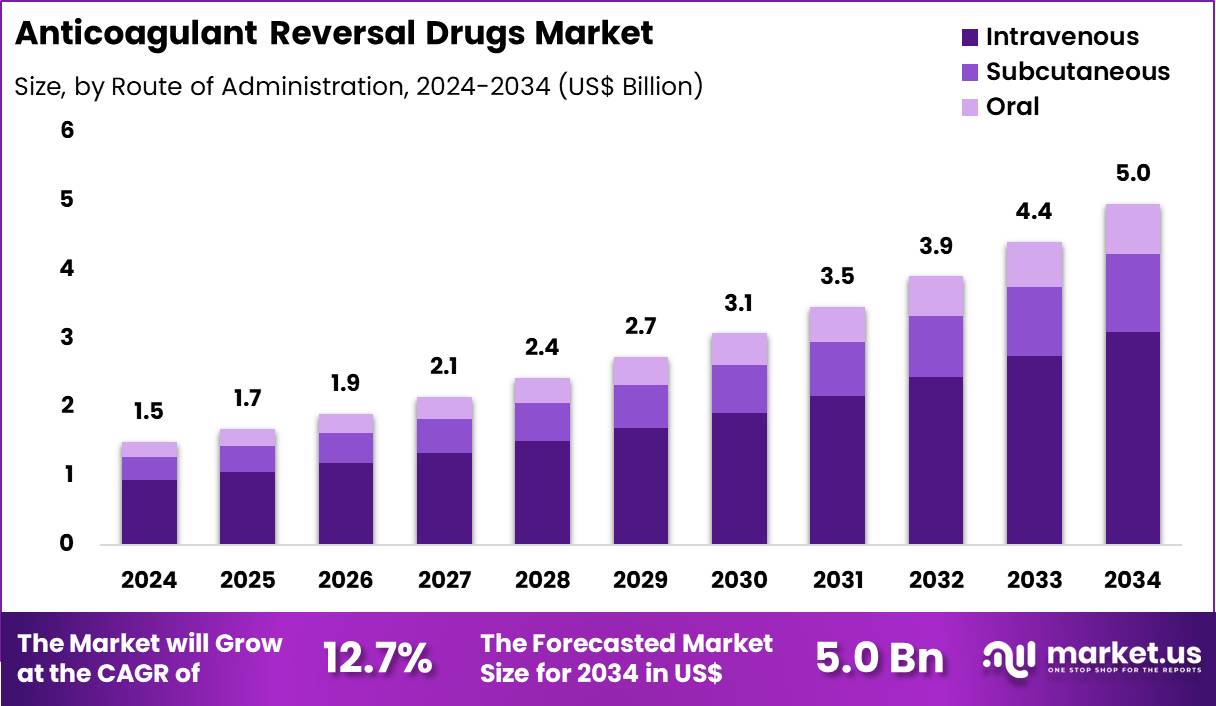

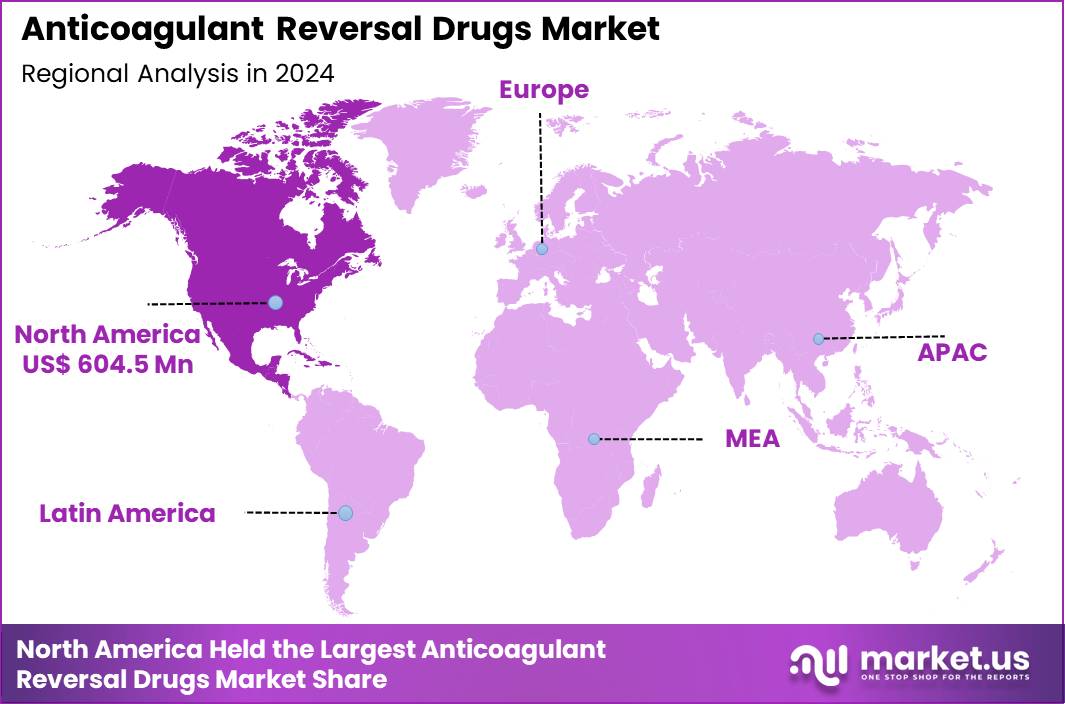

The Global Anticoagulant Reversal Drugs Market size is expected to be worth around US$ 5.0 Billion by 2034 from US$ 1.5 Billion in 2024, growing at a CAGR of 12.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 604.5 Billion.

Growing utilization of anticoagulant therapies propels demand for specialized reversal drugs that effectively counteract bleeding complications in critical situations. Clinicians increasingly prescribe anticoagulants to prevent thromboembolic events in patients with cardiovascular conditions, which heightens the risk of severe hemorrhage and necessitates immediate intervention options.

Healthcare providers rely on these reversal agents to restore hemostasis rapidly, particularly when patients experience life-threatening bleeds or require urgent procedures. Pharmaceutical companies respond by advancing targeted therapies that address specific anticoagulant mechanisms.

In October 2023, Alveron Pharma reported the successful completion of a Phase I clinical trial for OKL-1111, an investigational therapy developed for rapid intervention in severe bleeding events, including intracranial hemorrhage, particularly in patients affected by anticoagulant or antiplatelet therapies. Such innovations highlight how expanding anticoagulant use drives the need for reliable reversal solutions across emergency care settings.

Pharmaceutical firms seize opportunities to develop universal reversal agents that simultaneously neutralize multiple classes of anticoagulants and antiplatelets, broadening clinical utility beyond current specific antidotes. Researchers target compounds that enable swift administration in high-pressure environments, reducing delays associated with drug-specific preparations. These agents find applications in managing intracranial hemorrhages, where rapid clotting restoration prevents neurological damage and improves survival rates.

Clinicians also employ reversal drugs for gastrointestinal bleeding episodes, which demand urgent hemostasis to stabilize patients and minimize transfusion requirements. Additional opportunities emerge in trauma cases involving anticoagulated individuals, as these therapies facilitate hemorrhage control during initial resuscitation. Companies invest in expanding perioperative applications, allowing safe conduct of emergency surgeries by temporarily suspending anticoagulation effects without prolonged waiting periods.

Industry developers advance small-molecule reversal candidates that offer broader spectrum activity, addressing limitations of existing agents through enhanced safety profiles and ease of use. Companies secure funding to propel investigational therapies into advanced trials, emphasizing ready-to-use formulations that streamline emergency protocols.

Clinicians increasingly adopt evidence-based strategies for direct oral anticoagulant reversal, incorporating specific and nonspecific options based on bleeding severity. Researchers explore mechanisms that minimize off-target procoagulant risks while ensuring effective hemostasis restoration.

Market participants focus on therapies applicable to both anticoagulant and antiplatelet-induced bleeds, filling gaps in comprehensive emergency management. Ongoing clinical evaluations refine reversal approaches for diverse scenarios, including traumatic injuries and overdose events, fostering greater confidence in acute care interventions.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.5 billion, with a CAGR of 12.7%, and is expected to reach US$ 5.0 billion by the year 2034.

- The product segment is divided into vitamin k antagonists, prothrombin complex concentrates (PCC), fresh frozen plasma (FFP), protamine sulfate, idarucizumab, andexanet alfa and others, with prothrombin complex concentrates (PCC) taking the lead in 2024 with a market share of 35.6%.

- Considering indication, the market is divided into bleeding, perioperative/pre surgical reversal and supratherapeutic drug levels. Among these, bleeding held a significant share of 46.1%.

- Furthermore, concerning the route of administration segment, the market is segregated into intravenous, subcutaneous and oral. The intravenous sector stands out as the dominant player, holding the largest revenue share of 62.4% in the market.

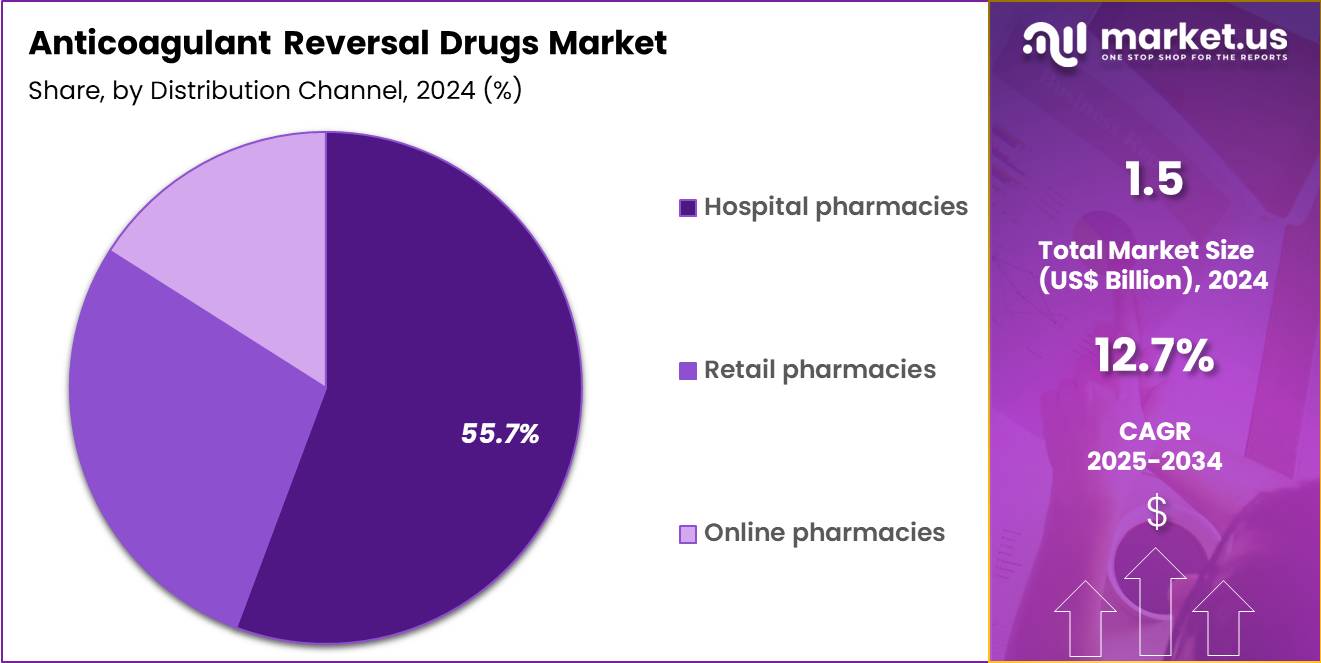

- The distribution channel segment is segregated into hospital pharmacies, retail pharmacies and online pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 55.7%.

- North America led the market by securing a market share of 40.3% in 2024.

Product Analysis

Prothrombin Complex Concentrates (PCC), holding 35.6%, are expected to dominate the product segment because they provide rapid and reliable reversal of vitamin K antagonist effects during life-threatening bleeding events. Clinicians increasingly prefer PCC due to faster onset of action and lower volume requirements compared with plasma-based alternatives. Growing use of oral anticoagulants in aging populations increases the incidence of emergency reversal needs, strengthening PCC demand.

Hospitals rely on PCC to stabilize patients quickly in trauma, stroke, and surgical emergencies. Improved safety profiles and standardized dosing protocols enhance physician confidence. Regulatory approvals and inclusion in clinical guidelines further support adoption. Expanded availability across tertiary care facilities improves access during critical situations. These factors keep PCC anticipated to remain the leading product category in this market.

Indication Analysis

Bleeding, holding 46.1%, is projected to dominate the indication segment because uncontrolled hemorrhage remains the most urgent and frequent complication associated with anticoagulant therapy. Rising prevalence of cardiovascular diseases increases anticoagulant usage, which directly elevates bleeding risk. Emergency departments prioritize rapid reversal to reduce mortality and long-term complications.

Clinical protocols emphasize immediate intervention for intracranial, gastrointestinal, and trauma-related bleeding. Growing awareness among physicians about early reversal benefits improves treatment rates. Advances in diagnostic imaging enable faster identification of bleeding sources, supporting timely drug administration. Increased hospital preparedness for bleeding emergencies strengthens consistent demand. These dynamics keep bleeding expected to remain the dominant indication.

Route of Administration Analysis

Intravenous administration, holding 62.4%, is expected to dominate because it ensures immediate drug bioavailability during critical care situations. Emergency reversal scenarios require fast systemic exposure, which intravenous delivery reliably provides. Hospitals standardize IV protocols for anticoagulant reversal to support predictable outcomes and controlled dosing. Complex bleeding cases often involve unstable patients who require monitored infusion rather than oral or subcutaneous options.

Advances in infusion safety systems improve administration accuracy and reduce errors. Intensive care units depend on IV routes for rapid titration and response assessment. Increasing use of PCC and monoclonal antidotes reinforces IV dominance. These factors keep intravenous administration anticipated to remain the preferred route.

Distribution Channel Analysis

Hospital pharmacies, holding 55.7%, are projected to dominate the distribution channel because anticoagulant reversal drugs primarily serve emergency and inpatient settings. Hospitals maintain centralized control over high-risk medications to ensure proper storage, dosing, and administration. Growing emergency admissions related to bleeding events increase on-site drug utilization.

Pharmacy-led stewardship programs support appropriate use and guideline adherence. Hospitals also stock reversal agents to meet regulatory and accreditation requirements for emergency preparedness. Integration with trauma centers and stroke units strengthens pharmacy-driven demand.

Increasing investment in hospital infrastructure further expands in-house pharmaceutical capabilities. These drivers keep hospital pharmacies expected to remain the leading distribution channel in this market.

Key Market Segments

By Product

- Vitamin‑K antagonists

- Prothrombin Complex Concentrates (PCC)

- Fresh frozen plasma (FFP)

- Protamine sulfate

- Idarucizumab

- Andexanet alfa

- Others

By Indication

- Bleeding

- Perioperative/Pre‑surgical reversal

- Supratherapeutic drug levels

By Route of Administration

- Intravenous

- Subcutaneous

- Oral

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Drivers

Increasing Prevalence of Atrial Fibrillation is Driving the Market

The rising incidence of atrial fibrillation among adults significantly increases the prescription of direct oral anticoagulants for stroke prevention and management of thromboembolic risks. This arrhythmia disrupts cardiac rhythm, leading to blood stasis and heightened clot formation potential. Clinicians favor direct oral anticoagulants over vitamin K antagonists due to predictable pharmacokinetics and reduced monitoring requirements.

Patients on these therapies face elevated risks of major bleeding events, particularly intracranial or gastrointestinal hemorrhages. Effective reversal agents are essential for managing such emergencies or facilitating urgent surgical interventions. Data from electronic health records indicate that atrial fibrillation prevalence has been increasing steadily from 2019 to 2023.

Analyses of large cohorts show prevalence rates around 4.2% in broader adult populations with accessible records. Aging populations and comorbidities like hypertension and diabetes contribute to this upward trajectory. Clinical guidelines endorse anticoagulation in high-risk atrial fibrillation cases, amplifying the need for reversal options. Consequently, this driver sustains demand growth in the anticoagulant reversal drugs sector.

Restraints

High Cost of Specific Reversal Agents is Restraining the Market

Targeted reversal therapies for direct oral anticoagulants command premium pricing, posing challenges to widespread clinical adoption and institutional procurement. Healthcare providers often weigh expenses against outcomes when selecting reversal strategies. Non-specific prothrombin complex concentrates offer viable alternatives at substantially lower costs for factor Xa inhibitor-related bleeding.

Retrospective analyses of utilization patterns reveal median projected costs exceeding $22,000 per patient for andexanet alfa regimens. In contrast, four-factor prothrombin complex concentrates incur median costs around $5,670 per patient. These disparities influence hospital formularies, protocol preferences, and resource allocation decisions.

Payer reimbursement structures may not adequately offset expenses for specific agents in all scenarios. Economic evaluations underscore the impact on overall treatment expenditures. Budget constraints in healthcare systems prioritize cost-effective options where efficacy differences are marginal. Thus, elevated pricing limits market expansion for specialized reversal products.

Opportunities

Regulatory Approval in Emerging Markets is Creating Growth Opportunities

Approvals from national regulatory bodies in high-population regions enable manufacturers to introduce specific reversal agents to previously underserved healthcare systems. Rising adoption of direct oral anticoagulants in these areas correlates with increasing cardiovascular disease burdens. Local authorities facilitate import and marketing to address bleeding complications associated with factor Xa inhibitors.

In January 2024, the Central Drugs Standard Control Organisation in India approved the import and marketing of andexanet alfa. This milestone provides access to a targeted reversal option for apixaban- or rivaroxaban-related life-threatening bleeds. Enhanced distribution networks and physician training programs support integration into emergency protocols.

Growing economies invest in advanced therapeutics to align with global standards. Strategic collaborations between manufacturers and regional stakeholders accelerate market entry. Diversification into these territories mitigates reliance on mature markets. Overall, such expansions unlock substantial patient volumes and revenue potential.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics accelerate the anticoagulant reversal drugs market as widespread anticoagulant adoption and rising cardiovascular interventions worldwide compel hospitals to prioritize rapid, specific reversal agents for managing bleeding risks effectively. Leading pharmaceutical firms strategically advance targeted therapies like idarucizumab and andexanet alfa, seizing opportunities from aging demographics and expanded stroke protocols to strengthen emergency care capabilities globally.

Persistent inflation and economic headwinds, however, escalate production costs for complex biologics and prothrombin concentrates, prompting healthcare systems to ration usage and defer non-critical procurements in constrained budgets. Geopolitical frictions, particularly U.S.-China trade barriers and supply chain vulnerabilities, frequently hinder access to essential active ingredients and manufacturing intermediates, fostering delays and instability for developers reliant on international sourcing.

Current U.S. tariff policies, featuring elevated duties and ongoing probes into imported pharmaceuticals, raise acquisition expenses for branded reversal agents and pressure affordability across American hospitals and distributors. These measures also provoke overseas countermeasures that limit U.S. exports of specialized drugs and challenge multinational clinical alliances.

Still, the tariff landscape ignites significant commitments to domestic production expansions and onshoring initiatives, establishing fortified supply frameworks that will propel innovation and secure lasting market resilience ahead.

Latest Trends

Discontinuation of Andexxa Commercial Sales in the United States in 2025 Represents a Recent Trend

AstraZeneca has elected to cease commercial distribution of Andexxa in the United States effective after December 22, 2025, following agreement with the Food and Drug Administration. This decision stems from inability to align on requirements for converting accelerated approval to full traditional approval. Andexxa previously provided specific reversal for apixaban and rivaroxaban in cases of uncontrolled or life-threatening bleeding.

The withdrawal eliminates a key targeted option from the domestic market landscape. Clinicians may increasingly rely on off-label use of four-factor prothrombin complex concentrates for factor Xa inhibitor reversal. Idarucizumab continues as the sole specific agent for dabigatran-related events.

Healthcare institutions must revise bleeding management guidelines and stock alternative agents. This shift highlights ongoing challenges in sustaining certain reversal therapies amid evolving safety and efficacy data. It consolidates the field toward fewer specialized products in the near term. The development reflects broader dynamics in post-marketing commitments and regulatory expectations.

Regional Analysis

North America is leading the Anticoagulant Reversal Drugs Market

In 2024, North America retained a 40.3% share of the global anticoagulant reversal drugs market, bolstered by widespread prescription of direct oral anticoagulants and robust emergency response frameworks. Cardiologists prioritize these agents for stroke prophylaxis in atrial fibrillation and venous thromboembolism cases, necessitating reliable antidotes for life-threatening bleeds.

Specialized stroke units stock specific reversal therapies like andexanet alfa, aligning with updated clinical pathways that emphasize rapid hemostasis restoration. Geriatric cohorts with polypharmacy regimens elevate intracranial hemorrhage risks, prompting integrated health networks to standardize reversal protocols.

Pharmaceutical developers refine four-factor prothrombin complex concentrates, offering versatile options for warfarin-associated coagulopathies in trauma settings. Regulatory endorsements from the Food and Drug Administration accelerate uptake of novel neutralizers, enhancing perioperative safety.

Quality improvement initiatives in hospitals track reversal utilization metrics, fostering evidence-driven procurement strategies. These integrated approaches solidify regional leadership, safeguarding patients amid escalating anticoagulation demands. The 2023 ACC/AHA/ACCP/HRS Guideline notes that about 2% to 4% of patients receiving oral anticoagulants experience major bleeding.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Practitioners foresee marked progression in reversal agent adoption across Asia Pacific throughout the forecast period, as cardiovascular epidemics intensify anticoagulation requirements. Electrophysiologists expand direct oral anticoagulant prescriptions for valvular and non-valvular indications, integrating targeted antidotes into hemorrhage management algorithms.

Policymakers subsidize access to idarucizumab in public hospitals, equipping emergency departments to handle upper gastrointestinal events efficiently. Regional cardiology societies advocate for andexanet inclusion in formularies, bridging gaps in high-burden stroke belts. Manufacturers optimize production of cost-effective prothrombin concentrates, catering to volume-driven needs in populous nations.

Academic centers lead multicenter registries, refining reversal timing for trauma-induced coagulopathies. Insurance reforms incentivize stocking of these therapies in private chains, accelerating urban deployment. These concerted actions strengthen therapeutic safeguards, countering rising embolic and hemorrhagic challenges. A detailed epidemiological review of atrial fibrillation in East Asia indicates that the proportion of patients older than 75 years reached 43.9% in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Anticoagulant Reversal Drugs market drive growth by prioritizing rapid-acting agents that address life-threatening bleeding events linked to direct oral anticoagulants and heparin-based therapies. Companies competing in the Anticoagulant Reversal Drugs market expand adoption through close engagement with emergency departments, trauma centers, and stroke units, positioning reversal solutions as critical-care standards.

Strategic focus within the Anticoagulant Reversal Drugs market includes clinical evidence generation and real-world outcome studies that support guideline inclusion and reimbursement acceptance. Commercial leaders strengthen penetration by aligning with hospital formularies and educating clinicians on protocol-based use during surgical and emergency scenarios.

Geographic expansion remains a core strategy as firms target regions with rising anticoagulant usage and improving acute-care infrastructure. Pfizer Inc. stands out in the Anticoagulant Reversal Drugs market through its global pharmaceutical scale, strong presence in cardiovascular care, and ability to support emergency-medicine solutions via robust manufacturing, regulatory expertise, and established hospital relationships.

Top Key Players

- Pfizer Inc.

- AstraZeneca

- CSL Behring Limited

- Octapharma AG

- Dr. Reddy’s Laboratories

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V.

- Novartis AG

- Lupin Ltd.

- Cipla Inc.

- Endo International plc

- Amneal Pharmaceuticals, Inc.

Recent Developments

- In July 2024, AstraZeneca moved to strengthen its rare disease strategy by acquiring Amolyt Pharma, a clinical-stage biotech company specializing in endocrine conditions. The deal adds a late-stage asset to the Alexion rare disease pipeline, most notably eneboparatide (AZP-3601), a therapeutic peptide in Phase III development. This candidate is being evaluated for a hormonal disorder linked to insufficient parathyroid hormone activity, reinforcing AstraZeneca’s presence in bone and mineral metabolism within rare endocrinology.

- In May 2024, Malawi’s Ministry of Health joined forces with bioMérieux and Pfizer to roll out a national public-sector program focused on antimicrobial stewardship. The initiative brings together efforts in diagnostics, infection control, and disease surveillance to improve how antibiotics are used across healthcare settings. By promoting responsible prescribing practices, the program aims to reduce resistance risks and support better patient outcomes nationwide.

Report Scope

Report Features Description Market Value (2024) US$ 1.5 Billion Forecast Revenue (2034) US$ 5.0 Billion CAGR (2025-2034) 12.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Vitamin K Antagonists, Prothrombin Complex Concentrates (PCC), Fresh Frozen Plasma (FFP), Protamine Sulfate, Idarucizumab, Andexanet Alfa and Others), By Indication (Bleeding, Perioperative/Pre Surgical Reversal and Supratherapeutic Drug Levels), By Route of Administration (Intravenous, Subcutaneous and Oral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc., AstraZeneca, CSL Behring Limited, Octapharma AG, Dr. Reddy’s Laboratories, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Mylan N.V., Novartis AG, Lupin Ltd., Cipla Inc., Endo International plc, Amneal Pharmaceuticals, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anticoagulant Reversal Drugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Anticoagulant Reversal Drugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- AstraZeneca

- CSL Behring Limited

- Octapharma AG

- Dr. Reddy’s Laboratories

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V.

- Novartis AG

- Lupin Ltd.

- Cipla Inc.

- Endo International plc

- Amneal Pharmaceuticals, Inc.