Animal Diagnostics Market By Product Type (Consumables, Reagents & Kits and Equipment & Instruments), By Animal Type (Production Animals (Cattle, Poultry, Swine, and Other Production Animals), Companion Animals (Dogs, Cats, Horses, and Other)), By Application (Clinical Chemistry, Microbiology, Parasitology, Histopathology, Cytopathology, and Others), By End-user (Reference Laboratories, Veterinarians, and Animal Owners/Producers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146385

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

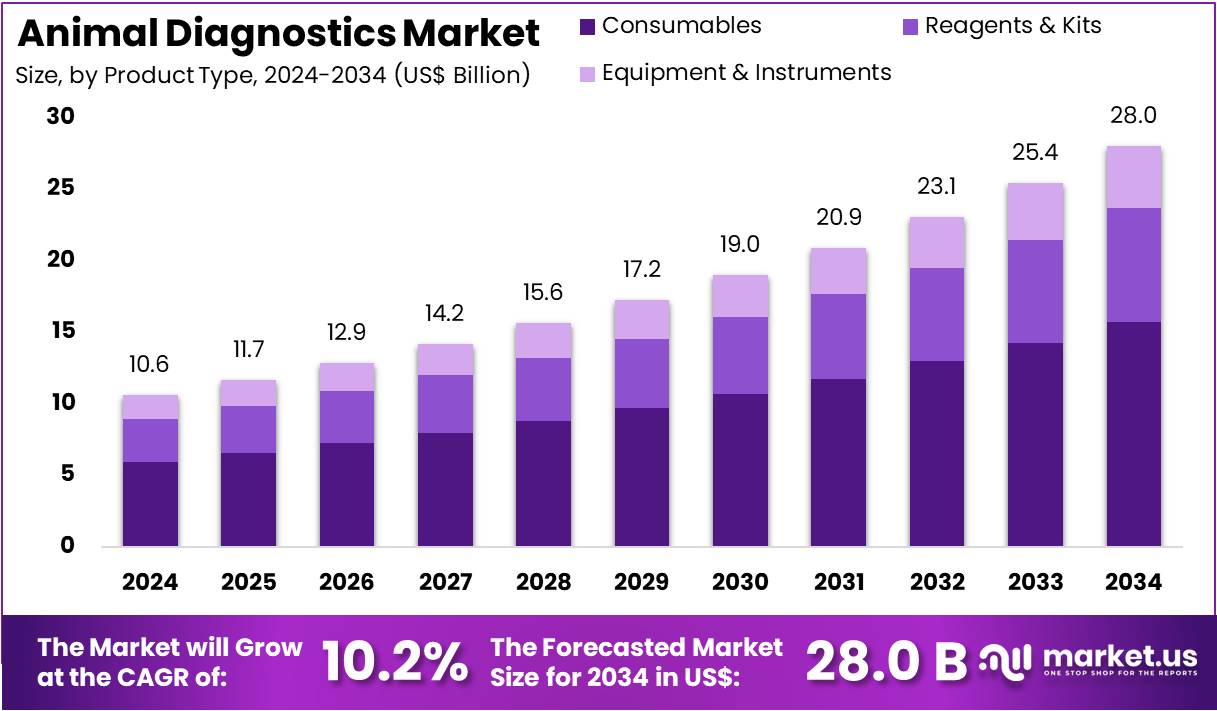

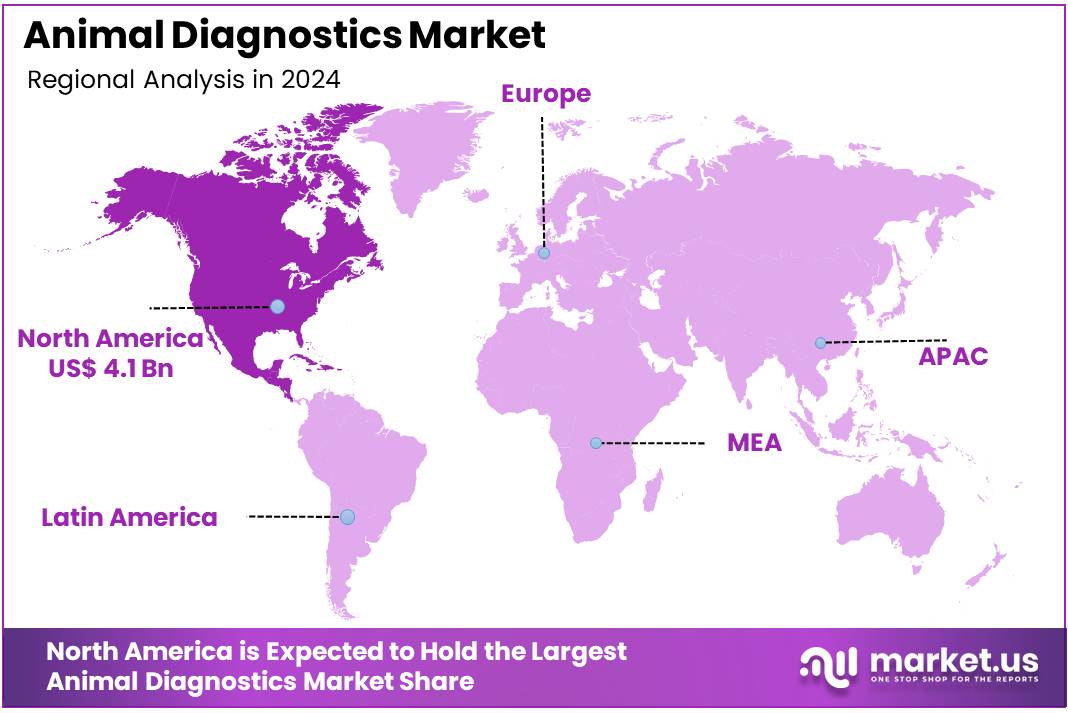

The Animal Diagnostics Market Size is expected to be worth around US$ 28.0 billion by 2034 from US$ 10.6 billion in 2024, growing at a CAGR of 10.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.1% share and holds US$ 4.1 Million market value for the year.

Growing awareness about animal health and the increasing need for rapid, accurate diagnostics are driving the animal diagnostics market. Veterinarians rely on diagnostic tools to detect diseases early, monitor treatment progress, and ensure the overall health of animals, whether they are pets, livestock, or wildlife.

The rise in zoonotic diseases, along with increasing pet ownership and the expansion of livestock farming, has significantly increased the demand for diagnostic solutions in veterinary care. Innovations in diagnostic technologies, such as portable devices, AI-powered analyzers, and multiplex assays, are improving diagnostic accuracy and speed, offering better outcomes for animals.

In September 2024, Zoetis unveiled its Vetscan OptiCell, an innovative hematology analyzer that integrates AI technology to provide fast, accurate Complete Blood Count (CBC) results at the point of care. This cartridge-based system aims to optimize workflow efficiency in veterinary clinics, offering lab-grade analysis while saving time, space, and costs. These advancements create opportunities for enhanced diagnostics in clinical settings, bolstering the growth of the animal diagnostics market.

Key Takeaways

- In 2024, the market for animal diagnostics generated a revenue of US$ 10.6 billion, with a CAGR of 10.2%, and is expected to reach US$ 28.0 billion by the year 2034.

- The product type segment is divided into consumables, reagents & kits and equipment & instruments, with consumables taking the lead in 2024 with a market share of 56.2%.

- Considering animal type, the market is divided into production animals and companion animals. Among these, companion animals held a significant share of 60.5%.

- Furthermore, concerning the application segment, the market is segregated into clinical chemistry, microbiology, parasitology, histopathology, cytopathology, and others. The clinical chemistry sector stands out as the dominant player, holding the largest revenue share of 47.8% in the animal diagnostics market.

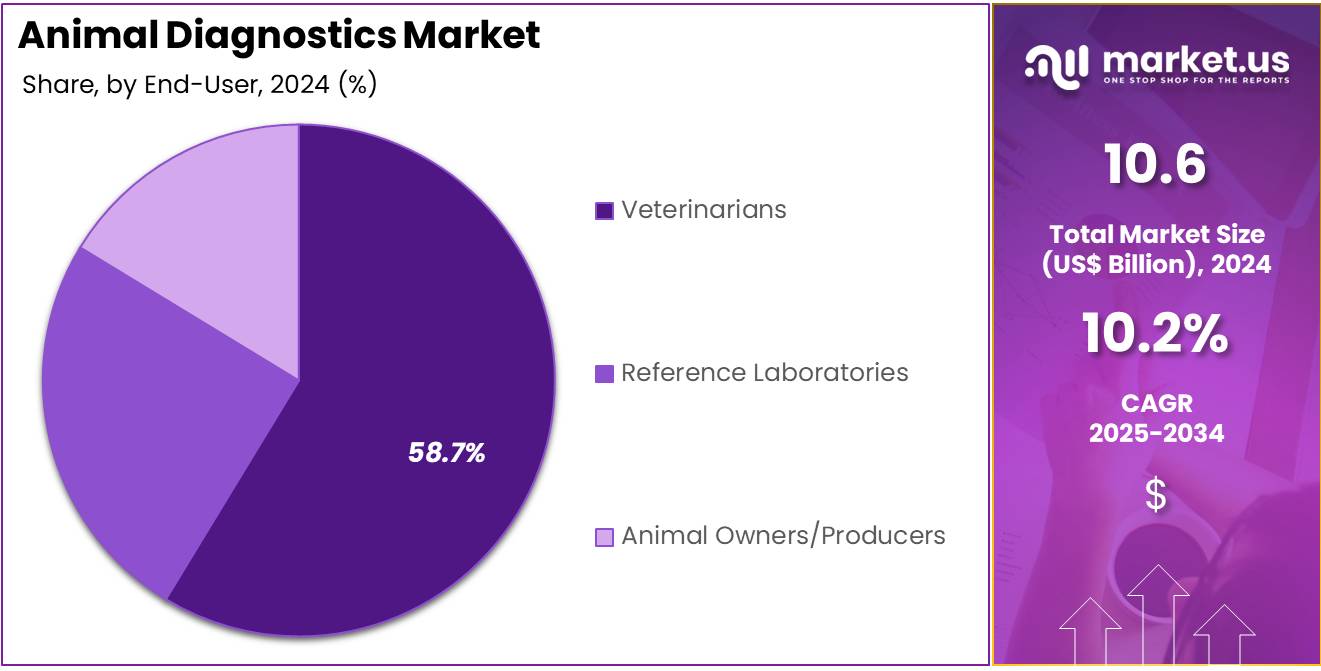

- The end-user segment is segregated into reference laboratories, veterinarians, and animal owners/producers, with the veterinarians segment leading the market, holding a revenue share of 58.7%.

- North America led the market by securing a market share of 39.1% in 2024.

Product Type Analysis

In 2024, the consumables segment led the veterinary diagnostics market with a 56.2% share. This dominance can be attributed to the rising need for cost-effective and easy-to-use products in animal care. Consumables such as test strips, reagents, and sample collection kits are vital for daily diagnostic tasks. These tools simplify routine animal health assessments. The increasing number of pets and heightened attention to companion animal health are key factors driving this demand. This trend highlights a growing dependence on basic yet effective diagnostic solutions.

Furthermore, the segment’s growth is supported by advances in diagnostic technologies. These improvements help veterinarians obtain quicker and more accurate results. As zoonotic diseases become more common, rapid diagnostics have become essential. This encourages greater use of consumables across veterinary practices. The shift toward preventive care and regular monitoring in animal health management also boosts the segment’s expansion. Overall, consumables will remain a critical component of veterinary diagnostics as the focus on animal well-being intensifies globally.

Animal Type Analysis

The companion animals held a significant share of 60.5% due to the growing awareness of pet health and the increasing number of pet owners globally. Companion animals, including dogs, cats, and other pets, are now considered integral members of families, leading to a higher demand for diagnostic tests to monitor their health.

The increasing prevalence of chronic diseases in pets and the growing willingness of owners to invest in preventive healthcare are expected to drive the demand for animal diagnostics tailored to companion animals. This trend, combined with the development of innovative diagnostic tools, will likely contribute to the growth of the companion animals segment.

Application Analysis

The clinical chemistry segment had a tremendous growth rate, with a revenue share of 47.8% as veterinarians increasingly rely on clinical chemistry tests to diagnose and monitor various animal diseases. Clinical chemistry provides vital information about an animal’s organ function, metabolic status, and overall health, which is crucial for identifying underlying health conditions.

The rising incidence of metabolic and chronic diseases in both companion and production animals, combined with advancements in clinical chemistry testing technologies, is anticipated to drive demand in this segment. Furthermore, the increasing need for accurate diagnostic results to guide treatment decisions is expected to contribute to the market growth.

End-User Analysis

The veterinarians segment grew at a substantial rate, generating a revenue portion of 58.7% as veterinary clinics, hospitals, and individual practitioners become the primary users of diagnostic tools and technologies. The growing number of veterinary practices, combined with increasing awareness of the importance of early disease detection and management, is expected to drive demand for diagnostic services.

Veterinarians play a crucial role in animal healthcare, particularly in diagnosing and treating common and complex conditions in both companion and production animals. As animal health becomes a priority, the veterinary sector is expected to expand its use of diagnostic products to improve patient outcomes and enhance veterinary care.

Key Market Segments

By Product Type

- Consumables, Reagents & Kits

- Equipment & Instruments

By Animal Type

- Production Animals

- Cattle

- Poultry

- Swine

- Others

- Companion Animals

- Dogs

- Cats

- Horses

- Other

By Application

- Clinical Chemistry

- Microbiology

- Parasitology

- Histopathology

- Cytopathology

- Others

By End-user

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

Drivers

Increasing Prevalence of Zoonotic Diseases is Driving the Market

The rising incidence of zoonotic diseases, such as avian influenza, Lyme disease, and other emerging infections, is a significant driver for the animal diagnostics market. Zoonoses, diseases transmitted from animals to humans, are becoming more prevalent due to increased human-animal interactions and changes in environmental conditions.

Governments and veterinary health organizations globally are prioritizing early detection to prevent outbreaks, leading to higher demand for diagnostic tools that can quickly identify these diseases. Zoonotic diseases represent a significant proportion of emerging infectious diseases in humans, reinforcing the need for robust animal health monitoring systems.

Key players like IDEXX Laboratories and Zoetis are expanding their infectious disease testing portfolios to meet the increasing demand. Furthermore, the growing emphasis on One Health initiatives, which promote collaborative, multi-sectoral approaches to address health risks at the human-animal-environment interface, is supporting further market expansion, especially in countries with dense livestock populations.

Restraints

High Costs of Advanced Diagnostic Tools are Restraining the Market

The high costs associated with advanced diagnostic technologies, such as PCR (Polymerase Chain Reaction) and next-generation sequencing, continue to limit widespread adoption, particularly in developing regions with constrained healthcare budgets. Many small-scale veterinary clinics and livestock farmers in these regions often cannot afford these diagnostic tests, which slows the market penetration of modern diagnostic solutions.

In addition, a significant portion of veterinary practices, even in developed countries, are unable to justify the costs of such technologies for routine use, given their high price points. Diagnostic tests like PCR, while highly effective, can cost over US$ 100 per sample, making them unaffordable for many pet owners and clinics.

While automation and high-throughput systems can increase efficiency, their initial investment remains a significant barrier. Governments and non-governmental organizations are taking steps to introduce subsidies and incentives, but affordability remains an ongoing challenge in resource-limited settings.

Opportunities

Expansion of Point-of-Care Testing is Creating Growth Opportunities

The trend toward decentralized, rapid testing solutions is significantly contributing to the growth of the animal diagnostics market. Point-of-care (POC) devices allow for quicker and more efficient diagnosis in both veterinary clinics and on-site in farms, reducing the time it takes to make important treatment decisions. With growing demand for faster, more accurate results, especially in livestock and dairy industries, where early detection can minimize economic losses due to disease outbreaks, these devices are increasingly sought after.

Companies like Heska Corporation and Abaxis have introduced portable analyzers that help veterinarians perform in-house tests with greater efficiency. This trend is particularly beneficial in rural areas and emerging markets where access to centralized labs is limited. Furthermore, government-supported animal health programs in regions like Asia and Africa are increasingly adopting POC solutions, driven by the need for accessible and affordable diagnostics.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic instability, such as inflation and supply chain disruptions, has significantly impacted the production costs for diagnostic equipment and reagents, leading to higher prices for end-users. The rising costs of raw materials, particularly those required for diagnostics, have squeezed profit margins for manufacturers and forced many companies to pass on these costs to consumers.

Trade restrictions and geopolitical tensions, such as the ongoing trade disputes between major economies, have also delayed the production and shipment of critical components, affecting the availability of diagnostic equipment. On the positive side, governmental focus on food security and health systems strengthening, particularly in Europe and Asia, has driven increased funding for livestock disease surveillance programs.

In addition, the rising disposable incomes in emerging markets have increased spending on companion animal health, helping to offset some of the economic pressures faced by manufacturers. Despite the short-term challenges posed by these factors, the overall market remains strong, driven by technological innovation and growing awareness of zoonotic disease risks.

Latest Trends

Increasing Demand for Pet Insurance is a Recent Market Trend

The increasing popularity of pet insurance is indirectly boosting the demand for diagnostic testing, as insured pets are more likely to undergo regular and comprehensive health screenings. As pet owners become more aware of the financial benefits of insurance coverage, there is growing interest in proactive health monitoring and diagnostic testing.

This shift encourages veterinarians to recommend more advanced diagnostic panels, knowing that the costs are more likely to be reimbursed. Major insurance providers have expanded their coverage to include diagnostics, which has further driven the adoption of these services in veterinary clinics.

As the trend of pet insurance grows, especially in developed markets like North America and Europe, diagnostic service providers are increasingly partnering with insurers to offer bundled testing packages, making the services more attractive and accessible for pet owners.

Regional Analysis

North America is leading the Animal Diagnostics Market

North America dominated the market with the highest revenue share of 39.1% owing to rising zoonotic disease concerns, increased pet ownership, and advancements in diagnostic technologies. The US Centers for Disease Control and Prevention (CDC) reported an increase in zoonotic disease cases from 2022 to 2024, prompting higher demand for early detection tools. The American Pet Products Association (APPA) stated that US pet ownership reached 70% of households in 2024, up from 67% in 2022, fueling the need for routine diagnostics.

Additionally, the USDA allocated US$ 50 million in 2023 to enhance livestock disease surveillance, accelerating the adoption of rapid testing solutions. Key players like IDEXX Laboratories reported increased revenue in 2023, attributed to expanded veterinary diagnostic services.

The Canadian Food Inspection Agency (CFIA) also recorded an increase in livestock testing volumes in 2024 compared to 2022, reflecting stricter food safety regulations. These factors collectively contributed to the market’s expansion, with diagnostics becoming integral to animal healthcare in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising livestock production, government initiatives, and increasing pet healthcare awareness. The Food and Agriculture Organization (FAO) estimated an increase in Asia’s livestock population from 2022 to 2024, driving demand for disease monitoring tools.

India’s National Animal Disease Control Programme (NADCP) vaccinated over 500 million livestock in 2023, emphasizing the need for companion diagnostics. China’s Ministry of Agriculture and Rural Affairs reported a surge in veterinary diagnostic lab approvals in 2024 compared to 2022, streamlining testing accessibility.

Japan’s pet insurance market expanded in 2023, indicating higher spending on advanced diagnostics. Additionally, Australia’s Department of Agriculture recorded a rise in biosecurity funding in 2024, reinforcing disease prevention measures. These developments suggest a robust outlook for diagnostic adoption, with technology and policy reforms playing pivotal roles in market growth across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the animal diagnostics market drive growth through technological innovation, strategic acquisitions, and expanding global distribution networks. They invest in developing advanced diagnostic tools and platforms to enhance disease detection and monitoring in animals. Collaborations with research institutions and healthcare providers facilitate the integration of new technologies and broaden market reach.

Additionally, targeting emerging markets with increasing pet ownership and awareness of animal health presents significant growth opportunities. IDEXX Laboratories, Inc., headquartered in Westbrook, Maine, is a global leader in veterinary diagnostics, software, and water microbiology testing. The company offers products and services that create clarity in a complex and evolving world, serving customers in over 175 countries.

IDEXX’s Companion Animal Group provides in-clinic laboratory analyzers, monitoring systems, and practice management software to enhance the health and well-being of pets. The company continues to innovate and expand its offerings to meet the evolving needs of veterinary professionals and animal health.

Top Key Players in the Animal Diagnostics Market

- Zoetis

- Virbac

- Thermo Fisher Scientific

- MiDOG Animal Diagnostics

- Innovative Diagnostics SAS

- FUJIFILM Corporation

- Esaote SPA

- EKF Diagnostics

Recent Developments

- In July 2024, EKF Diagnostics was reported to have launched the Biosen C-Line, a next-generation glucose and lactate analyzer tailored for both clinical and sports-related settings. The device features a modern touch screen interface and enhanced connectivity options, enabling smooth integration with hospital information systems. Its ability to deliver accurate glucose and lactate readings plays a vital role in the management of diabetes and the assessment of athletic performance, marking a significant advancement in diagnostic technology.

- In February 2024, MiDOG Animal Diagnostics launched an innovative All-in-One Diagnostic Test that rapidly identifies bacterial and fungal infections, including antibiotic resistance, in animals. This molecular-based diagnostic tool promises to streamline the diagnostic process, supporting veterinarians in providing more efficient and effective care for pets and a wide range of animal species.

Report Scope

Report Features Description Market Value (2024) US$ 10.6 billion Forecast Revenue (2034) US$ 28.0 billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables, Reagents & Kits and Equipment & Instruments), By Animal Type (Production Animals (Cattle, Poultry, Swine, and Other Production Animals), Companion Animals (Dogs, Cats, Horses, and Other)), By Application (Clinical Chemistry, Microbiology, Parasitology, Histopathology, Cytopathology, and Others), By End-user (Reference Laboratories, Veterinarians, and Animal Owners/Producers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zoetis, Virbac, Thermo Fisher Scientific, MiDOG Animal Diagnostics, Innovative Diagnostics SAS, FUJIFILM Corporation, Esaote SPA, and EKF Diagnostics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Animal Diagnostics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Animal Diagnostics MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis

- Virbac

- Thermo Fisher Scientific

- MiDOG Animal Diagnostics

- Innovative Diagnostics SAS

- FUJIFILM Corporation

- Esaote SPA

- EKF Diagnostics