Global Alpha Pinene Market Size, Share Analysis Report By Purity (Upto 95%, Above 95%), By End-Use (Agrochemicals, Plasticizer, Solvent, Others), By Sales Channel ( Direct Sale, Indirect Sale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162976

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

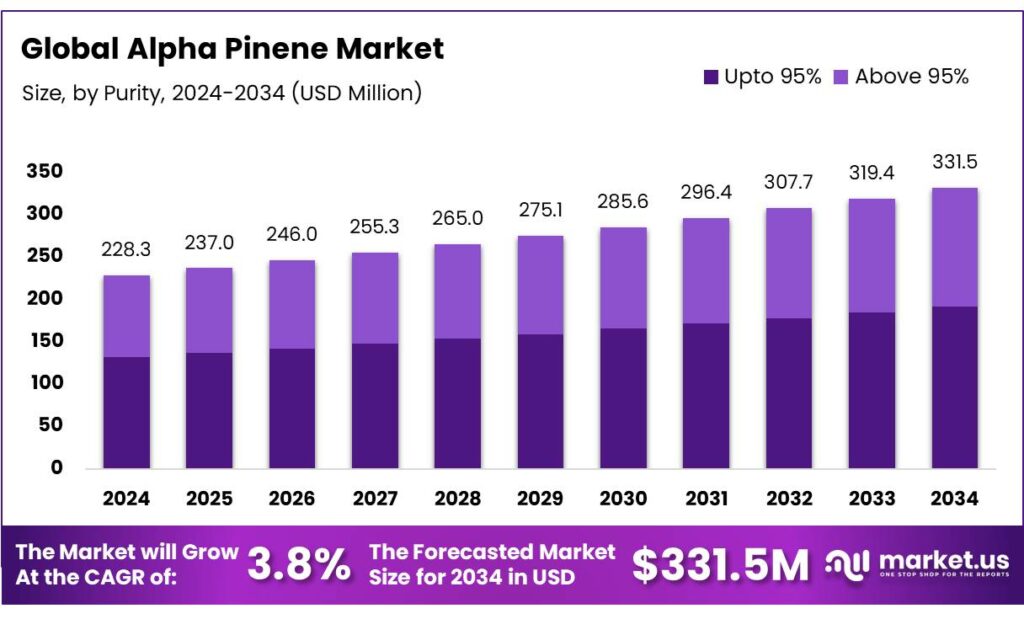

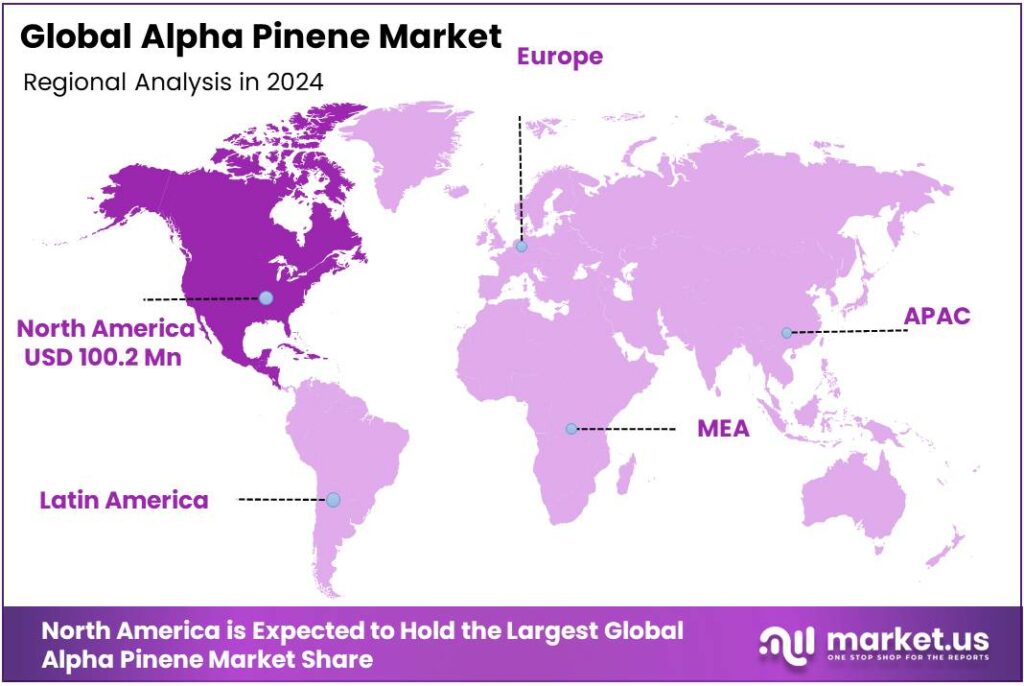

The Global Alpha Pinene Market size is expected to be worth around USD 331.5 Million by 2034, from USD 228.3 Million in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.9% share, holding USD 100.2 Million in revenue.

Alpha Pinene (CAS 80-56-8) is the dominant monoterpene in many turpentine streams and a versatile feedstock for fragrance chemicals, specialty solvents, terpene resins and advanced fuels. Species and geography matter: for example, Pinus elliottii gum turpentine typically contains ~60% α-pinene and ~30% Alpha Pinene, underscoring why turpentine fractionation remains the chief industrial source.

Driving factors include resilient pine-chemical value chains that secure bio-based feedstock, the need for renewable, odor-profiled aroma chemicals, and defense and aerospace interest in high-density fuels: pinene dimers can be hydrogenated to candidates with JP-10-like energy density, with literature reporting up to ~90% dimer yields via heterogeneous catalysts—pointing to a credible route from α-pinene to tactical or SAF-adjacent blendstocks.

Alpha Pinene supply will track turpentine flows and pulp operating rates, while prices remain sensitive to gum-rosin dynamics and tapping economics. On the demand side, U.S. biofuels capacity is in flux: the EIA reported eight biodiesel plant closures in 2024, trimming ~100 million gal/yr of capacity; at the same time, SAF capacity was projected to scale from ~2,000 bpd to nearly 30,000 bpd in 2024 if announced projects materialized—signaling a policy-backed pull for renewable molecules that can evolve into aviation blendstocks.

Demand drivers are diversified. First, consumer products: α-pinene derivatives are widely used in fragrances, cleaning agents, and flavors; these end-markets are resilient and benefit from “naturals” positioning. Second, adhesive/coatings value chains use terpene resins in pressure-sensitives and tackifiers—areas that gain from packaging growth and evolving VOC regulations. Third, policy tailwinds across the bioeconomy lift bio-based inputs: in the United States, biobased products contributed $489 billion of value added in 2021, supporting 3.94 million jobs and displacing 10.7 million barrels of oil equivalents.

Key Takeaways

- Alpha Pinene Market size is expected to be worth around USD 331.5 Million by 2034, from USD 228.3 Million in 2024, growing at a CAGR of 3.8%.

- Up to 95% purity segment held a dominant market position, capturing more than a 57.9% share of the global alpha-pinene market.

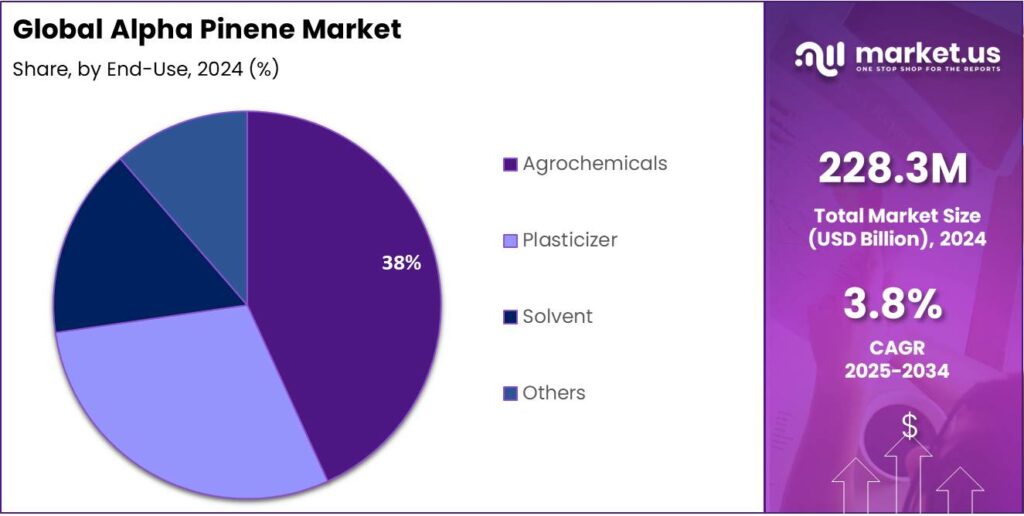

- Agrochemicals segment held a dominant market position, capturing more than a 38.8% share of the global alpha-pinene market.

- Direct Sale segment held a dominant market position, capturing more than a 68.3% share of the global alpha-pinene market.

- North America held a dominant position in the global alpha-pinene market, accounting for 43.9% of total revenue, valued at approximately USD 100.2 million.

By Purity Analysis

Up to 95% Alpha Pinene Leads the Market with 57.9% Share Owing to Its Broad Industrial Use

In 2024, the Up to 95% purity segment held a dominant market position, capturing more than a 57.9% share of the global alpha-pinene market. This grade of purity has been preferred across a wide range of industries such as fragrances, flavorings, and solvents, primarily because it provides a balance between cost efficiency and functional performance. The segment’s strong presence is supported by consistent demand from manufacturers of perfumes, cleaning agents, and resin intermediates, where ultra-high purity is not mandatory but stable quality and large-scale availability are essential.

In 2025, the Up to 95% segment is expected to continue leading market performance, as industrial producers increasingly utilize this grade for downstream applications such as camphene, synthetic fragrances, and pharmaceutical intermediates. Its economic advantage compared to higher-purity grades ensures steady adoption across both developed and emerging regions. The steady expansion of pine-derived chemical processing capacity, especially in Asia-Pacific and Europe, further reinforces the segment’s leadership position.

By End-Use Analysis

Agrochemicals Segment Dominates the Alpha Pinene Market with 38.8% Share Owing to Its Extensive Use in Crop Protection

In 2024, the Agrochemicals segment held a dominant market position, capturing more than a 38.8% share of the global alpha-pinene market. This strong presence is attributed to the compound’s broad use as an intermediate in the synthesis of insecticides, herbicides, and fungicides. Alpha-pinene’s natural origin and biodegradable nature make it an ideal ingredient for eco-friendly crop protection products, which are increasingly preferred under tightening environmental regulations. Its ability to enhance the effectiveness of bio-based pesticide formulations has further supported its growing demand across the agricultural sector.

The Agrochemicals segment is expected to maintain its leadership, driven by expanding agricultural production and rising emphasis on sustainable farming practices. The shift toward natural and renewable raw materials for agrochemical manufacturing is likely to accelerate the consumption of alpha-pinene in this segment. Moreover, ongoing R&D activities aimed at developing next-generation bio-pesticides and plant growth stimulants using terpene-based compounds are projected to provide additional momentum to this segment’s growth.

By Sales Channel Analysis

Direct Sale Channel Leads the Alpha Pinene Market with 68.3% Share Driven by Strong Manufacturer–Buyer Relationships

In 2024, the Direct Sale segment held a dominant market position, capturing more than a 68.3% share of the global alpha-pinene market. This dominance is largely attributed to the established relationships between manufacturers and industrial buyers, ensuring consistent supply, customized product specifications, and better pricing control. Direct sales are the preferred channel among major producers as they facilitate long-term contracts with key end-use industries such as fragrances, agrochemicals, and resins. This approach minimizes dependency on intermediaries, leading to improved logistics efficiency and better margin management.

The Direct Sale segment is expected to retain its leadership as large-scale industrial consumers continue to favor direct procurement for stable quality assurance and uninterrupted supply. The increasing adoption of digital procurement platforms by manufacturers is further enhancing transparency and strengthening direct trade relationships. Additionally, expanding production capacities and regional distribution hubs have allowed producers to serve clients more efficiently, reinforcing the dominance of direct sales within the supply chain.

Key Market Segments

By Purity

- Upto 95%

- Above 95%

By End-Use

- Agrochemicals

- Plasticizer

- Solvent

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Emerging Trends

Bio-based, clean-label shift pulling α-pinene into mainstream formulas

Across flavors, fragrances, home-care and coatings, the clearest recent trend is the switch to bio-based, low-VOC ingredients with traceable forestry origins—an environment where α-pinene (from turpentine) fits naturally. On the demand side, policy and procurement now reward renewable inputs. In the United States, the USDA’s BioPreferred® analysis shows the biobased-products sector contributed US$ 489 billion of value added and 3.94 million jobs in 2021, and displaced 10.7 million barrels of oil-equivalent—signals that push purchasers and brand owners toward bio-routes in food, fragrance and household lines.

Regulatory ceilings on VOCs are another practical pull. The U.S. EPA’s national consumer-product rule caps VOC content by category—for example 7 wt% for bathroom/tile cleaners (aerosols) and 18 wt% for cooking-spray aerosols—encouraging lower-emitting solvents and fragrance carriers where α-pinene and its derivatives can qualify. These numeric limits don’t prescribe specific chemistries, but they steadily reward bio-terpene systems that meet performance with less petroleum-aromatic content—exactly the space where α-pinene-derived terpenes, terpineols and tackifiers are gaining attention.

The feedstock picture shows why this trend feels durable. Turpentine supply is ultimately tied to forestry and pulp coproduct flows; despite a cyclical slowdown, the base remains huge. Global industrial roundwood removals were 1.92–1.925 billion m³ in 2023, down about 4% versus 2022—still a vast resource underpinning pine-chemicals. Meanwhile, trade data confirm active downstream processing hubs for turpentine (HS 380510): India appears as a top buyer by value in 2023, reflecting robust pull into aroma, resin and solvent chains

Drivers

Clean-label and low-VOC shift boosting α-pinene demand

A powerful tailwind for α-pinene is the push toward “natural,” low-VOC ingredients across everyday products—foods, beverages, home care, and coatings. Regulators now hard-cap VOCs in many consumer and architectural products, rewarding bio-based terpene routes when performance and cost align. In the United States, EPA’s national consumer-product standards set explicit VOC content limits—for example 10 wt% for general-purpose cleaners, 18 wt% for cooking-spray aerosols, and 35 wt% for automotive windshield washer fluid—pushing formulators toward lower-emitting solvents and fragrance carriers where α-pinene. In Europe, the Paints Directive 2004/42/EC requires labels to show the product’s VOC limit in g/L and enforces subcategory caps, which steers coatings makers toward resin and solvent systems compatible with tighter emission ceilings—another opening for pine-chemicals and α-pinene-based tackifiers/solvents.

Policy support for the bioeconomy amplifies this shift. The U.S. BioPreferred program reports the biobased products sector delivered US$ 489 billion in value added, supported 3.94 million jobs, and displaced 10.7 million barrels of oil-equivalent in 2021—direct incentives, procurement, and labeling that make bio-routes more attractive in foods, flavors, fragrances, and household products where α-pinene derivatives are commonplace. Energy-system decarbonization goals add momentum: the International Energy Agency highlights chemicals as a heavy energy user facing deep cuts, with the sector expected to take ~11% of low-emission hydrogen use by 2030 in its net-zero pathway—signals that nudge industry toward lower-carbon feedstocks and solvents when feasible, supporting bio-based terpene adoption alongside electrification and CCUS.

Numeric VOC caps and procurement programs are doing the heavy lifting. EPA’s category-specific limits force reformulation; EU labeling and maximum g/L ceilings make compliance visible at the can; and U.S. BioPreferred economics—US$ 489 billion value added and 10.7 million boe displaced—keep pulling bio-ingredients into mainstream product pipelines. Against that regulatory-policy backdrop, α-pinene’s role as a versatile, bio-based building block for flavors, fragrances, solvents, and tackifiers becomes a clear growth lever, provided supply chains continue channeling turpentine feedstocks from the 1.92 billion m³ industrial roundwood base into efficient upgrading routes.

Restraints

Raw-material cost volatility and supply-chain constraints

One of the major restraining factors for the growth of α-pinene lies in the volatile availability and rising cost of its forestry-derived feedstock, which undermines the economics of its production and downstream use. α-Pinene is sourced primarily from turpentine, a by-product of the kraft/sulphate pulping of pine wood. The industry’s reliance on pulp-wood streams and the fluctuating pulp/wood market make the supply of turpentine—and by extension α-pinene—vulnerable to shifts in forestry economics. For example, one study notes that wood prices in the pulp & paper industry have doubled within two years in certain regions such as Brazil, thereby raising input costs for coproducts like turpentine and incentivizing pulp mills to divert clean turpentine streams toward higher margin uses, limiting availability.

Moreover, the broader bio-chemical industry data shows that although global production of bio-based chemicals could reach 90 million tonnes and generate around US$ 10 billion revenue in earlier reports, the growth has been slower than projected due to feed-stock, process cost, and trade uncertainties. For the α-pinene value chain, this means that even though volumes of turpentine are available, the economics may not always favour extraction or upgrading into high-value derivatives when pulpwood costs rise or when competition for wood residues intensifies.

Supply-chain pressure is further exemplified by how turpentine volumes are tied to pulp mill operations: when pulp mills reduce output, or when forest harvesting declines, the amount of turpentine available for distillation drops. One report estimated that annual global production of crude sulphate turpentine is around 350 000 tonnes—a modest figure in the scale of chemical feedstocks and sensitive to upstream forestry trends.

Another dimension is regulatory and environmental pressure on forestry and pulping operations. The broader chemical industry already faces the challenge of decarbonisation: direct CO₂ emissions from primary chemical production stood at ~935 Mt in 2022 according to the International Energy Agency (IEA). For a forest-based feedstock chain, any new regulation on forest harvesting, biomass sustainability certification, or emissions from pulping/resin recovery operations adds compliance cost, which may either increase raw material cost for turpentine or reduce the competitiveness of upgrading it into α-pinene derivatives.

Opportunity

Expansion of Bio-based Value Chains for α-Pinene

A compelling growth opportunity for α-pinene rests in its role as a bio-based feedstock for chemicals and materials aligned with growing global bioeconomy investments. In the United States, the United States Department of Agriculture (USDA) reports that the biobased products industry contributed US$ 489 billion in value added in 2021, up from US$ 464 billion in 2020. Within that ecosystem, the chemicals segment—of which α-pinene derivatives are part—benefits from programmes such as the BioPreferred® initiative that promote procurement and labelling of biobased products.

From a consumer-and-regulatory vantage, this creates a sustained pull: companies increasingly prefer ingredients and intermediates from forestry, agricultural or waste-biomass streams over fossil-derived counterparts. In Europe, the European Commission states that bio-based products can replace fossil-based materials and potentially save up to 2.5 billion tons of CO₂ equivalent per year by 2030.

Government initiatives bolster the case. USDA’s 2023 “Bioeconomy Accomplishments Fact Sheet” reports that federal agencies spent US$ 90.5 million on biobased-products contracting in 2022—a 19% increase over 2021—indicating growing public-sector procurement involvement. In Europe, the Commission’s Research & Innovation page outlines that bio-based innovation supports sustainable biomass sourcing, value-chain expansion and substitution of fossil-resources, explicitly naming chemicals and materials among target sectors.

What this means in practical terms: companies specialising in α-pinene or its derivatives can capture a premium by aligning with labelled bio-based programmes, tapping into green-solvent demand and positioning under natural ingredient branding in flavors, fragrances, personal-care and industrial applications. For instance, terpene-resin tackifiers derived from α-pinene can replace petroleum-based resins in packaging adhesives and tape; as packaging sustainability accelerates, that substitution story gains traction.

Regional Insights

North America Dominates the Alpha Pinene Market with 43.9% Share Valued at USD 100.2 Million

In 2024, North America held a dominant position in the global alpha-pinene market, accounting for 43.9% of total revenue, valued at approximately USD 100.2 million. The region’s strong market presence is primarily supported by its well-established chemical manufacturing base, extensive use of bio-based feedstocks, and growing demand across the fragrance, agrochemical, and pharmaceutical sectors. The United States represents the largest share within the region, benefiting from advanced production facilities and strong research capabilities focused on terpene extraction and conversion. The increasing preference for sustainable and renewable chemical ingredients has further strengthened alpha-pinene’s adoption across diverse end-use industries.

The regional market is also being shaped by supportive government policies promoting the bioeconomy. The U.S. Department of Energy’s Bioenergy Technologies Office and Environment and Climate Change Canada have encouraged bio-based production routes that reduce carbon footprints, fostering investment in pine-derived chemical technologies. In addition, the rising use of alpha-pinene in eco-friendly solvents, natural fragrances, and green pesticides aligns with consumer shifts toward environmentally safe products. This trend has been particularly visible in the personal care and home care industries, which together account for a growing portion of alpha-pinene consumption in North America.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Symrise processes natural feedstocks including CST to separate α- and β-pinene and then convert them via hydrogenation or pyrolysis into fragrance, flavor and aroma chemicals. The firm’s platform supports about 30 % of its internal fragrance production using renewable terpene sources, signalling a strong vertical integration. Symrise thereby plays a significant role in the end-use chain of α-pinene for choices in natural and sustainable aroma molecules.

Yunnan Sky Dragon Forest Chemical leverages China’s abundant pine-forest resources to produce pine resin derivatives, rosin and α-pinene. Its annual production capacity includes around 15 000 tons of α-pinene and β-pinene, alongside 20 000 tons each of gum rosin and disproportionated rosin. The company’s regional footprint positions it well for competitive supply in Asia-Pacific.

DRT specialises in ingredients derived from pine resin and turpentine, including terpene extracts like α-pinene, under brands such as Alpha Pinene PF. The company’s product portfolio serves industries ranging from fragrances to plastics and elastomers through rosin-based and turpentine-derived chemicals. With heritage in pine chemistry and global production capability, DRT supports both specialty chemical and bulk resin markets.

Top Key Players Outlook

- Kraton Corporation

- Les Dérives Résiniques Et Terpéniques SA (DRT)

- Symrise pvt ltd

- Yasuhara Chemical Co.,Ltd.

- Yunnan Sky Dragon Forest Chemical Co., Ltd.

- Sichuan Zhongbang New Material Co., Ltd.

- Guangdong Pine Forest Perfume Ltd

Recent Industry Developments

In 2024, Kraton Corporation demonstrated its leadership in the pine-derived chemicals segment by investing USD 35 million in upgrading its crude tall oil (CTO)-based biorefinery tower at the Panama City, Florida facility, enhancing its capacity for pine-based intermediates including alpha-pinene and related derivatives.

In 2024, Yunnan Sky Dragon Forest Chemical reported a capacity of 6,000 tonnes/year for combined pinene and terpineol outputs, drawn from its turpentine oil processing operations in Yunnan province. Drawing on the region’s abundant pine-forest raw materials, the company emphasised cost-effective supply to downstream fragrance, solvent and agrochemical industries.

Report Scope

Report Features Description Market Value (2024) USD 228.3 Mn Forecast Revenue (2034) USD 331.5 Mn CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Upto 95%, Above 95%), By End-Use (Agrochemicals, Plasticizer, Solvent, Others), By Sales Channel ( Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kraton Corporation, Les Dérives Résiniques Et Terpéniques SA (DRT), Symrise pvt ltd, Yasuhara Chemical Co.,Ltd., Yunnan Sky Dragon Forest Chemical Co., Ltd., Sichuan Zhongbang New Material Co., Ltd., Guangdong Pine Forest Perfume Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kraton Corporation

- Les Dérives Résiniques Et Terpéniques SA (DRT)

- Symrise pvt ltd

- Yasuhara Chemical Co.,Ltd.

- Yunnan Sky Dragon Forest Chemical Co., Ltd.

- Sichuan Zhongbang New Material Co., Ltd.

- Guangdong Pine Forest Perfume Ltd