Global All-terrain Vehicle Market Size, Share, Growth Analysis By Engine Type (Below 400cc, 400-800cc, Above 800cc), By Application (Agriculture, Sports, Recreational, Military and Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142909

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

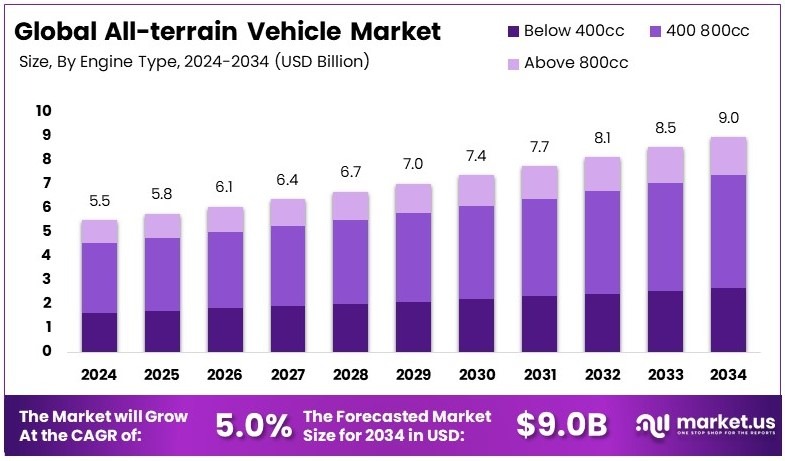

The Global All-Terrain Vehicle Market size is expected to be worth around USD 9.0 Billion by 2034, from USD 5.5 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

An All-Terrain Vehicle (ATV) is a four-wheeled vehicle designed for off-road use. It has strong tires and a powerful engine for rough terrains. ATVs are used in farming, recreation, and military operations. They provide high maneuverability and durability, making them ideal for challenging environments.

The All-Terrain Vehicle Market includes the production, sale, and demand for ATVs. Growth is driven by outdoor sports, agriculture, and defense needs. Manufacturers focus on innovation, electric ATVs, and safety features. Market trends include rising demand for adventure tourism and increased government support for off-road vehicle use.

The all-terrain vehicle (ATV) market is growing as more people engage in off-road activities. According to a survey by Parachute and Ipsos, 61% of Canadians have ridden an ATV at least once, and 15% ride frequently. This rising interest fuels demand for recreational and utility ATVs, driving market expansion worldwide.

ATVs are used for recreation, farming, and industrial applications. In rural areas, they help with agriculture and transport. Meanwhile, adventure tourism boosts sales, as off-road parks attract enthusiasts. Additionally, electric ATVs are gaining attention due to environmental concerns. As technology improves, manufacturers focus on making ATVs more efficient, durable, and safer.

The ATV market remains competitive, with global brands and local manufacturers offering various models. Customers look for durability, safety, and fuel efficiency. Moreover, e-commerce helps small businesses reach more buyers. While large companies dominate, niche players target specific users like farmers, hunters, and outdoor sports enthusiasts, increasing market diversity and competition.

ATV demand is rising in emerging markets where off-road transport is essential. In developed countries, outdoor recreation trends drive sales. Additionally, rental services allow more people to experience ATVs without purchasing. As tourism rebounds, ATV rental businesses expand. This growing interest in outdoor adventure creates opportunities for businesses and manufacturers.

The market is far from saturation, with ongoing innovation in design and fuel efficiency. Electric and hybrid ATVs attract eco-conscious buyers. Meanwhile, government incentives for electric vehicles encourage manufacturers to develop sustainable models. Off-road racing events also boost interest. Companies investing in technology and safety will likely see long-term growth.

Key Takeaways

- The All-terrain Vehicle (ATV) Market was valued at USD 5.5 billion in 2024 and is expected to reach USD 9.0 billion by 2034, growing at a 5.0% CAGR.

- In 2024, 400-800cc engine ATVs led the market with 52.6%, preferred for their balance of power and versatility.

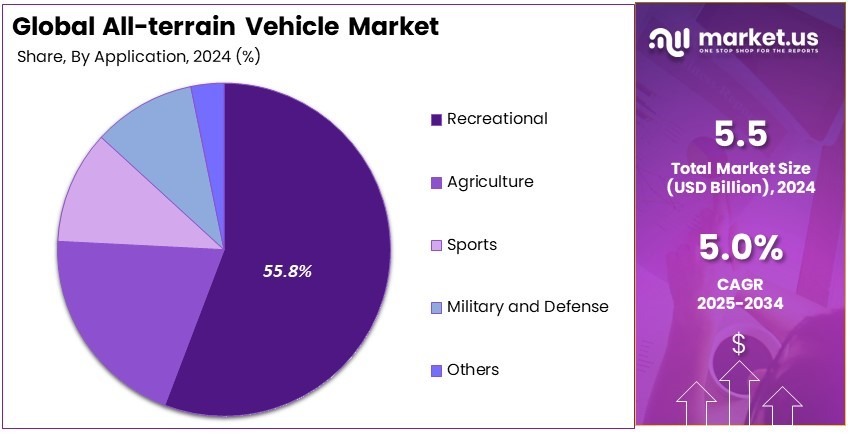

- In 2024, Recreational applications dominated with 55.8%, driven by increasing adventure sports and outdoor recreational activities.

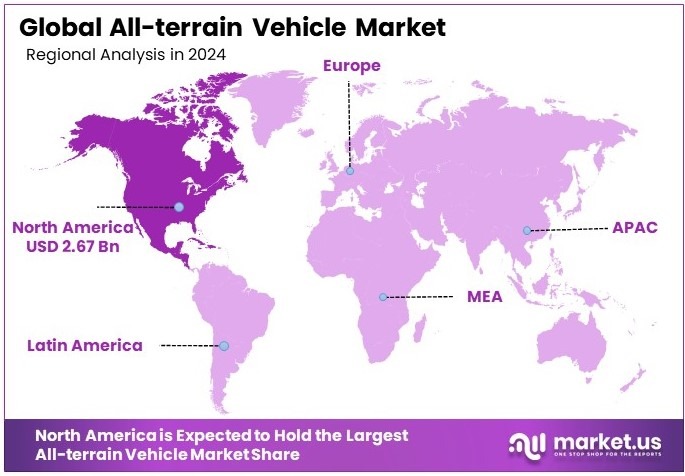

- In 2024, North America held the largest share at 48.6% (USD 2.67 billion), supported by strong consumer demand and extensive off-road infrastructure.

Engine Type Analysis

400 – 800cc dominates with 52.6% due to its balance of power and accessibility.

In the All-terrain Vehicle (ATV) market, the 400 – 800cc engine type segment stands out as the dominant force, capturing a 52.6% market share. This dominance can be attributed to the perfect balance these engines strike between power and manageability, making them suitable for a wide range of activities, from recreational to semi-professional use. They offer enough horsepower to handle challenging terrains, yet are not as intimidating or as costly as the larger models, making them accessible to a broader audience.

Meanwhile, the Below 400cc segment caters primarily to beginners and younger riders due to their lower power output and easier handling. These vehicles are important for cultivating early interest and skill development in ATV riding.

Conversely, the Above 800cc segment is tailored for experienced riders who demand more power for intensive use, such as in racing and heavy-duty work scenarios. Despite their lower market share, these ATVs are crucial for high-performance enthusiasts and professional applications, indicating their niche yet significant impact on the market.

Application Analysis

Recreational use leads with 55.8% due to its widespread popularity and diverse utility.

In terms of application, Recreational usage of ATVs dominates the market with a 55.8% share, reflecting the widespread popularity of ATVs for leisure and adventure activities. This high percentage highlights how ATVs are primarily perceived and used as tools for enjoyment and exploration in diverse environments, from beaches to mountainous terrains. The recreational segment benefits from continual innovations in ATV technology that enhance the riding experience, making it more enjoyable and safer for enthusiasts.

Agricultural applications, though smaller in comparison, are critical in rural and farming communities where ATVs are used for a wide range of tasks, from crop management to livestock handling. These vehicles provide essential utility in agricultural settings, proving their versatility and value beyond just recreation.

The Sports segment attracts competitive riders and adrenaline seekers, contributing to the market with high-performance ATVs designed for racing and competitive events. This segment is instrumental in driving technological advancements and design improvements across the entire market.

Similarly, Military and Defense applications, though limited in market share, underscore the strategic importance of ATVs. They are utilized for patrol, transport, and in complex terrains where larger vehicles cannot maneuver, highlighting their role in operational efficiencies in defense scenarios.

Lastly, the ‘Others’ category includes the use of ATVs in areas like forestry, emergency medical access in remote areas, and small-scale industrial tasks. This segment, while diverse, showcases the adaptability of ATVs to various niche applications, each contributing to the overall market dynamics and growth in specialized environments.

Key Market Segments

By Engine Type

- Below 400cc

- 400 – 800cc

- Above 800cc

By Application

- Agriculture

- Sports

- Recreational

- Military and Defense

- Others

Driving Factors

Off-Road Recreation and Utility Applications Drive Market Growth

The increasing popularity of off-road recreational activities and adventure tourism is a major driver of the all-terrain vehicle (ATV) market. More individuals and tour operators are investing in ATVs for activities such as trail riding, dune bashing, and nature exploration. This growing interest in outdoor experiences is pushing ATV manufacturers to introduce high-performance and durable models.

In addition to recreational use, ATVs are seeing rising demand in military and defense applications. Defense agencies worldwide rely on ATVs for patrolling, transportation, and combat support in rough terrains. These vehicles offer mobility advantages in areas where traditional transport is ineffective, making them essential for security operations.

Another key factor boosting ATV sales is their increasing use in agriculture and utility tasks. Farmers and ranchers use ATVs for tasks like field maintenance, livestock monitoring, and transportation of goods across vast lands. Utility ATVs are also widely used in forestry, construction, and rescue operations, further expanding market potential.

Additionally, there is a growing demand for high-performance and sport ATVs. Enthusiasts and professional riders seek ATVs with enhanced suspension, speed, and maneuverability for racing and competitive events. As ATV technology advances, manufacturers are investing in innovative designs to cater to both utility and recreational users.

Restraining Factors

High Costs and Safety Regulations Restrain Market Growth

The high cost of ATVs and their maintenance expenses remain a major challenge for the market. ATVs require specialized parts, frequent servicing, and protective gear, making them a costly investment. For many consumers, these expenses limit accessibility, slowing overall adoption rates.

Stringent safety regulations and regional restrictions on ATV usage further impact market growth. Many governments enforce strict rules regarding where ATVs can be operated, particularly in protected environments and urban areas. Additionally, safety standards for ATV manufacturing add to production costs, making compliance challenging for manufacturers.

The adoption of electric ATVs is also hindered by limited charging infrastructure. Unlike conventional ATVs, which rely on readily available fuel, electric models require charging stations that are scarce in remote and off-road areas. This limitation restricts their widespread use, particularly in regions with inadequate energy networks.

Another major concern affecting ATV adoption is the risk of accidents and injuries. ATVs are powerful vehicles designed for rough terrains, but improper handling and lack of safety training often lead to accidents. This risk reduces consumer confidence, particularly among new buyers who may hesitate to invest in an ATV due to safety concerns.

Growth Opportunities

Electric ATVs and Smart Features Provide Growth Opportunities

The development of electric and hybrid ATVs presents a major growth opportunity for the market. As sustainability becomes a priority, manufacturers are designing eco-friendly ATVs with lower emissions and quieter operations. These models appeal to environmentally conscious consumers and help companies comply with emission regulations.

Emerging markets are also driving ATV demand, particularly in regions with growing off-road tourism. Countries with scenic trails, dunes, and mountains are witnessing an increase in adventure tourism, creating opportunities for ATV rental businesses and manufacturers. Expanding into these markets allows companies to reach new customer segments.

Another promising opportunity is the integration of GPS and smart connectivity features in ATVs. Modern ATVs are equipped with navigation systems, ride-tracking features, and remote diagnostics, enhancing safety and convenience. These smart technologies attract tech-savvy consumers looking for advanced off-road experiences.

The rising popularity of ATV racing and motorsport events is further boosting market growth. Competitive racing leagues and off-road championships are gaining traction, increasing demand for high-performance ATVs. Manufacturers are capitalizing on this trend by developing sport-focused models with enhanced speed, durability, and agility.

Emerging Trends

Autonomous Technology and Customization Are Latest Trending Factors

The adoption of autonomous and semi-autonomous ATVs is a rising trend in industrial applications. Mining, agriculture, and logistics industries are exploring ATVs with automated navigation for tasks like crop monitoring, material transport, and remote inspections. These smart ATVs improve efficiency and reduce the need for manual labor in hazardous environments.

Another growing trend is the increasing availability of customizable and modular ATV designs. Consumers are looking for ATVs that can be modified with accessories, upgraded suspension systems, and interchangeable components to suit different terrains and activities. This demand for personalization is driving manufacturers to offer more adaptable models.

Lightweight and high-durability materials are also transforming ATV manufacturing. Advanced composites, aluminum alloys, and reinforced polymers are being used to create stronger yet lighter ATVs. These materials enhance performance while improving fuel efficiency and durability, making ATVs more reliable for extreme conditions.

The rise of subscription-based and rental ATV services is another significant trend. Instead of purchasing, many consumers prefer renting ATVs for short-term use, particularly for tourism and recreational events. Rental services make ATVs more accessible to a broader audience, further expanding market reach.

Regional Analysis

North America Dominates with 48.6% Market Share

North America leads the All-terrain Vehicle Market with a commanding 48.6% share, representing a market value of USD 2.67 billion. This significant dominance is driven by the region’s robust outdoor culture, extensive trail networks, and high consumer spending power.

Key factors influencing this strong market position include a widespread enthusiasm for outdoor recreational activities and a solid infrastructure supporting ATV usage. The region also benefits from established manufacturers and a regulatory environment that supports vehicle safety and environmental conservation.

Looking ahead, North America’s influence on the global All-terrain Vehicle Market is poised to continue its growth. The ongoing popularity of outdoor sports, coupled with advancements in ATV technology, such as electric ATVs, is expected to drive further market expansion.

Regional Mentions:

- Europe: Europe’s ATV market is driven by a growing trend towards outdoor leisure activities and the adoption of ATVs in agriculture. The region focuses on safety and environmental standards, which shape market offerings and consumer choices.

- Asia Pacific: Asia Pacific is seeing an increase in the adoption of ATVs, driven by rising disposable incomes and the popularity of adventure sports. Countries like Australia and New Zealand are key contributors to the region’s market growth.

- Middle East & Africa: The Middle East and Africa are experiencing modest growth in the ATV market, with increased use in tourism and adventure sports. The region’s vast deserts and landscapes offer ample opportunities for ATV activities, slowly driving market adoption.

- Latin America: Latin America is witnessing growth in the ATV market due to its diverse terrains and a rise in adventure tourism. The market is also supported by a gradual increase in disposable incomes, making ATVs more accessible to a broader audience.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the All-terrain Vehicle Market, Polaris Inc., American Honda Motor Co., Inc., Yamaha Motor Co., Ltd., and BRP are the frontrunners, each playing a critical role in shaping the industry landscape.

Polaris Inc. is a major player known for its robust and versatile vehicles, which are popular in both recreational and utility markets. American Honda Motor Co., Inc. brings reliability and innovation to the market, with a strong emphasis on vehicle safety and performance.

Yamaha Motor Co., Ltd. is recognized for its engineering excellence and product diversity, offering a range of ATVs that cater to both competitive sports and casual riding. BRP distinguishes itself with high-performance vehicles that incorporate cutting-edge design and technology, appealing to adventure seekers and professional users alike.

These top manufacturers drive the All-terrain Vehicle Market by focusing on technological advancements, customer satisfaction, and expanding their product lines to meet various consumer needs. Their efforts not only enhance user experience but also contribute to the expansion of the ATV market globally, underscoring their influential roles in the industry’s growth.

Major Companies in the Market

- Polaris Inc.

- American Honda Motor Co., Inc.

- Yamaha Motor Co., Ltd.

- BRP

- Kawasaki Heavy Industries, Ltd.

- Arctic Cat Inc.

- CFMOTO

- Suzuki Motor USA, LLC.

- KYMCO

- HISUN

- Others

Recent Developments

- In December 2023, the collaboration was initiated between Potential Motors, a Canadian automotive technology firm, and CFMOTO USA. This partnership marks the first instance of incorporating Potential Motors’ innovative Terrain Intelligence and Off-Road OS into the side-by-side vehicle models by CFMOTO USA.

- On July 2023, Polaris Inc. took a significant step to enhance its product offerings by acquiring Walker Evans Racing. This strategic acquisition is intended to strengthen Polaris’s capabilities in the domain of high-performance off-road components, which could potentially elevate the performance standards of its ATV products.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 9.0 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Engine Type (Below 400cc, 400-800cc, Above 800cc), By Application (Agriculture, Sports, Recreational, Military and Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Polaris Inc., American Honda Motor Co., Inc., Yamaha Motor Co., Ltd., BRP, Kawasaki Heavy Industries, Ltd., Arctic Cat Inc., CFMOTO, Suzuki Motor USA, LLC., KYMCO, HISUN, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global All-terrain Vehicle MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global All-terrain Vehicle MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Polaris Inc.

- American Honda Motor Co., Inc.

- Yamaha Motor Co., Ltd.

- BRP

- Kawasaki Heavy Industries, Ltd.

- Arctic Cat Inc.

- CFMOTO

- Suzuki Motor USA, LLC.

- KYMCO

- HISUN

- Others