Global Agriculture Packaging Market Size, Share, Growth Analysis By Product (Bags/Bins, Pouches, Silo Bags, Clamshells, Bottle, Trays, Others), By Material Type (Plastic, Rigid, Flexible, Paperboard, Corrugated Board, Glass, Jute, Others), By Barrier Type (Low-barrier, Medium-barrier, High-barrier), By Capacity (≤25 kg, 26-100 kg, More than 100 kg), By Application (Food Grains, Seeds & Pesticides, Silage, Vegetables & Fruits, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158898

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

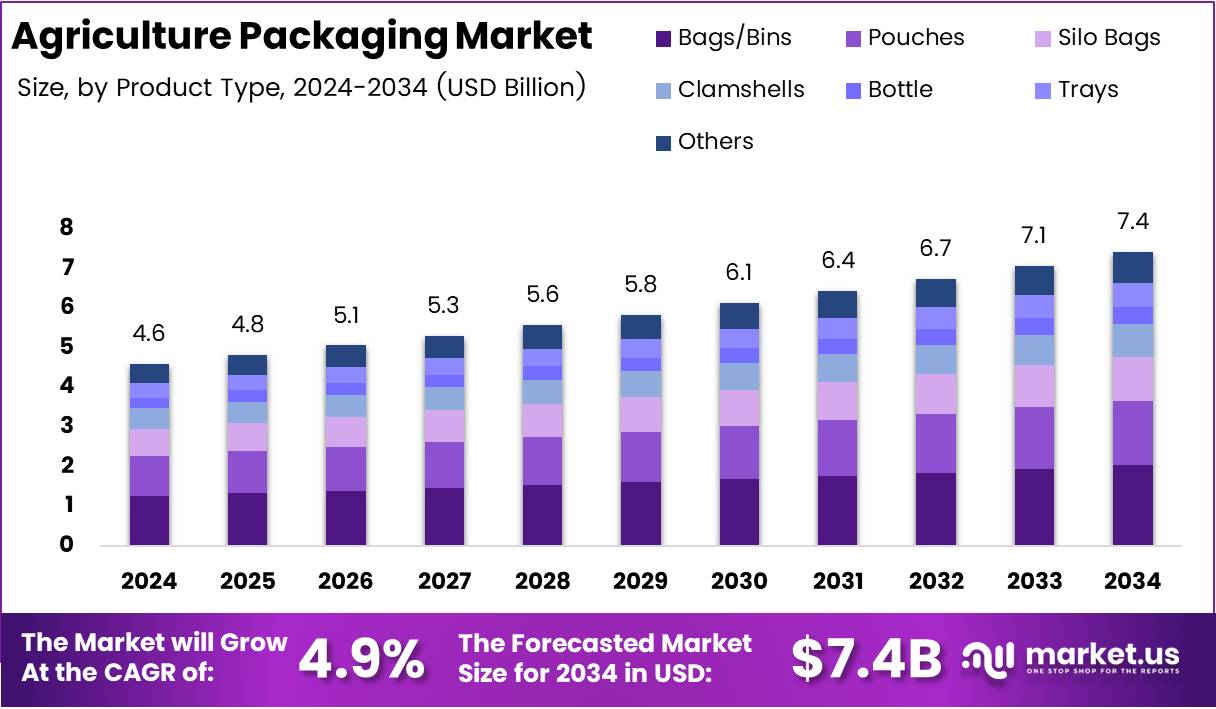

The Global Agriculture Packaging Market size is expected to be worth around USD 7.4 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Agriculture Packaging Market has experienced considerable growth in recent years, driven by the increasing demand for eco-friendly and sustainable packaging solutions. The shift towards sustainable practices within the agriculture sector has become more prominent as consumers and producers alike focus on reducing environmental impact. This trend aligns with global initiatives pushing for greater sustainability in the packaging industry.

As consumers grow more conscious of environmental issues, the demand for packaging solutions that are biodegradable, recyclable, or made from renewable resources has surged. This has led to innovations in materials like plant-based plastics and compostable films. The agriculture sector’s packaging solutions are increasingly designed to protect fresh produce while also minimizing waste.

Growth in the agriculture packaging market is primarily being fueled by rising consumer awareness and regulatory pressure. Governments across various regions are introducing new policies and regulations encouraging the adoption of sustainable practices. Additionally, the rise in organic farming and increasing global trade of agricultural products further contributes to the growth of this market.

Opportunities abound within the agriculture packaging market as businesses embrace advanced technologies to improve product safety and shelf life. Innovations in packaging, such as modified atmosphere packaging (MAP) and active packaging, are expected to drive growth. These innovations help preserve product freshness, reduce spoilage, and extend shelf life, thus minimizing food waste.

According to survey, 54% of U.S. consumers intentionally purchased products with sustainable packaging in the past six months. Furthermore, 90% are more likely to buy from brands that prioritize eco-friendly packaging.

Additionally, 80% of consumers are willing to pay more for sustainably produced or sourced goods, with an average price premium of 9.7%. These statistics reflect a clear shift in consumer preferences toward sustainable packaging, further driving market growth.

As governments continue to focus on eco-friendly policies, investments in sustainable agriculture packaging will likely continue to rise. Companies in the agriculture packaging market must keep pace with consumer demand and regulatory changes to remain competitive. Ultimately, the market is expected to thrive with increasing opportunities for companies that prioritize sustainability and innovation.

Key Takeaways

- The Global Agriculture Packaging Market is expected to be worth USD 7.4 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 4.9% from 2025 to 2034.

- Bags/Bins represent the leading product category with 27.4% market share due to their adaptability across agricultural storage needs.

- Plastic materials dominate the market with 48.2% share, driven by superior moisture barrier properties and durability.

- Medium-barrier packaging holds 48.3% market share, offering optimal protection-to-cost ratios for mainstream agricultural products.

- Small capacity packaging (up to 25 kg) leads with 43.8% market share, providing easy handling and reducing product waste risks.

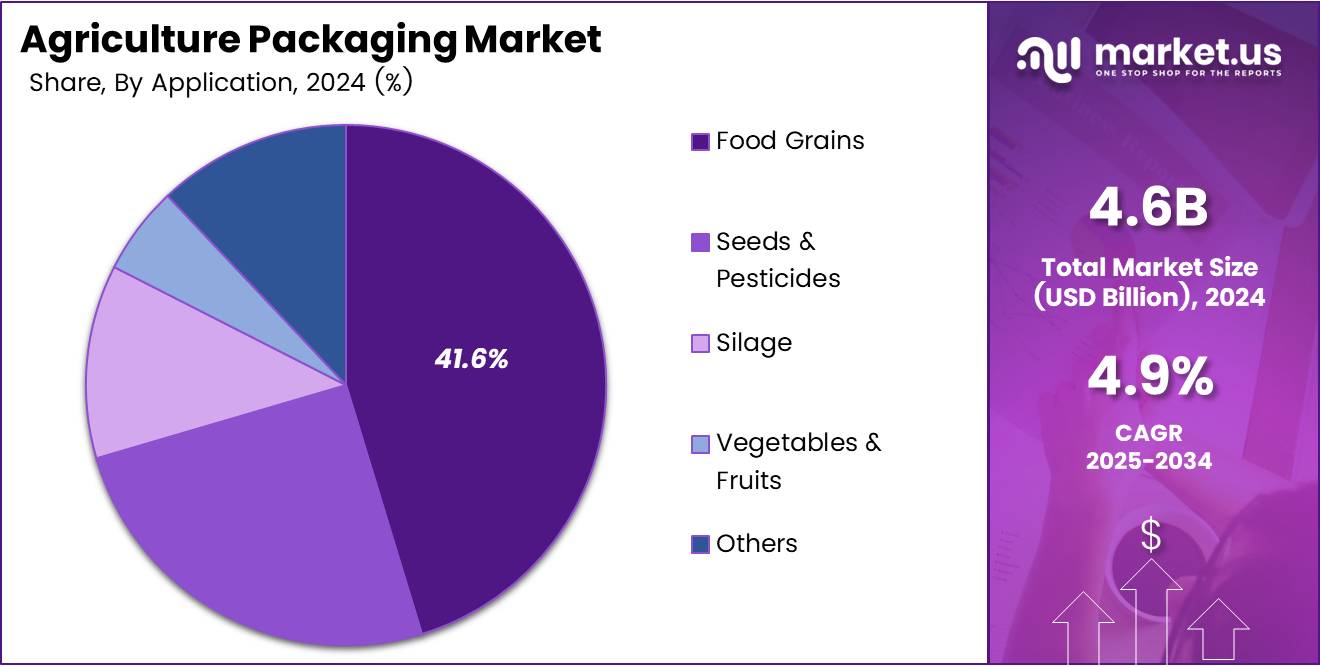

- Food Grains represent the largest application segment, capturing 41.6% market share, driven by global production volumes and storage needs.

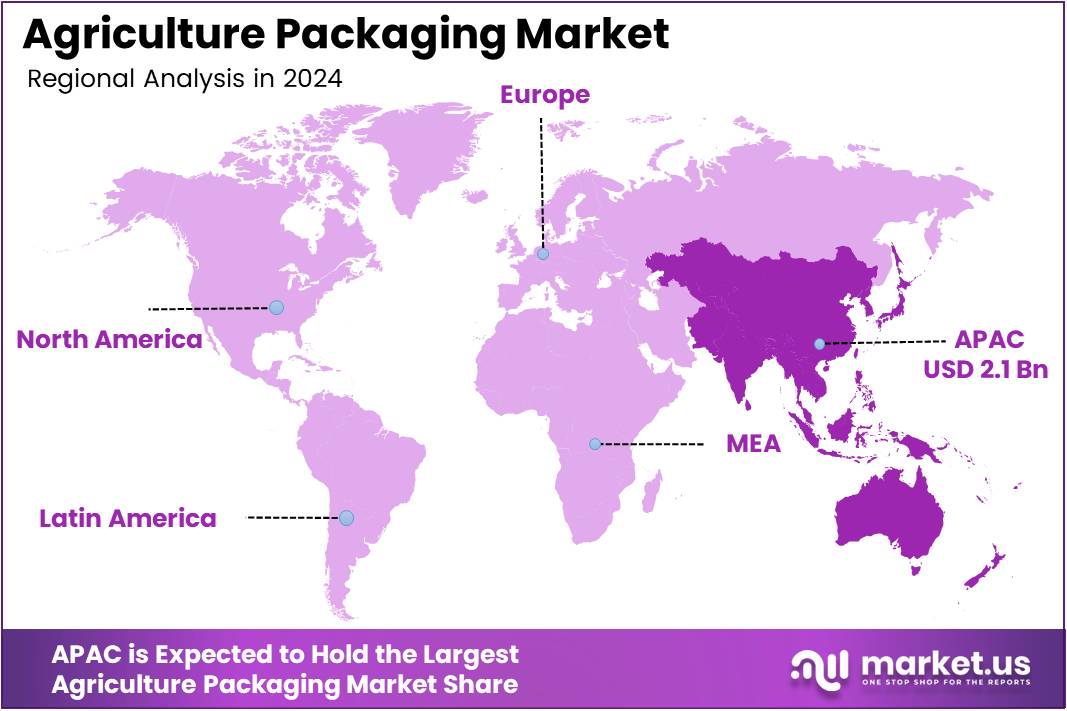

- Asia Pacific holds the largest share of the market with 45.8%, valued at USD 2.1 billion, due to eco-friendly packaging demand and sustainable agriculture practices.

By Product Type Analysis

Bags/Bins dominates with 27.4% due to their versatility and widespread agricultural applications.

Bags/Bins represent the leading product category, capturing 27.4% market share through their exceptional adaptability across diverse agricultural storage needs. These containers effectively accommodate various grain types, fertilizers, and bulk agricultural products. Moreover, their stackable design optimizes warehouse space utilization while ensuring product protection during transportation.

Pouches emerge as a significant secondary segment, gaining traction particularly in seed packaging and smaller quantity applications. Furthermore, their lightweight nature reduces shipping costs while providing excellent moisture barrier properties. Additionally, pouches offer superior branding opportunities through high-quality printing capabilities.

Silo Bags demonstrate substantial growth potential in large-scale grain storage applications. Meanwhile, their cost-effectiveness compared to permanent storage structures makes them attractive to farmers. Consequently, this segment shows promising expansion prospects in developing agricultural markets.

Clamshells, Bottle Trays, and Others collectively represent specialized packaging solutions catering to specific agricultural products. Nevertheless, these segments serve niche markets requiring customized protection and presentation features for premium agricultural products.

By Material Type Analysis

Plastic dominates with 48.2% due to its durability, moisture resistance, and cost-effectiveness.

Plastic materials command nearly half the market share at 48.2%, driven by their superior moisture barrier properties and chemical resistance. Additionally, plastic packaging offers excellent durability during handling and transportation processes. Furthermore, the material’s lightweight characteristics significantly reduce logistics costs while maintaining structural integrity.

Rigid plastic solutions provide exceptional protection for premium agricultural products requiring enhanced security. Meanwhile, their reusability factor appeals to environmentally conscious farmers seeking sustainable packaging alternatives. Consequently, rigid plastics maintain steady demand across high-value agricultural segments.

Flexible plastic packaging demonstrates remarkable growth through innovative barrier technologies and convenience features. Moreover, these solutions offer superior space efficiency during storage and transportation. Subsequently, flexible plastics capture increasing market attention from cost-sensitive agricultural operations.

Paperboard materials serve eco-friendly packaging requirements while providing adequate protection for lightweight agricultural products. Glass containers cater to premium organic products requiring chemical inertness. Jute packaging appeals to traditional markets emphasizing natural materials. Other materials collectively address specialized packaging needs across diverse agricultural applications.

By Barrier Type Analysis

Medium-barrier dominates with 48.3% due to optimal balance between protection and cost-effectiveness.

Medium-barrier packaging captures 48.3% market share by delivering optimal protection-to-cost ratios for mainstream agricultural products. Furthermore, this segment effectively prevents moisture ingress while maintaining reasonable manufacturing costs. Additionally, medium-barrier solutions accommodate diverse agricultural products without over-engineering protection requirements.

Low-barrier packaging serves cost-sensitive applications where basic protection suffices for short-term storage needs. Meanwhile, these solutions appeal to bulk commodity packaging requiring minimal barrier properties. Consequently, low-barrier options maintain relevance in price-competitive agricultural markets.

High-barrier packaging addresses premium agricultural products requiring maximum protection against environmental factors. Moreover, these solutions prevent oxygen transmission and moisture penetration effectively. Subsequently, high-barrier packaging commands premium pricing while ensuring extended shelf life for valuable agricultural products.

By Capacity Analysis

≤25 kg capacity dominates with 43.8% due to handling convenience and widespread small-scale applications.

Small capacity packaging up to 25 kg leads the market with 43.8% share, reflecting widespread preference for manageable package sizes. Furthermore, these packages facilitate easy handling by individual workers without mechanical assistance. Additionally, smaller packages reduce product waste risks while enabling precise quantity distribution.

Medium capacity packaging between 26-100 kg serves commercial farming operations requiring balanced efficiency and handling practicality. Meanwhile, this segment optimizes packaging costs per unit weight while maintaining reasonable handling requirements. Consequently, medium capacity solutions appeal to mid-scale agricultural enterprises.

Large capacity packaging exceeding 100 kg targets industrial-scale operations prioritizing maximum efficiency over handling convenience. Moreover, these solutions minimize packaging material usage per unit weight. Subsequently, large capacity options serve bulk commodity applications where mechanical handling equipment availability ensures practical implementation.

By Application Analysis

Food Grains dominates with 41.6% due to massive global consumption and storage requirements.

Food Grains represents the largest application segment, commanding 41.6% market share through enormous global production volumes and storage needs. Furthermore, diverse grain varieties require specialized packaging solutions ensuring product quality maintenance. Additionally, this segment drives continuous innovation in barrier technologies and preservation methods.

Seeds & Pesticides constitute a critical application segment requiring precise protection against contamination and environmental degradation. Meanwhile, these products demand specialized packaging ensuring viability maintenance and safety compliance. Consequently, this segment commands premium pricing through enhanced protection requirements.

Silage packaging serves livestock farming operations requiring effective fermentation and preservation capabilities. Moreover, specialized silage solutions prevent spoilage while maintaining nutritional content. Subsequently, this segment demonstrates steady growth alongside expanding livestock industries.

Vegetables & Fruits packaging addresses fresh produce protection during transportation and storage phases. Others collectively represent specialized agricultural products requiring customized packaging solutions for optimal preservation and presentation.

Key Market Segments

By Product

- Bags/Bins

- Pouches

- Silo Bags

- Clamshells

- Bottle

- Trays

- Others

By Material Type

- Plastic

- Rigid

- Flexible

- Paperboard

- Corrugated Board

- Glass

- Jute

- Others

By Barrier Type

- Low-barrier

- Medium-barrier

- High-barrier

By Capacity

- ≤25 kg

- 26-100 kg

- More than 100 kg

By Application

- Food Grains

- Seeds & Pesticides

- Silage

- Vegetables & Fruits

- Others

Drivers

Rising Consumer Preference for Fresh and Convenient Products Drives Market Growth

The agriculture packaging market is experiencing strong growth driven by several key factors. Consumer demand for eco-friendly packaging solutions is pushing manufacturers to develop sustainable alternatives. People are becoming more aware of environmental issues and want packaging that doesn’t harm the planet.

Technology improvements in packaging materials are making products last longer and stay fresher. New materials can better protect fruits, vegetables, and other farm products during transport and storage. This helps reduce food waste and keeps products in good condition.

The growth of organic farming and sustainable agriculture practices is creating more demand for special packaging. Organic products need packaging that maintains their quality and prevents contamination. These premium products require better protection during shipping.

Consumers today want convenience and fresh produce that lasts longer. They prefer packaging that is easy to open, reseal, and store. Modern lifestyles demand products that stay fresh for extended periods, driving innovation in packaging design and materials.

Restraints

Lack of Standardization in Packaging Regulations Restrains Market Growth

The agriculture packaging market faces significant challenges that limit its growth potential. One major issue is the lack of standardization in packaging regulations across different countries and regions. Each market has different rules about what materials can be used, how products should be labeled, and what safety standards must be met.

This regulatory confusion makes it difficult for companies to create packaging that works everywhere. Manufacturers must spend extra money and time adapting their products for different markets. Small companies especially struggle with these complex requirements.

Another major restraint is the limited shelf-life of agricultural products themselves. Even with the best packaging, fresh produce naturally deteriorates over time. This creates pressure on the entire supply chain to move products quickly.

Short shelf-life means packaging must be highly effective but also cost-efficient. Companies cannot invest too much in expensive packaging for products that will spoil quickly anyway. This balance between protection and cost remains a constant challenge for the industry.

Growth Factors

Expansion of E-commerce in Agricultural Products Creates Growth Opportunities

The agriculture packaging market has exciting growth opportunities ahead. The expansion of e-commerce in agricultural products is creating huge demand for better packaging solutions. More people are buying fresh produce, organic foods, and specialty agricultural products online.

Online shopping requires packaging that can protect products during long shipping journeys. Products must arrive in perfect condition, which means packaging needs to be stronger and more protective than traditional retail packaging.

The adoption of biodegradable and compostable packaging presents another major opportunity. Companies that develop eco-friendly alternatives to plastic packaging can capture growing market share. Consumers are willing to pay more for sustainable options.

Government incentives for sustainable packaging solutions are encouraging innovation. Many countries offer tax breaks, grants, and other benefits to companies that develop environmentally friendly packaging. These policies make it easier for businesses to invest in green packaging technologies.

The combination of online growth, sustainability trends, and government support creates a perfect environment for market expansion. Companies that can provide effective, eco-friendly packaging solutions for e-commerce will benefit most.

Emerging Trends

Smart Packaging Technologies Shape Future Market Trends

The agriculture packaging market is evolving rapidly with new trending factors. Smart packaging technologies are becoming increasingly popular. These include sensors that monitor temperature, humidity, and freshness levels. Smart packaging can tell consumers and retailers exactly when products are at their peak quality.

Development of plant-based and edible packaging represents another exciting trend. Companies are creating packaging from corn starch, seaweed, and other natural materials. Some packaging can even be eaten along with the product, eliminating waste completely.

Integration of supply chain optimization with packaging is improving efficiency across the industry. New packaging designs work better with automated sorting, handling, and distribution systems. This reduces costs and improves product quality throughout the supply chain.

Focus on reducing plastic waste in agricultural packaging is driving innovation. Companies are finding ways to use less plastic or replace it entirely with sustainable alternatives. This includes developing thinner but stronger materials, reusable containers, and packaging made from recycled materials.

These trends show how the industry is becoming more technology-focused and environmentally conscious. Companies that embrace these changes will be better positioned for future success.

Regional Analysis

Asia Pacific Dominates the Agriculture Packaging Market with a Market Share of 45.8%, Valued at USD 2.1 Billion

Asia Pacific holds the largest share of the agriculture packaging market, contributing 45.8% to the global market, valued at USD 2.1 billion. The growing demand for eco-friendly packaging and the significant rise in sustainable agriculture practices in the region are driving this growth. Rapid urbanization and an increasing preference for packaged fresh produce further contribute to the market expansion in countries like China and India.

North America Agriculture Packaging Market Trends

North America is a strong player in the agriculture packaging market, driven by rising consumer demand for sustainable and recyclable packaging materials. The region has seen a significant push for biodegradable packaging, especially in the U.S., where regulatory support for eco-friendly solutions is gaining momentum. The region continues to invest in research and development to enhance packaging technologies, supporting sustainable farming practices.

Europe Agriculture Packaging Market Trends

Europe is expected to witness steady growth in the agriculture packaging market. The increasing emphasis on environmental sustainability, along with stringent regulations on packaging waste reduction, is propelling the market. Countries such as Germany and France are adopting advanced packaging solutions, especially in the organic and fresh produce sectors, to meet growing consumer demands for eco-friendly and innovative packaging.

Latin America Agriculture Packaging Market Trends

In Latin America, the agriculture packaging market is driven by the rise in organic farming and the shift towards sustainable packaging solutions. Growing consumer awareness about environmental impacts and waste management is boosting the demand for eco-friendly packaging alternatives. Additionally, the increasing export of agricultural products from countries like Brazil and Mexico further accelerates the need for effective packaging solutions.

Middle East and Africa Agriculture Packaging Market Trends

The agriculture packaging market in the Middle East and Africa is witnessing gradual growth. The region’s focus on food security and improving agricultural efficiency drives demand for efficient packaging solutions. With increasing investments in the agriculture sector, especially in countries like South Africa and the UAE, the need for high-quality packaging solutions to preserve agricultural produce is rising. The region is also seeing an uptick in the adoption of sustainable packaging alternatives to align with global sustainability trends.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Agriculture Packaging Company Insights

In 2024, Bemis Company, Inc. continues to lead the global agriculture packaging market with a strong focus on sustainable packaging solutions. The company has developed innovative materials designed to extend shelf life and reduce environmental impact, aligning with the increasing demand for eco-friendly packaging.

Sonoco Products Company maintains a significant presence in the agriculture packaging market by offering a wide range of products such as flexible and rigid packaging solutions. Their commitment to integrating recycled materials into their packaging designs reflects the industry’s shift toward sustainability, catering to the growing demand for environmentally responsible solutions.

Mondi Group is another key player leveraging its extensive portfolio of sustainable packaging options. Known for its paper-based packaging solutions, Mondi’s commitment to circular economy principles has driven growth in the agriculture packaging sector, addressing consumer preference for recyclable and biodegradable materials.

LC Packaging International BV stands out by focusing on flexible packaging solutions, particularly in bulk packaging for agricultural products. The company’s investments in innovative packaging technology have bolstered its position in the market, ensuring product safety and efficiency for the agricultural supply chain.

These companies are at the forefront of meeting the evolving needs of the agriculture packaging sector, aligning their strategies with trends of sustainability and waste reduction while continuing to innovate to meet market demands.

Top Key Players in the Market

- Bemis Company, Inc.

- Sonoco Products Company

- Mondi Group

- LC Packaging International BV

- Packaging Corporation of America

- H.B. Fuller Company

- Atlantic Packaging

- NNZ Group

- Parakh Agro Industries Ltd

- International Paper Company

- DS Smith Plc

Recent Developments

- In Jul 2025, Bambrew secures $10.3M in funding to enhance its eco-friendly packaging solutions, aiming to expand its sustainable packaging production capacity and further develop innovative materials.

- In Nov 2024, Ukhi raises $1.2M in pre-seed funding to advance its bio-packaging solutions, positioning itself as a key player in the growing demand for sustainable alternatives to traditional packaging materials.

- In Jul 2025, Canpac Trends acquires Saptagiri Packagings Pvt. Ltd., bolstering its capabilities in premium and sustainable packaging solutions, with a strategic focus on expanding its product offerings and strengthening market position.

- In Mar 2024, AgroFresh acquires Pace International LLC, enhancing its post-harvest solutions portfolio and expanding its ability to provide innovative solutions to extend the shelf life of agricultural products.

Report Scope

Report Features Description Market Value (2024) USD 4.6 Billion Forecast Revenue (2034) USD 7.4 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bags/Bins, Pouches, Silo Bags, Clamshells, Bottle, Trays, Others), By Material Type (Plastic, Rigid, Flexible, Paperboard, Corrugated Board, Glass, Jute, Others), By Barrier Type (Low-barrier, Medium-barrier, High-barrier), By Capacity (≤25 kg, 26-100 kg, More than 100 kg), By Application (Food Grains, Seeds & Pesticides, Silage, Vegetables & Fruits, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bemis Company, Inc., Sonoco Products Company, Mondi Group, LC Packaging International BV, Packaging Corporation of America, H.B. Fuller Company, Atlantic Packaging, NNZ Group, Parakh Agro Industries Ltd, International Paper Company, DS Smith Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agriculture Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Agriculture Packaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bemis Company, Inc.

- Sonoco Products Company

- Mondi Group

- LC Packaging International BV

- Packaging Corporation of America

- H.B. Fuller Company

- Atlantic Packaging

- NNZ Group

- Parakh Agro Industries Ltd

- International Paper Company

- DS Smith Plc