Global Aerospace Foam Market By Type (Polyurethane, Polyimide, Metal Foams, Melamine, Polyethylene, and Others), By Application (Commercial Aviation, Military Aviation, and Business And General Aviation), By End-Use (OEM, and Aftermarket/MRO), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158770

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

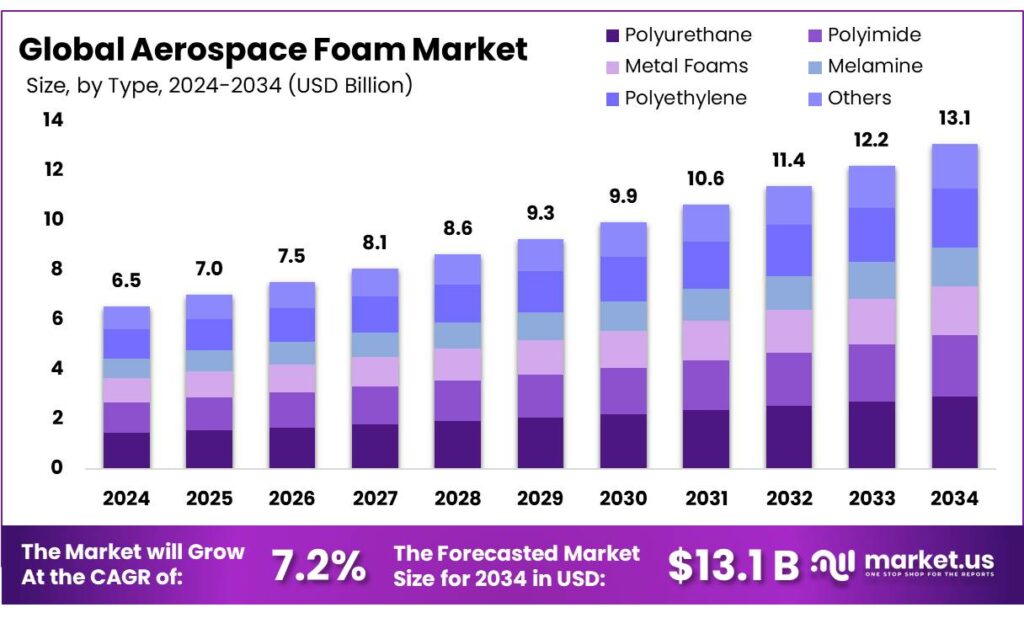

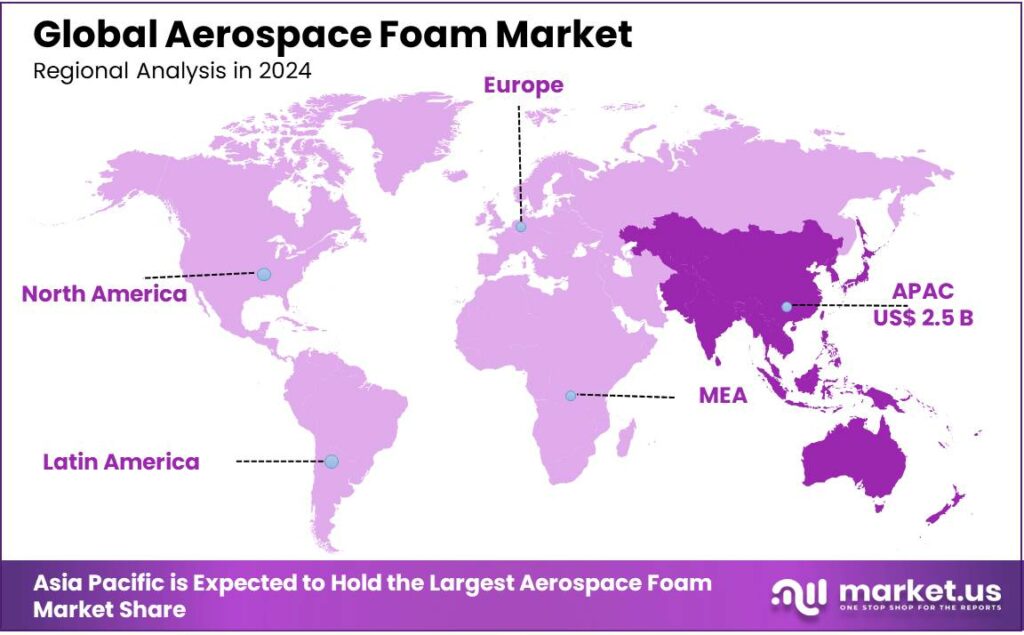

The Global Aerospace Foam Market size is expected to be worth around USD 13.1 Billion by 2034, from USD 6.5 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.5% share, holding USD 2.5 Billion in revenue.

Aerospace foam is a low-density, cellular structural material used in aircraft and spacecraft for its lightweight, insulating, and vibration-damping properties. It enhances efficiency and safety by providing temperature insulation, soundproofing, and energy absorption. One of the major drivers of the foam market in the aerospace industry is the demand for lightweight components to build aircraft for fuel efficiency. These foams are made from raw materials such as polyurethane, polyimide, metals, melamine, and polyethylene.

As almost all of these raw materials impact the environment, such concerns regarding natural welfare can hinder the growth of the market. However, in recent years, many technologies have emerged that focus on the circular economy by recycling and reusing the foams used in aircraft. Additionally, there have been advancements in the efficient raw materials used to manufacture foams for the aerospace industry. As air transport gains momentum, it is estimated that the aerospace foam market will grow to cater to the needs for manufacturing efficient aircraft.

- According to the International Air Transport Association (IATA), in 2024, there were roughly 4.8 billion passengers in the air.

Key Takeaways

- The global aerospace foam market was valued at USD 6.5 billion in 2024.

- The global aerospace foam market is projected to grow at a CAGR of 7.2% and is estimated to reach USD 13.1 billion by 2034.

- On the basis of types, polyurethane aerospace foam dominated the market in 2024, comprising about 22.1% share of the total global market.

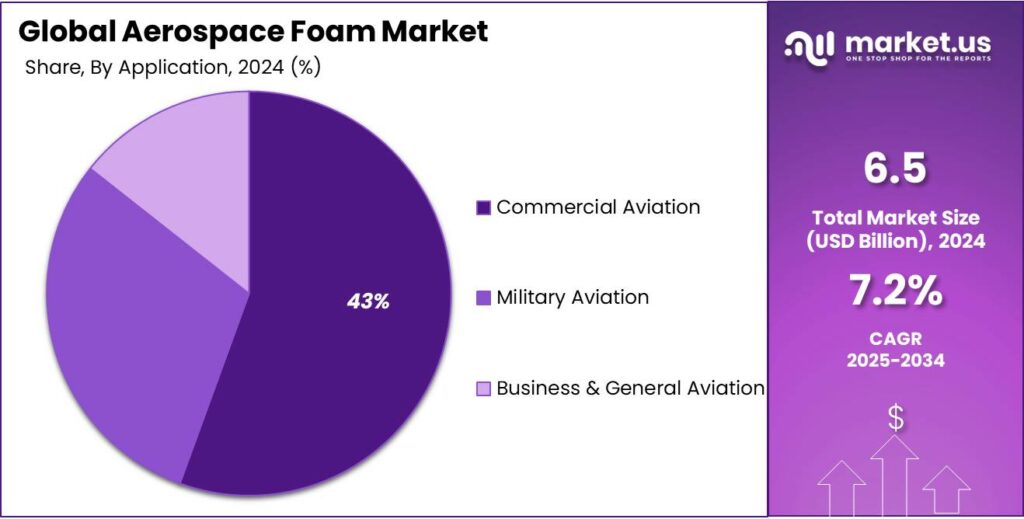

- Based on the applications of aerospace foam, in 2024, commercial aviation led the market, encompassing about 42.5% share of the total global market.

- Asia Pacific was the largest market for aerospace foam in 2024 due to its rapidly expanding aerospace industry.

Type Analysis

Polyurethane Foam Dominated the Aerospace Foam Market in 2024.

On the basis of type, the aerospace foam market is segmented into polyurethane, polyimide, metal foams, melamine, polyethylene, and others. Polyurethane foam dominated the market in 2024 with a market share of 22.1%. Polyurethane foam is the most widely used in the aerospace industry due to its optimal balance of lightweight properties, durability, cost-effectiveness, and versatility.

Unlike polyimide and melamine foams, which are more specialized and expensive, polyurethane offers excellent mechanical strength, flexibility, and insulation at a lower cost. It is widely used in aircraft seating, armrests, and insulation panels. In addition, compared to metal foams or polyethylene, polyurethane provides better cushioning, noise reduction, and ease of fabrication.

Application Analysis

Commercial Aviation Applications of Aerospace Foam Led the Market.

Based on the application of the aerospace foam, the market is divided into commercial aviation, military aviation, and business & general aviation. Commercial aviation of aerospace foam dominated the market in 2024 with a market share of 42.5%. Commercial aviation dominates the applications of aerospace foam primarily due to the sheer volume of aircraft production and passenger demand worldwide. Commercial aircraft, such as those produced by Boeing and Airbus, are manufactured in much higher numbers compared to military or business jets.

Each commercial aircraft contains large quantities of foam used in seating, insulation, soundproofing, and cabin interiors. For instance, a single Boeing 777 can seat over 300 passengers, requiring extensive use of polyurethane and other foams to ensure comfort, safety, and noise reduction. In contrast, military and general aviation aircraft are produced in smaller volumes and have more specialized, limited interior foam requirements.

Key Market Segments

By Type

- Polyurethane

- Polyimide

- Metal Foams

- Melamine

- Polyethylene

- Others

By Application

- Commercial Aviation

- Military Aviation

- Business & General Aviation

By End-Use

- OEM

- Aftermarket/MRO

Drivers

Demand for Lightweight Materials for Fuel Efficiency in Aircraft Drives the Aerospace Foam Market.

The increasing demand for lightweight materials to improve fuel efficiency in aircraft is a major driver of the aerospace foam market. Airlines and manufacturers are under pressure to reduce operating costs and carbon emissions, leading to a shift toward materials that contribute to overall weight reduction. Aerospace foams, such as polyurethane, polyethylene, and melamine foams, are used in a variety of interior and structural applications due to their light weight, thermal insulation, and acoustic properties.

- For instance, foam core covered with a brushed metal coating can replace the aluminum trim around seatback screens, decreasing the weight by more than 66% and the price by 33%. For every 1 kg of weight decreased, an aircraft saves roughly 0.03 kg of fuel for every 1,000 km flown, translating to substantial savings over long-haul flights.

Moreover, regulations from agencies such as the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) promoting energy-efficient and low-emission aircraft designs further support the use of advanced lightweight foams.

Restraints

Environmental Concerns Might Hamper the Growth of the Aerospace Foam Market.

Environmental concerns and pollution associated with the production and disposal of aerospace foams may hamper the growth of the aerospace foam market. Many foams, particularly those based on polyurethane and polystyrene, are derived from petroleum-based chemicals and involve the use of hazardous blowing agents that contribute to greenhouse gas emissions and ozone depletion. For instance, hydrofluorocarbons (HFCs), once commonly used in foam production, have a global warming potential thousands of times higher than CO₂.

Additionally, traditional foams are not biodegradable and often end up in landfills, where they persist for decades. Furthermore, the incineration of foam waste releases toxic fumes, such as isocyanates and dioxins, posing health and environmental risks. These factors have led to stricter regulations from environmental bodies such as the EPA and ECHA, which are placing increasing pressure on manufacturers to develop greener alternatives. Failure to adapt to these environmental standards could limit production capabilities and slow market expansion.

Opportunity

Technological Advancements in the Aerospace Foam Raw Materials Creates Opportunities in the Market.

Technological advancements in the development of raw materials for aerospace foams are creating significant opportunities in the aerospace foam market. Innovations in polymer chemistry and material science have led to the creation of foams with improved thermal resistance, fire retardancy, and mechanical strength while maintaining low density.

For instance, advancements in high-performance polyimide and melamine-based foams have enabled their use in demanding aerospace applications such as insulation panels, ducting, and cabin linings. These materials can withstand temperatures above 200°C and meet stringent flammability and smoke toxicity standards set by aviation regulators.

Additionally, the integration of nanomaterials, such as carbon nanotubes or graphene, into foam structures has enhanced properties such as conductivity and impact resistance without compromising weight. In addition, these advanced foams can reduce structural vibration and noise levels in aircraft cabins by up to 40%, enhancing passenger comfort.

Trends

Shift Towards Circular Economy.

The shift toward a circular economy and the recycling of foams is an emerging and influential trend in the aerospace foam market. With increasing environmental regulations and industry commitments to sustainability, aerospace manufacturers are exploring ways to reduce waste and enhance material lifecycle management. Traditional aerospace foams, particularly thermoset variants, have been difficult to recycle due to their cross-linked structures.

However, recent innovations in chemical recycling and the development of recyclable thermoplastic foams are addressing this challenge. For instance, closed-loop recycling systems allow polyurethane foams from decommissioned aircraft interiors to be processed and reused in non-critical aerospace components. This trend supports reduced carbon footprints and aligns with global aviation sustainability goals.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Aerospace Foam Market.

Geopolitical tensions significantly impact the aerospace foam market by disrupting global supply chains, increasing raw material costs, and altering defense and aviation priorities. Conflicts and strained relations between major economies, such as U.S.-China trade disputes and tensions in Eastern Europe, led to trade restrictions and sanctions on critical chemicals and polymers used in aerospace foam production.

For instance, aerospace-grade polyurethane and polyimide rely on specialized chemical feedstock that are imported from China in the US, and with reciprocal taxes of about 34% on all the Chinese chemical imports, the price of the chemicals and the raw material surged drastically.

Furthermore, heightened military tensions often shift focus toward defense spending, driving short-term demand for aerospace foams in military aircraft manufacturing, but potentially destabilizing long-term commercial aviation projects due to economic uncertainty. The Russia-Ukraine conflict, for instance, has affected the aerospace material supply in Europe, particularly titanium and composite feedstock, indirectly influencing foam availability. These dynamics make the aerospace foam market vulnerable to global political instability.

Regional Analysis

Asia Pacific was at the Forefront in the Global Aerospace Foam Market in 2024.

Asia Pacific held the major share of the global aerospace foam market, valued at around USD 2.5 billion, commanding an estimated 38.5% of total revenue share. The region has emerged at the forefront of the global aerospace foam market due to rapid advancements in the region’s aerospace manufacturing capabilities and increased air travel demand.

According to the International Air Transport Association (IATA), in 2024, the Asia-Pacific region accounted for a 33.6% share of the global passenger traffic market in terms of Revenue Passenger Kilometers (RPKs), with a year-on-year demand increase of 8.7%. Countries such as China, India, and Japan are investing heavily in both military and commercial aviation, driving the need for advanced materials like aerospace foams.

Additionally, low-cost carriers in the region are expanding their fleets, which boosts demand for cost-efficient, lightweight foams used in seating, insulation, and interior components. Similarly, the presence of local foam manufacturers and suppliers further strengthens the region’s position in the global aerospace foam supply chain.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major participants in the aerospace foam market are BASF SE, Boyd, Diab Group, DuPont, Aerofoam Industries, Armacell, Evonik Industries AG, Greiner Aerospace, Rogers Corporation, Technifab, UFP Technologies, Zotefoams plc, and Recticel NV/SA. To sustain a competitive advantage in the market, various companies undertake strategic initiatives. For instance, in June 2023, Solvay, a global market leader in polymer and composite materials, signed a long-term agreement with Zotefoams, the world’s largest manufacturer of innovative technical foams, for the supply of Solef polyvinylidene fluoride (PVDF) to manufacture a high-performance closed-cell cross-linked aerospace foam range.

Boyd is a global leader in precision-engineered, material-based solutions, with a significant focus on aerospace applications, including high-performance foam products such as Solimide insulation for aircraft. With strategically located production and design facilities worldwide, the company offers global capacity and local support to its customers.

DIAB Group is a global leader in structural core materials for sandwich composite applications, serving industries including aerospace, where they provide lightweight, high-strength Divinycell foam and thermoplastic foams. It is committed to environmentally friendly products and processes, with some products being recoverable and legacy products optimized to remove non-structural components.

Evonik Industries is a global specialty chemicals company that provides aerospace foam solutions, primarily its Rohacell brand of rigid structural foams. Their strategy emphasizes customer proximity, leading market positions, and customer-oriented innovation to drive profitable growth.

The major Players in The Industry

- BASF SE

- Boyd

- Diab Group

- DuPont

- 3A Composites

- Aerofoam Industries, LLC

- ARMACELL

- ERG Aerospace Corporation

- Evonik Industries AG

- General Plastics Manufacturing Company

- Grand Rapids Foam Technologies

- Greiner Aerospace

- Rogers Corporation

- Technifab, Inc.

- UFP Technologies, Inc.

- Zotefoams plc

- Recticel NV/SA

- Other Key Players

Key Developments

- In June 2025, ERG Aerospace, a leading developer of high-performance foam-based aerospace products, participated in the Paris Air Show to launch products engineered around Duocel foam technology, a lightweight, open-cell material with solid ligaments that forms the foundation of ERG’s advanced solutions.

- In June 2022, 3A Composites Core Materials acquired Solvay’s TegraCore polyphenylsulfone (PPSU) thermoplastic resin-based foam, which became part of a portfolio under the name Airex TegraCore.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 13.1 Bn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyurethane, Polyimide, Metal Foams, Melamine, Polyethylene, Others), By Application (Commercial Aviation, Military Aviation, Business & General Aviation), By End-Use (OEM and Aftermarket/MRO) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Boyd, Diab Group, DuPont, 3A Composites, Aerofoam Industries, LLC, Armacell, ERG Aerospace Corporation, Evonik Industries AG, General Plastics Manufacturing Company, Grand Rapids Foam Technologies, Greiner Aerospace, Rogers Corporation, Technifab, Inc., UFP Technologies, Inc., Zotefoams plc, Recticel NV/SA, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Boyd

- Diab Group

- DuPont

- 3A Composites

- Aerofoam Industries, LLC

- ARMACELL

- ERG Aerospace Corporation

- Evonik Industries AG

- General Plastics Manufacturing Company

- Grand Rapids Foam Technologies

- Greiner Aerospace

- Rogers Corporation

- Technifab, Inc.

- UFP Technologies, Inc.

- Zotefoams plc

- Recticel NV/SA

- Other Key Players