Global 3D Printed Drugs Market By Technology (Binder Jet/Inkjet Printing, Extrusion-Based Printing, Powder-Bed Fusion/Laser-Based Methods, Stereolithography (SLA)/Photopolymerisation and Others), By Application (Neurology, Chronic Disease Management, Targeted/Controlled Release Therapies and Others), By End-User (Pharmaceutical Manufacturers, Hospitals & Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172563

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

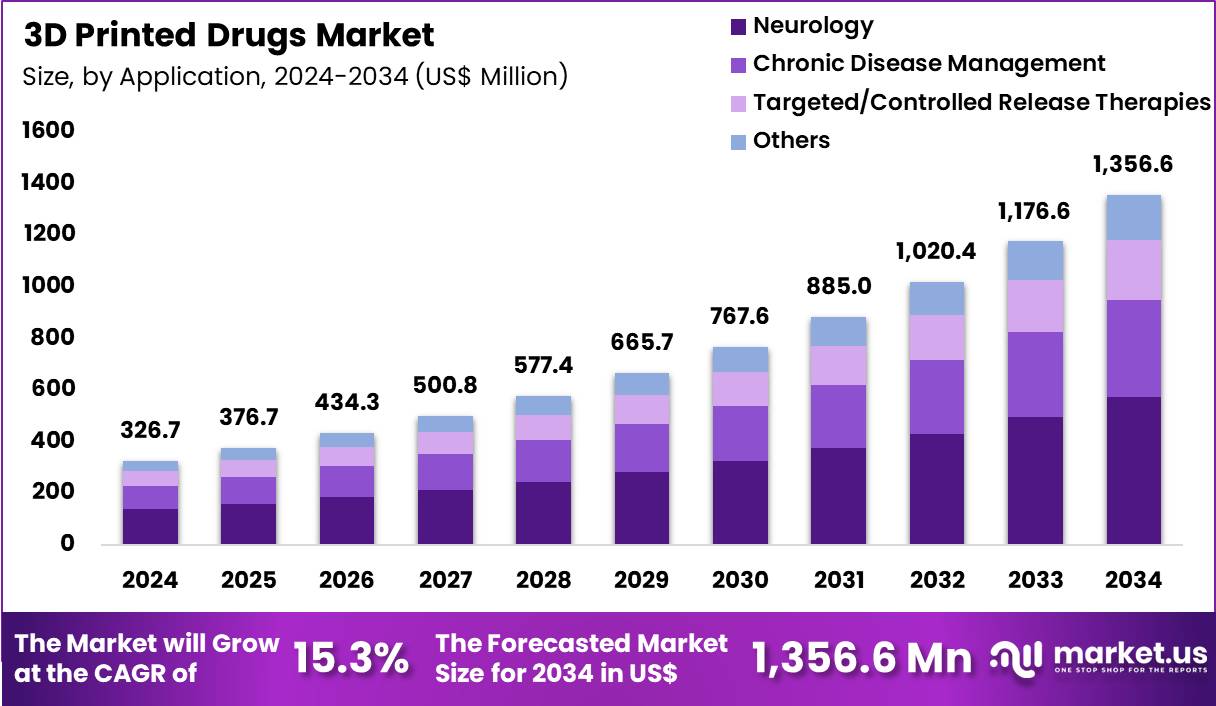

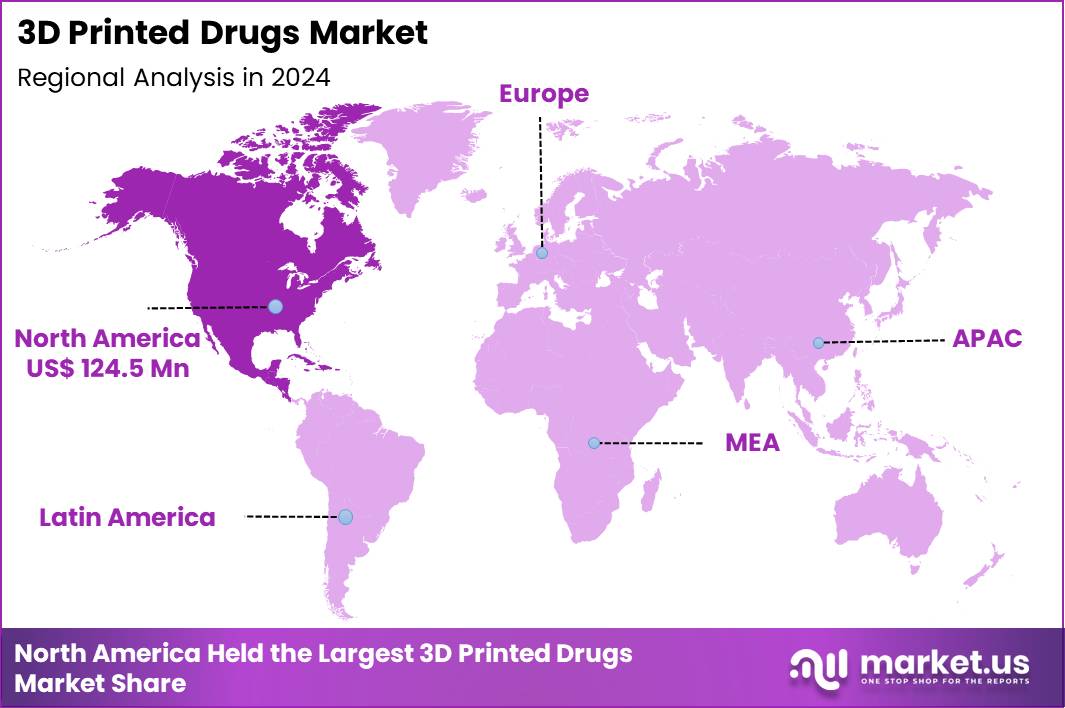

The Global 3D Printed Drugs Market size is expected to be worth around US$ 1356.6 Million by 2034 from US$ 326.7 Million in 2024, growing at a CAGR of 15.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.1% share with a revenue of US$ 124.5 Million.

Growing demand for personalized medication solutions propels pharmaceutical manufacturers to adopt 3D printing technologies that enable precise customization of dosage forms for individual patient profiles. Developers increasingly fabricate orodispersible tablets to address dysphagia challenges, allowing rapid dissolution in the mouth for patients with swallowing difficulties in neurology treatments. These techniques produce polypills that combine multiple active ingredients into single units, simplifying regimens for chronic conditions like hypertension and diabetes management.

Clinicians leverage 3D printed formulations for controlled-release profiles, optimizing therapeutic efficacy in pain management and psychiatric disorders. These methods support pediatric applications by creating flavored, chewable structures that enhance compliance in young patients requiring anticonvulsant therapy.

In April 2024, BMF Biotechnology Inc. was launched in San Diego to commercialize 3D BioChips capable of cultivating large scale tissues in vitro for drug and cosmetic development. This launch drives the 3D printed drugs market by expanding the use of high resolution bioprinting platforms in drug discovery, screening, and formulation development.

Advanced tissue models enable more accurate evaluation of drug behavior, supporting the design of complex, structure specific 3D printed drug products. Such capabilities accelerate innovation in personalized medicine and strengthen the translational pathway for 3D printed pharmaceuticals.

Pharmaceutical firms explore opportunities to implement binder jetting processes for high-dose loading in epilepsy medications, facilitating rapid disintegration and absorption without water intake. Companies engineer fused deposition modeling to incorporate thermoplastic polymers, enabling sustained delivery in cardiovascular therapies tailored to metabolic rates. These platforms expand applications in oncology by printing implants with localized chemotherapeutic release, minimizing systemic side effects during targeted tumor treatments.

Opportunities arise in geriatric care through multilayer tablets that sequence drug release, coordinating analgesics with anti-inflammatory agents for arthritis management. Developers pursue stereolithography for transparent hydrogel-based patches, delivering transdermal hormones in endocrine disorder protocols with adjustable permeation rates. Enterprises invest in semi-solid extrusion for viscous bioinks, crafting soft, swallowable forms suitable for nutritional supplements in malabsorption syndromes.

Industry innovators refine inkjet printing for micro-droplet deposition, achieving uniform distribution in multi-active polypills for metabolic disorder polypharmacy reduction. Manufacturers advance selective laser sintering to fuse powders without solvents, preserving stability in thermolabile biologics for immunotherapy applications. Market leaders integrate extrusion-based systems with smart excipients, triggering pH-responsive release in gastrointestinal-targeted anti-inflammatory drugs.

Developers incorporate digital light processing for high-throughput prototyping of gastro-retentive floating tablets in prolonged antibiotic therapies. Companies prioritize vat polymerization variants for biocompatible resins, forming flexible orodispersible films in acute migraine relief formulations. Ongoing advancements emphasize hybrid printing modalities that layer immediate and delayed release compartments, enhancing versatility in combination therapies for infectious disease management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 326.7 Million, with a CAGR of 15.3%, and is expected to reach US$ 1356.6 Million by the year 2034.

- The technology segment is divided into binder jet/inkjet printing, extrusion-based printing, powder-bed fusion/laser-based methods, stereolithography (SLA)/photopolymerisation and others, with binder jet/inkjet printing taking the lead in 2024 with a market share of 34.5%.

- Considering application, the market is divided into neurology, chronic disease management, targeted/controlled release therapies and others. Among these, neurology held a significant share of 42.2%.

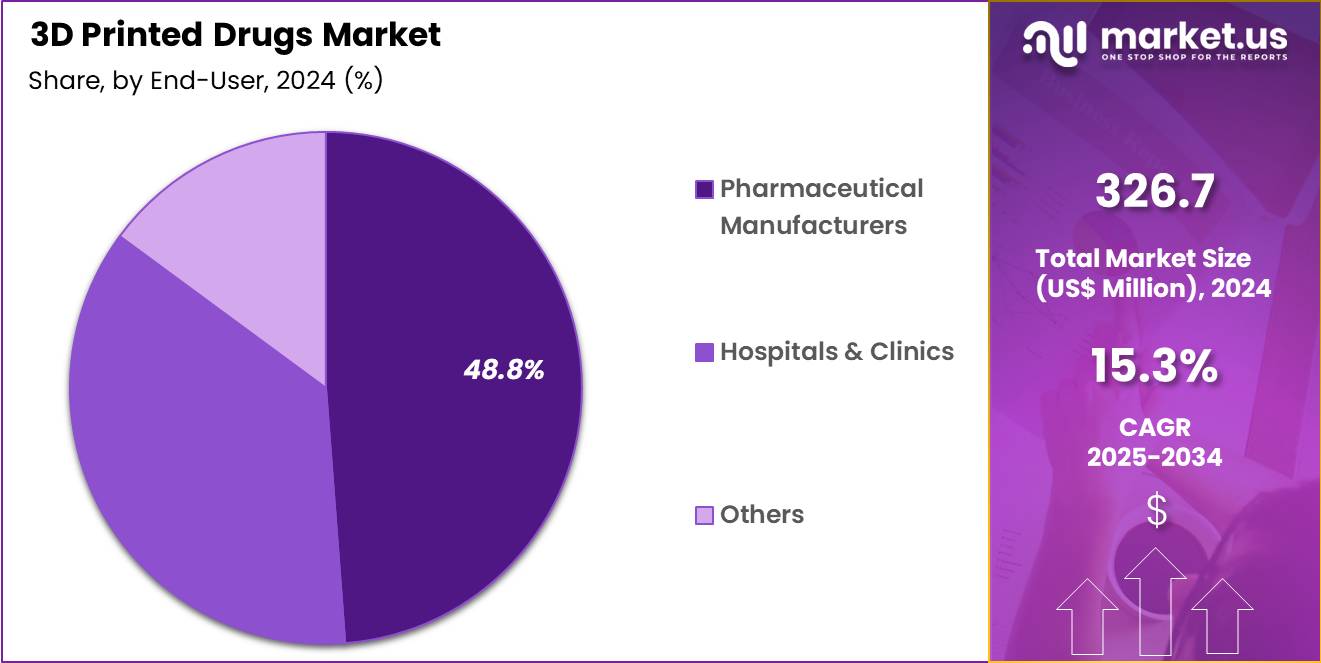

- The end-user segment is segregated into pharmaceutical manufacturers, hospitals & clinics and others, with the pharmaceutical manufacturers segment leading the market, holding a revenue share of 48.8%.

- North America led the market by securing a market share of 38.1% in 2024.

Technology Analysis

Binder jet or inkjet printing accounted for 34.5% of the 3D Printed Drugs market, driven by its suitability for precise dose deposition and high production repeatability. This technology supports accurate control over drug loading, which strengthens its role in personalized and multi dose formulations. Pharmaceutical developers favor binder jet or inkjet systems due to their compatibility with heat sensitive active ingredients.

Faster printing speeds compared to other additive methods improve scalability for commercial manufacturing. Regulatory familiarity with inkjet based processes improves confidence in clinical translation. The technology enables complex tablet geometries that support modified dissolution profiles. Cost efficiency in material usage enhances its appeal for pilot and mid scale production.

Integration with digital design platforms accelerates formulation optimization cycles. Growing focus on patient specific dosing further reinforces adoption. This segment is projected to expand steadily due to its precision, scalability, and formulation flexibility.

Application Analysis

Neurology represented 42.2% of the 3D Printed Drugs market, reflecting strong demand for individualized therapies in complex neurological disorders. Neurological conditions often require precise dosing adjustments, which aligns with the strengths of additive manufacturing. 3D printing enables customized release profiles that support stable drug plasma levels for neurological treatments.

Rising prevalence of epilepsy, Parkinson’s disease, and neurodegenerative disorders increases demand for advanced delivery solutions. Clinicians increasingly emphasize personalized medicine to improve treatment response and adherence. The ability to combine multiple drugs into a single printed dosage form simplifies therapy regimens.

Research institutions actively explore 3D printed formulations to address variability in neurological drug response. Regulatory interest in patient centric drug design supports clinical development activity. Improved therapeutic outcomes strengthen confidence among prescribers. As a result, neurology is anticipated to remain the leading application due to high customization needs and clinical complexity.

End-User Analysis

Pharmaceutical manufacturers held a 48.8% share of the 3D Printed Drugs market, supported by their central role in drug development and commercialization. These companies invest heavily in additive manufacturing to shorten formulation development timelines. Internal R and D teams leverage 3D printing to rapidly prototype and test novel dosage forms. Manufacturers use this technology to differentiate products through personalized and controlled release designs.

Alignment with precision medicine strategies enhances long term investment interest. Large scale players possess the regulatory expertise required to navigate approval pathways for printed drugs. Integration of 3D printing into existing production lines improves operational flexibility.

Strategic partnerships with technology providers accelerate innovation adoption. Intellectual property opportunities further attract manufacturer engagement. Consequently, pharmaceutical manufacturers are likely to maintain dominance due to resource strength, innovation capacity, and regulatory readiness.

Key Market Segments

By Technology

- Binder Jet/Inkjet Printing

- Extrusion-Based Printing

- Powder-Bed Fusion/Laser-Based Methods

- Stereolithography (SLA)/Photopolymerisation

- Others

By Application

- Neurology

- Chronic Disease Management

- Targeted/Controlled Release Therapies

- Others

By End-User

- Pharmaceutical Manufacturers

- Hospitals & Clinics

- Others

Drivers

Increasing research funding for personalized drug delivery is driving the market

The 3D printed drugs market is propelled by escalating research funding dedicated to personalized drug delivery systems, which enable tailored dosages and release profiles for individual patient needs. Funding bodies prioritize projects that leverage 3D printing to address challenges in pediatric and geriatric pharmacotherapy. Researchers utilize these resources to develop formulations that improve bioavailability and patient adherence.

Academic institutions collaborate with industry partners to advance binder jetting and extrusion techniques for pharmaceutical applications. Regulatory interest in innovative manufacturing methods encourages grant allocations for feasibility studies. Global health priorities, such as reducing medication errors, align with funded explorations in customized therapies.

Pharmaceutical developers benefit from subsidized prototyping to accelerate preclinical evaluations. Interdisciplinary teams integrate materials science with pharmacology in funded initiatives. In 2023, the National Institutes of Health awarded approximately $3 million to Texas A&M University for developing 3D printed pediatric medications. This investment exemplifies the momentum building toward scalable, patient-specific drug production technologies.

Restraints

Slow pace of regulatory approvals is restraining the market

The 3D printed drugs market is hindered by the slow pace of regulatory approvals, which requires extensive validation of manufacturing processes and product consistency. Developers must demonstrate equivalence to traditional methods in stability, purity, and efficacy through rigorous testing. Limited precedent for 3D printed formulations complicates submission dossiers and review timelines.

Regulatory agencies emphasize risk assessments for novel excipients and printing parameters. Small-scale manufacturers face disproportionate burdens in meeting good manufacturing practice standards. Post-approval monitoring obligations add operational complexities for market entrants. International harmonization lags, creating barriers to global commercialization.

Investor hesitation stems from uncertainty in approval pathways for complex geometries. No new 3D printed drug products received U.S. Food and Drug Administration approval between 2022 and 2024, per annual reports. These delays collectively stifle innovation and limit market entry for emerging technologies.

Opportunities

Potential for distributed manufacturing under new legislation is creating growth opportunities

The 3D printed drugs market presents opportunities through the potential for distributed manufacturing enabled by forthcoming legislation, allowing on-site production in pharmacies and hospitals. This framework supports real-time customization of medications for urgent or rare needs. Developers can explore point-of-care printing to reduce supply chain dependencies and enhance access in remote areas.

Regulatory shifts accommodate automation in compounding, fostering innovation in dosage forms. Partnerships between technology providers and healthcare facilities accelerate pilot implementations. Patient-centric models benefit from reduced lead times and minimized waste in drug production. Global adoption may extend to resource-limited settings with portable printing systems.

Intellectual property strategies protect proprietary printing algorithms in decentralized environments. Legislation effective in 2025 permits 3D printing within distributed manufacturing networks, as outlined in pharmaceutical industry analyses. These changes position the market for expanded scalability and diversified applications in personalized care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends accelerate the 3D printed drugs market as robust healthcare investments and escalating demand for personalized medicine compel pharmaceutical firms to scale up additive manufacturing for tailored dosages and rapid prototyping. Executives at innovative companies strategically deploy advanced printers and bioprinting inks, capitalizing on chronic disease surges to penetrate high-growth segments in precision therapeutics worldwide.

Stubborn inflation and economic slowdowns, however, inflate costs for raw polymers and active pharmaceutical ingredients, prompting developers to curtail R&D spending and delay clinical trials amid fiscal pressures. Geopolitical strains, particularly U.S.-China trade disputes and regional conflicts, routinely sever supply chains for essential 3D printing components and excipients, fostering production delays and operational uncertainties for globally reliant manufacturers.

Current U.S. tariffs elevate landed costs on imported pharmaceutical intermediates and equipment, amplifying procurement expenses for American distributors and eroding margins for importers dependent on overseas sources. These tariffs also incite reciprocal barriers from trading partners that constrain U.S. exports of cutting-edge 3D drug technologies and disrupt multinational collaborative efforts.

Still, the tariff pressures galvanize substantial commitments to North American fabrication centers and onshoring initiatives, forging resilient supply architectures that will accelerate technological breakthroughs and secure enduring market vitality for the long term.

Latest Trends

Advancements in 3D printing technologies for oral drug delivery is a recent trend

In 2024, the 3D printed drugs market has highlighted advancements in printing technologies tailored for oral drug delivery, emphasizing multi-material extrusion for controlled release profiles. These innovations enable fabrication of polypills combining multiple active ingredients in a single dosage form. Researchers focus on biocompatible polymers to enhance dissolution rates and targeted delivery.

Clinical studies evaluate printed orodispersible tablets for improved pediatric compliance. Manufacturers integrate digital twins for predictive modeling of print outcomes. Regulatory discussions address validation of layer-by-layer construction in quality assurance. Academic publications underscore scalability from benchtop to industrial printers.

Collaborative projects explore integration with robotics for high-throughput production. Ethical considerations guide equitable access to advanced formulations. This trend, as detailed in 2024 scientific reviews, promotes efficient and adaptable manufacturing paradigms in pharmaceuticals.

Regional Analysis

North America is leading the 3D Printed Drugs Market

In 2024, North America held a 38.1% share of the global 3D printed drugs market, driven by progressive regulatory frameworks and a surge in personalized pharmacotherapy tailored to individual patient needs. Biopharmaceutical companies accelerated development of layer-by-layer fabricated tablets that enable precise dosage adjustments for chronic conditions like epilepsy and inflammatory diseases, supported by federal incentives for innovative manufacturing techniques.

Academic collaborations with industry leaders refined melt extrusion deposition methods, enhancing drug bioavailability and compliance in pediatric and geriatric populations facing swallowing difficulties. Heightened focus on supply chain resilience prompted investments in on-demand printing systems, mitigating shortages during regional health crises. Venture funding targeted multi-drug polypills for comorbid therapies, aligning with national health priorities to reduce polypharmacy risks.

Hospital formularies increasingly incorporated these formulations for orphan drug applications, leveraging digital design tools for rapid prototyping. These initiatives collectively advanced therapeutic customization, positioning the region at the forefront of pharmaceutical evolution. Triastek obtained FDA IND clearances for four 3D printed drugs between 2022 and 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate vigorous expansion in 3D printed pharmaceuticals throughout Asia Pacific over the forecast period, propelled by governmental pushes for indigenous innovation and addressing unmet needs in densely populated areas with limited access to conventional medications. Health ministries allocate resources to pilot programs fabricating customized orodispersible films for infectious disease management, optimizing release profiles suited to tropical stability requirements.

Local startups engineer binder jetting platforms for mass production of combination therapies targeting diabetes and hypertension epidemics among urban workers. International tech transfers equip university labs with stereolithography equipment, accelerating trials for sustained-release implants in oncology care. Economic partnerships foster regulatory alignments, enabling exporters to scale polypill outputs compliant with international bioavailability standards.

Community clinics adopt desktop printers for immediate-response formulations during outbreaks, bridging gaps in remote healthcare delivery. These strategies harness demographic scale and policy agility, fortifying regional self-reliance in drug supply. China’s NMPA granted IND clearances to five 3D printed products from Triastek by March 2023.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the 3D Printed Drugs market drive growth by advancing proprietary printing platforms that enable precise dose control, complex release profiles, and patient-specific formulations aligned with precision medicine goals. Companies expand adoption by collaborating with regulators and healthcare providers to demonstrate manufacturing reliability, quality assurance, and therapeutic consistency at commercial scale.

Strategic focus includes lifecycle management through customized dosing strengths and novel drug formats that improve adherence in pediatric, geriatric, and dysphagia populations. Commercial teams pursue partnerships with pharma innovators to apply printing technologies to reformulations and niche indications where differentiation matters most.

Investment priorities center on scalable production, materials science, and digital design workflows that shorten development timelines. Aprecia Pharmaceuticals anchors the space with its ZipDose technology, FDA-approved manufacturing capabilities, and focused strategy on leveraging additive manufacturing to deliver differentiated oral solid dosage medicines.

Top Key Players

- Aprecia Pharmaceuticals LLC

- FabRx Ltd

- Cycle Pharmaceuticals

- Osmotica Pharmaceuticals

- Hewlett Packard Caribe

- Teva Pharmaceuticals

- Affinity Therapeutics

- Bioduro

- Extend Biosciences

- Triastek

- Laxxon Medical

- CurifyLabs

- MB Therapeutics

Recent Developments

- In December 2024, Biosapien completed a USD 5.5 million pre series A fundraising round to advance its patented localized cancer drug delivery platform. This development drives the 3D printed drugs market by accelerating investment into precision drug delivery systems that benefit from additive manufacturing for customized dosing, localized release, and complex geometries. Funding support enables further integration of 3D printing technologies in drug formulation and delivery design, strengthening the role of patient specific, locally administered therapeutics within oncology focused 3D printed drug pipelines.

- In March 2024, Desktop Metal, through its healthcare division Desktop Health, launched the ScanUP digital dentistry program to enhance digital workflows and patient care efficiency. This initiative supports the 3D printed drugs market by advancing digital healthcare ecosystems where personalized treatment planning and fabrication intersect. Improved digital dentistry infrastructure promotes broader acceptance of additive manufacturing in clinical environments, indirectly reinforcing the adoption of 3D printed pharmaceutical forms such as customized dental drug devices, localized therapeutics, and patient specific dosage formats.

Report Scope

Report Features Description Market Value (2024) US$ 326.7 Million Forecast Revenue (2034) US$ 1356.6 Million CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Binder Jet/Inkjet Printing, Extrusion-Based Printing, Powder-Bed Fusion/Laser-Based Methods, Stereolithography (SLA)/Photopolymerisation and Others), By Application (Neurology, Chronic Disease Management, Targeted/Controlled Release Therapies and Others), By End-User (Pharmaceutical Manufacturers, Hospitals & Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aprecia Pharmaceuticals LLC, FabRx Ltd, Cycle Pharmaceuticals, Osmotica Pharmaceuticals, Hewlett Packard Caribe, Teva Pharmaceuticals, Affinity Therapeutics, Bioduro, Extend Biosciences, Triastek, Laxxon Medical, CurifyLabs, MB Therapeutics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aprecia Pharmaceuticals LLC

- FabRx Ltd

- Cycle Pharmaceuticals

- Osmotica Pharmaceuticals

- Hewlett Packard Caribe

- Teva Pharmaceuticals

- Affinity Therapeutics

- Bioduro

- Extend Biosciences

- Triastek

- Laxxon Medical

- CurifyLabs

- MB Therapeutics