Global 2,2-Dimethoxypropane Market Size, Share Analysis Report By Types (Below 99.0%, 99.0-99.5%, Above 99.5%), By Application (Pharmaceuticals, Pesticide, Perfume, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159990

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

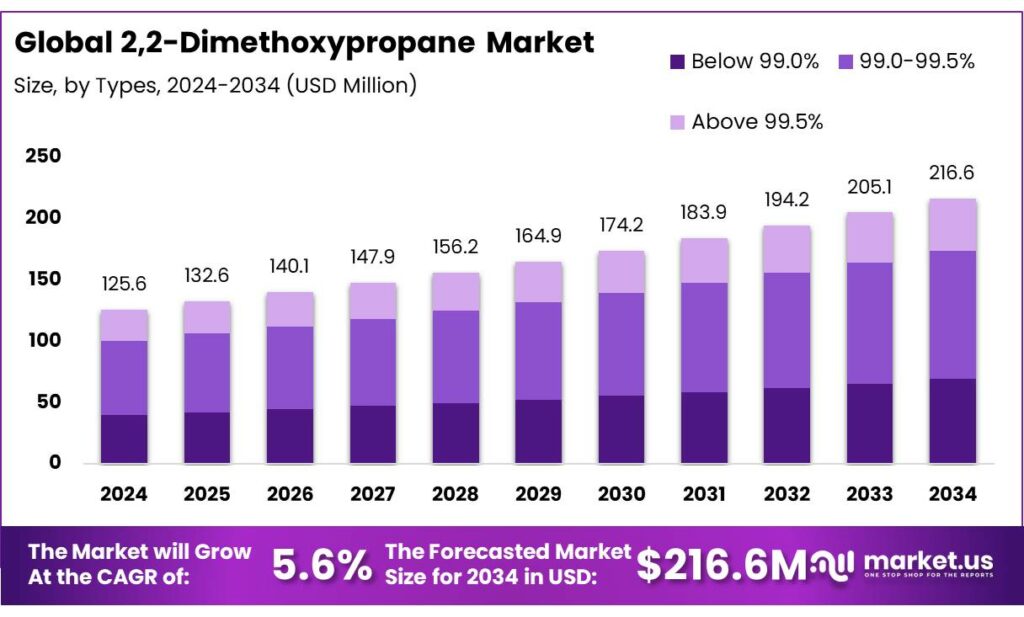

The Global 2,2-Dimethoxypropane Market size is expected to be worth around USD 216.6 Million by 2034, from USD 125.6 Million in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

2,2-Dimethoxypropane (DMP), also known as acetone dimethyl acetal, is a colorless liquid organic compound with the molecular formula C₅H₁₂O₂. It is primarily utilized as a reagent in organic synthesis, particularly as a water scavenger in reactions sensitive to moisture. 2,2-Dimethoxypropane is produced through the condensation of acetone and methanol, resulting in a compound that effectively binds water molecules, facilitating reactions that require anhydrous conditions.

The Indian chemical industry is a significant contributor to the nation’s economy, accounting for approximately 7% of the Gross Domestic Product (GDP) as of 2022. India ranks as the world’s sixth-largest producer of chemicals and the third-largest in Asia. The sector generates employment for over five million people and produces around 80,000 different chemical products.

The industrial scenario for 2,2-Dimethoxypropane is characterized by a few key manufacturers, including BASF, Ningbo Huana Chemical, Jiangsu Dingye Pharmaceutical, and Hangzhou Ruiqi Chemical. These companies dominate the global supply, with the top three accounting for a significant share of the market revenue. In India, companies like Yeve Chemicals contribute to the supply chain, offering 2,2-Dimethoxypropane with a monthly production capacity of 10,000 kilograms.

Driving factors for the growth of the 2,2-Dimethoxypropane market include its essential role in pharmaceutical synthesis, particularly in the production of intermediates for various drugs. Additionally, the compound’s application in agrochemicals, such as pesticides and herbicides, contributes to its demand. The increasing need for efficient chemical synthesis processes, coupled with the expansion of the pharmaceutical and agrochemical industries, further propels the market growth.

Key Takeaways

- 2,2-Dimethoxypropane Market size is expected to be worth around USD 216.6 Million by 2034, from USD 125.6 Million in 2024, growing at a CAGR of 5.6%.

- 99.0-99.5% held a dominant market position, capturing more than a 48.2% share.

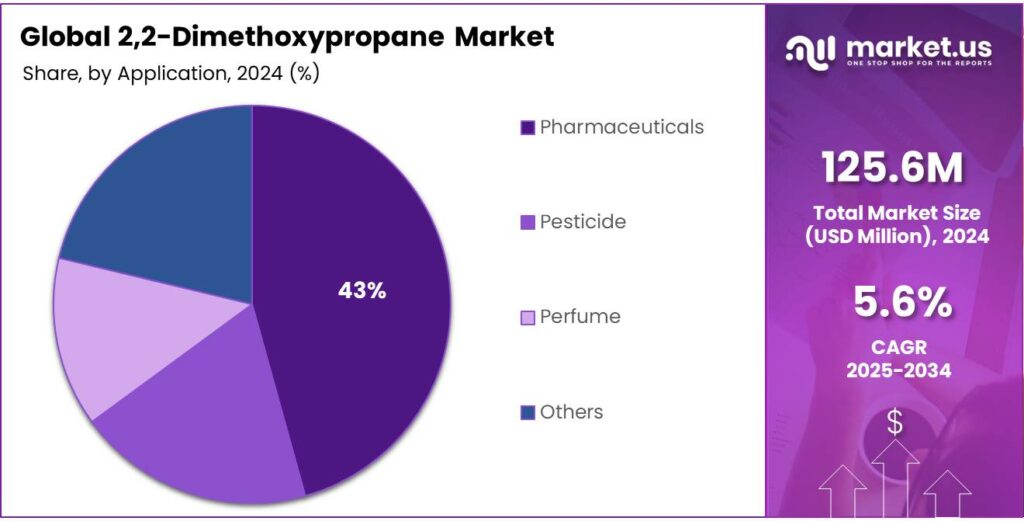

- Pharmaceuticals held a dominant market position, capturing more than a 43.8% share.

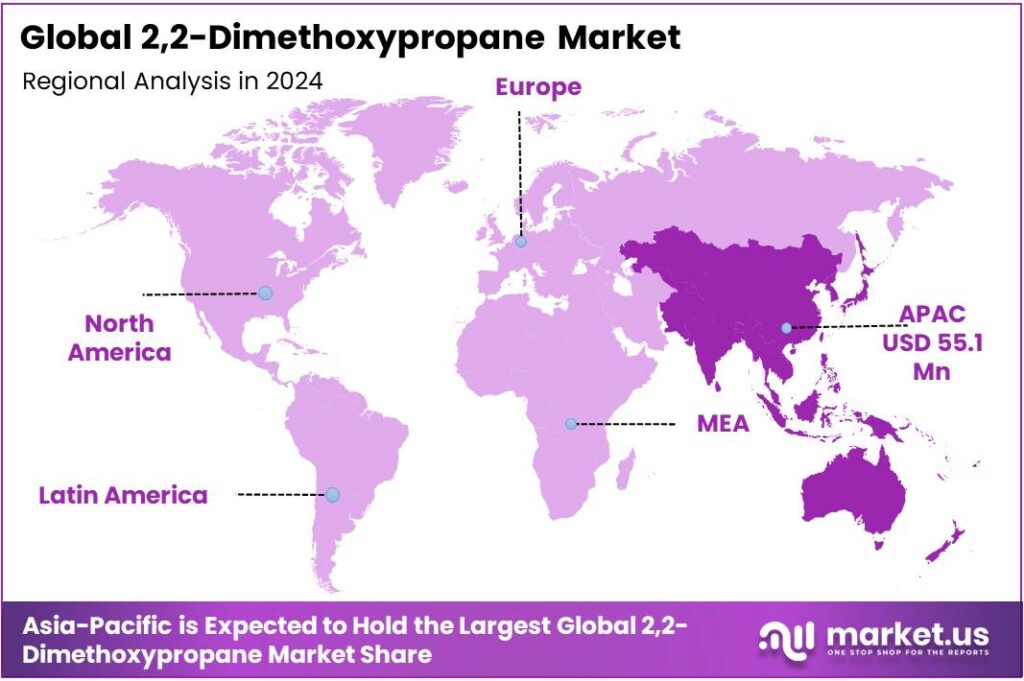

- Asia Pacific (APAC) region held a dominant position in the global 2,2-Dimethoxypropane market, capturing more than a 43.9% share, valued at approximately USD 55.1 million.

By Type Analysis

99.0-99.5% purity dominates with 48.2% share in 2024 due to balanced cost and performance

In 2024, 99.0-99.5% held a dominant market position, capturing more than a 48.2% share of the total 2,2-Dimethoxypropane market by purity type. This mid-grade purity is preferred by many buyers because it offers a strong balance between high performance and moderate cost. Industries such as pharmaceuticals, cosmetics/perfume, and pesticides often accept this purity range when ultra-high (>99.5%) purity is not strictly required, but consistency and reliability are essential. Demand in 2024 showed that manufacturers producing 2,2-Dimethoxypropane in this range benefited from scale economies, stable raw material access, and less demanding purification steps compared to the >99.5% range.

By 2025, the 99.0-99.5% segment continues to be strong; though growth in the >99.5% category is seen in niche uses, this mid-purity type remains the go-to choice for many bulk applications. Buyers in pesticide formulation and perfume production in regions such as Asia Pacific and Europe are especially driving demand for 99.0-99.5% due to its acceptable purity for end‐use, lower cost of procurement, and easier supply chain logistics. The persistent lead of this purity band is supported by its technical suitability, favorable cost-benefit ratio, and current manufacturing capabilities.

By Application Analysis

Pharmaceuticals dominate with 43.8% share in 2024 driven by strong demand for formulation intermediates

In 2024, Pharmaceuticals held a dominant market position, capturing more than a 43.8% share of the 2,2‑Dimethoxypropane market by application. The strong demand in this segment is primarily driven by its use as a key reagent and intermediate in drug synthesis, protecting sensitive functional groups, and enabling controlled reactions in active pharmaceutical ingredient (API) production. The compound’s efficiency in acetal formation and water scavenging makes it highly valuable in formulations requiring high stability and purity. Pharmaceutical manufacturers increasingly prefera 2,2‑Dimethoxypropane because it simplifies reaction steps, reduces solvent usage, and helps maintain high yields, contributing to cost‑effective production.

By 2025, the pharmaceutical segment is expected to maintain its leading position as demand grows from both generic and specialty drug manufacturers. With rising global healthcare expenditure, especially in regions such as North America and Asia Pacific, the requirement for reliable and high-quality reagents like 2,2‑Dimethoxypropane continues to expand. Its application in both small-molecule drugs and complex APIs ensures that the pharmaceutical sector remains the primary driver of market growth, supporting consistent volume and value contributions to the overall 2,2‑Dimethoxypropane market.

Key Market Segments

By Types

- Below 99.0%

- 99.0-99.5%

- Above 99.5%

By Application

- Pharmaceuticals

- Pesticide

- Perfume

- Others

Emerging Trends

Integration of 2,2-Dimethoxypropane in Pharmaceutical and Biochemical Research

In recent years, 2,2-Dimethoxypropane (DMP) has garnered attention in the pharmaceutical and biochemical research sectors due to its unique properties as a dehydrating agent and its role in protecting hydroxyl groups during chemical reactions. This trend is particularly evident in India, where advancements in chemical research and development are being actively supported by government initiatives.

The Indian government’s commitment to enhancing the chemical and pharmaceutical industries is reflected in various policy measures and investments. For instance, the Department for Promotion of Industry and Internal Trade (DPIIT) has facilitated $300 million in investments across sectors such as automotive, chemicals, and textiles, with companies like Lubrizol making substantial commitments in Maharashtra and Gujarat. These investments are expected to bolster the domestic production of specialty chemicals, including DMP, thereby reducing dependency on imports and fostering innovation within the country.

Furthermore, the government’s focus on establishing world-class industrial smart cities under the National Industrial Corridor Development Programme (NICDP) is set to create modern industrial hubs equipped with next-generation technologies. These developments are anticipated to generate significant employment opportunities and attract further investments in the chemical sector, providing a conducive environment for the growth of DMP-related applications.

The integration of DMP in pharmaceutical and biochemical research aligns with the global shift towards more efficient and sustainable chemical processes. Its application in the synthesis of various compounds underscores its importance in advancing research methodologies and therapeutic developments.

Drivers

Government Initiatives and Policy Support in India

One of the significant drivers propelling the growth of the 2,2-Dimethoxypropane (DMP) market is the robust support from the Indian government aimed at enhancing the chemical and petrochemical sectors. These initiatives are fostering a conducive environment for domestic manufacturing, research, and innovation, thereby stimulating demand for specialty chemicals like DMP.

The Indian government has been actively promoting the chemical industry through various schemes and policies. For instance, the Petrochemicals Research & Innovation Commendation (PRIC) Scheme was introduced to recognize and support innovations in the petrochemical sector. This scheme encourages research and development, leading to more efficient energy consumption, better plastic waste management, and the development of new products. Such initiatives not only enhance the industry’s competitiveness but also create a favorable market for chemicals like DMP, which are integral to advanced chemical processes.

Furthermore, the government’s focus on improving the Ease of Doing Business (EoDB) has significantly impacted the chemical sector. By streamlining regulatory processes and reducing bureaucratic hurdles, India has become an attractive destination for both domestic and international investments in the chemical industry. This policy shift has led to increased production capacities and technological advancements, thereby boosting the demand for high-quality chemical intermediates such as DMP.

The Department of Chemicals and Petrochemicals (DCPC) has also been instrumental in implementing flagship initiatives to improve the overall competitiveness, quality, and output of the chemical industry. These efforts are part of a broader strategy to transform India into a global chemical manufacturing hub, which in turn drives the demand for specialty chemicals like DMP.

Restraints

Environmental and Regulatory Challenges

The production and use of 2,2-Dimethoxypropane (DMP) face significant hurdles due to stringent environmental regulations and sustainability concerns. These challenges are particularly pertinent in India, where the chemical industry is under increasing scrutiny to adopt eco-friendly practices and reduce its environmental footprint.

In India, the chemical sector’s contribution to the national economy is substantial, with the industry accounting for approximately 2.1% of the country’s Gross Value Added (GVA) in 2022–23. Despite this, the sector grapples with environmental issues such as hazardous waste management, solvent emissions, and energy consumption. The government’s push for sustainable practices has led to the implementation of stringent regulations, including the Hazardous and Other Wastes Rules and the Environment Protection Act, which impose limitations on the use of certain chemicals and production methods.

These regulations necessitate significant investments in cleaner technologies and compliance measures, which can be particularly challenging for small and medium enterprises (SMEs) in the chemical industry.

Moreover, the Indian government’s initiatives, such as the Production-Linked Incentive (PLI) scheme, aim to promote self-reliance in the chemical sector by encouraging domestic manufacturing. While these policies are beneficial, they also require companies to meet specific environmental standards and adopt sustainable practices to qualify for incentives. This dual pressure of adhering to environmental regulations and meeting policy criteria can strain the resources of chemical manufacturers, especially those dealing with specialty chemicals like DMP.

The emphasis on sustainability has also led to a shift in consumer and industry preferences towards greener alternatives. This trend poses a challenge for DMP, as its production and application processes may not align with the growing demand for environmentally friendly chemicals. Consequently, manufacturers are compelled to invest in research and development to modify existing processes or develop new, more sustainable methods of production. Such investments can be resource-intensive and may not yield immediate returns, further complicating the growth prospects for DMP in the current regulatory landscape.

Opportunity

Expansion of India’s Chemical Sector and Government Support

India’s chemical industry is experiencing significant growth, presenting substantial opportunities for 2,2-Dimethoxypropane (DMP) manufacturers. The sector’s expansion is driven by increasing domestic demand, export potential, and robust government initiatives aimed at enhancing manufacturing capabilities.

The Indian government recognizes the chemical industry as a key growth element and aims to increase its share to approximately 25% of the GDP in the manufacturing sector by 2025. To achieve this, the government has implemented various initiatives, including the Production-Linked Incentive (PLI) scheme, which offers financial incentives to domestic manufacturers to boost production and innovation. Additionally, the “Make in India” and “Atmanirbhar Bharat” campaigns encourage local manufacturing and reduce dependency on imports.

These government initiatives are creating a favorable environment for the growth of the chemical sector, including the demand for specialty chemicals like DMP. Manufacturers are encouraged to invest in capacity expansion, research and development, and adoption of sustainable practices to align with national objectives and global standards. This support not only enhances the competitiveness of Indian chemical products in the global market but also drives innovation and quality improvements within the industry.

Regional Insights

Asia Pacific leads with 43.9% share in 2024, valued at USD 55.1 million, driven by robust demand in pharmaceuticals and agrochemicals

In 2024, the Asia Pacific (APAC) region held a dominant position in the global 2,2-Dimethoxypropane market, capturing more than a 43.9% share, valued at approximately USD 55.1 million. This leadership is attributed to the region’s strong industrial base, substantial chemical manufacturing capacity, and increasing demand from end-use industries such as pharmaceuticals, agrochemicals, and specialty chemicals.

The pharmaceutical sector in APAC is a significant consumer of 2,2-Dimethoxypropane, utilizing it as a reagent in the synthesis of various active pharmaceutical ingredients (APIs). The growing healthcare infrastructure and rising pharmaceutical production in countries like India and China contribute to the increased demand for this compound. Additionally, the agrochemical industry in APAC employs 2,2-Dimethoxypropane in the formulation of pesticides and herbicides, further bolstering its market presence.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF, a global leader in the chemical industry, offers a wide range of specialty chemicals, including 2,2-Dimethoxypropane. The company is known for its innovation and sustainable solutions, which cater to various sectors such as agriculture, automotive, and healthcare. BASF’s expertise in research and development enables it to produce high-quality products that meet industry standards, positioning the company as a key player in the chemical market worldwide.

Jiangsu Dingye Pharmaceutical is a prominent Chinese chemical manufacturer that provides a wide range of pharmaceutical intermediates, including 2,2-Dimethoxypropane. Known for its efficient production processes, the company serves the global market, particularly in the areas of chemical synthesis and drug development. Jiangsu Dingye Pharmaceutical emphasizes quality and customer satisfaction, positioning itself as a reliable player in the chemical industry.

Sanjaychem India is a well-established supplier of specialty chemicals, including 2,2-Dimethoxypropane, catering to pharmaceutical, chemical, and industrial sectors. Based in India, the company is committed to delivering high-quality products and services. Sanjaychem India’s focus on research, manufacturing, and distribution ensures it remains competitive in the global chemical market, offering reliable solutions for clients worldwide.

Top Key Players Outlook

- BASF

- Ningbo Huana Chemical

- Jiangsu Dingye Pharmaceutical

- EMCO Dyestuff

- Sanjaychem India

- Mubychem

- Manasa Life Sciences.

- Jignesh Agency Pvt Ltd

Recent Industry Developments

In September 2024 BASF’s, inaugurated a new world-scale production plant for alkyl ethanolamines at its Verbund site in Antwerp, Belgium. This investment increased BASF’s global annual production capacity for alkyl ethanolamines, including dimethyl ethanolamine (DMEOA) and methyl diethanolamine (MDEOA), by nearly 30% to more than 140,000 tons per year.

EMCO’s manufacturing unit is located in Surat, Gujarat, where it produces a wide array of chemicals, including DMP. The company exports its products to over 50 countries, with significant markets in Canada, Australia, the Philippines, Russia, and Chile.

Report Scope

Report Features Description Market Value (2024) USD 125.6 Mn Forecast Revenue (2034) USD 216.6 Mn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Below 99.0%, 99.0-99.5%, Above 99.5%), By Application (Pharmaceuticals, Pesticide, Perfume, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Ningbo Huana Chemical, Jiangsu Dingye Pharmaceutical, EMCO Dyestuff, Sanjaychem India, Mubychem, Manasa Life Sciences., Jignesh Agency Pvt Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  2,2-Dimethoxypropane MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

2,2-Dimethoxypropane MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Ningbo Huana Chemical

- Jiangsu Dingye Pharmaceutical

- EMCO Dyestuff

- Sanjaychem India

- Mubychem

- Manasa Life Sciences.

- Jignesh Agency Pvt Ltd