Global 2-Ethylhexanol Market Size, Share, And Business Benefits By Purity (Lower than 99% Purity, 99%-99.5% Purity, Higher than 99.5% Purity), By Application (Plasticizers, 2-EH Acrylate, 2-EH Nitrate, Others), By End Use (Building and Construction, Electrical and Electronics, Automotive, Personal Care, Food and Beverage, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 139549

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

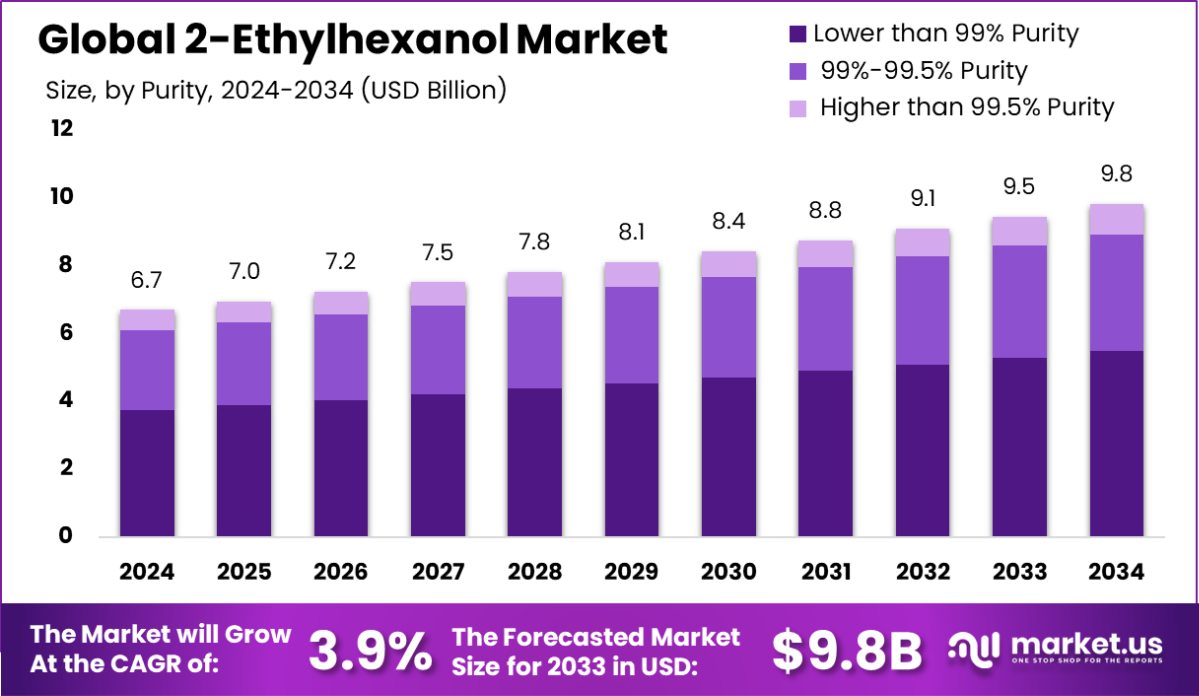

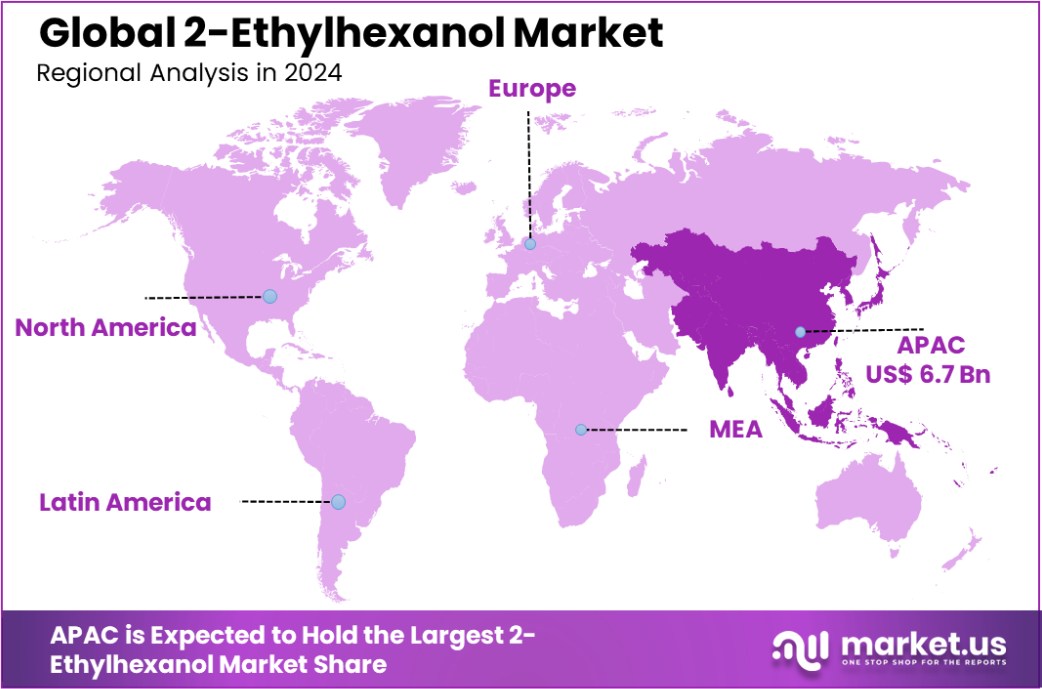

The Global 2-Ethylhexanol Market is expected to be worth around USD 9.8 Billion by 2034, up from USD 6.7 Billion in 2024, and grow at a CAGR of 3.9% from 2025 to 2034. Asia-Pacific led the 2-Ethylhexanol market with 41.3%, reaching USD 6.7 Bn.

2-Ethylhexanol (2-EH) is an organic compound, a higher aliphatic alcohol primarily used as a feedstock in the manufacture of low-volatility esters such as dioctyl phthalate. It is a colorless liquid that is poorly soluble in water but soluble in most organic solvents. 2-EH serves as a key ingredient in the production of plasticizers, coatings, adhesives, and other specialty chemicals.

The 2-Ethylhexanol market is witnessing significant growth driven by the rising demand for plasticizers in various applications including flooring, wall coverings, and consumer goods. The global expansion of the automotive and construction industries further amplifies the demand for flexible PVC, which uses 2-EH-based plasticizers, thereby propelling market growth.

The primary growth factor for the 2-Ethylhexanol market is the increasing utilization of flexible PVC in various end-user industries such as automotive, construction, and healthcare. 2-EH acts as a crucial component in the production of plasticizers, which are essential for manufacturing flexible, durable PVC products. Additionally, advancements in the chemical processing and coatings industries support the consumption of 2-EH, promoting further market expansion.

The 2-Ethylhexanol market is thriving due to its critical role in the growing global plasticizer market, driven by shifts towards environmentally friendly non-phthalate options and increasing industrial uses. Additionally, opportunities in developing sustainable, bio-based 2-EH and expansion in burgeoning Asia-Pacific markets offer substantial potential for market players looking to innovate and capture emerging demand in these dynamic sectors.

The 2-Ethylhexanol market is positioned for strategic growth, bolstered by the evolving regulatory landscape and increasing industrial applications. Notably, the classification of the compound under California’s Proposition 65 for carcinogenicity evaluation underscores the urgency for innovation in safer, non-phthalate plasticizers.

Moreover, the availability of financial incentives, such as grants covering up to 20% of project costs from state governments and public sector undertakings, further enhances the market’s potential for growth and transformation.

Key Takeaways

- The Global 2-Ethylhexanol Market is expected to be worth around USD 9.8 Billion by 2034, up from USD 6.7 Billion in 2024, and grow at a CAGR of 3.9% from 2025 to 2034.

- The 2-Ethylhexanol market sees 56.1% of its products with a purity between 99% and 99.5%.

- Plasticizers dominate applications, representing 46.2% of the 2-Ethylhexanol market usage.

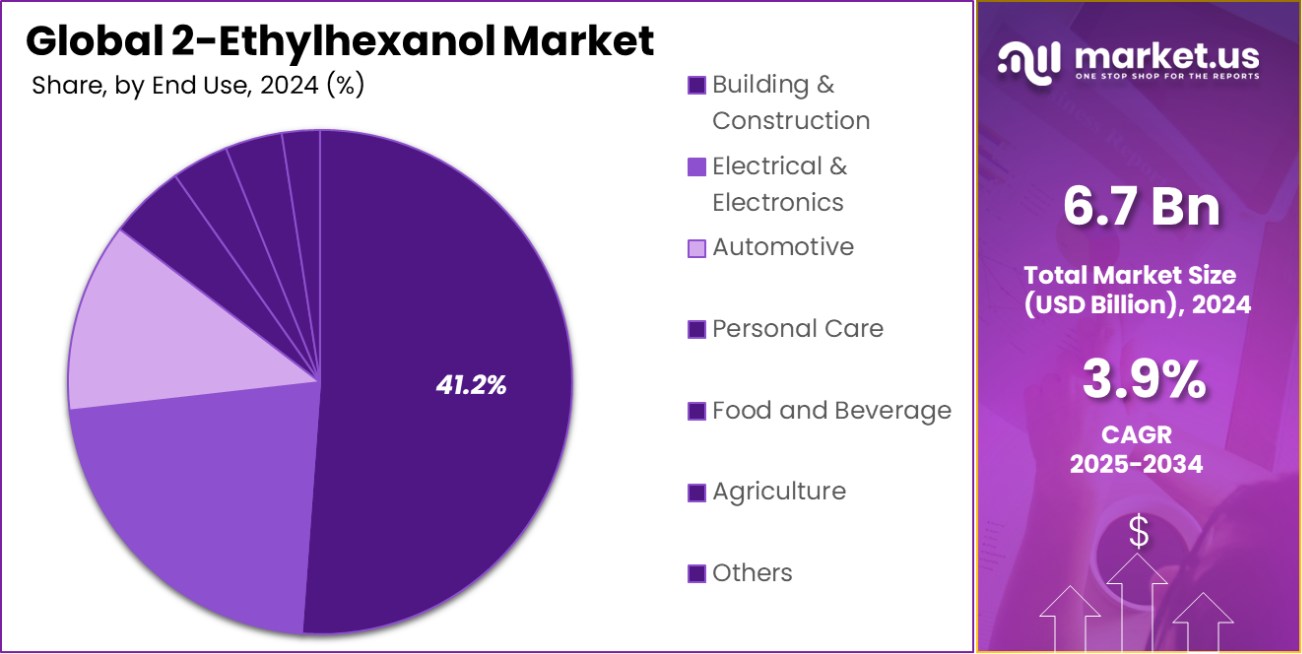

- Building and construction end uses constitute 41.2% of the market for 2-Ethylhexanol.

- Asia-Pacific dominated the 2-Ethylhexanol Market with a 41.3% share, reaching USD 6.7 billion.

By Purity Analysis

The 2-Ethylhexanol Market sees 56.1% purity between 99% and 99.5%.

In 2024, the By Purity segment of the 2-Ethylhexanol Market was significantly led by the 99%-99.5% purity category, capturing a dominant 56.1% market share. This segment outperformed others due to its optimal balance of purity and cost-effectiveness, making it highly preferable across various industrial applications.

The substantial share held by this purity range underscores its critical role in manufacturing processes where high efficiency and specific performance standards are essential, yet cost constraints are still a consideration. This purity level meets the stringent requirements for producing acrylates and plasticizers, which are pivotal in the production of flexible PVC used in construction, automotive, and consumer goods.

Notably, the market segments by purity are stratified into three primary categories: Lower than 99% Purity, 99%-99.5% Purity, and Higher than 99.5% Purity. The dominance of the 99%-99.5% segment reflects its widespread acceptance and application, affirming its essential position in the market dynamics of 2-Ethylhexanol.

This segment’s prominence is projected to influence future market strategies and investment decisions within the industry, guiding the development of technologically advanced production methods that align with environmental standards and economic feasibility.

By Application Analysis

Plasticizers account for 46.2% of 2-Ethylhexanol Market applications.

In 2024, Plasticizers held a dominant market position in the By Application segment of the 2-Ethylhexanol Market, capturing a 46.2% share. This segment maintained its lead due to the widespread use of 2-Ethylhexanol (2-EH) in the production of phthalate and non-phthalate plasticizers, which are essential in manufacturing flexible polyvinyl chloride (PVC).

The demand for plasticizers is driven by their extensive application in construction materials, automotive interiors, and consumer goods, where flexibility, durability, and chemical resistance are critical factors.

The By Application segment of the 2-Ethylhexanol Market is categorized into Plasticizers, 2-EH Acrylate, and 2-EH Nitrate. Among these, Plasticizers continue to dominate, as industries prioritize materials that enhance the mechanical properties of end products while complying with environmental and regulatory standards. The segment’s growth is further supported by the increasing adoption of sustainable and bio-based plasticizers, aligning with global sustainability goals.

Looking ahead, the Plasticizers segment is expected to retain its leadership position as industries focus on innovative formulations that improve performance, safety, and environmental compatibility, ensuring continued demand for 2-Ethylhexanol-based plasticizers across multiple applications.

By End-Use Analysis

Building and construction lead with 41.2% in end-use demand.

In 2024, Building & Construction held a dominant market position in the By End Use segment of the 2-Ethylhexanol Market, capturing a 41.2% share. This leadership is primarily attributed to the extensive use of 2-Ethylhexanol (2-EH) in plasticizers, which are integral to the production of polyvinyl chloride (PVC) materials used in construction applications. Flexible PVC is widely employed in flooring, roofing membranes, pipes, and window profiles, driving substantial demand for 2-EH-derived plasticizers in the sector.

The By End Use segment of the 2-Ethylhexanol Market comprises Building & Construction, Electrical & Electronics, Automotive, Personal Care, Food & Beverage, and Agriculture. Among these, Building & Construction remains the largest consumer, owing to ongoing urbanization, infrastructure expansion, and the rising demand for durable and cost-effective materials.

Looking ahead, the Building & Construction segment is expected to maintain its dominance, driven by increasing investments in smart infrastructure projects and the growing need for advanced, high-performance building materials, ensuring a steady demand for 2-Ethylhexanol-based products.

Key Market Segments

By Purity

- Lower than 99% Purity

- 99%-99.5% Purity

- Higher than 99.5% Purity

By Application

- Plasticizers

- 2-EH Acrylate

- 2-EH Nitrate

- Others

By End Use

- Building and Construction

- Electrical and Electronics

- Automotive

- Personal Care

- Food and Beverage

- Agriculture

- Others

Driving Factors

Rising Demand for Plasticizers in PVC Production

One of the biggest drivers of the 2-Ethylhexanol (2-EH) Market is the growing demand for plasticizers, especially in polyvinyl chloride (PVC) manufacturing. 2-EH is a key ingredient in making phthalate and non-phthalate plasticizers, which are widely used in flexible PVC applications.

Industries like construction, automotive, and consumer goods rely on these plasticizers to improve flexibility, durability, and resistance in materials. As global urbanization and infrastructure projects grow, so does the need for PVC-based products, ensuring strong demand for 2-EH-derived plasticizers. Additionally, the shift towards eco-friendly plasticizers further boosts the market’s long-term growth.

Restraining Factors

Strict Environmental Regulations on Chemical Emissions

One of the key challenges in the 2-Ethylhexanol (2-EH) Market is the strict environmental regulations imposed on chemical production and emissions. 2-EH manufacturing involves volatile organic compounds (VOCs) and hazardous air pollutants, leading to regulatory scrutiny, especially in Europe and North America.

Governments are enforcing stringent emission standards and promoting eco-friendly alternatives, which could limit the growth of traditional 2-EH-based plasticizers. Companies must invest in cleaner production technologies and sustainable formulations to comply with these regulations.

Growth Opportunity

Growing Demand for Bio-Based Plasticizers Worldwide

A major growth opportunity in the 2-Ethylhexanol (2-EH) Market is the rising demand for bio-based plasticizers. With increasing environmental concerns and strict regulations on phthalate plasticizers, industries are shifting toward sustainable alternatives.

Bio-based plasticizers, derived from renewable sources, offer low toxicity and improved biodegradability, making them ideal for construction, automotive, and consumer goods applications. This shift is driving research and development investments in green chemistry solutions, creating new market opportunities for 2-EH-based bio-plasticizers.

Latest Trends

Shift Towards Non-Phthalate Plasticizers in Manufacturing

A key trend in the 2-Ethylhexanol (2-EH) Market is the growing adoption of non-phthalate plasticizers. Due to health and environmental concerns, many industries are moving away from phthalate-based plasticizers, which were traditionally made using 2-EH. Governments worldwide are tightening regulations on phthalates, encouraging manufacturers to develop safer alternatives.

This shift is driving innovation in non-phthalate formulations, such as bio-based plasticizers, which offer better safety and sustainability. The construction, automotive, and packaging industries are rapidly adopting non-phthalate solutions, reshaping demand patterns in the 2-EH market and creating new growth opportunities for alternative plasticizer technologies.

Regional Analysis

In 2024, Asia-Pacific dominated the 2-Ethylhexanol market with a 41.3% share, valued at USD 6.7 billion.

In 2024, Asia-Pacific dominated the 2-Ethylhexanol Market, accounting for a 41.3% share and reaching USD 6.7 billion. The region’s strong market position is driven by rapid industrialization, expanding construction activities, and growing demand for plasticizers in key economies like China, India, and Japan. The thriving automotive and chemical manufacturing industries further fuel the demand for 2-Ethylhexanol-based products across diverse applications.

North America remains a key player, benefiting from strong demand in the plasticizers and acrylate industries, supported by technological advancements and the presence of major chemical manufacturers. Europe, with its strict environmental regulations, is witnessing a shift toward sustainable and non-phthalate plasticizers, driving innovation in bio-based solutions.

Meanwhile, the Middle East & Africa, and Latin America are experiencing moderate market growth, primarily due to infrastructure development and increasing applications in agriculture and personal care. The Middle East’s petrochemical sector plays a crucial role in sustaining 2-Ethylhexanol production, while Latin America sees steady demand from the construction and automotive industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, leading chemical manufacturers play a critical role in shaping the 2-Ethylhexanol (2-EH) Market, driven by technological advancements, capacity expansions, and regulatory adaptations.

BASF SE and Dow remain dominant players, leveraging their strong R&D capabilities and global distribution networks to cater to the increasing demand for plasticizers, acrylates, and nitrates. Their focus on sustainable production methods and bio-based alternatives further strengthens their market position.

SABIC and SINOPEC, backed by their robust petrochemical supply chains, contribute significantly to the Asia-Pacific market’s dominance (41.3%, USD 6.7 Bn). Their access to low-cost raw materials and large-scale production capacities gives them a competitive edge, particularly in China and the Middle East. Similarly, China National Petroleum Corporation (CNPC), as a state-owned giant, plays a vital role in securing domestic supply and expanding exports.

Eastman Chemical Company and Mitsubishi Chemical Corporation continue to invest in specialty chemicals, focusing on high-performance applications of 2-EH beyond conventional plasticizers. Their expertise in advanced material solutions positions them well in regulated markets such as North America and Europe.

LG Chem, Ltd., INEOS Holdings Limited, and Formosa Plastic Group focus on scalability and operational efficiency, ensuring stable production and supply chain reliability. Their strategic expansions in Asia-Pacific and North America reinforce their global market presence.

Top Key Players in the Market

- Dow

- BASF SE

- Eastman Chemical Company

- SABIC

- SINOPEC

- Mitsubishi Chemical Corporation

- LG Chem, Ltd.

- INEOS Holdings Limited

- Formosa Plastic Group

- China National Petroleum Corporation

Recent Developments

- In 2024, Dow’s collaboration with Johnson Matthey led to the selection of their LP Oxo Process Technology for a new oxo plant in China, enhancing 2-EH production capabilities. This development underscores Dow’s commitment to advancing efficient production methods in the 2-EH sector.

- In 2024, Eastman Chemical Company announced a price increase of $0.04 per pound for 2-Ethylhexanol (2-EH), effective January 1, citing elevated operating costs. Later that year, on February 15, they implemented another price increase of $0.04 per pound for 2-EH.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Billion Forecast Revenue (2034) USD 9.8 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Lower than 99% Purity, 99%-99.5% Purity, Higher than 99.5% Purity), By Application (Plasticizers, 2-EH Acrylate, 2-EH Nitrate, Others), By End Use (Building and Construction, Electrical and Electronics, Automotive, Personal Care, Food and Beverage, Agriculture, Others Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dow, BASF SE, Eastman Chemical Company, SABIC, SINOPEC, Mitsubishi Chemical Corporation, LG Chem, Ltd., INEOS Holdings Limited, Formosa Plastic Group, China National Petroleum Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dow

- BASF SE

- Eastman Chemical Company

- SABIC

- SINOPEC

- Mitsubishi Chemical Corporation

- LG Chem, Ltd.

- INEOS Holdings Limited

- Formosa Plastic Group

- China National Petroleum Corporation