Global 2,6-Xylidine Market Size, Share, And Industry Analysis Report By Type (Phenol Amination Method, Nitrification Reduction Method), By Application (Lidocaine, Metalaxyl, Metazachlor, Furalaxyl), By End-use (Agrochemicals, Pharmaceuticals, Chemical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169434

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

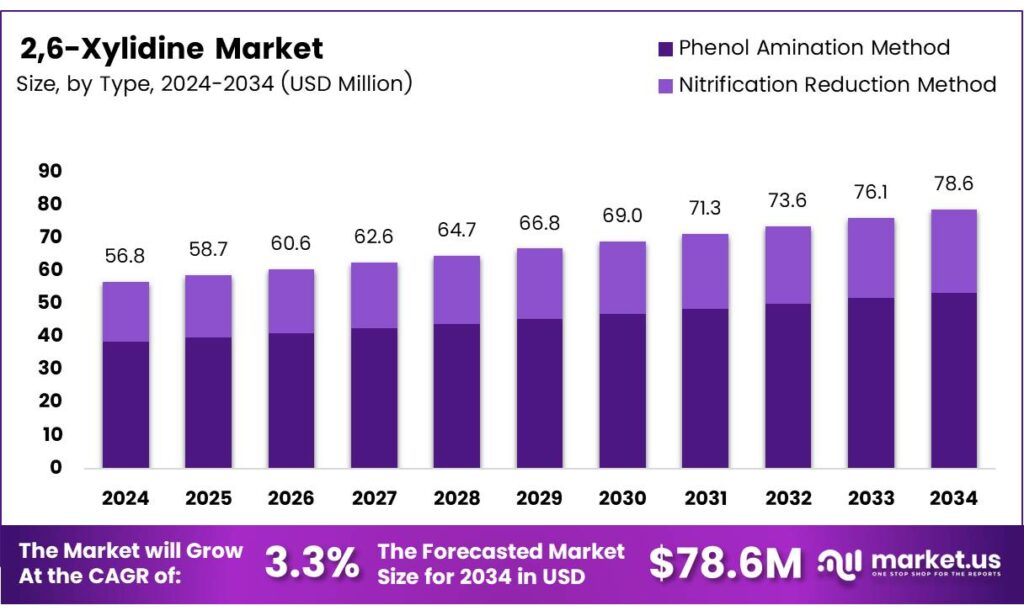

The Global 2,6-Xylidine Market size is expected to be worth around USD 78.6 million by 2034, from USD 56.8 million in 2024, growing at a CAGR of 3.3% during the forecast period from 2025 to 2034.

The 2,6-Xylidine Market represents the commercial ecosystem around the production, trade, and downstream use of 2,6-dimethylaniline, a critical aromatic amine. It serves as a base intermediate for agrochemicals, dyes, rubber chemicals, pharmaceuticals, and polymer additives, aligning closely with specialty chemicals demand and advanced material synthesis trends.

2,6-Xylidine is valued for its steric configuration, which supports selective reactivity and thermal stability in formulations. As industries seek performance-driven intermediates, demand steadily grows from coatings, electronics, and automotive ecosystems, where reliability, purity, and consistent molecular behavior strongly influence procurement decisions.

Poly(p-phenylene oxide) (PPO) emerges as a strategic feedstock. PPO is a high-performance engineering plastic, produced from oxidative condensation of 2,6-dimethylphenol, and widely applied across electronics and automotive manufacturing. PPO production value stands near USD 1.67 billion, yet secondary chemical conversion pathways remain underexplored.

PPO can be converted in a one-pot process into substituted phenols, then aminated to produce dimethylanilines. Under optimized Pd₇Ru₃/CNT catalysis, yields reached 30%, demonstrating technical feasibility for chemical upcycling routes. Less than 10% of global plastic waste is recycled, pushing policy support toward catalytic conversion and chemical upcycling technologies rather than traditional disposal.

Supply-side reliability also supports market confidence. VWR, BLDpharm, and ANR Technologies product catalogs, consistent availability of PPO, phenols, catalysts, solvents, and carbon nanotube supports a scalable research-to-commercial transition. Consequently, the 2,6-Xylidine Market stands positioned at the intersection of specialty chemicals growth, sustainable chemistry policy, and value-added polymer recycling innovation.

Key Takeaways

- The Global 2,6-Xylidine Market is projected to reach USD 78.6 million by 2034, growing from USD 56.8 million in 2024, at a CAGR of 3.3% during the forecast period from 2025 to 2034.

- Phenol Amination Method dominates the market by type, holding a leading share of 63.7%.

- Lidocaine is the largest application segment, accounting for a significant 49.9% share of global demand.

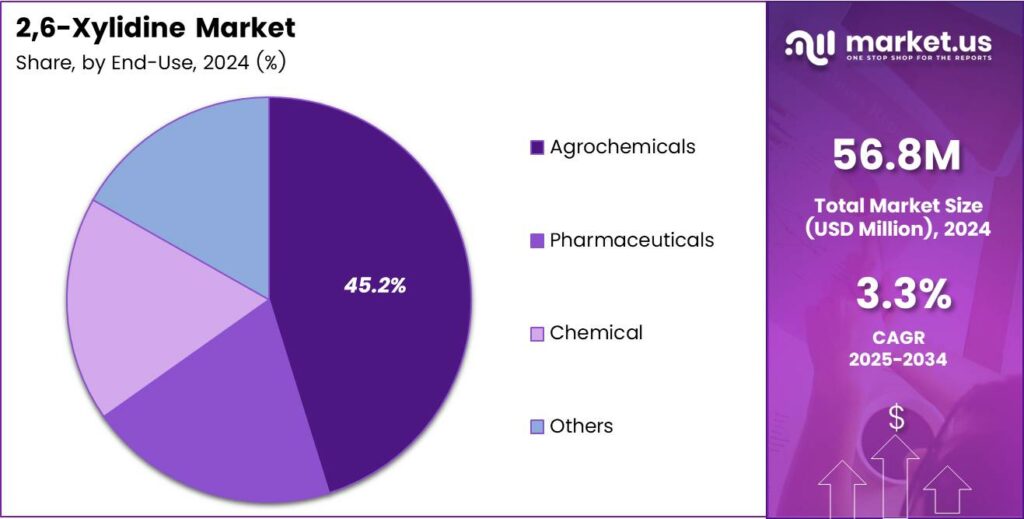

- Agrochemicals represent the top end-use sector, contributing nearly 45.2% of overall consumption.

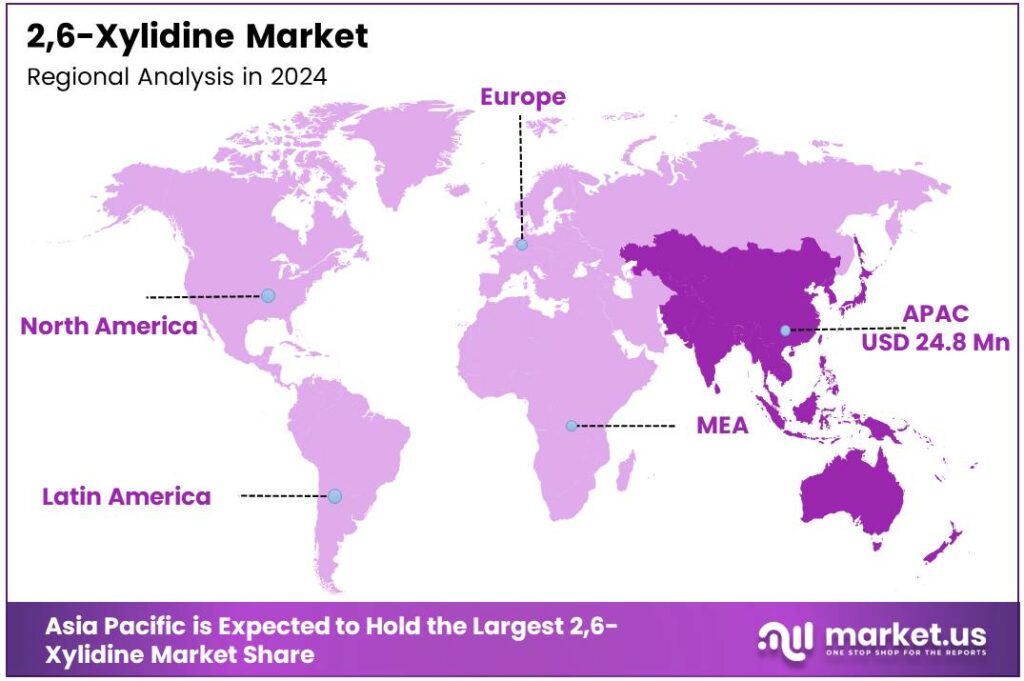

- Asia-Pacific is the dominant regional market with a share of 43.8%, valued at USD 24.8 million in 2024.

By Type Analysis

Phenol Amination Method dominates with 63.7% share, supported by process efficiency and stable output quality.

In 2024, Phenol Amination Method held a dominant market position in the By Type Analysis segment of the 2,6-Xylidine Market, with a 63.7% share. This method remains widely adopted because it enables controlled reaction conditions and consistent purity levels, thereby supporting large-scale manufacturing requirements across pharmaceutical and agrochemical intermediate production.

The Nitrification Reduction Method plays a complementary role in the type landscape, offering alternative synthesis routes where feedstock flexibility is required. Although its adoption is comparatively lower, it continues to attract interest for niche production needs and specific regulatory environments that favor diversified manufacturing pathways.

By Application Analysis

Lidocaine leads with a 49.9% share, driven by steady pharmaceutical demand.

In 2024, Lidocaine held a dominant market position in the By Application Analysis segment of the 2,6-Xylidine Market, with a 49.9% share. Demand remains stable as Lidocaine continues to be a key local anesthetic, ensuring consistent consumption of 2,6-Xylidine as a core intermediate.

Metalaxyl represents an important agricultural application, supported by its use in crop protection formulations. Its demand pattern closely follows seasonal farming cycles, maintaining steady but moderate consumption of 2,6-Xylidine. Metazachlor relies on 2,6-Xylidine for herbicide synthesis, particularly in cereal crop protection.

Its usage is influenced by regional farming practices and regulatory approvals. Furalaxyl and Others together sustain niche demand, driven by specialized fungicide formulations and diversified chemical applications, contributing to overall application balance.

By End-Use Analysis

Agrochemicals dominate with a 45.2% share, reflecting strong agricultural dependency.

In 2024, Agrochemicals held a dominant market position in the By End-use Analysis segment of the 2,6-Xylidine Market, with a 45.2% share. The segment benefits from continuous demand for herbicides and fungicides, making agriculture a key consumption pillar. Pharmaceuticals form a crucial end-use, primarily linked to anesthetic drug synthesis.

This segment values consistent quality and regulatory compliance, supporting steady demand. The Chemical end-use segment utilizes 2,6-Xylidine as an intermediate for diversified synthesis processes, ensuring stable off-take across specialty chemical production. Others include smaller industrial uses that collectively contribute to market stability through application diversity.

Key Market Segments

By Type

- Phenol Amination Method

- Nitrification Reduction Method

By Application

- Lidocaine

- Metalaxyl

- Metazachlor

- Furalaxyl

- Others

By End-use

- Agrochemicals

- Pharmaceuticals

- Chemical

- Others

Emerging Trends

Process Optimization and Supply Chain Localization Shape Market Trends

One major trend in the 2,6-Xylidine market is a focus on process improvement. Analysts see companies investing in better reaction control to improve yields and reduce waste. These efforts help lower production risks while meeting stricter safety and environmental rules.

Another trending factor is supply chain localization. Pharmaceutical manufacturers prefer nearby chemical suppliers to ensure a consistent supply and shorter lead times. This trend supports the regional production of 2,6-Xylidine, especially in Asia.

Collaboration between chemical and pharma companies is increasing. Long-term supply agreements provide stability for both sides. These trends indicate a shift toward safer, more integrated, and reliable production systems shaping the market’s future.

Drivers

Growing Demand for Pharmaceutical Intermediates Drives Market Growth

The 2,6-Xylidine market is mainly driven by its strong role as a key intermediate in pharmaceutical production. Analysts note that this compound is widely used to manufacture active ingredients for local anesthetics and pain-relief medicines. As healthcare access improves across developing regions, demand for such drugs continues to rise steadily. This directly supports higher consumption of 2,6-Xylidine.

- This trend increases the need for reliable chemical intermediates, including 2,6-Xylidine. Its proven performance in drug synthesis makes it a preferred choice for formulators. Many agrochemical firms now require high-purity intermediates to meet stringent safety and efficacy standards. Since 2,6-Xylidine is commercially available at 98–99.6% purity, it fits the requirement well.

In addition, rising focus on quality and consistency in pharmaceutical inputs supports stable demand. Producers value 2,6-Xylidine for its predictable reaction behavior and established processing routes. Overall, sustained growth in medicine production remains the strongest force supporting the market.

Restraints

Strict Chemical Safety Regulations Limit Market Expansion

A key restraint for the 2,6-Xylidine market is increasing regulatory pressure on aromatic amines. Analysts observe that this compound requires careful handling due to toxicity concerns. Governments are imposing tighter rules on storage, transport, and use, which raises compliance costs for manufacturers.

Environmental regulations also act as a barrier. Waste management and emission control linked to 2,6-Xylidine production require additional investment. Smaller producers may struggle to meet these standards, limiting capacity growth in some regions.

In addition, worker safety requirements increase operational complexity. Companies must invest in protective equipment, monitoring systems, and training. These extra costs can reduce profit margins and discourage new entrants. As a result, regulation remains a significant factor slowing faster market expansion.

Growth Factors

Expansion of Generic Drug Manufacturing Creates New Opportunities

Growth opportunities in the 2,6-Xylidine market are closely tied to the expanding generic pharmaceuticals sector. Analysts highlight that patent expiries for several drugs are pushing manufacturers to scale up generic versions. This increases demand for stable and cost-effective intermediates like 2,6-Xylidine.

Emerging markets offer strong potential. Many developing countries are investing in local drug manufacturing to improve affordability. This trend opens new supply opportunities for chemical producers serving regional pharmaceutical plants.

There is also an opportunity in process optimization. Producers who develop safer and more efficient manufacturing routes for 2,6-Xylidine can gain a competitive advantage. Cleaner processes help meet regulations while lowering costs. Overall, pharmaceutical expansion in cost-sensitive markets supports long-term growth potential.

Regional Analysis

Asia-Pacific Dominates the 2,6-Xylidine Market with a Market Share of 43.8%, Valued at USD 24.8 million

Asia-Pacific leads the 2,6-Xylidine market due to strong growth in pharmaceutical intermediates, agrochemicals, and dye manufacturing across emerging economies. In 2024, the region accounted for a dominant 43.8% share, valued at USD 24.8 million, supported by expanding chemical production capacity and cost-efficient manufacturing. Rapid industrialization, improving healthcare access, and increasing local availability of raw materials continue to strengthen regional demand.

North America represents a mature yet stable market for 2,6-Xylidine, driven mainly by pharmaceutical synthesis and specialty chemical applications. Demand remains consistent due to steady drug development activities and strict quality specifications favoring controlled production. The region benefits from advanced R&D infrastructure and strong regulatory oversight, which support reliable consumption levels.

Europe shows moderate growth in the 2,6-Xylidine market, supported by its well-established chemical and pharmaceutical industries. Increasing emphasis on high-purity intermediates and sustainable chemical processes influences market dynamics. Regulatory compliance and environmental standards add cost pressure but also encourage process optimization. Steady demand from specialty applications contributes to consistent market performance across the region.

The Middle East and Africa region is developing gradually, with demand linked to expanding pharmaceutical distribution and basic chemical manufacturing. Investments in industrial infrastructure and diversification away from oil-based revenues support long-term potential. Although current consumption remains limited compared to major regions, improving healthcare access and chemical supply chains are creating new market opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE plays a central role in the 2,6-Xylidine value chain, leveraging its scale in aromatic intermediates and integrated production sites. In 2024, the company’s broad portfolio, process know-how, and backward integration into key feedstocks help stabilize supply and pricing for pharmaceutical and agrochemical formulators. BASF’s focus on efficiency, safety, and environmental compliance also supports long-term reliability for downstream customers.

Lanxess AG approaches the 2,6-Xylidine business from a specialty chemicals perspective, emphasizing high-purity intermediates and tailored grades. In 2024, its strong regulatory, quality, and application-support capabilities remain a key differentiator for stringent end uses such as active pharmaceutical ingredients. Through portfolio streamlining and operational discipline, Lanxess aims to preserve margins while serving niche but critical demand pockets.

Mitsubishi Gas Chemical Company, Inc. adds a strong Asian manufacturing and technology footprint to the 2,6-Xylidine landscape. In 2024, its expertise in fine chemicals and electronic/functional materials allows it to optimize multipurpose assets and share R&D across product lines. This flexible production strategy helps the company handle smaller, customized batches and navigate shifting regional demand patterns.

Koei Chemical Co., Ltd. operates as a focused producer of specialty aromatic amines and related intermediates, and 2,6-Xylidine fits naturally within that portfolio. In 2024, Koei’s strengths lie in process optimization, consistent product quality, and long-term partnerships with pharmaceutical and agrochemical manufacturers. Its relatively specialized positioning enables quick response to specification changes and evolving regulatory expectations.

Top Key Players in the Market

- BASF SE

- Lanxess AG

- Mitsubishi Gas Chemical Company, Inc.

- Koei Chemical Co., Ltd.

- Aarti Industries Limited

- Shandong WNN Industrial Co., Ltd.

- Bodal Chemicals Ltd.

- Jiangsu Baoling Chemical Co., Ltd

- Sinopec Shanghai Petrochemical Company Limited

Recent Developments

- In 2025, BASF SE remains a key producer of 2,6-Xylidine, positioning it as a major building block in the synthesis of pharmaceuticals such as lidocaine and ranolazine, as well as in crop protection agents. The company’s product portfolio highlights its ongoing role in the aromatic amines sector, with no major disruptions or expansions reported.

- In 2025, Lanxess AG focuses on related xylidine isomers, notably 3,5-Xylidine (also known as m-Xylidine), which serves as an intermediate in dyes, agrochemicals, and pharmaceuticals. No direct production or developments specific to 2,6-Xylidine were identified.

Report Scope

Report Features Description Market Value (2024) USD 56.8 million Forecast Revenue (2034) USD 78.6 million CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Phenol Amination Method, Nitrification Reduction Method), By Application (Lidocaine, Metalaxyl, Metazachlor, Furalaxyl, Others), By End-use (Agrochemicals, Pharmaceuticals, Chemical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF SE, Lanxess AG, Mitsubishi Gas Chemical Company, Inc., Koei Chemical Co., Ltd., Aarti Industries Limited, Shandong WNN Industrial Co., Ltd., Bodal Chemicals Ltd., Jiangsu Baoling Chemical Co., Ltd, Sinopec Shanghai Petrochemical Company Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Lanxess AG

- Mitsubishi Gas Chemical Company, Inc.

- Koei Chemical Co., Ltd.

- Aarti Industries Limited

- Shandong WNN Industrial Co., Ltd.

- Bodal Chemicals Ltd.

- Jiangsu Baoling Chemical Co., Ltd

- Sinopec Shanghai Petrochemical Company Limited