Global Gesture-Controlled Wearables Market Size, Share Analysis By Product Type (Smartwatches, Fitness Trackers, Smart Glasses, Headsets & Wearable Headphones, Other Wearables), By Gesture Type (Touch Gestures, Motion Gestures, Facial Gestures, Voice Gestures, Others), By Technology (Optical Technology, Infrared Technology, Electromyography (EMG), Capacitive Sensing, Others), By End-User (Consumer Electronics, Healthcare, Sports & Fitness, Media & Entertainment, Military & Defense, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155090

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of AI

- US Market Size

- Top 5 Trends and Innovations

- Top 5 Growth Factors

- By Product Type

- By Gesture Type

- By Technology

- By End-User

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

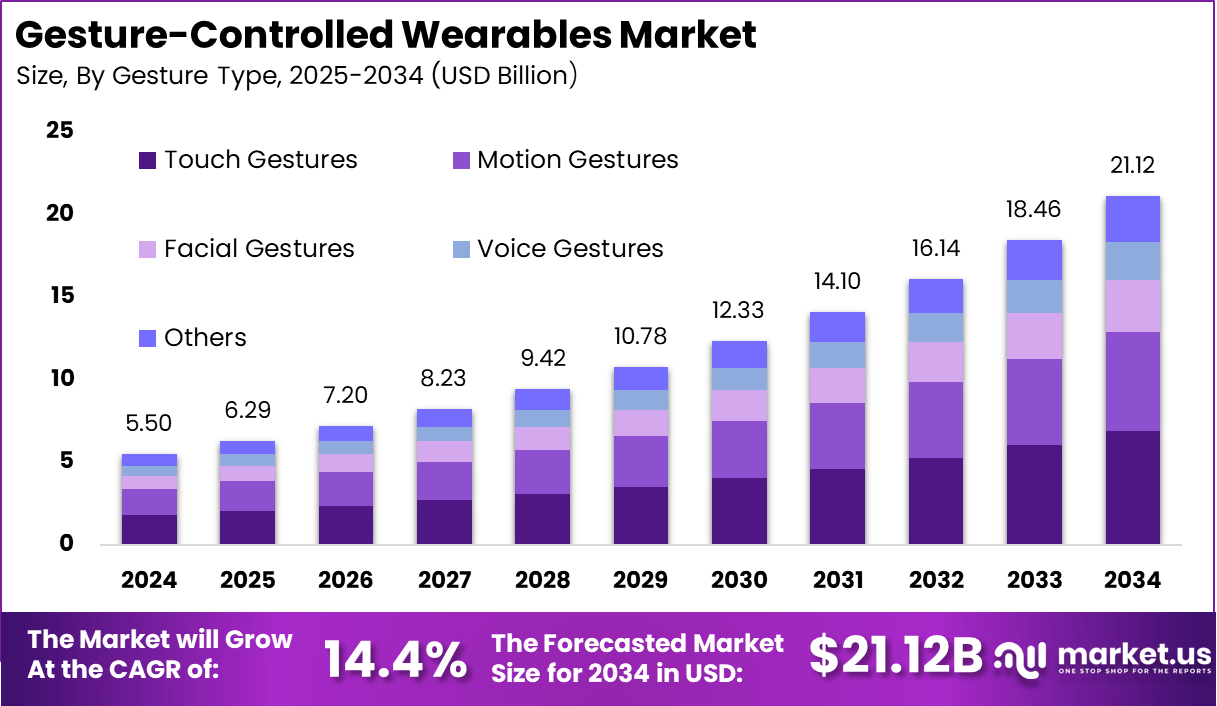

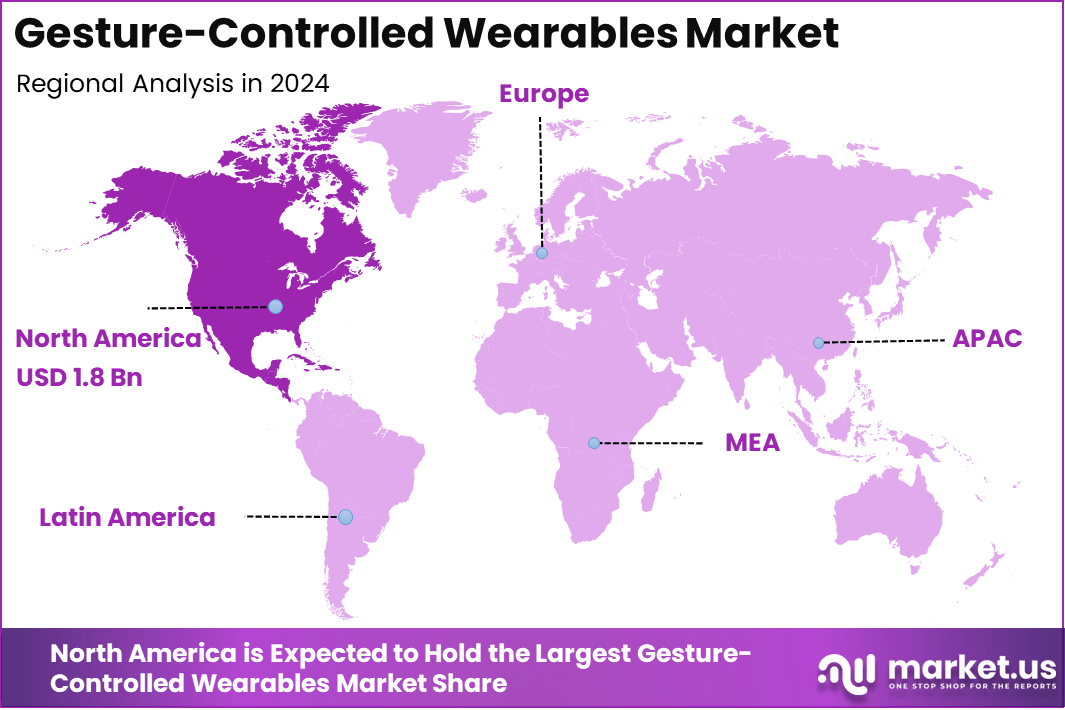

The Global Gesture-Controlled Wearables Market size is expected to be worth around USD 21.12 Billion By 2034, from USD 5.50 billion in 2024, growing at a CAGR of 14.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 34.4% share, holding USD 1.8 Billion revenue.

The gesture-controlled wearables market is a dynamic segment of the broader wearable technology industry, characterized by devices that allow users to control and interact with digital systems through intuitive hand and body gestures. This technology replaces traditional touch and button-based inputs, offering an enhanced, seamless, and often touchless user experience.

Gesture control in wearables leverages advanced sensor technologies, including motion sensors, 3D depth-sensing cameras, and machine learning algorithms to interpret natural human movements. The adoption of such technology spans multiple sectors including healthcare, automotive, consumer electronics, gaming, and AR/VR environments, enhancing how users interact with smart devices, improving hygiene, and lowering physical interface dependencies.

Market Size and Growth

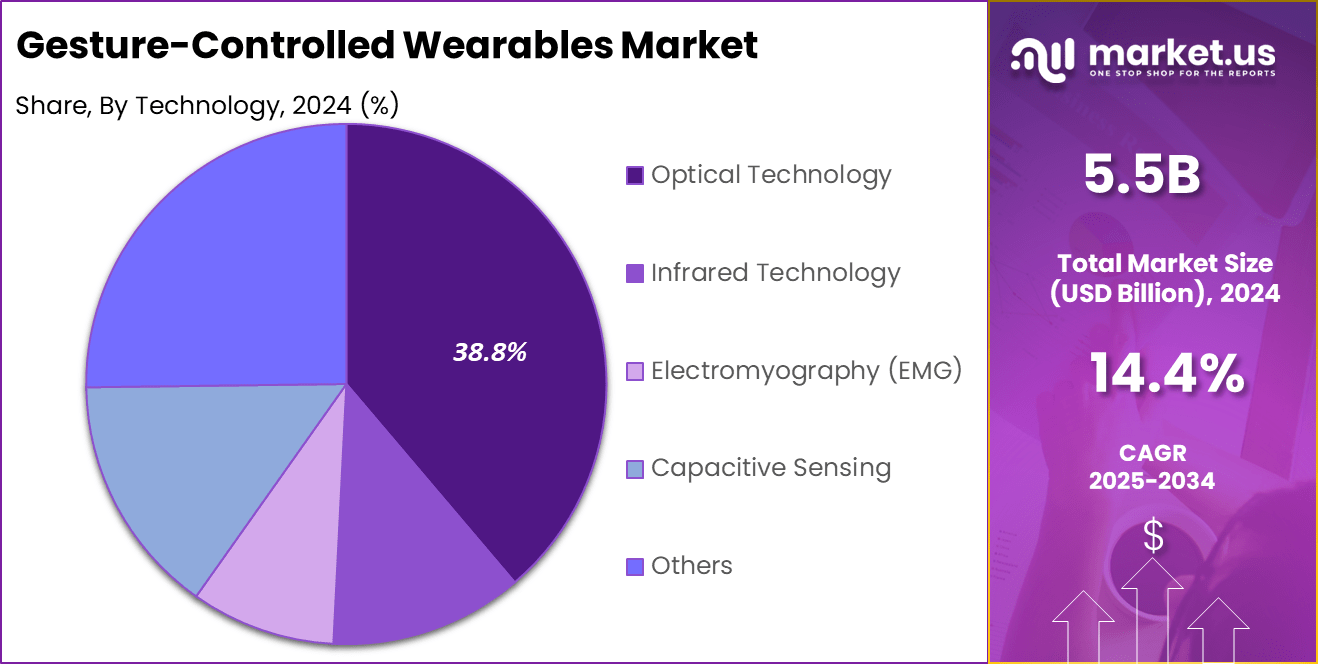

Metric Statistic / Value Market Value (2024) USD 5.50Bn Forecast Revenue (2034) USD 21.12 Bn CAGR(2025-2034) 14.4% Leading Segment By Technology – Optical Technology: 38.8% Leading Region Share North America [34.4% Market Share] Largest Country U.S. [USD 1.62 Bn Market Revenue], CAGR: 11.8% The top driving factors fueling this market include a heightened demand for touchless human-machine interaction, which has accelerated following global health concerns, pushing users and industries toward safer, contact-free interfaces. Technological advances such as AI-powered gesture recognition, improved sensor precision, and low-latency systems have made gesture-controlled wearables more reliable and intuitive, encouraging their incorporation into everyday devices.

According to Market.us, The global smart wearables market is anticipated to reach USD 386.5 billion by 2033, up from USD 67.3 billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033. This growth reflects the increasing adoption of connected devices for health monitoring, fitness tracking, communication, and lifestyle applications.

In parallel, the global wearable AI market is expected to expand from USD 31.2 billion in 2023 to USD 304.8 billion by 2033, registering a CAGR of 25.6% over the same period. The rapid growth is driven by advancements in artificial intelligence, enabling wearables to deliver more personalized, predictive, and context-aware user experiences

Investment opportunities in the gesture-controlled wearables market are ripe given the rapid growth of smart wearable devices and the increasing emphasis on health and safety. Investors are particularly attracted to advancements in wearable gesture technology integrated with AI, edge computing, and biometric security. Emerging markets with rising smartphone and wearable penetration offer fertile ground for expansion.

Key Insight Summary

- The market is projected to grow from USD 5.50 billion in 2024 to approximately USD 21.12 billion by 2034, at a strong CAGR of 14.4%, fueled by demand for intuitive, hands-free device interactions.

- North America led globally with a 34.4% share, generating USD 1.8 billion in 2024, supported by tech-savvy consumers and a mature wearable ecosystem.

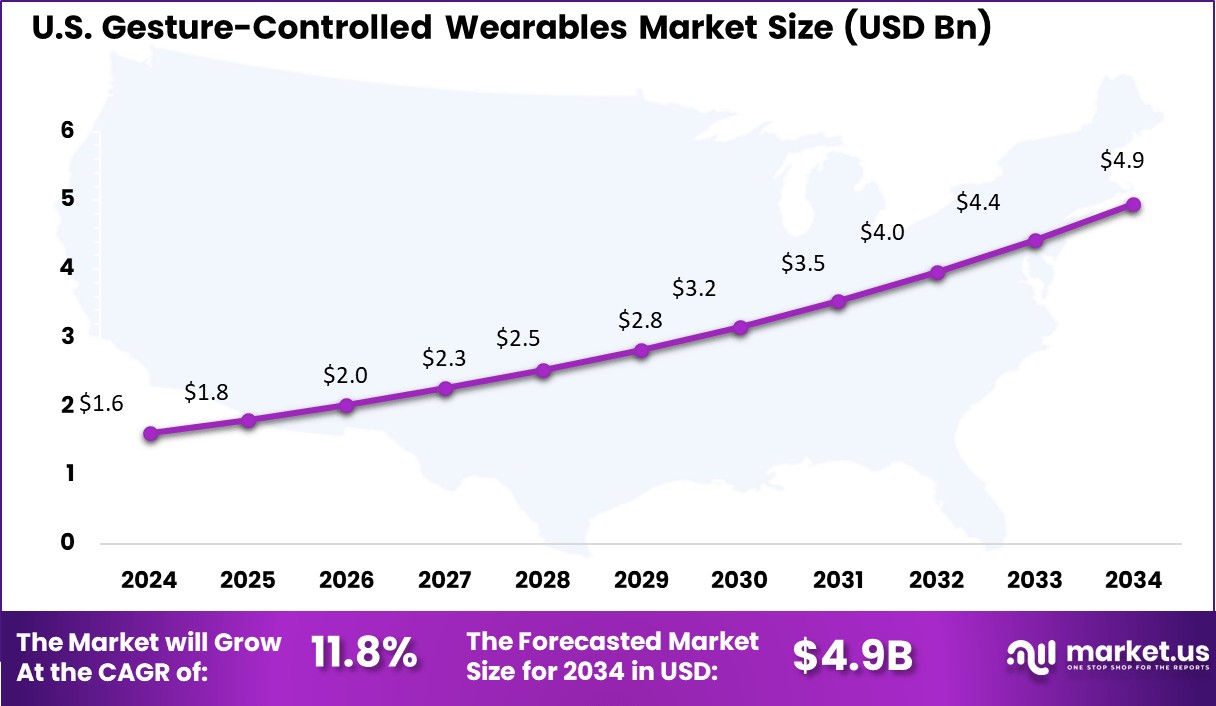

- The U.S. market alone contributed USD 1.62 billion and is expected to grow at a CAGR of 11.8%, driven by early adoption of gesture-based controls in fitness, productivity, and gaming wearables.

- By product type, Smartwatches dominated with a 34.7% share, leveraging gesture recognition for navigation, notifications, and fitness tracking.

- Touch gestures were the most prevalent gesture type, accounting for 32.6%, due to their accuracy, familiarity, and ease of integration into consumer devices.

- Optical technology led with a 38.8% share, enabling precise motion detection through cameras, sensors, and infrared systems.

- Consumer electronics emerged as the top end-user segment, holding 30.5%, reflecting strong integration of gesture control into mainstream wearable devices.

Role of AI

Role/Function Description Enhanced Recognition Accuracy AI/ML improves precision of recognizing natural, context-aware user gestures. Predictive & Adaptive Algorithms Learns and adapts to a user’s gestures to ensure seamless, low-latency interaction. Complex Gesture Interpretation Deep learning allows systems to handle varied gestures across challenging environments. Multimodal Interaction Combines gestures with voice and eye tracking for richer control experiences. Personalized Gesture Profiles AI learns user preferences and optimizes gesture mapping for comfort and efficiency. US Market Size

The U.S. Gesture-Controlled Wearables Market was valued at USD 1.6 Billion in 2024 and is anticipated to reach approximately USD 4.9 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 11.8% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 34.4% share and generating USD 1.8 billion in revenue. The region’s leadership can be attributed to strong consumer adoption of advanced wearable technologies, driven by the integration of gesture-recognition features in fitness bands, smartwatches, AR glasses, and healthcare devices.

High disposable incomes, along with a tech-savvy population, have created a favorable environment for early adoption. Furthermore, the presence of well-established technology companies and continuous product innovations has strengthened the market’s growth momentum.

The demand in North America is also being supported by expanding applications in healthcare monitoring, gaming, virtual reality, and industrial operations. Gesture-controlled wearables are increasingly being deployed in medical rehabilitation and sports performance tracking, reflecting a broader acceptance beyond lifestyle and entertainment.

Top 5 Trends and Innovations

Trend/Innovation Description Ultra-Low Latency Gesture Recognition Real-time AI-driven recognition for seamless and natural device interaction. Multimodal Sensor Fusion Combining vision, IMU, EMG, and proximity sensing for improved gesture accuracy. Emotion-Responsive Sensors Wearables adapt interaction based on biometric and emotional signals. Fashion-Forward Form Factors Smart rings, gloves, interactive fabrics, and AR headsets with built-in gesture recognition. Energy-Efficient, Self-Powered Sensors Hardware miniaturization and energy harvesting for longer wearable battery life. Top 5 Growth Factors

Growth Factor Description Demand for Touchless Interfaces Post-pandemic hygiene and UX trends driving adoption in multiple industries. Advances in Sensors & Edge AI Better accuracy, compact designs, and low power usage in wearables. Growth of AR/VR & Metaverse Natural gesture input is key for immersive XR experiences. Shift Towards Contactless Tech Demand rising in public, healthcare, and automotive environments. Interactive Clothing & Second-Skin Tech Integration of gesture control into fashion and textile-based wearables. By Product Type

In 2024, Smartwatches represent 34.7% of the gesture-controlled wearables market, highlighting their leading role as a preferred product type. These devices combine traditional wearable features with advanced gesture control capabilities, allowing users to interact with their devices more intuitively through hand and finger movements.

Smartwatches are widely adopted due to their portability, convenience, and multifunctionality, making them ideal for fitness tracking, notifications, and media control through touch and gesture inputs. The integration of gesture control into smartwatches enhances user experience by minimizing the need for physical buttons and providing seamless, hands-free interaction.

By Gesture Type

In 2024, Touch gestures account for 32.6% of the market share in gesture types, underscoring their popularity as the primary mode of interaction in wearables. Touch gestures include taps, swipes, and pinches that enable quick, precise commands and navigation on small device screens. Their intuitive nature makes them accessible for a wide user base, contributing significantly to the ease of use in gesture-controlled wearables.

The emphasis on touch gestures is supported by advancements in touchscreen sensitivity and responsiveness, allowing for smooth and accurate control even on compact wearable devices. This mode remains dominant because it balances simplicity with functionality in everyday wearable applications.

By Technology

In 2024, Optical technology leads the market in enabling gesture control, comprising 38.8% of the technological segment. This technology uses sensors such as cameras, infrared, and light-based detectors to recognize and interpret users’ hand and finger movements with high precision. Optical systems offer the advantage of contactless interaction, enhancing hygiene and usability, especially in settings where touch needs to be minimized.

The adoption of optical technology also supports advanced gesture recognition, including 3D movement detection and fine motor controls, which expand the range of possible interactions beyond simple touch. Its growing use reflects the wearable industry’s focus on delivering more immersive and flexible user interfaces.

By End-User

In 2024, the consumer electronics sector accounts for 30.5% of the end-user share in the gesture-controlled wearables market. This sector is a major adopter of gesture-enabled wearables, driven by consumer demand for innovative devices that enhance connectivity, entertainment, and health monitoring. Products targeted at this segment are designed to blend cutting-edge technology with mainstream usability, appealing to tech-savvy individuals seeking convenience and personalization.

Additionally, consumer electronics companies continuously push for innovation to maintain competitiveness, incorporating gesture control to differentiate their offerings. This focus encourages the development of diverse wearable devices that cater to lifestyle, fitness, and communication needs, driving sustained market growth.

Key Market Segments

By Product Type

- Smartwatches

- Fitness Trackers

- Smart Glasses

- Headsets & Wearable Headphones

- Other Wearables

By Gesture Type

- Touch Gestures

- Motion Gestures

- Facial Gestures

- Voice Gestures

- Others

By Technology

- Optical Technology

- Infrared Technology

- Electromyography (EMG)

- Capacitive Sensing

- Others

By End-User

- Consumer Electronics

- Healthcare

- Sports & Fitness

- Media & Entertainment

- Military & Defense

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Market growth is propelled by rising consumer demand for hygienic, contactless interaction with technology, accelerated by heightened health and safety awareness post-pandemic. Gesture-controlled wearables enhance user convenience by allowing hands-free control of smart devices, improving accessibility and user experience.

In automotive and gaming sectors, these devices provide improved safety and interaction by enabling intuitive gesture navigation and control without physical contact. Advances in AI and computer vision technologies are key drivers, as they improve system precision, adaptiveness, and customization to individual users’ gestures.

Restraint Analysis

Despite promising prospects, the market faces challenges from high development and implementation costs associated with advanced gesture recognition systems. Complex hardware requirements, including 3D depth sensors, infrared cameras, and AI processors, contribute to the elevated price points, which can limit adoption among cost-sensitive consumers and smaller businesses.

Technical issues such as inconsistent gesture recognition reliability under varying lighting, hand shapes, and user behavior introduce usability concerns. Additionally, privacy concerns related to biometric data collection and the need for regulatory compliance regarding data security present significant hurdles. The lack of standardized gesture sets across devices and platforms also reduces user convenience and interoperability.

Opportunity Analysis

Gesture-controlled wearables hold vast potential to revolutionize human-machine interaction by delivering natural, intuitive, and immersive control experiences across diverse sectors. Integration with emerging technologies like augmented reality (AR), virtual reality (VR), and extended reality (XR) opens new avenues for applications in gaming, training, remote collaboration, and healthcare.

The wearable market can benefit from personalization features powered by AI, enabling context-aware gesture recognition and adaptive interfaces tailored to user preferences and environments. Expansion into healthcare with touchless monitoring and rehabilitation functions presents meaningful social impact opportunities.

Challenge Analysis

Key challenges include balancing advanced AI-driven gesture recognition capabilities with user comfort, privacy protection, and cost management. Maintaining data security while handling sensitive biometric information is critical to foster consumer trust and regulatory compliance.

The technological complexity of integrating gesture recognition sensors into compact, ergonomic wearable form factors requires sustained R&D investment. Achieving consistency and accuracy in diverse real-world conditions, such as varying light and user variability, remains technically demanding.

Additionally, market education to raise awareness and encourage broader adoption, along with establishing standardized protocols and gestures for seamless user experience across devices, are necessary for long-term success. Competitive pressures and rapid innovation cycles demand agile business strategies to keep pace with evolving consumer expectations.

Competitive Analysis

Alphabet Inc., Apple Inc., and Microsoft Corporation have been instrumental in shaping the gesture-controlled wearables landscape through strong R&D capabilities and integration of advanced AI-powered gesture recognition systems. Their focus on seamless device connectivity, intuitive controls, and enhanced user experience has positioned them as leaders in the market.

Cognitec Systems GmbH, eyeSight Technologies Ltd, and Infineon Technologies AG contribute significantly with specialized expertise in computer vision, biometric authentication, and sensor innovation. Their solutions enhance accuracy and responsiveness in gesture tracking, which is critical for AR/VR devices, gaming, and industrial applications.

Intel Corporation and Microchip Industry Incorporated focus on advanced processing technologies that ensure low-latency interaction and power efficiency, supporting next-generation wearable designs. The emphasis on compact, energy-efficient hardware further boosts market adoption among high-performance wearables.

NXP Semiconductors, Omnivision Technologies, SoftKinetic, Synaptics Incorporated, Robert Bosch GmbH, and Ignitec Ltd are recognized for their role in integrating sensor fusion, imaging systems, and haptic feedback capabilities. Their offerings enable gesture-controlled wearables to deliver immersive and interactive user experiences. Collaborations with OEMs and tech developers help accelerate innovation cycles and expand use cases in healthcare, automotive, and consumer electronics.

Top Key Players in the Market

- Alphabet Inc.

- Apple Inc.

- Cognitec Systems GmbH

- eyeSight Technologies Ltd

- Infineon Technologies AG

- Intel Corporation

- Microchip Industry Incorporated

- Microsoft Corporation

- NXP Semiconductors

- Omnivision Technologies, Inc.

- SoftKinetic.

- Synaptics Incorporated

- Robert Bosch GmbH

- Ignitec ltd.

- Other Major Players

Recent Developments

- In 2024, Wearable Devices Ltd. marked a pivotal innovation with the launch of its Mudra Band for Apple Watch, an AI-powered neural gesture control wearable, expanded to major retail platforms like Walmart in October. This move significantly increased accessibility to millions of users, accelerating the adoption of gesture control across consumer electronics.

- Apple’s contribution in this field is particularly notable with its introduction of new gesture controls in its Apple Watch Ultra 2 and Apple Watch Series 9 smartwatches in 2024. The company has patented advanced gestures such as side-to-side finger movements and clenched fist gestures, which enable users to reply to messages, answer calls, scroll, and accept inputs without touching the screen.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Smartwatches, Fitness Trackers, Smart Glasses, Headsets & Wearable Headphones, Other Wearables), By Gesture Type (Touch Gestures, Motion Gestures, Facial Gestures, Voice Gestures, Others), By Technology (Optical Technology, Infrared Technology, Electromyography (EMG), Capacitive Sensing, Others), By End-User (Consumer Electronics, Healthcare, Sports & Fitness, Media & Entertainment, Military & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alphabet Inc., Apple Inc., Cognitec Systems GmbH, eyeSight Technologies Ltd, Infineon Technologies AG, Intel Corporation, Microchip Industry Incorporated, Microsoft Corporation, NXP Semiconductors, Omnivision Technologies, Inc., SoftKinetic, Synaptics Incorporated, Robert Bosch GmbH, Ignitec Ltd., Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Gesture-Controlled Wearables MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Gesture-Controlled Wearables MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alphabet Inc.

- Apple Inc.

- Cognitec Systems GmbH

- eyeSight Technologies Ltd

- Infineon Technologies AG

- Intel Corporation

- Microchip Industry Incorporated

- Microsoft Corporation

- NXP Semiconductors

- Omnivision Technologies, Inc.

- SoftKinetic.

- Synaptics Incorporated

- Robert Bosch GmbH

- Ignitec ltd.

- Other Major Players