Global Haute Couture Market Size, Share, Growth Analysis By Fashion Category (Apparel, Accessories, Footwear, Others), By Type (Female Couture, Male Couture), By Application (Catwalk, Daily Wearing), By End User (Private Clients, Celebrities and Public Figures, Museums and Exhibitions, Fashion Collectors, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 37561

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

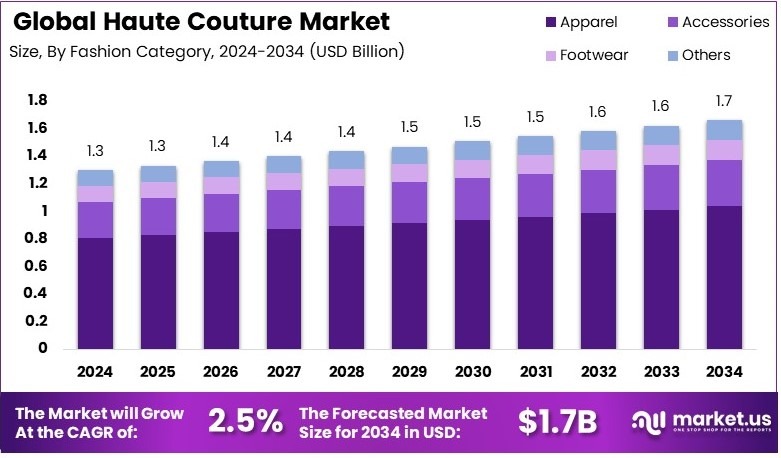

The Global Haute Couture Market size is expected to be worth around USD 1.7 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 2.5% during the forecast period from 2025 to 2034.

Haute Couture involves the creation of exclusive, tailor-made fashion, distinguished by meticulous craftsmanship and high-quality materials. The Haute Couture market caters primarily to an elite clientele, offering unique garments that embody the zenith of fashion design. This market operates within a competitive yet niche sector, characterized by high barriers to entry and significant customer loyalty.

Economic indicators suggest potential growth in luxury goods spending. For instance, the Bureau of Economic Analysis reported a rise in personal and disposable income in December 2024, indicating an increase in consumer purchasing power. Similarly, the U.S. Census Bureau noted a 4% growth in inflation-adjusted median household income in 2023, reaching $80,610, which may enhance consumer spending on luxury goods.

Furthermore, consumer preferences show a strong inclination towards customized products, with 81% of consumers willing to pay a premium for personalized clothing. This trend supports the haute couture market, where exclusivity and customization are paramount. Moreover, local and global impacts of haute couture extend beyond direct sales, influencing fashion trends and maintaining high standards within the broader fashion industry.

However, despite these positive aspects, the market faces challenges such as saturation and intense competitiveness within its niche. Nevertheless, regulatory frameworks and government incentives in key markets continue to shape haute couture’s operational landscape, supporting its sustained presence and impact in the fashion industry. Thus, while the market for haute couture is limited by its exclusivity, it remains a significant, dynamic component of the global fashion ecosystem.

Key Takeaways

- The Haute Couture Market was valued at USD 1.3 Billion in 2024 and is expected to reach USD 1.7 Billion by 2034, with a CAGR of 2.5%.

- In 2024, Apparel dominated the fashion category segment with 62.3%, driven by its high demand among luxury consumers.

- In 2024, Female Couture led the type segment with 83.3%, owing to the prominence of women’s fashion in haute couture.

- In 2024, Daily Wearing dominated the application segment with 73.2%, reflecting the increasing demand for exclusive fashion pieces for personal use.

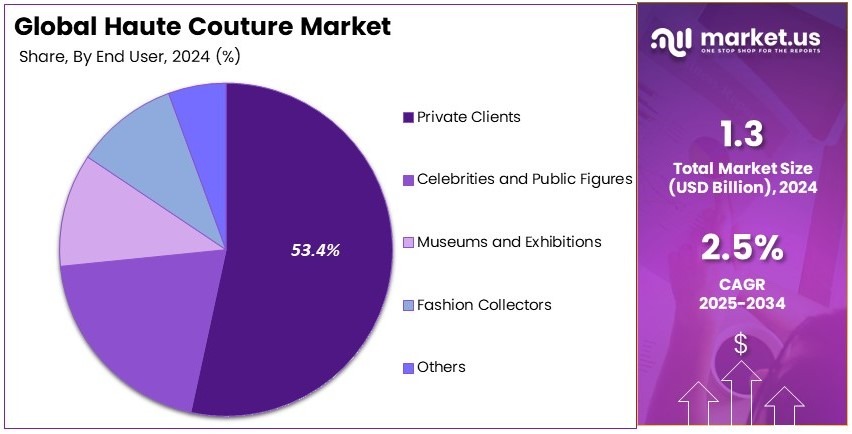

- In 2024, Private Clients accounted for 53.4% of the end-user segment, driven by high-net-worth individuals seeking custom designs.

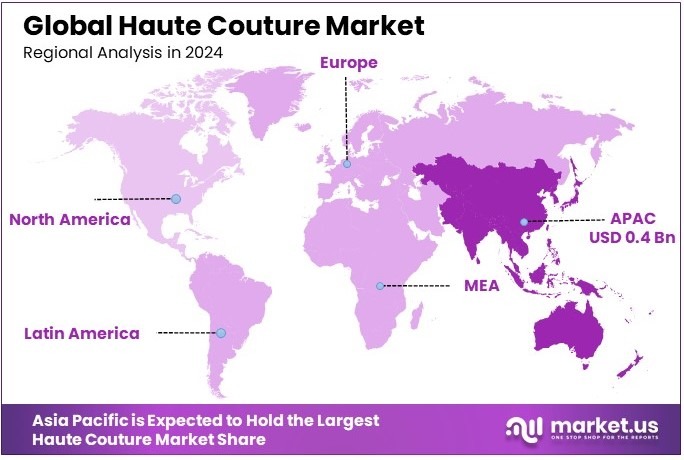

- In 2024, APAC held a 31.3% market share, valued at USD 0.4 Bn, due to the rising affluence and luxury spending in the region.

Fashion Category Analysis

Apparel dominates with 62.3% due to high demand for couture dresses and clothing.

The fashion category in the Haute Couture market is predominantly led by apparel, accounting for 62.3% of the total market share. This dominance is driven by the increasing demand for custom-made clothing, especially dresses, evening wear, and exclusive collections that offer a personalized fit and high-end craftsmanship.

Luxury brands often launch exclusive couture collections that cater to affluent clients who value uniqueness and quality. Apparel also benefits from the wider appeal of haute couture, which is often seen as a symbol of status and elegance, attracting wealthy clients willing to pay premium prices for one-of-a-kind creations. This segment has seen a steady growth, supported by the rise in high-net-worth individuals (HNWIs) and a growing interest in sustainable fashion choices, which couture brands increasingly emphasize.

Other sub-segments in the fashion category, such as accessories, footwear, and others, have a smaller role in market growth. Accessories, though essential for haute couture outfits, only capture a fraction of the market. Similarly, footwear, while important, is often seen as complementary to the apparel itself and does not command the same level of attention.

These sub-segments contribute to the overall appeal but do not overshadow apparel in terms of market share or growth. The other category, which includes luxury items like bags or jewelry, remains a niche with a growing but still limited influence compared to the apparel segment.

Type Analysis

Female Couture dominates with 83.3% due to strong demand from female clientele seeking exclusive fashion.

The Haute Couture market is primarily driven by female couture, holding an overwhelming 83.3% market share. This sub-segment’s dominance is largely attributed to the high demand among women for exclusive, custom-made fashion. Female couture collections from top designers like Chanel, Dior, and Valentino are highly sought after for special occasions such as galas, red carpet events, and weddings.

These collections often reflect a blend of artistic expression and luxury fabrics and craftsmanship, appealing to a broad base of affluent women. The continued focus on personalized designs and the prestige associated with owning exclusive couture pieces further strengthens this sub-segment’s position in the market.

Male couture, on the other hand, is growing but still represents a smaller part of the market. While men’s fashion in haute couture has been gaining attention, particularly with designers like Tom Ford and Savile Row tailors, it remains a niche compared to the broader and more established market for women’s couture.

The demand for male couture is influenced by the rise of celebrity culture and the increasing popularity of custom-tailored suits for special events. However, despite growth, this segment accounts for only a fraction of the total haute couture market, as many men opt for ready-to-wear luxury instead.

Application Analysis

Daily Wearing dominates with 73.2% due to growing demand for couture in everyday fashion.

The application segment is largely driven by daily wearing, with 73.2% of the market share. This reflects a growing trend where luxury couture pieces are increasingly being incorporated into everyday wardrobes, not just for special occasions.

The line between ready-to-wear and haute couture is blurring, with many high-end fashion houses offering pieces that cater to both exclusive events and daily wear. Celebrities and fashion-forward individuals often showcase couture designs as part of their regular outfits, contributing to the demand for more versatile, wearable pieces. This shift has made couture fashion more accessible while maintaining its exclusivity.

Catwalk applications, in contrast, represent a smaller portion of the market. While catwalks remain vital for showcasing new collections and setting trends, the commercial value of couture pieces worn on the runway is less than that of couture intended for daily wear.

These runway collections often set the tone for the fashion industry, influencing trends in the ready-to-wear market, but the direct impact on haute couture sales is more limited. Other applications, such as costume or art exhibitions, are also niche, contributing to overall growth but without significantly affecting the dominant daily wearing trend.

End User Analysis

Private Clients dominate with 53.4% due to the personal nature of haute couture purchases.

Private clients are the largest consumer group in the haute couture market, holding 53.4% of the market share. These individuals, typically wealthy, invest in custom-made couture pieces that are tailored specifically to their preferences, body shape, and style.

The allure of haute couture is deeply rooted in its exclusivity and personalization, which appeals strongly to private clients looking to stand out at social events, galas, and other high-profile occasions. Additionally, private clients often form long-term relationships with designers, making them a reliable source of revenue for haute couture houses.

Celebrities and public figures, while influential in driving haute couture trends, account for a smaller share of the market. They play a crucial role in promoting the luxury image of haute couture, especially through red carpet appearances. However, their influence is more indirect, as many couture houses cater to private clients who purchase for personal use rather than public displays.

Fashion collectors and museums represent an even more niche segment, with their purchases often reflecting an interest in preserving and showcasing fashion history rather than in personal use. The “others” category also exists, but its role in the overall market growth remains limited compared to the private clients.

Key Market Segments

By Fashion Category

- Apparel

- Accessories

- Footwear

- Others

By Type

- Female Couture

- Male Couture

By Application

- Catwalk

- Daily Wearing

By End User

- Private Clients

- Celebrities and Public Figures

- Museums and Exhibitions

- Fashion Collectors

- Others

Driving Factors

Rising Income and Consumer Demand Drive Market Growth

The growth of the Haute Couture market can be attributed to several interconnected factors. Rising disposable income and consumer spending power have significantly increased demand for luxury goods. As individuals have more financial freedom, they are willing to invest in high-end, exclusive fashion.

Additionally, there is an increasing demand for customized and personalized products. Consumers today seek more than just luxury; they desire unique pieces that reflect their personal identity. Consequently, the expansion of e-commerce and digital platforms has facilitated access to luxury goods, reaching a global audience and making exclusive products more accessible.

This shift in consumer behavior highlights the growing importance of digital engagement for high-end brands. Furthermore, the focus on sustainable and ethical production practices is contributing to the rise of conscious consumerism. Shoppers are now more inclined to invest in brands that prioritize environmental and ethical considerations, thus expanding the market base for Haute Couture brands that embrace these principles.

Restraining Factors

High Costs and Market Fluctuations Restrain Market Growth

Despite these positive drivers, several factors present challenges to the growth of the Haute Couture market. High production costs and limited profit margins are key restraining elements. Crafting exclusive garments requires skilled labor, rare materials, and intricate designs, which increases operational costs. This can hinder profitability, especially during periods of low demand.

Furthermore, regulatory challenges and compliance requirements often complicate market entry and operational efficiency. Luxury brands must navigate complex regulations, particularly concerning international trade and intellectual property protections, which can strain resources.

Additionally, the Haute Couture market is highly dependent on seasonal demand and market fluctuations. Fashion trends change rapidly, and consumer interest can be volatile, making it difficult for brands to maintain consistent sales.

Moreover, the persistent threat of counterfeit goods and intellectual property theft undermines brand value and market confidence. Counterfeit products often infiltrate the market, diluting the exclusivity that luxury brands rely on to attract high-paying customers. These factors collectively represent significant barriers to sustainable growth for Haute Couture brands.

Growth Opportunities

Expanding Markets and Eco-Innovations Provide Opportunities

There are several growth opportunities in the Haute Couture market that businesses can capitalize on. The emergence of new markets in developing economies presents a significant opportunity for expansion. As middle-class populations grow in regions such as Asia and Latin America, there is a rising demand for luxury goods, including high-end fashion.

Moreover, strategic collaborations and partnerships with global brands can help Haute Couture businesses expand their reach and brand influence. By aligning with established names, smaller or emerging players can tap into new consumer segments and gain credibility.

Another promising opportunity lies in the development of eco-friendly and bio-based alternatives. As sustainability becomes a focal point for consumers, brands that integrate these alternatives into their designs will likely gain a competitive advantage.

Additionally, technological advancements in manufacturing and supply chain processes offer increased efficiency and cost savings. By adopting cutting-edge technologies, brands can streamline production while maintaining the exclusivity and quality that define Haute Couture.

Emerging Trends

Personalized Fashion and Tech Integration Are Latest Trending Factors

The Haute Couture market is also witnessing a shift towards trending factors that further fuel its growth. Increased focus on personalization and unique offerings has become a key trend. Consumers are no longer satisfied with mass-produced luxury goods; they seek tailored products that reflect their individuality. This trend has prompted many Haute Couture brands to offer bespoke services, allowing customers to design and customize their own garments.

Moreover, the growing popularity of social media influencers in luxury branding is changing how consumers engage with fashion. These influencers play a significant role in shaping consumer preferences, increasing brand visibility, and driving demand for exclusive items.

Similarly, the adoption of smart wearables and tech-integrated fashion is emerging as a trend in luxury apparel. Smart textiles and clothing with built-in technology appeal to a tech-savvy demographic looking for functionality and style.

Furthermore, the surge in demand for natural and organic ingredients is influencing the fashion industry, particularly in the development of sustainable fabrics. These trends collectively illustrate how the Haute Couture market is evolving to meet the changing preferences of modern consumers.

Regional Analysis

Asia Pacific Dominates with 31.3% Market Share

Asia Pacific (APAC) holds a dominant 31.3% share of the Haute Couture market, valued at USD 0.4 billion. The region’s prominence in the Haute Couture market can be attributed to its expanding luxury fashion market, growing affluence, and increasing interest in bespoke, high-end fashion. Countries like Japan, China, and India are central to this growth, driven by a rising class of affluent consumers seeking exclusive and custom-designed garments.

The factors contributing to APAC’s high market share include its rapidly growing fashion industry, supported by both traditional craftsmanship and modern fashion houses. The demand for Haute Couture is further fueled by cultural shifts, particularly in urban centers where there is a strong affinity for luxury and personalized fashion. Additionally, the rise in fashion-conscious consumers and the presence of major fashion events in cities such as Tokyo, Hong Kong, and Shanghai play a key role in bolstering the region’s dominance.

The market dynamics in APAC show that the region’s luxury fashion industry is evolving rapidly, influenced by both global fashion trends and local preferences. As the market becomes more sophisticated, the demand for Haute Couture continues to rise, with increased spending from high-net-worth individuals and growing interest in personalized and exclusive pieces. The region’s historical appreciation for craftsmanship, alongside an appetite for modern luxury, creates an ideal environment for the Haute Couture market to thrive.

Regional Mentions:

- North America: North America holds a significant share of the Haute Couture market, driven by affluent consumers and a high concentration of fashion events like New York Fashion Week. Luxury fashion houses continue to target high-net-worth individuals in cities such as New York and Los Angeles.

- Europe: Europe, traditionally the heart of Haute Couture, remains a strong market leader with its long history of prestigious fashion houses in Paris and Milan. The region’s emphasis on luxury craftsmanship and traditional fashion continues to be a key growth factor.

- Middle East & Africa: The Middle East has witnessed growing interest in Haute Couture, particularly in the UAE and Saudi Arabia, where luxury fashion and high-end events like Dubai Fashion Week attract wealthy consumers seeking exclusive designs.

- Latin America: Latin America’s Haute Couture market is expanding, fueled by an emerging middle class and increasing interest in exclusive luxury brands. Cities such as São Paulo and Mexico City are becoming key fashion hubs within the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Haute Couture market is dominated by a few key players that have established themselves as global icons in the fashion industry. The top four players—Dior, Chanel, Giorgio Armani Prive, and Atelier Versace—are the primary trendsetters and drivers of the market.

Dior is one of the most prominent names in haute couture, known for its luxurious designs and sophisticated craftsmanship. It maintains a strong market position with its exclusive collections and high-profile fashion shows. Dior’s legacy and emphasis on innovative, yet timeless designs, ensure its continued dominance.

Chanel is another leading player, renowned for its classic elegance and iconic status in the haute couture world. Chanel’s focus on intricate craftsmanship, high-quality materials, and consistent innovation in design has kept it at the forefront. The brand’s status as a symbol of sophistication and exclusivity contributes to its significant share in the market.

Giorgio Armani Prive offers a more modern and minimalist approach to haute couture, attracting a broad audience. Its designs are known for clean lines, luxurious fabrics, and understated glamour. Armani’s dedication to quality and attention to detail positions it as a top contender in the haute couture industry.

Atelier Versace continues to be a major player, combining bold and extravagant designs with refined craftsmanship. Known for its high fashion glamour, Versace’s presence at international fashion events boosts its visibility and ensures it remains one of the top brands in the haute couture market.

These brands maintain their leadership through exceptional artistry, creativity, and exclusivity, helping to shape and influence the haute couture market for years to come.

Major Companies in the Market

- Dior

- Chanel

- Giorgio Armani Prive

- Atelier Versace

- Jean Paul Gauthier

- Ellie Saab

- Zuhair Murad

- Ralph & Russo

- Givenchy

- Julien Fournie

- Saint Laurent

- Valentino

- Stephane

- Schiaparelli

- Viktor & Rolf

- Giambattista Valli

- Guo Pei

- Iris Van Herpen

- Yuima Nakazato

- Georges Hobeika

Recent Developments

- Hermès: In February 2025, Hermès announced plans to introduce an haute couture line, potentially launching between 2026 and 2027. Executive Chairman Axel Dumas emphasized the necessity for aesthetic appeal and specialized craftsmanship in this endeavor.

- Versace Home and RGZ Developers: In August 2024, Versace Home collaborated with RGZ Developers to design eight exclusive villas in Marbella’s Nueva Andalucía area, each valued at over €10 million. These approximately 2,000 square meter villas feature luxurious amenities, including private gardens, wellness centers, multiple swimming pools, and advanced AI-controlled security systems. This project marks Versace Home’s first venture of this kind in mainland Europe.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 1.7 Billion CAGR (2025-2034) 2.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fashion Category (Apparel, Accessories, Footwear, Others), By Type (Female Couture, Male Couture), By Application (Catwalk, Daily Wearing), By End User (Private Clients, Celebrities and Public Figures, Museums and Exhibitions, Fashion Collectors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Dior, Chanel, Giorgio Armani Prive, Atelier Versace, Jean Paul Gauthier, Ellie Saab, Zuhair Murad, Ralph&Russo, Givenchy, Julien Fournie, Saint Laurent, Valentino, Stephane, Shiaparrelli, Viktor&Rolf, Giambattista Valli, Guo Pei, Iris Van Herpen, Yuima Nakazato, Georges Hobeika Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dior

- Chanel

- Giorgio Armani Prive

- Atelier Versace

- Jean Paul Gauthier

- Ellie Saab

- Zuhair Murad

- Ralph & Russo

- Givenchy

- Julien Fournie

- Saint Laurent

- Valentino

- Stephane

- Schiaparelli

- Viktor & Rolf

- Giambattista Valli

- Guo Pei

- Iris Van Herpen

- Yuima Nakazato

- Georges Hobeika