Generic Drugs Market By Therapeutic Area (Cardiovascular Diseases, Oncology, Central Nervous System Disorders, Respiratory Diseases, Other Drug Classes), By Route of Administration (Oral, Topical, Parenteral, Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118335

- Number of Pages: 249

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Therapeutic Area Analysis

- Route of Administration Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Top Key Players

- Report Scope

Report Overview

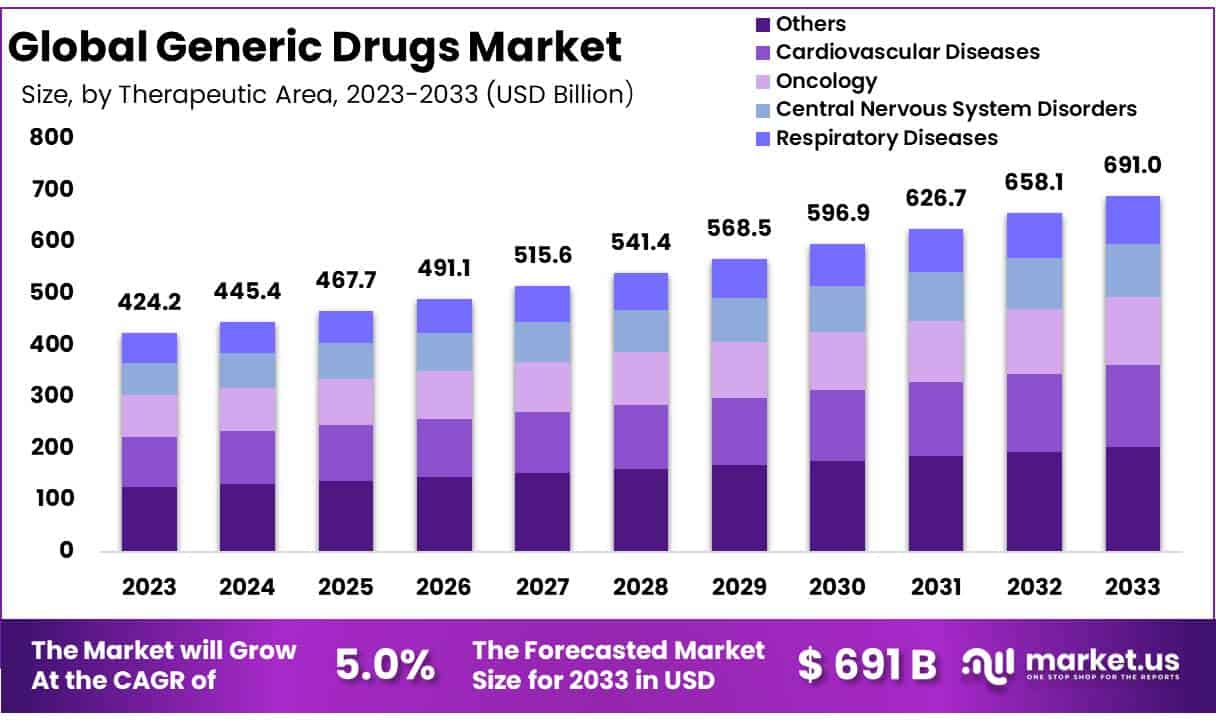

The Global Generic Drugs Market size is expected to be worth around USD 691 Billion by 2033 from USD 424.2 Billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

Generic drugs market has been instrumental in the provision of affordable healthcare, thus ensuring that people from all walks of life have access to life-saving medication. Generic drugs are affordable drugs availed in the market with similar formulation, strength and quality as compared to their branded counterparts. In other words, they are bioequivalent to branded drugs, and meet the same standards of safety and efficacy, while being available at a much lower price point. As a result, it has been made possible to deliver medication to the poor and impoverished.

Generic drugs are manufactured once the patent on branded drugs expires, and in some rare cases if manufacturing processes have been granted patents instead of product. Generic drug manufacturers then reverse engineer the drug manufacturing process to formulate drugs, with minor tweaks to ensure that there are no patent violations. In this way, expiration of patents acts as a driver for the market. Furthermore, this encourages innovation and competition among players.

The market for generic drugs spans a multitude of therapeutic areas, for example, cardiovascular disorders, oncology and respiratory diseases. Increasing prevalence of such chronic illnesses has also proven to be a driving force for the market. Conversely, tedious regulatory processes, while beneficial, may deter market growth. Overall, the market for generic drugs continues to grow, helmed by increasing demand for cost-effective healthcare solutions, encouraging government initiatives and strategic partnerships between stakeholders and manufacturers.

- FDA approved or tentatively approved 956 generic drug applications in 2023, as per the 2023 Annual Report by the Office of Generic Drugs.

- According to a report by the International Generic and Biosimilar Medicines Association, generic medicine contributes to over 60-80% of total medical volume sales worldwide.

- According to a research published in the BMC Pharmacology and Toxicology journal, generic drugs tends to be cheaper than branded ones by 20-90%.

Key Takeaways

- The global generic drugs market generated a revenue of USD 424.2 billion in 2023, and is expected to reach USD 491.0 billion by the end of the forecast period, with a CAGR of 5.0%.

- When categorizing based on therapeutic area, the market includes segments such as cardiovascular diseases, oncology, central nervous system disorders, respiratory diseases, and others. The “others” category captured the largest market share in 2023, accounting for 29.5%.

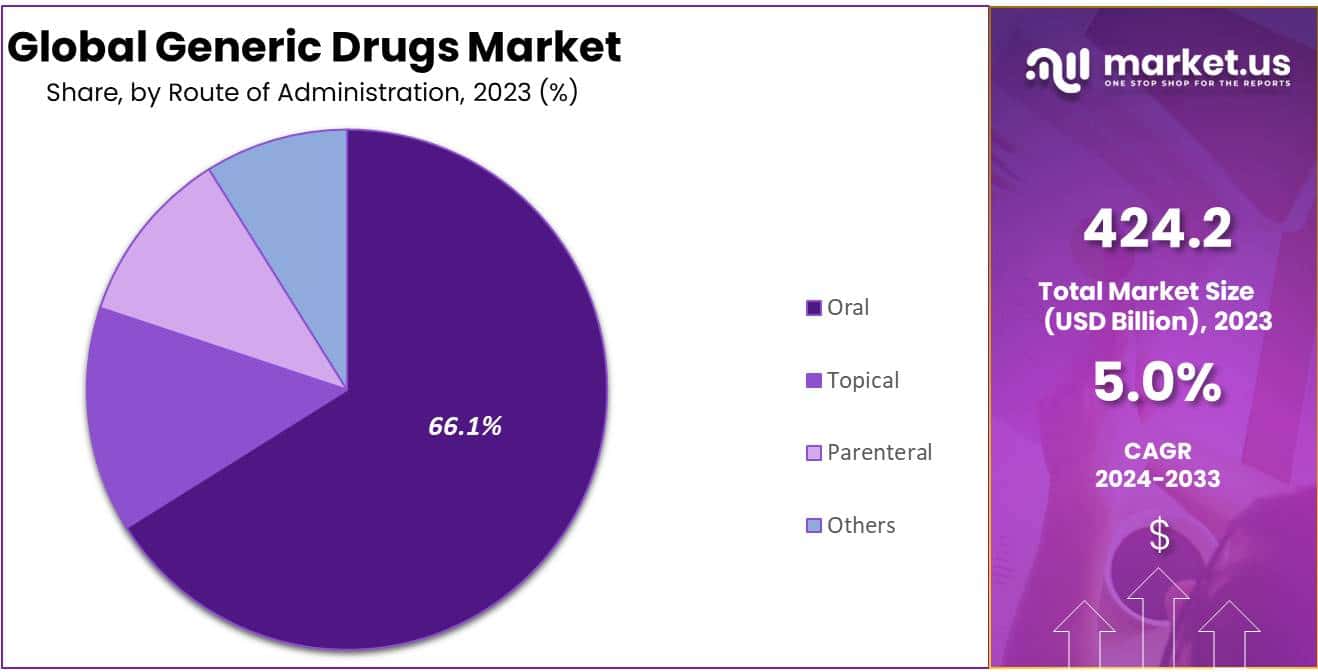

- Regarding the route of administration, segments include oral, topical, parenteral, and others. Among these, the oral segment contributed the highest revenue to the market, holding a market share of 66.1% in 2023.

- In terms of distribution channels for generic drugs, the market is divided into retail pharmacies, hospital pharmacies, and online pharmacies. The retail pharmacy segment led the market in revenue generation, commanding a share of 56.4% in 2023.

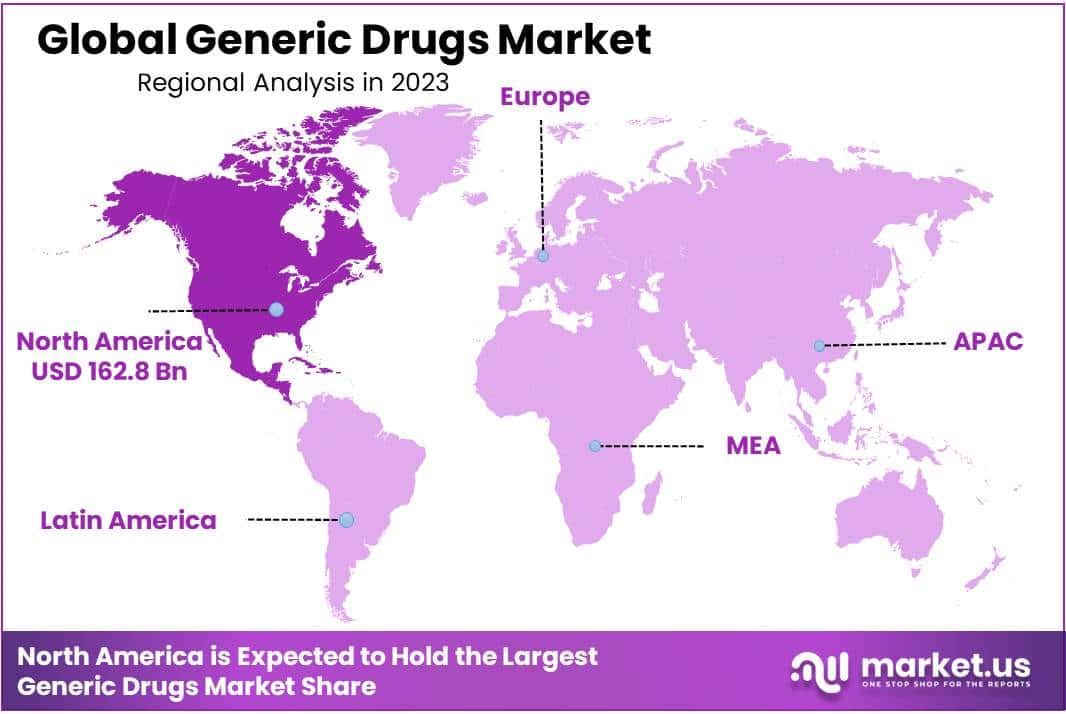

- Region wise, North America maintained its stronghold on the market, with a market share of 38.4%.

Therapeutic Area Analysis

When classified on the basis of therapeutic area, the segments observed in the market are cardiovascular diseases, oncology, central nervous system disorders, respiratory diseases, and others. In this classification, the others segment secured the largest market share in 2023, amounting to 29.5%. The dominance of this particular segment is expected to last throughout the forecast period as well, primarily due to increasing demand of generics on a global scale. Additionally, aging populations affect the demand as well, seeing that the elderly people are at a higher risk of developing a chronic disorder.

Route of Administration Analysis

Based on route of administration, the segments observed in the market are oral, topical, parenteral, and others. Among these, the oral segment generated the most revenue for the market, with a market share of 66.1% in 2023. This is credited to the convenience offered by oral route of administration. Not only are such drugs easy to administer, and thus can be self-administered, but the means of administration is also considered the safest for prolonged and repeated use. Oral generics are thus most manufactured generics, therefore claiming the largest market share.

Distribution Channel Analysis

As far as distribution channels for generic drugs are considered, the market is segmented into retail pharmacies, hospital pharmacies and online pharmacies. Among these, the retail pharmacy segment generated the most revenue for the market, with a revenue share of 56.4% in 2023. This is due to comparatively high prevalence of retail pharmacies. Patients have easy access to medication through retail channels, which fosters market growth.

Key Market Segments

By Therapeutic Area

- Cardiovascular Diseases

- Oncology

- Central Nervous System Disorders

- Respiratory Diseases

- Other Therapeutic Areas

By Route of Administration

- Oral

- Topical

- Parenteral

- Other Routes of Administration

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Drivers

Increasing Prevalence of Chronic Diseases

The incidence of chronic diseases is escalating worldwide, which has proven to be a major driving force for the market. Chronic conditions more often than not require adherence to a complicated treatment regimen, which makes pricing, and by extension affordability, a critical factor for patients. Factors such as population aging, unhealthy lifestyle choices and underdeveloped healthcare infrastructure further contribute to the growing burden of chronic diseases on a global scale.

Patent Expirations

When patents of drugs expire, other manufactures are able to legally produce and subsequently market variations or versions of the drug. This creates opportunities for pharmaceutical companies to enter the market and expand their portfolio with ease. Such market entry opportunities are crucial in market growth since they encourage firms for ventures in the generic drugs market.

Restraints

Patent Litigation Complications

More often than not, brand-name companies try to protect their patents by engaging in legal battles with generic drug manufacturers. such legal disputes result in extended monopoly of branded medication in the market. This limits competition and healthcare remains inaccessible for the needy. Furthermore, firms may hesitate to enter the market due to the possibility of legal action. In this way, patent litigation poses a major threat to the growth of the generic drugs market.

Opportunities

Biosimilars pose a considerable opportunity for the global generic drugs market. They are, in essence, similar versions of biologic drugs, but are available at a much lower price point. As per an article by the Association of Accessible Medicines, while generics account for majority of prescriptions filled, they only account for 17.5% of drug costs. This affordability has driven the demand for generic drugs on a global scale. Thus, pharmaceutical companies can greatly benefit from entering this market.

Furthermore, emerging markets in Asia-Pacific and Latin America present the market with countless opportunities. Factors such as increasing healthcare expenditures, and developing healthcare infrastructure drive market growth in these regions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions such as economic growth, inflation rates and government healthcare expenditure influence the market for generic drugs in a significant manner. Individuals often look to affordable healthcare alternatives, which drives the demand for generic medication. Fluctuations in currency and exchange rates often impact pricing of generic drugs as well. Trade agreements, barriers and disputes may lead to pricing pressures, thus creating uncertainties within the market.

Additionally, government policies affect the market significantly. For instance, the Patent Act 1970 by the government of India allowed only processes to be patented instead of products. This act also mandated patents be licensed to others lest the patent is used for social benefit. This resulted in a booming pharmaceutical industry, with a sizeable generic drug production.

Latest Trends

One of the major trends observed in the market is the shift towards production of complex generics and specialty generics. Such generics, while difficult to manufacture, target niche patient populations and require specialised manufacturing capabilities. Furthermore, adoption of digital technologies has revolutionized the industry as a whole. Digital platforms, telemedicine and electronic health records streamline the communication process between patients and healthcare providers.

Additionally, the increasing use of digital technologies has enhanced medication management, which in turn has improved adherence to treatment regimen, thus leading to better patient outcomes. Another trend is pharmaceutical companies are leaning towards sustainable practices such as energy conservation, waste reduction and responsible sourcing. By launching environmental initiatives that align with corporate social responsibility, businesses are able to resonate with environmentally conscious consumers and stakeholders.

Regional Analysis

North America is leading the Generic Drugs Market

North America remained the largest contributor to the global generic drugs market in 2023 and is expected dominate the market in the forecast period as well. The revenue share of the region amounted to 38.4% in 2023. This is primarily attributed to the increasing prevalence of chronic disorders and growing patent expirations.

Additionally, US is highly lucrative market with a high demand for generic medication. According to the Office of Generic Drugs Annual Report by the FDA, generic drugs are filled for over 91% of prescriptions. All the aforementioned factors have culminated in domination of the region in the global generic drugs market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to undergo a period of exponential growth, accompanied by a promising CAGR. The growth of the market in this region is predominantly driven by the high incidence of chronic disorders. Moreover, factors such as population aging and rapidly developing healthcare infrastructure contribute to market expansion. Pharmaceutical businesses in fast-growing economies like China and India are highly robust.

According to the Press Information Bureau, India has become the largest provider of generic drugs, producing to 20% of generic drugs consumed worldwide. With these factors encouraging market growth, generic drugs market in Asia-Pacific is predicted to flourish.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global market for generic drugs is mildly fragmented, characterised by a prominent presence of multiple established players and high rates of entry. The competition is high, fuelled by increasing prevalence of chronic disorder and subsequently rising demand for generic medicine. Market players employ tactics such as mergers, acquisitions and product innovations to further cement their positions in the market.

Additionally, increasing investments are being made in research and development of new generic drugs, which has resulted in frequent product launches, thus increasing market rivalry.

Recent Developments

- In October 2023, Viatris, announced divestment of its active pharmaceutical ingredients (API) and women’s healthcare divisions in India for a total of USD 1.2 billion as part of a broader global divestiture initiative totaling USD 3.6 billion. The API segment is being acquired by IQuest Enterprises, while the women’s healthcare division is being sold to Insud Pharma.

- In November 2023, Teva Pharmaceuticals was granted FDA approval for its generic version of Forteo, which is to be used for postmenopausal women with osteoporosis and men with primary or hypogonadal osteoporosis.

- In April 2024, Teva Pharmaceuticals International GmbH, a subsidiary of Teva Pharmaceutical Industries Ltd., forged a strategic licensing agreement with mAbxience, a biotechnology firm based in Spain. This partnership focuses on a biosimilar candidate under development to treat various oncology conditions.

Top Key Players

- Teva Pharmaceuticals

- Sandoz

- Viatris

- Sun Pharma

- Cipla

- Reddy’s Laboratories

- Other Key Players

Report Scope

Report Features Description Market Value (2023) USD 424.2 Billion Forecast Revenue (2033) USD 691 Billion CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Therapeutic Area – Cardiovascular Diseases, Oncology, Central Nervous System Disorders, Respiratory Diseases, Other Therapeutic Areas; By Route of Administration – Oral, Topical, Parenteral, Others; By Distribution Channel – Retail Pharmacies, Hospital Pharmacies, Online Pharmacies Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Teva Pharmaceuticals, Sandoz, Viatris, Sun Pharma, Cipla, Dr. Reddy’s Laboratories, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Generic Drugs Market?The generic drugs market refers to the segment of the pharmaceutical industry that produces medications which are chemically identical to brand-name drugs, but are typically sold at lower prices once the patent protection for the original drug expires.

How big is the Generic Drugs Market?The global Generic Drugs Market size was estimated at USD 424.2 Billion in 2023 and is expected to reach USD 691 Billion in 2033.

What is the Generic Drugs Market growth?The global Generic Drugs Market is expected to grow at a compound annual growth rate of 5.0%. From 2024 To 2033

Who are the key companies/players in the Generic Drugs Market?Some of the key players in the Generic Drugs Markets are Teva Pharmaceuticals, Sandoz, Viatris, Sun Pharma, Cipla, Dr. Reddy’s Laboratories, and Other Key Players.

Why are Generic Drugs Important?Generic drugs play a crucial role in providing affordable healthcare solutions. They offer cost-effective alternatives to brand-name medications, making essential treatments more accessible to patients and healthcare systems worldwide.

What Drives the Growth of the Generic Drugs Market?Several factors contribute to the growth of the generic drugs market, including patent expirations of brand-name drugs, increasing demand for affordable healthcare, government initiatives to promote generic drug usage, and advancements in generic drug manufacturing technologies.

What is the Future Outlook for the Generic Drugs Market?Despite challenges, the generic drugs market is expected to continue its growth trajectory, driven by increasing demand for affordable medications, expanding healthcare access in developing countries, and ongoing efforts to streamline regulatory processes and ensure product quality and safety.

-

-

- Teva Pharmaceuticals

- Sandoz

- Viatris

- Sun Pharma

- Cipla

- Reddy’s Laboratories

- Other Key Players