Global Generative AI Market By Component (Services, Software), By Model (Large Language Models, Image & Video Generative Models, Multi-modal Generative Models, Others), By Technology (Generative Adversarial Networks (GANs), Transformer, Variational Auto-encoder (VAE), Diffusion Networks), By End-User (Media & Entertainment, BFSI, IT & Telecommunication, Healthcare, Automotive & Transportation, Other End-Users), By Application (Computer Vision, NLP, Robotics & Automation, Content Generation, Predictive Analytics, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 98888

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Component Analysis

- Model Analysis

- Technology Analysis

- End-User Analysis

- Application Analysis

- Top use cases for generative AI

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Impact of Macroeconomic Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

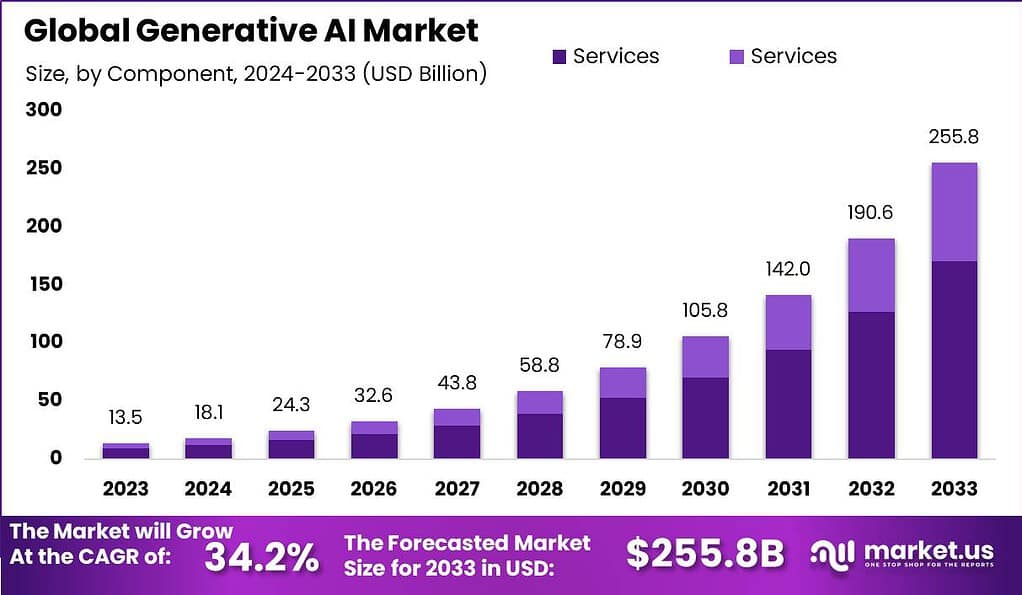

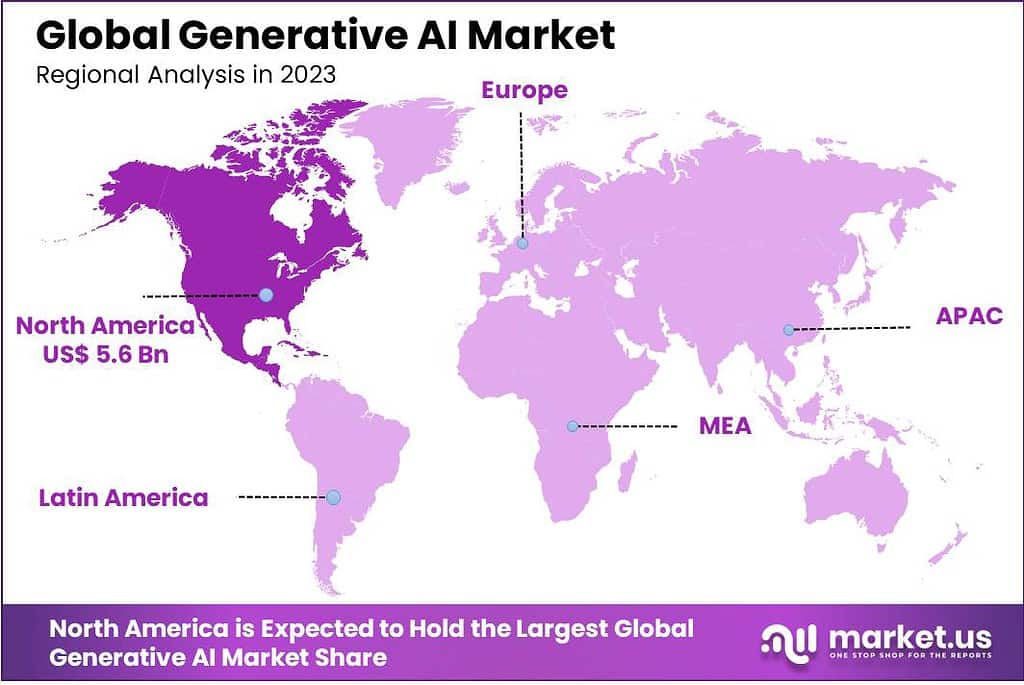

The Global Generative AI Market size is expected to be worth around USD 255.8 Billion by 2033, from USD 13.5 Billion in 2023, growing at a CAGR of 34.2% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 42.1% share, holding USD 5.6 Billion revenue.

Generative AI, also known as generative adversarial networks (GANs), is a branch of artificial intelligence that focuses on generating new data samples that resemble a given training dataset. Unlike traditional AI models that rely on predefined rules or patterns, generative AI models learn to create new content by leveraging the power of deep learning algorithms.

The global generative AI market encompasses the development, implementation, and utilization of artificial intelligence systems capable of producing original and innovative outputs such as music, art, literature, and various media forms. Generative AI, also referred to as creative AI or art AI, employs machine learning algorithms to analyze extensive datasets, learning patterns from them, and subsequently generating novel content similar to the identified patterns.

The demand for generative AI is driven by its ability to streamline processes and enhance creativity, reducing the time and cost associated with content creation. Industries such as advertising, gaming, and film are particularly keen on adopting this technology to generate unique content and improve user engagement. Additionally, as more businesses aim to personalize their services, the need for generative AI tools that can produce tailored content quickly is increasing.

Several factors contribute to the growth of the generative AI market. The advancement in machine learning and neural networks has significantly improved the capabilities of generative AI systems, making them more efficient and versatile. Increased data availability and enhanced computing power also allow these systems to learn and generate better outputs. Moreover, the ongoing digital transformation in various sectors fuels the integration of AI technologies, including generative AI.

Generative AI offers substantial opportunities across various industries. In healthcare, it can be used to generate patient-specific reports and simulate surgical procedures. In the field of education, it can create customized learning materials and interactive content. There’s also a significant opportunity in the software industry, where generative AI can help in coding, debugging, and even testing software. As the technology matures, its potential applications and the markets it can disrupt are expected to grow, presenting significant investment opportunities for businesses and innovators.

For instance, In March 2023, Microsoft Corporation introduced a new model, Visual ChatGPT, which integrates various visual foundation models. This development allows users to interact with ChatGPT through graphical user interfaces, enhancing capabilities such as image generation and editing. This launch signifies a strategic expansion in Microsoft’s product offerings, potentially tapping into new customer segments and expanding the utility of AI-driven platforms in the tech industry.

According to an article published by Forbes, the market value for generative AI is projected to experience a substantial growth of US$180 billion over the next eight years. This estimation underscores the immense market potential and investment opportunities associated with generative AI technologies.

A recent study conducted by renowned professors from Harvard Business School, The Wharton School, The Warwick Business School, and MIT Sloan reveals that generative AI can boost employee productivity by up to 40%. This finding suggests that the integration of generative AI technology in various industries could lead to substantial efficiency gains.

Furthermore, a survey conducted on the subject highlights that in a midpoint adoption scenario, generative AI has the capability to increase US labor productivity by 0.5 to 0.9 % points annually through 2030. This projection underscores the long-term potential of generative AI in driving productivity growth within the economy.

The banking sector, in particular, is poised for a transformative shift driven by AI. Enterprise generative AI tools are expected to reshape banking operations, customer interactions, and risk assessments, resulting in an estimated annual value addition ranging from $200 billion to $340 billion. This significant potential value demonstrates the transformative impact that generative AI can have on the banking industry.

In terms of investment and adoption, the generative AI market is experiencing remarkable growth. Total funding in generative AI startups is projected to reach $6 billion in 2023, indicating strong investor interest and confidence in the technology. Additionally, the number of downloads of generative AI tools is expected to surpass 10.1 million by mid-2023, a considerable increase from 1.1 million in 2022.

Key Takeaways

- The Generative AI Market generated a revenue of US$ 13.5 billion with a CAGR of 34.2% and is expected to reach US$ 255.8 billion by 2033.

- The generative AI market is characterized by the dominance of the software segment, constituting 66.7% of revenue in 2023, driven by heightened demand and model enhancements.

- The transformer technology segment holds the largest revenue share at 45.1%, with a projected CAGR of 32.2%, due to its versatility in language processing and image generation.

- Large language models lead the model segment, expected to grow significantly, while computer vision anticipates the fastest CAGR, driven by expanded applications in transportation and surveillance.

- Media & entertainment dominates among end-users with a market share of 24.3%, leveraging generative AI for image and video creation, with

- In 2023, the NLP led the market when classified by applications, and projected to sustain growth, with computer vision poised for rapid expansion, driven by its adoption in various sectors.

- Regionally, North America remained the leading segment with a market share of 42.1%.

- Generative AI is expected to boost the United States GDP by 21% by 2030.

- Over 75% of consumers worry about misinformation from AI.

- ChatGPT hit ~1 million users within its first five days of launch.

- 64% of businesses believe AI will boost productivity.

- 58% of companies in China are already using AI, with another 30% considering it. This is higher than in the United States, where only 25% are using AI, but 43% are looking into it.

- 73% of surveyed people in India are using generative AI, followed by 49% in Australia, 45% in the US, and 29% in the UK.

- A significant portion of generative AI users are Millennials or Gen Z, making up 65% of the total, with 72% of them being employed.

- Nearly 6 in 10 users feel they are getting close to mastering generative AI.

- 70% of Gen Z have reported using the technology, and 52% of them trust it to help make informed decisions.

- 52% of users find themselves using generative AI more frequently over time.

- 75% of users are looking to use generative AI for automating tasks at work and for work communications.

- 38% use generative AI for fun or experimentation, and 34% for learning about topics of interest.

- Among marketers, the most common uses of generative AI include basic content creation and writing copy (both at 76%), inspiring creative thinking (71%), analyzing market data (63%), and generating image assets (62%).

Component Analysis

In 2023, the Software segment held a dominant market position within the Generative AI market, capturing more than a 66.7% share. This significant market share can be attributed to the increasing demand for AI-driven applications and platforms that offer innovative solutions across various industries, including healthcare, automotive, finance, and entertainment.

The software component of Generative AI encompasses a wide array of applications, from natural language processing and image generation to predictive analytics and automation tools. These applications are crucial for businesses seeking to leverage AI for enhancing operational efficiency, driving innovation, and gaining a competitive edge in their respective markets.

The dominance of the Software segment is further bolstered by the continuous advancements in AI technologies, leading to the development of more sophisticated and versatile software solutions. Companies are investing heavily in research and development to innovate and improve their offerings, which in turn fuels the growth of the Software segment.

Moreover, the scalability and flexibility of AI software allow for its application in solving complex challenges and creating new opportunities for businesses, thereby driving demand. The integration of AI software into existing systems and processes has become more seamless, encouraging wider adoption.

Furthermore, the rise in cloud computing and the availability of AI software as a service (SaaS) have made it easier for companies of all sizes to access and implement AI capabilities, contributing to the growth of the Software segment. This accessibility, combined with the increasing recognition of the value generated by AI applications in optimizing decision-making and enhancing customer experiences, underscores the segment’s leading position in the Generative AI market.

Model Analysis

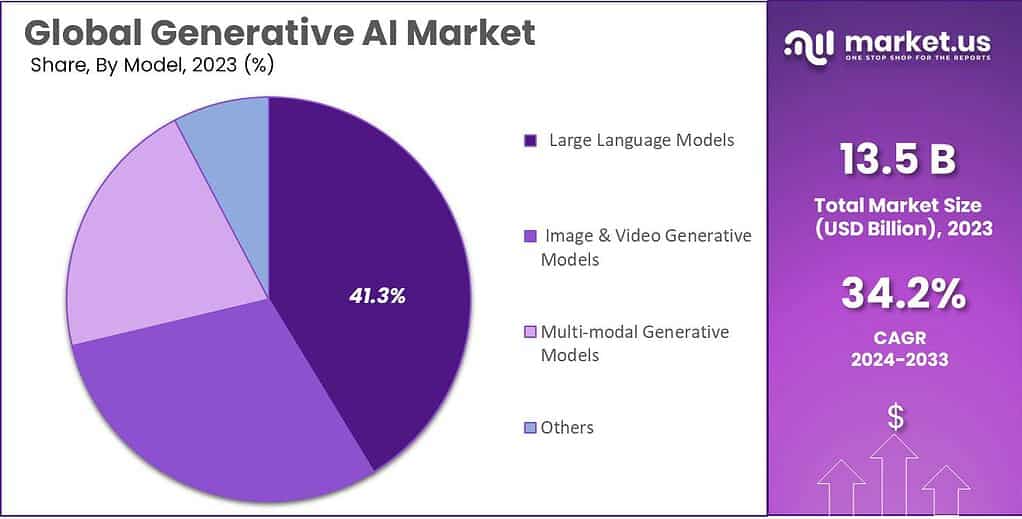

In 2023, the Large Language Models segment held a dominant market position, capturing more than a 41.3% share of the generative AI market. This prominence can be attributed to the widespread adoption of these models across various sectors, including but not limited to, customer service, content creation, and programming assistance.

Large Language Models, characterized by their ability to understand, generate, and interpret human language with remarkable accuracy, have become indispensable tools for businesses seeking to enhance operational efficiency and deliver personalized customer experiences.

The leading position of Large Language Models in the generative AI market is further bolstered by continuous advancements in natural language processing (NLP) technologies. These advancements have significantly improved the models’ capabilities in terms of context understanding, coherence, and text generation quality, making them more versatile and effective for a wide range of applications.

Furthermore, the integration of Large Language Models into existing business processes and platforms has been facilitated by their scalability and the development of more user-friendly interfaces, thereby lowering the barrier to entry for organizations of all sizes. Moreover, the economic impact of implementing Large Language Models cannot be overstated. Businesses that leverage these models report considerable gains in productivity and customer satisfaction, translating to higher revenue growth and competitive advantage.

The segment’s growth is also driven by an increasing awareness among companies about the benefits of AI-driven automation and data-driven decision-making. With the market for generative AI expected to expand further, the share of Large Language Models is anticipated to grow, reflecting their critical role in the digital transformation journey of enterprises worldwide. This trend is supported by substantial investments in AI research and development, aiming to enhance the models’ efficiency, reduce operational costs, and explore new applications in emerging fields.

Technology Analysis

In 2023, the Transformer segment emerged as the dominant force in the generative AI market, capturing a significant market share of more than 45.1%. The Transformer technology has rapidly gained traction due to its exceptional capabilities in natural language processing (NLP) tasks and its ability to generate coherent and contextually relevant outputs.

This segment’s leading position can be attributed to several key factors. Firstly, the Transformer architecture introduced a groundbreaking approach to sequence modeling, enabling more effective representation and understanding of sequential data. Its self-attention mechanism allows the model to focus on different parts of the input sequence, capturing long-range dependencies and improving context awareness. This has proven particularly advantageous in language-related tasks, such as machine translation, text generation, and sentiment analysis.

Secondly, the Transformer’s success can be attributed to its versatility and adaptability across various domains. Its ability to handle both short and long sequences, along with its scalability, has made it highly suitable for a wide range of applications, including language generation, image synthesis, and music composition. The Transformer’s flexibility has allowed it to address diverse industry needs, leading to widespread adoption across different sectors.

Furthermore, the Transformer’s performance has been particularly remarkable in the realm of natural language generation. Its ability to generate coherent and contextually relevant text has made it an invaluable tool for applications such as chatbots, virtual assistants, and content creation. The Transformer’s ability to capture complex linguistic patterns, maintain context, and produce high-quality outputs has positioned it as the technology of choice for language generation tasks.

End-User Analysis

In 2023, the Media & Entertainment segment emerged as the leading sector in the generative AI market, capturing a significant market share of over 24.3% with a robust compound annual growth rate (CAGR) of 36.4%.

Several key factors have contributed to the segment’s dominant position. Firstly, the Media & Entertainment industry has witnessed a rapid adoption of generative AI to enhance content creation and delivery. Generative AI models have empowered filmmakers, game developers, and content creators by enabling them to generate realistic visuals, characters, and immersive experiences. The ability to generate high-quality and diverse content at scale has driven efficiency and creativity within the industry, leading to increased audience engagement and revenue generation.

Secondly, the Media & Entertainment segment has benefited from the advancements in generative AI technologies, such as generative adversarial networks (GANs) and deep learning algorithms. These technologies have revolutionized visual effects, computer-generated imagery (CGI), and virtual reality (VR) experiences. By leveraging generative AI, the industry has been able to create stunning visual effects, lifelike animations, and interactive virtual environments, thereby elevating the overall entertainment experience.

Furthermore, the Media & Entertainment sector has embraced generative AI to personalize content recommendations and improve user engagement. Through the analysis of user preferences, generative AI algorithms can generate tailored recommendations, personalized advertisements, and customized experiences. This level of personalization has led to increased viewer satisfaction and retention, ultimately driving revenue growth for media and entertainment companies.

Application Analysis

In 2023, the NLP (Natural Language Processing) segment emerged as the dominant player in the generative AI market, capturing a significant market share. The NLP segment’s leadership position can be attributed to several key factors that have propelled its growth and adoption within the industry.

Firstly, NLP has witnessed remarkable advancements in generative AI technologies, enabling the development of sophisticated language models and text generation capabilities. These advancements have revolutionized various sectors, including customer service, virtual assistants, chatbots, and content generation. NLP-powered generative AI has the ability to understand and generate human-like text, making it invaluable for applications such as automated customer support, content creation, and language translation.

Secondly, the widespread adoption of digital platforms and the surge in online content have generated a massive amount of textual data. NLP-based generative AI offers powerful tools to analyze and extract insights from this textual data, enabling organizations to make data-driven decisions, enhance customer experiences, and gain a competitive edge. The ability to process and generate text has made the NLP segment a key driver in areas such as predictive analytics, sentiment analysis, and personalized recommendations.

Furthermore, the increasing demand for natural language understanding and communication has fueled the growth of the NLP segment. NLP-powered generative AI has the capacity to comprehend and respond to human language, enabling seamless interactions between users and machines. This has led to the widespread adoption of NLP-based applications in voice assistants, virtual agents, and automated language processing systems.

Top use cases for generative AI

- Customer Service: Generative AI is extensively used to power virtual customer support agents. These agents can handle a wide range of customer queries efficiently, providing quick and accurate responses, thus reducing the workload on human customer service representatives and improving overall customer satisfaction.

- Content Creation: In the realm of marketing, generative AI tools are used to create personalized marketing messages based on customer data, significantly enhancing engagement and efficiency in communication workflows.

- Document Handling: Advances in AI have transformed how documents are searched and synthesized, making information discovery and analysis more efficient. AI-powered tools can now perform semantic searches, extract key facts, and even provide personalized search results. Additionally, AI can generate summaries and analyze the sentiment of documents, which is particularly useful in sectors like legal, academic, and customer feedback analysis.

- Design and Engineering: In industries such as manufacturing, automotive, and aerospace, generative AI is utilized for generative design. This involves using AI to create optimized part designs that meet specific performance, material, and manufacturing method constraints, thereby innovating product development and improving efficiency.

- Legal and Compliance: AI-driven tools are automating the generation and review of legal documents to ensure compliance with relevant laws and regulations. This not only speeds up the process but also reduces the risk of non-compliance, making it invaluable for legal teams across various sectors.

- Supply Chain Management: Generative AI assists in optimizing supply chain operations by predicting demand and automating logistics planning. This application can lead to significant cost reductions and improvements in customer service, crucial for businesses aiming to maintain efficient supply chains in dynamic markets.

Key Market Segments

By Component

- Services

- Software

By Model

- Large Language Models

- Image & Video Generative Models

- Multi-modal Generative Models

- Others

By Technology

- Generative Adversarial Networks (GANs)

- Transformer

- Variational Auto-encoder (VAE)

- Diffusion Networks

By End-User

- Media & Entertainment

- BFSI

- IT & Telecommunication

- Healthcare

- Automotive & Transportation

- Other End-Users

By Application

- Computer Vision

- NLP

- Robotics & Automation

- Content Generation

- Predictive Analytics

- Others

Driving Factors

Demand for unique and personalised products and services drive market growth

Generative AI is revolutionizing industries by offering personalized products and services through unique designs and recommendations tailored to individual user preferences. By automating processes and reducing manual errors, businesses benefit from heightened productivity and efficiency. Advanced deep learning models like GANs and VAEs enable the creation of intricate and realistic data such as images and audio, utilizing large datasets to enhance accuracy and performance.Potential for efficient content creation liked to accelerating growth

The surge in demand for AI-generated content fuels the growth of the generative AI market, prompting businesses to explore novel business models harnessing AI tools for scalable content creation. A report by the EU Law Enforcement Agency states that over 90% of content published online will be AI-generated by the year 2026. Pioneering model developers craft state-of-the-art generative AI tools, empowering businesses to curate engaging and distinctive content for their audiences at a rapid rate, thereby propelling the market forward with innovative solutions and applicationsRestraining Factors

Shortage of skilled personnel may hinder market growth

The scarcity of skilled professionals in the realm of Generative AI presents a notable challenge, as expertise in machine learning, statistics, and computer science is essential for effective implementation. This shortage may impede companies from developing and integrating Generative AI solutions, slowing down its adoption across industries. Furthermore, compliance with legal and regulatory frameworks, such as data protection laws and industry-specific regulations, adds complexity and cost to the utilization of Generative AI, potentially inhibiting its uptake.Growth Opportunities

Providing cost-effective solutions to business problems

Opportunities for growth abound in leveraging generative AI to develop novel products and services, thereby enhancing the customer experience. Through generative AI, businesses can now explore avenues previously deemed impractical or cost-prohibitive, offering personalized designs, products, and recommendations to customers. This innovation not only opens new revenue streams but also fosters fresh business opportunities, empowering companies to cater to evolving consumer needs and preferences effectively.Moreover, by automating and refining various operational processes, generative AI mitigates manual errors and enhances overall efficiency and productivity. According to an article by India AI, the AI-powered technologies enable 40% increase in productivity in workplaces by 2035.

Impact of Macroeconomic Factors

Macroeconomic factors significantly influence the generative AI market. Economic stability, government policies, and trade relations affect investment in AI research and development. Government policies and regulatory changes can disrupt supply chains and international collaborations crucial for AI advancements. Moreover, currency fluctuations and trade tariffs may impact the cost of AI technologies and their accessibility globally. Political stability fosters innovation and investment confidence, while economic downturns or political unrest may hinder market growth.

Latest Trends

An emerging trend involves the fusion of generative AI with blockchain technology, facilitating the creation of secure and verifiable digital assets. This integration paves the way for the development of unique digital creations, revolutionizing sectors such as the creative industries, where artists, musicians, and designers can produce innovative works with unprecedented authenticity. This trend underscores a growing adoption of generative AI across various industries, exemplified by the presence of AI-generated artworks and music in the market.

Notably, generative models like GANs are finding increased utility in gaming, enabling the creation of lifelike environments and animations. Moreover, the healthcare sector is witnessing a rising adoption of generative AI for applications such as drug discovery, medical imaging analysis, and disease diagnosis.

Regional Analysis

North America is leading the Generative AI Market

North America emerged as the dominant region in the global generative AI market in 2023, capturing the largest revenue share of 42.1% and is projected to sustain a robust CAGR of 33% throughout the forecast period. This dominance is attributed to the presence of leading technology firms in the region, particularly in the United States, which is witnessing a surging demand for AI-driven solutions across various sectors including healthcare, finance, and retail.The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Meanwhile, the Asia Pacific (APAC) region is poised to exhibit the highest growth rate during the forecast period in the generative AI market. This growth trajectory is propelled by the substantial investments in AI research and development across major economies like China, Japan, and South Korea. These nations are actively fostering innovation and technological advancement in the AI landscape, thereby fostering a conducive environment for the expansion of the generative AI market across the APAC region. According to India AI, the expenditure on AI in India rose by US$ 109.6 million in 2018 alone.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the landscape of generative AI, several key players emerge as frontrunners, shaping the direction and dynamics of the market. These companies exhibit distinct strengths, strategic initiatives, and technological innovations that contribute to their prominence and competitive advantage.

IBM Corporation stands as a cornerstone in the generative AI landscape, leveraging its extensive experience and technological expertise to drive innovation in artificial intelligence. With a diverse portfolio spanning from Watson AI to cloud computing solutions, IBM continues to pioneer advancements in natural language processing and image generation, positioning itself as a trusted partner for enterprises seeking AI-driven transformation.

Top Market Leaders

- IBM Corporation

- Genie AI Ltd.

- MOSTLY AI Inc.

- Google LLC

- D-ID

- Amazon Web Services Inc.

- Microsoft Corporation

- Adobe Inc.

- Synthesia

- Other Key Players

Recent Developments

- In June 2023, Salesforce expanded its AI offerings by launching two generative AI products aimed at enhancing commerce experiences and personalizing consumer interactions: Commerce GPT and Marketing GPT. Commerce GPT is designed to optimize e-commerce platforms by tailoring browsing experiences, whereas Marketing GPT focuses on leveraging Salesforce’s real-time data cloud platform.

- Google LLC, in April 2023, made significant strides in democratizing AI with updates to its Vertex AI platform. These enhancements not only introduced new AI models and tools but also simplified the integration and deployment of AI technologies across various business functions. Google’s initiative is seen as a pivotal development in making potent AI tools more accessible to businesses, thereby fostering a more inclusive adoption across industries.

- Amazon Web Services (AWS) unveiled several new generative AI services at its annual re

conference in June 2023. A standout among these is the Amazon Bedrock service, which provides foundational AI models that are readily accessible to developers. This initiative is particularly crucial as it facilitates the rapid development and scaling of generative AI applications, thereby enhancing AWS’s positioning as a critical player in supporting the AI infrastructure needs of modern enterprises. - In August 2023, Microsoft Corporation deepened its partnership with IBM to offer more robust generative AI solutions, particularly targeting the enterprise sector. This collaboration is strategically focused on integrating AI across various industries, with special emphasis on automating processes in healthcare and procurement via Microsoft’s Azure OpenAI Service. This partnership underscores the growing trend of leveraging AI to drive efficiency and innovation in sectors that are traditionally more manual and process-oriented.

Report Scope

Report Features Description Market Value (2023) USD 13.5 Bn Forecast Revenue (2033) USD 255.8 Bn CAGR (2024-2033) 34.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Services, Software), By Model (Large Language Models, Image & Video Generative Models, Multi-modal Generative Models, Others), By Technology (Generative Adversarial Networks (GANs), Transformer, Variational Auto-encoder (VAE), Diffusion Networks), By End-User (Media & Entertainment, BFSI, IT & Telecommunication, Healthcare, Automotive & Transportation, Other End-Users), By Application (Computer Vision, NLP, Robotics & Automation, Content Generation, Predictive Analytics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM Corporation, Genie AI Ltd., MOSTLY AI Inc., Google LLC, D-ID, Rephrase.ai, Amazon Web Services Inc., Microsoft Corporation, Adobe Inc., Synthesia, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI?Generative AI refers to a subcategory of Artificial Intelligence (AI) that employs algorithms to produce new content such as images, videos, texts and audios that simulate human creativity and decision-making processes.

How big is Generative AI Market?The Global Generative AI Market size is expected to be worth around USD 255.8 Billion by 2033, from USD 13.5 Billion in 2023, growing at a CAGR of 34.2% during the forecast period from 2024 to 2033.

What are the key applications of Generative AI?Generative AI finds numerous applications across a range of fields, from creative arts and content generation, image synthesis, text-to-image conversion, video creation and design optimization to data augmentation, simulation and generative modeling for research and development purposes.

What are the benefits of using Generative AI?Generative AI offers numerous advantages that can enhance productivity and creativity, including automating content creation, rapid prototyping, design iteration, personalized content generation and data augmentation for machine learning models, thus increasing overall productivity and creativity.

Who are the biggest players in Generative AI Market?Top Key Players: IBM Corporation, Genie AI Ltd., MOSTLY AI Inc., Google LLC, D-ID, Rephrase.ai, Amazon Web Services Inc., Microsoft Corporation, Adobe Inc., Synthesia, Other Key Players

-

-

- IBM Corporation

- Genie AI Ltd.

- MOSTLY AI Inc.

- Google LLC

- D-ID

- ai

- Amazon Web Services Inc.

- Microsoft Corporation

- Adobe Inc.

- Synthesia

- Other Key Players