Global Gas Pipeline Infrastructure Market Size, Share Report By Operation (Gathering Pipeline, Transmission Pipeline, Distribution Pipeline), By Diameter (Small (less than 12 inches), Medium (12 to 24 inches), Large (24 inches or more)), By Pressure (Low (less than 100 psi), Medium (100 to 500 psi), High (above 500 psi)), By Application (Compressor Station, Metering Station, Orthers), By Location (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154733

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

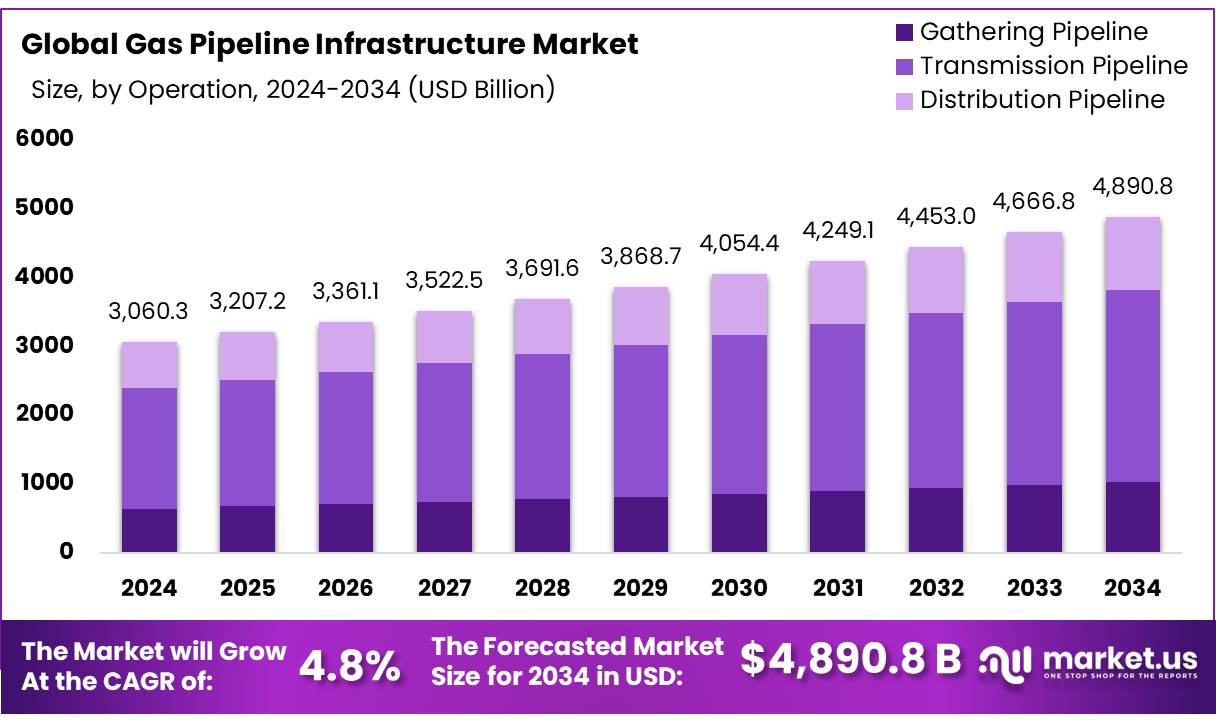

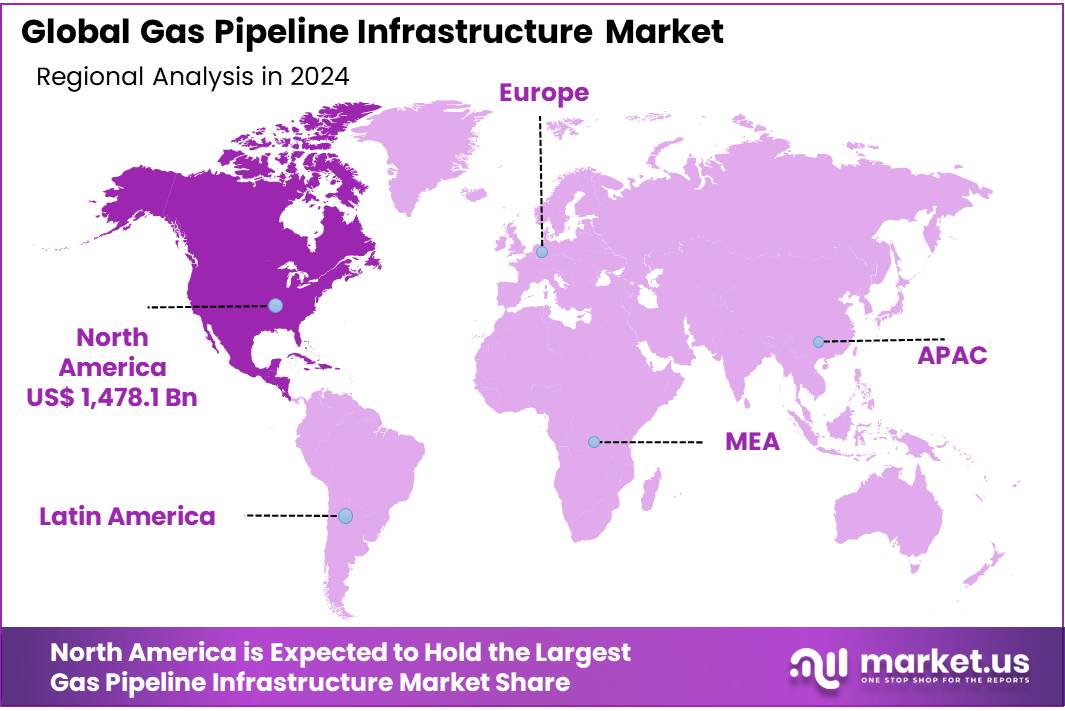

The Global Gas Pipeline Infrastructure Market size is expected to be worth around USD 4890.8 Billion by 2034, from USD 3060.3 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 48.30% share, holding USD 1,478.1 Billion in revenue.

Gas pipeline infrastructure comprises transmission and distribution systems transporting natural gas from production to end‑use markets. The network includes high‑pressure long‑distance pipelines, compressor and metering stations, and interconnections between countries and regions.

According to the U.S. Energy Information Administration, 2024 pipeline projects in the United States added approximately 6.5 billion cubic feet per day (Bcf/d) of takeaway capacity across Appalachia, Haynesville, Permian, and Eagle Ford regions, with total new capacity of 17.8 Bcf/d including interstate and LNG export‑linked pipelines.

Energy demand growth, particularly in Asia and industrializing regions, is driving infrastructure expansion. Shell forecasts that global LNG demand will rise from approximately 407 million tonnes in 2023 to between 630 and 718 million tonnes by 2040, with India and China as primary drivers. China’s gas consumption is expected to reach 425 billion cubic metres (bcm) in 2024, with imports (pipeline and LNG) increasing 17.4% year‑on‑year over the first five months of 2024 to 54.28 million tonnes.

The government’s ambitious “One Nation, One Gas Grid” initiative is central to this expansion, with a target to extend the pipeline network to 34,500 kilometers by 2025. This endeavor is supported by substantial investments, including a $67 billion commitment to develop the domestic natural gas sector over the next five to six years.

The expansion of the gas pipeline network is complemented by the development of city gas distribution (CGD) projects. For instance, in Coimbatore, Indian Oil Corporation Limited (IOCL) has laid 103 kilometers of underground pipelines, providing PNG to approximately 4,000 residents. The project aims to reach 300,000 residential connections by 2030. Similarly, in Chennai, THINK Gas is extending PNG access to 20,000 homes along key roads, with plans to simplify the onboarding process and reduce costs.

Key Takeaways

- Gas Pipeline Infrastructure Market size is expected to be worth around USD 4890.8 Billion by 2034, from USD 3060.3 Billion in 2024, growing at a CAGR of 4.8%.

- Transmission Pipeline held a dominant market position, capturing more than a 57.2% share in the global gas pipeline infrastructure market.

- Large diameter pipelines (24 inches or more) held a dominant market position, capturing more than a 51.8% share in the global gas pipeline infrastructure market.

- High (above 500 psi) held a dominant market position, capturing more than a 56.6% share in the gas pipeline infrastructure market.

- Compressor Station held a dominant market position, capturing more than a 46.9% share in the gas pipeline infrastructure market.

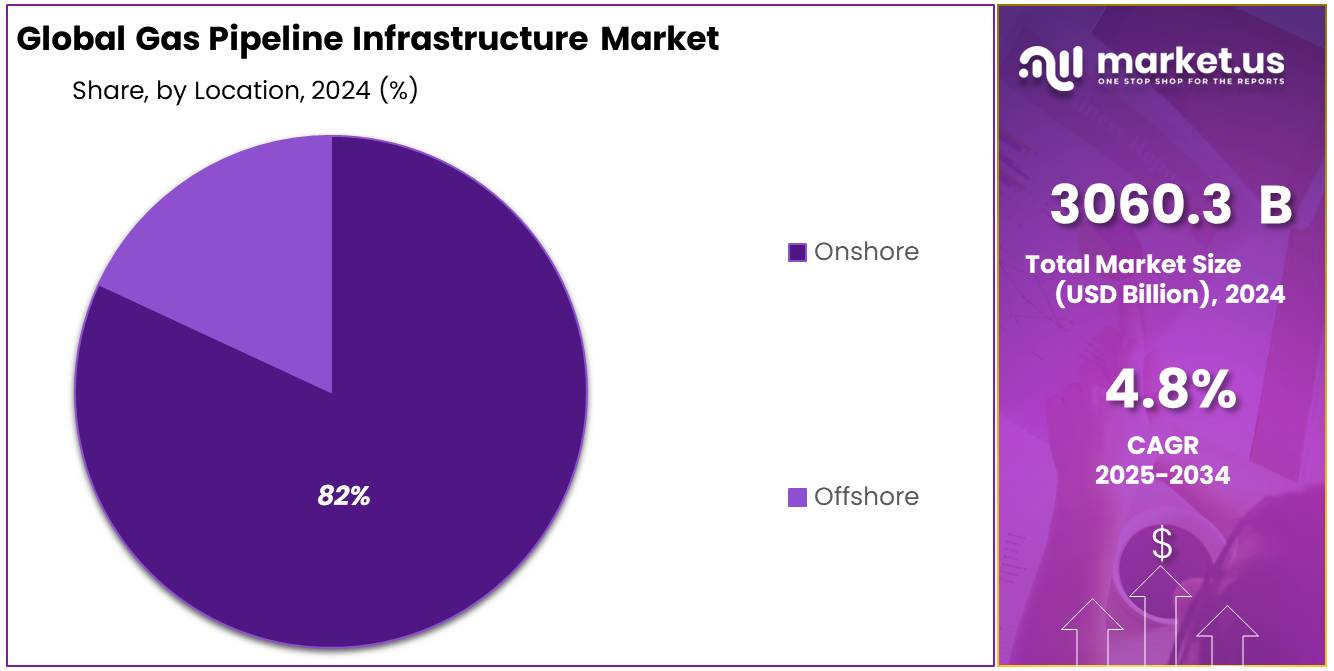

- Onshore held a dominant market position, capturing more than an 82.4% share in the global gas pipeline infrastructure market.

- North America emerged as the leading region in the gas pipeline infrastructure market, accounting for approximately 48.30% of total global market value, equivalent to US D 1,478.1 billion.

By Operation Analysis

Transmission Pipeline dominates with 57.2% share in 2024 driven by large-scale inter-regional gas movement

In 2024, Transmission Pipeline held a dominant market position, capturing more than a 57.2% share in the global gas pipeline infrastructure market. This dominance was primarily due to the continued need for long-distance transportation of natural gas from production basins to high-demand urban and industrial areas. These high-capacity pipelines form the backbone of national and transnational gas supply networks, enabling energy security and cross-border gas trade.

As natural gas consumption rises in emerging economies and LNG terminals expand globally, the importance of transmission networks has become even more critical. Additionally, investments in cross-country gas corridors, such as the Trans Adriatic Pipeline and Power of Siberia, further pushed the demand for large-scale transmission systems in 2024. The year also saw major policy backing and funding for pipeline expansions and upgrades, ensuring that transmission lines remain the key focus of gas infrastructure development. The segment continued to attract infrastructure funding from both public and private sectors, supporting steady growth heading into 2025.

By Diameter Analysis

Large Diameter Pipelines (24 inches or more) lead with 51.8% share in 2024 due to high-volume transmission demand

In 2024, Large diameter pipelines (24 inches or more) held a dominant market position, capturing more than a 51.8% share in the global gas pipeline infrastructure market. This strong lead was supported by the growing need for high-capacity transmission systems capable of moving large volumes of gas across long distances. These large pipelines are typically used in national trunk lines and cross-border projects, where reliability and efficiency are critical.

Their use also minimizes pressure loss and reduces the need for frequent compressor stations, making them more cost-effective over longer routes. The rise in LNG import terminals and gas-fired power plants further pushed demand for larger pipelines during 2024, especially in regions like North America, Europe, and Asia-Pacific. As new infrastructure developments continued into 2025, particularly in energy-intensive economies, large diameter pipelines remained central to expansion efforts, reinforcing their market dominance.

By Pressure Analysis

High-Pressure Pipelines (above 500 psi) dominate with 56.6% share in 2024 driven by demand for long-distance gas transmission

In 2024, High (above 500 psi) held a dominant market position, capturing more than a 56.6% share in the gas pipeline infrastructure market. This segment gained strong traction due to its ability to efficiently transport large volumes of natural gas across vast distances without frequent compression. High-pressure pipelines are commonly used in major transmission networks, especially where inter-regional or cross-border movement of gas is involved.

Their capability to maintain consistent flow and reduce transmission losses has made them the preferred choice for national energy grids and large-scale distribution systems. In 2024, rising industrial gas consumption and expanding urban pipelines further boosted the need for high-pressure infrastructure. As global gas trade and LNG distribution continue to scale up in 2025, these pipelines remain essential to meeting the performance and safety requirements of growing energy demand.

By Application Analysis

Compressor Station leads with 46.9% share in 2024 due to its vital role in maintaining gas flow and pressure

In 2024, Compressor Station held a dominant market position, capturing more than a 46.9% share in the gas pipeline infrastructure market. These stations play a critical role in ensuring the smooth movement of natural gas through long-distance pipelines by maintaining the required pressure levels. As gas travels over hundreds or even thousands of kilometers, pressure tends to drop, and compressor stations are essential to keep the flow steady and efficient.

The growing number of high-capacity transmission pipelines globally further strengthened the deployment of compressor stations in 2024. Looking ahead to 2025, infrastructure upgrades and expansions in both developing and developed regions are expected to keep compressor stations at the core of operational efficiency in gas delivery networks.

By Location Analysis

Onshore Pipelines dominate with 82.4% share in 2024 due to easier installation and wider network reach

In 2024, Onshore held a dominant market position, capturing more than an 82.4% share in the global gas pipeline infrastructure market. This strong lead is mainly due to the vast network of land-based pipelines used for domestic gas transmission and distribution. Onshore pipelines are typically more cost-effective to install and maintain compared to offshore systems, making them the preferred choice for connecting production sites with consumption centers in cities, industrial zones, and power plants.

Their accessibility allows for easier monitoring, repairs, and integration with existing infrastructure. In many countries, especially across North America, Asia, and Europe, onshore gas pipelines form the backbone of national energy supply chains. The expansion of regional pipeline networks and the development of inter-state transmission corridors in 2024 further pushed the dominance of the onshore segment. As energy demand grows and infrastructure projects continue in 2025, onshore pipelines are expected to retain their leading role in global gas delivery.

Key Market Segments

By Operation

- Gathering Pipeline

- Transmission Pipeline

- Distribution Pipeline

By Diameter

- Small (less than 12 inches)

- Medium (12 to 24 inches)

- Large (24 inches or more)

By Pressure

- Low (less than 100 psi)

- Medium (100 to 500 psi)

- High (above 500 psi)

By Application

- Compressor Station

- Metering Station

- Orthers

By Location

- Onshore

- Offshore

Emerging Trends

Expansion of Natural Gas Pipeline Network

India is undergoing a significant transformation in its energy sector, with a strong emphasis on expanding its natural gas pipeline infrastructure. This expansion is pivotal to achieving the government’s vision of a unified national gas grid, ensuring equitable access to cleaner energy across the country.

- As of September 2024, the total length of authorized natural gas pipelines in India stands at approximately 33,475 kilometers, with around 24,945 kilometers operational and an additional 10,459 kilometers under construction. This development is part of the government’s ambitious plan to increase the total network to 35,750 kilometers, thereby completing the national gas grid. The Petroleum and Natural Gas Regulatory Board (PNGRB) has also introduced a unified tariff system, promoting the “One Nation, One Grid” initiative, which aims to standardize transportation costs and enhance the efficiency of the pipeline network.

A notable project under this expansion is the Jagdishpur-Haldia-Bokaro-Dhamra Natural Gas Pipeline (JHBDPL), also known as the Urja Ganga project. Spanning approximately 2,540 kilometers, this pipeline is set to provide piped natural gas (PNG) to households and compressed natural gas (CNG) to vehicles in regions including Uttar Pradesh, Bihar, Jharkhand, West Bengal, Odisha, and Assam. The project is expected to enhance energy accessibility, reduce dependency on traditional fuels, and contribute to environmental sustainability.

The government’s commitment to this sector is further demonstrated by the allocation of ₹994.5 crore (approximately $120 million) for the development of pipeline infrastructure connecting Compressed Bio Gas (CBG) plants to City Gas Distribution (CGD) networks. This initiative is part of the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme, which aims to promote the production and utilization of CBG as a green fuel. The scheme mandates a phased blending of CBG with CNG and PNG, starting at 1% in FY 2025-26 and increasing to 5% by FY 2028-29.

Drivers

Government Initiatives Driving Gas Pipeline Infrastructure Expansion in India

A significant catalyst for the expansion of India’s gas pipeline infrastructure is the government’s strategic initiatives aimed at enhancing energy accessibility, promoting cleaner fuels, and fostering economic development. These efforts are evident in the substantial investments and policy frameworks that support the growth of the natural gas sector.

One of the most ambitious undertakings is the “One Nation, One Gas Grid” initiative, which envisions the creation of a unified national gas pipeline network. As of March 2024, approximately 33,478 kilometers of natural gas pipelines have been authorized, with 24,881 kilometers operational and 10,404 kilometers under construction. This extensive network aims to connect various regions, ensuring equitable distribution of natural gas across the country.

To further bolster this infrastructure, the government has committed a substantial investment of approximately $67 billion over the next five to six years. These funds are earmarked for the development of domestic natural gas sectors, including the expansion of city gas distribution networks and the establishment of liquefied natural gas (LNG) terminals.

A notable project under this initiative is the Urja Ganga Gas Pipeline Project, also known as the Jagdishpur-Haldia-Bokaro-Dhamra Natural Gas Pipeline (JHBDPL). This 2,540-kilometer pipeline is under construction to provide piped natural gas (PNG) to households and compressed natural gas (CNG) to vehicles in regions including Uttar Pradesh, Bihar, Jharkhand, West Bengal, Odisha, and Assam.

The government’s proactive approach extends to the city gas distribution (CGD) sector, which has seen significant growth. As of May 2025, India has recorded approximately 15.3 million piped natural gas (PNG) domestic connections, reflecting a steady progress in consumer conversion and revenue realization.

Restraints

Challenges in Land Acquisition for Gas Pipeline Infrastructure in India

A significant challenge hindering the expansion of India’s gas pipeline infrastructure is the complex and often contentious process of land acquisition. Despite the government’s ambitious plans to create a unified national gas grid, securing the necessary land has proven to be a formidable obstacle.

The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement (RFCTLARR) Act of 2013 stipulates stringent conditions for acquiring land, especially agricultural land. Under this Act, multi-crop irrigated lands cannot be acquired except in exceptional circumstances, and only after obtaining the consent of at least 80% of the affected families. This provision has led to significant resistance from farmers and landowners, particularly in regions where agriculture is the primary livelihood.

For instance, in Punjab, a proposal to acquire approximately 65,000 acres of fertile land for industrial development faced strong opposition from farmers, leading to widespread protests and legal challenges. The stringent requirements of the RFCTLARR Act have made it increasingly difficult for developers to secure the necessary land for pipeline projects, leading to delays and cost overruns.

Moreover, the process of land acquisition often lacks transparency and is susceptible to delays due to bureaucratic hurdles. In some cases, landowners allege that acquisitions are carried out without proper consultation or adequate compensation. For example, in Ratnagiri, Maharashtra, residents opposed the acquisition of land for a liquefied natural gas (LNG) pipeline project, citing low compensation rates and a lack of consultation. Such instances highlight the challenges in balancing development objectives with the rights and concerns of landowners.

These challenges are further compounded in ecologically sensitive areas, such as forests and tribal regions, where additional legal and environmental clearances are required. Obtaining these clearances can be a lengthy process, leading to significant delays in project timelines. For example, the Srikakulam-Angul pipeline project, a key component of the national gas grid, has experienced delays due to difficulties in securing forest and environmental clearances. The project’s completion has been rescheduled from June 2025 to December 2025 as a result.

Opportunity

Expansion of City Gas Distribution (CGD) Networks

One of the most promising avenues for the growth of India’s gas pipeline infrastructure lies in the expansion of City Gas Distribution (CGD) networks. These networks aim to provide piped natural gas (PNG) to households, commercial establishments, and industries, offering a cleaner and more efficient alternative to traditional fuels like liquefied petroleum gas (LPG) and coal.

As of September 2024, the Petroleum and Natural Gas Regulatory Board (PNGRB) has authorized 307 geographical areas for the development of CGD infrastructure, with the potential to cover nearly 100% of the country’s area and population. By the end of 2024, approximately 13.6 million domestic PNG connections and 7,259 compressed natural gas (CNG) stations were operational across India.

- The government’s commitment to this sector is evident in its approval of ₹994.5 crore (approximately $120 million) for the development of pipeline infrastructure connecting Compressed Bio Gas (CBG) plants to CGD networks. This initiative is part of the Sustainable Alternative Towards Affordable Transportation (SATAT) scheme, which aims to promote the production and utilization of CBG as a green fuel. The scheme mandates a phased blending of CBG with CNG and PNG, starting at 1% in FY 2025-26 and increasing to 5% by FY 2028-29.

The expansion of CGD networks not only enhances energy access but also contributes to environmental sustainability by reducing the reliance on polluting fuels. With continued government support and investment, the CGD sector is poised to play a pivotal role in India’s energy transition, offering significant growth opportunities for stakeholders across the value chain.

Regional Insights

North America dominates with 48.30% share and valuation of US $1,478.1 billion in 2024

In 2024, North America emerged as the leading region in the gas pipeline infrastructure market, accounting for approximately 48.30% of total global market value, equivalent to US D 1,478.1 billion. This dominance reflects the extensive and mature pipeline network across the United States and Canada, underpinned by a dense system of transmission and distribution infrastructure. Notably, the U.S. alone maintains an intricate web of interstate and intrastate pipelines extending over 305,000 miles as of recent estimates, forming the backbone of the continent’s energy delivery networks

Major operators such as TC Energy and Enbridge hold significant positions in the region’s infrastructure landscape. TC Energy manages more than 91,900 km of natural gas pipelines and transports over 25% of North American daily gas demand. Similarly, Enbridge operates about 38,375 km of natural gas transmission pipelines across Canada and the U.S., delivering approximately 16.2 billion cubic feet per day (Bcf/d) of gas.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Enbridge operates one of North America’s most extensive gas pipeline systems, covering approximately 38,375 km across five Canadian provinces, 30 U.S. states, and offshore regions, and transporting around 16.2 billion cubic feet per day of natural gas. In 2025, the firm committed to significant capital expansion, investing C$2 billion in new gas‑transmission projects and expanding storage capacity to meet growing LNG export and power‑generation demand.

Gazprom, majority state‑owned, controls nearly 161,700 km of pipelines transporting over 660 billion cubic metres of gas annually from Russia to domestic and export markets. Key projects include Nord Stream and TurkStream, the latter growing 16 % year‑on‑year in Q1 2025 to support Turkish and European demand. Despite sanctions and declining EU volume, Gazprom remains central to Eurasian energy transit infrastructure.

TransCanada Pipelines, under TC Energy, owns and operates Canada’s longest natural gas pipeline network—up to 48‑inch diameter—traversing Alberta, Saskatchewan, Manitoba, Ontario and Quebec. TC Energy manages about 93,600 km of pipeline systems supplying over 30 % of North American daily gas demand. Its network moves gas from Western Canadian basins into major U.S. markets via integrated systems like Canadian Mainline and NGTL.

Top Key Players Outlook

- Enbridge Inc.

- Gazprom

- TransCanada Pipelines Limited

- Kinder Morgan

- Pembina Gas Infrastructure

- Saipem

- Enagás S.A.

- Bechtel Corporation

- Assam Gas Company Ltd.

- McDermott

Recent Industry Developments

In 2024, Enbridge Gas conducted leak surveys across 22,755 km (14,139 miles) of distribution mains and 939,748 service lines in Ontario and Quebec, supported by a US $14.8 million investment in advanced detection technology.

TransCanada Pipelines Limited, now part of TC Energy, oversees a massive natural gas infrastructure network across North America—approximately 93,300 km (58,100 miles) of pipeline and over 653 Bcf of natural gas storage capacity as of 2024.

Report Scope

Report Features Description Market Value (2024) USD 3060.3 Bn Forecast Revenue (2034) USD 4890.8 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operation (Gathering Pipeline, Transmission Pipeline, Distribution Pipeline), By Diameter (Small (less than 12 inches), Medium (12 to 24 inches), Large (24 inches or more)), By Pressure (Low (less than 100 psi), Medium (100 to 500 psi), High (above 500 psi)), By Application (Compressor Station, Metering Station, Orthers), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Enbridge Inc., Gazprom, TransCanada Pipelines Limited, Kinder Morgan, Pembina Gas Infrastructure, Saipem, Enagás S.A., Bechtel Corporation, Assam Gas Company Ltd., McDermott Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Gas Pipeline Infrastructure MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Gas Pipeline Infrastructure MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Enbridge Inc.

- Gazprom

- TransCanada Pipelines Limited

- Kinder Morgan

- Pembina Gas Infrastructure

- Saipem

- Enagás S.A.

- Bechtel Corporation

- Assam Gas Company Ltd.

- McDermott