Global Fuel Cells In Aerospace And Defense Market Size, Share, And Business Benefits By Technology (Alkaline Fuel Cell, Direct Methanol Fuel Cell, Phosphoric Acid Fuel Cell, Proton Exchange Membrane, Solid Oxide Fuel Cell), By Power Rating (10 to 50 kW, 50 to 200 kW, Over 200 kW, Under 10 kW), By Fuel Type (Ammonia, Hydrogen, Methanol), By Application (Auxiliary Power Units, Backup Power, Primary Propulsion), By End User (Commercial Aerospace, Military, Space Agencies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154782

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

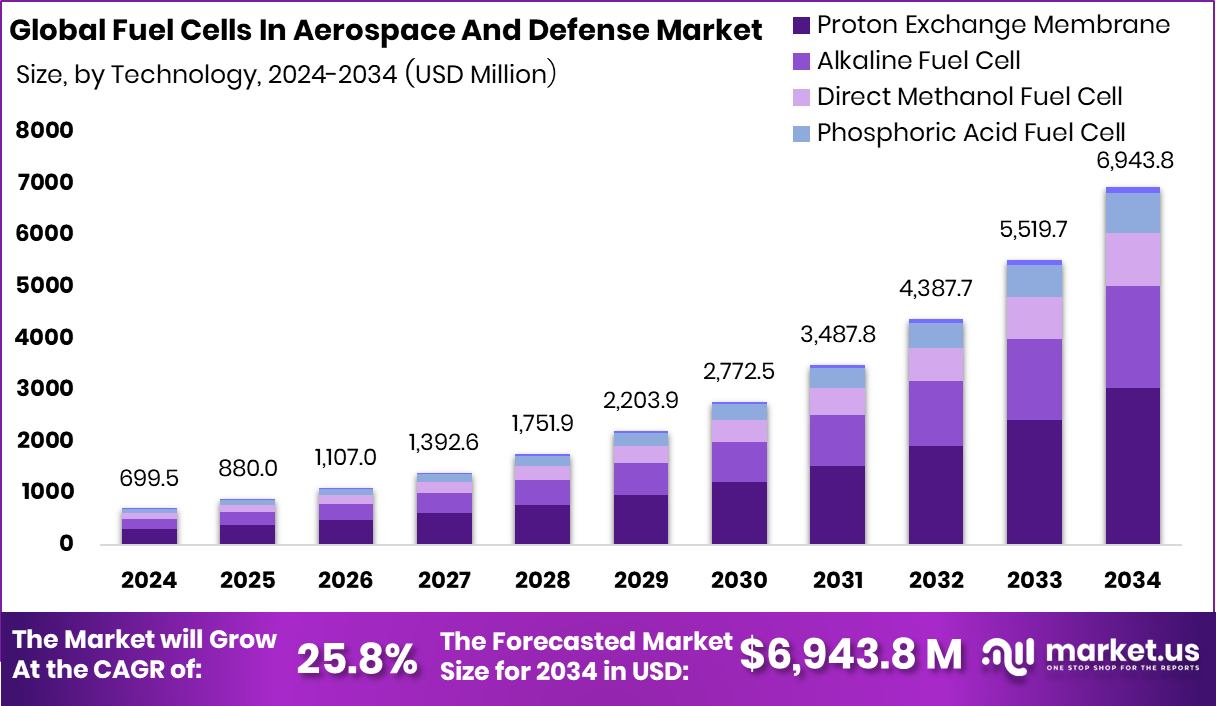

The Global Fuel Cells In Aerospace And Defense Market is expected to be worth around USD 6,943.8 million by 2034, up from USD 699.5 million in 2024, and is projected to grow at a CAGR of 25.8% from 2025 to 2034. Strong defense budgets and innovation drive North America’s USD 293.0 Mn market leadership.

Fuel cells in aerospace and defense refer to advanced energy systems that convert hydrogen or other fuels directly into electricity through electrochemical reactions. These systems are valued for their high energy efficiency, silent operation, low thermal signature, and minimal emissions, making them ideal for critical military operations and next-generation aircraft. Unlike traditional combustion-based power sources, fuel cells offer a cleaner and quieter alternative that aligns with modern defense and aviation needs focused on sustainability and stealth. According to an industry report, India has unlocked $8 million in funding to support green hydrogen projects.

The growth of this market is being strongly driven by the rising emphasis on clean energy alternatives and the need to reduce dependency on fossil fuels in defense and aerospace applications. Many countries are prioritizing decarbonization in military and space programs, encouraging the adoption of fuel cells as a reliable onboard power source. Their lightweight nature and longer operational endurance compared to batteries are pushing their use in unmanned systems, surveillance equipment, and auxiliary power units. According to an industry report, Daimler Truck has received €226 million in government funding aimed at advancing fuel cell truck development.

Demand is being boosted by the increasing requirement for long-duration missions, where traditional batteries fall short. Fuel cells provide continuous power for longer periods without recharging, making them suitable for remote or hostile environments. The operational efficiency and reduced logistical burden of transporting fuel are also key demand drivers. According to an industry report, A £200 million hydrogen-from-waste facility in Thames Freeport has secured funding.

There is a significant opportunity in integrating fuel cells into hybrid propulsion systems for both manned and unmanned aerial platforms. As space exploration expands and modern warfare evolves, there is growing interest in decentralized power systems that are lightweight, scalable, and efficient—an area where fuel cells hold clear advantages. According to an industry report, The University of Sheffield will lead a new £1.5 million UK government-backed initiative focused on accelerating Sustainable Aviation Fuel (SAF) production. Also, Turkey’s Akfen has secured a €3.4 million grant through Eurogia2030 for its mobile hydrogen refueling station project.

Key Takeaways

- The Global Fuel Cells In Aerospace And Defense Market is expected to be worth around USD 6,943.8 million by 2034, up from USD 699.5 million in 2024, and is projected to grow at a CAGR of 25.8% from 2025 to 2034.

- Proton Exchange Membrane technology dominates the market, capturing a 43.8% share in fuel cell systems.

- Fuel cells under 10 kW account for 36.2% of total installations in aerospace applications.

- Hydrogen remains the primary fuel source, representing 72.9% of total consumption in defense-related fuel cells.

- Auxiliary Power Units lead application-wise, contributing to 54.4% of total usage across the aerospace industry.

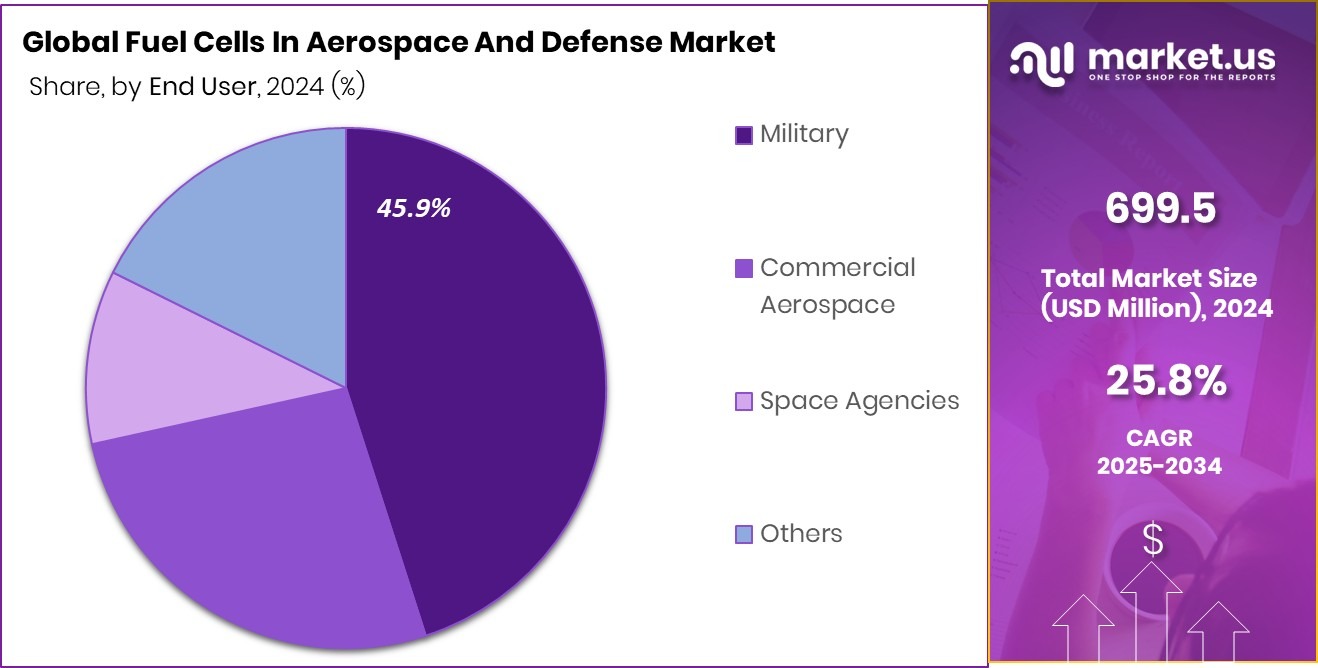

- Military end-users constitute 45.9% of the market, indicating strong adoption in defense and tactical operations.

- North America reached a market value of USD 293.0 million in 2024.

By Technology Analysis

Proton Exchange Membrane technology dominates with a 43.8% market share.

In 2024, Proton Exchange Membrane held a dominant market position in the By Technology segment of the Fuel Cells in Aerospace and Defense Market, with a 43.8% share. This leading position can be attributed to its operational efficiency, compact size, and suitability for aerospace applications, where weight and reliability are critical. Proton Exchange Membrane (PEM) fuel cells are known for their low operating temperature, quick start-up capability, and high power density, making them particularly well-suited for both unmanned aerial vehicles (UAVs) and auxiliary power units (APUs) in military aircraft.

Their ability to operate efficiently under dynamic load conditions has further increased their adoption in defense platforms that demand consistent performance and a low acoustic signature. Moreover, the increased focus on decarbonizing military and aerospace operations has encouraged the adoption of PEM technology due to its zero-emission operation and compatibility with green hydrogen sources.

In addition, the technology’s relatively mature infrastructure and ease of integration into existing aerospace frameworks have played a vital role in securing its dominant position. As defense and aerospace stakeholders prioritize cleaner propulsion systems, the 43.8% share captured by PEM in 2024 underscores its critical role in shaping future advancements in fuel cell-powered aviation and defense applications.

By Power Rating Analysis

Under 10 kW fuel cells hold 36.2% market share.

In 2024, Under 10 kW held a dominant market position in the By Power Rating segment of the Fuel Cells in Aerospace and Defense Market, with a 36.2% share. This leading share reflects the growing use of compact and low-power fuel cell systems in lightweight aerospace and defense applications, particularly in unmanned aerial vehicles (UAVs), small drones, and portable military equipment. The Under 10 kW range offers a favorable balance between energy output and weight, which is essential for systems requiring high mobility and efficiency without compromising endurance.

This segment has benefited from increasing demand for silent, lightweight power sources that enhance operational stealth and extend mission duration in tactical scenarios. The 36.2% share captured in 2024 highlights the segment’s relevance in supporting portable and small-scale platforms, where traditional power sources are either too bulky or insufficiently efficient.

The growing emphasis on electrification in aerospace missions and the integration of advanced surveillance and communication equipment in defense operations have further reinforced the demand for fuel cells within this power bracket. The Under 10 kW segment’s dominance indicates a clear shift toward compact, efficient, and emission-free energy systems tailored to meet the evolving requirements of next-generation aerospace and defense technologies.

By Fuel Type Analysis

Hydrogen remains the leading fuel type with a 72.9% share.

In 2024, Hydrogen held a dominant market position in the By Fuel Type segment of the Fuel Cells in Aerospace and Defense Market, with a 72.9% share. This strong market presence highlights hydrogen’s growing acceptance as a primary fuel source due to its high energy density, clean combustion profile, and ability to support long-duration missions in both aerospace and defense applications.

The 72.9% share reflects the increasing shift toward low-emission energy solutions, especially in strategic sectors where reliability and performance are critical. Hydrogen fuel is particularly valued for enabling zero-emission propulsion, aligning with broader sustainability and decarbonization goals within defense and aviation programs. Additionally, hydrogen’s capability to power both stationary and mobile systems makes it an attractive option for a wide range of platforms, from UAVs to auxiliary power units.

Its dominance in 2024 indicates a clear industry preference for scalable and efficient fuel solutions that can be deployed in various mission-critical scenarios. The significant market share also signals ongoing advancements in hydrogen storage and refueling infrastructure, which are making the technology more practical and accessible for military and aerospace use cases.

By Application Analysis

Auxiliary Power Units lead applications, contributing 54.4% market share.

In 2024, Auxiliary Power Units held a dominant market position in the By Application segment of the Fuel Cells in Aerospace and Defense Market, with a 54.4% share. This significant share reflects the rising adoption of fuel cells as an efficient and cleaner alternative for powering auxiliary systems in aircraft and defense platforms. Fuel cell-based Auxiliary Power Units (APUs) are being increasingly integrated into aircraft to provide on-ground power for lighting, avionics, and other electrical systems without relying on the main engines.

Their ability to deliver quiet, low-emission, and reliable energy solutions has made them highly suitable for aerospace environments where operational efficiency and reduced environmental impact are key priorities. The 54.4% share also signifies growing defense sector interest in replacing conventional APUs with fuel cell-based systems to reduce thermal and acoustic signatures during missions.

As sustainability gains momentum in aviation and military operations, the focus on lightweight and compact APUs has intensified, further driving fuel cell deployment. The dominance of the Auxiliary Power Units segment in 2024 indicates that the demand for clean and autonomous power solutions is aligning with fuel cell technology’s capabilities, making it a strategic fit for modern aerospace and defense energy needs.

By End User Analysis

The military sector leads end-user adoption with 45.9% market contribution.

In 2024, the Military held a dominant market position in the end-user segment of the Fuel Cells in Aerospace and Defense Market, with a 45.9% share. This commanding position reflects the increasing integration of fuel cell technologies into military operations, driven by the demand for efficient, silent, and low-emission power sources in defense applications. Military forces are increasingly adopting fuel cells to power various systems such as auxiliary power units, unmanned aerial vehicles, and portable soldier power systems, aiming to enhance energy independence and operational flexibility in remote or hostile environments.

The 45.9% market share signifies the military sector’s strong focus on adopting advanced technologies that offer tactical advantages, including reduced thermal and acoustic signatures and enhanced endurance. Fuel cells are particularly valued for their ability to support longer missions without frequent refueling, making them well-suited for defense logistics and field operations.

The emphasis on cleaner energy alternatives for reducing carbon footprint and improving mission sustainability has also contributed to this uptake. The 2024 dominance of the military segment underlines the growing trust in fuel cell systems as a strategic asset, supporting evolving defense energy needs and enhancing overall mission efficiency and reliability in modern warfare scenarios.

Key Market Segments

By Technology

- Alkaline Fuel Cell

- Direct Methanol Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane

- Solid Oxide Fuel Cell

By Power Rating

- 10 to 50 kW

- 50 to 200 kW

- Over 200 kW

- Under 10 kW

By Fuel Type

- Ammonia

- Hydrogen

- Methanol

By Application

- Auxiliary Power Units

- Backup Power

- Primary Propulsion

By End User

- Commercial Aerospace

- Military

- Space Agencies

- Others

Driving Factors

Rising Demand for Clean and Silent Power Systems

One of the main driving factors for fuel cells in the aerospace and defense market is the growing demand for clean and silent power systems. Defense and aerospace operations often take place in sensitive environments where noise and heat signatures must be minimized. Fuel cells operate quietly and produce almost no harmful emissions, making them ideal for military vehicles, drones, and aircraft that require stealth and energy efficiency.

Unlike diesel generators or combustion engines, fuel cells help reduce the environmental impact while improving the tactical advantages in the field. As more defense agencies and space programs move towards sustainable technologies, the push for quieter and cleaner energy systems is expected to accelerate the adoption of fuel cells in this sector.

Restraining Factors

High Cost of Fuel Cell System Integration

A major restraining factor in the fuel cells for the aerospace and defense market is the high cost involved in developing and integrating these systems. Fuel cells require advanced materials, specialized components, and precise engineering to meet the safety and performance standards needed in aviation and military applications. These factors significantly increase production and maintenance costs compared to traditional power systems.

Additionally, supporting infrastructure like hydrogen storage, fueling stations, and safety mechanisms adds to the total expense. For many defense programs and aerospace projects with limited budgets, this becomes a major barrier. Until production costs decrease and supporting infrastructure becomes more common, the high price of adoption may slow down the broader use of fuel cells in this industry.

Growth Opportunity

Expanding Use in Unmanned Aerial Vehicle Programs

A key growth opportunity lies in the expanding use of fuel cells in unmanned aerial vehicle (UAV) programs. As UAVs become more common for defense surveillance, reconnaissance, and border monitoring, there is a need for longer flight times and more efficient power sources. Fuel cells offer lightweight, reliable, and long-endurance energy solutions that outperform traditional batteries.

They allow drones to fly longer missions without frequent recharging or refueling. This makes them ideal for critical operations in remote or hostile areas where access to fuel and power is limited. With the global rise in demand for high-performance drones in defense and intelligence sectors, fuel cell technology is expected to gain strong momentum as a preferred power source for UAV platforms.

Latest Trends

Hybrid Systems Combining Fuel Cells and Batteries

One of the latest trends in the aerospace and defense sector is the growing use of hybrid systems that combine fuel cells with batteries. These setups are designed to bring the best of both technologies—fuel cells offer long-lasting power, while batteries provide quick bursts of energy when needed. This combination improves overall performance, allowing aircraft and defense systems to operate more efficiently and for longer periods.

Hybrid systems also provide greater flexibility in energy management during missions, which is important in unpredictable defense environments. As mission requirements become more complex and demand both endurance and responsiveness, hybrid fuel cell-battery solutions are becoming a preferred choice in many advanced aerospace and defense applications.

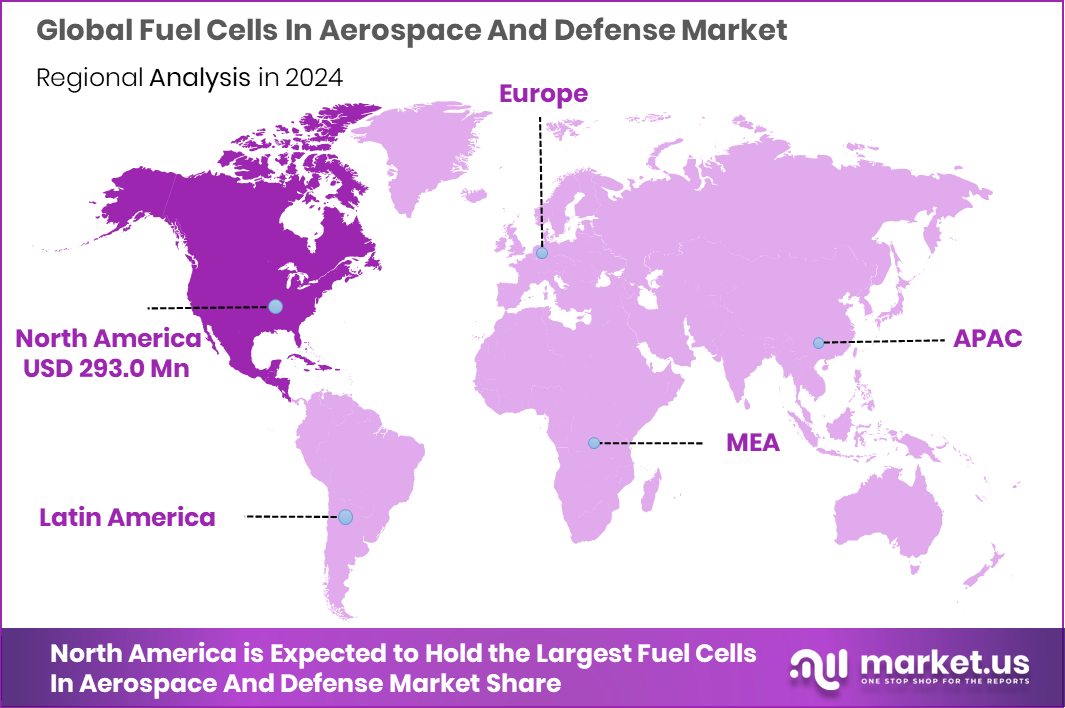

Regional Analysis

North America holds a 41.9% market share in fuel cells for aerospace and defense.

The global fuel cells in the aerospace and defense market demonstrate strong regional performance, with North America emerging as the dominant region. In 2024, North America accounted for the largest market share, holding 41.9% and reaching a valuation of USD 293.0 million. This dominance can be attributed to the region’s advanced defense infrastructure, strong government funding for clean energy projects, and increasing adoption of next-generation power systems in military and aerospace applications. The presence of established aerospace programs and a focus on long-endurance unmanned systems further support fuel cell integration in the region.

Europe also presents a growing interest in fuel cell technologies within its defense and aviation sectors. Countries in this region are increasingly focused on reducing emissions and enhancing operational efficiency in military operations. Asia Pacific is witnessing gradual adoption, supported by expanding defense budgets and a shift towards modern energy solutions in military strategies.

Meanwhile, the Middle East & Africa and Latin America regions are at emerging stages of adopting fuel cell technologies but show potential due to rising interest in upgrading defense capabilities. However, North America remains the leading force in this market, supported by its technological advancements and high-value investments, setting the pace for global growth in the sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Advent Technologies showcased its strength in high-performance, high-temperature fuel cell systems. Its technology compatibility with rugged aerospace conditions positioned the company as a trusted supplier for unmanned systems and auxiliary power units in defense applications.

AFC Energy PLC concentrated on scalable hydrogen-based solutions, particularly in ground support and mobile energy units. The company’s modular approach facilitated integration into military infrastructure, enhancing operational reliability and sustainability in remote or deployed environments.

Australian Fuel Cells Pty Ltd. emerged as a specialist in compact and lightweight fuel cell units aimed at portable and mission-critical defense gear. Its emphasis on miniaturization and durability suited the exacting requirements of field equipment and tactical applications.

Ballard Power Systems, Inc. maintained prominence through its established expertise in PEM (proton exchange membrane) fuel cells. The company’s longstanding presence in clean power technology gave it an advantage in aerospace auxiliary applications and long-duration unmanned platforms where reliability, endurance, and stealth are critical.

Top Key Players in the Market

- Advent Technologies

- AFC Energy PLC

- Australian Fuel Cells Pty Ltd.

- Ballard Power Systems, Inc.

- Bloom Energy Corporation

- Cummins Inc.

- Doosan Fuel Cell Co., Ltd.

- ElringKlinger AG

- FuelCell Energy, Inc.

- GenCell Ltd.

Recent Developments

- In August 2024, Ballard showcased the same FCmove®‑XD engine at IAA Transportation 2024 (Sept‑Oct). This highlighted its modular design, high power density, and rugged format—characteristics aligning with onboard power demands of aerospace-UAV and field defense systems.

- In May 2024, AFC Energy entered into a strategic supply agreement with Illuming Power to scale the production of its S Series air-cooled fuel cell plates and stacks. This was intended to raise the manufacturing capability of systems used in ground support and mobile defense platforms.

Report Scope

Report Features Description Market Value (2024) USD 699.5 Million Forecast Revenue (2034) USD 6,943.8 Million CAGR (2025-2034) 25.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Alkaline Fuel Cell, Direct Methanol Fuel Cell, Phosphoric Acid Fuel Cell, Proton Exchange Membrane, Solid Oxide Fuel Cell), By Power Rating (10 to 50 kW, 50 to 200 kW, Over 200 kW, Under 10 kW), By Fuel Type (Ammonia, Hydrogen, Methanol), By Application (Auxiliary Power Units, Backup Power, Primary Propulsion), By End User (Commercial Aerospace, Military, Space Agencies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Advent Technologies, AFC Energy PLC, Australian Fuel Cells Pty Ltd., Ballard Power Systems, Inc., Bloom Energy Corporation, Cummins Inc., Doosan Fuel Cell Co., Ltd., ElringKlinger AG, FuelCell Energy, Inc., GenCell Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fuel Cells In Aerospace And Defense MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Fuel Cells In Aerospace And Defense MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advent Technologies

- AFC Energy PLC

- Australian Fuel Cells Pty Ltd.

- Ballard Power Systems, Inc.

- Bloom Energy Corporation

- Cummins Inc.

- Doosan Fuel Cell Co., Ltd.

- ElringKlinger AG

- FuelCell Energy, Inc.

- GenCell Ltd.