Global Formulation Development Outsourcing Market By Service (Formulation Development and Preformulation), By Formulation Type (Oral, Injectable, Topical and Others), By Therapeutic Area (Oncology, Cardiovascular, Dermatology, Genetic Disorders and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 83445

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

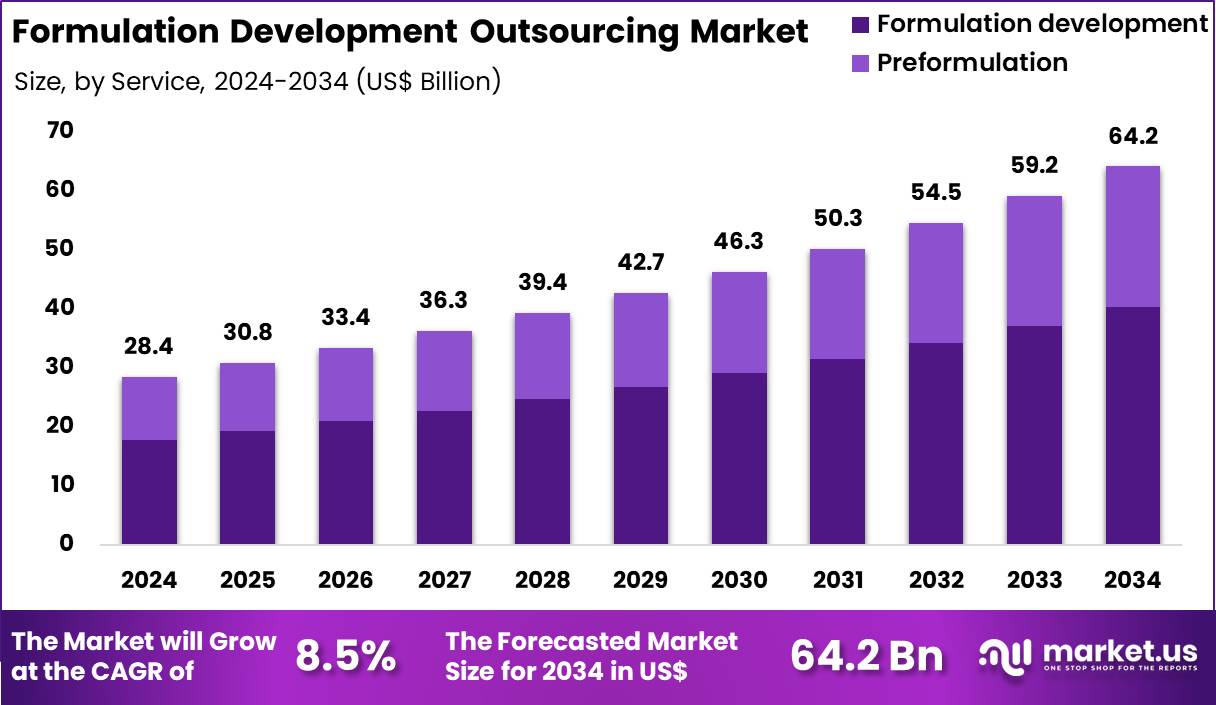

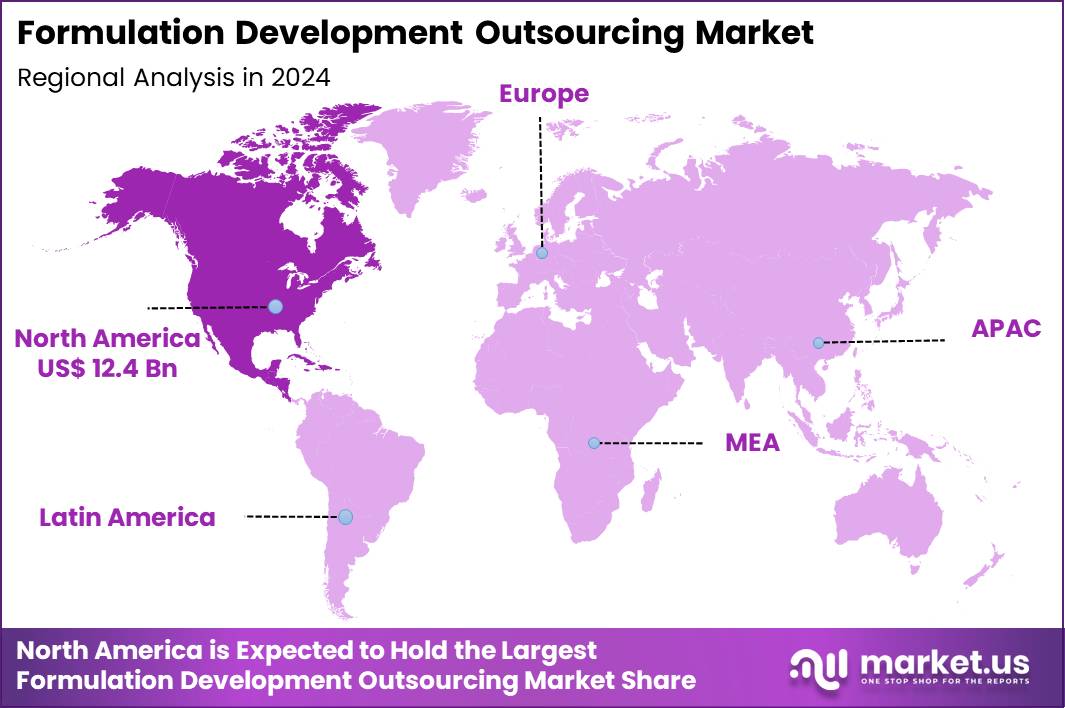

The Global Formulation Development Outsourcing Market size is expected to be worth around US$ 64.2 Billion by 2034 from US$ 28.4 Billion in 2024, growing at a CAGR of 8.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.7% share with a revenue of US$ 12.4 Billion.

Increasing complexity in drug formulation requirements compels biopharmaceutical companies to outsource development activities to specialized contract research organizations that possess advanced expertise and infrastructure. Companies increasingly delegate solubility enhancement projects for poorly water-soluble small molecules, employing techniques such as amorphous solid dispersions and lipid-based systems to improve bioavailability.

Outsourcing partners conduct preclinical formulation screening for biologics, optimizing excipient selection and buffer compositions to maintain stability and bioactivity during storage and administration. These services support development of modified-release oral dosage forms, where contract laboratories design matrix tablets or multiparticulates that achieve desired pharmacokinetic profiles. CDMOs perform lyophilization cycle optimization for injectable proteins and vaccines, ensuring long-term potency and elegant cake appearance.

In May 2024, AGC Biologics partnered with BioConnection to jointly offer coordinated drug substance and drug product services. This alliance strengthens the formulation development outsourcing market by promoting integrated outsourcing models in which biopharmaceutical companies can work with a single provider across development stages. Such arrangements reduce operational complexity, minimize technology transfer risks, and accelerate formulation to fill finish progression, making external partners more attractive for end-to-end development support.

Contract development organizations seize opportunities to expand capabilities in nanoparticle and liposomal delivery systems, enabling clients to advance novel oncology and RNA-based therapeutics with enhanced targeting and reduced toxicity. Providers develop pediatric-friendly formulations such as taste-masked granules and orodispersible films, addressing compliance challenges in younger patient populations.

These services facilitate 505(b)(2) pathway submissions by reformulating existing molecules into differentiated products with improved convenience or safety profiles. Outsourcing partners accelerate biosimilar development through comparability exercises that demonstrate equivalent physicochemical and functional attributes to reference products.

Companies advance continuous manufacturing-compatible formulations that support scalable, cost-efficient production of high-value biologics. Firms invest in analytical method development alongside formulation work, generating robust data packages that streamline regulatory submissions and de-risk clinical progression.

Key Takeaways

- In 2024, the market generated a revenue of US$ 28.4 Billion, with a CAGR of 8.5%, and is expected to reach US$ 64.2 Billion by the year 2034.

- The service segment is divided into formulation development and preformulation, with formulation development taking the lead with a market share of 62.8%.

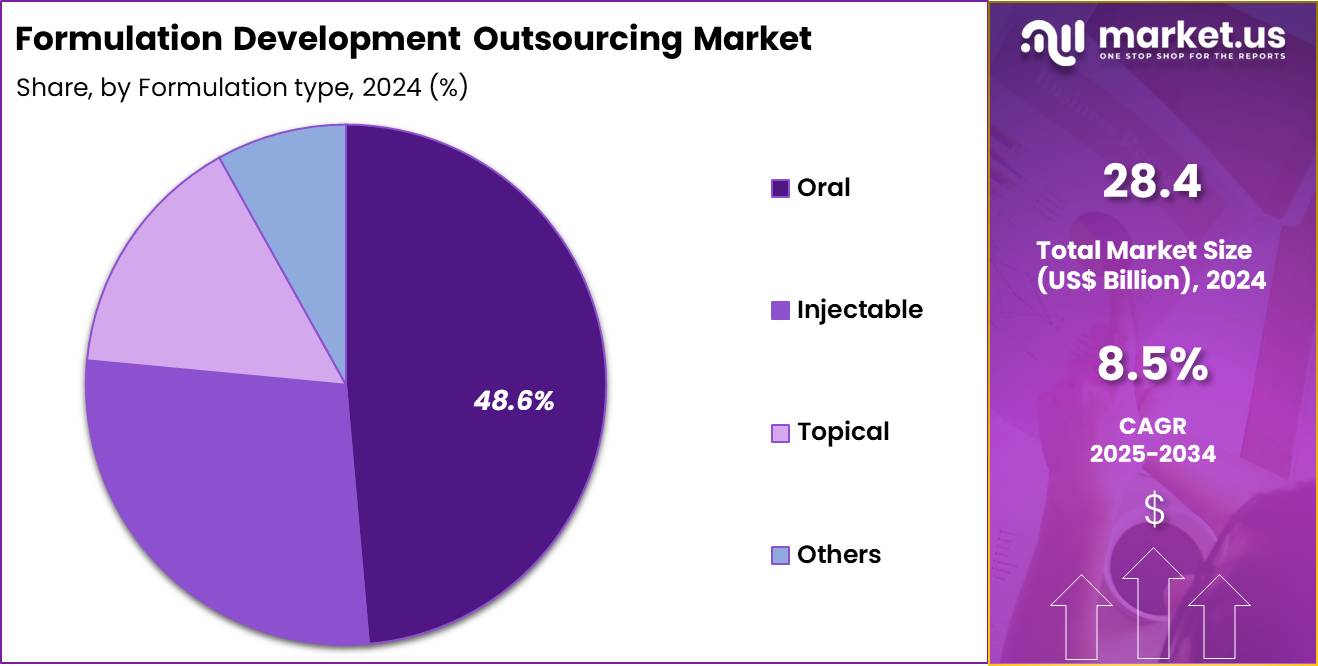

- Considering formulation type, the market is divided into oral, injectable, topical and others. Among these, oral held a significant share of 48.6%.

- Furthermore, concerning the therapeutic area segment, the market is segregated into oncology, cardiovascular, dermatology, genetic disorders and others. The oncology sector stands out as the dominant player, holding the largest revenue share of 41.7% in the market.

- North America led the market by securing a market share of 43.7%.

Service Analysis

Formulation development accounted for 62.8% of growth within the service category and represents the core offering in the Formulation Development Outsourcing market. Pharmaceutical companies increasingly outsource formulation work to accelerate development timelines. Growing molecule complexity increases reliance on specialized formulation expertise. Outsourcing partners provide advanced equipment and experienced scientists. Early optimization improves bioavailability and stability outcomes.

Sponsors prioritize formulation development to reduce late-stage failures. Outsourcing supports parallel development across multiple dosage forms. Cost optimization strategies favor external development over in-house expansion. Small and mid-sized biopharma companies depend heavily on outsourcing partners. Regulatory expectations increase demand for robust formulation data.

Rapid proof-of-concept studies drive early outsourcing engagement. Formulation development aligns closely with IND and NDA milestones. Outsourcing firms offer scalable resources for fluctuating project loads. Risk-sharing models improve sponsor confidence. Access to novel excipients supports innovation. Global outsourcing networks shorten development cycles.

Technology transfer capabilities strengthen long-term partnerships. Continuous manufacturing trends increase formulation complexity. Sponsors seek vendors with end-to-end development capabilities. The segment is projected to remain dominant due to strategic importance in drug development. Overall growth reflects speed, expertise, and cost efficiency benefits.

Formulation Type Analysis

Oral formulations represented 48.6% of growth within the formulation type category and remain the most preferred dosage form in outsourcing engagements. Oral delivery supports high patient compliance and convenience. Most small-molecule drugs target oral administration. Pharmaceutical pipelines contain a high proportion of oral candidates. Oral formulation development requires extensive solubility and dissolution optimization.

Outsourcing partners specialize in enhancing bioavailability for poorly soluble drugs. Modified-release oral systems increase development demand. Generic drug development strengthens oral formulation volumes. Cost-effective manufacturing supports oral dominance. Regulatory pathways for oral products remain well established. Clinical trial enrollment improves with oral dosing convenience.

Pediatric and geriatric suitability increases demand for tailored oral forms. Fixed-dose combination development supports outsourcing growth. Oral solid dosage scale-up expertise attracts sponsors. Taste masking and stability challenges drive external support. Global demand for oral generics sustains volume. Rapid prototyping supports early clinical studies.

Outsourcing enables faster reformulation cycles. Continuous improvement in excipient science benefits oral development. The segment is anticipated to retain leadership due to pipeline concentration and patient preference. Growth reflects ease of administration and broad therapeutic applicability.

Therapeutic Area Analysis

Oncology captured 41.7% of growth within the therapeutic area category and stands as the leading driver of outsourcing demand. Oncology pipelines expand rapidly across global biopharma companies. High failure risk increases emphasis on optimized formulations. Complex molecules require advanced delivery strategies. Outsourcing partners provide specialized oncology formulation expertise. Targeted therapies demand precise release and stability control. Oral oncology drugs increase formulation complexity. Poor solubility challenges drive innovation.

Sponsors prioritize rapid development to address unmet medical needs. Accelerated approval pathways increase development intensity. Oncology trials require multiple formulation iterations. Personalized medicine trends increase formulation customization. Cytotoxic handling requirements favor specialized outsourcing facilities. Investment in oncology R&D remains high across regions. Combination therapies increase formulation workload.

Stability under stressed conditions becomes critical. Regulatory scrutiny drives demand for high-quality formulation data. Outsourcing supports global clinical trial supply. Oncology-focused CDMOs expand capacity and capabilities. The segment is expected to remain dominant due to pipeline depth and therapeutic urgency. Overall growth reflects innovation intensity and clinical priority in oncology drug development.

Key Market Segments

By Service

- Formulation development

- Preformulation

By Formulation Type

- Oral

- Injectable

- Topical

- Others

By Therapeutic Area

- Oncology

- Cardiovascular

- Dermatology

- Genetic disorders

- Others

Drivers

Increasing drug development pipelines is driving the market

The formulation development outsourcing market is significantly driven by the increasing drug development pipelines, as pharmaceutical companies seek specialized expertise to accelerate the transition from discovery to clinical trials. Outsourcing partners provide advanced capabilities in solubility enhancement and bioavailability optimization, enabling faster market entry for new therapies. Regulatory demands for robust formulation data further encourage reliance on experienced service providers to ensure compliance.

Biotechnology firms, in particular, outsource to leverage scalable processes without substantial in-house investment. Clinical trial phases benefit from outsourced formulation, reducing risks associated with poor drug performance. Global collaborations between pharma giants and contract development organizations (CDOs) foster innovation in complex dosage forms.

Academic partnerships with outsourcing firms contribute to cutting-edge research in drug delivery systems. Patient access to novel treatments improves through efficient formulation strategies. Economic pressures on R&D budgets make outsourcing a cost-effective solution for pipeline expansion. The U.S. Food and Drug Administration approved 37 novel drugs in 2022, 55 in 2023, and 50 in 2024, reflecting the growing need for formulation support.

Restraints

Regulatory complexities in outsourcing are restraining the market

The formulation development outsourcing market is restrained by regulatory complexities, which require stringent oversight of data integrity and quality assurance in outsourced processes. Service providers must navigate diverse international standards, leading to delays in project timelines and increased compliance costs. Pharmaceutical clients face challenges in validating outsourced formulations for submission dossiers, deterring reliance on external partners.

Regulatory agencies conduct frequent audits of CDOs, resulting in potential disruptions if deficiencies are found. Clinical development is impacted by the need for thorough technology transfer documentation between parties. Global variations in GMP requirements complicate cross-border outsourcing arrangements. Academic analyses highlight the risk of intellectual property disputes in regulated environments.

Patient safety concerns arise from inconsistencies in outsourced quality controls. Economic implications include higher insurance premiums for liability in regulated markets. These factors collectively limit the scalability and attractiveness of outsourcing for formulation development.

Opportunities

Growth in biopharmaceutical outsourcing is creating growth opportunities

The formulation development outsourcing market presents growth opportunities through the growth in biopharmaceutical outsourcing, where specialized CDOs offer expertise in handling complex biologics like monoclonal antibodies. Developers can expand services to include advanced drug delivery systems for targeted therapies, addressing unmet needs in oncology and immunology. Regulatory pathways for biologics encourage outsourcing to accelerate formulation optimization.

Healthcare innovation benefits from outsourced capabilities in lyophilization and nanoparticle technologies. Pharmaceutical firms can reduce capital expenditure by leveraging CDO infrastructure for biopharma projects. Clinical trials gain from outsourced stability testing and scale-up expertise. Global adoption in emerging markets aligns with biopharma infrastructure development.

Academic collaborations refine bioprocessing methods for outsourced applications. Patient therapies advance with faster development of stable biologic formulations. Lonza’s Biologics segment reported revenues of CHF 3.1 billion in 2024, up 8% from 2023, reflecting strong demand for outsourced services.

Impact of Macroeconomic / Geopolitical Factors

Global economic stability fosters partnerships in pharmaceutical R&D, invigorating the formulation development outsourcing market as companies seek specialized expertise to accelerate drug pipelines amid rising healthcare demands. Executives prioritize cost-effective strategies in booming economies, which expands access to advanced formulation technologies for biopharma firms worldwide.

However, economic volatility from high interest rates hampers funding availability, restricting smaller enterprises from outsourcing complex projects in uncertain financial climates. Geopolitical instabilities in major API-producing regions fracture global collaborations, escalating risks of regulatory barriers that slow down cross-border knowledge transfers.

Leaders address these tensions by reallocating resources to diversified outsourcing hubs, which minimizes exposure and cultivates adaptive operational models. Current US tariffs on imported pharmaceuticals and raw materials, often reaching substantial levels from key suppliers like China, heighten expenses for international outsourcers reliant on affordable inputs.

American organizations respond by intensifying domestic collaborations, which stimulates local innovation ecosystems and reduces dependency on volatile imports. Continuous emphasis on scalable, efficient formulation processes ultimately reinforces the market’s robustness, enabling sustained collaboration and breakthrough drug deliveries for global health needs.

Latest Trends

Adoption of AI in formulation design is a recent trend

In 2024, the formulation development outsourcing market has exhibited a prominent trend toward the adoption of artificial intelligence in formulation design, which enhances predictive modeling for drug stability and release profiles. Service providers are integrating AI tools to optimize excipient selection and reduce trial-and-error in development.

Healthcare research benefits from AI-driven simulations for faster biopharma formulation. Regulatory evaluations accommodate AI with evidence of validation for clinical use. Clinical efficiency improves with AI predicting interactions in complex formulations. Academic studies evaluate AI performance in diverse drug classes.

Global networks adopt AI to standardize outsourced formulation processes. Patient therapies gain from precise designs enabling better efficacy. Ethical protocols ensure transparency in AI applications. Lonza highlighted AI advancements in their 2024 annual report, contributing to efficiency in Biologics and Small Molecules segments.

Regional Analysis

North America is leading the Formulation Development Outsourcing Market

In 2024, North America held a 43.7% share of the global formulation development outsourcing market, fueled by pharmaceutical companies’ increasing reliance on external partners to navigate complex regulatory landscapes and accelerate innovative drug delivery systems for biologics and small molecules, particularly amid talent shortages in internal R&D teams.

Contract organizations offered specialized capabilities in solubility enhancement and bioavailability optimization, enabling faster clinical trial transitions for oncology and neurology candidates. Heightened focus on patient-centric designs, such as taste-masked pediatric forms and extended-release injectables, drove outsourcing to meet stringent FDA timelines.

Rising biosimilar competition prompted firms to delegate stability testing and scale-up processes, optimizing resource allocation in competitive environments. Biotech startups leveraged outsourced expertise for early-phase prototyping, bridging gaps in formulation science for orphan indications.

Collaborative quality systems ensured compliance with good manufacturing practices, fostering trust in multi-site developments. Supply networks adapted to provide customized excipient blends, supporting rapid iteration in high-priority pipelines. According to a 2025 analysis, outsourcing was determined for 98% of 2024 newly approved drugs in API production and 97% for finished dose forms.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders forecast considerable momentum in formulation development outsourcing throughout Asia Pacific over the forecast period, as nations prioritize cost-effective innovation to address surging chronic disease therapies amid expanding middle-class access to healthcare. Developers outsource solubility challenges for generic hybrids, adapting techniques to humid storage needs in tropical zones.

Health authorities incentivize partnerships through tax breaks, empowering local firms to scale biosimilar prototypes for export markets. Biotech entities delegate bioavailability studies to specialized providers, tailoring approaches to ethnic metabolic diversities in antidiabetic agents. Regional consortia streamline regulatory alignments through joint submissions, accelerating approvals for controlled-release variants.

Pharmaceutical leaders transfer advanced extrusion technologies, ensuring affordability for pediatric formulations in micronutrient-deficient areas. Policy frameworks promote skill-building workshops on excipient selection, extending capabilities to emerging hubs. China’s National Medical Products Administration green-lit 83 new drugs in 2024, highlighting the region’s accelerating innovation that bolsters outsourcing demands.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Formulation Development Outsourcing market drive growth by offering integrated expertise across solubility enhancement, bioavailability improvement, and dosage form optimization to accelerate client development timelines. Companies expand demand by embedding early in drug pipelines, supporting preclinical to clinical transitions with flexible, milestone-driven engagement models.

Commercial strategies focus on building long-term partnerships with biotech and mid-size pharma firms that lack internal formulation depth but require rapid scalability. Innovation priorities include advanced delivery technologies, platform-based approaches, and data-driven formulation screening that reduce development risk.

Market expansion targets regions with strong clinical trial activity and rising outsourcing adoption due to cost and speed pressures. Catalent operates as a leading participant by leveraging its global development network, deep formulation science capabilities, and proven track record in translating complex molecules into clinically and commercially viable drug products.

Top Key Players

- Catalent, Inc.

- Patheon (Thermo Fisher Scientific)

- PCI Pharma Services

- Recipharm AB

- Lonza Group

- Samsung Bioepis

- FUJIFILM Diosynth Biotechnologies

- Parexel International

- Charles River Laboratories

- WuXi AppTec

Recent Developments

- In April 2024, CoreRx Inc. completed the acquisition of Societal CDMO Inc. in a transaction valued at USD 130 million. The deal expanded CoreRx’s capabilities in complex small molecule formulation, clinical manufacturing, and early stage development. This consolidation drives the formulation development outsourcing market by increasing the availability of specialized expertise and infrastructure, encouraging drug developers to outsource sophisticated formulation challenges rather than build in house capabilities.

- In July 2023, Aenova Group entered into a collaboration with Galvita centered on the development and manufacturing of oral dosage forms. The partnership enhances the formulation development outsourcing landscape by broadening access to advanced oral formulation know how. Pharmaceutical companies benefit from the ability to externalize formulation optimization, bioavailability enhancement, and scale up activities to experienced partners, supporting more efficient product development timelines.

Report Scope

Report Features Description Market Value (2024) US$ 28.4 Billion Forecast Revenue (2034) US$ 64.2 Billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Formulation Development and Preformulation), By Formulation Type (Oral, Injectable, Topical and Others), By Therapeutic Area (Oncology, Cardiovascular, Dermatology, Genetic Disorders and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Catalent, Inc., Patheon (Thermo Fisher Scientific), PCI Pharma Services, Recipharm AB, Lonza Group, Samsung Bioepis, FUJIFILM Diosynth Biotechnologies, Parexel International, Charles River Laboratories, WuXi AppTec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Formulation Development Outsourcing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Formulation Development Outsourcing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Catalent, Inc.

- Patheon (Thermo Fisher Scientific)

- PCI Pharma Services

- Recipharm AB

- Lonza Group

- Samsung Bioepis

- FUJIFILM Diosynth Biotechnologies

- Parexel International

- Charles River Laboratories

- WuXi AppTec