Global Fluoropolymer Films Market Size, Share, And Business Benefits By Type (Polyvinyl Fluoride, Polytetrafluoroethylene, Polyvinylidene Fluoride, Fluorinated Ethylene Propylene, Others), Application (Barrier Films, Release Films, Microporous Films, Security Films, Others), By End Use (Automotive, Construction, Aerospace and Defence, Packaging, Electrical and Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159133

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

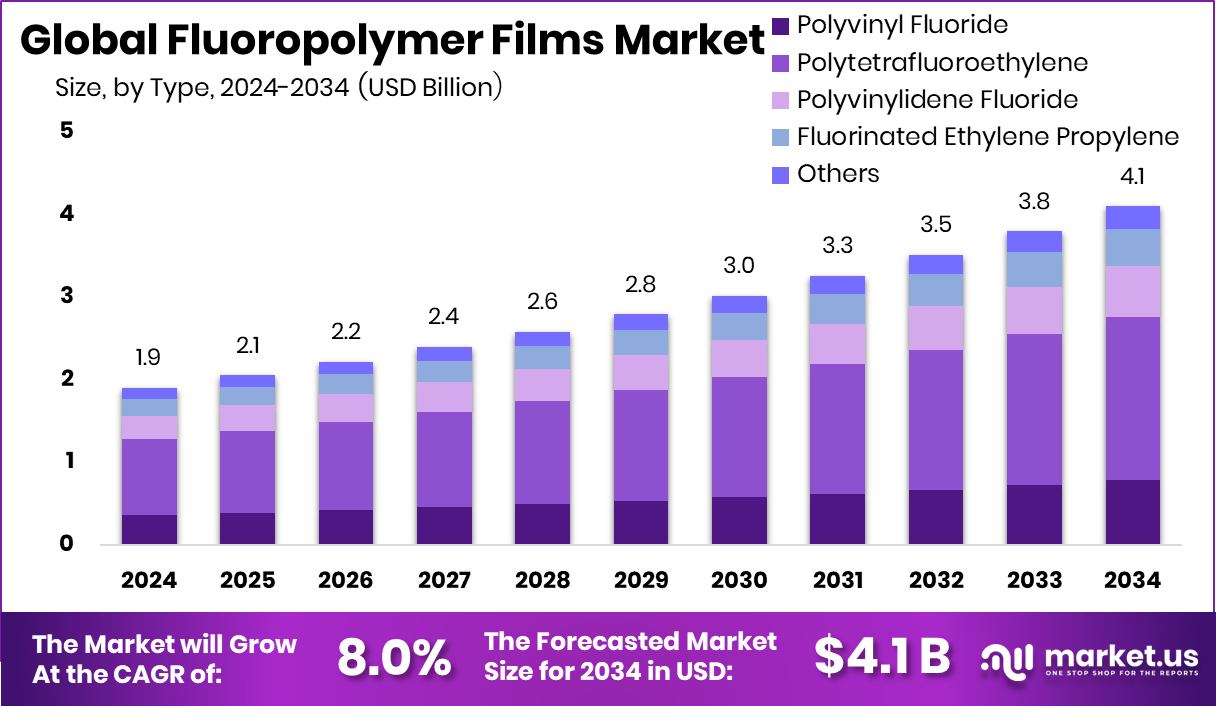

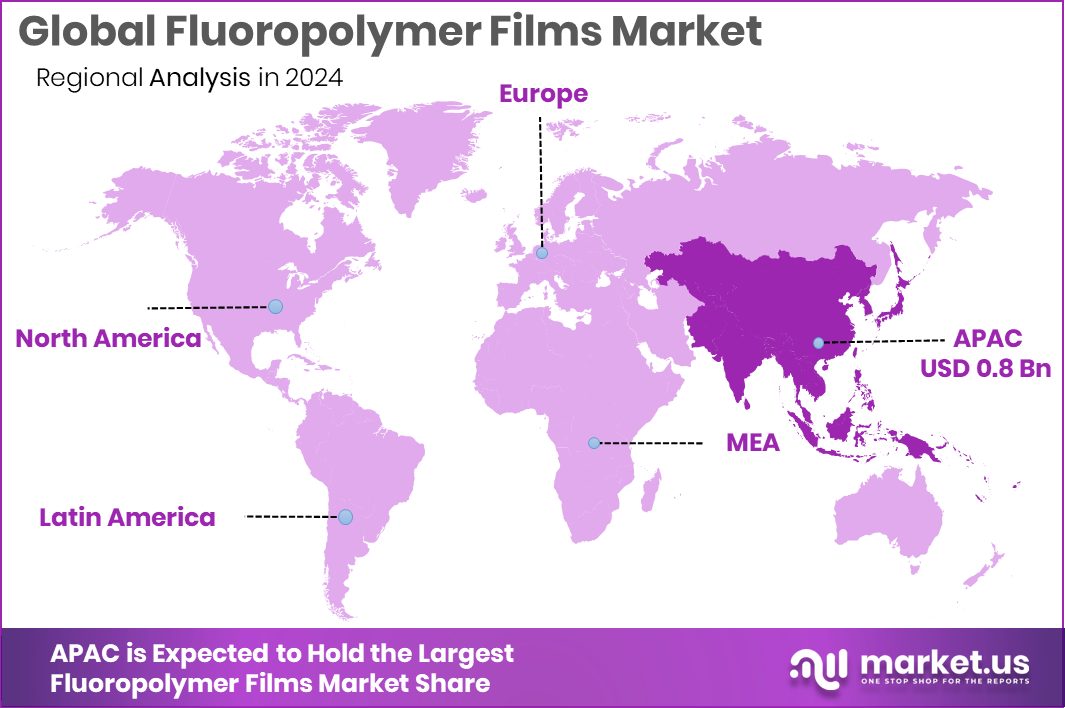

The Global Fluoropolymer Films Market is expected to be worth around USD 4.1 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034. Rising industrial demand in the Asia Pacific drives the Fluoropolymer Films Market, reaching USD 0.8 Bn.

Fluoropolymer films are specialized materials made from fluorinated polymers, known for their exceptional chemical resistance, high-temperature stability, and low-friction properties. These films are widely used in various industries, including electronics, automotive, aerospace, and healthcare, for applications such as cable insulation, protective coatings, and medical packaging.

The increasing demand for high-performance materials across industries is a significant driver of the fluoropolymer films market. Industries such as electronics, automotive, and medical sectors require materials that can withstand harsh environments, making fluoropolymer films an ideal choice due to their durability and reliability. Technological advancements and innovations in film processing techniques further enhance the performance and application scope of these films.

The demand for fluoropolymer films is rising globally, driven by their unique properties that meet the stringent requirements of various applications. In the electronics industry, for instance, the need for materials that offer excellent dielectric properties and thermal stability is propelling the use of fluoropolymer films. Similarly, the automotive sector’s focus on lightweight and durable materials is contributing to the increased adoption of these films.

Emerging sectors such as renewable energy and medical devices present new opportunities for the fluoropolymer films market. The growing emphasis on sustainable energy solutions has led to the use of fluoropolymer films in solar panels and wind turbines, where their resistance to environmental factors is crucial. Additionally, the medical industry’s need for sterile and reliable packaging materials is opening avenues for the use of these films in pharmaceutical applications.

In a significant development, Solvay has secured a $178 million grant to produce electric vehicle (EV) battery materials in Augusta. This investment underscores the increasing importance of advanced materials in the EV sector and highlights the potential for fluoropolymer films in emerging technologies.

Key Takeaways

- The Global Fluoropolymer Films Market is expected to be worth around USD 4.1 billion by 2034, up from USD 1.9 billion in 2024, and is projected to grow at a CAGR of 8.0% from 2025 to 2034.

- Polytetrafluoroethylene dominates the Fluoropolymer Films Market, accounting for 48.3% of total usage.

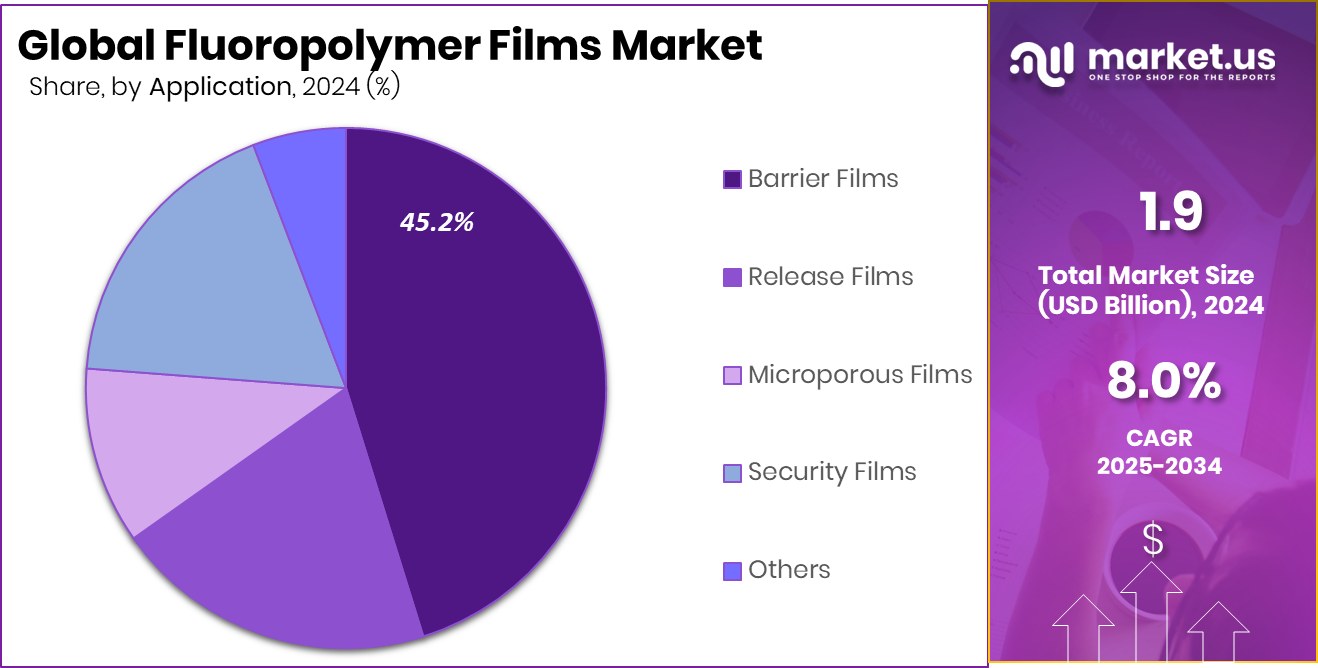

- Barrier films lead applications in the Fluoropolymer Films Market, representing 45.2% of demand.

- Packaging is the largest end-use segment in the Fluoropolymer Films Market at 31.6%.

- The Asia Pacific region contributed significantly to market growth, valued at USD 0.8 Bn.

By Type Analysis

Polytetrafluoroethylene dominates the Fluoropolymer Films Market with 48.3% share.

In 2024, Polytetrafluoroethylene (PTFE) held a dominant market position in the By Type segment of the Fluoropolymer Films Market, accounting for a 48.3% share. This leadership is largely attributed to PTFE’s exceptional chemical resistance, high thermal stability, and low friction properties, making it a preferred choice across demanding applications such as electronics insulation, automotive components, and industrial coatings.

Manufacturers and end-users continue to favor PTFE films for their reliability and long lifespan, which reduces maintenance and replacement costs. Additionally, advancements in processing technologies have enhanced PTFE film performance, further strengthening its position in the market. The high adoption of PTFE in critical sectors underscores its strategic importance within the fluoropolymer films industry.

By Application Analysis

Barrier Films lead the Fluoropolymer Films Market applications, accounting for 45.2% globally.

In 2024, Barrier Films held a dominant market position in the By Application segment of the Fluoropolymer Films Market, capturing a 45.2% share. This strong performance is driven by the growing need for materials that provide superior protection against moisture, chemicals, and gases in industries such as food packaging, pharmaceuticals, and electronics.

Barrier films are highly valued for their ability to extend product shelf life and ensure safety, making them an essential choice for sensitive applications. Additionally, technological improvements in film manufacturing have enhanced their durability and efficiency, further boosting adoption. The widespread use of barrier films across multiple sectors highlights their critical role in supporting quality, reliability, and long-term performance in the fluoropolymer films market.

By End Use Analysis

Packaging drives the fluoropolymer films market growth, contributing 31.6% of usage.

In 2024, packaging held a dominant market position in the By End Use segment of the Fluoropolymer Films Market, accounting for a 31.6% share. The growth in this segment is largely driven by the increasing demand for high-performance packaging materials that offer superior chemical resistance, thermal stability, and barrier properties. Fluoropolymer films in packaging are widely used to preserve the quality and shelf life of food, pharmaceuticals, and sensitive electronic components.

Innovations in film processing have improved flexibility, strength, and transparency, making these films more adaptable for diverse packaging needs. The preference for durable and reliable packaging solutions continues to reinforce the importance of fluoropolymer films in the packaging sector, supporting market expansion and adoption.

Key Market Segments

By Type

- Polyvinyl Fluoride

- Polytetrafluoroethylene

- Polyvinylidene Fluoride

- Fluorinated Ethylene Propylene

- Others

By Application

- Barrier Films

- Release Films

- Microporous Films

- Security Films

- Others

By End Use

- Automotive

- Construction

- Aerospace and Defence

- Packaging

- Electrical and Electronics

- Others

Driving Factors

Rising Demand for High-Performance Materials Globally

One of the main driving factors for the Fluoropolymer Films Market is the growing global demand for high-performance materials that can withstand extreme conditions. Industries such as electronics, automotive, aerospace, and healthcare increasingly require materials that are chemically resistant, heat-stable, and durable. Fluoropolymer films meet these needs effectively, offering low friction, excellent insulation, and long-term reliability.

The expansion of sectors like electric vehicles and renewable energy further supports the adoption of these films, as advanced materials are essential for battery components, solar panels, and other critical applications. Additionally, technological improvements in film manufacturing have enhanced their quality and application versatility. This rising demand across multiple high-growth industries continues to propel the fluoropolymer films market forward.

Restraining Factors

High Production Costs Limiting Wider Market Adoption

A key restraining factor for the Fluoropolymer Films Market is the high production cost associated with manufacturing these specialized materials. Fluoropolymer films require advanced processing techniques and high-quality raw materials, which significantly increase their overall cost compared to conventional films. This makes it challenging for small and medium-sized enterprises to adopt them widely, especially in cost-sensitive applications such as packaging or consumer goods.

Additionally, the energy-intensive production process adds to operational expenses, limiting profit margins for manufacturers. While the films offer superior chemical resistance, thermal stability, and durability, their high cost can slow down market growth. Until production becomes more cost-efficient, the adoption of fluoropolymer films in certain sectors may remain constrained.

Growth Opportunity

Expanding Applications in Renewable Energy and Electronics

A major growth opportunity for the Fluoropolymer Films Market lies in their expanding use in renewable energy and advanced electronics. These films are highly valued for their chemical resistance, thermal stability, and insulating properties, making them ideal for solar panels, wind turbines, and high-performance electronic devices. As the world moves toward sustainable energy solutions and smarter electronics, the demand for reliable and durable materials increases.

Fluoropolymer films can protect sensitive components from harsh environmental conditions while improving efficiency and lifespan. Innovations in film processing and material formulations are also opening new application possibilities, allowing manufacturers to develop more specialized solutions. This trend positions fluoropolymer films as a critical material for emerging technologies, driving future market growth.

Latest Trends

Increasing Use of Electric Vehicle Battery Components

A notable trend in the Fluoropolymer Films Market is their growing adoption in electric vehicle (EV) battery components. These films are prized for their excellent chemical resistance, thermal stability, and insulating properties, which are crucial for ensuring battery safety and performance. With the rapid expansion of the EV sector, manufacturers are seeking materials that can enhance battery efficiency, durability, and reliability.

In line with this, Solvay recently secured a significant grant to produce EV battery materials, highlighting the strategic importance of advanced materials like fluoropolymer films in this sector. As EV production and battery technology continue to evolve, the demand for fluoropolymer films in this high-growth application is expected to rise, reinforcing their market relevance.

Regional Analysis

In 2024, Asia Pacific dominated the Fluoropolymer Films Market with a 45.80% share, USD 0.8 Bn.

In 2024, the Fluoropolymer Films Market exhibited strong regional dynamics, with the Asia Pacific emerging as the dominating region, accounting for a 45.80% share and a market value of USD 0.8 billion. This leadership is driven by the rapid industrialization across countries in the region, coupled with increasing demand from the electronics, automotive, and renewable energy sectors. Manufacturers are increasingly adopting fluoropolymer films for applications such as cable insulation, protective coatings, and battery components due to their exceptional chemical resistance, thermal stability, and durability.

The growth in the Asia Pacific is further supported by technological advancements in film processing, which have enhanced the quality and performance of fluoropolymer films, making them suitable for high-performance applications. Additionally, government initiatives and investments in sustainable energy projects, including electric vehicles and solar infrastructure, are fueling material demand. Consumer awareness and industrial emphasis on long-lasting, reliable materials also contribute to the region’s market dominance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M continued to leverage its extensive portfolio of fluoropolymer products, including the 3M™ Dyneon™ and 3M™ Scotchpak™ series. These films are renowned for their exceptional chemical resistance, thermal stability, and low surface energy, making them ideal for applications in electronics, aerospace, and industrial sectors. 3M’s commitment to innovation and quality has solidified its position in the market.

AGC Chemicals offered a diverse range of high-performance fluoropolymer films under the Fluon® brand, such as ETFE and PFA films. These films are characterized by excellent heat resistance, chemical inertness, and optical transparency, catering to industries like solar energy, electronics, and architecture. AGC’s focus on advanced material solutions has enhanced its competitiveness in the global market.

American Durafilm specializes in distributing and fabricating high-performance fluoropolymer films, including Teflon® FEP and PFA, and Kapton® films. Their offerings are known for superior chemical and thermal resistance, serving critical applications in medical devices, aerospace, and industrial processes. American Durafilm’s expertise in custom fabrication and fast delivery has made it a preferred partner for specialized requirements.

Top Key Players in the Market

- 3M

- AGC Chemicals

- American Durafilm

- Arkema Group

- Asahi Kasei Corporation

- DAIKIN INDUSTRIES, Ltd.

- DuPont

- Fluoro-Plastics

- Fluortek AB

- Guarniflon India PVT., LTD.

Recent Developments

- In April 2024, 3M completed the spin-off of its healthcare business, resulting in the formation of Solventum Corporation as an independent company. This move allows 3M to focus on its core industrial and consumer businesses, potentially impacting its fluoropolymer film operations.

- In April 2024, American Durafilm announced the addition of Cavero Coatings to its portfolio. Cavero Coatings is a family-owned company specializing in high-temperature and high-release powder and water-based coatings. This strategic move enhances American Durafilm’s surface finishing solutions, providing customers with advanced coatings suitable for demanding applications.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 4.1 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyvinyl Fluoride, Polytetrafluoroethylene, Polyvinylidene Fluoride, Fluorinated Ethylene Propylene, Others), Application (Barrier Films, Release Films, Microporous Films, Security Films, Others), By End Use (Automotive, Construction, Aerospace and Defence, Packaging, Electrical and Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, AGC Chemicals, American Durafilm, Arkema Group, Asahi Kasei Corporation, DAIKIN INDUSTRIES, Ltd., DuPont, Fluoro-Plastics, Fluortek AB, Guarniflon India PVT., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fluoropolymer Films MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Fluoropolymer Films MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- AGC Chemicals

- American Durafilm

- Arkema Group

- Asahi Kasei Corporation

- DAIKIN INDUSTRIES, Ltd.

- DuPont

- Fluoro-Plastics

- Fluortek AB

- Guarniflon India PVT., LTD.