Global Flame retardant chemicals Market Size, Share, And Business Benefits By Product Type (Halogenated Chemicals, Non-Halogenated Chemicals), By Grade (Technical Grade, Industrial Grade), By Substrate (Plastic, Wood, Fiber, Metal, Others), By Application (Polyolefins, Epoxy Resins, Polyvinyl Chloride, Polyurethane, Polystyrene, Others), By End User (Construction, Transportation, Electrical and Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142056

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

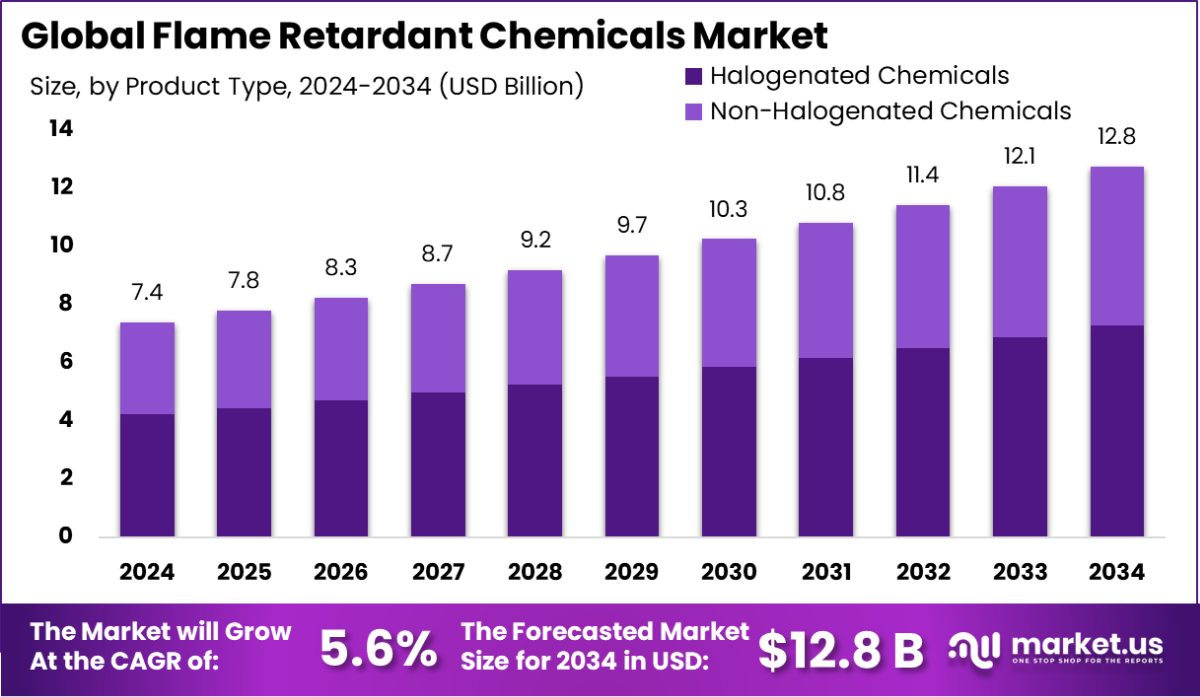

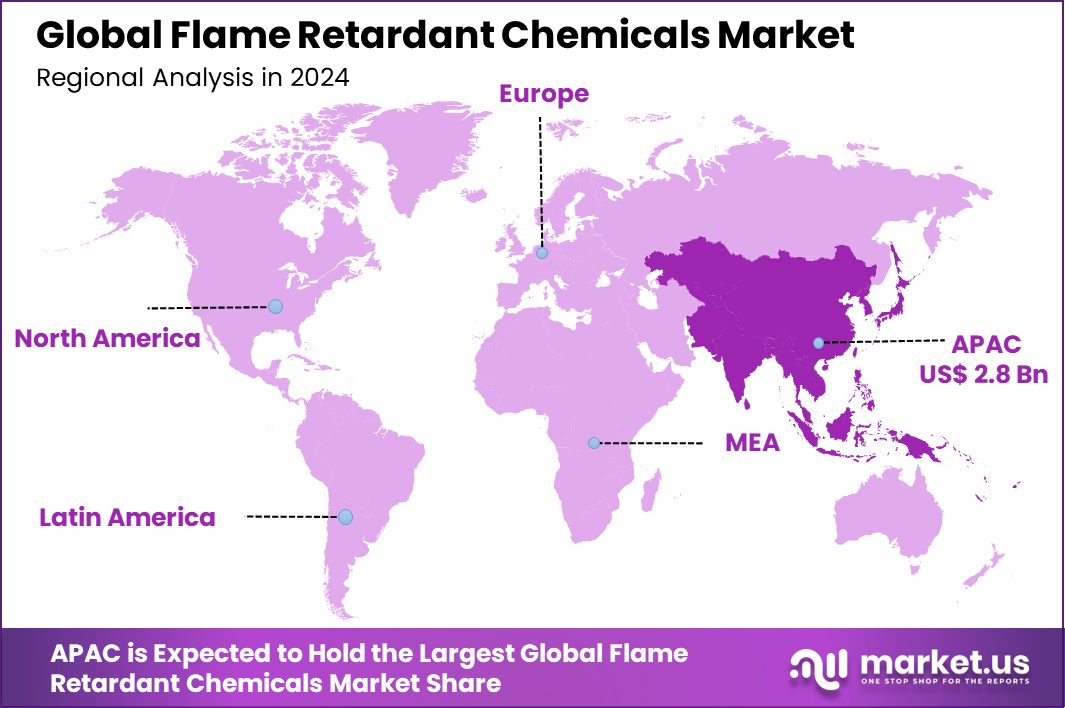

Global Flame retardant chemicals Market is expected to be worth around USD 12.8 billion by 2034, up from USD 7.4 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034. With a market share of 38.9%, Asia-Pacific leads in flame retardant chemicals, achieving sales of USD 2.8 billion.

Flame retardant chemicals are substances added to materials to slow or prevent the spread of fire. They are widely used in textiles, electronics, furniture, and construction materials to enhance fire safety. These chemicals function by disrupting the combustion process, either by forming a protective barrier, releasing water or inert gases, or altering the decomposition pathway of the material. However, regulatory scrutiny has increased due to potential environmental and health risks, leading to stricter policies and a shift toward safer alternatives.

The flame retardant chemicals market is growing due to rising fire safety regulations across industries. Governments worldwide mandate fire-resistant materials in construction, automotive, and consumer goods, driving demand. For example, California banned products containing more than 0.1% of the flame retardants pentaBDE or octaBDE by mass through AB 302, pushing manufacturers toward non-toxic alternatives. Additionally, the shift toward electric vehicles (EVs) has increased the demand for flame-retardant plastics in battery systems, further fueling market expansion.

Growing concerns about environmental contamination have led to increased investment in research and development for safer, eco-friendly flame retardants. Minnesota allocated $4.4 million to identify sources of PFAS (some of which are used as flame retardants) entering facilities and to develop pollution prevention and reduction initiatives. This highlights the opportunity for companies to develop sustainable alternatives that comply with evolving regulations and consumer preferences.

The market also benefits from increasing awareness regarding workplace and household fire hazards. Insurance companies and regulatory bodies are enforcing stricter fire safety compliance, pushing businesses to invest in flame-retardant materials. Emerging markets in Asia-Pacific are witnessing rapid urbanization, increasing the need for fire-safe infrastructure, contributing to the demand for innovative flame-retardant solutions.

Key Takeaways

- Global Flame retardant chemicals Market is expected to be worth around USD 12.8 billion by 2034, up from USD 7.4 billion in 2024, and grow at a CAGR of 5.6% from 2025 to 2034.

- Halogenated chemicals dominate the flame retardant market, holding a substantial 57.4% share by product type.

- Industrial-grade flame retardants are preferred, representing 64.5% of the market by grade.

- Plastics are a major substrate in the market, with flame retardants used in 43.4% of cases.

- In applications, polyolefins benefit greatly from these chemicals, making up 36.5% of their usage.

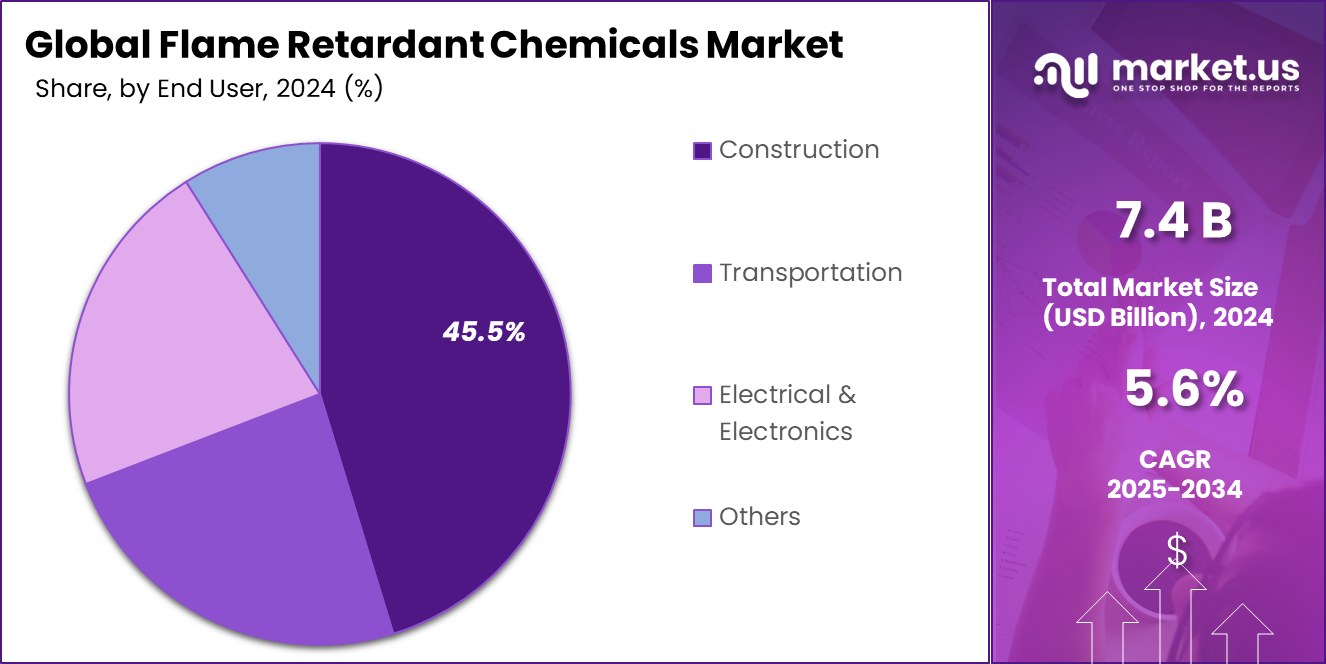

- The construction sector is the largest end-user of flame retardants, accounting for 45.5% of the market.

- The market for flame retardant chemicals in Asia-Pacific dominates with a 38.9% share, generating USD 2.8 billion.

By Product Type Analysis

Halogenated chemicals dominate the market with a 57.4% share in flame retardants.

In 2024, Halogenated Chemicals held a dominant market position in the By-Product Type segment of the Flame Retardant Chemicals Market, with a 57.4% share. This substantial market share can be attributed to the effectiveness of halogenated flame retardants in slowing down the chemical reactions that contribute to combustion processes.

These chemicals are particularly prevalent in industries where fire resistance is crucial, such as in electronics and construction materials. The dominance of halogenated chemicals has been supported by their long-standing integration in various applications, where they provide cost-effective solutions to meet stringent fire safety standards.

However, the segment faces challenges due to increasing regulatory scrutiny and shifting consumer preferences toward more environmentally friendly alternatives. This is due to the potential health and environmental risks associated with halogen compounds, such as toxicity and bioaccumulation concerns. Despite these challenges, the ongoing use in critical applications sustains their leading position in the market.

Moving forward, the halogenated flame retardants market must navigate these regulatory and environmental hurdles by innovating safer, more sustainable formulations to retain its market share and respond to the evolving demands of the fire safety regulations and material manufacturing industries.

By Grade Analysis

Industrial grade flame retardants lead, comprising 64.5% of the market’s total.

In 2024, Industrial Grade held a dominant market position in the By Grade segment of the Flame Retardant Chemicals Market, with a 64.5% share. This leadership is largely due to the extensive application of industrial-grade flame retardants in a variety of sectors that require materials to adhere to high safety standards. These sectors include construction, automotive, and electronics, where materials must effectively withstand high temperatures and minimize fire risks.

The prominence of industrial-grade flame retardants is supported by their robust performance characteristics, which make them indispensable in settings that demand high levels of fire resistance. These chemicals are favored for their ability to integrate seamlessly into the manufacturing processes of various materials, such as plastics, textiles, and building materials, enhancing their fire-retardant properties without compromising the material integrity or functionality.

Despite facing growing environmental and health concerns over certain chemical compositions, the segment continues to thrive due to ongoing product innovations aimed at reducing adverse impacts while maintaining or improving fire retardant capabilities. The future of the industrial-grade segment looks to be shaped heavily by advancements in technology and formulation that align with global regulatory changes and a shift toward sustainability in material production.

By Substrate Analysis

Plastics are the primary substrates, holding a 43.4% share in applications.

In 2024, Plastic held a dominant market position in the By Substrate segment of the Flame Retardant Chemicals Market, capturing a 43.4% share. This leading position is primarily driven by the critical role of flame retardants in enhancing the fire safety of plastic products, which are widely used across various industries, including automotive, construction, and electronics.

The high demand in these sectors is due to plastic’s versatility, affordability, and broad range of applications, from electrical housings and interior components to insulation materials.

The use of flame retardant chemicals in plastics not only improves their fire resistance but also meets the stringent safety standards required by international safety codes and regulations. As plastics are inherently flammable, the integration of these chemicals is essential for preventing fire-related incidents, thereby ensuring product safety and consumer protection.

Moreover, as the market for plastics continues to grow, especially in emerging economies with increasing urbanization and industrial activities, the demand for flame retardant chemicals in this substrate is expected to remain robust. Manufacturers are continually challenged to develop effective, environmentally friendly, flame-retardant solutions to keep pace with regulatory pressures and market expectations for safer and more sustainable products.

By Application Analysis

Polyolefins use flame retardant chemicals extensively, accounting for 36.5% of applications.

In 2024, Polyolefins held a dominant market position in the By Application segment of the Flame Retardant Chemicals Market, with a 36.5% share. This prominence is attributed to the widespread use of polyolefins in various high-volume applications that require enhanced fire resistance properties. Polyolefins, including polyethylene and polypropylene, are essential components in numerous industries, such as automotive, construction, and packaging due to their versatility, durability, and cost-effectiveness.

The significant market share of polyolefins in flame retardant applications is bolstered by their extensive use in consumer goods, electrical components, and building materials where safety regulations mandate stringent fire resistance standards. The flame retardant treatments for polyolefins improve their safety profiles by significantly reducing the risk of fire hazards, thus meeting both regulatory requirements and consumer safety expectations.

Furthermore, the ongoing advancements in flame retardant technology are expected to enhance the efficacy and environmental safety of treatments used with polyolefins, driving their continued dominance in the market. As manufacturers focus on sustainable practices, the development of non-toxic and high-performance flame retardant solutions will likely further solidify the leading position of polyolefins in this market segment.

By End User Analysis

The construction sector is the largest end-user, consuming 45.5% of flame retardants.

In 2024, Construction held a dominant market position in the By End User segment of the Flame Retardant Chemicals Market, with a 45.5% share. This substantial market share is a result of the critical need for fire safety in residential, commercial, and industrial buildings, driving the integration of flame retardant chemicals into a wide range of construction materials, including insulation, wiring, roofing, and paneling. The high prevalence of flame retardants in this sector is bolstered by stringent building codes and fire regulations that mandate enhanced safety measures.

The construction industry’s commitment to safety and durability underpins this strong demand as builders and developers seek to minimize the risk of fire-related disasters and ensure the longevity of their structures. As urbanization and infrastructure projects continue to expand globally, the reliance on flame retardant chemicals in construction materials is expected to maintain its upward trajectory.

Moreover, the push towards more sustainable and environmentally friendly building practices influences the development and adoption of newer, safer, flame retardant formulations. This trend is set to support the ongoing dominance of the construction sector in the flame retardant chemicals market, aligning with broader environmental and health safety goals while catering to the essential needs of fire protection.

Key Market Segments

By Product Type

- Halogenated Chemicals

- Non-Halogenated Chemicals

By Grade

- Technical Grade

- Industrial Grade

By Substrate

- Plastic

- Wood

- Fiber

- Metal

- Others

By Application

- Polyolefins

- Epoxy Resins

- Polyvinyl Chloride

- Polyurethane

- Polystyrene

- Others

By End User

- Construction

- Transportation

- Electrical and Electronics

- Others

Driving Factors

Increasing Stringency of Fire Safety Regulations

One of the primary driving factors for the Flame Retardant Chemicals Market is the increasing stringency of fire safety regulations globally. Governments and regulatory bodies are continuously updating and enforcing stricter safety standards to minimize the risk of fire-related incidents.

This trend compels manufacturers across various industries—such as construction, electronics, and automotive—to incorporate advanced flame retardant technologies into their products.

As a result, the demand for effective flame retardant chemicals is on the rise. Manufacturers are prompted to innovate and develop new, safer, and more environmentally friendly flame retardant solutions to comply with these regulations, driving growth in the market while enhancing public safety.

Restraining Factors

Environmental Concerns Over Certain Flame Retardant Chemicals

A significant restraining factor for the Flame Retardant Chemicals Market is the growing environmental and health concerns associated with certain types of flame retardants, particularly halogenated compounds. These chemicals have been scrutinized for their potential to cause environmental damage and health issues, such as toxicity and bioaccumulation in wildlife and humans.

As public awareness and regulatory focus on environmental protection increase, the demand for traditional flame retardant chemicals faces challenges. This shift is pushing manufacturers to invest in research and development of safer, non-toxic alternatives. However, the transition involves high costs and technological hurdles, potentially slowing down market growth as companies and consumers look for products that are not only effective but also environmentally responsible.

Growth Opportunity

Shift Towards Eco-Friendly Flame Retardant Solutions

A major growth opportunity within the Flame Retardant Chemicals Market lies in the shift toward eco-friendly and sustainable flame retardant solutions. As environmental regulations tighten and consumer preferences lean more towards health-conscious and eco-sensitive products, the market for green flame retardants is rapidly expanding. This trend is encouraging manufacturers to innovate and develop new formulations that are less harmful to the environment and human health.

These advancements include the creation of flame retardants that are free from halogens and other toxic chemicals. By capitalizing on this shift, companies can not only comply with regulatory demands but also differentiate themselves in a competitive market. The transition to sustainable flame retardants opens up new avenues for growth and is likely to attract a broader consumer base seeking safer alternatives.

Latest Trends

Advancements in Non-Halogenated Flame Retardant Technologies

A prominent trend in the Flame Retardant Chemicals Market is the advancement in non-halogenated flame retardant technologies. This shift is driven by the need to eliminate the environmental and health risks associated with halogenated flame retardants. Non-halogenated flame retardants, which include phosphorus, nitrogen, and magnesium-based compounds, are gaining popularity due to their lower toxicity and reduced environmental impact.

These advancements are not only making flame-retardant products safer but also improving their performance in terms of durability and effectiveness in preventing fires. As more industries, particularly electronics and textiles, require safer materials, the adoption of non-halogenated flame retardants is expected to rise, setting a new standard in fire safety measures across multiple sectors.

Regional Analysis

In Asia-Pacific, the Flame Retardant Chemicals Market holds 38.9% with revenues reaching USD 2.8 billion.

In the global landscape of the Flame Retardant Chemicals Market, the Asia-Pacific region stands out as the dominating force, commanding a substantial 38.9% market share and generating revenues of USD 2.8 billion. This dominance is largely attributed to rapid industrialization and urbanization across key economies such as China, India, and Japan.

These countries are witnessing significant growth in the construction, automotive, and electronics sectors, all of which require extensive use of flame retardant chemicals to meet strict fire safety standards and consumer safety regulations.

Meanwhile, North America and Europe also hold significant positions in the market due to stringent regulatory frameworks governing fire safety in materials and ongoing technological innovations in flame retardant formulations. The markets in these regions are driven by a high demand for advanced, environmentally friendly, flame-retardant chemicals that align with tighter health and safety regulations.

The Middle East & Africa, and Latin America regions, although smaller in comparison, are experiencing gradual growth. This growth is spurred by increasing awareness of fire safety in the construction and automotive sectors, coupled with economic development that drives demand for flame retardant chemicals. However, these regions still face challenges such as the need for regulatory enhancements and technology transfer to harness their full market potential.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, leading players in the global Flame Retardant Chemicals Market continue to focus on innovation, regulatory compliance, and sustainability to maintain competitive advantages. Akzo Nobel leverages its extensive expertise in specialty chemicals to develop high-performance, flame retardant coatings, addressing growing demand in construction and industrial applications. The company’s strong research and development (R&D) investments position it as a key innovator in eco-friendly solutions.

Albemarle Corporation, a dominant supplier in the flame retardant sector, benefits from its strong lithium-based product portfolio and bromine business. Its global footprint and integrated supply chain provide a competitive edge, especially in high-growth markets such as electronics and automotive applications. The company’s focus on non-halogenated alternatives aligns with increasing environmental regulations.

BASF SE, a market leader in chemical manufacturing, continues to drive advancements in phosphorus-based and polymeric flame retardants. With its extensive R&D infrastructure, BASF aims to enhance product efficiency while complying with stricter fire safety standards in Europe and North America.

Budenheim Iberica SLU specializes in phosphorus-based flame retardants, benefiting from the rising preference for halogen-free solutions. Its expertise in sustainable formulations caters to the evolving regulatory landscape, particularly in Europe.

Clariant AG emphasizes sustainable chemistry, leading the shift toward non-toxic and bio-based flame retardants. Its strategic collaborations and strong European presence enable it to capture emerging opportunities in the eco-friendly segment.

DIC Corporation, with a diversified chemical portfolio, focuses on advanced formulations for industrial applications. Its innovation-driven approach and expansion into emerging markets strengthen its position in the global flame retardant chemicals industry.

Top Key Players in the Market

- Akzo Nobel

- Albemarle Corporation

- BASF SE

- Budenheim Iberica SLU

- Clariant AG

- DIC Corporation

- Dow Inc.

- Henkel

- Huber Engineered Materials

- ICL Group Ltd.

- Israel Chemicals Ltd.

- Italmatch Chemicals S.p.A.

- LANXESS AG

- M. Huber Corporation

- Momentive Performance Materials Inc.

- Nabaltec AG

- Nippon Carbide Industries Co. Inc.

- PCC SE

- RTP Company

- Shandong Brother Sci.&Tech. Co. Ltd.

- Thor Group Limited

- Zhejiang Wansheng Co. Ltd.

Recent Developments

- In February 2025, Henkel launched the Loctite HB XE Line, a new generation of adhesive for cross-laminated timber (CLT) and glued laminated timber (GLT) that meets high fire protection standards.

- In January 2025, BASF SE introduced a new flame-retardant grade of Ultramid® T6000 polyphthalamide (PPA) for terminal block applications in electric vehicles.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Billion Forecast Revenue (2034) USD 12.8 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Halogenated Chemicals, Non-Halogenated Chemicals), By Grade (Technical Grade, Industrial Grade), By Substrate (Plastic, Wood, Fiber, Metal, Others), By Application (Polyolefins, Epoxy Resins, Polyvinyl Chloride, Polyurethane, Polystyrene, Others), By End User (Construction, Transportation, Electrical and Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel, Albemarle Corporation, BASF SE, Budenheim Iberica SLU, Clariant AG, DIC Corporation, Dow Inc., Henkel, Huber Engineered Materials, ICL Group Ltd., Israel Chemicals Ltd., Italmatch Chemicals S.p.A., LANXESS AG, M. Huber Corporation, Momentive Performance Materials Inc., Nabaltec AG, Nippon Carbide Industries Co. Inc., PCC SE, RTP Company, Shandong Brother Sci.&Tech. Co. Ltd., Thor Group Limited, Zhejiang Wansheng Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Flame retardant chemicals MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Flame retardant chemicals MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel

- Albemarle Corporation

- BASF SE

- Budenheim Iberica SLU

- Clariant AG

- DIC Corporation

- Dow Inc.

- Henkel

- Huber Engineered Materials

- ICL Group Ltd.

- Israel Chemicals Ltd.

- Italmatch Chemicals S.p.A.

- LANXESS AG

- M. Huber Corporation

- Momentive Performance Materials Inc.

- Nabaltec AG

- Nippon Carbide Industries Co. Inc.

- PCC SE

- RTP Company

- Shandong Brother Sci.&Tech. Co. Ltd.

- Thor Group Limited

- Zhejiang Wansheng Co. Ltd.