Feminine Hygiene Products Market By Product Type (Menstrual Care Products (Tampons, Sanitary Napkins, Menstrual Cups and Others) and Cleaning & Deodorizing Products (Feminine Powders, Soaps & Washes and Others)), By Distribution Channel (Supermarkets, Online Retail Stores, Drug Stores and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2024

- Report ID: 130703

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

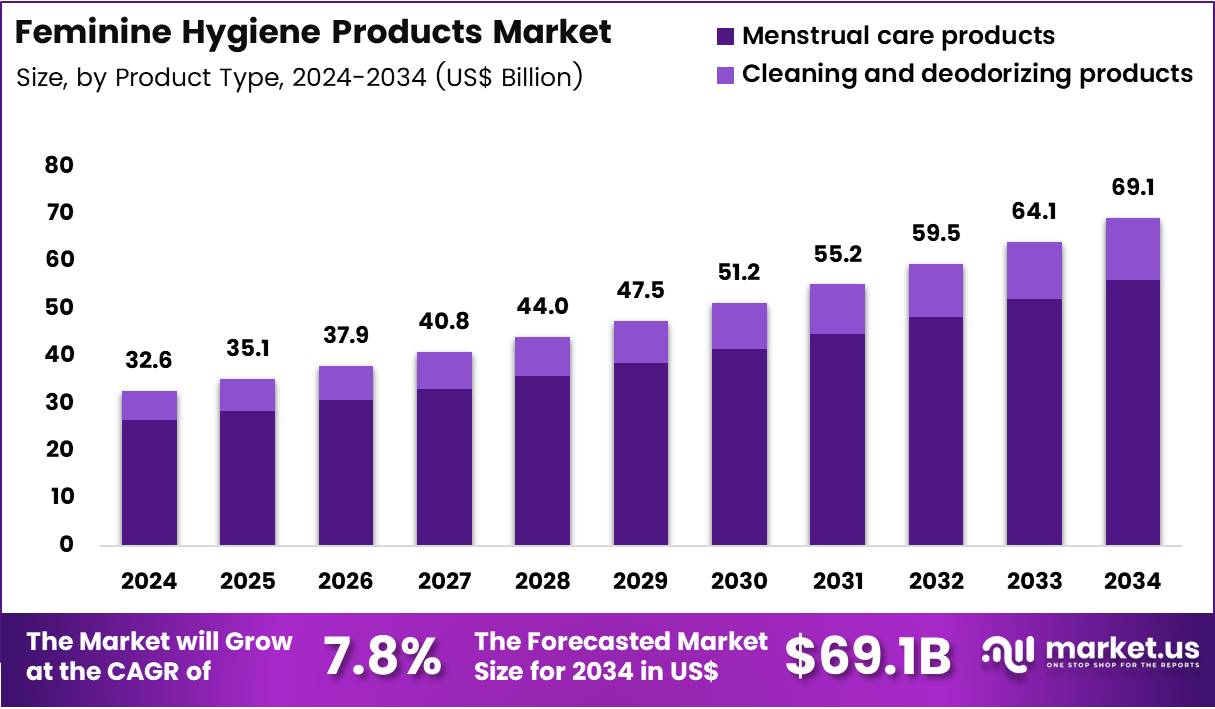

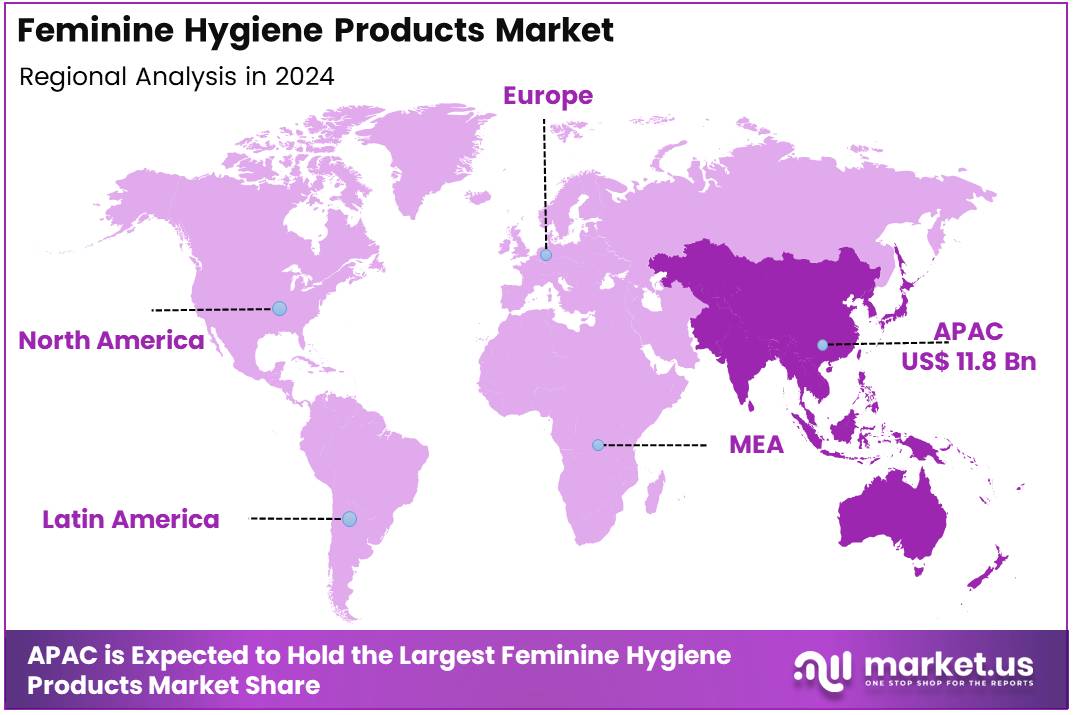

The Global Feminine Hygiene Products Market size is expected to be worth around US$ 69.1 Billion by 2034 from US$ 32.6 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, Asia Pacific led the market, achieving over 36.3% share with a revenue of US$ 11.8 Billion.

Feminine hygiene products such as sanitary pads, tampons, panty liners, menstrual cups, and intimate washes play a critical role in supporting menstrual health, comfort, and personal hygiene. Demand for these products continues to rise as awareness of menstrual health improves and access expands in emerging economies.

In recent years, consumer preferences have shifted toward sustainable and reusable options, including menstrual cups and organic pads, reflecting growing environmental consciousness and a desire to reduce long-term waste.

Accessibility and equity have become central themes shaping the market. Surveys indicate that 89% of women in North America support the provision of free pads and tampons in schools and healthcare facilities, while 75% believe period products should be universally free.

These views highlight increasing expectations for menstrual care to be treated as a basic necessity rather than a discretionary expense. Policy support is also strengthening, as reflected in initiatives such as Governor Josh Shapiro’s 2024–25 budget, which allocates funding to provide period products in schools.

The commercial landscape is adapting to these expectations. Around 66% of women report a preference for businesses that offer free period products, creating a competitive advantage for brands that prioritize menstrual equity. In January 2024, The Honey Pot strengthened its market position through a US$380 million acquisition by Compass Diversified, enabling the brand to scale production, expand distribution, and reinforce leadership in plant-based feminine care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 32.66 Billion, with a CAGR of 7.8%, and is expected to reach US$ 69.1 Billion by the year 2034.

- The product type segment is divided into menstrual care products and cleaning & deodorizing products, with menstrual care products taking the lead in 2024 with a market share of 81.2%.

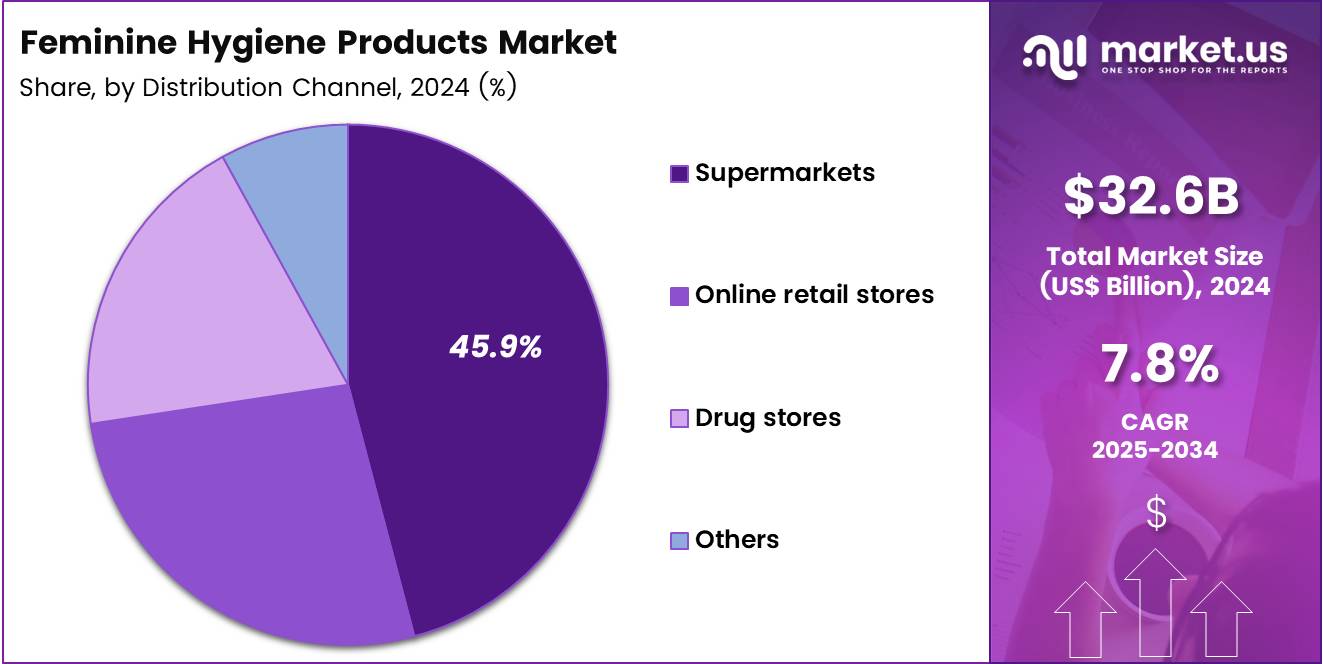

- Considering distribution channel, the market is divided into supermarkets, online retail stores, drug stores and others. Among these, supermarkets held a significant share of 45.9%.

- Asia Pacific led the market by securing a market share of 36.3% in 2024.

Product Type Analysis

In 2023, Menstrual Care Products accounted for 81.2% of the Feminine Hygiene Products Market, positioning this category as the dominant product segment due to the widespread adoption of sanitary napkins and tampons driven by ease of use and broad availability. Rising awareness of menstrual hygiene, coupled with strong consumer preference for high-absorbency and reliable products, has continued to support demand across urban and semi-urban populations.

The growing acceptance of menstrual cups among environmentally conscious users has further strengthened this segment, supported by sustainability-driven purchasing behavior. Ongoing product innovation, including ultra-thin and skin-friendly absorbent pads, has helped retain a large and loyal consumer base. Strong distribution coverage and brand familiarity also contribute to sustained volume consumption. As a result, menstrual care products remain central to manufacturers’ portfolio strategies.

In contrast, Cleaning and Deodorizing Products represent a smaller but steadily expanding share of the market, supported by rising awareness of intimate hygiene and infection prevention. Demand growth is closely linked to increasing consumer focus on daily feminine care routines beyond menstruation.

Preference for natural, pH-balanced, and dermatologically tested formulations has gained momentum, particularly among younger consumers. Although this segment remains niche compared to menstrual care products, its growth reflects a broader shift toward holistic feminine wellness. Manufacturers continue to invest in formulation safety and education-led marketing to expand adoption.

Distribution Channel Analysis

In 2023, Supermarkets held a 45.9% share of the Feminine Hygiene Products Market, making them the leading distribution channel due to convenience, product variety, and competitive pricing. Consumers favor supermarkets for one-stop access to multiple brands and product formats, including sanitary pads, tampons, and menstrual cups.

Regular promotions and the availability of both premium and value options further reinforce high footfall and repeat purchases. Drug stores follow as an important channel, benefiting from strong consumer trust in pharmacy-led health and wellness offerings. Online retail is emerging as a fast-growing channel, driven by discreet purchasing, home delivery, and increasing adoption among digitally active consumers.

Smaller retail formats continue to support accessibility in localized markets, while manufacturers increasingly balance in-store visibility with expanding e-commerce strategies to sustain distribution growth.

Key Market Segments

By Product Type

- Menstrual Care Products

- Tampons

- Sanitary Napkins

- Menstrual Cups

- Others

- Cleaning & Deodorizing Products

- Feminine Powders, Soaps & Washes

- Others

Distribution Channel

- Supermarkets

- Online Retail Stores

- Drug Stores

- Others

Drivers

Increasing Awareness of Menstrual Health is Driving the Market

Growing awareness of menstrual hygiene and its role in women’s health, dignity, and social inclusion continues to be a primary driver of the feminine hygiene products market. Large-scale education initiatives led by governments, NGOs, healthcare providers, and international agencies have helped normalize discussions around menstruation, reducing stigma and misinformation.

Social media, digital health platforms, and influencer-led campaigns have further accelerated awareness by promoting safe menstrual practices and highlighting the availability of modern hygiene products. As a result, adoption of sanitary pads, tampons, panty liners, and menstrual cups has increased across urban and semi-urban populations.

Product innovation has reinforced this momentum, with manufacturers introducing ultra-thin designs, higher absorbency materials, hypoallergenic surfaces, and breathable layers that enhance comfort and reliability. Public initiatives such as school-based product distribution, tax exemptions, and subsidized access programs in developing regions have also expanded usage among low-income groups, supporting sustained market growth.

Restraints

High Product Costs and Social Barriers are Restraining Adoption

Despite rising demand, the market faces notable restraints linked to affordability and persistent socio-cultural barriers. Premium products such as organic pads, biodegradable materials, and menstrual cups often involve higher upfront costs, limiting adoption in price-sensitive and low-income regions.

Although these products offer long-term economic and environmental benefits, the initial investment discourages many consumers. Limited awareness in rural and remote areas further constrains market penetration, as access to education, retail infrastructure, and healthcare guidance remains uneven.

Cultural taboos and social discomfort around menstruation continue to hinder open discussion, slowing education efforts and reducing acceptance of alternative product formats such as tampons and reusable solutions. These combined factors restrict demand expansion and prevent deeper penetration in several emerging economies.

Opportunities

Expansion into Underserved Markets is Creating Growth Opportunities

Significant growth opportunities exist in underserved and underdeveloped regions where access to feminine hygiene products remains inconsistent. Companies can unlock new demand by introducing low-cost product variants, strengthening last-mile distribution, and partnering with local health organizations, schools, and community groups to improve awareness.

Product diversification also presents strong potential, as consumers increasingly seek solutions tailored to specific life stages and needs, including adolescent care, postpartum protection, night-use products, and active lifestyles. Rising environmental consciousness is further driving demand for biodegradable and reusable options, aligning feminine hygiene with broader wellness and ethical consumption trends. Brands that successfully balance affordability, innovation, and sustainability are well positioned to build long-term consumer trust and capture sustained growth.

Impact of Macroeconomic / Geopolitical Factors

Global economic expansions channel investments into women’s health sectors, elevating the feminine hygiene products market through increased consumer spending on essential sanitary items in developing regions. Leaders capitalize on growing awareness of menstrual wellness to introduce innovative and sustainable product lines, which broadens appeal across diverse demographics.

Nevertheless, persistent worldwide inflation raises costs for raw materials such as cotton and absorbent polymers, compelling manufacturers to adjust pricing strategies in competitive environments. Geopolitical tensions in key agricultural and manufacturing regions disrupt reliable access to essential inputs, creating logistical challenges for international supply chains.

Executives respond by diversifying sourcing networks and strengthening regional partnerships, which enhances operational stability and reduces exposure to single-point risks. Current US tariffs on imported hygiene products from major producing countries increase landed costs for foreign brands entering the American market.

Domestic producers benefit from this policy shift by expanding local production capabilities, which supports job growth and accelerates adaptation to consumer preferences. Ongoing advancements in eco-conscious and comfortable designs steadily strengthen the industry’s position, promising continued expansion and greater accessibility for users worldwide.

Latest Trends

Sustainability-Focused Packaging and Education-Led Awareness are Emerging as Key Market Trends

The feminine hygiene products market is increasingly shaped by sustainability-driven packaging innovations and education-centered awareness initiatives. Brands are adopting minimalist, eco-friendly packaging designs that reduce plastic use and incorporate biodegradable or recyclable materials, responding to growing consumer concern about environmental impact. This shift not only supports sustainability goals but also enhances brand credibility among environmentally conscious buyers.

At the same time, companies and organizations are intensifying educational campaigns in schools and communities to normalize conversations around menstruation and improve menstrual health literacy. These programs help dismantle social stigmas, encourage the adoption of modern hygiene products, and build confidence among younger consumers. By combining sustainable product presentation with education-led engagement, brands are influencing purchasing behavior while fostering long-term loyalty and responsible consumption patterns.

Regional Analysis

Asia Pacific is leading the Feminine Hygiene Products Market

Asia Pacific accounted for 36.3% of the overall market in 2024, and the Feminine Hygiene Products market expanded rapidly as awareness of menstrual health improved across urban and semi-urban populations. Government-led education campaigns and NGO initiatives reduced stigma around menstruation, encouraging consistent product usage among adolescents and working women.

Rising female workforce participation increased demand for convenient and reliable hygiene solutions suitable for long daily routines. E-commerce platforms and direct-to-consumer brands improved product accessibility in remote areas. Growing preference for affordable sanitary napkins and panty liners supported volume growth across developing economies.

Local manufacturing expansion helped reduce prices and ensure steady supply. Product innovation focused on comfort, absorbency, and skin safety strengthened consumer trust. These combined factors drove strong market growth across Asia Pacific in 2024.

The North America region is expected to experience the highest CAGR during the forecast period

North America is expected to witness steady growth during the forecast period as the Feminine Hygiene Products market benefits from premiumization and product innovation. Consumers increasingly prefer organic, chemical-free, and sustainable options that align with health and environmental concerns.

Higher awareness of intimate wellness encourages routine usage beyond menstruation, supporting demand for liners and cleansing products. Subscription models and omnichannel retail strategies improve convenience and brand loyalty. Manufacturers invest in biodegradable materials and reusable alternatives to meet evolving consumer expectations.

Educational initiatives continue to normalize conversations around menstrual and intimate health. Rising focus on comfort, discretion, and long-wear performance supports product upgrades. These trends position North America for consistent and value-driven market expansion ahead.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Feminine Hygiene Products market drive growth by expanding product portfolios with skin-friendly materials, improved absorbency, and discreet designs that address comfort, safety, and lifestyle needs. Companies strengthen demand through education-driven marketing and digital engagement that normalize menstrual health and build long-term brand trust among younger consumers.

Commercial strategies emphasize wide retail penetration, direct-to-consumer channels, and subscription models that improve accessibility and repeat purchasing. Innovation priorities focus on sustainable materials, reusable formats, and biodegradable options that align with environmental awareness and regulatory trends.

Market expansion targets emerging economies where rising hygiene awareness and female workforce participation support volume growth. Procter & Gamble stands out as a leading participant through its globally recognized brands, large-scale manufacturing capabilities, and continuous investment in consumer-led innovation across feminine care categories.

Top Key Players

- Unilever

- Unicharm Corporation

- Procter & Gamble

- Prestige Consumer Healthcare Inc.

- Premier FMCG (Pty) Ltd.

- Ontex BV

- Maxim Hygiene

- KCWW

- Kao Corporation

- GLENMARK PHARMACEUTICALS LTD

- Essity Aktiebolag

- Edgewell Personal Care

Recent Developments

- In February 2024, Drylock Technologies outlined plans to expand its North American operations by establishing its first US based baby care manufacturing facility in Reidsville, North Carolina. The project involves an investment of more than USD 26.9 million and the creation of 113 new jobs, strengthening local production capacity and reducing reliance on imports. This move supports faster supply response, improved logistics efficiency, and greater proximity to the US consumer market for hygiene products.

- In October 2024, Good Glamm Group completed the acquisition of Sirona for approximately USD 54 million, marking a strategic expansion in the feminine hygiene space. By integrating Sirona’s portfolio of menstrual cups, organic tampons, and other women focused hygiene products, Good Glamm Group broadened its offerings and reinforced its position in the fast growing menstrual care segment. The acquisition also enables cross platform distribution through Good Glamm’s digital first ecosystem, supporting scale and brand penetration.

Report Scope

Report Features Description Market Value (2024) US$ 32.6 Billion Forecast Revenue (2034) US$ 69.1 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Menstrual Care Products (Tampons, Sanitary Napkins, Menstrual Cups and Others) and Cleaning & Deodorizing Products (Feminine Powders, Soaps & Washes and Others)), By Distribution Channel (Supermarkets, Online Retail Stores, Drug Stores and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Unilever, Unicharm Corporation, Procter & Gamble, Prestige Consumer Healthcare Inc., Premier FMCG (Pty) Ltd., Ontex BV, Maxim Hygiene, KCWW, Kao Corporation, GLENMARK PHARMACEUTICALS LTD, Essity Aktiebolag, Edgewell Personal Care. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Feminine Hygiene Products MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Feminine Hygiene Products MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Procter & Gamble

- GLENMARK PHARMACEUTICALS LTD

- Unicharm Corporation

- Unilever

- Maxim Hygiene

- KCWW

- Edgewell Personal Care

- Premier FMCG (Pty) Ltd.

- Essity Aktiebolag

- Ontex BV

- Bodywise (UK) Limited

- Kao Corporation

- Prestige Consumer Healthcare Inc.