Global Feed Acidifiers Market Size, Share and Future Trends Analysis Report By Type (Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Malic Acid, Sorbic Acid, Others), By Form (Dry, Liquid), By Compound (Blended, Single), By Livestock (Poultry, Swine, Ruminants, Aquaculture, Pets, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149253

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

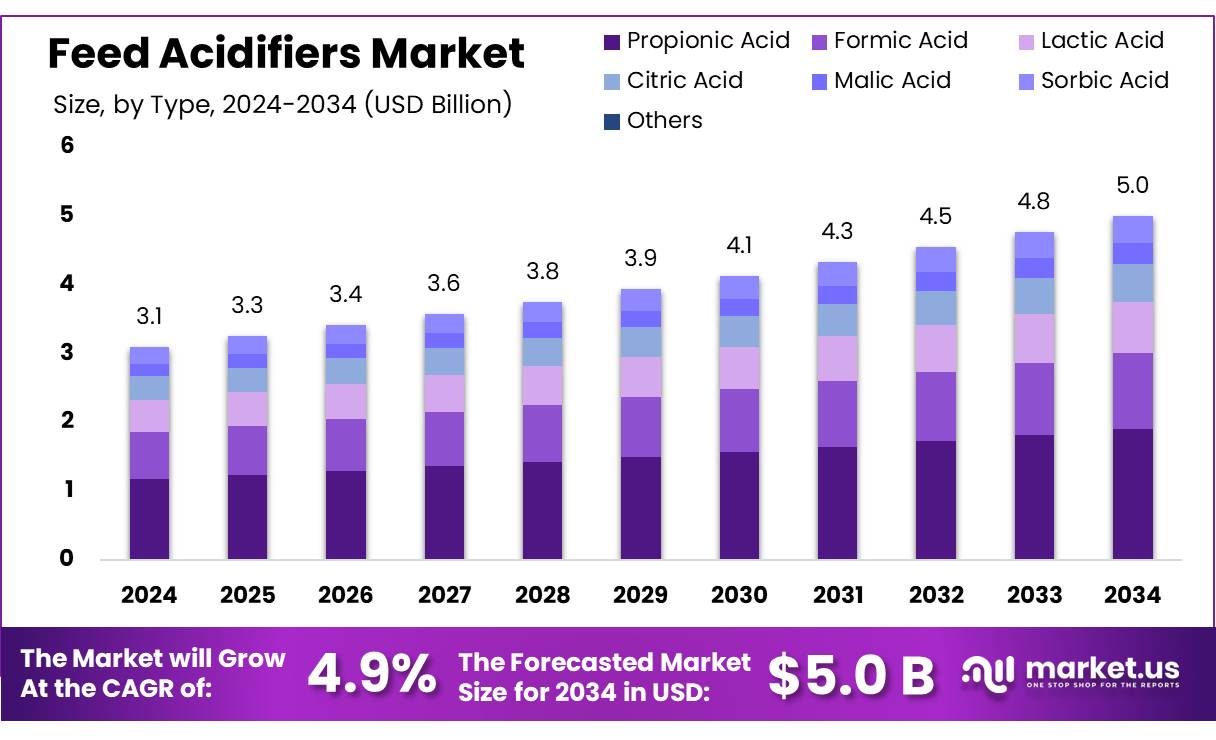

The Global Feed Acidifiers Market size is expected to be worth around USD 5.0 Bn by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The feed acidifiers market, integral to enhancing livestock nutrition and health, is experiencing substantial growth driven by increasing demand for animal protein, regulatory shifts, and a global emphasis on sustainable agriculture. Feed acidifiers, including organic acids like propionic, formic, and lactic acids, are incorporated into animal feed to improve gut health, nutrient absorption, and feed efficiency, while reducing reliance on antibiotic growth promoters.

Animal Husbandry Infrastructure Development Fund (AHIDF), with an allocation of INR 15,000 crore, is one such initiative that aims to enhance private sector investment in animal husbandry infrastructure, including feed plants. Additionally, the government’s focus on boosting agricultural production and ensuring food security has led to increased awareness and adoption of feed additives among farmers.

According to the Food and Agriculture Organization of the United Nations (FAO), global meat production reached approximately 337 million tonnes in 2023, reflecting a steady annual increase driven by rising protein demand. This expansion has fueled the need for efficient and safe feed additives like acidifiers to ensure animal health and productivity.

Governments worldwide have enacted regulatory frameworks to support the adoption of such additives. For instance, the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have issued guidelines encouraging the use of non-antibiotic alternatives in feed, fostering a conducive environment for feed acidifiers growth.

Key drivers of the feed acidifiers concentrates market include the rising global population, which the United Nations estimates will reach 8.5 billion by 2030, amplifying the demand for animal protein. Furthermore, increased consumer awareness about food safety and animal welfare is pushing producers toward antibiotic-free and natural growth promoters, thereby boosting acidifier utilization. Technological advancements in acidifier formulations have enhanced their stability and targeted delivery in feed, improving their efficacy.

Future growth opportunities lie in technological advancements aimed at improving acidifier stability, targeted delivery, and synergistic combinations with probiotics and enzymes. Furthermore, expanding demand from the aquaculture sector, which accounts for approximately 60% of global fish consumption, presents new avenues for feed acidifier concentrate applications. The increasing focus on circular economy principles and environmental sustainability also drives innovation toward bio-based acidifiers derived from renewable resources.

Key Takeaways

- Feed Acidifiers Market size is expected to be worth around USD 5.0 Bn by 2034, from USD 3.1 Billion in 2024, growing at a CAGR of 4.9%.

- Propionic Acid held a dominant market position, capturing more than a 38.9% share of the global feed acidifiers market.

- Dry held a dominant market position, capturing more than a 67.4% share in the global feed acidifiers market.

- Blended held a dominant market position, capturing more than a 69% share in the global feed acidifiers market.

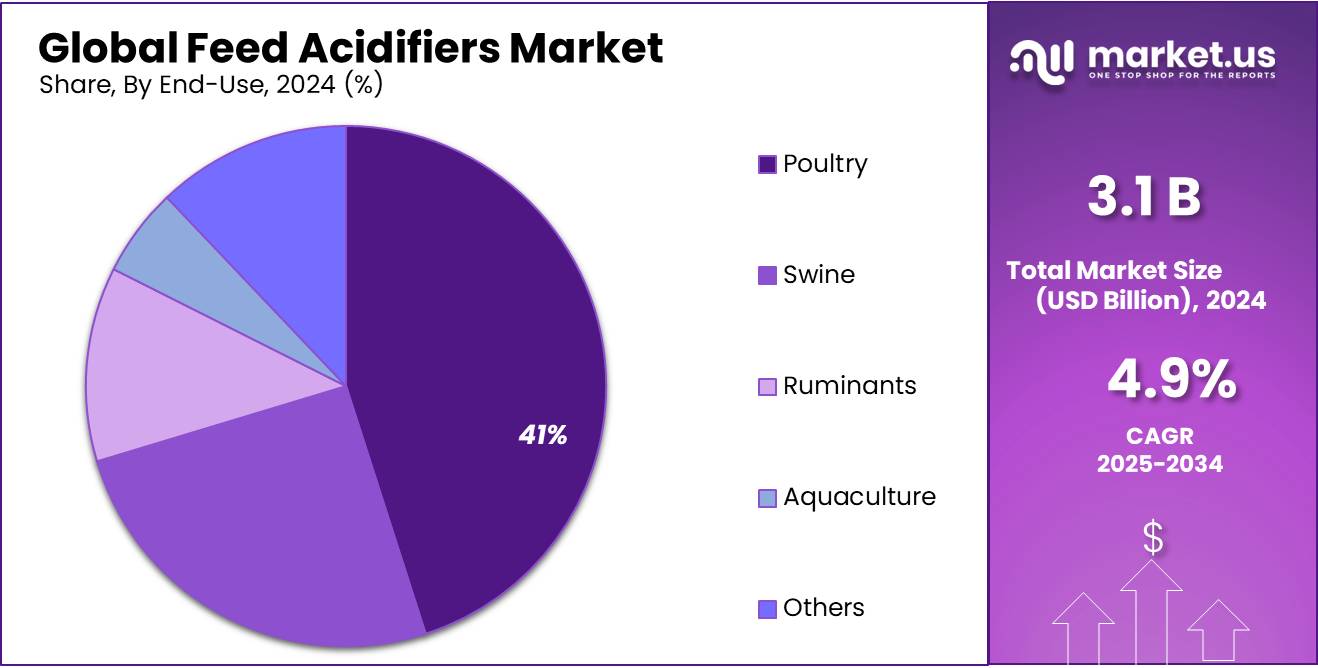

- Poultry held a dominant market position, capturing more than a 41.2% share of the global feed acidifiers market.

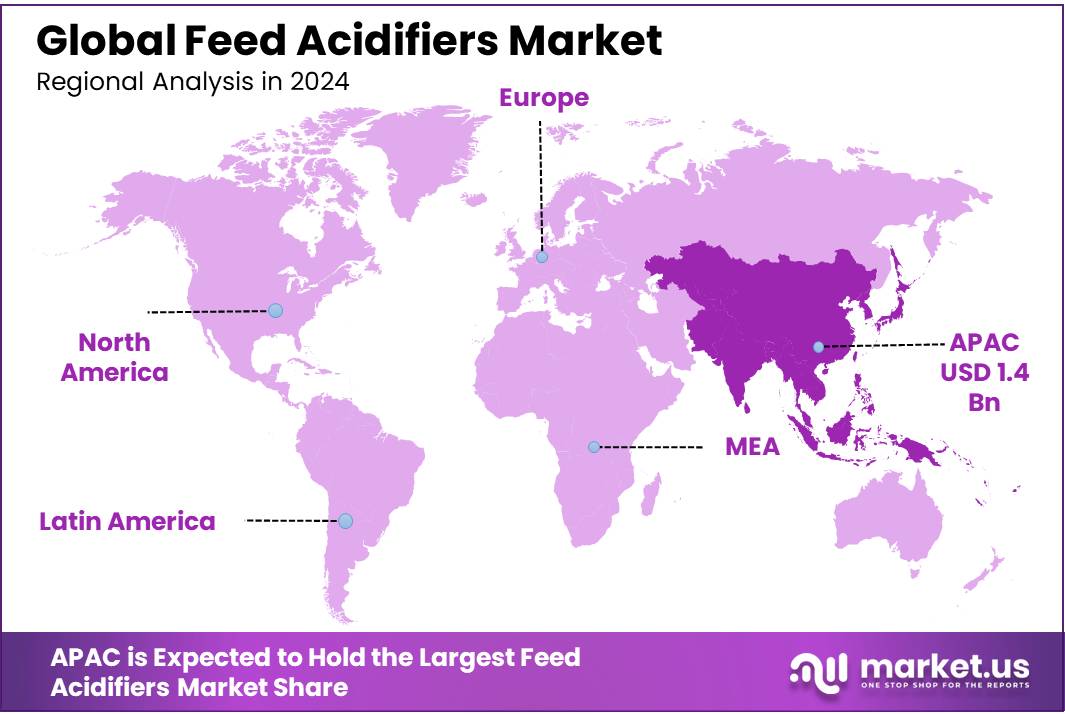

- Asia-Pacific (APAC) region solidified its leadership in the global feed acidifiers market, commanding a substantial 43.1% share, equivalent to approximately USD 6.0 billion.

By Type

Propionic Acid leads with 38.9% share in 2024, driven by its strong preservative and gut health benefits.

In 2024, Propionic Acid held a dominant market position, capturing more than a 38.9% share of the global feed acidifiers market. This stronghold can be attributed to its dual function—acting both as a mold inhibitor in feed storage and as an acidifier that promotes better digestion and gut health in animals. Its widespread use in poultry and swine feed, particularly in regions with warm and humid climates, continues to drive its adoption due to its ability to prevent feed spoilage.

Propionic acid is especially favored in feed mills where maintaining the shelf life of compound feed is critical for reducing operational losses. With growing pressure to reduce antibiotic use in livestock, propionic acid stands out as a reliable and effective alternative. By 2025, its market share is expected to remain stable as demand for efficient and natural feed additives grows in both developed and emerging livestock economies.

By Form

Dry Form dominates with 67.4% share in 2024 due to ease of handling and longer shelf life.

In 2024, Dry held a dominant market position, capturing more than a 67.4% share in the global feed acidifiers market. This dominance is mainly due to its practical benefits such as better stability, ease of storage, and longer shelf life compared to liquid forms. Dry feed acidifiers are easier to mix uniformly into compound feed and premixes, which improves consistency in dosage and effectiveness across large batches.

They are widely preferred in feed manufacturing units where bulk production demands efficiency in formulation and transport. Their solid form also minimizes the risk of spillage and simplifies packaging, which is a key factor for large-scale commercial use. By 2025, the dry segment is expected to retain its lead position, especially in Asia-Pacific and North American feed industries, where large-volume feed production requires reliable and easily manageable solutions.

By Compound

Blended Acidifiers lead with 69% share in 2024 owing to their enhanced effectiveness and balanced formulation.

In 2024, Blended held a dominant market position, capturing more than a 69% share in the global feed acidifiers market. This leadership is driven by the combined benefits offered by multiple acids in a single formulation, which helps in targeting a broader spectrum of gut pathogens while improving feed conversion efficiency. Blended acidifiers typically include a mix of organic acids like propionic, formic, and lactic acids, creating a synergistic effect that enhances gut health, digestion, and growth performance in livestock.

These combinations are especially preferred in poultry and swine feed applications, where performance optimization is critical. Blended forms also allow feed producers to tailor formulations to specific animal needs, making them a flexible and cost-effective solution. By 2025, demand for blended acidifiers is expected to stay strong, supported by ongoing shifts toward antibiotic-free production systems and rising awareness about animal wellness in key livestock-producing regions.

By Livestock

Poultry sector dominates with 41.2% share in 2024 due to rising meat demand and digestive health benefits.

In 2024, Poultry held a dominant market position, capturing more than a 41.2% share of the global feed acidifiers market. This strong performance is closely linked to the growing global demand for poultry meat and eggs, especially in developing countries where poultry is a primary protein source. Feed acidifiers are widely used in poultry diets to improve gut health, enhance nutrient absorption, and reduce the risk of bacterial infections such as Salmonella and E. coli, without relying on antibiotics.

Their role in boosting growth performance while maintaining food safety standards has made them a key additive in poultry production. By 2025, the poultry segment is expected to maintain its lead, supported by expansion in commercial poultry farming and ongoing shifts towards more sustainable and efficient feeding practices across Asia-Pacific, Latin America, and parts of Africa.

Key Market Segments

By Type

- Propionic Acid

- Formic Acid

- Lactic Acid

- Citric Acid

- Malic Acid

- Sorbic Acid

- Others

By Form

- Dry

- Liquid

By Compound

- Blended

- Single

By Livestock

- Poultry

- Swine

- Ruminants

- Aquaculture

- Pets

- Others

Drivers

Rising Global Meat Demand Fuels Growth in Feed Acidifiers Market

The increasing global demand for meat is a significant driver for the feed acidifiers market. As populations grow and incomes rise, especially in developing countries, meat consumption patterns are shifting, leading to higher production levels. According to the Food and Agriculture Organization (FAO), global meat production is forecasted to reach 373 million tonnes in 2024, marking a 1.4% increase from the previous year. This growth is primarily attributed to the rising demand for poultry and bovine meat.

Poultry meat, in particular, is experiencing significant growth due to its affordability and adaptability to various cuisines. The FAO notes that poultry meat has become the most produced meat globally, surpassing pork. This surge in poultry production necessitates efficient feed solutions to ensure animal health and optimize growth, thereby increasing the demand for feed acidifiers.

Feed acidifiers play a crucial role in enhancing animal digestion and nutrient absorption, leading to improved feed efficiency and growth performance. They also help in maintaining gut health and reducing the incidence of diseases, which is vital in intensive farming systems where animals are raised in confined spaces. With the global shift towards reducing antibiotic use in animal agriculture, feed acidifiers offer a natural alternative to promote animal health and performance.

Moreover, government initiatives and regulations aimed at ensuring food safety and sustainable livestock production are further propelling the adoption of feed acidifiers. For instance, the European Union’s ban on antibiotic growth promoters has led to increased reliance on alternative feed additives like acidifiers. Similarly, in the United States, regulatory frameworks encourage the use of safe and effective feed additives to promote animal health and food safety.

Restraints

High Cost of Feed Acidifiers Limits Adoption Among Small and Medium Livestock Producers

The adoption of feed acidifiers in livestock nutrition faces a significant hurdle due to their high cost, particularly impacting small and medium-scale farmers. These acidifiers, while beneficial for animal health and growth, are often priced higher than traditional feed additives like antibiotics. This price disparity makes it challenging for smaller producers to incorporate them into their feeding regimes.

The cost of feed acidifiers is further exacerbated by the rising prices of raw materials used in their production. Natural sources such as seeds, plant leaves, and tree bark, from which vitamins, minerals, antioxidants, and feed acids are extracted, have seen increased initial costs for extraction. This rise in raw material prices hampers the growth of the market.

Moreover, feed constitutes a significant portion of the total cost of livestock production. The Food and Agriculture Organization (FAO) notes that feed cost can form up to 70% of the total cost of production in animal farming. Therefore, any increase in feed additive costs directly impacts the overall profitability of livestock operations.

Opportunity

Expanding Livestock Sector in India Presents Growth Opportunities for Feed Acidifiers Market

India’s livestock sector has witnessed significant growth, creating substantial opportunities for the feed acidifiers market. According to the 20th Livestock Census conducted by the Department of Animal Husbandry and Dairying, the total livestock population in India reached 535.78 million, marking a 4.6% increase over the previous census in 2012. This growth underscores the expanding scale of animal husbandry in the country.

The surge in livestock numbers is accompanied by increased demand for efficient and sustainable animal nutrition solutions. Feed acidifiers, known for enhancing gut health and nutrient absorption, are poised to meet this demand. Their role in improving feed efficiency and animal productivity makes them valuable additives in livestock diets.

Government initiatives further bolster this growth trajectory. Programs like the National Livestock Mission aim to develop the livestock sector through feed and fodder development, livestock development, and skill enhancement. Such initiatives create a conducive environment for the adoption of advanced feed additives, including acidifiers.

Moreover, India’s position as the world’s largest milk producer, contributing 22% of global production, highlights the importance of dairy farming in the country’s agricultural landscape. The emphasis on improving milk yield and quality aligns with the benefits offered by feed acidifiers, which can enhance digestive efficiency and overall animal health.

Trends

Growing Demand for Natural and Organic Feed Acidifiers

A significant trend in the feed acidifiers market is the increasing preference for natural and organic acidifiers. This shift is driven by consumer demand for sustainable and antibiotic-free animal products. Natural acidifiers, derived from sources like plant extracts and organic acids, are gaining popularity due to their perceived safety and environmental benefits.

The European Union’s ban on antibiotic growth promoters has accelerated the adoption of natural alternatives, including organic acidifiers. This regulatory change has prompted feed manufacturers to reformulate products, emphasizing natural ingredients to meet both legal requirements and consumer expectations.

In addition to regulatory influences, the market is witnessing technological advancements such as microencapsulation. This technology enhances the stability and efficacy of acidifiers, allowing for targeted delivery within the animal’s digestive system. Such innovations improve the performance of natural acidifiers, making them more competitive with synthetic counterparts.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region solidified its leadership in the global feed acidifiers market, commanding a substantial 43.1% share, equivalent to approximately USD 6.0 billion. This dominance is propelled by the region’s expansive livestock industry, particularly in countries like China and India, where the demand for animal protein continues to rise.

The market’s growth trajectory is further supported by the increasing adoption of sustainable farming practices and the shift towards antibiotic-free animal nutrition. Feed acidifiers, known for enhancing gut health and nutrient absorption, are becoming integral in modern livestock diets. In India, government initiatives promoting scientific animal husbandry and improved feed quality standards have bolstered the use of such additives. The implementation of the Animal Husbandry Infrastructure Development Fund has particularly facilitated the modernization of feed manufacturing facilities.

Technological advancements, such as microencapsulation, are enhancing the efficacy of feed acidifiers, ensuring targeted delivery and improved stability. This innovation is crucial in meeting the specific nutritional needs of various livestock species. Moreover, the region’s focus on aquaculture, especially in countries like Vietnam and Indonesia, is contributing to the market’s expansion. The increasing awareness of the benefits of feed acidifiers in improving aquatic species’ health and productivity is driving their adoption in aquafeeds.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE plays a key role in the feed acidifiers market through its diverse range of organic acid solutions aimed at improving animal gut health and feed hygiene. The company focuses on propionic and formic acid-based additives, especially in poultry and swine sectors. BASF leverages strong R&D capabilities and a global supply chain to expand its presence, particularly in Asia and Europe. Its solutions align with antibiotic-free farming trends, supporting sustainable livestock production through advanced nutritional technologies.

Yara International ASA is a significant player in feed acidifiers, particularly known for its organic acid-based solutions that support gut health and improve feed conversion efficiency. The company integrates sustainable agriculture principles into its product offerings and emphasizes the use of feed acidifiers in antibiotic-reduction programs. Yara’s presence is notable across Europe, with growing interest in Asia-Pacific. Its strategic focus includes partnerships and innovations that improve livestock productivity and enhance animal welfare across commercial farming operations.

Kemin Industries, Inc. actively contributes to the global feed acidifiers market with its patented blends of organic acids and encapsulated technologies. These acidifiers are developed to improve nutrient absorption and maintain pH balance in livestock. Kemin serves poultry, swine, and aquaculture sectors, offering tailored solutions for each species. The company emphasizes research-based innovation, backed by strong manufacturing and distribution networks, especially across North America, Europe, and Asia, supporting global demand for sustainable, antibiotic-free feed systems.

Top Key Players in the Market

- BASF SE

- Yara International ASA

- Kemin Industries, Inc.

- Biomin Holding GmbH

- Kemira Oyj

- Perstorp Holding AB

- Novus International, Inc.

- Corbion NV

- Impextraco NV

- Addcon Group GmbH

- Anpario PLC

- Peterlabs Holdings Berhad

- Jefo Nutrition, Inc.

- Pancosma SA

- Nutrex NV

Recent Developments

In 2024, Kemira Oyj reported a revenue of EUR 2,948.1 million, reflecting a 13% decrease from the previous year, primarily due to the divestment of its Oil & Gas segment. Despite this, the company’s Industry & Water segment, which includes feed acidifiers, demonstrated resilience with a slight increase in sales volumes. Kemira’s operative EBITDA stood at EUR 585.4 million, with an operative EBITDA margin of 19.9%, indicating stable profitability.

In 2024, Kemin Industries, Inc. reinforced its position in the feed acidifiers market with the launch of FORMYL™, an innovative acidifier targeting swine health. This product combines encapsulated calcium formate and citric acid, effectively reducing harmful bacteria like E.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 5.0 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Malic Acid, Sorbic Acid, Others), By Form (Dry, Liquid), By Compound (Blended, Single), By Livestock (Poultry, Swine, Ruminants, Aquaculture, Pets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Yara International ASA, Kemin Industries, Inc., Biomin Holding GmbH, Kemira Oyj, Perstorp Holding AB, Novus International, Inc., Corbion NV, Impextraco NV, Addcon Group GmbH, Anpario PLC, Peterlabs Holdings Berhad, Jefo Nutrition, Inc., Pancosma SA, Nutrex NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Yara International ASA

- Kemin Industries, Inc.

- Biomin Holding GmbH

- Kemira Oyj

- Perstorp Holding AB

- Novus International, Inc.

- Corbion NV

- Impextraco NV

- Addcon Group GmbH

- Anpario PLC

- Peterlabs Holdings Berhad

- Jefo Nutrition, Inc.

- Pancosma SA

- Nutrex NV