Global Fats And Oil Market Size, Share, And Enhanced Productivity By Type (Vegetable Oils (Sunflower, Palm, Soybean, Canola/Rapeseed, Coconut, Others), Fats (Butter, Tallow, Lard, Fish Oil, Others)), By Source (Plant-based, Animal-based), By Form (Solid, Liquid), By Distribution Channel (B2B, B2C), By End-Use (Food (Food and Beverage Processing, Foodservice / Culinary), Non-Food (Nutraceuticals and Supplements, Cosmetics and Personal Care, Biofuels, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175282

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

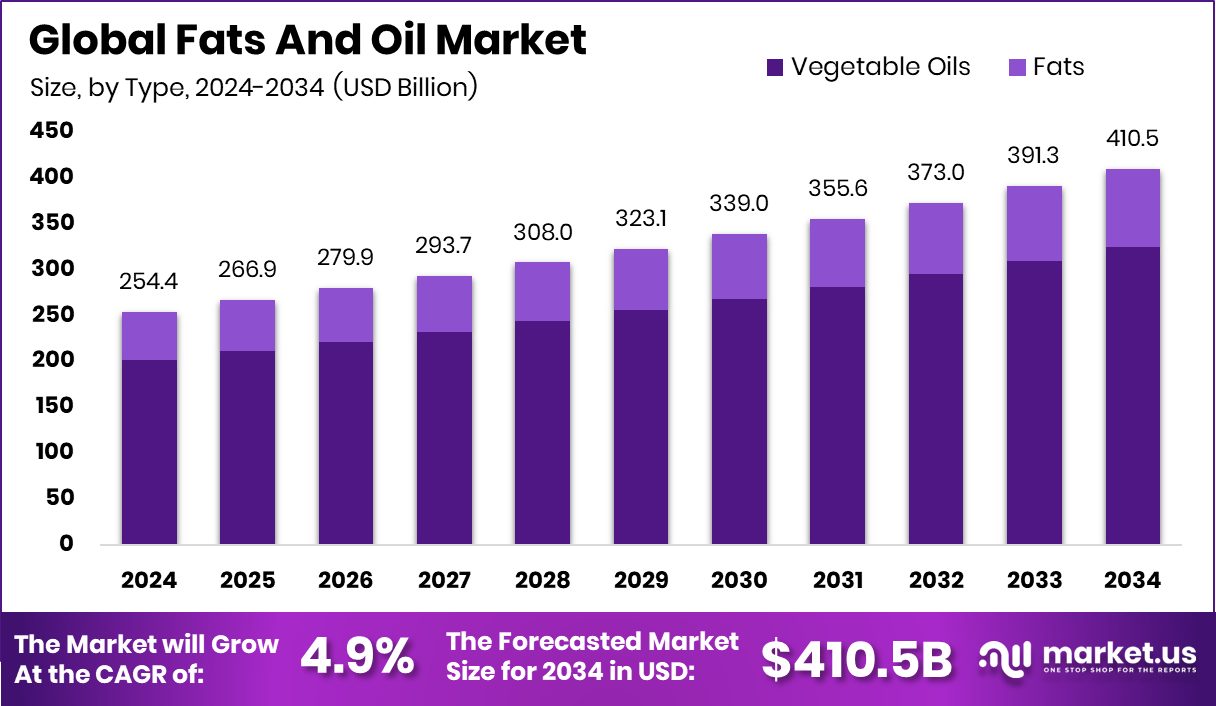

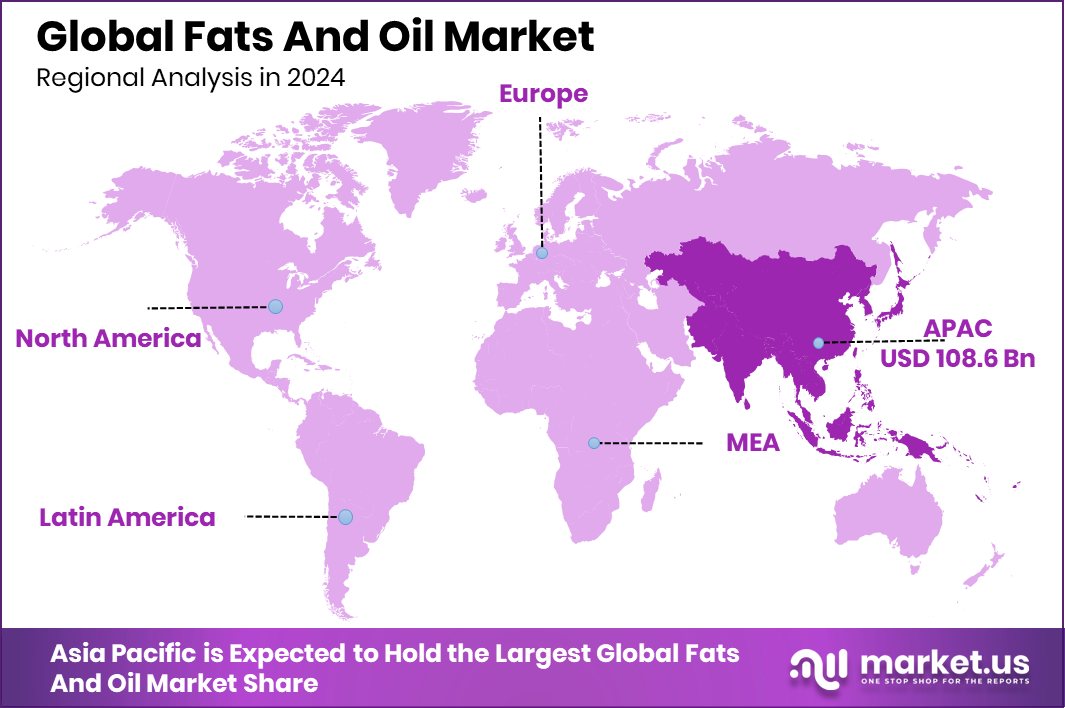

The Global Fats And Oil Market is expected to be worth around USD 410.5 billion by 2034, up from USD 254.4 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. The Fats and Oils Market in the Asia Pacific achieved a 42.70% share, worth USD 108.6 Bn.

Fats and oils are essential lipid substances derived from plants and animals, widely used for cooking, food manufacturing, personal care, pharmaceuticals, and industrial applications. They provide energy, support nutrient absorption, and serve as key functional ingredients in countless everyday products. In the context of modern industries, fats and oils include vegetable oils such as sunflower, palm, soybean, canola, and coconut, along with animal-based fats like butter, tallow, lard, and fish oil.

The Fats and Oil Market refers to the global system of producing, processing, and distributing these oils and fats across food, non-food, and specialty sectors. This market covers plant-based and animal-based sources, solid and liquid forms, B2B and B2C channels, and diverse end uses such as food processing, culinary applications, supplements, cosmetics, and biofuels.

Growth in this market is supported by rising interest in healthier, more functional fat alternatives. Innovations in fermented, precision-grown, and lab-developed lipids are gaining traction, highlighted by developments such as Melt&Marble securing €7 million to scale lab-grown skincare fats and Perfat Technologies raising €2.5 million for advanced food fat solutions.

Demand continues to expand as consumers seek better nutritional profiles and sustainable ingredients. Companies investing in eco-friendly lipid production, such as Germany’s Insempra with its $20 million Series A, demonstrate this momentum.

Opportunities are widening in sustainable and clean-label oils, supported by new technologies like those being advanced by Clean Food Group, which obtained £2.3 million to accelerate commercializing its next-generation fats and oils platform.

Key Takeaways

- The Global Fats And Oil Market is expected to be worth around USD 410.5 billion by 2034, up from USD 254.4 billion in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- Vegetable oils dominate the fats and oil market, capturing 79.2% due to strong global demand.

- Plant-based sources lead with 83.4% share, driven by rising health awareness and dietary preferences.

- Liquid forms account for 78.3% of market consumption, reflecting convenience and versatile usage trends.

- B2B distribution holds 67.1%, supported by large-scale food processors and industrial manufacturers worldwide.

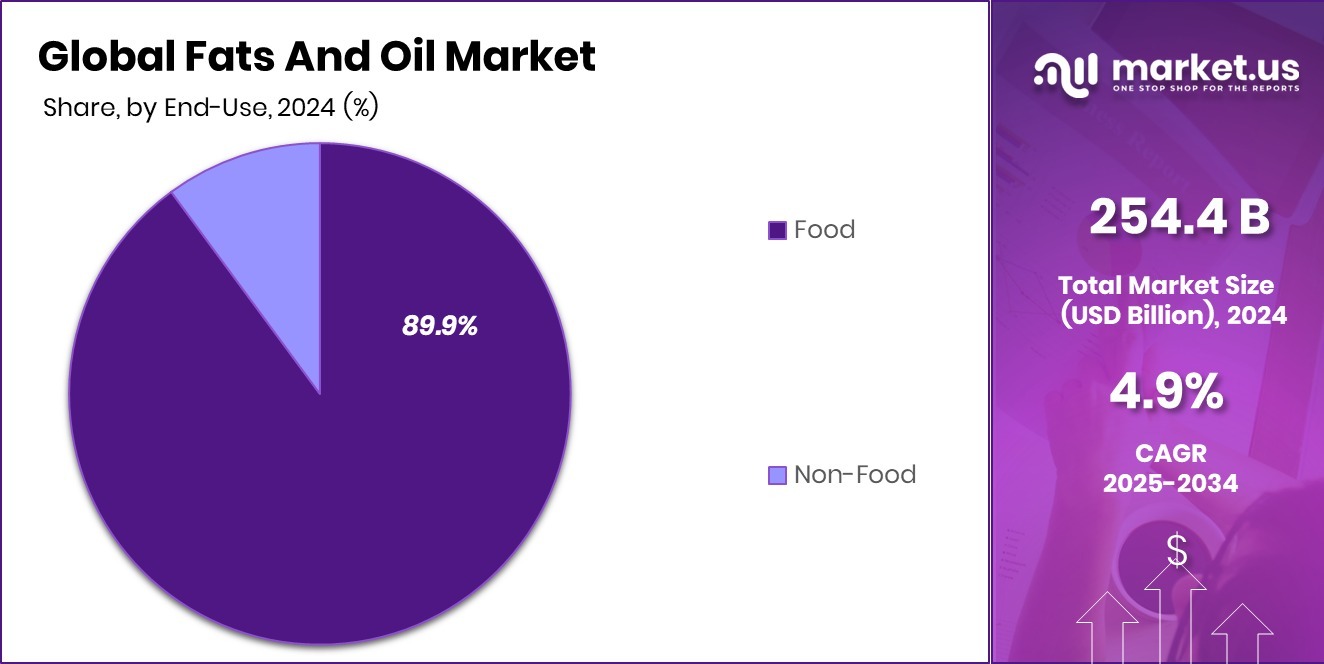

- Food end-use segment commands 89.9%, making it the primary consumer of fats and oils globally.

- In the Asia Pacific, the market reached USD 108.6 Bn with a 42.70% share.

By Type Analysis

Vegetable oils dominate the fats and oil market with 79.2% share.

In 2024, the Fats and Oils Market was strongly driven by the dominance of vegetable oils, which accounted for 79.2% of the total market share. This leadership reflects rising consumer preference for healthier, plant-derived oil options such as sunflower, soybean, palm, and canola oils. Growing awareness about unsaturated fats, expanding vegan lifestyles, and increased use of vegetable oils in packaged foods, bakery items, and ready-to-eat meals supported this segment’s growth.

Food manufacturers also shifted heavily toward oils with better oxidative stability to meet clean-label and non-GMO trends. Additionally, high global production volumes and cost efficiency strengthened vegetable oils’ position, making them the most widely used category across household cooking, commercial foodservice, and industrial applications.

By Source Analysis

Plant-based sources lead the fats and oil market, holding 83.4% share.

In 2024, plant-based sources dominated the Fats and Oils Market with a remarkable 83.4% share, driven by global shifts toward sustainable and healthier dietary patterns. Consumers increasingly chose plant-derived oils over animal fats, supported by nutritional advantages such as lower saturated fat content and higher omega-3 and omega-6 availability. Rising flexitarian and vegetarian lifestyles further accelerated demand.

Major food processors and cosmetic manufacturers also preferred plant-based fats due to cleaner sourcing, regulatory acceptance, and greater supply-chain stability. International food companies expanded their product portfolios using palm, coconut, soy, and olive oils to meet market demand. The higher versatility of plant oils across bakery, confectionery, personal care, and biodiesel applications reinforced this segment’s dominance.

By Form Analysis

Liquid form strongly dominates the fats and oils market with 78.3% share.

In 2024, the liquid form segment captured 78.3% of the total Fats and Oils Market, reflecting the widespread use of liquid oils in cooking, frying, salad dressings, and food processing. Liquid oils such as sunflower, soybean, and olive oil remained preferred due to their ease of handling, storage convenience, and compatibility with high-volume industrial operations.

Manufacturers prioritized liquid oils as they align with formulation needs for snacks, ready meals, bakery shortenings, and emulsifiers. These oils also gained traction in nutraceutical and pharmaceutical products due to their better absorption and functional properties. With rising urbanization and fast-paced lifestyles, bottled and packaged liquid oils experienced strong retail demand, reinforcing their leading market position globally.

By Distribution Channel Analysis

B2B channels account for 67.1% share in the fats and oil market.

In 2024, the B2B distribution channel held a substantial 67.1% share of the Fats and Oils Market, supported by strong procurement from food processors, bakeries, confectionery manufacturers, restaurants, and industrial buyers. Bulk purchasing of soybean oil, palm oil, and other specialty oils increased as companies expanded production capacities to meet rising packaged food and convenience product demands.

The rapid growth of the HoReCa sector also contributed to higher consumption of frying and cooking oils. Manufacturers relied on long-term supply contracts with distributors to ensure stable pricing and availability amid fluctuating global oilseed production. The B2B segment remained essential for maintaining large-scale production efficiency and consistent quality in food and non-food applications.

By End-Use Analysis

Food end-use leads the fats and oil market with 89.9% share.

In 2024, the food segment emerged as the largest end-use category in the Fats and Oils Market, accounting for an impressive 89.9% share. This dominance is attributed to the extensive utilization of fats and oils in bakery products, confectionery, snacks, frying applications, cooking oils, and packaged food items. Rising global consumption of ready-to-eat meals, frozen foods, and fast food significantly fueled demand.

Vegetable oils served as essential ingredients for texture, flavor enhancement, and shelf-life improvement. The expanding retail sector and increasing household use in emerging economies further strengthened this segment. As consumers sought healthier alternatives, demand for low-trans-fat and fortified oils increased, shaping reformulation strategies across leading food manufacturers.

Key Market Segments

By Type

- Vegetable Oils

- Sunflower

- Palm

- Soybean

- Canola/Rapeseed

- Coconut

- Others

- Fats

- Butter

- Tallow

- Lard

- Fish Oil

- Others

By Source

- Plant-based

- Animal-based

By Form

- Solid

- Liquid

By Distribution Channel

- B2B

- B2C

By End-Use

- Food

- Food and Beverage Processing

- Foodservice / Culinary

- Non-Food

- Nutraceuticals and Supplements

- Cosmetics and Personal Care

- Biofuels

- Others

Driving Factors

Rising demand for plant-based oils

The Fats and Oil Market continues to grow as consumer interest in plant-based oils accelerates, supported by innovation from emerging companies. French startup The VERY Food Co is completing an €850,000 funding round, and Mokableis is securing ¥150 million in seed funding reflect the rising investment momentum behind healthier, plant-derived fat alternatives. These developments signal strong confidence in plant-focused formulations and reinforce market demand for oils sourced from plants rather than conventional animal-based fats.

Restraining Factors

Price volatility of oilseeds globally

Despite rising demand, the Fats and Oil Market faces challenges due to unpredictable oilseed price fluctuations, impacting production costs and supply stability. The situation is highlighted by Colipi raising EUR 1.8 million in seed funding to explore more stable, microbial-based fat production pathways, showing how price instability drives interest in alternative fat sources. Such volatility continues to restrict consistent growth, especially for manufacturers dependent on large-scale oilseed imports.

Growth Opportunity

Expansion in biofuel-focused oil processing

Opportunities are expanding in biofuel-oriented oil processing as industries seek renewable feedstocks to support cleaner energy solutions. Innovative players like Time-Travelling Milkman, advancing dairy fat alternatives with $2.3 million funding, and Plonts, launching plant-based cheese after securing $12 million in seed funding, show growing interest in multipurpose lipid technologies. These innovations can also be leveraged for next-generation biofuel applications, supporting broader sustainability goals.

Latest Trends

Precision-fermented fats are gaining strong attention

A major trend shaping the Fats and Oil Market is the rising appeal of precision-fermented fats, driven by the search for sustainable, functional, and customizable lipid ingredients. Kapiva’s ₹50 crore innovation fund, aimed at building future-ready wellness solutions, underscores the growing industry shift toward scientifically advanced fat alternatives. This trend reflects a broader move toward evidence-backed, technology-driven fat production methods gaining significant market traction.

Regional Analysis

Asia Pacific holds a 42.70% share, valuing the Fats and Oils Market at USD 108.6 Bn.

In the Fats and Oils Market, Asia Pacific emerged as the leading region, capturing a dominant 42.70% share, valued at USD 108.6 billion, supported by large-scale consumption across food processing, household cooking, and regional manufacturing activities. This strong position reflects high population density, expanding packaged food demand, and the region’s significant vegetable oil production base.

North America maintained steady growth, driven by rising utilization of edible oils in processed food categories and increased adoption of healthier oil variants across households and foodservice channels. Europe continued to show maturity in consumption patterns, supported by stable demand for olive, sunflower, and rapeseed oils across retail and industrial uses.

The Middle East & Africa region recorded growing reliance on imported edible oils, supported by expanding bakery and confectionery sectors. Latin America remained an emerging but essential contributor, benefiting from soybean and palm-oil-linked activities that support both domestic consumption and export flows.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Wilmar International strengthened its position through large-scale integrated operations spanning oilseed crushing, refining, and consumer-packaged oils. Its diversified product capabilities and strong presence across Asian markets allowed it to efficiently cater to rising demand for edible oils, specialty fats, and value-added formulations.

Cargill, Incorporated maintained a significant foothold by leveraging its extensive global supply chain and expertise in processing, sourcing, and distributing various fat and oil ingredients required across food manufacturing and industrial applications. In 2024, the company continued focusing on efficiency, operational reliability, and enhancing quality standards to support food processors seeking a consistent supply.

Archer-Daniels-Midland (ADM) further contributed to market momentum through its broad oilseed processing network and established portfolio of refined oils, oleochemicals, and functional fat products. ADM’s integrated approach, from raw material handling to finished oil solutions, positioned it as a critical supplier to both retail and industrial channels.

Top Key Players in the Market

- Wilmar International Limited

- Cargill, Incorporated

- Archer-Daniels-Midland (ADM)

- AAK AB

- Bunge Limited

- Musim Mas Group

- IOI Corporation Berhad

- Fuji Oil Holdings Inc.

- IFFCO Group

- Associated British Foods PLC (ABF)

Recent Developments

- In July 2025, Bunge Limited completed its merger with Viterra Limited, creating a larger global agribusiness company that strengthens its position in food, feed, and oilseed processing for fats and oils. This combination brings together complementary assets and broader crop handling capabilities to link farmers with food and industrial customers more effectively.

- In July 2024, AAK USA received GRAS approval from the U.S. FDA for shea stearin, meaning this versatile fat is now officially recognized as safe for use in food products like bakery items, spreads, and plant-based foods. This approval opens new opportunities for food manufacturers using shea stearin as a plant-based fat source.

Report Scope

Report Features Description Market Value (2024) USD 254.4 Billion Forecast Revenue (2034) USD 410.5 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vegetable Oils (Sunflower, Palm, Soybean, Canola/Rapeseed, Coconut, Others), Fats (Butter, Tallow, Lard, Fish Oil, Others)), By Source (Plant-based, Animal-based), By Form (Solid, Liquid), By Distribution Channel (B2B, B2C), By End-Use (Food (Food and Beverage Processing, Foodservice / Culinary), Non-Food (Nutraceuticals and Supplements, Cosmetics and Personal Care, Biofuels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Wilmar International Limited, Cargill, Incorporated, Archer-Daniels-Midland (ADM), AAK AB, Bunge Limited, Musim Mas Group, IOI Corporation Berhad, Fuji Oil Holdings Inc., IFFCO Group, Associated British Foods PLC (ABF) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wilmar International Limited

- Cargill, Incorporated

- Archer-Daniels-Midland (ADM)

- AAK AB

- Bunge Limited

- Musim Mas Group

- IOI Corporation Berhad

- Fuji Oil Holdings Inc.

- IFFCO Group

- Associated British Foods PLC (ABF)