Global Ezekiel Bread Market Size, Share, And Industry Analysis Report By Source (Sprouted Wheat, Sprouted Barley, Malted Barley, Sprouted Millet, Sprouted Spelt, Sprouted Lentils, Sprouted Soybeans, Others), By Nature (Organic, Conventional), By Sales Channel (Supermarkets and Hypermarkets, Departmental Stores, Convenience Outlets, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172079

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

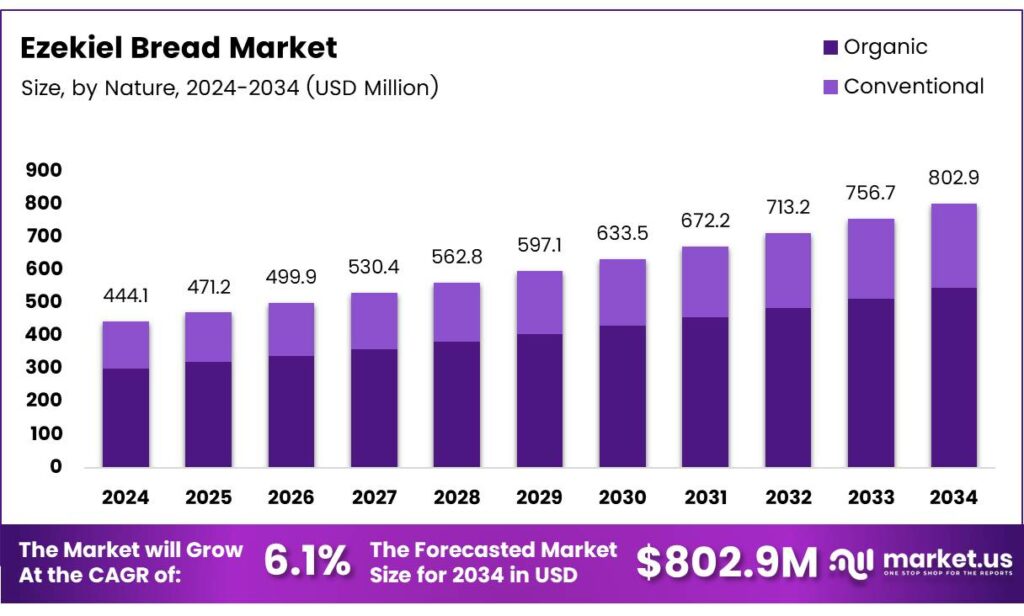

The Global Ezekiel Bread Market size is expected to be worth around USD 802.9 million by 2034, from USD 444.1 million in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Ezekiel Bread Market represents a specialized segment within the functional and whole-grain bakery category. Essentially, Ezekiel bread is produced using sprouted grains and legumes, enhancing nutrient absorption. As consumers increasingly value clean-label foods, demand steadily shifts toward sprouted grain bread with perceived health benefits.

Consequently, market growth is driven by rising awareness of digestive health, plant-based protein intake, and minimally processed foods. Ezekiel bread aligns with preventive nutrition trends, especially among urban consumers. Retailers and foodservice operators increasingly stock premium sprouted bread to improve margins and attract health-conscious buyers seeking functional bakery products.

- Ezekiel bread’s nutritional profile strengthens its positioning in the healthy bread segment, as Food for Life states that one slice delivers 80 calories, 0.5 grams of fat, and 15 grams of carbohydrates, supporting balanced energy intake. The same label highlights 3 grams of dietary fiber and 5 grams of protein per slice, improving satiety and muscle support. The bread provides key micronutrients, including niacin, zinc, selenium, and manganese, reinforcing its value as a nutrient-dense functional bread option.

Meanwhile, opportunity expansion is supported by evolving consumer purchasing behavior and digital grocery platforms. Online food retail enables better education around sprouted grain benefits, improving conversion rates. Additionally, subscription-based food models encourage repeat purchases, strengthening long-term demand for Ezekiel bread across wellness-focused households and specialty nutrition segments.

Key Takeaways

- The Global Ezekiel Bread Market is projected to grow from USD 444.1 million in 2024 to USD 802.9 million by 2034, registering a 6.1% CAGR during 2025–2034.

- Sprouted Wheat dominates the market with a 38.6% share in 2024, driven by strong consumer acceptance and nutritional benefits.

- The Organic Segment leads with a 67.3% market share in 2024, reflecting rising clean-label and chemical-free food preferences.

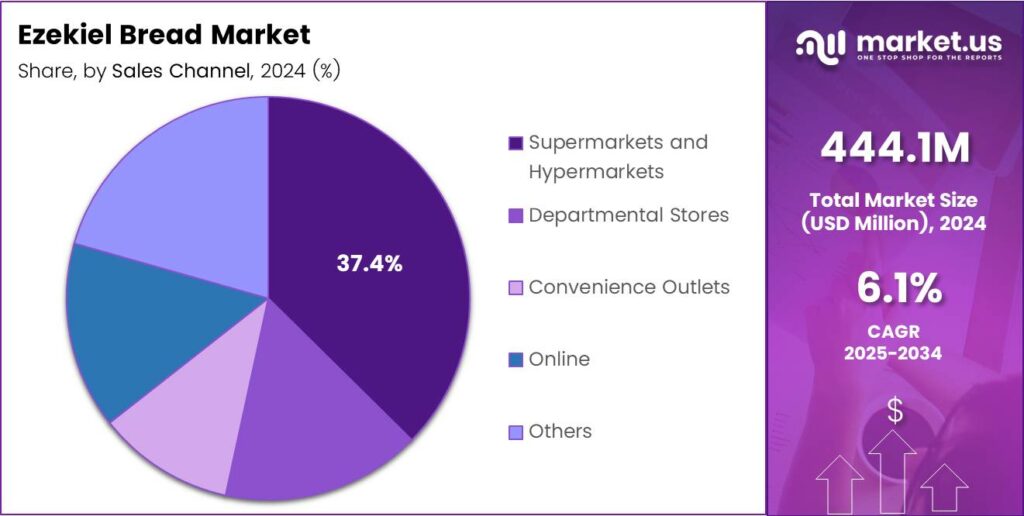

- Supermarkets and Hypermarkets hold the largest share at 37.4% in 2024, supported by wide product visibility and organized retail reach.

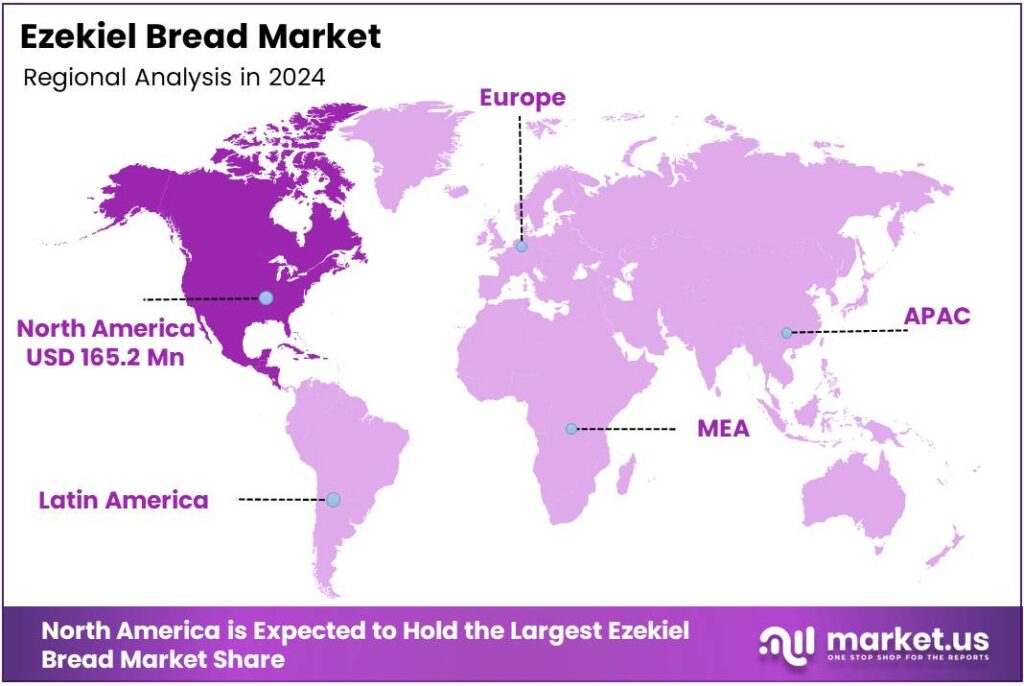

- North America dominates the Ezekiel Bread Market with a 37.2% share, valued at USD 165.2 million in 2024.

By Source Analysis

Sprouted Wheat dominates with 38.6% due to its strong nutritional image and wide consumer acceptance.

In 2024, Sprouted Wheat held a dominant market position in the By Source Analysis segment of the Ezekiel Bread Market, with a 38.6% share. It leads because it offers high fiber, protein balance, and a familiar taste. As a result, consumers consistently prefer it for daily healthy bread consumption.

Sprouted Barley follows steadily as it supports digestion and heart health. It is often chosen by health-focused buyers seeking grain diversity. Moreover, its mild flavor allows easy blending with other grains, helping manufacturers expand multigrain Ezekiel bread offerings.

Malted Barley plays a supportive role by enhancing texture and natural sweetness. It improves fermentation quality and shelf appeal. Consequently, bakeries use it to differentiate products while maintaining traditional sprouted grain positioning within the Ezekiel bread category.

Sprouted Millet, Sprouted Spelt, Sprouted Lentils, Sprouted Soybeans, and Others cater to niche dietary needs. These sources attract consumers seeking gluten alternatives or plant protein variety. Gradually, they support innovation and premium positioning across specialized Ezekiel bread product lines.

By Nature Analysis

Organic dominates with 67.3% due to rising clean-label awareness and trust in natural food choices.

In 2024, Organic held a dominant market position in the By Nature Analysis segment of the Ezekiel Bread Market, with a 67.3% share. This dominance reflects strong demand for chemical-free grains. Consumers increasingly associate organic Ezekiel bread with safety, purity, and long-term wellness benefits.

Organic Ezekiel bread also benefits from strict certification standards. These standards build consumer confidence and support premium pricing. Additionally, health-conscious households actively seek organic labels, making this segment the primary revenue generator for established and emerging brands.

Conventional Ezekiel bread remains relevant due to affordability and wider availability. It appeals to price-sensitive consumers who still value sprouted grain benefits. Therefore, this segment supports volume sales while helping brands reach broader demographic groups.

By Sales Channel Analysis

Supermarkets and Hypermarkets dominate with 37.4% due to strong visibility and organized retail reach.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Sales Channel Analysis segment of the Ezekiel Bread Market, with a 37.4% share. These outlets offer a wide product variety, clear labeling, and frequent promotions, encouraging impulse and repeat purchases.

Departmental Stores contribute through curated health food sections. They attract urban consumers looking for trusted brands in a comfortable shopping environment. As a result, they support steady sales of premium and specialty Ezekiel bread variants.

Convenience Outlets serve quick-purchase needs. Although limited in assortment, they provide easy access for working consumers. Consequently, they help increase consumption frequency, especially in densely populated residential and commercial areas.

Online and Other channels are growing through home delivery and subscription models. They appeal to digitally active buyers seeking convenience. Gradually, these channels strengthen brand-consumer engagement and support long-term market expansion.

Key Market Segments

By Source

- Sprouted Wheat

- Sprouted Barley

- Malted Barley

- Sprouted Millet

- Sprouted Spelt

- Sprouted Lentils

- Sprouted Soybeans

- Others

By Nature

- Organic

- Conventional

By Sales Channel

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Outlets

- Online

- Others

Emerging Trends

Growing Popularity of Clean-Label and Sprouted Foods Shapes Market Trends

One key trending factor is the growing demand for clean-label food products. Consumers prefer bread made with simple, recognizable ingredients. Ezekiel bread aligns well with this trend due to its natural formulation. Sprouted food consumption is gaining popularity among fitness-focused individuals.

- Sprouted grains are perceived as easier to digest and more nutritious, supporting steady demand growth. Typical grain consumption patterns show that Americans are not yet meeting these goals, with whole grains making up only around 15.8% of total grain intake among adults.

Social media also influences trends. Health influencers and diet communities often highlight Ezekiel bread in meal plans, increasing product visibility and trial rates. Sustainability awareness is another trend shaping the market. Consumers value brands that use responsible sourcing and minimal processing. Ezekiel bread producers focusing on transparency and ethical practices gain a competitive advantage.

Drivers

Rising Consumer Focus on Whole Grain and Natural Nutrition Drives Market Growth

The Ezekiel bread market is mainly driven by growing awareness about healthy eating habits. Consumers are actively choosing whole-grain and sprouted foods that offer better digestion and balanced nutrition. Ezekiel bread fits this need as it is made from sprouted grains and legumes, making it attractive to health-conscious buyers.

- The increasing interest in plant-based and clean-label foods. Ezekiel bread contains simple ingredients without artificial additives, which builds trust among consumers. More than 80% of people in some food health surveys view whole grains as healthy, a number that outpaces many other nutrients and food categories.

People who read labels carefully are more likely to prefer such products for daily consumption. Urban lifestyles also support market growth. Busy consumers want ready-to-eat food that is healthy and filling. Ezekiel bread offers convenience along with nutrition, making it suitable for breakfast and snacks.

Restraints

Higher Product Cost Compared to Regular Bread Limits Market Expansion

One major restraint in the Ezekiel bread market is its higher price. Compared to conventional white or wheat bread, Ezekiel bread costs more due to its sprouting process and quality ingredients. This limits adoption among price-sensitive consumers. Limited availability is another challenge.

Ezekiel bread is mainly sold in specialty stores or selected supermarkets. In many regions, especially smaller cities, access remains low, restricting market reach. Taste and texture also act as barriers for some consumers. Ezekiel bread has a dense texture and earthy flavor, which may not appeal to those used to soft, refined bread.

Shorter shelf life further affects distribution. Since it contains fewer preservatives, storage and transportation become challenging. Recommendations from nutritionists and fitness experts help boost demand. The bread’s high fiber and protein content align well with weight management and wellness goals. This steady shift toward preventive health supports long-term market expansion.

Growth Factors

Higher Product Cost Compared to Regular Bread Limits Market Expansion

One major restraint in the Ezekiel bread market is its higher price. Compared to conventional white or wheat bread, Ezekiel bread costs more due to its sprouting process and quality ingredients. This limits adoption among price-sensitive consumers. Limited availability is another challenge.

Ezekiel bread is mainly sold in specialty stores or selected supermarkets. In many regions, especially smaller cities, access remains low, restricting market reach. Taste and texture also act as barriers for some consumers. Ezekiel bread has a dense texture and earthy flavor, which may not appeal to those used to soft, refined bread.

Shorter shelf life further affects distribution. Since it contains fewer preservatives, storage and transportation become challenging. Recommendations from nutritionists and fitness experts help boost demand. The bread’s high fiber and protein content align well with weight management and wellness goals. This steady shift toward preventive health supports long-term market expansion.

Regional Analysis

North America Dominates the Ezekiel Bread Market with a Market Share of 37.2%, Valued at USD 165.2 Million

North America leads the Ezekiel Bread Market due to strong consumer awareness around whole grains and plant-based nutrition. In this region, the market accounted for a 37.2% share, valued at USD 165.2 million, supported by high demand for clean-label and sprouted grain products. Established retail infrastructure and growing health-focused diets continue to strengthen regional growth.

Europe represents a mature yet steadily growing market, driven by increasing adoption of organic and functional bakery products. Consumers in this region show strong interest in natural ingredients, digestive health, and low-glycemic foods. The presence of health-conscious urban populations and supportive food quality regulations enhances product acceptance. Demand is also supported by rising vegan and flexitarian dietary patterns across key European economies.

The Asia Pacific market is witnessing gradual growth, supported by rising urbanization and changing dietary habits. Growing awareness of whole grains and high-protein foods among middle-income consumers is improving market penetration. Expansion of modern retail channels and online food platforms further supports accessibility. However, the market remains in a developing phase compared to Western regions due to traditional bread consumption patterns.

The Middle East and Africa region shows moderate growth potential, driven by increasing health awareness among urban consumers. Demand is mainly concentrated in premium food segments and specialty health stores. Rising lifestyle-related health concerns are encouraging interest in nutrient-dense bread options. However, limited product awareness and higher price sensitivity may restrict faster adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Ezekiel Bread market continues to evolve with several prominent players driving innovation, distribution, and consumer preference shifts.

Food for Life remains at the forefront due to its long-established reputation and extensive product portfolio, which resonates strongly with health-conscious consumers seeking sprouted grain options. Its strategic focus on quality and organic certification helps maintain loyal customer engagement across multiple regions.

Bake house has been gaining traction through targeted regional penetration and partnerships with specialty retailers, leveraging niche marketing to highlight bread freshness and artisanal attributes. This approach supports its competitive standing amidst larger, more diversified brands.

Allied Bakeries is increasingly emphasizing streamlined supply chain operations to ensure cost-efficiency and broader market access, particularly in European segments where consumer demand for functional foods is accelerating. Its investments in production technologies also enhance consistency, a key factor in maintaining shelf presence.

Silver Hills Bakery distinguishes itself through a strong brand narrative centered on wholesome ingredients and sustainable practices, appealing to environmentally aware demographics. The company’s emphasis on transparency in sourcing further reinforces its appeal among millennials and Gen Z buyers prioritizing ethical consumption.

Top Key Players in the Market

- Food for Life

- Bake house

- Allied Bakeries

- Silver Hills Bakery

- ShaSha Bread Co.

- Rainbows Health Food

- Oasis Bread

- Berlin Natural Bakery

Recent Developments

- In 2025, Angelic Bakehouse, a producer of sprouted whole grain breads aligned with the Ezekiel-style sector, introduced new products, including Everything Sprouted Bread, with sprouted whole grain offerings highlighted at industry events. The company also rolled out 10 new bread variations with improved formulas focusing on texture and taste, alongside a packaging redesign.

- In 2025, Food for Life is a leading producer in the Ezekiel Bread sector, specializing in organic, sprouted grain products inspired The company launched Ezekiel 4:9 organic sprouted flourless pita bread, expanding its product line to include a versatile, nutrient-rich option made from sprouted whole grains.

Report Scope

Report Features Description Market Value (2024) USD 444.1 Million Forecast Revenue (2034) USD 802.9 Million CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Sprouted Wheat, Sprouted Barley, Malted Barley, Sprouted Millet, Sprouted Spelt, Sprouted Lentils, Sprouted Soybeans, Others), By Nature (Organic, Conventional), By Sales Channel (Supermarkets and Hypermarkets, Departmental Stores, Convenience Outlets, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Food for Life, Bake house, Allied Bakeries, Silver Hills Bakery, ShaSha Bread Co., Rainbows Health Food, Oasis Bread, Berlin Natural Bakery Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Food for Life

- Bake house

- Allied Bakeries

- Silver Hills Bakery

- ShaSha Bread Co.

- Rainbows Health Food

- Oasis Bread

- Berlin Natural Bakery