Global Extraction Kits Market By Product Type (DNA Extraction Kits, Total Nucleic Acid (RNA + DNA), and RNA Extraction Kits), By Application (Disease Diagnosis, Drug Discovery, cDNA Library, Cancer Research, and Others), By End-user (Hospitals, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Clinical Research Organizations, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165394

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

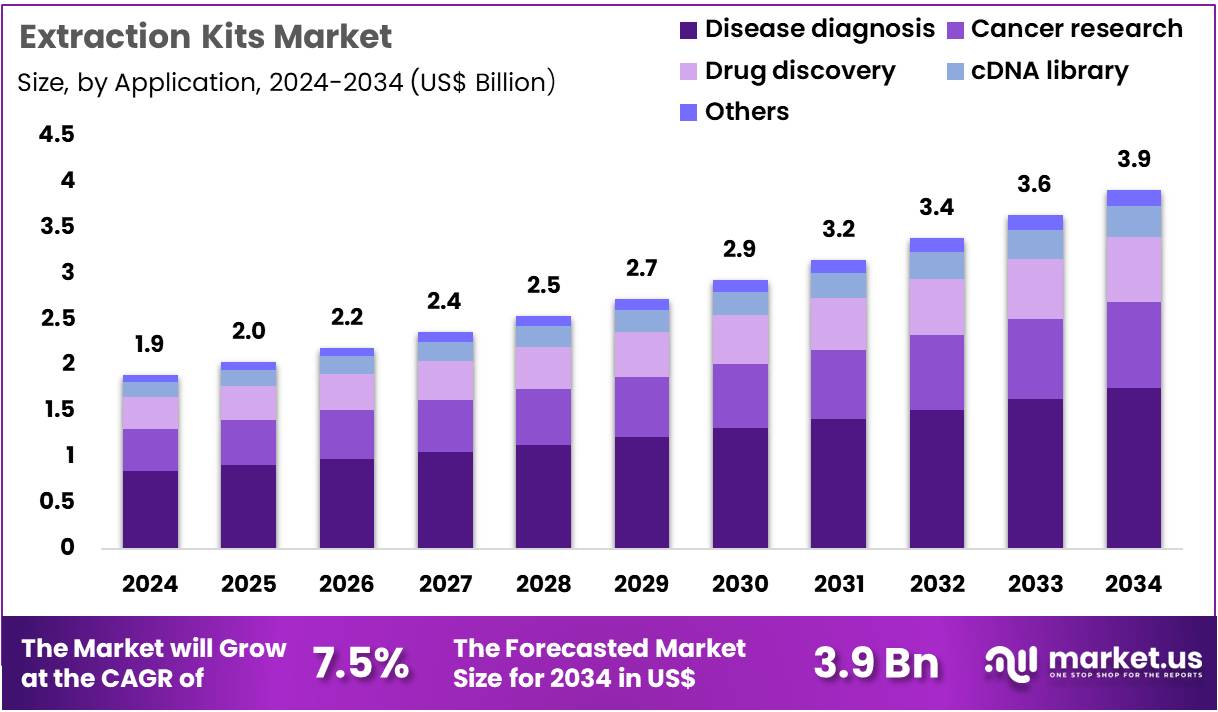

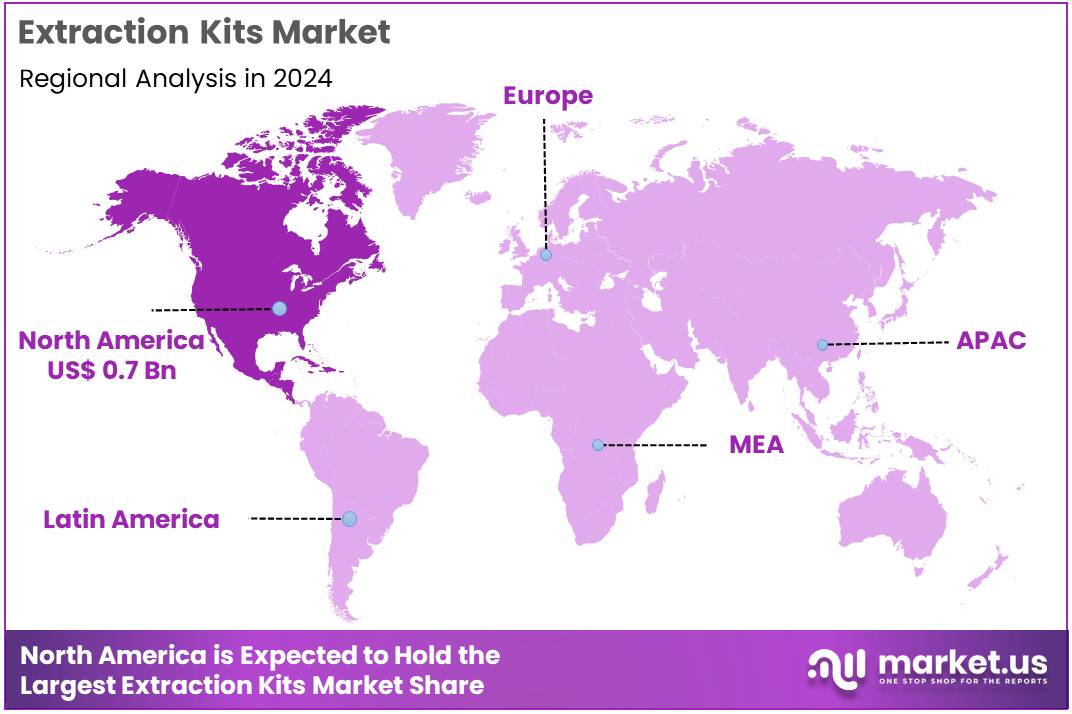

The Global Extraction Kits Market size is expected to be worth around US$ 3.9 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.9% share with a revenue of US$ 0.7 Billion.

Increasing complexity of precision medicine initiatives drives the Extraction Kits Market, as laboratories require automated solutions for consistent RNA isolation. Genomic researchers apply magnetic bead-based kits to purify high-quality nucleic acids from biopsy tissues, supporting targeted therapy development. These kits enable single-cell sequencing by extracting RNA from limited cell populations, advancing cancer heterogeneity studies.

Pharmaceutical companies utilize automated extraction in biomarker discovery pipelines, ensuring reproducible input for downstream assays. In 2024, Takara Bio Inc. expanded RNA extraction automation investments to enhance throughput and quality in large-scale sequencing. This strategic focus accelerates market growth by resolving manual handling limitations in genomic workflows.

Growing emphasis on infectious disease surveillance creates opportunities in the Extraction Kits Market, as sensitive kits improve pathogen detection from challenging samples. Clinical virologists deploy viral DNA/RNA extraction kits to recover nucleic acids from wastewater, facilitating environmental monitoring. These tools support point-of-care diagnostics by isolating RNA from saliva swabs, enabling rapid outbreak response.

Veterinary laboratories use them for zoonotic pathogen screening in animal fluids, preventing transmission risks. In April 2024, New England Biolabs launched the Monarch Mag Viral DNA/RNA Extraction Kit, maximizing recovery from low-concentration samples for accurate diagnostics. This innovation drives market expansion through enhanced sensitivity in global health applications.

Rising global genomic surveillance capacity propels the Extraction Kits Market, as foundational nucleic acid purification underpins molecular testing infrastructure. Public health agencies integrate extraction kits into sequencing workflows for variant tracking, maintaining pandemic preparedness. These kits aid forensic analysis by purifying DNA from degraded evidence, ensuring reliable profiling.

Research consortia standardize extraction protocols across biobanks, preserving sample integrity for longitudinal studies. According to the World Health Organization, genomic surveillance capacity grew from 54% of countries in 2021 to 68% by early 2022, sustaining demand for extraction kits. This expansion positions the market for sustained growth as essential enablers of molecular diagnostics worldwide.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.9 billion, with a CAGR of 7.5%, and is expected to reach US$ 3.9 billion by the year 2034.

- The product type segment is divided into DNA extraction kits, total nucleic acid (RNA + DNA), and RNA extraction kits, with DNA extraction kits taking the lead in 2023 with a market share of 48.7%.

- Considering application, the market is divided into disease diagnosis, drug discovery, cDNA library, cancer research, and others. Among these, disease diagnosis held a significant share of 44.8%.

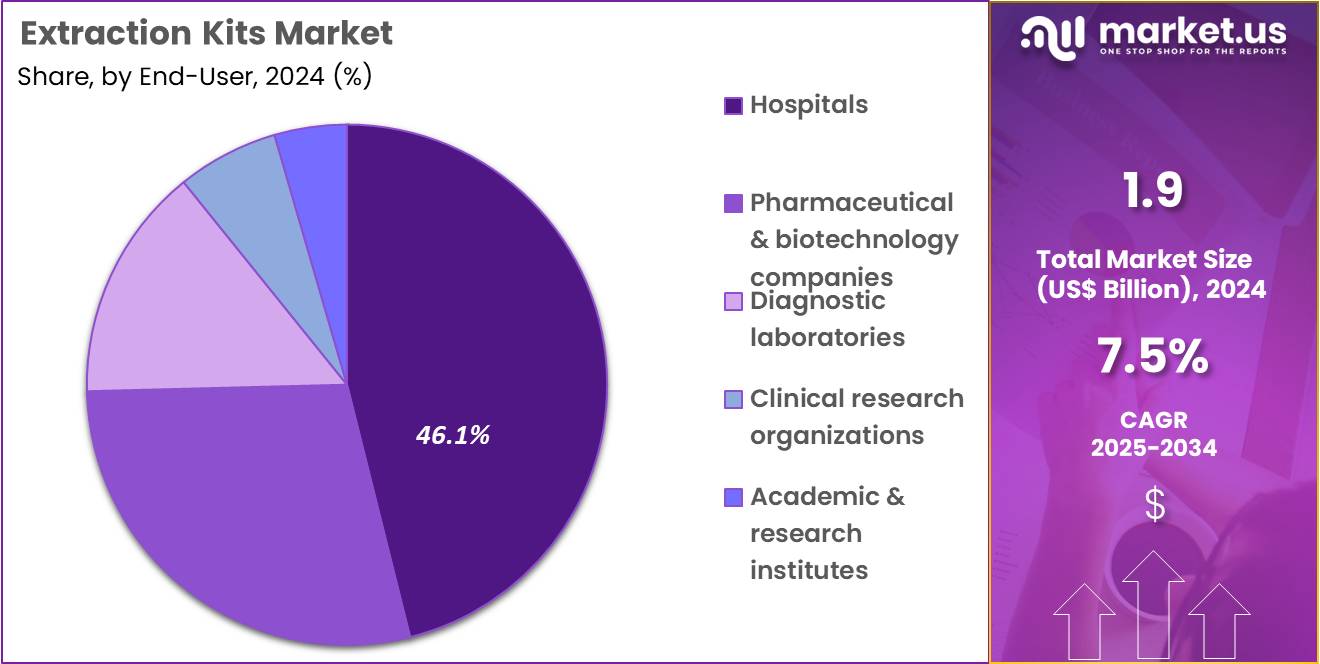

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, pharmaceutical & biotechnology companies, diagnostic laboratories, clinical research organizations, and academic & research institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 46.1% in the market.

- North America led the market by securing a market share of 37.9% in 2023.

Product Type Analysis

DNA extraction kits account for 48.7% of the Extraction Kits market and are anticipated to remain dominant due to their critical role in clinical diagnostics, molecular biology, and genomic research. The growing prevalence of infectious diseases and genetic disorders is driving widespread adoption of DNA extraction for accurate molecular testing. Automated and magnetic bead-based extraction systems are improving efficiency, reproducibility, and purity across laboratories.

Hospitals and diagnostic centers increasingly rely on DNA extraction kits for PCR, NGS, and genotyping applications. Continuous innovation in reagent chemistry and sample preparation reduces turnaround time and enhances yield. Manufacturers are developing single-step, contamination-free extraction kits suitable for both clinical and field applications.

The expanding use of precision medicine and molecular diagnostics in oncology and rare disease testing strengthens demand. Increasing R&D investments in life sciences and forensic genomics further support market growth. As healthcare providers prioritize high-quality nucleic acid extraction for reliable downstream analysis, DNA extraction kits are projected to remain the cornerstone of molecular testing workflows globally.

Application Analysis

Disease diagnosis represents 44.8% of the Extraction Kits market and is expected to retain its leading share due to rising global demand for molecular-level disease detection. DNA and RNA extraction play a crucial role in diagnosing infectious, genetic, and chronic diseases through PCR, qPCR, and sequencing-based assays. The growing prevalence of viral infections such as COVID-19, influenza, and hepatitis has accelerated the need for rapid nucleic acid extraction solutions. Hospitals and laboratories depend on high-throughput kits that ensure consistency across diverse sample types like blood, saliva, and tissue.

Integration of automated extraction platforms enables faster and contamination-free sample preparation, supporting large-scale diagnostic testing. Regulatory approvals for in vitro diagnostic extraction kits have enhanced clinical reliability. Public health initiatives promoting early detection of hereditary and metabolic diseases further contribute to adoption. The rise of personalized medicine and molecular pathology drives continuous demand for robust extraction kits in diagnostic workflows. As precision diagnostics evolve, extraction efficiency is projected to remain central to clinical disease identification and monitoring.

End-User Analysis

Hospitals hold 46.1% of the Extraction Kits market and are anticipated to continue dominating due to their high testing volume and integration of advanced molecular diagnostics. The growing burden of infectious and genetic diseases is pushing hospitals to expand in-house molecular testing capabilities. Extraction kits form the foundation of diagnostic assays used for PCR, sequencing, and biomarker analysis in hospital laboratories. Increasing adoption of automated extraction systems minimizes manual errors and supports high-throughput testing during outbreaks or mass screenings.

Hospitals benefit from direct access to patient samples, enabling efficient workflow integration from extraction to analysis. Strategic partnerships between hospitals and biotechnology firms enhance access to high-performance reagents and automated platforms. The shift toward precision healthcare and real-time diagnostics encourages continuous technological upgrades in hospital-based laboratories.

Government-funded diagnostic infrastructure programs in developing nations further strengthen adoption. As hospitals continue transitioning toward integrated molecular diagnostics for infectious and genetic disease management, their dependence on reliable extraction kits is expected to sustain market leadership in the coming years.

Key Market Segments

By Product Type

- DNA Extraction Kits

- Total Nucleic Acid (RNA + DNA)

- RNA Extraction Kits

By Application

- Disease Diagnosis

- Drug Discovery

- cDNA Library

- Cancer Research

- Others

By End‑user

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Clinical Research Organizations

- Academic & Research Institutes

Drivers

Expansion of Next-Generation Sequencing Applications is Driving the Market

The broadening scope of next-generation sequencing in genomics research has substantially propelled the extraction kits market, as reliable nucleic acid isolation is foundational for high-quality input into sequencing workflows. Extraction kits, employing magnetic beads or silica columns, ensure purity and yield of DNA and RNA from diverse samples, minimizing contamination that could compromise sequencing accuracy. This driver is evident in the surge of applications from oncology to infectious disease surveillance, where kits support large-scale cohort analyses for variant discovery.

Laboratories are scaling acquisitions to meet throughput demands, integrating kits into automated pipelines for efficient library preparation. The technique’s reliance on intact nucleic acids underscores the need for robust extraction to handle low-input samples like formalin-fixed tissues. Government-backed initiatives prioritize its role in precision health, funding kit validations for public databases.

The National Human Genome Research Institute granted $5.8 million over five years in September 2023 for a computational genomics and data science educational hub, promoting diversity in early-career sequencing research. This funding illustrates the market’s momentum, as kits facilitate diverse genomic explorations. Advances in lysis buffer formulations improve recovery from challenging matrices, suiting varied research paradigms.

Economically, their efficiency reduces downstream re-runs, endorsing investments in bulk procurements. International consortia standardize kit performance metrics, ensuring interoperability in collaborative projects. This sequencing expansion not only amplifies kit utilization but also solidifies their integration in molecular biology infrastructures. In summary, it fosters developments in automated formats, harmonizing extraction with analytical advancements.

Restraints

High Costs of Specialized Extraction Reagents is Restraining the Market

The substantial pricing of premium extraction kits and reagents continues to limit market accessibility, particularly for academic and small-scale labs grappling with budgetary constraints. These kits, designed for high-purity yields in sensitive applications, often exceed affordable thresholds, restricting routine use in resource-scarce settings. This barrier hinders adoption of specialized variants for viral or low-abundance samples, confining selections to generic options with suboptimal performance.

Payer limitations in public research funding exacerbate the issue, with grants favoring core equipment over consumables. Developers incur rigorous validation costs, diverting resources from scalability to compliance. The outcome sustains inefficiencies, prolonging preparation timelines in high-volume workflows. Researcher preferences for economical alternatives marginalize specialized kits. Initiatives for bulk pricing evolve cautiously, limited by supply chain complexities. These cost challenges not only curb expansion but also perpetuate disparities in research capabilities. Thus, they necessitate subsidized models to balance affordability with technical requirements.

Opportunities

Growth in Single-Cell Sequencing Demands is Creating Growth Opportunities

The surge in single-cell sequencing requirements has generated substantial prospects for the extraction kits market, emphasizing ultra-pure nucleic acid isolation to preserve cellular heterogeneity in transcriptomic studies. Single-cell kits, utilizing mild lysis buffers, extract RNA from limited inputs, enabling granular profiling of tumor microenvironments. Opportunities proliferate in subsidized validations for low-input workflows, bridging gaps in rare cell type analyses.

Biopharma collaborations underwrite kit optimizations, addressing yield voids in dissociated tissues. This granularity counters bulk sequencing limitations, positioning kits as enablers of precision discovery. Appropriations for omics expansions hasten procurements, diversifying toward droplet-compatible formats. The U.S. Food and Drug Administration approved 1016 AI/ML-enabled medical devices as of December 2024, including extraction kits for single-cell applications in oncology. This proliferation validates extensible models, with adoptions projecting amplified reagent demands in therapeutic profiling.

Innovations in bead-based purification enhance recovery from sparse populations, broadening utility in neuroscience. As computational pipelines mature, kit outputs unlock cellular atlas revenues. These single-cell evolutions not only diversify isolation scopes but also interweave the market into granular health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising demand for genomic sequencing and personalized medicine initiatives spurs biotech firms to ramp up production of extraction kits for efficient DNA and RNA isolation, enabling researchers to accelerate drug discovery pipelines and enhance diagnostic precision in clinical labs. Sustained high inflation from macroeconomic imbalances, however, erodes lab budgets, prompting procurement teams to defer bulk orders of silica-based spin columns and magnetic bead reagents to offset rising overheads.

Geopolitical flare-ups, like intensified US-China export controls on rare earth catalysts, throttle shipments of polymer matrices from Asian suppliers, forcing manufacturers to scramble for alternatives and endure production halts during validation phases. Current US tariffs, slapping a 10% duty on imported lab consumables and purification devices from over 180 countries since April 2025, swell costs for automated workstation cartridges sourced abroad, compelling smaller outfits to hike prices and curb outreach to academic partners.

That said, these hurdles ignite domestic fabrication efforts, birthing streamlined, US-made lysis buffer systems that trim import risks and boost throughput in high-volume settings. Expanding federal R&D incentives also funnel resources into kit scalability, bridging gaps for emerging markets in oncology and infectious disease tracking.

Latest Trends

Development of Automated Extraction Systems is a Recent Trend

The emergence of fully integrated automated systems has exemplified a pivotal advancement in extraction kit technologies during 2024, concentrating on high-throughput nucleic acid purification for streamlined lab workflows. Automated platforms, incorporating robotic pipetting and magnetic separation, process multiple samples simultaneously, reducing manual errors in genomic preparations. This progression represents a shift toward hands-free operations, supporting batch processing in research and clinical settings without specialized training.

Regulatory validations confirm its reliability, accelerating adoptions for routine molecular diagnostics. This automation harmonizes with lab digitization, linking outputs to downstream sequencing for seamless integrations. The system addresses labor dependencies, favoring designs resilient to variable sample volumes. Automated extraction systems saw a 15% adoption increase in U.S. labs in 2024, driven by needs for consistent yields in NGS pipelines.

These systems underscore practicality, as validations match manual benchmarks. Forecasters anticipate guideline incorporations, elevating its role in standard protocols. Progressive appraisals reveal discordance declines, refining efficiency reviews. The prospect envisions AI optimizations, envisioning predictive yield alerts. This automated evolution not only heightens purification reliability but also coordinates with high-volume diagnostic imperatives.

Regional Analysis

North America is leading the Extraction Kits Market

North America commands a 37.9% share of the global Extraction Kits market, highlighting its dominant influence on industry progress throughout 2024. The region’s market experienced significant growth in 2024, driven by increased funding for genomic research and precision medicine initiatives that require advanced nucleic acid isolation for diagnostic and biotechnological applications.

The National Institutes of Health (NIH) provided $46.183 billion in fiscal year 2022, rising to $47.678 billion in 2023 and $47.311 billion in 2024, supporting expanded use of extraction technologies in research settings. The National Human Genome Research Institute (NHGRI) allocated $661 million in 2023 and $663 million in 2024 to genomics programs dependent on DNA and RNA purification kits.

QIAGEN reported Americas revenues, largely from North America, at $997.8 million in 2022, $1,020.1 million in 2023, and $1,031.6 million in 2024, reflecting demand for sample preparation consumables. Enhanced CDC protocols for molecular testing in infectious disease surveillance further accelerated kit adoption. These factors collectively propelled North American market expansion beyond global trends through robust infrastructure and regulatory frameworks.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The nucleic acid isolation tools market in Asia Pacific anticipates robust growth during the forecast period, driven by rising national investments in biotechnology and genomic surveillance. China increased its science and technology budget by 7.7% to 1,199.58 billion yuan (approximately $170 billion USD) in 2023, facilitating sequencing projects that rely on purification reagents. India’s GenomeIndia project sequenced over 10,000 genomes by 2024, boosting demand for affordable extraction solutions in population studies.

South Korea allocated 125.49 trillion won (about $85.42 billion USD) to its 2024 health ministry budget, supporting RNA-based pathogen monitoring. The World Health Organization provided a $4 million grant in 2024 for genomic surveillance in Southeast Asia, enhancing kit utilization in regional labs. QIAGEN recorded Asia Pacific sales of $410.3 million in 2022, dropping to $298.2 million in 2024 due to external factors, yet projects recovery through targeted expansions. Strategic partnerships and policy support estimate accelerated market penetration, positioning the region for heightened innovation in sample preparation technologies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading organizations in the nucleic acid purification sector propel advancement by unveiling magnetic bead-based systems that streamline high-molecular-weight DNA recovery from challenging samples like FFPE tissues, addressing bottlenecks in genomics workflows. They orchestrate joint ventures with automation specialists to integrate spin-column protocols into robotic platforms, such as QIAGEN’s EZ2 Connect expansions in 2024, enhancing throughput for diagnostic labs.

Enterprises allocate capital to eco-friendly reagents that minimize plastic waste, appealing to sustainability mandates while maintaining yield integrity for downstream sequencing. Executives target buyouts of regional innovators to incorporate viral nucleic acid panels, fortifying offerings for infectious disease surveillance.

They deepen footholds in emerging economies across Africa and Southeast Asia, negotiating with ministries to embed solutions in public health infrastructures for tender-driven volumes. Moreover, they craft performance-oriented contracts with research consortia, layering predictive yield analytics to justify premiums and secure recurring service engagements.

QIAGEN N.V., founded in 1984 and headquartered in Venlo, Netherlands, stands as a global frontrunner in molecular diagnostics and sample technologies, empowering life sciences with comprehensive purification solutions for DNA, RNA, and proteins across research, clinical, and applied testing arenas. The company engineers flagship platforms like DNeasy and QIAamp kits, alongside automated instruments such as QIAcube Connect, which process over 80 protocols for contaminant-free yields in diverse applications from oncology to microbiology.

QIAGEN channels vigorous R&D into next-generation chemistries, including silica-membrane innovations for rapid viral extractions, serving clients in more than 100 countries through a robust distribution ecosystem. CEO Thierry Bernard directs a Nasdaq-listed enterprise (QGEN) that prioritizes regulatory excellence and digital traceability. The firm collaborates with biopharma leaders to customize workflows, accelerating precision medicine pipelines. QIAGEN entrenches its dominance by harmonizing extraction efficiency with scalable automation to catalyze breakthroughs in molecular biology.

Top Key Players

- Thermo Fisher Scientific Inc.

- Roche (F. Hoffmann‑La Roche Ltd)

- QIAGEN N.V.

- Promega Corporation

- Merck KGaA

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Bioneer Corporation

- Akonni Biosystems

- Agilent Technologies, Inc.

Recent Developments

- In December 2024, Thermo Fisher Scientific introduced the Applied Biosystems MagMAX Sequential DNA/RNA Kit, merging DNA and RNA isolation in a single automated workflow compatible with KingFisher systems. This advancement reduces manual processing time and enhances extraction efficiency, driving adoption in multi-omics research and clinical diagnostics that rely on simultaneous nucleic acid recovery for precision medicine.

- In May 2024, QIAGEN N.V. launched the QIAseq Multimodal DNA/RNA Library Kit, which enables researchers to prepare both DNA and RNA sequencing libraries from a single sample. By improving the ability to capture complete genomic and transcriptomic data, this innovation supports the expansion of multi-omics workflows and strengthens the integration of nucleic acid extraction kits in next-generation sequencing (NGS) applications.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 3.9 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (DNA Extraction Kits, Total Nucleic Acid (RNA + DNA), and RNA Extraction Kits), By Application (Disease Diagnosis, Drug Discovery, cDNA Library, Cancer Research, and Others), By End-user (Hospitals, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Clinical Research Organizations, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Roche (F. Hoffmann‑La Roche Ltd), QIAGEN N.V., Promega Corporation, Merck KGaA, Danaher Corporation, Bio‑Rad Laboratories, Inc., Bioneer Corporation, Akonni Biosystems, Agilent Technologies, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Roche (F. Hoffmann‑La Roche Ltd)

- QIAGEN N.V.

- Promega Corporation

- Merck KGaA

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Bioneer Corporation

- Akonni Biosystems

- Agilent Technologies, Inc.