Global EV Supply Chain Management Market Size, Share, Growth Analysis By Component (Batteries, Power Electronics, Motors, Chassis and Body Structure, Charging Infrastructure and Systems, Software and Connectivity Solutions), By Stage (Upstream (Raw Materials and Components), Midstream (Manufacturing and Assembly), Downstream (Distribution)), By Deployment Mode (On-premises, Cloud), By Organization Size (SMEs, Large Enterprises), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers and Three-Wheelers, Off-Highway Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142712

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

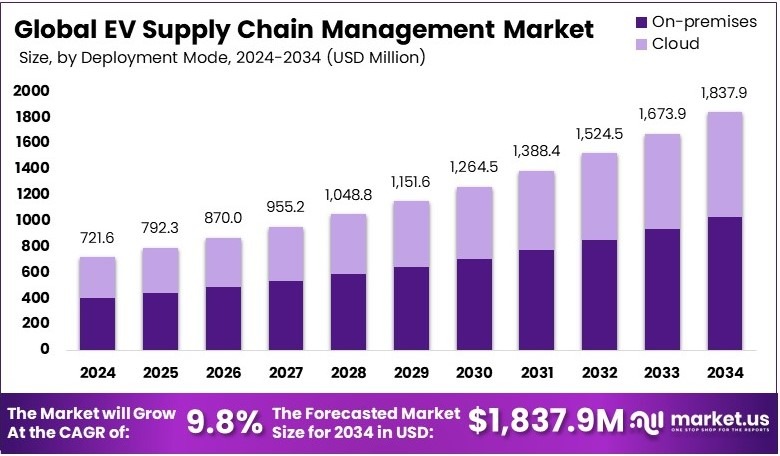

The Global EV Supply Chain Management Market size is expected to be worth around USD 1,837.9 Million by 2034, from USD 721.6 Million in 2024, growing at a CAGR of 9.8% during the forecast period from 2025 to 2034.

EV (Electric Vehicle) Supply Chain Management refers to the planning, coordination, and optimization of resources for electric vehicle production and distribution. It includes sourcing raw materials, battery production, manufacturing, logistics, and recycling. Efficient supply chain management ensures cost savings, reduces delays, and improves sustainability in the EV industry.

The EV Supply Chain Management Market includes companies, technologies, and services that manage the flow of materials and components in the EV industry. This market is driven by the increasing demand for EVs, government policies, and advancements in battery technology. It focuses on improving efficiency, reducing costs, and ensuring a steady supply of essential materials.

According to the United States Department of Energy (DOE), over $3 billion has been allocated to battery projects across 14 states. This investment, driven by the 2021 bipartisan infrastructure law, aims to strengthen domestic EV production and reduce dependence on foreign suppliers. Consequently, this initiative is expected to create 12,000 jobs, including 8,000 in construction.

As Electric Vehicle adoption increases, supply chain resilience becomes critical. Companies are focusing on localizing production to mitigate risks and ensure stable access to essential raw materials such as lithium, nickel, and cobalt. Moreover, battery recycling is emerging as a key strategy to reduce costs and enhance sustainability.

General Motors (GM) has partnered with LG Energy Solution to form Ultium Cells LLC, a joint venture dedicated to EV battery production. Their Ohio facility, which began operations in September 2022, has a 35 GWh annual capacity. Furthermore, their Tennessee plant, launched in March 2024, offers 50 GWh.

In addition, GM and Samsung SDI are investing in a new Indiana plant, set to open in 2026 with over 30 GWh capacity. These developments highlight the industry’s rapid expansion and growing competition. As a result, major automakers are ramping up investments to maintain a strong foothold in the market while ensuring a stable supply chain.

Government policies continue to drive market growth. The DOE’s investment supports the Biden administration’s climate objectives by expanding EV infrastructure and domestic production. In contrast, supply chain challenges remain, particularly in sourcing critical materials.

However, companies are addressing these issues by developing more efficient battery technologies and securing long-term contracts with raw material suppliers. Consequently, these efforts are expected to reduce costs and improve battery efficiency, making EVs more accessible to consumers.

Demand for EVs is rising as battery prices drop and charging networks expand. Consequently, automakers are investing in supply chain efficiency to keep up. For instance, developing economies present new opportunities, as growing urbanization increases the need for affordable and sustainable transportation. Likewise, domestic production reduces reliance on foreign imports, ensuring market stability. Furthermore, advancements in battery recycling create additional business opportunities, enhancing sustainability and cost efficiency.

Key Takeaways

- The EV Supply Chain Management Market was valued at USD 721.6 million in 2024 and is expected to reach USD 1,837.9 million by 2034, with a CAGR of 9.8%.

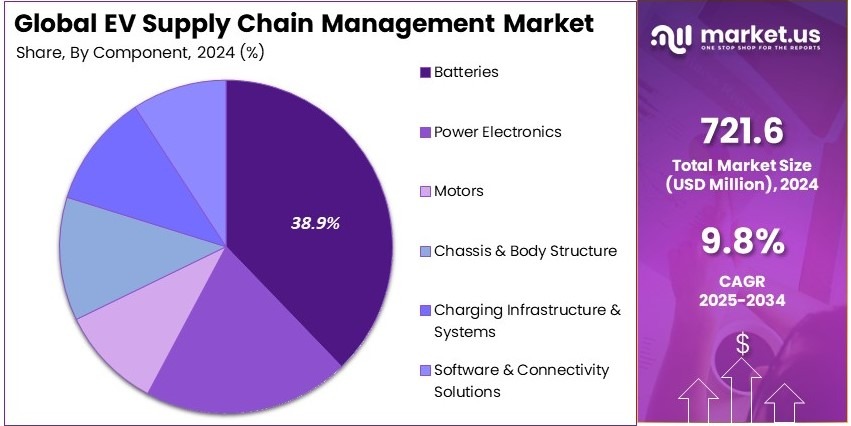

- In 2024, Batteries dominated the component segment with 38.9% due to their critical role in energy storage and vehicle performance.

- In 2024, Midstream (Manufacturing & Assembly) led with 48.9% market share, driven by increasing production of EV components.

- In 2024, On-premises deployment held the largest share of 56.85%, owing to security and operational control benefits.

- In 2024, Large enterprises dominated with 54.2% market share due to their high investment in supply chain solutions.

- In 2024, Passenger Vehicles accounted for 38.9% of the market, supported by rising EV adoption.

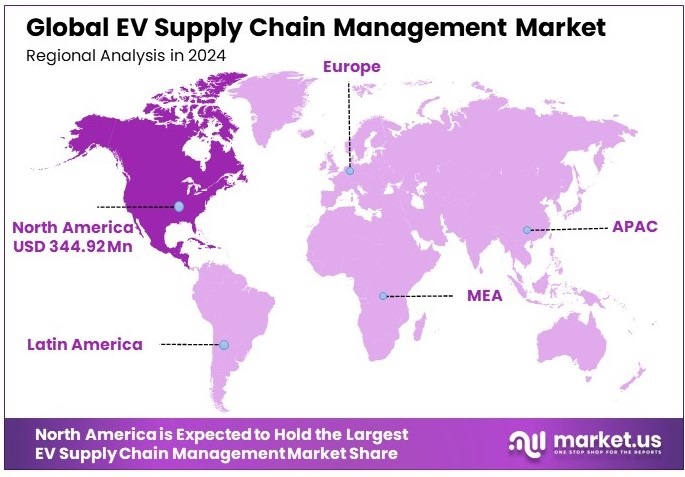

- In 2024, North America led with 47.8% market share, valued at USD 344.92 million, due to strong EV infrastructure development.

Component Analysis

Batteries dominate with 38.9% due to their critical role in EV performance and range.

In the EV Supply Chain Management Market, the component segment is pivotal, with batteries emerging as the dominant sub-segment, holding a significant 38.9% market share. This dominance can be attributed to the increasing demand for electric vehicles that offer longer ranges and quicker charging times. Batteries, as a core component, directly influence these attributes, making their role in the supply chain crucial for meeting consumer expectations and regulatory standards.

Other sub-segments such as Power Electronics, Motors, Chassis & Body Structure, Charging Infrastructure & Systems, and Software & Connectivity Solutions also play integral roles. Power Electronics, for instance, are essential for managing the flow and control of electrical power, which significantly impacts vehicle efficiency and safety. Similarly, Motors are critical for the conversion of electrical energy into mechanical energy, directly affecting the vehicle’s performance.

Stage Analysis

Midstream (Manufacturing & Assembly) dominates with 48.9% due to its central role in integrating various components into a functional vehicle.

The stage segment of the EV Supply Chain is crucial, with Midstream (Manufacturing & Assembly) taking the lead by holding a 48.9% share. This stage is where various components are assembled to create the final electric vehicle, highlighting its significance in ensuring quality and efficiency in production. The integration of advanced manufacturing technologies and assembly processes here directly correlates with the production capacity and output quality of EVs, influencing market competitiveness.

In contrast, the Upstream segment involves the procurement of raw materials and parts, which is fundamental for quality control and cost management. Downstream activities focus on distribution, where strategic logistics and market placement play crucial roles in product availability and customer satisfaction.

Deployment Mode Analysis

On-premises deployment mode holds the largest share with 56.85% due to its enhanced security and control.

Deployment mode is a critical aspect of EV Supply Chain Management, with on-premises solutions dominating the market at 56.85%. This preference stems from the higher level of security and control it offers enterprises, which is paramount in managing sensitive data and proprietary technologies. On-premises systems allow for better customization and integration with existing infrastructure, which is vital for large-scale manufacturing setups.

Cloud deployment, on the other hand, offers scalability and flexibility, which are beneficial for businesses looking for cost-effective and agile solutions. Despite its benefits, the critical need for security in proprietary manufacturing processes places on-premises solutions at the forefront.

Organization Size Analysis

Large Enterprises dominate with 54.2% due to their extensive resources and capacity for innovation.

In terms of organization size, large enterprises hold a predominant position in the EV Supply Chain Management Market with a 54.2% share. This segment’s dominance is due to the substantial resources that large enterprises possess, which allow for greater investment in research and development, as well as in advanced manufacturing technologies. These capabilities enable them to innovate and scale operations efficiently, meeting the growing demand for electric vehicles.

SMEs, while smaller in market share, are crucial for introducing innovation and specialized solutions. Their agility and niche expertise can drive advancements in specific areas of the supply chain, contributing significantly to the overall growth of the market.

Vehicle Type Analysis

Passenger Vehicles dominate with 38.9% due to their widespread consumer acceptance and growing infrastructure support.

Finally, in the vehicle type segment, Passenger Vehicles lead with a 38.9% market share. The dominance of passenger vehicles in the EV market can be largely credited to increasing consumer acceptance, supported by the expanding charging infrastructure and government incentives aimed at promoting EV adoption. This segment’s growth is fueled by the rising demand for sustainable and economical transportation solutions among individual consumers.

Commercial Vehicles, Two-Wheelers & Three-Wheelers, and Off-Highway Vehicles also contribute to the market dynamics. Commercial vehicles are gaining traction due to the push for green logistics solutions, while two-wheelers and three-wheelers offer cost-effective mobility solutions in densely populated urban areas. Off-Highway Vehicles are tailored for specific industrial and agricultural needs, providing specialized electric solutions in niche markets.

Key Market Segments

By Component

- Batteries

- Power Electronics

- Motors

- Chassis & Body Structure

- Charging Infrastructure & Systems

- Software & Connectivity Solutions

By Stage

- Upstream (Raw Materials & Components)

- Midstream (Manufacturing & Assembly)

- Downstream (Distribution)

By Deployment Mode

- On-premises

- Cloud

By Organization Size

- SMEs

- Large Enterprises

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers & Three-Wheelers

- Off-Highway Vehicles

Driving Factors

Government Incentives and Strategic Partnerships Drive Market Growth

Rising government incentives and subsidies are playing a key role in strengthening the EV supply chain. Governments worldwide are offering financial support to boost electric vehicle production and improve supply chain efficiency. These incentives include tax credits, grants, and subsidies for automakers, battery manufacturers, and supply chain operators.

Another factor driving growth is the increasing investment in battery recycling and second-life applications. As EV adoption rises, managing used batteries becomes a priority. Companies are investing in recycling technologies to extract valuable materials such as lithium and cobalt, reducing the need for new raw materials. Second-life applications, such as repurposing EV batteries for energy storage, also contribute to supply chain sustainability.

In addition, the expansion of domestic rare earth metal mining is reducing dependency on imports. Many countries are prioritizing the local sourcing of critical minerals to ensure a stable supply for EV battery production. This reduces supply chain risks and enhances national energy security.

Strategic partnerships between automakers and energy providers are further improving supply chain efficiency. These collaborations focus on securing a steady supply of raw materials, optimizing logistics, and ensuring stable energy sources for battery production. As these partnerships grow, the EV supply chain becomes more resilient and cost-effective.

Restraining Factors

High Costs and Logistics Challenges Restrain Market Growth

The EV supply chain faces several challenges that hinder its expansion. One major obstacle is the high initial cost and capital investment required to build supply chain infrastructure. Establishing battery plants, raw material processing units, and logistics networks demands significant financial resources. Smaller manufacturers often struggle to compete due to these high costs.

Another challenge is the complexity of logistics and supply chain disruptions caused by global semiconductor shortages. The EV industry relies heavily on semiconductor chips for battery management systems and vehicle control units. Shortages have led to production delays and increased costs, making supply chain planning more difficult.

Additionally, the limited availability of skilled labor for EV component manufacturing poses a challenge. As the industry grows, the demand for specialized workers in battery assembly, electronics, and automation increases. However, many regions lack a sufficient workforce trained in these areas, creating bottlenecks in production.

Inconsistent standardization of EV components across different regions further complicates supply chain management. Different regulations, specifications, and quality standards create inefficiencies, making it harder for manufacturers to scale production and streamline operations. Overcoming these challenges requires industry-wide collaboration, policy alignment, and investment in workforce development.

Growth Opportunities

AI and Blockchain Technology Provide Opportunities

Advancements in solid-state battery technology are creating new opportunities for supply chain efficiency. Solid-state batteries offer higher energy density, faster charging, and longer lifespan compared to traditional lithium-ion batteries. As these batteries become commercially viable, supply chain processes will improve due to better energy storage and reduced material dependency.

The development of AI-driven predictive analytics is also transforming EV supply chain management. AI tools help companies optimize inventory, predict demand fluctuations, and identify potential supply chain bottlenecks. This reduces waste, improves efficiency, and minimizes disruptions in production.

Expanding localized EV component production is another major opportunity. By manufacturing key components closer to assembly plants, automakers can reduce costs and delivery times. This strategy minimizes reliance on overseas suppliers, making the supply chain more resilient to global disruptions.

Increased adoption of blockchain technology is further enhancing transparency in EV supply chains. Blockchain ensures secure and verifiable tracking of raw materials, components, and finished products. This helps manufacturers comply with environmental and ethical sourcing standards, improving trust and accountability in the supply chain. These innovations are driving the next phase of EV supply chain development, making operations more efficient and sustainable.

Emerging Trends

Sustainability and Automation Are Latest Trending Factors

The push for a sustainable and carbon-neutral EV supply chain is a major trend shaping the market. Companies are adopting eco-friendly practices such as using renewable energy in production facilities, reducing emissions in logistics, and sourcing ethical raw materials. Automakers are also working to create closed-loop recycling systems to minimize waste and lower environmental impact.

The rise of cloud-based supply chain management platforms is another key trend. These platforms allow real-time tracking of materials, components, and shipments. By leveraging cloud technology, manufacturers can improve inventory visibility, reduce inefficiencies, and enhance collaboration across the supply chain.

A growing demand for modular battery manufacturing is also influencing the industry. Modular battery designs simplify production and logistics by allowing manufacturers to use standardized components. This reduces supply chain complexity and improves scalability, making it easier to meet rising EV demand.

The integration of robotic automation in EV supply chain warehousing is further improving efficiency. Robots are being used for sorting, packaging, and transportation of EV components. Automation speeds up operations, reduces errors, and lowers labor costs. As these trends gain momentum, the EV supply chain is becoming more advanced, flexible, and sustainable.

Regional Analysis

North America Dominates with 47.8% Market Share in the EV Supply Chain Management Market

North America leads the EV Supply Chain Management Market with a 47.8% share, translating to USD 344.92 million. This dominance is fueled by the region’s advanced automotive infrastructure, significant investments in electric vehicle technologies, and supportive government policies aimed at reducing carbon emissions.

The region’s market strength is further bolstered by the presence of major EV manufacturers and a network of suppliers that continuously innovate in battery technology and EV components. Additionally, consumer awareness and demand for eco-friendly transportation solutions contribute to the growth of the EV market in North America.

Looking ahead, North America’s influence in the global EV Supply Chain Management Market is expected to remain strong. The region’s commitment to sustainability and technological advancement predicts continued expansion and leadership in this field, driven by further investments and policy support.

Regional Mentions:

- Europe: Europe holds a significant share of the market, supported by stringent environmental regulations and heavy investments in EV infrastructure. The region’s focus on reducing vehicle emissions and promoting electric mobility underpins its strong market position.

- Asia Pacific: Known for rapid technological adoption, Asia Pacific is quickly advancing in the EV market. Countries like China and Japan are leading with aggressive policies favoring electric vehicles and substantial technological innovations in battery production and vehicle design.

- Middle East & Africa: The Middle East and Africa are gradually expanding in the EV market, with investments aimed at diversifying energy sources and reducing oil dependency. The region is also seeing increased interest in adopting green technologies.

- Latin America: Latin America is slowly progressing in the EV market, with initiatives to adopt electric buses and promote sustainable urban transportation solutions gaining ground. Despite economic challenges, the region shows potential for growth in the coming years.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the EV Supply Chain Management Market, several key players stand out due to their influential roles and strategic positions within the industry. LG Energy Solution, Panasonic Corporation, Samsung SDI, and Foxconn are among the top companies shaping the market dynamics.

LG Energy Solution is a frontrunner in the production of lithium-ion batteries, crucial for EVs, holding a substantial market share due to its high-quality and durable battery solutions. Panasonic Corporation closely follows, known for its collaboration with major automotive brands to supply batteries and other essential components that enhance vehicle efficiency and longevity.

Samsung SDI also plays a pivotal role with its innovative battery technologies that push the boundaries of energy density and charging speed, making electric vehicles more appealing to a broader consumer base. Meanwhile, Foxconn has recently entered the electric vehicle market, leveraging its vast manufacturing capabilities to produce EV components, which positions it as a potential disruptor in the supply chain logistics.

Together, these companies not only drive technological advancements but also significantly impact the supply chain strategies due to their large-scale production capabilities and global distribution networks. Their collective efforts are crucial in addressing the growing demand for electric vehicles and meeting sustainability goals within the automotive industry.

Major Companies in the Market

- LG Energy Solution

- Panasonic Corporation

- Samsung SDI

- Foxconn (Hon Hai Precision Industry Co., Ltd.)

- Ganfeng Lithium

- EVE Energy Co., Ltd.

- Tata Motors

- Ryder System, Inc.

- IXM

- EVBox

- Valeo

- Forvia

- CATL

- Others

Recent Developments

- Scania and Northvolt: In March 2025, Swedish truck manufacturer Scania, a shareholder in the financially troubled battery maker Northvolt, secured an alternative supply of battery cells. This strategic move aims to diversify Scania’s supply chain following Northvolt’s Chapter 11 bankruptcy filing in the U.S. in November 2024. In 2024, Scania delivered 266 zero-emission vehicles, underscoring the urgency of securing reliable battery suppliers to meet future emissions targets.

- BYD: In March 2025, Chinese electric vehicle manufacturer BYD raised $5.6 billion through a share sale in Hong Kong, the largest equity follow-on offering in the global automotive sector in a decade. The funds are earmarked for BYD’s overseas expansion, including establishing production lines in Hungary, Turkey, and Brazil. Despite a temporary dip in its Hong Kong-listed shares, BYD’s stock has risen over 30% within the year.

Report Scope

Report Features Description Market Value (2024) USD 721.6 Million Forecast Revenue (2034) USD 1,837.9 Million CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Batteries, Power Electronics, Motors, Chassis and Body Structure, Charging Infrastructure and Systems, Software and Connectivity Solutions), By Stage (Upstream (Raw Materials and Components), Midstream (Manufacturing and Assembly), Downstream (Distribution)), By Deployment Mode (On-premises, Cloud), By Organization Size (SMEs, Large Enterprises), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Two-Wheelers and Three-Wheelers, Off-Highway Vehicles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape LG Energy Solution, Panasonic Corporation, Samsung SDI, Foxconn (Hon Hai Precision Industry Co., Ltd.), Ganfeng Lithium, EVE Energy Co., Ltd., Tata Motors, Ryder System, Inc., IXM, EVBox, Valeo, Forvia, CATL, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  EV Supply Chain Management MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

EV Supply Chain Management MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LG Energy Solution

- Panasonic Corporation

- Samsung SDI

- Foxconn (Hon Hai Precision Industry Co., Ltd.)

- Ganfeng Lithium

- EVE Energy Co., Ltd.

- Tata Motors

- Ryder System, Inc.

- IXM

- EVBox

- Valeo

- Forvia

- CATL

- Others