Global EV Plant Construction Market Size, Share, Growth Analysis By Type (Assembly Plants, Battery Manufacturing Plants, Research & Development Centers, Charging Infrastructure Facilities), By Construction (New Plant Construction, Plant Expansion, Renovation & Upgrades), By End User (Auto-Makers, Battery Manufacturers, Charging Infrastructure Providers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156785

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

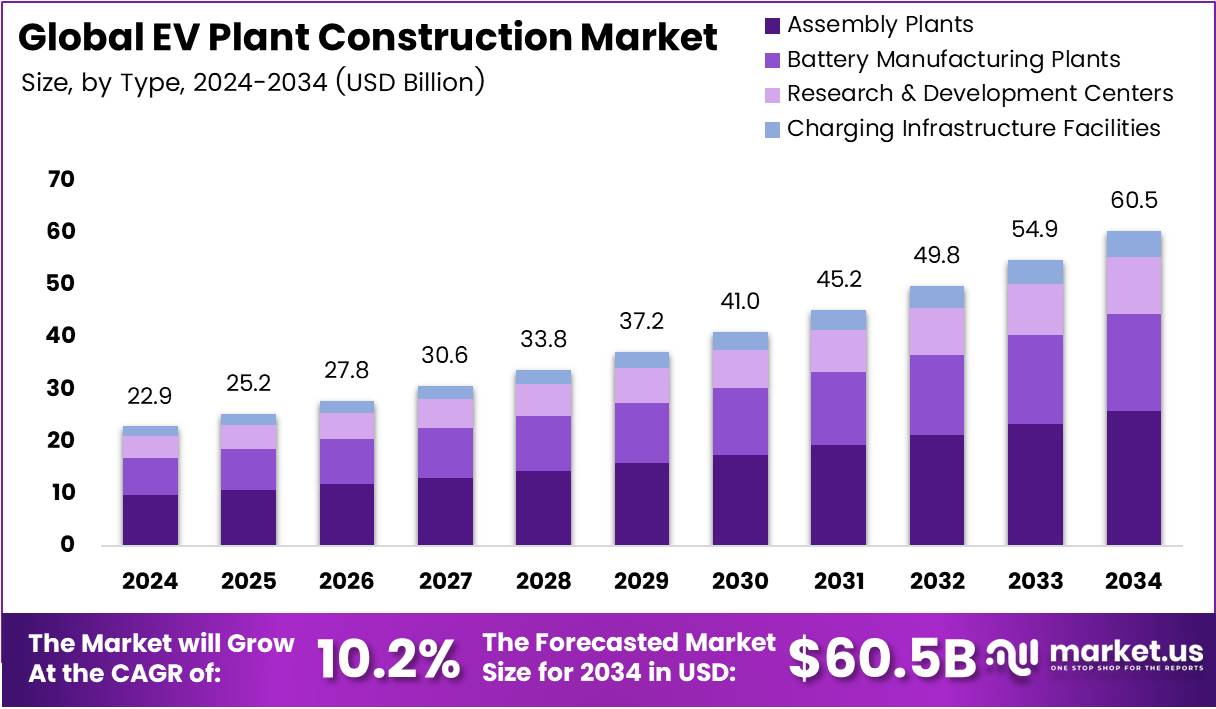

The Global EV Plant Construction Market size is expected to be worth around USD 60.5 Billion by 2034, from USD 22.9 Billion in 2024, growing at a CAGR of 10.2% during the forecast period from 2025 to 2034.

The EV Plant Construction Market refers to the infrastructure and facilities built specifically for manufacturing electric vehicles and their components. It covers gigafactories, battery plants, and assembly lines designed to meet the surging global demand for EVs. The sector is expanding rapidly as automakers and suppliers scale up investments in capacity and technology.

Growth is strongly driven by rising EV adoption worldwide, supported by decarbonization targets and incentives. Automakers are racing to establish new facilities across regions to ensure proximity to demand centers. This dynamic has positioned EV plant construction as a strategic priority for global automotive value chains.

Opportunities continue to emerge as governments push for energy transition and cleaner mobility solutions. Investments in gigafactories not only address production capacity but also stimulate local economies through jobs and technology transfer. Emerging markets in Southeast Asia and South America are witnessing early signs of facility development.

Moreover, the regulatory environment is shaping plant construction strategies. Requirements for sustainable supply chains, reduced emissions, and localized manufacturing have compelled companies to reimagine factory models. Integration of renewable power, smart grids, and automation is now standard in modern EV plant projects, ensuring efficiency and compliance with evolving environmental standards.

Governments are investing heavily to build enabling infrastructure and strengthen confidence for investors. Subsidies, tax benefits, and land allocations have encouraged large-scale projects. Strategic partnerships between automakers, energy providers, and technology firms are reshaping the competitive landscape, creating robust ecosystems around EV plant hubs.

According to Argus Media, China added 4.22 million charging points in 2024, marking a 25% year-on-year increase, strengthening demand for localized EV manufacturing. Similarly, the EU’s Alternative Fuels Infrastructure Regulation requires ≥150 kW fast chargers every 60 km on major corridors starting 2025, directly influencing EV plant location planning.

According to Canary Media, the US registered sales of 1.3 million new EVs in 2024, creating significant pressure to expand domestic production. Furthermore, according to published stats, Indonesia’s CATL-linked project began operations with 6.9 GWh cell capacity by end-2026 (phase-in), while BYD’s Brazil complex in Bahia secured R$3 billion (~US$600M) investment.

Key Takeaways

- The global EV Plant Construction Market is projected to reach USD 60.5 Billion by 2034, up from USD 22.9 Billion in 2024, at a CAGR of 10.2%.

- In 2024, Assembly Plants led the By Type segment with a 42.7% share, driven by rising EV demand and automation needs.

- New Plant Construction dominated the By Construction segment in 2024 with a 59.9% share, supported by large-scale investments in new EV facilities.

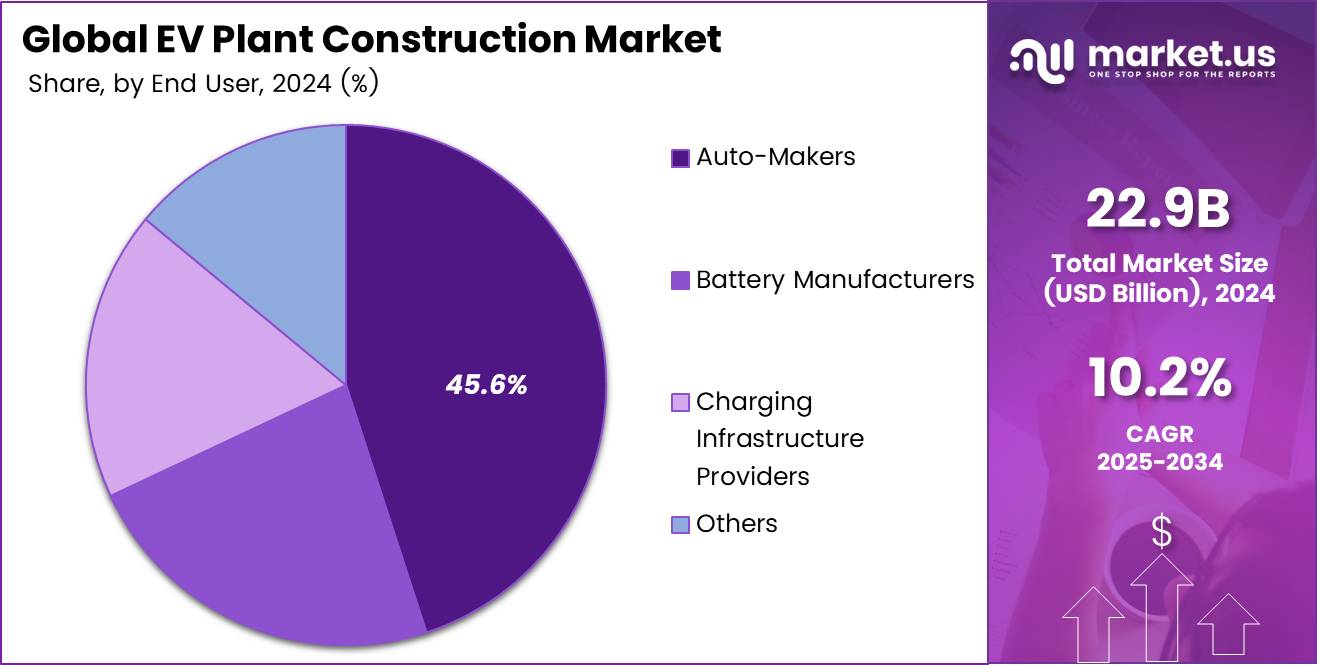

- Auto-Makers held the top spot in the By End User segment with a 45.6% share in 2024, reflecting OEMs’ strong push toward electrification.

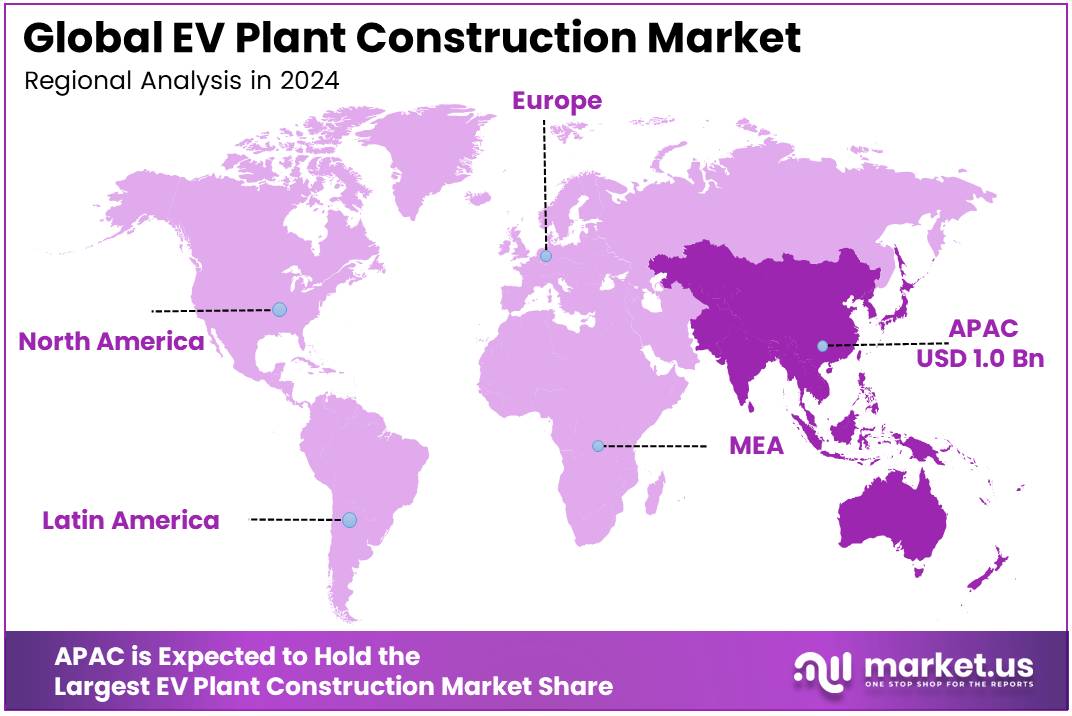

- APAC was the leading regional market in 2024, holding a 34.8% share valued at USD 1.0 Billion, supported by incentives and gigafactory projects.

Type Analysis

Assembly Plants dominate with 42.7% due to their critical role in large-scale EV production capacity.

In 2024, Assembly Plants held a dominant market position in By Type Analysis segment of EV Plant Construction Market, with a 42.7% share. Their dominance stems from increasing global EV demand, requiring advanced production lines and automation to streamline vehicle manufacturing and ensure consistent quality standards across regions.

Battery Manufacturing Plants are also a key segment, supporting large-scale EV rollouts with secure supply chains. Growth in this category is driven by rising demand for localized battery production to reduce costs and enhance energy density. Their role is further reinforced by global policies supporting battery independence.

Research & Development Centers contribute to innovation by focusing on next-generation EV technologies. These facilities prioritize advancements in lightweight materials, safety systems, and digital integration. Their growth reflects increasing corporate investments in R&D for differentiation and compliance with stringent environmental regulations.

Charging Infrastructure Facilities represent another important segment, essential for scaling EV adoption. Governments and private players are expanding these facilities to ensure wider charging availability. Growing infrastructure developments reduce range anxiety, thereby strengthening consumer confidence in EV adoption and indirectly boosting plant construction demand.

Construction Analysis

New Plant Construction dominates with 59.9% due to large-scale investments in greenfield EV projects worldwide.

In 2024, New Plant Construction held a dominant market position in By Construction Analysis segment of EV Plant Construction Market, with a 59.9% share. This reflects the surge in global investment for building state-of-the-art EV facilities to meet rising production targets and government mandates.

Plant Expansion remains a significant segment, driven by automakers upgrading existing facilities to increase EV capacity. This trend allows companies to adapt their traditional plants into dual production hubs for both conventional and electric vehicles, offering flexibility and cost optimization.

Renovation & Upgrades form another important segment, highlighting sustainability-focused retrofits. Companies are modernizing older facilities with energy-efficient systems, automation technologies, and compliance upgrades to meet emission norms. These projects support the transition from conventional automotive infrastructure to future-ready EV ecosystems.

End User Analysis

Auto-Makers dominate with 45.6% as they lead global investments in EV manufacturing infrastructure.

In 2024, Auto-Makers held a dominant market position in By End User Analysis segment of EV Plant Construction Market, with a 45.6% share. Their leadership is linked to aggressive commitments toward electrification, with global OEMs investing heavily in dedicated EV factories.

Battery Manufacturers account for a notable share, as they strengthen localized battery ecosystems. Their focus is on securing supply chains and supporting automotive OEMs with high-capacity production plants aligned with global sustainability targets.

Charging Infrastructure Providers are expanding their presence, contributing to the market by developing large-scale charging hubs. These end users are essential in creating a seamless charging ecosystem that complements EV production growth and consumer adoption.

Others, including research institutions and technology firms, also play a role by investing in specialized facilities. Their contributions revolve around niche manufacturing, pilot-scale innovations, and collaborative projects to accelerate EV development and deployment.

Key Market Segments

By Type

- Assembly Plants

- Battery Manufacturing Plants

- Research & Development Centers

- Charging Infrastructure Facilities

By Construction

- New Plant Construction

- Plant Expansion

- Renovation & Upgrades

By End User

- Auto-Makers

- Battery Manufacturers

- Charging Infrastructure Providers

- Others

Drivers

Escalating Government Mandates for Domestic EV Manufacturing Facilities Drive Market Growth

Governments across major economies are mandating domestic EV manufacturing to reduce reliance on imports. Such directives encourage local production hubs, strengthening the EV plant construction market. These initiatives ensure that automakers align with national policies focused on energy security and carbon neutrality.

The rising demand for localized EV supply chains further accelerates construction activities. Countries are prioritizing supply chain resilience to avoid disruptions in battery and component imports. This localized approach enhances national competitiveness, leading to steady investments in advanced EV facilities.

Private sector investment in gigafactories and EV plants is another growth driver. Leading automotive and energy companies are allocating billions into new facilities to expand their market presence. These investments also foster job creation and technological innovation in the construction process.

Rapid urbanization across Asia and other regions is boosting the need for large-scale EV infrastructure. Growing cities demand cleaner transportation alternatives, leading to accelerated construction of EV plants and charging networks. This trend aligns with long-term sustainability goals and urban mobility strategies.

Restraints

High Upfront Capital Expenditure for Land Acquisition and Facility Setup Restrains Market Growth

The construction of EV plants requires significant financial commitment, particularly for land acquisition and infrastructure development. High upfront costs discourage smaller firms from entering the market and limit the pace of expansion for established players.

Another key challenge is the shortage of skilled labor specialized in EV plant construction. Expertise in advanced facility setup, automation integration, and cleanroom environments is limited. This skill gap increases construction timelines and overall project costs, slowing down market growth.

Growth Factors

Expansion of Greenfield EV Plant Projects in Emerging Economies Creates Growth Opportunities

Emerging markets are actively investing in greenfield EV plants to attract global automakers. These regions offer lower land costs, government subsidies, and expanding consumer demand, making them attractive destinations for EV plant construction.

The adoption of modular and prefabricated construction techniques is also creating opportunities. These methods reduce project timelines, minimize costs, and improve flexibility, allowing rapid scaling of EV production facilities worldwide.

Public–private partnerships are increasingly supporting large-scale EV industrial parks. Collaborative funding models reduce financial risks while enhancing infrastructure quality, encouraging more companies to expand operations in new markets.

Integration of renewable energy systems into EV plant designs offers long-term value. Solar and wind-powered facilities not only reduce carbon footprints but also lower operational costs, reinforcing sustainability in plant construction strategies.

Emerging Trends

Shift Toward Smart Factories with Digital Twin and Automation Technologies Shapes Market Trends

EV plant construction is rapidly moving toward smart factories. Digital twin models and automation systems optimize workflows, improve accuracy, and enhance productivity, making them a preferred trend in the sector.

Sustainability is another strong trend, with a growing emphasis on eco-friendly building materials and low-carbon construction practices. These align with global climate goals and consumer expectations for greener industries.

Strategic collaborations between automakers and construction companies are becoming more common. Such alliances combine engineering expertise with industrial capabilities, ensuring efficient and innovative EV facility development.

Multi-purpose EV plants are also gaining traction. Facilities designed to produce cars, trucks, and even battery storage units offer flexibility and scalability. This diversification trend strengthens profitability and supports the broader transition to electrified mobility.

Regional Analysis

APAC Dominates the EV Plant Construction Market with a Market Share of 34.8%, Valued at USD 1.0 Billion

In 2024, APAC led the EV plant construction market with a 34.8% share, reaching USD 1.0 Billion. The region benefits from large-scale government incentives in China, India, and Southeast Asia, along with strategic investments in gigafactories. Rising EV adoption and localized supply chain strategies further strengthen APAC’s dominance in this sector.

North America EV Plant Construction Market Trends

North America is experiencing robust growth driven by federal funding programs and state-level EV mandates. The U.S. has prioritized domestic battery and EV production, supported by infrastructure programs that accelerate plant construction. Increasing private sector investments in gigafactories also play a major role in strengthening market presence.

Europe EV Plant Construction Market Trends

Europe is advancing due to strong regulatory backing under the European Green Deal and AFIR mandates. The region focuses on sustainable EV plant construction with an emphasis on green technologies. Growing partnerships between automakers and governments ensure steady development of EV infrastructure across core and emerging European markets.

Middle East and Africa EV Plant Construction Market Trends

The Middle East and Africa market is in an early stage, but increasing diversification strategies and smart city initiatives are encouraging EV-related investments. Governments are setting up frameworks for clean mobility projects, while Gulf countries are beginning to explore EV assembly and component manufacturing zones.

Latin America EV Plant Construction Market Trends

Latin America is gradually emerging, with Brazil and Mexico leading in EV-related infrastructure development. Government programs to attract foreign investments and growing consumer interest in EV adoption are shaping opportunities. The focus is primarily on building localized production hubs to reduce reliance on imports and strengthen regional supply chains.

U.S. EV Plant Construction Market Trends

The U.S. market plays a central role in North America, driven by large-scale projects under federal incentives. Rapid construction of battery gigafactories and EV assembly plants reflects strong policy support and rising consumer demand. The country’s emphasis on domestic supply chain resilience continues to boost EV infrastructure expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key EV Plant Construction Company Insights

In 2024, the global EV Plant Construction Market saw strong participation from leading engineering and construction firms driving large-scale projects. Bechtel Corporation maintained a significant presence by leveraging its expertise in complex infrastructure projects, particularly in large assembly and battery manufacturing plants. Its role in streamlining project execution timelines positioned it as a key partner for automotive OEMs.

AECOM continued to expand its influence through integrated design, engineering, and construction solutions tailored for EV manufacturing facilities. Its focus on sustainable building practices and alignment with government regulations enabled it to secure critical contracts in emerging EV hubs. The company’s strategic approach reinforced its leadership in environmentally compliant projects.

Barton Malow strengthened its foothold by focusing on the North American market, where demand for EV plants is accelerating. Known for its specialization in automotive facility construction, the company emphasized modular building approaches that reduced costs and accelerated delivery schedules. This strategy enhanced its competitiveness in localized EV supply chain development.

Fluor Corporation demonstrated its capabilities by managing large-scale, multi-phase EV plant construction projects across global markets. The company’s expertise in project management, coupled with its focus on energy-efficient designs, helped it secure collaborations with major EV manufacturers. Its diversified portfolio in industrial and infrastructure projects ensured resilience and adaptability in this rapidly evolving market.

Together, these players shaped the competitive landscape in 2024 by combining advanced engineering capabilities with sustainability, efficiency, and speed of execution, positioning themselves as key enablers of the EV transition.

Top Key Players in the Market

- Bechtel Corporation

- AECOM

- Barton Malow

- Fluor Corporation

- Jacobs Engineering

- Shimizu Corporation

- Skanska

- Turner Construction

- WSP

- Yates Construction

Recent Developments

- In Feb 2025, the US government offered $710 million in loans to accelerate EV technology projects. This initiative is aimed at boosting domestic innovation and supporting large-scale clean energy manufacturing.

- In Jun 2025, Lumina announced plans to raise $20-40 million in Series A funding. The capital is expected to be directed toward scaling its electric construction equipment line and expanding market presence.

- In Jul 2025, the European Union committed €852 million to supercharge EV battery manufacturing. The funding focuses on strengthening regional supply chains and enhancing competitiveness in the global battery sector.

Report Scope

Report Features Description Market Value (2024) USD 22.9 Billion Forecast Revenue (2034) USD 60.5 Billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Assembly Plants, Battery Manufacturing Plants, Research & Development Centers, Charging Infrastructure Facilities), By Construction (New Plant Construction, Plant Expansion, Renovation & Upgrades), By End User (Auto-Makers, Battery Manufacturers, Charging Infrastructure Providers, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bechtel Corporation, AECOM, Barton Malow, Fluor Corporation, Jacobs Engineering, Shimizu Corporation, Skanska, Turner Construction, WSP, Yates Construction Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  EV Plant Construction MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

EV Plant Construction MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bechtel Corporation

- AECOM

- Barton Malow

- Fluor Corporation

- Jacobs Engineering

- Shimizu Corporation

- Skanska

- Turner Construction

- WSP

- Yates Construction