Europe Fructose for Food And Beverage Market By Product Type (High Fructose Corn Syrup, Fructose Syrups, and Fructose Solids), By Form (Liquid, and Crystalline), By Source (Corn, Sugarcane, Sugar Beet, Fruits, Wheat, and Others) By End-use (Bakery, Confectionery, Dairy Products, Beverages, Breakfast Cereals, Processed Foods, and Others), By Countries and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141900

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

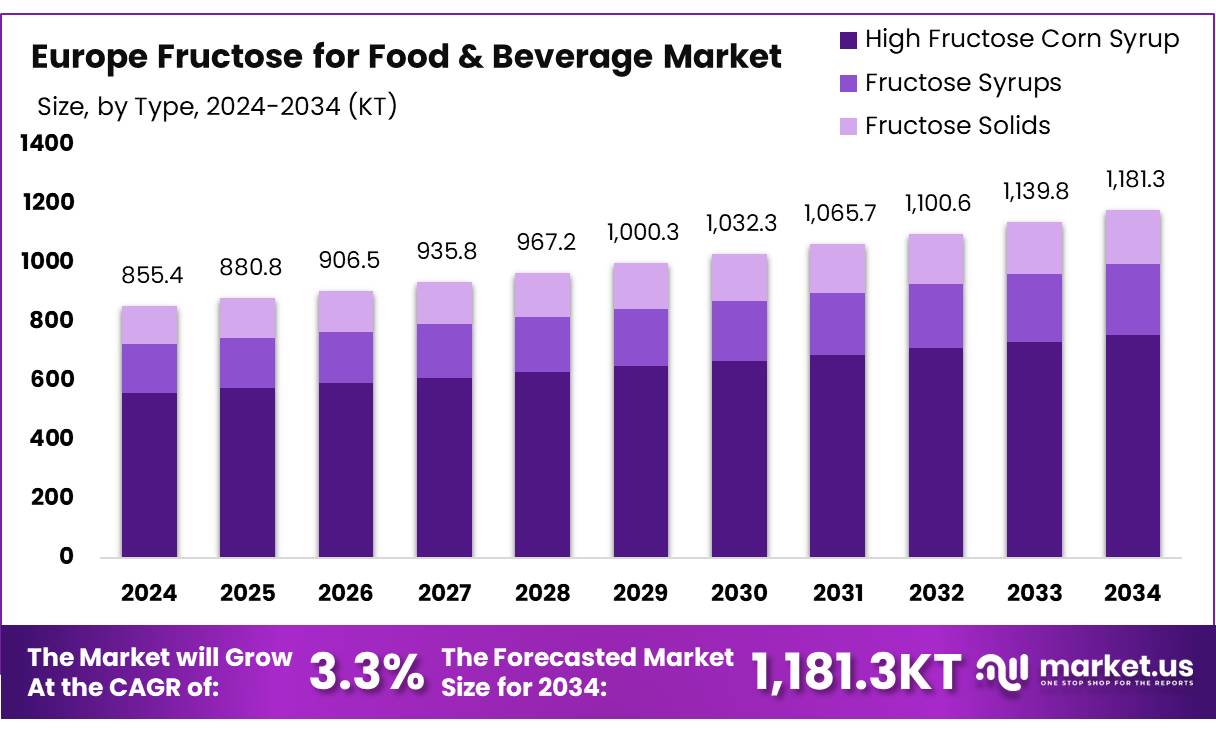

Europe Fructose for Food And Beverage Market size is expected to be worth around 1,181.3 KT by 2034, from 855.4 KT in 2024, growing at a CAGR of 3.3% during the forecast period from 2025 to 2034.

Fructose is a simple sugar (monosaccharide) found naturally in fruits, vegetables, and honey. It is one of the key sugars that make up sucrose (table sugar) alongside glucose. Fructose is sweeter than glucose and is often used as a sweetener in food and beverages, especially in processed products. It can be derived from corn (high fructose corn syrup, or HFCS) or extracted directly from fruits. Its high sweetness level allows manufacturers to use smaller amounts of it, which reduces overall caloric content.

Fructose is widely used in products such as soft drinks, fruit juices, confectioneries, and baked goods. The European fructose market for the food and beverage industry has seen a steady rise, driven by increased demand for low-calorie sweeteners, health-conscious consumers, and rising concerns over sugar consumption.

With the growing awareness about the negative health impacts of excess sugar intake, including obesity and diabetes, there is a significant shift towards healthier alternatives like fructose and high-fructose corn syrup (HFCS). However, regulatory pressure and health concerns about HFCS have led to some caution in its use. Despite this, fructose is still widely employed in dietary products, beverages, and confectioneries across Europe, with a growing market for sugar-free or low-calorie alternatives. As demand for sugar substitutes increases, fructose remains a key player in the evolving European food and beverage landscape.

Key Takeaways

- The Europe Fructose for Food & Beverage Market was valued at 855.4 KT in 2024.

- The Europe Fructose for Food & Beverage Market is projected to reach 1,181.3 KT by 2034.

- Among product types of fructose for food & beverages, the high fructose corn syrup type held the majority of the revenue share at 65.4%.

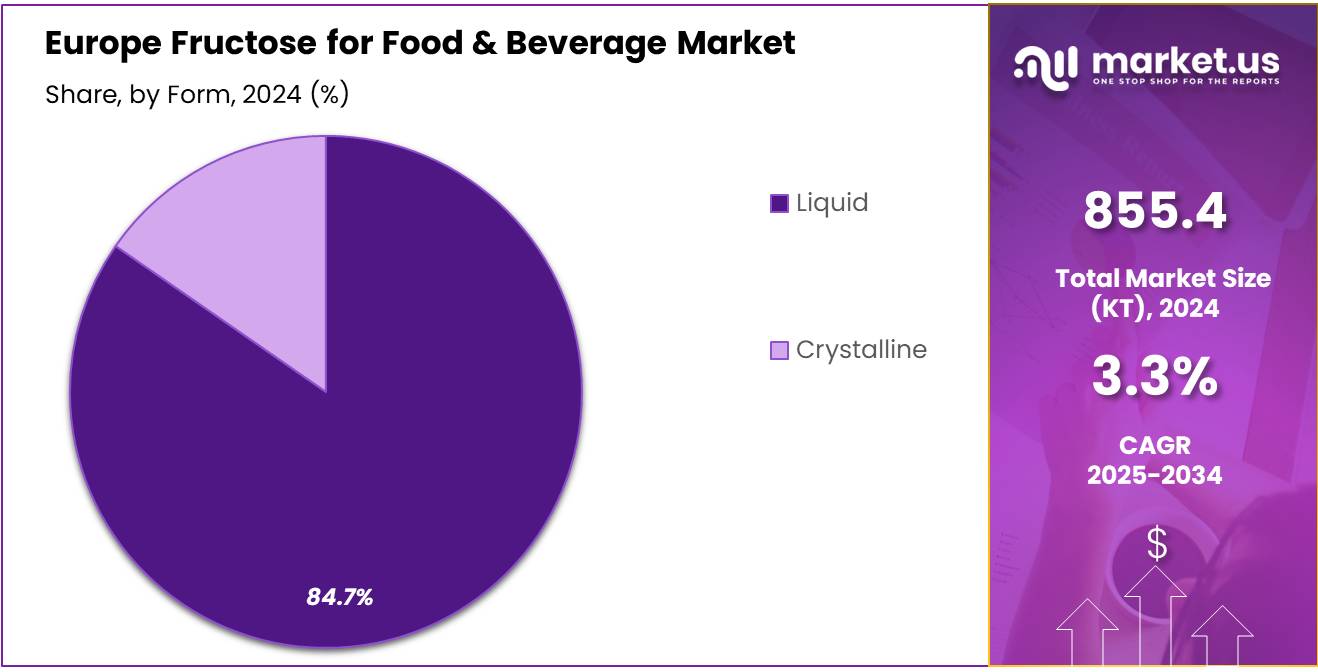

- Based on form, liquid fructose accounted for the largest market share with 84.7%.

- Among sources, corn accounted for the majority of the Fructose for Food & Beverage market share with 3%.

- By end-use, fructose is majorly use in beverage products with a market share of 6%.

- Among countries, France held the major market share of 21.2% as of 2024.

Product Type Analysis

High Fructose Corn Syrup (HFCS) Held The Major Share Owing To Its Wide Applications

European fructose for food & beverage market is segmented based on type into high fructose corn syrup, fructose syrups, and fructose solids. Among these, the high fructose corn syrup type held the majority of revenue share in 2024, with a market share of 65.4%, primarily due to its cost-effectiveness, wide applications, and functional advantages. HFCS is a cheaper alternative to sucrose and other fructose types, making it highly preferred by food and beverage manufacturers. Its liquid form allows for easier handling and blending in large-scale production, unlike fructose solids.

Additionally, HFCS provides better moisture retention, prevents crystallization, and extends shelf life, making it a key ingredient in carbonated beverages, fruit juices, baked goods, dairy products, and confectionery. The high supply of corn-based sweeteners further supports its dominance, as many food producers opt for cost-efficient, scalable ingredients.

Moreover, HFCS exhibits better stability compared to traditional sugar, ensuring consistency in taste and texture for mass-produced goods. While other fructose types, such as fructose syrups and solids, are growing in niche segments, HFCS remains the preferred choice for large-scale food and beverage production. Its versatility, affordability, and processing benefits solidify its market leadership, making it the top contributor to European fructose market revenue in 2024.

Form Analysis

Liquid Fructose Dominated the Europe Fructose for Food & Beverage Market

Based on products, the market is segmented into liquid and crystalline. Among these products, liquid Fructose accounted for the majority of the market share with 84.7%. Its widespread use is driven by its versatility, ease of handling, and superior solubility compared to crystalline fructose. Liquid fructose is highly preferred in industries such as beverages, dairy, confectionery, and bakery due to its ability to blend seamlessly with other ingredients, ensuring a consistent sweetness profile without crystallization issues. Manufacturers favor liquid fructose for its cost-effectiveness and efficiency in large-scale food processing, as it eliminates the need for additional dissolving steps required for crystalline fructose.

Additionally, liquid fructose provides better moisture retention, making it ideal for products requiring a longer shelf life and enhanced texture. Despite the presence of crystalline fructose in niche applications, the demand for liquid fructose remains dominant, reinforcing its position as the leading product segment in the European fructose market.

Source Analysis

Owing to The Cost Efficiency Of Corn Based Fructose, It Has Dominated The Europe’s Market

The fructose for food & beverage market in Europe was further categorized based on sources such as corn, sugarcane, sugar beet, fruits, wheat & others. Among these, corn accounted for the largest market share of 72.3% as of 2024. The dominance of corn-based fructose is primarily due to its cost efficiency, high availability, and large-scale industrial production. Corn-derived fructose, particularly high fructose corn syrup (HFCS), is widely used in beverages, confectionery, dairy, and baked goods due to its stable sweetness, easy blending, and extended shelf life.

The efficient processing and high yield of fructose from corn make it the preferred raw material for manufacturers seeking a reliable and scalable sweetener source. Additionally, corn-based fructose is more economically viable compared to sugarcane or fruit-derived alternatives, which are often subject to higher costs and supply constraints. While sugarcane, sugar beet, and fruit-based fructose cater to niche markets, corn remains the primary choice for large-scale food and beverage production, reinforcing its leading position in the European market.

End-Use Analysis

Owing to The Cost Efficiency Of Corn Based Fructose, It Has Dominated The Europe’s Market

Based on end-use the fructose for food & beverage market in Europe was further classified as bakery, confectionery, dairy products, beverages, breakfast cereals, processed foods & others. Among these, beverages accounted for the major market share of 63.6% as of 2024 due to the increasing demand for natural and low-calorie sweeteners in the food and beverage industry. With a growing consumer shift toward health-conscious diets and reduced sugar intake, beverage manufacturers have widely adopted fructose as a substitute for artificial sweeteners and high-calorie sugars. The rising popularity of functional drinks, energy drinks, flavored water, and fruit-based beverages has further fueled this demand.

Additionally, fructose’s higher sweetness level compared to sucrose allows beverage manufacturers to use smaller quantities, reducing calorie content while maintaining taste. The European market’s strict regulations on sugar consumption and government efforts to reduce obesity and diabetes rates have also contributed to increased fructose use in soft drinks, sports drinks, and natural juices. Furthermore, the expansion of ready-to-drink beverages and innovations in plant-based and organic drinks have solidified fructose’s dominance in the beverage segment.

Key Market Segments

By Product Type

- High Fructose Corn Syrup

- HFCS 42

- HFCS 55

- Others

- Fructose Syrups

- Fructose F10

- Fructose F20

- Others

- Fructose Solids

By Form

- Liquid

- Crystalline

By Source

- Corn

- Sugarcane

- Sugar Beet

- Fruits

- Wheat

- Others

By End-Use

- Bakery

- Confectionery

- Dairy Products

- Beverages

- Breakfast Cereals

- Processed Foods

- Others

Drivers

Increasing Demand for Health-Conscious and Low-Sugar Products Is Anticipated to Boost Europe’s Market Growth

As awareness around the negative health impacts of excessive sugar consumption rises, particularly in relation to obesity, diabetes, and other chronic conditions, consumers are becoming more selective in their dietary choices. This shift in consumer behavior has led to an increased demand for healthier alternatives, including low-calorie, low-sugar, and naturally sweetened products.

Fructose, particularly in the form of high fructose corn syrup (HFCS), fructose syrups, and fructose solids, offers a more efficient sweetening solution that delivers similar or higher sweetness levels than traditional sucrose while reducing overall calorie content in products. This demand for healthier products has prompted food and beverage manufacturers to explore and implement alternative sweeteners that provide the desired taste and texture without the negative effects of added sugars.

Fructose is seen as an attractive option in this context due to its higher sweetness intensity compared to glucose or sucrose, which means less sweetener is needed to achieve the same level of sweetness. This allows companies to reduce the total amount of sugar in their products, making them more appealing to health-conscious consumers and those adhering to low-sugar diets.

Restraints

Health Concerns and Regulatory Scrutiny May Hinder Market Growth to A Certain Extent

Fructose, particularly in the form of high fructose corn syrup (HFCS), has been the subject of extensive research due to its potential adverse health effects. Excessive consumption of fructose has been linked to liver fat accumulation, insulin resistance, increased risk of metabolic syndrome, and other health issues such as obesity and cardiovascular diseases.

These concerns have led to a negative public perception of fructose, especially in comparison to natural sweeteners like honey or stevia, which are marketed as healthier alternatives. The mounting health concerns have prompted governments and health organizations to increase their focus on regulating the use of fructose, particularly in processed foods and sugary drinks.

In European Union (EU) countries, sugar taxes and strict labeling requirements are becoming more common, with many countries enacting sugar-related taxes on soft drinks and sugary products. These regulations are partly aimed at reducing the excessive consumption of added sugars, including fructose, and addressing the growing rates of obesity and diabetes in the population. As a result, food manufacturers are facing pressure to reduce the use of fructose-based sweeteners in their products, which may limit growth opportunities for the fructose market.

Opportunity

Growth of the Plant-Based and Clean Label Trend Will Create Lucrative Opportunities in the Market

Consumers are increasingly seeking out products that are not only healthy but also sustainably sourced and transparent in terms of ingredients. This has led to the rise of plant-based alternatives in categories such as dairy, meat substitutes, and snacks. These products often use alternative sweeteners, including fructose, as part of their ingredient formulations to achieve the desired taste profile without compromising on health or sustainability. The rise of plant-based eating habits aligns well with the use of fructose from sources such as fruits, sugar beets, and corn, making it a key ingredient in natural, vegan, and organic products.

The clean label movement, which emphasizes minimal, recognizable ingredients and transparency in product labeling, also presents a significant opportunity for fructose. As consumers demand simpler, more transparent ingredient lists, food manufacturers are focusing on removing artificial sweeteners and preservatives from their products. Fructose, derived from natural plant sources, fits well within this framework, providing manufacturers with an opportunity to market their products as natural and clean while still offering the desired sweetness and functional benefits. Additionally, since fructose can be derived from various plant-based sources, it allows manufacturers to cater to the increasing consumer demand for products that are both plant-derived and free from synthetic additives.

Trends

Enhanced Production Processes and Sustainability Initiatives Influencing the Market

In response to sustainability concerns, several fructose manufacturers are investing in advanced production technologies aimed at reducing the environmental impact of fructose manufacturing. These advancements include the adoption of eco-friendly methods that reduce energy consumption and water usage during fructose extraction.

Companies are also focusing on reducing waste by implementing circular economy practices, such as utilizing by-products from fructose production in other industries, including bioplastics and animal feed. Furthermore, some manufacturers are working to improve the efficiency of fructose production through enzymatic processing and fermentation techniques, which not only reduce costs but also make the process more sustainable.

Geopolitical Impact Analysis

Geopolitical Tensions Have Had A Significant Impact On The Growth Of The Fructose For Food & Beverage Market In Europe, Primarily Through Disruptions In Supply Chains, Trade Policies, And Price Volatility.

Geopolitical tensions, such as trade disputes or conflicts between major powers, have led to disruptions in the global supply chain, particularly in regions where key fructose ingredients like corn, sugar beets, and fruits are produced. The imposition of trade tariffs, export restrictions, or sanctions on countries that supply these raw materials has caused delays and cost increases.

These disruptions impact the cost-effectiveness of fructose production, leading manufacturers to seek alternative suppliers or invest in local sourcing, which can result in higher prices for finished products. The Russia-Ukraine conflict has disrupted global supply chains, affecting the availability of key agricultural inputs. Both countries are major exporters of crops like wheat, barley, and sunflower oil, which are essential for food production. This has led to inflation in food prices and increased costs for raw materials used in fructose production, indirectly impacting the market.

Tariffs and trade restrictions due to geopolitical conflicts between the European Union and other regions, particularly the U.S. and Asia, have made it more challenging for manufacturers to import raw materials at competitive prices. This results in higher operational costs for fructose producers, pushing the price of fructose-based products upward, which may lead to reduced consumer demand or a shift to alternative sweeteners.

Ongoing geopolitical issues contribute to economic instability, which directly affects consumer spending power and preferences. Economic downturns or uncertainty can lead consumers to become more price-sensitive, impacting the demand for premium or healthier fructose-sweetened products. In such environments, cost-effective and sugar substitutes are often preferred, limiting the growth of fructose-based products.

- The European food and beverage sector has seen fluctuations in M&A activity. For instance, deal volumes fell by 30% in the first half of 2023 due to economic challenges, but there has been a rise in deal activity in the UK food and beverage sector more recently.

Key Countries Covered

- Europe

- Germany

- K.

- France

- Spain

- Italy

- Russia & CIS

- Rest of Europe

Key Players Analysis

Market Players In The European Fructose For Food & Beverage Industry Are Adopting Several Key Strategies To Stay Competitive

Market players in the European fructose for food & beverage industry are adopting a wide range of strategies, from product innovation and sustainability efforts to expansion into new markets and strategic partnerships, in order to stay competitive. By focusing on health-conscious trends, regulatory compliance, e-commerce growth, and cost optimization, companies are positioning themselves for future growth in an evolving market. These strategies enable fructose producers to address emerging consumer preferences, comply with regulatory changes, and remain resilient in a competitive landscape.

Market Key Players

The European fructose for food & beverage market is highly competitive, with Cargill, Tate & Lyle, Ingredion, Südzucker, and Roquette Frères being some of the leading manufacturers in the region. These companies focus on providing a range of fructose products, including HFCS, fructose syrups, and fructose solids, to meet the demand for healthier, low-calorie, and sustainable alternatives to traditional sweeteners. As consumer preferences continue to evolve toward healthier and cleaner options, these manufacturers are investing in product innovation, sustainability, and strategic partnerships to maintain their positions in the market.

The following are some of the major players in the industry

- Tate & Lyle

- Cargill, Inc.

- Ingredion Incorporated

- Südzucker Group

- Roquette Frères

- Foodchem International Corporation

- Azelis

- Emsland Group

- Eurosweet GmbH

- Airedale Group

- Agrana Group

- Galam Ltd

- Hamburg Fructose Gmbh International

- Other Key Players

Recent Development

July 07, 2020: Cargill Inc. indeed launched CTruSweet® 01795, a 95% pure fructose syrup, as part of their sweetener portfolio. This innovative product is designed to enable a 30% reduction in sugar and calorie content in beverages and other food applications through lower usage levels.

August 19, 2022: Cargill announced a $50 million investment to build a state-of-the-art corn syrup refinery in Fort Dodge, Iowa. This facility aims to meet the growing global demand for corn syrup, which is widely used in products such as infant formula, confections, baked goods, and beverages due to its functional benefits like solubility and crystallization resistance. The refinery will employ energy-efficient technologies and leverage the MidAmerican Energy electrical grid, which is powered by over 88% renewable energy sources. These measures are expected to reduce CO2 emissions by nearly 50% compared to conventional production methods.

Report Scope

Report Features Description Market Volume (2024) 855.4 KT Forecast Revenue (2034) 1,181.3 KT CAGR (2024-2033) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (High Fructose Corn Syrup, Fructose Syrups, and Fructose Solids), By Form (Liquid, and Crystalline), By Source (Corn, Sugarcane, Sugar Beet, Fruits, Wheat, and Others) By End-use (Bakery, Confectionery, Dairy Products, Beverages, Breakfast Cereals, Processed Foods, and Others) Country Analysis Europe – Germany, France, U.K., Italy, Spain, Russia & CIS, Denmark, Sweden, Norway, Finland, and Rest of Europe Competitive Landscape Tate & Lyle, Cargill, Inc., Ingredion Incorporated, Südzucker Group, Roquette Frères, Foodchem International Corporation, Azelis, Emsland Group, Eurosweet GmbH, Airedale Group, Agrana Group, Galam Ltd, Hamburg Fructose Gmbh International & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)  Europe Fructose for Food And Beverage MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Fructose for Food And Beverage MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tate & Lyle

- Cargill, Inc.

- Ingredion Incorporated

- Südzucker Group

- Roquette Frères

- Foodchem International Corporation

- Azelis

- Emsland Group

- Eurosweet GmbH

- Airedale Group

- Agrana Group

- Galam Ltd

- Hamburg Fructose Gmbh International

- Other Key Players