Global Essential Oils Market Size, Share Analysis Report By Type (Citrus, Eucalyptus, Lavender, Rosemary, Tea Tree, Peppermint, Others), By Application (Personal Care and Cosmetics, Food and Beverages, Spa and Relaxation, Pharmaceuticals and Medicinal Formulations, Others), By Distribution Channel (Retail Distribution, Direct Distribution, MLM Distribution) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153985

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

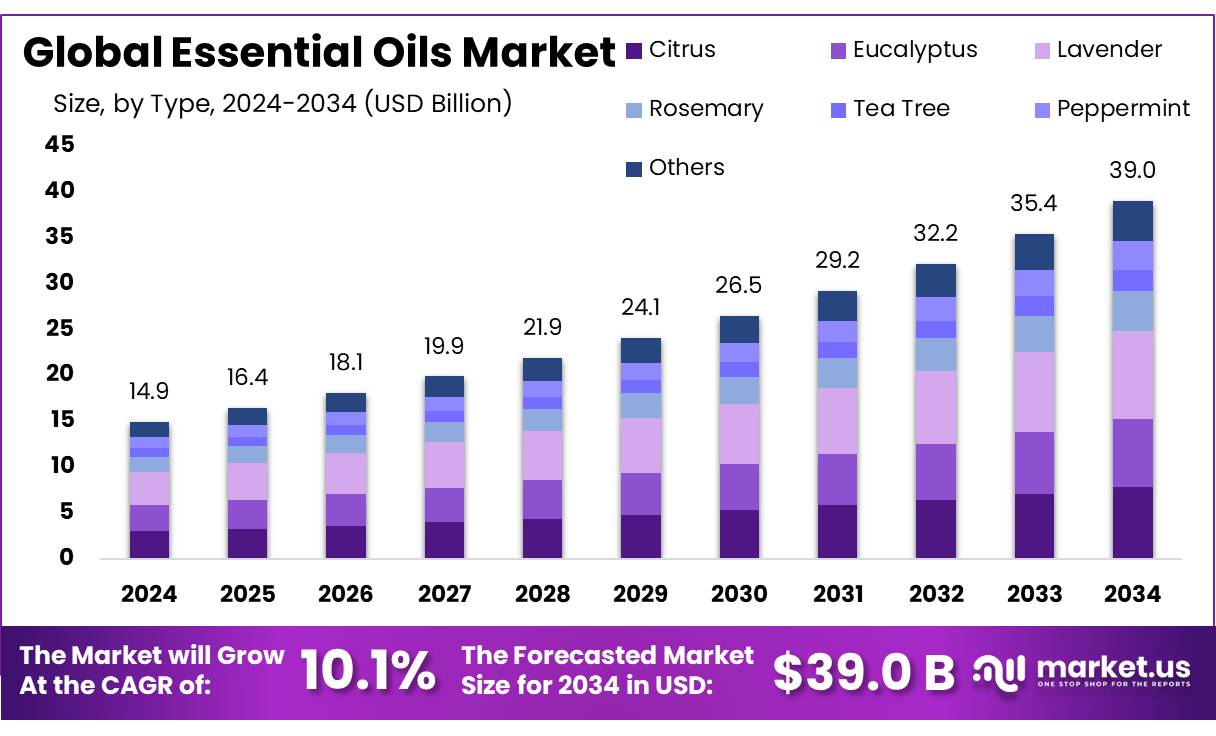

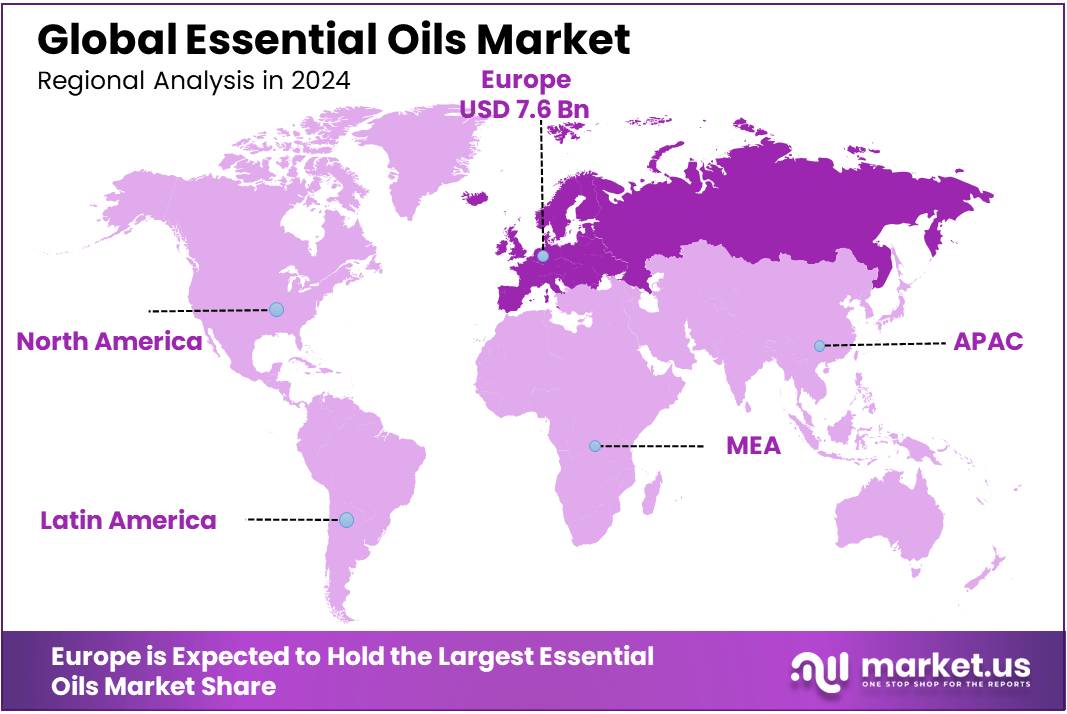

The Global Essential Oils Market size is expected to be worth around USD 39.0 Billion by 2034, from USD 14.9 Billion in 2024, growing at a CAGR of 10.1% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 51.6% share, holding USD 7.6 billion in revenue.

The essential oils concentrates industry plays a vital role in the global natural products sector, encompassing a diverse array of applications from aromatherapy and cosmetics to food flavoring and pharmaceuticals. These concentrated oils are extracted from various plant parts, including flowers, leaves, bark, and seeds, through processes like steam distillation and cold pressing. The industry has witnessed significant growth due to the increasing consumer preference for natural and organic products, as well as the expanding wellness and personal care markets.

The Food and Agriculture Organization (FAO) has reported that the vegetable oil price index averaged 155.7 points in June 2025, up 2.3% from the previous month and 18.2% above its June 2024 level. This increase is attributed to higher prices for palm, rapeseed, and soy oil, which are key feedstocks for essential oil production. Such price fluctuations can impact the cost structure of essential oils, influencing market dynamics.

In 2023, the U.S. Census Bureau reported that Florida’s essential oils exports amounted to $286.8 million, underscoring the state’s prominence in the global essential oils market. This figure reflects the state’s robust production capabilities and its strategic position in the international trade of essential oils.

Government initiatives have also played a crucial role in supporting the growth of the essential oils industry. For instance, Bulgaria’s Ministry of Agriculture published its National Action Plan for the Development of Organic Production for 2020–2027, aiming to enhance the country’s organic farming sector, which includes the cultivation of aromatic plants for essential oil production.

In the United States, legislation such as the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act has facilitated over USD 600 billion in clean energy and manufacturing investments since 2021. These investments contribute to the development of sustainable production practices and infrastructure within the essential oils sector.

Key Takeaways

- Essential Oils Market size is expected to be worth around USD 39.0 Billion by 2034, from USD 14.9 Billion in 2024, growing at a CAGR of 10.1%.

- Lavender held a dominant market position, capturing more than a 24.8% share in the global essential oils market.

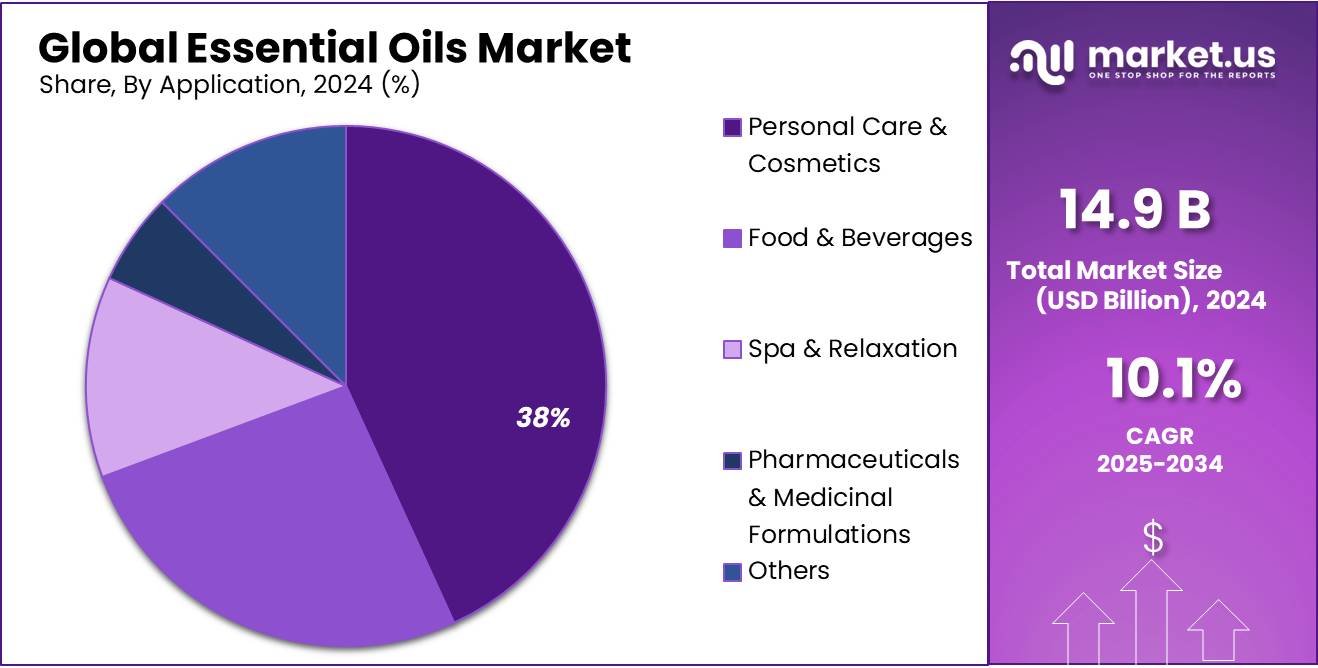

- Personal Care & Cosmetics held a dominant market position, capturing more than a 38.1% share in the global essential oils market.

- Retail Distribution held a dominant market position, capturing more than a 56.2% share in the global essential oils market.

- Europe emerged as the leading region in the global essential oils market, holding a dominant 51.6% share, which translated to a market value of approximately USD 7.6 billion.

By Type Analysis

Lavender leads with 24.8% market share due to its wide usage in aromatherapy and cosmetics.

In 2024, Lavender held a dominant market position, capturing more than a 24.8% share in the global essential oils market. This leading position was mainly supported by its strong presence across aromatherapy, skincare, and personal care applications. The calming and anti-inflammatory properties of lavender oil made it a preferred choice for stress relief, sleep aids, and skin care solutions.

Its wide acceptability among consumers and versatility in formulations further strengthened its demand. The year 2025 is expected to witness steady growth in lavender oil consumption, particularly as wellness and natural product trends continue to expand globally. Increased use in spa treatments, cosmetic formulations, and household air-freshening products is likely to contribute to its sustained dominance.

By Application Analysis

Personal Care & Cosmetics dominates with 38.1% share driven by demand for natural products.

In 2024, Personal Care & Cosmetics held a dominant market position, capturing more than a 38.1% share in the global essential oils market. This strong share was mainly due to the rising consumer shift towards clean-label and plant-based beauty products. Essential oils such as lavender, tea tree, and rose are widely used in skincare, haircare, and fragrances for their natural benefits and pleasant aroma.

Companies are increasingly replacing synthetic ingredients with essential oils to meet growing consumer demand for safer and eco-friendly formulations. The segment is expected to continue its growth in 2025, supported by product innovation and expanding demand across emerging markets. Additionally, the rising popularity of DIY beauty routines and premium wellness brands using essential oils in cosmetics is further contributing to this segment’s dominance.

By Distribution Channel Analysis

Retail Distribution leads with 56.2% share due to easy availability across offline stores.

In 2024, Retail Distribution held a dominant market position, capturing more than a 56.2% share in the global essential oils market. This strong presence was mainly supported by the wide reach of supermarkets, health stores, pharmacies, and specialty shops that offer essential oils directly to consumers. Retail outlets allow buyers to physically inspect products, read labels, and choose from a variety of brands, which adds to their convenience and trust.

Many consumers still prefer purchasing essential oils through retail channels, especially for personal care or home use, as it gives them confidence in authenticity and quality. In 2025, retail distribution is expected to maintain its lead, supported by increasing shelf space for wellness products and rising demand in urban and semi-urban regions. The continued expansion of organized retail, along with product demonstrations and in-store promotions, is likely to keep this segment at the forefront.

Key Market Segments

By Type

- Citrus

- Orange

- Lemon

- Grapefruit

- Lime

- Others

- Eucalyptus

- Lavender

- Rosemary

- Tea Tree

- Peppermint

- Others

By Application

- Personal Care & Cosmetics

- Food & Beverages

- Spa & Relaxation

- Pharmaceuticals & Medicinal Formulations

- Others

By Distribution Channel

- Retail Distribution

- Direct Distribution

- MLM Distribution

Emerging Trends

Rise of Functional Fragrances in Wellness

A notable trend in the essential oils market is the increasing demand for functional fragrances—scents designed not only for their aroma but also for their potential to enhance mood, reduce stress, and improve mental clarity. This shift reflects a broader consumer interest in products that contribute to overall well-being.

According to a 2025 report by Vogue Business, emerging brands like Moods, Vyrao, and Edeniste are leading this movement by integrating neuroscience with natural essential oils to create mood-enhancing scents. Established beauty houses, including Estée Lauder, Coty, and Puig, are also embracing this shift amidst slowing fragrance growth, launching science-based functional scents promoting emotional and mental well-being.

This trend is supported by consumer research indicating that 78% of UK consumers believe fragrances can improve mental well-being, and they expect brands to incorporate mood-boosting properties into their products. The growing focus on wellness and self-care is driving the development of essential oil-based products that offer more than just fragrance, aligning with the increasing consumer preference for natural and organic ingredients.

In response to this demand, companies are innovating by blending traditional aromatherapy with modern science to create products that not only smell pleasant but also provide tangible benefits for mental and emotional health. This convergence of fragrance and wellness is expected to continue shaping the essential oils market in the coming years.

Drivers

Consumer Demand for Natural Wellness Products

A significant driving force behind the growth of the essential oils concentrates industry is the increasing consumer preference for natural and holistic wellness products. As individuals become more health-conscious, there’s a noticeable shift towards products that are perceived as safer and more beneficial for overall well-being. This trend is particularly evident in the food and beverage sector, where essential oils are utilized not only for their aromatic properties but also for their potential health benefits.

In 2023, Florida’s essential oils exports were valued at approximately USD 286.8 million, marking a 5.3% increase from the previous year and a 65.8% rise since 2014. This growth underscores the expanding global demand for essential oils, driven by consumers seeking natural alternatives in various products.

Supporting this demand, the Food and Agriculture Organization (FAO) reported that the vegetable oil price index averaged 155.7 points in June 2025, up 2.3% from the previous month and 18.2% above its June 2024 level. This increase reflects higher prices for palm, rapeseed, and soy oil, key ingredients in the production of essential oils. The rising prices indicate a robust market for these oils, influenced by both consumer demand and production costs.

To further bolster the industry, governments are implementing initiatives to support sustainable agriculture and the production of natural products. For instance, the United States has introduced policies under the Bipartisan Infrastructure Law and the Inflation Reduction Act, aiming to promote clean energy and sustainable practices in various sectors, including agriculture. These policies create a conducive environment for the growth of the essential oils industry by encouraging sustainable farming practices and reducing the carbon footprint of production processes.

Restraints

Supply Chain Vulnerabilities

The essential oils industry faces significant challenges stemming from supply chain vulnerabilities, which can disrupt production and affect product availability. These vulnerabilities are influenced by factors such as geopolitical tensions, natural disasters, and logistical complexities. For instance, the COVID-19 pandemic led to widespread disruptions in global supply chains, affecting the availability of essential oils. Countries like India, major producers of essential oils, experienced lockdowns that halted production and export activities, leading to shortages and delays in the supply of oils like tea tree and eucalyptus.

Additionally, geopolitical issues, such as trade disputes and tariff implementations, have further strained the supply chain. The United States, for example, imposed tariffs on imports from countries like China and India, which are significant exporters of essential oils. These tariffs have increased costs and created uncertainties in the supply of essential oils, compelling companies to seek alternative sourcing strategies or face higher operational expenses.

Natural disasters and climate change also play a role in disrupting the supply chain. Events like floods, droughts, and wildfires can damage crops and affect the quality and quantity of essential oils produced. For example, the 2019–2020 bushfires in Australia significantly impacted the production of eucalyptus oil, a major export product, leading to reduced supply and increased prices.

To mitigate these supply chain vulnerabilities, companies are adopting strategies such as diversifying their supplier base, investing in local sourcing, and enhancing inventory management systems. These measures aim to create more resilient supply chains that can withstand external shocks and ensure a steady supply of essential oils to meet market demand.

Opportunity

Government Support for Essential Oils Industry

The essential oils industry is experiencing significant growth, driven by increasing consumer demand for natural products and supported by various government initiatives. In the United States, the Department of Agriculture (USDA) has awarded approximately $40.5 million in grants to support the processing and promotion of domestic organic products, including essential oils. These projects aim to enhance infrastructure, improve processing capacity, and explore emerging technologies to promote organic products, benefiting over 27,000 producers and more than 31.8 million consumers.

Additionally, the USDA’s BioPreferred Program plays a crucial role in promoting biobased products, including essential oils. This program facilitates the development and expansion of markets for biobased products through certification and labeling, creating a market for these products through government-wide purchasing requirements. In 2022, more than 1,100 new products received certification under this program, indicating a growing recognition of biobased products in the market.

This growth is driven by demand in food and beverages, spa and relaxation industries, and other sectors. The Rwandan government is supporting this sector through initiatives aimed at improving productivity, quality management, and market linkages, thereby enhancing the export potential of essential oils.

These government initiatives are instrumental in fostering the growth of the essential oils industry by providing financial support, promoting biobased products, and enhancing market access. As consumer preference for natural products continues to rise, such support will be crucial in meeting the increasing demand and ensuring the sustainable development of the essential oils sector.

Regional Insights

Europe dominates the essential oils market with 51.6% share, valued at USD 7.6 billion.

In 2024, Europe emerged as the leading region in the global essential oils market, holding a dominant 51.6% share, which translated to a market value of approximately USD 7.6 billion. This strong regional position is supported by a mature wellness and personal care industry, a high preference for natural and organic products, and a well-established regulatory framework that ensures product quality and safety.

European countries such as Germany, France, and the United Kingdom are key contributors to the regional market due to their long-standing traditions in aromatherapy, herbal medicine, and premium cosmetics manufacturing. Additionally, the rise in demand for clean-label products and plant-based formulations has led to a surge in the use of essential oils across skincare, cosmetics, and homecare applications.

The region also benefits from a strong distribution infrastructure, including pharmacies, specialty wellness stores, and health-focused retail chains that make essential oils widely accessible to consumers. In 2025, the market in Europe is expected to grow steadily, driven by increasing investments in research and innovation, particularly in the formulation of multifunctional oils used in personal care and therapeutic segments.

Consumer awareness regarding the harmful effects of synthetic ingredients has further pushed the shift toward natural alternatives, reinforcing demand across both Western and Eastern Europe. Furthermore, the growing adoption of essential oils in dietary supplements, aromatherapy devices, and spa treatments is anticipated to sustain Europe’s leading position in the coming years. Overall, the region’s cultural affinity for natural wellness products and a supportive regulatory climate continue to fuel its market leadership.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sydney Essential Oil Co. (SEOC), based in Australia, is a leading manufacturer and exporter of high-quality essential oils and natural ingredients. The company specializes in pure essential oils sourced from local and global growers, with a focus on sustainable practices. SEOC supplies to industries including aromatherapy, personal care, and pharmaceuticals. Its strong presence in Oceania and Asia-Pacific markets, combined with its commitment to organic certification and ethical sourcing, has positioned SEOC as a trusted name in the global essential oils industry.

H. Reynaud & Fils (HRF), a family-owned company based in France, specializes in the production of natural essential oils and aromatic raw materials. With over a century of expertise, HRF supplies to the perfumery, cosmetics, and flavor industries. The company is recognized for its high-grade oils derived from Mediterranean botanicals. HRF’s commitment to artisanal methods, long-term supplier relationships, and regulatory compliance ensures product purity and consistency. It remains a valued supplier in the European and international fragrance markets.

Young Living Essential Oils, headquartered in the United States, is one of the world’s largest and most recognized producers of essential oils. The company manages its own farms globally and promotes a “Seed to Seal” quality commitment. It serves various sectors including wellness, household products, and personal care. Known for its direct selling model, Young Living has built a large consumer base. Its investment in organic farming, education, and global sourcing makes it a dominant player in the essential oils market.

Top Key Players Outlook

- Sydney Essential Oil Co. (SEOC)

- Biolandes SAS

- India Essential Oils

- H. Reynaud & Fils (HRF)

- Young Living Essential Oils

- DoTerra

- Essential Oils of New Zealand

- Farotti S. R. L.

- Flavex Naturextrakte GmbH

- Falcon

- Ungerer Limited

Recent Industry Developments

In 2024 Sydney Essential Oil Co. (SEOC), reached a valuation of USD 171.30 million and is projected to grow at a compound annual growth rate (CAGR) of 7.60% through 2034, indicating a strong and sustained demand for natural wellness products.

In 2024, Biolandes SAS reported an annual revenue of USD 13.6 million, positioning it as a significant player in the global essential oils market.

Report Scope

Report Features Description Market Value (2024) USD 14.9 Bn Forecast Revenue (2034) USD 39.0 Bn CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Citrus, Eucalyptus, Lavender, Rosemary, Tea Tree, Peppermint, Others), By Application (Personal Care and Cosmetics, Food and Beverages, Spa and Relaxation, Pharmaceuticals and Medicinal Formulations, Others), By Distribution Channel (Retail Distribution, Direct Distribution, MLM Distribution) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Sydney Essential Oil Co. (SEOC), Biolandes SAS, India Essential Oils, H. Reynaud & Fils (HRF), Young Living Essential Oils, DoTerra, Essential Oils of New Zealand, Farotti S. R. L., Flavex Naturextrakte GmbH, Falcon, Ungerer Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sydney Essential Oil Co. (SEOC)

- Biolandes SAS

- India Essential Oils

- H. Reynaud & Fils (HRF)

- Young Living Essential Oils

- DoTerra

- Essential Oils of New Zealand

- Farotti S. R. L.

- Flavex Naturextrakte GmbH

- Falcon

- Ungerer Limited