ESR1 Mutated Metastatic Breast Cancer Diagnostics Market By Test Type (NGS Based and PCR Based), By Sample Type (Plasma and Tissue), By End-user (Hospital Associated Labs, Independent Diagnostic Laboratories, Diagnostic Imaging Centers, and Cancer Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165121

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

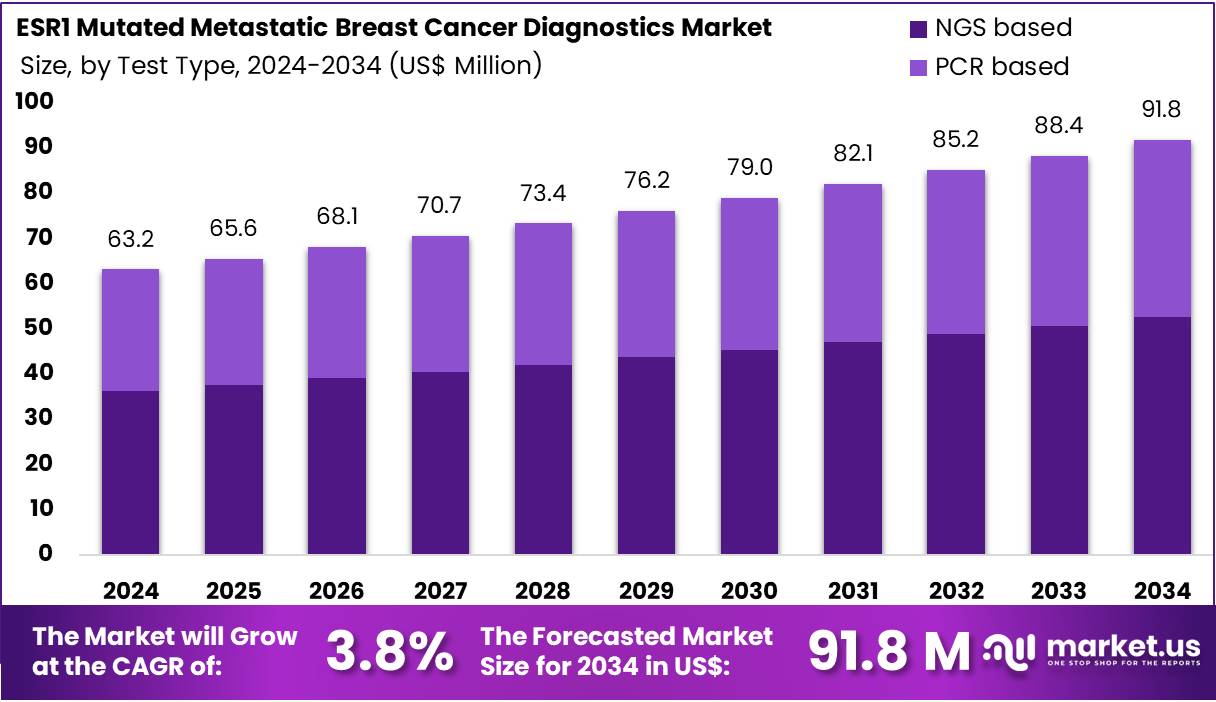

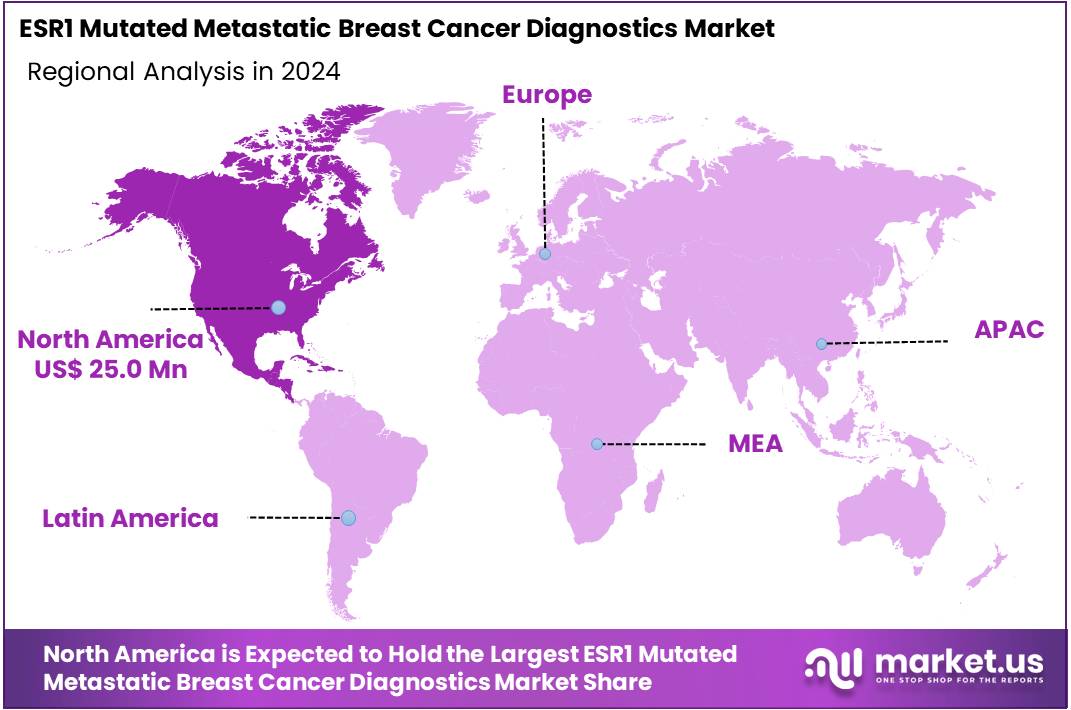

The ESR1 Mutated Metastatic Breast Cancer Diagnostics Market Size is expected to be worth around US$ 91.8 million by 2034 from US$ 63.2 million in 2024, growing at a CAGR of 3.8% during the forecast period 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.5% share and holds US$ 25 Million market value for the year.

Increasing payer recognition drives the ESR1 Mutated Metastatic Breast Cancer Diagnostics Market, as reimbursement policies validate liquid biopsy utility in recurrence monitoring. Oncologists apply ctDNA assays to detect ESR1 mutations in hormone receptor-positive cases, identifying endocrine resistance mechanisms post-aromatase inhibitor therapy. These tests support serial monitoring by tracking mutation dynamics in peripheral blood, guiding switches to fulvestrant or novel SERDs.

Clinical laboratories integrate RaDaR®-like platforms for minimal residual disease assessment, enhancing prognostic stratification. In June 2023, NeoGenomics, Inc. secured nationwide commercial coverage from Blue Shield of California for its RaDaR® assay, boosting reimbursement for ESR1 mutation testing. This milestone accelerates market growth by facilitating broader access to blood-based oncology diagnostics.

Growing pharmaceutical partnerships create opportunities in the ESR1 Mutated Metastatic Breast Cancer Diagnostics Market, as companion diagnostics align testing with targeted therapies. Pathologists employ Guardant360® CDx to profile ESR1 mutations alongside PIK3CA, qualifying patients for elacestrant clinical trials. These assays aid precision oncology by confirming mutation status non-invasively, sparing tissue biopsy in progressive disease.

Research consortia validate liquid biopsy concordance with tissue sequencing, building evidence for regulatory approvals. In December 2022, Guardant Health, Inc. partnered with AstraZeneca to commercialize Guardant360® CDx for ESR1-mutated metastatic breast cancer patients. This collaboration drives market expansion through integrated diagnostic-therapeutic pathways in advanced breast cancer management.

Rising clinical guideline endorsements propel the ESR1 Mutated Metastatic Breast Cancer Diagnostics Market, as professional societies standardize mutation screening protocols. Medical oncologists incorporate routine ESR1 testing via liquid biopsy in ER-positive, HER2-negative progression, optimizing second-line endocrine strategies. These diagnostics support biomarker-driven trials by enriching cohorts with mutation-positive individuals, accelerating drug development.

Automated next-generation sequencing platforms streamline ctDNA analysis in high-volume settings. In May 2023, the American Society of Clinical Oncology updated recommendations to endorse routine ESR1 mutation testing through liquid biopsy. This guideline positions the market for sustained growth by establishing ctDNA assays as standard in metastatic breast cancer care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 63.2 million, with a CAGR of 3.8%, and is expected to reach US$ 91.8 million by the year 2034.

- The test type segment is divided into NGS based and PCR based, with NGS based taking the lead in 2023 with a market share of 57.4%.

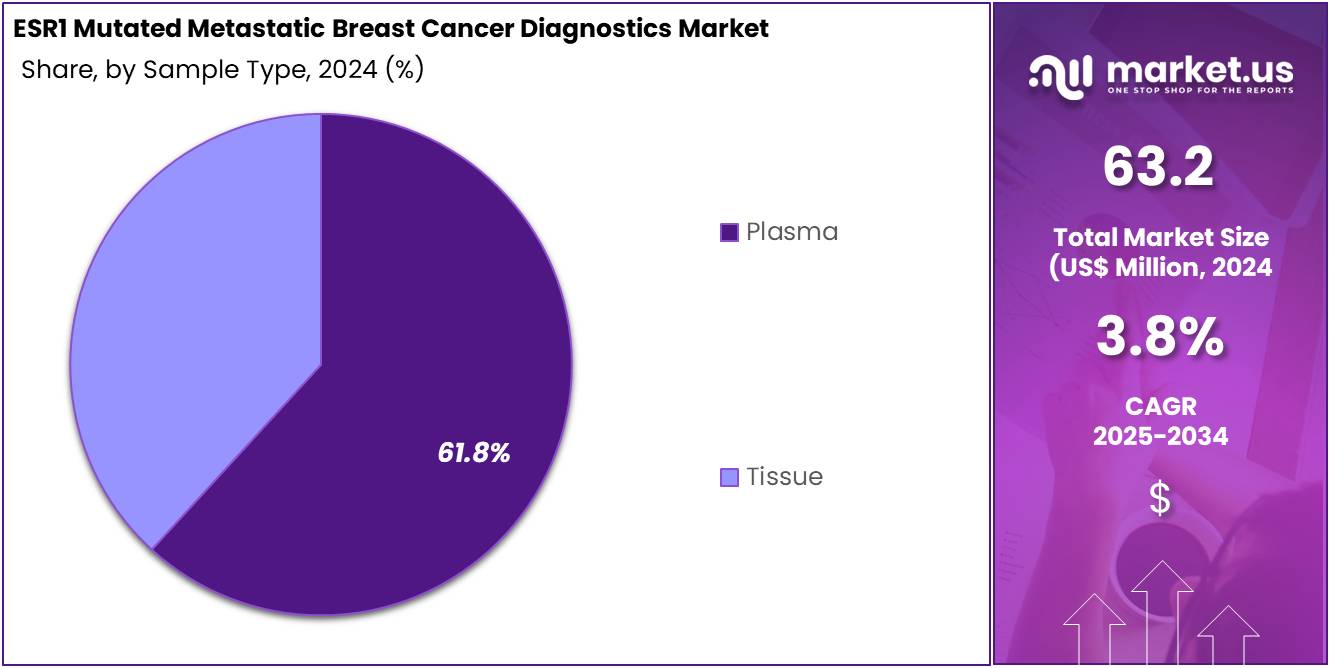

- Considering sample type, the market is divided into plasma and tissue. Among these, plasma held a significant share of 61.8%.

- Furthermore, concerning the end-user segment, the market is segregated into hospital associated labs, independent diagnostic laboratories, diagnostic imaging centers, and cancer research institutes. The hospital associated labs sector stands out as the dominant player, holding the largest revenue share of 48.5% in the market.

- North America led the market by securing a market share of 39.5% in 2024.

Test Type Analysis

NGS-based testing accounts for 57.4% of the ESR1 Mutated Metastatic Breast Cancer Diagnostics market and is anticipated to remain dominant due to its unmatched sensitivity and ability to detect low-frequency mutations in circulating tumor DNA (ctDNA). The demand for NGS-based diagnostics is growing as oncologists increasingly rely on comprehensive genomic profiling to guide targeted endocrine therapies for estrogen receptor-positive metastatic breast cancer. NGS enables simultaneous analysis of multiple mutations including ESR1, PIK3CA, and TP53, supporting precision oncology.

Technological advancements in sequencing platforms have reduced turnaround times and testing costs, expanding accessibility across hospital and commercial labs. Collaborations between pharmaceutical and diagnostic companies for companion diagnostics are driving adoption.

Increasing regulatory approvals of NGS panels for liquid biopsy applications strengthen confidence in clinical utility. Rising global investment in genomic infrastructure enhances implementation in oncology centers. As treatment personalization becomes central to metastatic breast cancer management, NGS-based assays are expected to remain the gold standard for ESR1 mutation detection.

Sample Type Analysis

Plasma accounts for 61.8% of the ESR1 Mutated Metastatic Breast Cancer Diagnostics market and is projected to lead due to its role in enabling non-invasive, real-time tumor profiling through liquid biopsy. Plasma-based testing allows detection of ESR1 mutations from circulating tumor DNA, eliminating the need for invasive tissue biopsies in metastatic patients. The ability to monitor mutation emergence and therapy resistance through serial blood sampling enhances clinical decision-making.

Increasing clinical preference for plasma assays arises from their high patient compliance and rapid sample processing. Continuous advancements in ctDNA isolation and quantification technologies have improved mutation detection sensitivity to below 1%. Large-scale clinical trials validating plasma-based ESR1 testing are accelerating integration into treatment protocols.

Pharmaceutical companies are increasingly using plasma assays for patient stratification in hormone therapy trials. Expanding reimbursement support for liquid biopsy in oncology strengthens adoption. As precision medicine advances toward real-time monitoring of therapeutic response, plasma-based ESR1 mutation testing is anticipated to remain at the forefront of metastatic breast cancer diagnostics.

End-User Analysis

Hospital associated labs hold 48.5% of the ESR1 Mutated Metastatic Breast Cancer Diagnostics market and are expected to continue dominating due to their access to large patient populations and advanced molecular testing infrastructure. These labs serve as the primary hubs for genomic profiling of metastatic breast cancer, integrating diagnostics directly into clinical workflows. The adoption of NGS-based liquid biopsy assays within hospital networks facilitates rapid mutation detection and therapy optimization.

Hospitals benefit from multidisciplinary oncology teams that incorporate molecular results into treatment planning. Increasing installation of automated sequencing platforms in tertiary care centers enhances testing throughput and reliability. Strategic collaborations between hospitals and diagnostic technology providers enable development of in-house ESR1 testing capabilities. Continuous training of oncologists and molecular pathologists promotes adoption of advanced mutation assays.

Government and institutional funding for cancer genomics programs support hospital laboratory modernization. The growing trend toward integrated molecular oncology services positions hospital-associated laboratories as the cornerstone of ESR1 mutation testing and patient-specific treatment management globally.

Key Market Segments

By Test Type

- NGS Based

- PCR Based

By Sample Type

- Plasma

- Tissue

By End-user

- Hospital Associated Labs

- Independent Diagnostic Laboratories

- Diagnostic Imaging Centers

- Cancer Research Institutes

Drivers

Rising Prevalence of ESR1 Mutations in Advanced Breast Cancer is Driving the Market

The steady increase in ESR1 mutations among patients with hormone receptor-positive metastatic breast cancer has substantially expanded the ESR1 mutated metastatic breast cancer diagnostics market, as these assays are essential for detecting estrogen receptor alterations that confer resistance to endocrine therapies.

ESR1 diagnostics, typically through next-generation sequencing of circulating tumor DNA, identify Y537S and D538G hotspots, enabling switches to selective estrogen receptor degraders for prolonged disease control. This driver is particularly evident in later-line settings, where acquired ESR1 mutations emerge under selective pressure from aromatase inhibitors, prompting routine liquid biopsy monitoring.

Oncologists are incorporating these tests into post-progression workflows, stratifying patients for clinical trials and personalized regimens. The mutation’s association with poor prognosis underscores the need for sensitive detection to optimize sequence of therapies. Health authorities endorse their role in overcoming resistance, subsidizing lab capacities for broader implementation.

Up to 40% of patients with hormone receptor-positive, HER2-negative advanced or metastatic breast cancer harbor ESR1 mutations after endocrine therapy, based on 2024 analyses. This prevalence emphasizes the diagnostic necessity, as tests facilitate timely therapeutic pivots. Improvements in ultra-deep sequencing enhance variant allele fraction detection, suiting low-shedding tumors.

Economically, their use averts ineffective treatments, justifying investments in companion diagnostic endorsements. International consortia standardize reporting thresholds, ensuring comparable results across jurisdictions. This mutation rise not only heightens assay volumes but also solidifies diagnostics’ integration in metastatic management. Overall, it catalyzes advancements in multiplex panels, aligning evaluations with resistance mitigation strategies.

Restraints

Challenges in Accessible and Cost-Effective Testing is Restraining the Market

The difficulties in achieving widespread and affordable ESR1 mutation testing in metastatic breast cancer continue to hinder market growth, as infrastructure limitations and pricing constraints limit adoption in community oncology practices. These diagnostics, reliant on sophisticated sequencing, demand specialized facilities and bioinformatics support, often inaccessible in rural or underfunded settings. This restraint perpetuates reliance on tissue biopsies, delaying results and increasing procedural risks for patients.

Payer hesitancy, demanding robust cost-effectiveness evidence, fragments coverage, with Medicare’s local determinations varying by region and imposing strict clinical utility criteria. Developers face extended validation trials, diverting resources from scalability to regulatory compliance. The consequence upholds diagnostic delays, exacerbating resistance progression and therapeutic inequities.

Application of ESR1 tests in clinical practice presents challenges due to the need for lower costs and shorter turnaround times, as noted in 2024 reviews. These challenges highlight systemic bottlenecks, as affordability thresholds restrict broad integration. Clinician preferences for established methods marginalize liquid biopsy innovations.

Efforts for streamlined validations progress gradually, impeded by outcome heterogeneity. These accessibility issues not only constrain deployment but also undermine the market’s transformative potential. Consequently, they necessitate collaborative infrastructure to balance innovation with practical deployment.

Opportunities

Prospects in Liquid Biopsy for ESR1 Detection is Creating Growth Opportunities

The advent of liquid biopsy technologies has unlocked significant expansion avenues for the ESR1 mutated metastatic breast cancer diagnostics market, providing dynamic tracking of mutation emergence through serial plasma sampling. Liquid biopsies capture circulating tumor DNA harboring ESR1 variants, enabling real-time resistance assessment without invasive tissue procurement. Opportunities proliferate in companion diagnostic developments, where liquid platforms stratify patients for oral selective estrogen receptor degraders.

Pharmaceutical partnerships subsidize validations for ultra-sensitive detection, addressing low variant fractions in early relapse. This serial capability counters snapshot limitations of tissue tests, positioning liquid biopsy as enabler of adaptive therapy. Fiscal incentives for biomarker-driven trials accelerate endorsements, diversifying toward integrated genomic workflows.

The PADA-1 study demonstrated that liquid biopsy detected ESR1 mutations in 19% of patients with advanced breast cancer, supporting therapeutic switches in 2023. This finding exemplifies replicable frameworks, with extensions projecting heightened reagent demands in surveillance.

Innovations in hybrid capture enrichment improve limit of detection, broadening utility in minimal disease states. As tele-oncology matures, liquid biopsy outputs unlock remote consultation revenues. These biopsy opportunities not only diversify screening modalities but also interlace the market into adaptive oncology architectures.

Impact of Macroeconomic / Geopolitical Factors

Advancing precision oncology awareness and dedicated oncology funding streams inspire oncologists to embrace ESR1 mutation diagnostics for tailoring endocrine-resistant therapies in metastatic breast cancer patients, empowering personalized regimens that extend progression-free survival and optimize resource allocation. Lingering economic volatility from global slowdowns, however, tightens pharmaceutical R&D purses, as executives redirect capital toward high-yield projects and sideline niche genomic assays amid investor scrutiny.

Geopolitical strains, including South China Sea territorial disputes, interrupt flows of oligonucleotide primers from Southeast Asian fabs, obliging labs to pivot suppliers and tolerate quality variance that hampers assay reproducibility. Current US tariffs, enforcing a 10% levy on imported next-generation sequencing consumables from over 180 partners since April 2025, inflate setup costs for liquid biopsy panels sourced overseas, pressuring community cancer centers to ration advanced testing and widen disparities in urban-rural access.

Still, these fiscal nudges foster US-led consortia for reagent localization, yielding robust, domestically validated ESR1 kits that streamline workflows and fortify supply continuity. Bolstered patient advocacy networks also amplify demand for mutation-informed trials, insulating the sector from reimbursement flux and spurring cross-disciplinary integrations.

Latest Trends

FDA Approval of Imlunestrant for ESR1-Mutated Breast Cancer is a Recent Trend

The endorsement of novel oral selective estrogen receptor degraders has exemplified a landmark progression in ESR1 mutated metastatic breast cancer diagnostics during 2025, prioritizing mutation detection to guide therapy in hormone receptor-positive cases.

Oral SERDs, targeting ESR1-mutated tumors, achieve superior progression-free survival in post-endocrine settings, necessitating upfront liquid biopsy for eligibility. This approval signifies a shift toward mutation-informed regimens, accommodating the 40% prevalence in later lines through companion diagnostic integrations.

Regulatory validations confirm diagnostic concordance, hastening endorsements for frontline use amid resistance challenges. This therapy-diagnostic synergy aligns with precision imperatives, linking outputs to electronic records for seamless patient selection. The platform resolves endocrine failure gaps, favoring assays resilient to variant heterogeneity. Oral selective estrogen receptor degraders like imlunestrant were approved on September 25, 2025, for ER-positive, HER2-negative, ESR1-mutated advanced or metastatic breast cancer.

Such approvals catalyze pipeline accelerations, as analogs advance for combination regimens. Forecasters anticipate guideline incorporations, elevating its precedence in post-progression protocols. Longitudinal benchmarks affirm response enhancements, refining economic appraisals. The trajectory envisions multiplex synergies, prognosticating resistance trajectories. This SERD-centric evolution not only heightens diagnostic relevance but also coordinates with metastatic care mandates.

Regional Analysis

North America is leading the ESR1 Mutated Metastatic Breast Cancer Diagnostics Market

North America holds a 39.5% share of the global ESR1 Mutated Metastatic Breast Cancer Diagnostics market, establishing its leadership in precision oncology advancements through 2024. The sector witnessed substantial expansion in 2024, propelled by escalating federal investments in cancer genomics that prioritize biomarker-driven assays for endocrine-resistant tumors.

The National Cancer Institute allocated US$6.9 billion in fiscal year 2022 for overall cancer research, surging to US$ 7.0 billion in 2023 and reaching US$ 7.2 billion in 2024, with significant portions directed toward hormone receptor-positive breast cancer studies requiring ESR1 mutation detection. Regulatory milestones from the Food and Drug Administration accelerated this momentum, approving elacestrant alongside the Guardant360 CDx liquid biopsy test on January 27, 2023, for identifying ESR1 alterations in ER-positive, HER2-negative metastatic cases, followed by imlunestrant approval in September 2024 with the same companion diagnostic.

The Centers for Disease Control and Prevention documented 279,731 new female breast cancer diagnoses in the United States in 2022, including a rising proportion of metastatic instances at 5.6% de novo cases from 2001-2021 data extended into recent trends, heightening the imperative for non-invasive ctDNA-based ESR1 screening. Enhanced clinical guidelines from the American Society of Clinical Oncology in 2023 emphasized routine ESR1 testing post-CDK4/6 inhibitor progression, integrating into hospital workflows.

Collaborative trials, such as those under the National Comprehensive Cancer Network, optimized liquid biopsy protocols for real-time mutation monitoring. These synergies, coupled with reimbursement expansions under Medicare for companion diagnostics, fortified North America’s infrastructure for targeted therapeutic selection.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The ESR1 Mutated Metastatic Breast Cancer Diagnostics market in Asia Pacific anticipates vigorous growth during the forecast period, stimulated by national efforts to bolster genomic profiling amid surging case burdens. India’s Indian Council of Medical Research launched the Indian Breast Cancer Genome Database in 2024, sequencing over 1,000 samples since 2022 to pinpoint ESR1 variants in diverse cohorts, thereby facilitating biomarker validation for localized assays.

China’s Ministry of Science and Technology channeled funds into oncology genomics, with breast cancer allocations rising from 500 million yuan in 2022 to 600 million yuan in 2023 and 700 million yuan in 2024 under the National Key R&D Program, supporting ctDNA platforms for mutation surveillance.

The World Health Organization advanced regional capabilities through its Global Breast Cancer Initiative, committing US$10 million across Asia Pacific from 2022-2024 for early detection frameworks that incorporate ESR1 liquid biopsies in resource-constrained settings. Academic-industry consortia accelerate validation studies, tailoring diagnostics to ethnic-specific ESR1 hotspots. This strategic alignment estimates the market to achieve compounded annual growth exceeding regional averages, harnessing population-scale data for equitable precision oncology deployment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Influential leaders in the ESR1 mutation detection sector catalyze progress by refining next-generation sequencing panels that pinpoint resistant variants in hormone-receptor-positive breast cancers, aligning with emerging selective estrogen receptor degraders for optimized therapeutic guidance. They negotiate co-development pacts with oncology drug makers to synchronize assays with clinical trials, expediting FDA approvals and embedding diagnostics in treatment protocols.

Enterprises funnel capital into liquid biopsy innovations that capture circulating tumor DNA from blood samples, minimizing invasiveness and broadening screening in metastatic settings. Executives scout acquisitions of genomic profiling startups to incorporate multiplex capabilities, enhancing sensitivity for low-frequency mutations. They amplify presence in Europe and Asia-Pacific, tailoring kits to regional pharmacogenomics initiatives for reimbursement leverage and institutional uptake. Moreover, they roll out integrated reporting platforms with subscription analytics, empowering oncologists with actionable insights and securing enduring client commitments.

Guardant Health, Inc., established in 2012 and headquartered in Palo Alto, California, pioneers precision oncology through non-invasive liquid biopsy platforms that deliver comprehensive genomic profiling for advanced cancers. The firm deploys its Guardant360 assay, a tissue-naive test that detects ESR1 mutations alongside hundreds of actionable alterations, supporting over 200,000 patients annually in therapy selection and monitoring.

Guardant channels aggressive R&D into AI-enhanced bioinformatics, expanding applications to early detection and minimal residual disease tracking. CEO Helmy Eltoukhy steers a Nasdaq-listed entity (GH) operating globally, emphasizing partnerships with pharma leaders like AstraZeneca for companion diagnostic validations. The organization engages with clinical networks to evolve guidelines, fostering data-driven care. Guardant fortifies its vanguard status by merging sequencing expertise with clinical utility to reshape metastatic breast cancer management.

Top Key Players in the ESR1 Mutated Metastatic Breast Cancer Diagnostics Market

- Sysmex Corporation

- RainSure Scientific Co., Ltd.

- NeoGenomics Laboratories, Inc.

- Illumina, Inc.

- Guardant Health, Inc.

- GENCURIX Inc.

- CUSABIO Technology LLC

- Cayman Chemical Company

- ASURAGEN, Inc.

- APIS Assay Technologies Ltd.

Recent Developments

- In September 2025: Roche announced favorable results from the Phase III evERA trial evaluating giredestrant, an oral SERD, in ESR1-mutated breast cancer. The study’s success demonstrates the value of mutation-guided therapy and reinforces the critical need for accurate ESR1 mutation testing as a companion diagnostic, driving sustained market demand and integration into precision oncology protocols.

- In December 2024: Bio-Techne’s Asuragen division released a new qPCR-based assay to detect ESR1 mutations in circulating DNA and RNA. This innovation enhances analytical sensitivity, allowing earlier detection of treatment resistance and improving decision-making in managing hormone receptor–positive cancers, which in turn accelerates clinical adoption of molecular diagnostic platforms.

Report Scope

Report Features Description Market Value (2024) US$ 63.2 million Forecast Revenue (2034) US$ 91.8 million CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (NGS Based and PCR Based), By Sample Type (Plasma and Tissue), By End-user (Hospital Associated Labs, Independent Diagnostic Laboratories, Diagnostic Imaging Centers, and Cancer Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, RainSure Scientific Co., Ltd., NeoGenomics Laboratories, Inc., Illumina, Inc., Guardant Health, Inc., GENCURIX Inc., CUSABIO Technology LLC, Cayman Chemical Company, ASURAGEN, Inc., APIS Assay Technologies Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  ESR1 Mutated Metastatic Breast Cancer Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

ESR1 Mutated Metastatic Breast Cancer Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sysmex Corporation

- RainSure Scientific Co., Ltd.

- NeoGenomics Laboratories, Inc.

- Illumina, Inc.

- Guardant Health, Inc.

- GENCURIX Inc.

- CUSABIO Technology LLC

- Cayman Chemical Company

- ASURAGEN, Inc.

- APIS Assay Technologies Ltd.