Global Esports Streaming Platforms Market Size, Share Analysis Report By Platform (PC Gaming Platforms, Console Gaming Platforms, Mobile Gaming Platforms), By Game Type (Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Real-Time Strategy (RTS), Others), By Revenue Source (Sponsorship, Advertising, Media Rights, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149930

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

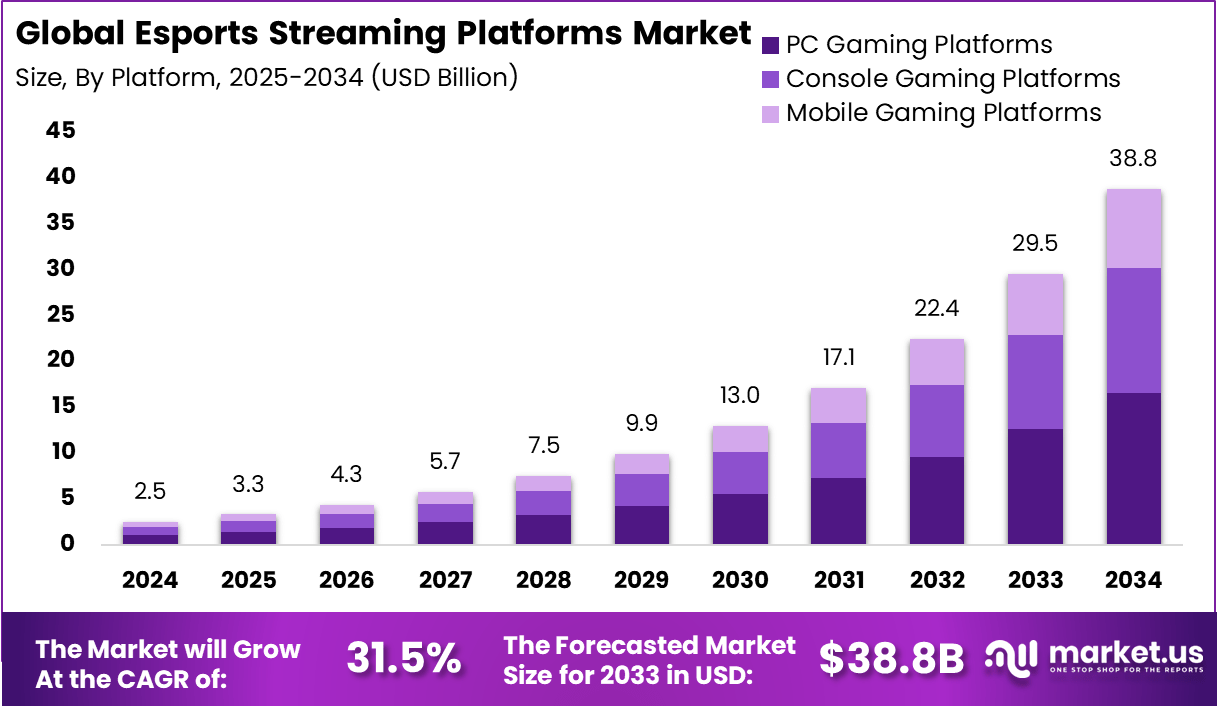

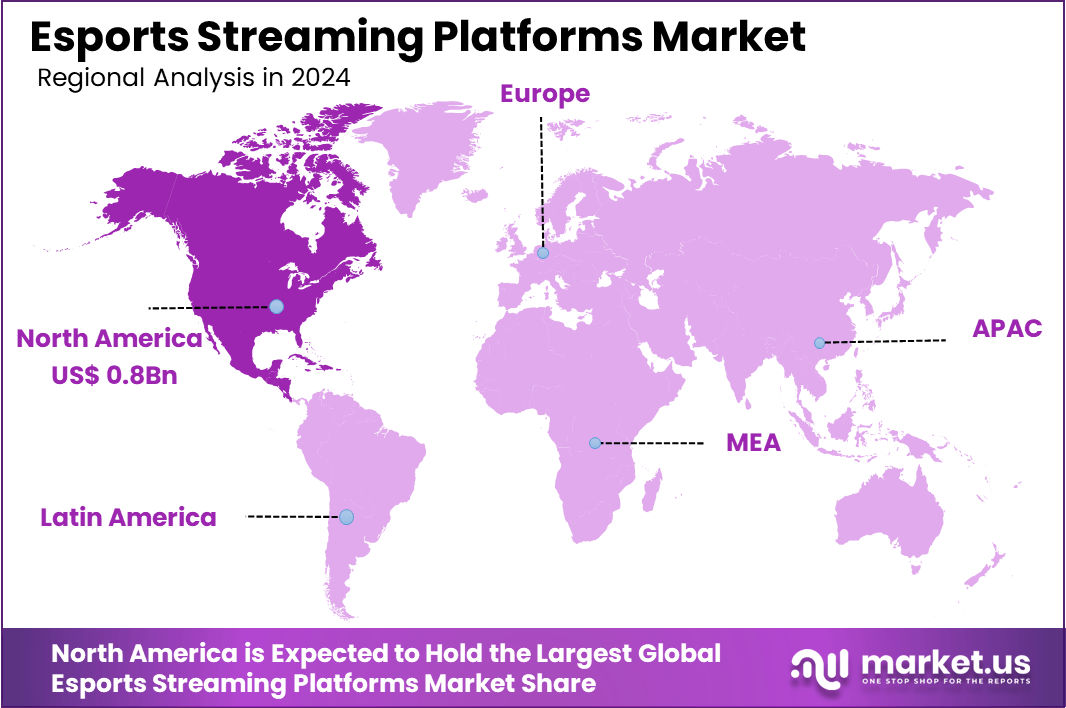

The Global Esports Streaming Platforms Market size is expected to be worth around USD 38.8 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 31.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.4% share, holding USD 0.8 Billion revenue.

Esports streaming platforms are digital services that enable the live broadcast and on-demand viewing of competitive gaming events. These platforms serve as the primary medium for fans to engage with esports content, offering features such as real-time chat, interactive overlays, and monetization options for streamers. Prominent examples include Twitch, YouTube Gaming, and Kick, each providing unique tools to enhance viewer experience and community interaction

The esports streaming platforms market has witnessed significant growth, driven by the increasing popularity of competitive gaming and the proliferation of high-speed internet access. Key drivers of this market include the escalating demand for interactive and immersive viewing experiences, the monetization opportunities through subscriptions and digital goods, and the strategic partnerships between streaming platforms and esports organizations.

Additionally, the adoption of emerging technologies such as augmented reality (AR) and virtual reality (VR) is enhancing viewer engagement, offering novel ways to experience esports events. Investment opportunities in the esports streaming sector are abundant, with venture capitalists and major corporations recognizing the potential for substantial returns.

According to Market.us, The global esports market has witnessed robust expansion in recent years and is projected to reach approximately USD 16.7 billion by 2033, rising from USD 2.3 billion in 2023, with a CAGR of 21.9% over the forecast period from 2024 to 2033. The strong growth of the esports market is being fueled by a surge in global player participation, the formal structuring of esports leagues, and a sharp rise in brand sponsorships.

Parallel to the core esports industry, the Esports Content Creation Market is experiencing an even faster growth trajectory. It is anticipated to grow from USD 2.2 billion in 2024 to an impressive USD 43.6 billion by 2034, registering a staggering CAGR of 34.8% during the 2025–2034 forecast period.

The market’s growth trajectory is supported by the expanding global audience, the diversification of revenue streams, and the continuous innovation in content delivery and user engagement strategies. As the industry matures, regulatory frameworks are also evolving to address issues related to digital rights, content moderation, and fair competition, ensuring a sustainable and equitable environment for all stakeholders.

Key Takeaways

- The Global Esports Streaming Platforms Market is projected to grow from USD 2.5 Billion in 2024 to around USD 38.8 Billion by 2034, accelerating at a robust CAGR of 31.5% over the forecast period.

- In 2024, North America dominated the global landscape with over 33.4% market share, generating approximately USD 0.8 Billion in revenue.

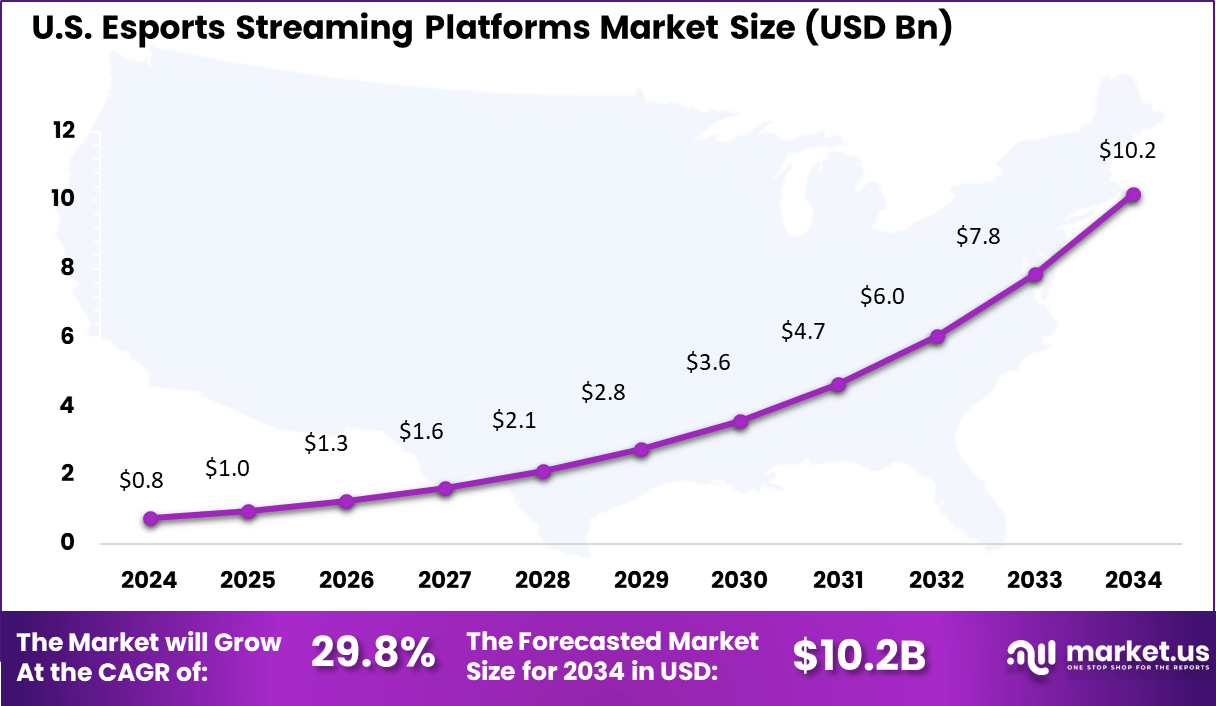

- The United States alone contributed nearly USD 0.8 Billion in 2024 and is forecasted to surge to USD 10.2 Billion by 2034, growing at a CAGR of 29.8% from 2025 to 2034.

- By platform, PC Gaming Platforms took the lead with a 42.7% share in 2024, supported by high viewer engagement and superior content quality.

- Among game types, Multiplayer Online Battle Arena (MOBA) games held a significant 22.9% share, driven by fanbase loyalty and competitive gameplay formats.

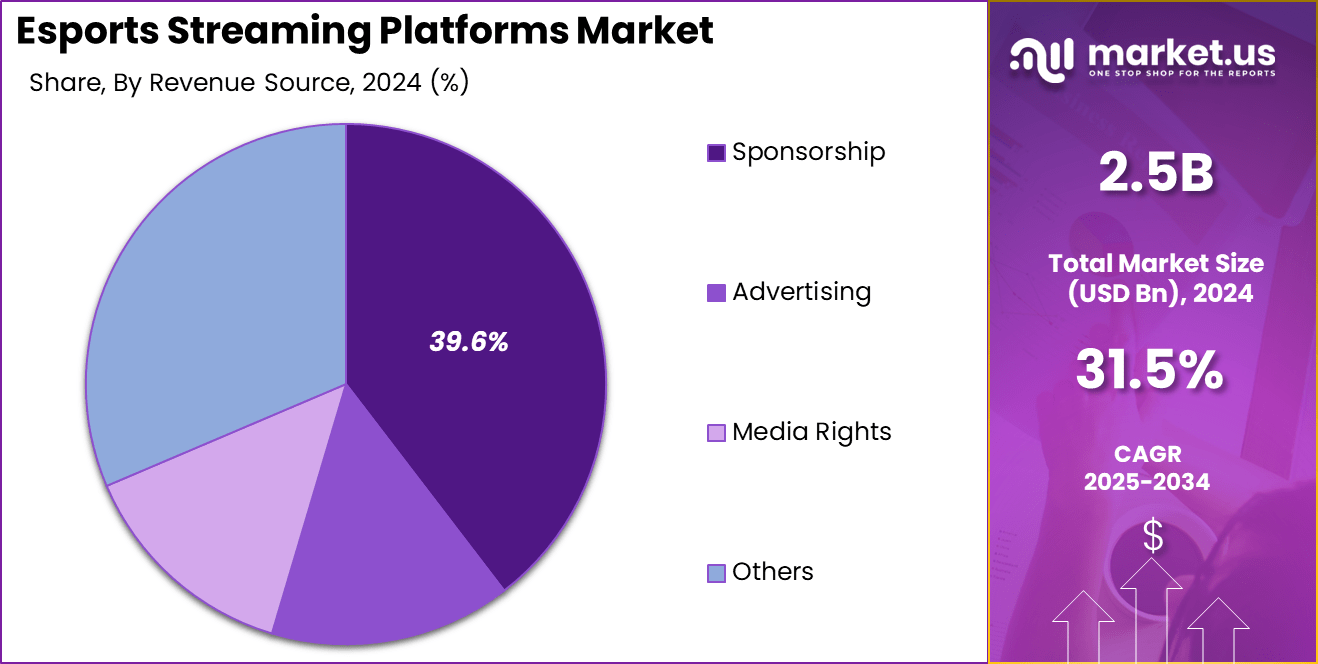

- From a revenue standpoint, Sponsorships accounted for the largest stream, securing 39.6% share in 2024, reflecting strong brand interest and commercial backing in the esports ecosystem.

Impact of AI

Artificial Intelligence (AI) is reshaping esports streaming platforms, enhancing viewer engagement, streamlining content delivery, and unlocking new revenue streams. One significant impact of AI is in content personalization. AI algorithms analyze viewer preferences and behaviors to deliver tailored content recommendations, enhancing user satisfaction and retention.

For instance, a major esports platform utilized AI to personalize content delivery during live events for games like “Call of Duty” and “League of Legends,” leading to increased viewer engagement and satisfaction. AI also plays a crucial role in real-time analytics and performance monitoring.

By analyzing vast amounts of data during live streams, AI provides insights into player performance and audience engagement, enabling broadcasters to make informed decisions and improve the viewing experience.

Moreover, AI-driven automation is revolutionizing content creation and moderation. Automated tools assist in generating highlights, managing chat interactions, and ensuring compliance with community guidelines, thereby reducing the workload on human moderators and enhancing the overall quality of streams .

US Market Expansion

The US Esports Streaming Platforms Market is valued at approximately USD 0.8 Billion in 2024 and is predicted to increase from USD 2.8 Billion in 2029 to approximately USD 10.2 Billion by 2034, projected at a CAGR of 29.8% from 2025 to 2034.

In 2024, North America held a dominant position in the global esports streaming platforms market, securing over 33.4% of the market share and generating approximately USD 0.8 billion in revenue. This leadership is attributed to the region’s advanced digital infrastructure, widespread high-speed internet access, and a mature gaming ecosystem

The region’s strong economic landscape and high disposable incomes have fostered a culture that embraces digital entertainment, making esports a mainstream phenomenon. The integration of esports into traditional sports leagues and educational institutions has also contributed to its widespread acceptance.

Furthermore, the presence of major game developers and publishers in North America has facilitated the rapid growth and professionalization of the esports industry. These factors collectively underscore North America’s leading position in the esports streaming platforms market as of 2024.

Platform Insights

In 2024, the PC Gaming Platforms segment held a dominant position in the esports streaming platforms market, capturing more than a 42.7% share. This leadership is primarily attributed to the superior performance capabilities, high-end graphics, and customization options that PCs offer compared to other platforms.

PC gaming has remained a preferred choice for professional and competitive gamers, as it allows for seamless gameplay with better frame rates, higher resolution, and advanced hardware support. The rise of esports and professional gaming tournaments has further strengthened the demand for PC-based game streaming, as many players and streamers rely on high-performance setups to deliver an optimal gaming and viewing experience.

Additionally, PC game streaming platforms such as Steam, NVIDIA GeForce Now, and Microsoft’s Xbox Cloud Gaming have expanded their offerings, making it easier for users to access a vast library of games without needing high-end hardware.

The growing adoption of cloud gaming services has also contributed to the dominance of the PC segment, allowing gamers to stream high-quality games on their devices without requiring powerful processors or expensive graphics cards. As technological advancements continue to enhance PC gaming experiences, this segment is expected to maintain its strong market presence in the coming years.

Game Type Insights

In 2024, the Multiplayer Online Battle Arena (MOBA) segment held a dominant position in the esports streaming platforms market, capturing more than a 22.9% share. This prominence is attributed to the genre’s widespread popularity and its strong presence in the competitive gaming scene.

Leading titles such as League of Legends, Dota 2, and Mobile Legends: Bang Bang have cultivated extensive global communities, with major tournaments like the League of Legends World Championship drawing millions of viewers worldwide. For instance, the 2024 League of Legends World Championship final achieved a peak viewership of 6.94 million, excluding China, setting a new record in esports history.

The MOBA genre’s success is further bolstered by its accessibility across various platforms, including PC and mobile devices. Games like Honor of Kings have significantly contributed to the genre’s growth, particularly in regions like Asia, where mobile gaming is prevalent.

The game’s global version was launched in June 2024, following pre-releases in several countries, and it became the highest-grossing mobile game of the year with $2.6 billion in revenue. Additionally, the free-to-play model with in-game purchases has made MOBA games more accessible, attracting a broader audience and fostering community engagement.

Revenue Source Insights

In 2024, the sponsorship segment held a dominant position in the esports streaming platforms market, capturing more than a 39.6% share. This leadership is primarily attributed to the increasing investments by brands seeking to engage with the expansive and diverse esports audience.

Sponsorships have become a vital revenue stream, enabling companies to associate their brands with popular esports events, teams, and influencers, thereby enhancing visibility and consumer engagement. The interactive nature of esports platforms allows sponsors to integrate their messaging seamlessly, creating more impactful and memorable brand experiences for viewers.

The growth of sponsorship in esports is further bolstered by the genre’s global appeal and the high level of viewer engagement. Major tournaments and leagues attract millions of viewers worldwide, providing sponsors with extensive reach and exposure. Additionally, the demographic profile of esports audiences—predominantly young, tech-savvy individuals – aligns well with the target markets of many brands, making sponsorships an effective marketing strategy.

Key Market Segments

By Platform

- PC Gaming Platforms

- Console Gaming Platforms

- Mobile Gaming Platforms

By Game Type

- Multiplayer Online Battle Arena (MOBA)

- First-Person Shooter (FPS)

- Real-Time Strategy (RTS)

- Others

By Revenue Source

- Sponsorship

- Advertising

- Media Rights

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Rise of Co-Streaming and Multistreaming

Co-streaming has become a significant trend in esports, allowing content creators to broadcast official events with their own commentary. In 2024, co-streaming accounted for 44% of all esports viewership, translating to 1.2 billion hours watched.

This approach not only broadens the reach of esports events but also fosters a more personalized viewing experience for audiences. Additionally, multistreaming – broadcasting simultaneously across multiple platforms – is gaining traction.

Mobile-First and Vertical Streaming Formats

With the increasing consumption of content on mobile devices, streaming platforms are adapting to meet this demand. Twitch, for instance, introduced vertical livestreams optimized for portrait mode viewing on mobile devices.

This feature, initially tested on select channels, aims to enhance the mobile viewing experience. Furthermore, platforms are focusing on mobile esports, with games like Mobile Legends: Bang Bang leading in viewership on TikTok Live, accounting for 65% of all esports watch time on the platform in 2024.

Business Benefits

Esports streaming platforms present powerful business benefits, especially in expanding audiences and boosting revenue. The global esports audience is expected to reach 640 million by 2025, growing at an annual rate of 8.7%, driven by increasing accessibility across devices.

Notably, 68% of fans prefer viewing on mobile, making cross-platform streaming critical for engagement. Interactive tools like live chats, donations, and polls significantly enhance viewer participation, building loyal communities and improving brand stickiness.

On the revenue front, the esports industry earned around $1.38 billion in 2022, with 60% stemming from sponsorships. Streaming platforms create multiple monetization avenues, including ads, subscriptions, and direct fan support. The rise of co-streaming has further opened new markets, allowing rights holders to broaden reach and boost sponsor exposure.

Driver

Expansion of Mobile Gaming and High-Speed Internet Access

The proliferation of smartphones and the widespread availability of high-speed internet have significantly contributed to the growth of esports streaming platforms. Mobile devices have become the primary medium for gaming and content consumption, especially in emerging markets.

This shift has enabled a broader audience to access esports content, leading to increased viewership and engagement. The convenience of mobile gaming allows users to participate in gaming communities and watch live streams from virtually anywhere, fostering a more inclusive and expansive esports ecosystem.

Moreover, the integration of advanced technologies such as 5G has enhanced the streaming experience by reducing latency and improving video quality. This technological advancement has made live streaming more accessible and enjoyable, thereby attracting a larger audience base.

Restraint

Bandwidth Limitations and Latency Issues

Despite the advancements in internet infrastructure, bandwidth limitations and latency issues remain significant challenges for esports streaming platforms. High-quality streaming requires substantial bandwidth, and in regions where internet connectivity is suboptimal, users often experience buffering and delays. These technical issues can detract from the viewing experience, leading to decreased user satisfaction and engagement.

Latency issues not only affect viewers but also impact streamers, as delays can hinder real-time interactions and responsiveness. This is particularly detrimental in competitive gaming scenarios where timing is critical. Addressing these technical challenges requires significant investment in infrastructure and technology, which may not be feasible for all platforms, especially smaller or emerging ones.

Opportunity

Diversification Through Multistreaming and Platform Integration

The emergence of multistreaming – broadcasting content simultaneously across multiple platforms – presents a significant opportunity for esports streamers and platforms. This approach allows content creators to reach a wider audience by tapping into different user bases across platforms such as Twitch, YouTube, and Facebook Gaming. By diversifying their presence, streamers can increase their visibility, attract more viewers, and enhance monetization opportunities.

Furthermore, platform integration facilitates cross-platform promotions and collaborations, fostering a more interconnected and robust esports community. The ability to engage with audiences on various platforms simultaneously can lead to increased brand recognition and loyalty. As the esports industry continues to grow, leveraging multistreaming capabilities can be a strategic move for content creators and platforms aiming to expand their reach and influence.

Challenge

Monetization Complexities and Revenue Generation

Monetizing esports streaming platforms effectively remains a complex challenge. While advertising, subscriptions, and donations are common revenue streams, reliance on these methods can be unstable and unpredictable. Fluctuations in viewer engagement and changes in platform algorithms can significantly impact income, making it difficult for streamers and platforms to maintain consistent revenue.

Additionally, the competitive nature of the streaming industry means that platforms must continuously innovate to attract and retain both viewers and content creators. This often involves significant investment in technology, content acquisition, and marketing, which can strain financial resources. Balancing the need for revenue generation with the provision of free or affordable content to users is a delicate task that requires strategic planning and execution.

Key Player Analysis

In 2024, Tencent Holdings Limited significantly advanced its sustainable data center initiatives. The company launched a renewable-powered microgrid at its Huailai County data center, integrating wind, solar, and battery energy storage systems . This project marked China’s first fully integrated microgrid combining these technologies. Additionally, Tencent’s data centers achieved 29 green and low-carbon certifications by the end of 2024.

Nintendo of America Inc. focused on innovation and expansion in 2024. The company acquired Shiver Entertainment, enhancing its capabilities in porting AAA titles to the Switch platform. In June 2025, Nintendo plans to release the Nintendo Switch 2, featuring upgraded hardware and backward compatibility with most Switch games.

Valve Corporation continued to strengthen its position in the gaming industry through its digital distribution platform, Steam. While specific sustainable data center initiatives were not publicly disclosed, Valve’s commitment to digital distribution inherently supports reduced physical production and distribution, contributing to environmental sustainability. The company’s focus on delivering high-quality gaming experiences remains central to its operations.

Top Key Players Covered

- Tencent Holding Limited

- Nintendo of America Inc.

- Valve Corporation

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Gameloft SE

- Modern Times Group (MTG)

- Gfinity plc

- Allied Esports

- Take-Two Interactive

- Huya

- Fragbite Group

- Others

Recent Developments

- March 2025: Tencent invested €1.16 billion for a 25% stake in a new Ubisoft subsidiary focusing on franchises like Rainbow Six and Assassin’s Creed. This move aims to strengthen Tencent’s position in esports content distribution.

- March 2025: Nintendo’s Direct event set a new live viewership record on YouTube with over 1.1 million concurrent viewers, indicating growing interest in its esports-related announcements.

- Early 2025: Valve implemented a new rule requiring tournament organizers to send team invites at least eight weeks prior to main events. This change aims to streamline esports event planning and broadcasting.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Bn Forecast Revenue (2034) USD 38.8 Bn CAGR (2025-2034) 31.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (PC Gaming Platforms, Console Gaming Platforms, Mobile Gaming Platforms), By Game Type (Multiplayer Online Battle Arena (MOBA), First-Person Shooter (FPS), Real-Time Strategy (RTS), Others), By Revenue Source (Sponsorship, Advertising, Media Rights, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tencent Holding Limited, Nintendo of America Inc., Valve Corporation, Activision Blizzard, Inc., Electronic Arts Inc., Gameloft SE, Modern Times Group (MTG), Gfinity plc, Allied Esports, Take-Two Interactive, Huya, Fragbite Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Esports Streaming Platforms MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Esports Streaming Platforms MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tencent Holding Limited

- Nintendo of America Inc.

- Valve Corporation

- Activision Blizzard, Inc.

- Electronic Arts Inc.

- Gameloft SE

- Modern Times Group (MTG)

- Gfinity plc

- Allied Esports

- Take-Two Interactive

- Huya

- Fragbite Group

- Others