Global Energy Drinks Market By Product(Drinks, Shots, Mixers), By Packaging(Cans, Bottles), By Type(Conventional, Organic), By Distribution channel(On-trade, Off-trade), By Region and Companies - Industry Segment Report, Market Assessment, Market Size, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 12548

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

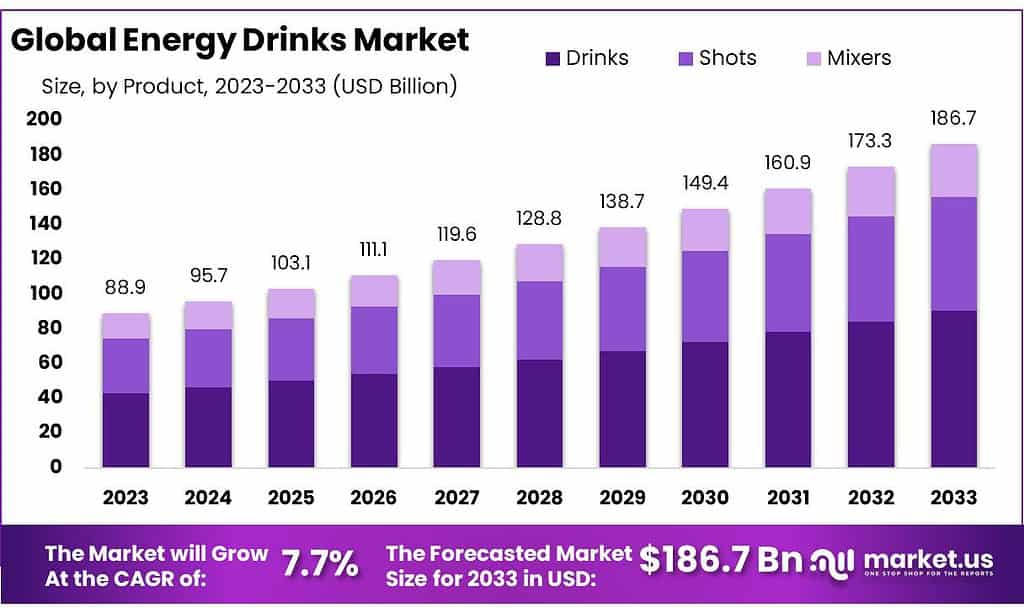

The global energy drinks market size is expected to be worth around USD 186.7 billion by 2033, from USD 88.9 billion in 2023, growing at a CAGR of 7.7% during the forecast period from 2023 to 2033.

Market growth has been propelled by increasing consumer interest in energy drinks to improve both physical and cognitive performance. Consumers increasingly opting for beverages without sugar content, glucose or high fructose corn syrup; market players promote these functional drinks as functional beverages to increase energy and alertness as well as provide physical lift.

In Australia, energy drinks are regulated under the Food Standards Australia New Zealand (FSANZ) guidelines, which stipulate that energy drinks must contain no more than 80 mg of caffeine per 250 ml. This limit is designed to ensure consumer safety by preventing excessive caffeine intake, which can lead to health issues. The regulation aligns with the caffeine content found in a standard cup of coffee, thereby providing a familiar benchmark for consumers.

Health Canada has established a maximum caffeine limit of 180 mg per single-serving can of energy drink, with larger containers capped at 400 mg per liter. This regulation aims to protect consumers, particularly vulnerable populations such as children and pregnant women, from the adverse effects of high caffeine consumption. The regulations reflect a growing concern about the health implications associated with energy drink consumption.Starting January 1, 2024, Poland will implement a ban on the sale of energy drinks containing caffeine or taurine to individuals under 18 years old. The law mandates that these beverages must be clearly labeled, indicating their high caffeine content. Non-compliance can result in fines up to 200,000 zloty (approximately €44,677).

Additionally, vendors selling these products to minors could face fines of up to 2,000 zloty (around €447). This initiative is part of a broader effort to safeguard youth from the potential health risks associated with energy drinks1.

The UK government has allocated £289 million to the Industrial Energy Transformation Fund (IETF), aimed at assisting energy-intensive industries, including beverage manufacturers. This fund supports projects that enhance energy efficiency and reduce carbon emissions.

For instance, Britvic Soft Drinks received £4.4 million to implement heat recovery systems at its production site as part of efforts to decarbonize the manufacturing sector while maintaining competitiveness.

Key Takeaways

- The global energy drinks market is projected to reach USD 186.7 billion by 2033, growing at a CAGR of 7.7% from USD 88.9 billion in 2023.

- In 2023, energy drinks held over 48.6% market share, known for their quick energy and focus-enhancing benefits.

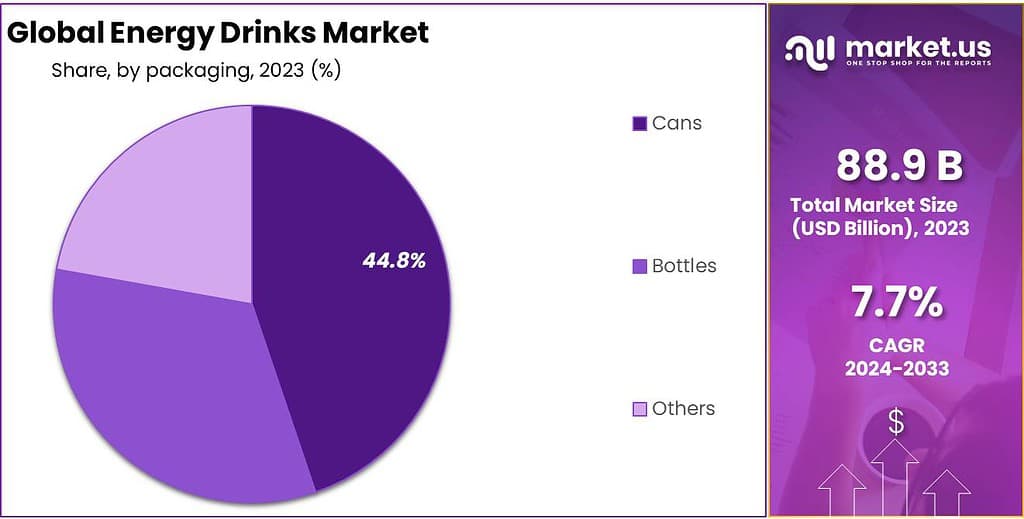

- Cans held over 44.8% revenue share in 2023, favored for portability, while bottling is expected to grow due to aluminum shortages.

- Conventional energy drinks dominated with a 50.9% revenue share in 2023, but organic drinks are expected to grow faster, driven by health-conscious consumers.

- Off-trade channels contributed to 68.9% of total revenue in 2023, as consumers prefer evaluating quality, brands, and ingredients.

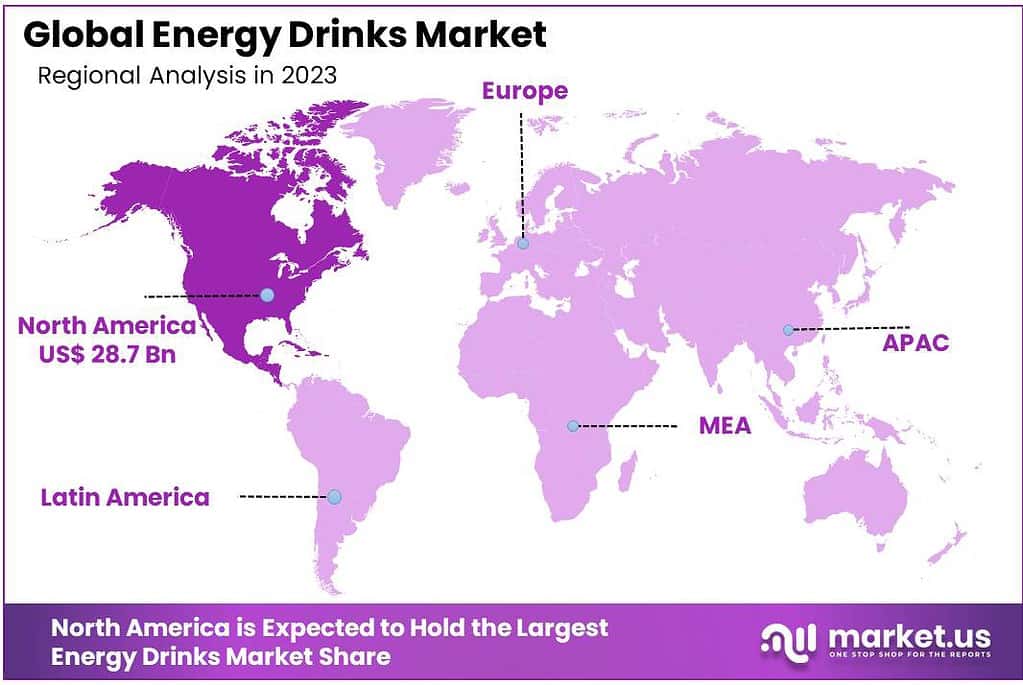

- North America led in revenue share in 2023, with over 32.3% in 2023 driven by increased disposable income, local brand promotion, and marketing activities.

Product Analysis

In 2023, energy drinks dominated the market with a significant energy drinks market share of over 48.6%. These beverages are packed with caffeine and other stimulants, making them popular for their quick energy and focus-enhancing effects.

In 2023, the drinks segment accounted for the majority of energy drinks market revenue & was anticipated to continue its dominance over the estimated period. Consumers prefer drinks over other beverages because they provide instant hydration and significant nutritional benefits of energy drinks for health awareness and well-being of the body. Due to the variety of beverages, drinks enjoy a wider consumer base.

Over the forecast period, mixers are expected to experience significant growth. This segment has seen much growth due to the increasing availability of mixers. Consumers of energy drinks are also choosing mixers for making premium cocktails & alcoholic beverages.

To attract new customers, many brands are trying new flavors in mixers. The negative effects of alcohol can be reduced by mixing alcohol with caffeinated mixers, energy drinks, and cola. These results are significantly less than when alcohol is consumed alone.

Packaging Analysis

The greater revenue share was held by Cans, at more than 44.8% in 2023. It is expected it will sustain its lead in the estimated period. These beverages are becoming more popular than canned wine due to the sophistication of consumers’ tastes. Metal containers are preferable by young consumers because they can easily be carried around and don’t break like glasses.

Due to the coronavirus outbreak, numerous bars, restaurants, and pubs were forced to close down. This has seen a significant increase in metal cans. This trend is expected not to change over the estimated period.

Over the forecast period, the bottles segment will experience the second-greatest growth rate. The ready-to-drink idea was initiated with a plastic bottle packaging design. It quickly became popular. The aluminum shortage in certain countries, such as the United States, has introduced products into glass bottles.

Type Analysis

In 2023, the conventional segment had the highest revenue share at over 50.9%. It is estimated to continue its lead in the forecast period. The conventional segment is expected to grow because of a lack of awareness about organic products.

Organic drinks are still relatively new, and consumers are unaware of the many benefits of organically functional beverages. Due to the different ingredients, conventional drinks tend to be cheaper than organic ones.

As organic beverages are perceived as having more nutrients and antioxidants, the organic market is expected to grow at a faster CAGR during the estimated period. Health-conscious consumers prefer organic products over those made from conventional ingredients. This has played a significant role in the growth of organic energy drinks sales.

Distribution Channel Analysis

In 2023, 68.9% of total revenue was from the off-trade segment. This is still the main source of product consumption of energy drinks. Product sales of energy drinks have increased due to the rising popularity of energy drinks. Consumers purchase these products after evaluating their quality, brands, and ingredients, This increases product sales via other trade channels.

Major players often sell their entire product line via off-trade channels like hypermarkets and supermarkets. These stores are well-known for their large customer base. Walmart, Walgreens, CVS Pharmacy, Kroger, Safeway, Walgreens, and Walgreens carry the product in the United States.

Between 2023 and 2032, the on-trade channel will grow rapidly. This segment is driven by the increasing availability of bars that offer a variety of beverages. These factors will increase product sales in the energy drinks market, & this trend is expected to continue over the next few years.

Key Market Segments

By Product

- Drinks

- Shots

- Mixers

By Type

- Conventional

- Organic

By Packaging

- Cans

- Bottles

By Distribution Channel

- On-trade

- Off-trade

Market Drivers

Demand For Health and Fitness Products Has Increased

An increasing demand for health and fitness products is reshaping the energy drinks market. Consumers are becoming more aware of the health risks associated with consuming liquid calories and are seeking transparency in product ingredients.

This trend has driven the popularity of natural energy drinks and healthy non-alcoholic beverages. The ongoing uncertainty related to the duration of the COVID-19 pandemic has made access to health information more crucial than ever.

Caffeinated energy drinks are gaining recognition as a beneficial choice for pre-workout routines. They contain taurine, caffeine, sugar, and vitamins that enhance energy levels and focus during exercise.

Common elements like taurine and B vitamins in these drinks contribute to better workout performance. Additionally, non-alcoholic alternatives like flavored water are gaining favor among sports enthusiasts.

Market Restraints

Risk Associated with The Inclusion of Potentially Hazardous Elements

Concerns arise regarding the potential inclusion of harmful elements in energy drinks. Consumers are worried about prohibited colors, additives, industrial chemicals, drug residues, unreported allergens, and heavy metals. Such elements can have adverse health effects, particularly in the Asia-Pacific non-alcoholic beverage market.

Moreover, the caffeine, taurine, and sugar content in these drinks can elevate insulin levels, posing risks for individuals with diabetes. Extreme ingredients in some energy drinks make them unsuitable for a significant portion of the population, with particular uncertainties surrounding energy drinks for children.

Key Opportunities

Opportunities Will Be Available in Plenty Within the Sports Industry

The sports industry presents ample growth opportunities for the energy drink sector. A strong demand for energy drinks among athletes and sports enthusiasts aiming to enhance their performance and stamina is driving significant growth.

Energy drinks with carbohydrates contribute to improved performance by accelerating the body’s recovery process and boosting energy levels. Caffeine, known for its ergogenic benefits, aids athletes in enhancing their performance. This growing trend within the sports industry is likely to create new and fruitful opportunities for market expansion.

Market Challenges

One of the significant challenges facing the energy drinks market is addressing health concerns and adapting to potential regulatory changes.

With increased awareness of health risks linked to energy drinks, manufacturers must adjust to evolving health and safety standards to ensure consumer well-being and market sustainability.

Regional Analysis

North America accounted for the highest revenue share, with over 32.3% in 2023. The rise in energy drink consumption in the region can also be attributed to increased disposable income, the promotion and emergence of local brands, and increased marketing and promotional activities that encourage product growth.

Because of the changing demographics, tastes, and habits of consumers, North Americans consume more energy drinks worldwide than in any other market. Globalization and migration have influenced consumers’ drinking habits. The market key company now has the opportunity to include a wide range of drinks in their portfolios.

From 2023 to 2032, Asia Pacific will likely be the fastest-growing regional market. Due to the willingness of consumers to try new flavors and the high demand of immigrants living in the country who are interested in different beverages, the market is likely to see significant strong growth in China, India, and Japan’s economies. The region has seen product launches appeal to many consumers.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

There are a few established players and several smaller and medium-sized players. major players hold the majority of the market share for energy drinks. They are pursuing various strategies, including product launches, expansions of product portfolios, and mergers and acquisitions. For example, Anheuser-Busch Companies LLC plans to launch energy drinks in India in January 2022.

This is because millennials and affluent customers in key cities dominate the Indian market for the energy drinks industry. PepsiCo was founded in February 2022. Inc. introduced a hemp energy drink to the U.S. that contained ingredients like hemp oil, vitamin B and spearmint, lemon balm, caffeine, and vitamin C.

Market Key Players

- Red Bull GmbH

- Monster Beverage Corp

- Rockstar

- TC Pharmaceutical Industry Co Ltd

- Shenzhen Eastroc Beverage Co Ltd

- Fujian Dali Food Co Ltd

- Suntory Holdings Ltd

- National Beverage Corp

- Dr Pepper Snapple Group

- Living Essentials Marketing LLC

- Vital Pharmaceuticals Inc

- Britvic PLC

- Other Key Players

Recent Development

February 2022 – PepsiCo, Inc. introduced a hemp energy drink to the market in the United States in February 2022. This beverage included hemp oil, vitamin B, spearmint, lemon balm, and caffeine as some of its components.

January 2022 – In collaboration with PepsiCo, Inc., Starbucks introduced its line of energy drinks in January of 2022. The item can be purchased in grocery stores, major retailers, and convenience stores all over the United States. Beginning in March 2022, the product will also be made accessible at Starbucks locations nationwide.

January 2022 – Anheuser-Busch Companies LLC plans to offer energy drinks in India in January 2022. This decision was made since the millennial generation and wealthy consumers in India’s major urban centers are the primary drivers of growth in the energy drink category.

Report Scope

Report Features Description Market Value (2023) USD 88.9 Billion Forecast Revenue (2033) USD 186.7 Billion CAGR (2023-2032) 7.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Drinks, Shots, Mixers), By Packaging(Cans, Bottles), By Type(Conventional, Organic), By Distribution channel(On-trade, Off-trade) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Red Bull GmbH, Monster Beverage Corp, Rockstar, TC Pharmaceutical Industry Co Ltd, Shenzhen Eastroc Beverage Co Ltd, Fujian Dali Food Co Ltd, Suntory Holdings Ltd, National Beverage Corp, Dr Pepper Snapple Group, Living Essentials Marketing LLC, Vital Pharmaceuticals Inc, Britvic PLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Red Bull GmbH

- Monster Beverage Corp

- Rockstar

- TC Pharmaceutical Industry Co Ltd

- Shenzhen Eastroc Beverage Co Ltd

- Fujian Dali Food Co Ltd

- Suntory Holdings Ltd

- National Beverage Corp

- Dr Pepper Snapple Group

- Living Essentials Marketing LLC

- Vital Pharmaceuticals Inc

- Britvic PLC

- Other Key Players