Global Eltrombopag Drugs Market By Type (Tablets and Oral Suspension), By Application (Hospitals & Clinic, Pharmacy, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150585

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

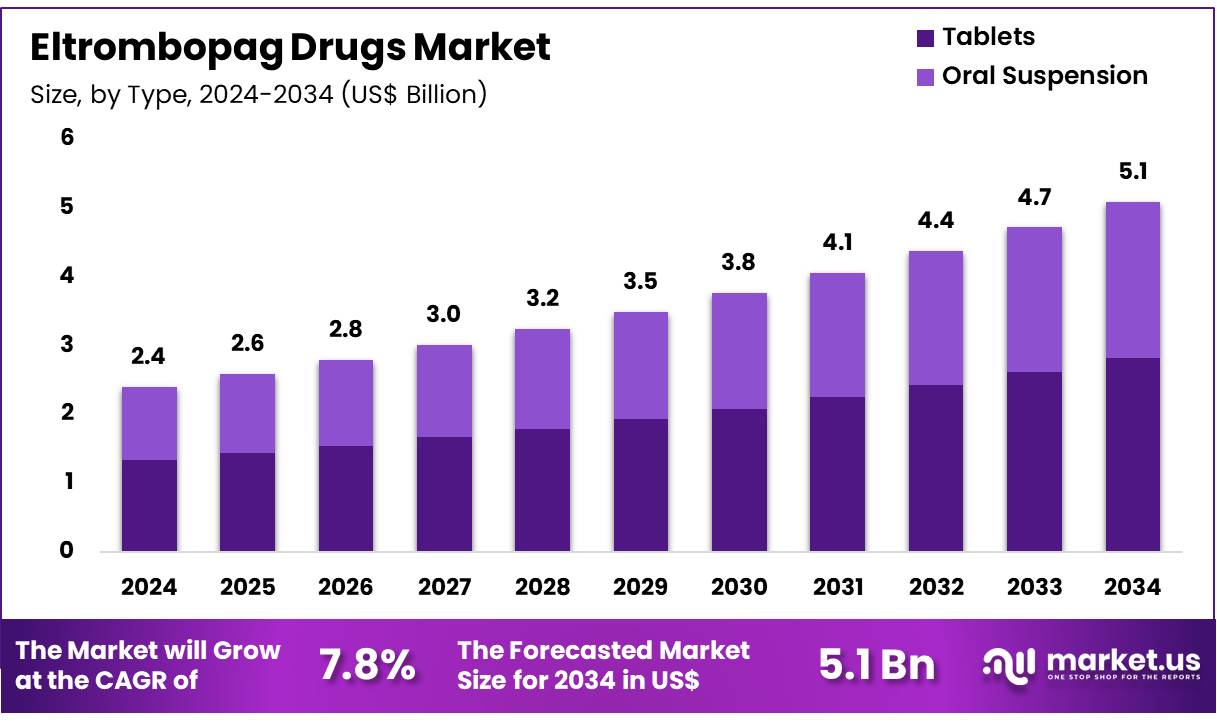

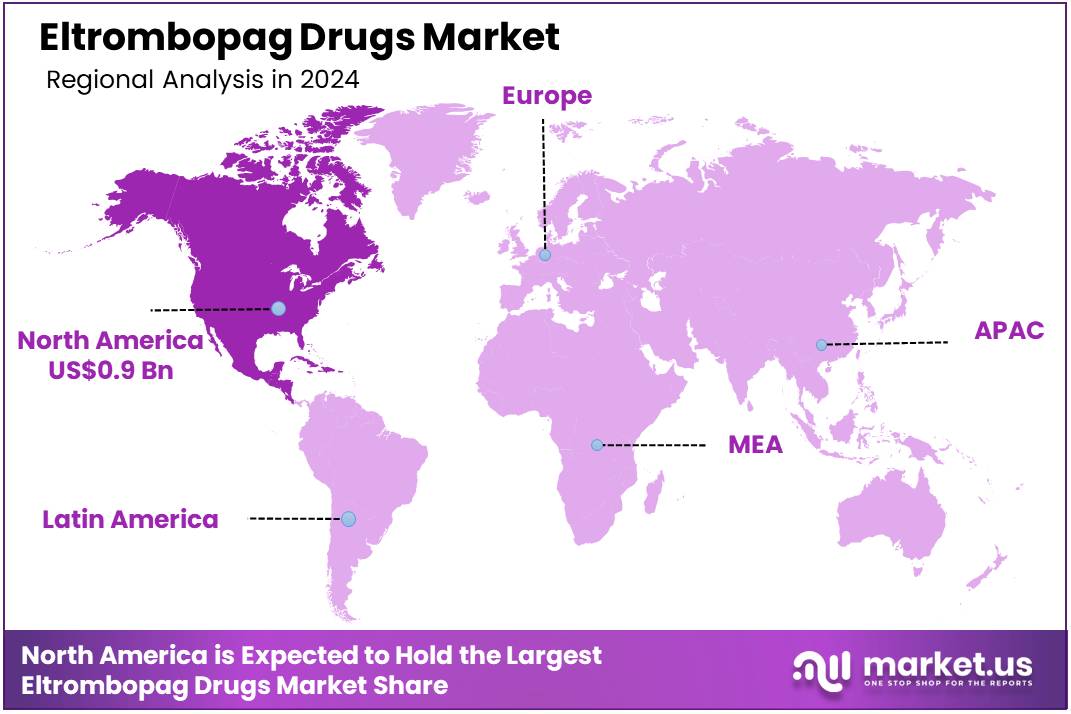

Global Eltrombopag Drugs Market size is expected to be worth around US$ 5.1 Billion by 2034 from US$ 2.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.2% share with a revenue of US$ 0.9 Billion.

Increasing recognition of thrombocytopenia as a significant health concern is driving the growth of the eltrombopag drugs market. Eltrombopag, a thrombopoietin receptor agonist, has emerged as a key treatment for patients with conditions like chronic immune thrombocytopenia (ITP) and severe aplastic anemia.

In January 2024, China’s National Medical Products Administration granted approval for Sino Biopharmaceutical Limited’s Eltrombopag Olamine Tablets, marketed as Taipusheng, for use in both adults and children aged six and older. This approval represents a significant step forward in expanding treatment options for thrombocytopenia, enhancing the drug’s accessibility in global markets.

The growing demand for effective therapies, particularly in pediatric and adult populations with platelet disorders, has spurred investment in further clinical trials and research. Recent trends show a rising focus on personalized treatment options, as eltrombopag continues to be a valuable tool for managing low platelet counts in various hematologic disorders.

Opportunities for market expansion exist as more patients seek alternatives to traditional therapies. Furthermore, advancements in drug formulations and delivery methods offer potential for broader applications of eltrombopag in treating other related conditions.

Key Takeaways

- In 2024, the market for eltrombopag drugs generated a revenue of US$ 2.4 billion, with a CAGR of 7.8%, and is expected to reach US$ 5.1 billion by the year 2034.

- The type segment is divided into tablets and oral suspension, with tablets taking the lead in 2024 with a market share of 55.3%.

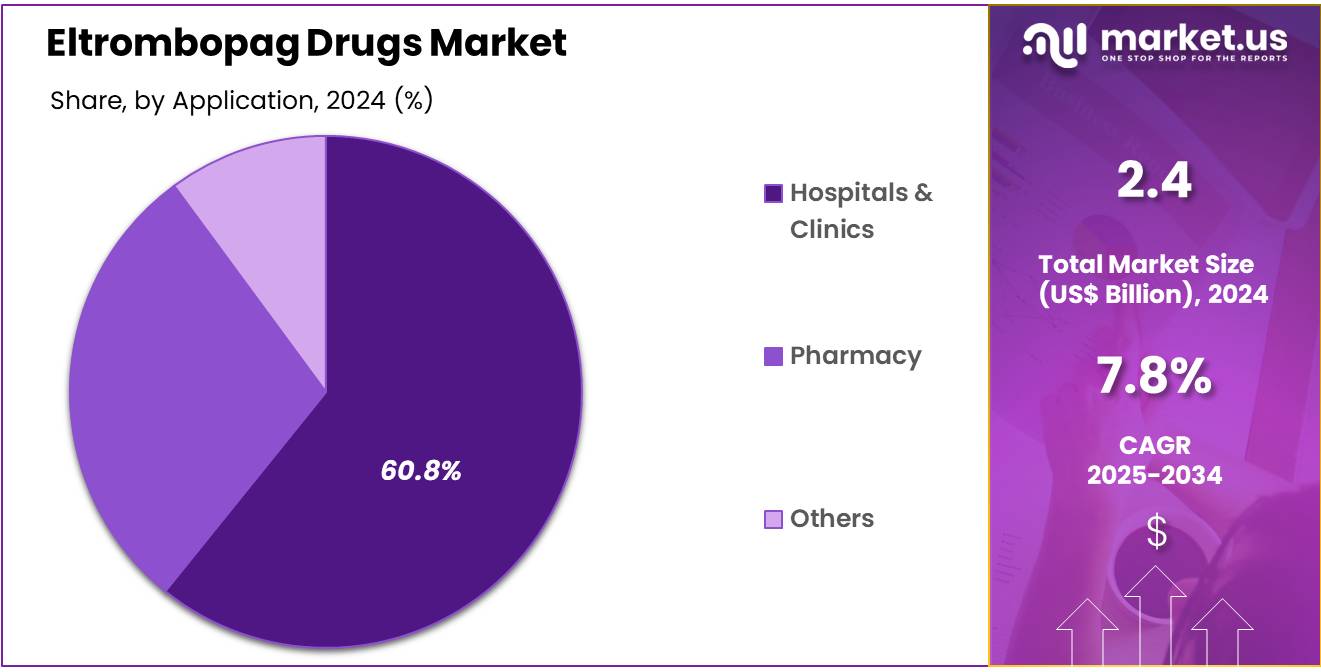

- Considering application, the market is divided into hospitals & clinic, pharmacy, and other. Among these, hospitals & clinic held a significant share of 60.8%.

- North America led the market by securing a market share of 37.2% in 2024.

Type Analysis

The tablets segment claimed a market share of 55.3% owing to the increasing preference for oral administration over other forms of medication. Tablets offer convenience, accurate dosing, and ease of administration, making them a popular choice for patients who require long-term treatment for conditions like chronic immune thrombocytopenia (ITP) and severe aplastic anemia.

The segment’s growth is fueled by the rising number of patients diagnosed with these conditions and the growing adoption of eltrombopag tablets as a first-line treatment option due to their proven effectiveness and manageable side-effect profile. The anticipated increase in awareness about the availability of oral options for thrombocytopenia treatment is likely to further support the expansion of this segment.

Application Analysis

The hospitals & clinic held a significant share of 60.8% due to the rising demand for specialized treatments for blood disorders like ITP and aplastic anemia. Hospitals and clinics remain the primary healthcare settings for administering and monitoring treatments like eltrombopag, especially for patients requiring close medical supervision and tailored therapy regimens.

The segment’s growth is supported by the increasing prevalence of these blood disorders, alongside the growing focus on personalized treatment approaches in clinical settings. With healthcare facilities investing in advanced therapies and expanding access to eltrombopag treatments, this segment is expected to see continued demand for both oral and intravenous forms of the drug, further boosting its market presence.

Key Market Segments

By Type

- Tablets

- Oral Suspension

By Application

- Hospitals & Clinic

- Pharmacy

- Other

Drivers

Increasing Prevalence of Target Indications is Driving the Market

The rising prevalence of key indications for which eltrombopag is approved, primarily chronic immune thrombocytopenia (ITP) and severe aplastic anemia (SAA), is a significant driver for the eltrombopag drugs market. ITP is an autoimmune bleeding disorder characterized by low platelet counts, while SAA is a rare, life-threatening blood disorder.

According to the Journal of Yeungnam Medical Science, 2023, the annual incidence of immune thrombocytopenia (ITP) is estimated to be two cases per 100,000 adults, with approximately two-thirds of adult ITP cases leading to chronic ITP. The persistent nature of these conditions often necessitates long-term treatment.

Additionally, data from a large national claims database in the US, published in March 2025, showed that eltrombopag was a frequently prescribed treatment in patients with acquired aplastic anemia, highlighting its established role in managing these severe hematological disorders. This sustained patient population requiring ongoing care for these conditions directly fuels the demand for these drugs.

Restraints

High Cost and Limited Access are Restraining the Market

The substantial cost of eltrombopag treatment and potential challenges in patient access act as significant restraints on the market. Eltrombopag is a specialized medication for rare blood disorders, and its pricing reflects the research and development investment for such niche indications.

While specific global average costs are difficult to find, local market prices, like those in India in June 2025, show a wide range, for example, ₹25,000 per box for 50mg, which translates to a considerable expense for patients without adequate insurance or in healthcare systems with limited reimbursement.

This high cost can create a financial burden for patients and healthcare systems, potentially limiting the drug’s uptake, especially in regions with developing healthcare infrastructure. The need for specialized diagnosis and monitoring also contributes to access challenges, further impacting market growth.

Opportunities

Expansion of Approved Indications and Generic Availability Create Growth Opportunities

The expansion of approved indications for eltrombopag and the recent availability of generic formulations present significant growth opportunities in the market. Beyond its initial approvals for ITP and SAA, additional applications or patient populations could unlock new avenues for growth.

More specifically, generic formulations of eltrombopag became commercially available in May 2025 for severe aplastic anemia and immune thrombocytopenia in the US. This generic availability is expected to increase patient access by offering more affordable treatment options, potentially leading to broader adoption and higher treatment rates, particularly in regions where cost was a significant barrier. This strategic shift is anticipated to expand the overall patient base benefiting from eltrombopag, fueling market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the eltrombopag drugs market, particularly given its focus on rare and chronic diseases that often require lifelong treatment. Economic stability generally supports robust healthcare spending, which is crucial for the reimbursement and accessibility of high-cost specialty drugs like eltrombopag.

Conversely, economic downturns can lead to budget tightening in healthcare systems and reduced patient affordability, potentially affecting adherence to treatment or hindering access to new patients. Geopolitical factors, such as stability in international trade relations and reliable global supply chains for active pharmaceutical ingredients (APIs) and manufacturing, are also critical.

For instance, the World Economic Forum’s annual meeting in January 2024 highlighted ongoing concerns about global supply chain resilience. However, the essential nature of eltrombopag for life-threatening conditions like severe aplastic anemia means that patient needs often override economic fluctuations, providing a baseline of stable demand and ensuring continued investment in these vital therapies.

Current US tariff policies could introduce complexities for the eltrombopag drugs market. Tariffs on imported raw materials or intermediates necessary for the manufacturing of complex biological drugs like eltrombopag could increase production costs for pharmaceutical companies.

While specific tariffs directly impacting eltrombopag were not explicitly identified in public reports from 2022-2024, broader discussions in May 2025 regarding potential new US tariffs on pharmaceutical products signal a risk of increased prices for imported medicines. This could translate to higher list prices or out-of-pocket costs for patients, potentially affecting access despite the clinical need.

However, such policies could also encourage pharmaceutical companies to localize production of components or even the entire drug manufacturing process within the US. This could lead to a more secure domestic supply chain and potentially foster innovation within the country, ensuring long-term drug availability and resilience against future global disruptions.

Latest Trends

Increasing Focus on Long-Term Management and Treatment Optimization is a Recent Trend

A notable recent trend in the eltrombopag drugs market is the increasing focus on the long-term management and optimization of treatment regimens for patients with chronic conditions. Studies are exploring the possibility of safely discontinuing or tapering thrombopoietin receptor agonists (TPO-RAs) like eltrombopag after a sustained response, aiming to reduce the treatment burden and potential long-term side effects.

Research published in Blood in January 2025 from the STOPAGO study, a prospective multicenter study in France, demonstrated that nearly half of chronic ITP patients who achieved complete response to TPO-RAs for more than one year were able to safely stop therapy and remain stable for up to four years, with most patients (92%) receiving eltrombopag. This trend towards optimizing long-term treatment strategies reflects a more nuanced approach to patient care, balancing efficacy with quality of life, and influencing prescribing patterns.

Regional Analysis

North America is leading the Eltrombopag Drugs Market

North America dominated the market with the highest revenue share of 37.2% owing to the increasing diagnosis of conditions like chronic immune thrombocytopenia (ITP) and severe aplastic anemia, for which eltrombopag is an established treatment. Novartis, a key player in this segment, reported Promacta/Revolade (eltrombopag) sales of US$ 2,088 million in 2022 and US$ 2,216 million in 2023, indicating consistent demand and growth for this therapeutic agent.

The drug is crucial for managing thrombocytopenia in patients who have had an insufficient response to other treatments. The FDA’s continued approval and oversight of such therapies ensure their availability and use in the North American healthcare system, contributing to the steady expansion of the market for this specific drug.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare expenditures, a growing awareness of hematological disorders, and improving diagnostic capabilities across the region. While consolidated, region-wide governmental statistics on the precise prevalence of ITP for 2022-2024 are not readily available, the World Bank data for 2022 indicates that current health expenditure as a percentage of GDP in the East Asia & Pacific region was 6.6%, reflecting an increasing investment in healthcare infrastructure and patient access to advanced treatments.

This rising healthcare spending is expected to facilitate greater adoption of drugs like eltrombopag as more patients are diagnosed and receive appropriate care in various Asia Pacific countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the eltrombopag drug market focus on strategies such as expanding therapeutic indications, enhancing drug formulations, and forming strategic partnerships to drive growth. They invest in research and development to explore new applications of eltrombopag, including its use in treating conditions like severe aplastic anemia and myelodysplastic syndromes.

Advancements in drug formulations, such as extended-release versions, aim to improve patient compliance and treatment outcomes. Collaborations with healthcare providers and research institutions facilitate the development and distribution of these therapies, ensuring broader access and adherence to regulatory standards. Additionally, companies emphasize expanding their presence in emerging markets to capitalize on the increasing demand for effective treatments for platelet-related disorders.

Novartis Pharmaceuticals, a leading entity in this domain, offers eltrombopag under the brand name Promacta in the United States and Revolade in other regions. The company focuses on developing innovative therapies for various medical conditions, including thrombocytopenia and severe aplastic anemia. Novartis has received regulatory approvals for eltrombopag in multiple countries, expanding its global reach.

The company’s commitment to research and development, coupled with its global presence, positions it as a significant player in the eltrombopag drug market. In 2024, Novartis reported annual sales of $563 million for its eltrombopag medications, primarily driven by the treatment of chronic immune thrombocytopenia in the United States.

Top Key Players

- Teva

- Shandong Jewim Pharmaceutical

- Novartis

- Ningbo Menovo Tiankang Pharmaceutical

- Longfu Pharmaceutical

- Jiaheng (Zhuhai Hengqin) Pharmaceutical Technology Company Limited

- Guangdong

- Changzhou Pharmaceutical Factory

Recent Developments

- In October 2024, Jiaheng (Zhuhai Hengqin) Pharmaceutical Technology Company Limited received approval from China’s National Medical Products Administration to distribute Eltrombopag Olamine tablets in the country.

- In November 2023, Teva’s Alvaiz (eltrombopag) tablets were authorized by the US FDA for the treatment of thrombocytopenia in both adults and children aged 6 and above.

Report Scope

Report Features Description Market Value (2024) US$ 2.4 Billion Forecast Revenue (2034) US$ 5.1 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Tablets and Oral Suspension), By Application (Hospitals & Clinic, Pharmacy, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teva, Shandong Jewim Pharmaceutical, Novartis, Ningbo Menovo Tiankang Pharmaceutical, Longfu Pharmaceutical, Jiaheng (Zhuhai Hengqin) Pharmaceutical Technology Company Limited , Guangdong, Changzhou Pharmaceutical Factory Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teva

- Shandong Jewim Pharmaceutical

- Novartis

- Ningbo Menovo Tiankang Pharmaceutical

- Longfu Pharmaceutical

- Jiaheng (Zhuhai Hengqin) Pharmaceutical Technology Company Limited

- Guangdong

- Changzhou Pharmaceutical Factory