Global Electrical Contacts Market Size, Share, And Business Benefits By Type (Silver-Based Materials, Copper-Based Materials, Gold-Based Materials, Palladium-Based Materials, Others), By Electrical Contact (Rivet-Type, Plate-Type, Material-Wire), By Applications (Low-Voltage Products (Switches, Relays, Connectors, Others), Medium and High Voltage Products (Circuit Breakers, Transformers, Generators, Others)), By End-User (Electronics and Telecommunication, Power Distribution Center, Automotive, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154050

- Number of Pages: 248

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

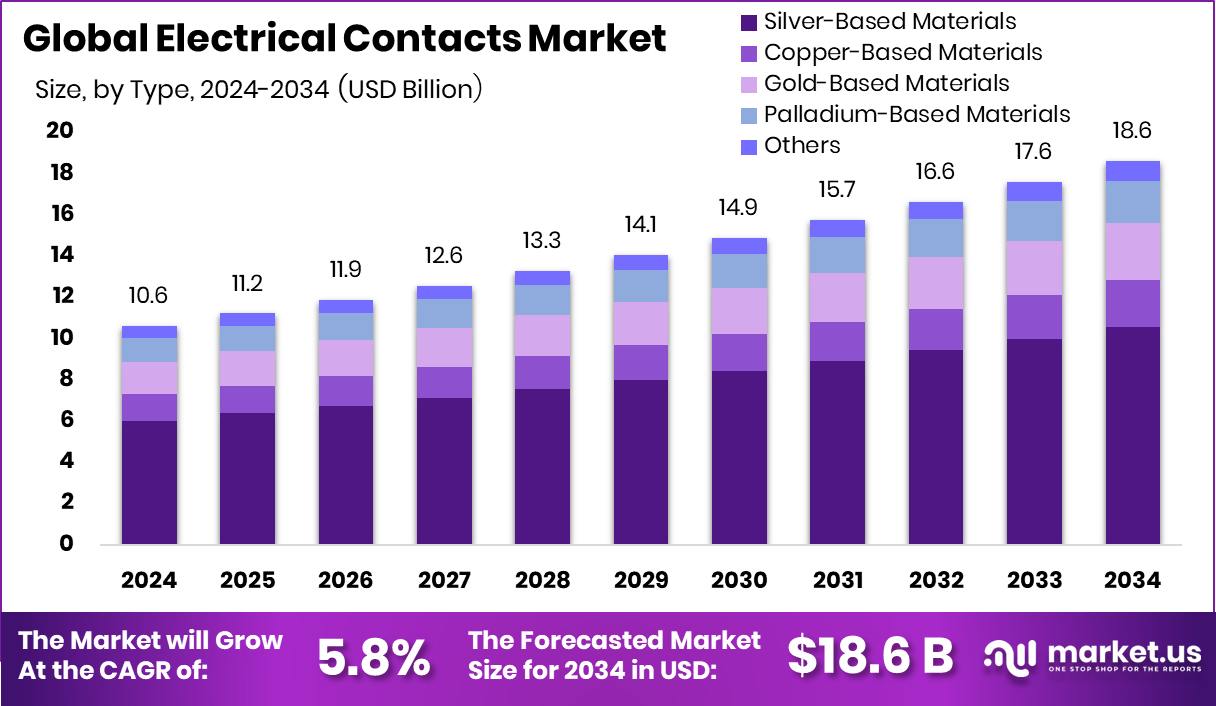

The Global Electrical Contacts Market is expected to be worth around USD 18.6 billion by 2034, up from USD 10.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

Electrical contacts are conductive components used to make or break an electrical circuit by allowing current to flow between two points. They are typically made from metals such as copper, silver, or alloys due to their high conductivity and durability. These contacts are essential in switches, relays, circuit breakers, and connectors, where they open or close circuits under mechanical or electrical control.

The electrical contacts market refers to the global industry involved in the design, production, and distribution of contact components used in various electrical systems and devices. This market spans multiple sectors, including power generation, industrial automation, automotive, consumer electronics, and telecommunications. Growth in this market is supported by increasing electricity demand, ongoing industrial automation, and rising integration of electronics in everyday applications.

The market is experiencing steady growth driven by global electrification and the modernization of power infrastructure. The transition to renewable energy systems and smart grid development is accelerating demand for reliable contact materials in switching equipment. Moreover, the rising need for uninterrupted power supply and safety across residential and industrial facilities is encouraging the installation of advanced switchgear, further boosting market expansion. EMA has conditionally approved the import of 1.75 GW of electricity from Australia.

Emerging opportunities lie in the adoption of eco-friendly contact materials and the shift toward high-voltage DC systems, especially in energy and transportation infrastructure. As countries invest in electric mobility, charging stations, and grid enhancements, the need for robust and high-performance electrical contacts will rise. Meanwhile, the National Grid has secured £1.5 million in funding from Ofgem to support innovation initiatives aimed at advancing progress toward net zero.

Key Takeaways

- The Global Electrical Contacts Market is expected to be worth around USD 18.6 billion by 2034, up from USD 10.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the electrical contacts market, silver-based materials dominate with 56.8% due to their high conductivity performance.

- Rivet-type contacts hold 53.1% market share, offering durability and stability in electrical switching applications.

- Low-voltage products account for 69.3%, reflecting widespread usage across home appliances and industrial automation equipment.

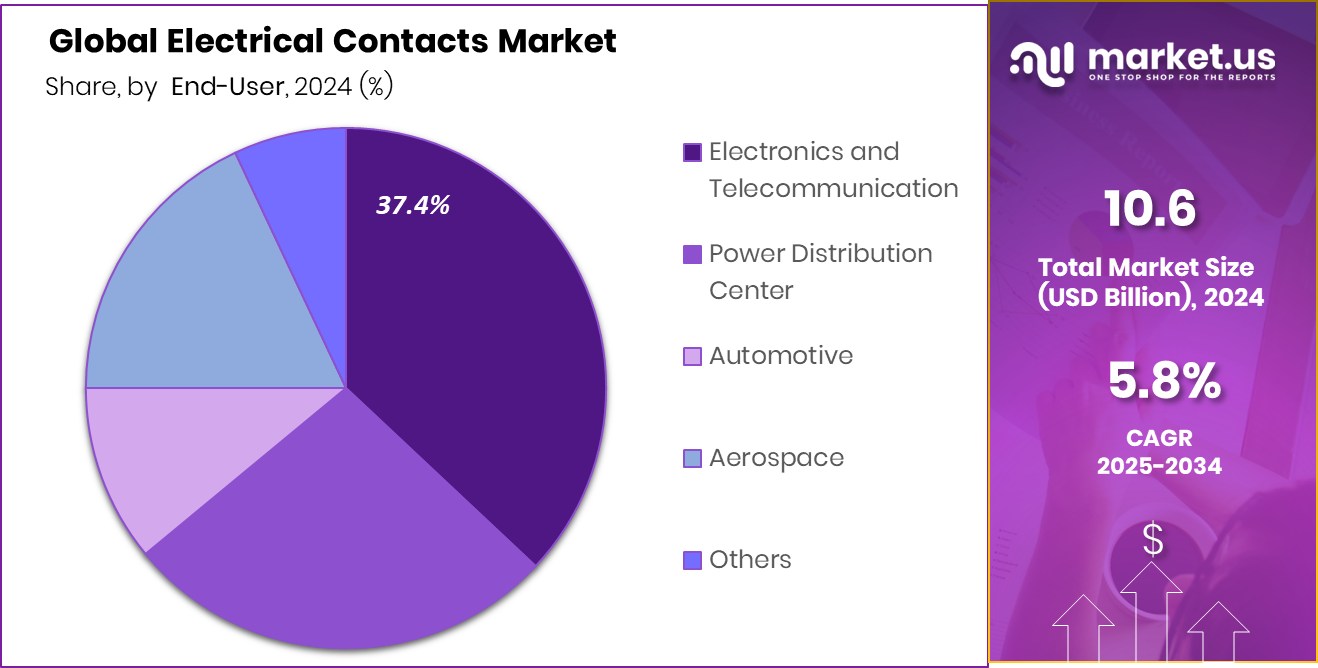

- Electronics and telecommunication sectors lead end-user adoption with a 37.4% share, driven by digital infrastructure growth.

By Type Analysis

Silver-based materials dominate the electrical contacts market with a 56.8% share.

In 2024, Silver-Based Materials held a dominant market position in the By Type segment of the Electrical Contacts Market, with a 56.8% share. This leading position can be attributed to silver’s superior electrical and thermal conductivity, which makes it the preferred material for high-performance contact applications. Silver-based electrical contacts are widely used across switches, relays, and circuit breakers where minimal contact resistance and high reliability are required.

The 56.8% share reflects the strong demand for long-lasting and efficient contact materials, particularly in systems where consistent current transfer is critical. Additionally, the growing emphasis on energy efficiency and operational safety has reinforced the preference for silver-based options over alternatives. Manufacturers continue to leverage silver alloys to balance performance and cost, making these materials a dependable choice in both low-voltage and high-voltage applications.

As end-users prioritize stability and precision in their electrical systems, silver-based contacts are expected to retain their dominance within this segment, supported by continuous improvements in alloy formulations and coating technologies aimed at enhancing lifecycle performance and reducing maintenance needs.

By Electrical Contact Analysis

Rivet-type contacts lead the electrical contacts market, holding 53.1% globally.

In 2024, Rivet-Type held a dominant market position in the By Electrical Contact segment of the Electrical Contacts Market, with a 53.1% share. This substantial market share is largely due to the rivet-type contact’s reliability, durability, and ease of integration into various electrical components. These contacts are widely used in electromechanical devices such as relays, switches, and contactors, where consistent mechanical pressure and electrical conductivity are critical for efficient operation.

The dominance of rivet-type contacts is supported by their cost-effective production and adaptability across a range of load conditions. Their stable performance under mechanical stress and ability to withstand repeated operations make them a preferred choice in both industrial and residential electrical systems. Manufacturers favor rivet-type configurations for their simplicity in assembly and strong bonding with base metals, ensuring long-term stability in high-use environments.

The 53.1% share highlights the widespread acceptance of this type, particularly in applications demanding robust contact integrity and low maintenance. With the ongoing push for reliability and safety in electrical infrastructure, rivet-type contacts are expected to maintain their leading role, especially as demand continues to grow in control systems and circuit protection devices requiring high endurance and consistent electrical performance.

By Applications Analysis

Low-voltage products drive the electrical contacts market with a 69.3% usage share.

In 2024, Low-Voltage Products held a dominant market position in the By Applications segment of the Electrical Contacts Market, with a 69.3% share. This clear dominance reflects the extensive use of electrical contacts in low-voltage systems such as circuit breakers, contactors, switches, and residential wiring devices. The widespread demand for low-voltage infrastructure in homes, commercial buildings, and industrial control systems has significantly contributed to this segment’s leading position.

The 69.3% share signifies the market’s strong reliance on low-voltage applications, where electrical contacts play a critical role in ensuring reliable current transfer and operational safety. These contacts are essential for regulating electricity flow, protecting circuits from overloads, and supporting automation systems across multiple sectors. The increasing adoption of smart homes, digital control panels, and low-voltage distribution networks continues to drive the need for robust and efficient contact solutions tailored to these uses.

Manufacturers focus on durability, arc resistance, and long operational life in these products, aligning with user expectations for minimal maintenance and consistent performance. As demand for energy-efficient and compact electrical systems rises globally, low-voltage products are expected to remain at the forefront of the application landscape within the electrical contacts market, reinforced by ongoing infrastructure development and modernization efforts.

By End-User Analysis

The electronics and telecommunications segment captures 37.4% of the electrical contacts market.

In 2024, Electronics and Telecommunication held a dominant market position in the By End-User segment of the Electrical Contacts Market, with a 37.4% share. This leadership is attributed to the increasing integration of electrical contacts in a wide range of electronic and telecommunication devices, including mobile phones, network switches, routers, and consumer electronics. These applications demand high-performance contact solutions that ensure precise signal transmission, minimal electrical resistance, and long-term reliability.

The 37.4% share reflects the rapid growth in digital connectivity and the expansion of communication infrastructure, both of which heavily rely on dependable electrical interfaces. Electrical contacts play a critical role in maintaining uninterrupted signal flow and efficient power delivery within compact electronic assemblies.

The rising consumption of portable electronic devices, paired with ongoing deployment of 5G and high-speed data infrastructure, continues to strengthen the demand for advanced contact components in this segment. Manufacturers are focusing on miniaturized, corrosion-resistant contact materials tailored for high-frequency and low-voltage operations.

Key Market Segments

By Type

- Silver-Based Materials

- Copper-Based Materials

- Gold-Based Materials

- Palladium-Based Materials

- Others

By Electrical Contact

- Rivet-Type

- Plate-Type

- Material-Wire

By Applications

- Low-Voltage Products

- Switches

- Relays

- Connectors

- Others

- Medium and High Voltage Products

- Circuit Breakers

- Transformers

- Generators

- Others

By End-User

- Electronics and Telecommunication

- Power Distribution Center

- Automotive

- Aerospace

- Others

Driving Factors

Rising Electrification Across Sectors Boosts Contact Demand

One of the main driving factors of the electrical contacts market is the growing electrification across residential, industrial, and commercial sectors. As more machines, systems, and vehicles rely on electric power, the demand for reliable electrical connections has increased. From everyday appliances to industrial automation systems and electric vehicles, electrical contacts play a key role in enabling current flow and switching operations.

This trend is also supported by global energy transition efforts, where clean energy projects and smart grids are being developed to replace traditional systems. As a result, there is a higher need for durable and high-performing contact materials that can support safe and efficient electrical operations across these modern applications.

Restraining Factors

Fluctuating Raw Material Prices Affect Cost Stability

One of the key restraining factors in the electrical contacts market is the frequent fluctuation in raw material prices, especially for metals like silver, copper, and palladium. These metals are essential for producing high-quality electrical contacts due to their excellent conductivity and durability. However, their prices are often impacted by global economic trends, mining output, and geopolitical tensions.

When prices rise sharply, it increases the production cost for manufacturers, making it harder to maintain profit margins. This can also lead to higher prices for end-users, which affects market growth. Small and medium-sized manufacturers are especially vulnerable to such volatility, making it difficult to plan long-term production or invest in product innovations confidently.

Growth Opportunity

Expansion in Electric Vehicle Charging Infrastructure Offers Growth Opportunity

A significant growth opportunity in the electrical contacts market stems from the ongoing global expansion of electric vehicle (EV) charging infrastructure. As EV adoption accelerates, the need for efficient, reliable, and durable electrical connections at charging stations is increasing rapidly. Electrical contacts used in charging connectors, switchgear, and control systems must support high current flow, resist wear and corrosion, and ensure secure, safe operations.

This evolving demand opens room for specialized contact materials and designs optimized for frequent use and harsh outdoor conditions. Manufacturers that invest in R&D to develop long-lasting, high-performance contact solutions tailored for EV infrastructure stand to gain substantially. The transition toward cleaner transportation systems is expected to drive sustained growth in this segment of the electrical contacts market.

Latest Trends

Adoption of Contactless and Smart Switching Technologies Expanding

The electrical contacts market is experiencing a growing trend toward contactless and smart switching technologies. Instead of traditional mechanical contacts, many modern systems now use solid-state or magnetic solutions that enable switching without physical contact. This shift enhances reliability by reducing wear and eliminating issues related to arcing and mechanical fatigue.

Additionally, smart switching allows for integration with digital controls and real‑time monitoring of system status, enabling better performance tracking and predictive maintenance. These technologies are particularly valuable in industrial automation, telecommunications, and renewable energy systems where operational uptime and system longevity are critical.

Regional Analysis

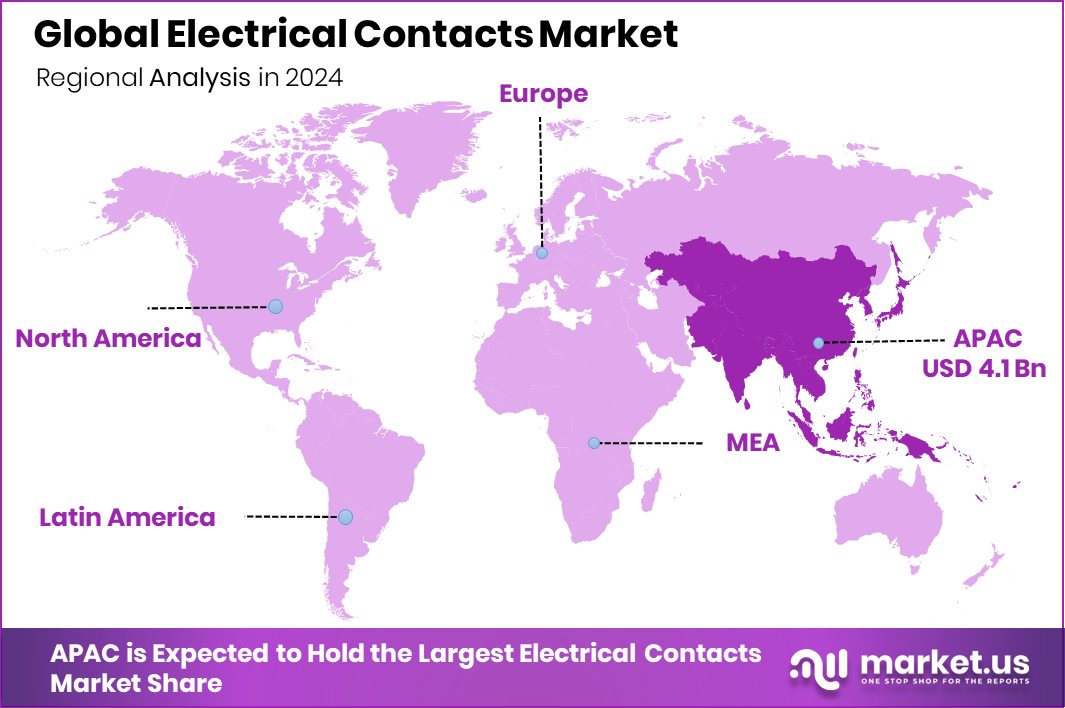

Asia-Pacific led the electrical contacts market with a 38.7% share, USD 4.1 Bn.

In 2024, Asia-Pacific held the dominant position in the electrical contacts market, accounting for 38.7% of the global share, with a market value of USD 4.1 billion. The region’s leadership is supported by strong growth in industrial automation, consumer electronics manufacturing, and energy infrastructure projects, particularly across China, India, Japan, and Southeast Asia. Increasing investments in electrification and infrastructure development have contributed to the high demand for electrical contacts across residential, commercial, and industrial applications.

North America continues to remain a significant regional market, driven by steady advancements in smart grid systems and widespread use of low-voltage switchgear. Europe, meanwhile, benefits from established automotive and industrial automation sectors, along with efforts toward sustainable energy use. The Middle East & Africa region is gradually expanding, supported by infrastructure modernization and rising electricity demand. Latin America’s growth is also being shaped by developments in residential electrification and small-scale industrialization.

While all regions contribute to the global landscape, Asia-Pacific’s share of 38.7% underlines its position as the central hub for both production and consumption of electrical contact components. This trend is expected to continue as the region further scales its manufacturing capabilities and continues investing in electrification initiatives across various end-user sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, METALOR Technologies SA continued to demonstrate its strong foothold in the electrical contacts segment through consistent product innovation in precious metal-based alloys. The company leveraged its expertise in refining and metallurgical processes to deliver high-performance electrical contact materials. With an increasing focus on environmental compliance and durability, METALOR’s tailored solutions for automotive, power, and switchgear applications are expected to contribute significantly to its global revenue share.

Modison Limited maintained its position as a key player in the Indian and international markets by focusing on manufacturing silver and silver alloy electrical contact materials. The company’s vertical integration—from refining silver to producing contact tips and assemblies—ensured cost efficiency and quality control. In 2024, Modison’s growth was supported by increasing domestic demand for switchgear components and expanding exports, particularly in low and medium-voltage sectors.

Heraeus Group sustained its leadership in the high-purity contact materials domain, capitalizing on its R&D strengths and wide application reach across industries such as energy, electronics, and automotive. The firm’s emphasis on digitalized production and recycling of precious metals enhanced both cost-effectiveness and environmental responsibility.

Top Key Players in the Market

- METALOR Technologies SA

- Modison Limited

- Heraeus Group

- Zhejiang Fuda Alloy Materials Technology Co., Ltd.

- Nippon Tungsten Co., Ltd.

- Materion Corporation

- Umicore

- Wenzhou Hongfeng Electrical Alloy Co., Ltd.

- Chugai Electric Industrial Co., Ltd.

- Taewon Precision Company

- Electrical Contacts, Ltd.

- Longsun Group Co., Ltd.

Recent Developments

- In July 2025, Materion completed its acquisition of manufacturing assets in Dangjin, South Korea, formerly owned by Konasol. This move adds tantalum sputtering and deposition capability in Asia to support semiconductor applications, which often use contact and connector metals .

- In December 2024, Umicore completed a bolt-on acquisition of Shinhao Materials LLC, leading to the creation of Umicore Suzhou Semiconductor Materials Co., Ltd. (USSM) in China. This expanded Umicore’s product reach into advanced copper plating additives (IntraCu® technology) relevant to semiconductor packaging, which overlaps with connector and contact material coatings.

Report Scope

Report Features Description Market Value (2024) USD 10.6 Billion Forecast Revenue (2034) USD 18.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Silver-Based Materials, Copper-Based Materials, Gold-Based Materials, Palladium-Based Materials, Others), By Electrical Contact (Rivet-Type, Plate-Type, Material-Wire), By Applications (Low-Voltage Products (Switches, Relays, Connectors, Others), Medium and High Voltage Products (Circuit Breakers, Transformers, Generators, Others)), By End-User (Electronics and Telecommunication, Power Distribution Center, Automotive, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape METALOR Technologies SA, Modison Limited, Heraeus Group, Zhejiang Fuda Alloy Materials Technology Co., Ltd., Nippon Tungsten Co., Ltd., Materion Corporation, Umicore, Wenzhou Hongfeng Electrical Alloy Co., Ltd., Chugai Electric Industrial Co., Ltd., Taewon Precision Company, Electrical Contacts, Ltd., Longsun Group Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electrical Contacts MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Electrical Contacts MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- METALOR Technologies SA

- Modison Limited

- Heraeus Group

- Zhejiang Fuda Alloy Materials Technology Co., Ltd.

- Nippon Tungsten Co., Ltd.

- Materion Corporation

- Umicore

- Wenzhou Hongfeng Electrical Alloy Co., Ltd.

- Chugai Electric Industrial Co., Ltd.

- Taewon Precision Company

- Electrical Contacts, Ltd.

- Longsun Group Co., Ltd.