Global Edge AI Hardware Market By Device (Smartphones, Cameras, Robots, Wearables, Smart Speaker, Other Devices), By Processor (CPU, GPU, FPGA, ASIC), By End-use Industry (Consumer Electronics, Real Estate, Automotive, Transportation, Healthcare, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123237

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

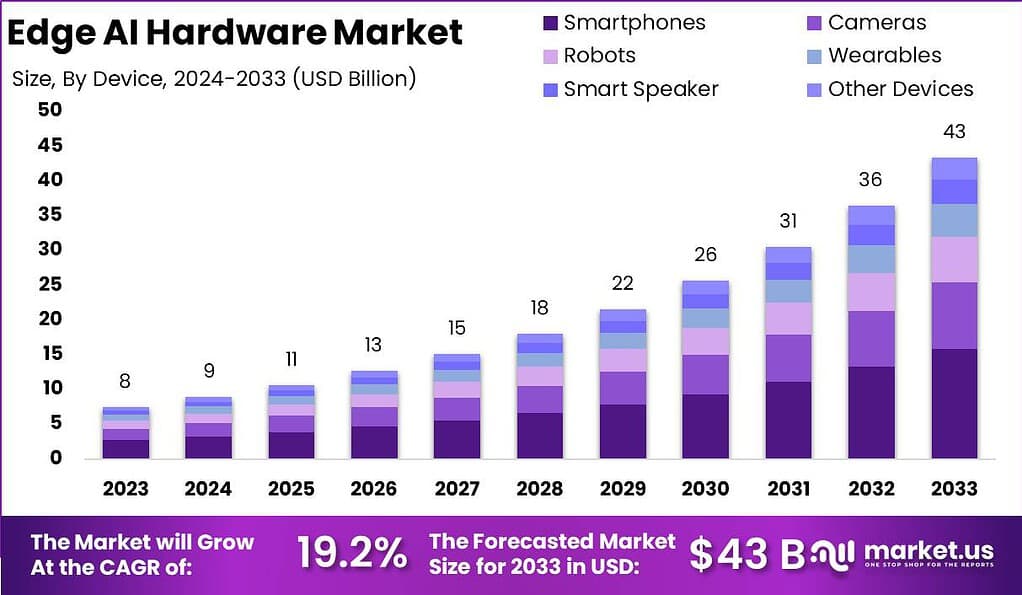

The Global Edge AI Hardware Market size is expected to be worth around USD 43 Billion By 2033, from USD 8 Billion in 2023, growing at a CAGR of 19.2% during the forecast period from 2024 to 2033.

The Edge AI hardware market has witnessed significant growth in recent years, driven by several factors. Edge AI refers to the deployment of artificial intelligence algorithms and processing capabilities on edge devices, such as smartphones, Internet of Things (IoT) devices, and embedded systems. This approach enables real-time data analysis and decision-making at the edge of the network, without relying heavily on cloud computing.

One of the key growth factors for the Edge AI hardware market is the exponential growth of IoT devices. With the proliferation of connected devices, there is a massive influx of data generated at the edge. Edge AI hardware enables efficient processing and analysis of this data locally, reducing latency and bandwidth requirements. This is particularly crucial for applications that require real-time responses, such as autonomous vehicles, industrial automation, and smart cities.

Another growth factor is the increasing demand for privacy and data security. Edge AI hardware allows data to be processed locally, minimizing the need for transmitting sensitive information to the cloud. This enhances privacy and mitigates potential security risks associated with data transfer. Additionally, edge devices equipped with AI capabilities can perform on-device data processing, reducing the reliance on cloud infrastructure and addressing concerns related to data privacy regulations.

However, the Edge AI hardware market also faces certain challenges. One of the primary challenges is the limited computational power and energy constraints of edge devices. AI algorithms typically require substantial processing power, which can be a challenge to implement on resource-constrained devices. Hardware manufacturers need to develop energy-efficient and compact solutions to overcome these limitations.

Moreover, the diversity of edge devices poses a challenge in terms of hardware compatibility and optimization. Different devices have varying hardware architectures and capabilities, making it challenging to develop AI models that can run efficiently across a wide range of edge devices. Hardware vendors need to provide flexible and scalable solutions to accommodate the diverse requirements of edge AI applications.

Despite the challenges, the Edge AI hardware market offers significant opportunities. The increasing adoption of 5G networks provides a boost to the market, as it enables faster and more reliable connectivity, enhancing the capabilities of edge devices. This allows for seamless integration of AI capabilities into various industries, such as healthcare, retail, and agriculture.

Furthermore, the ongoing advancements in AI chip design and manufacturing technologies present opportunities for innovation and performance improvement in Edge AI hardware. Companies are investing in developing specialized AI chips, such as neural processing units (NPUs) and field-programmable gate arrays (FPGAs), to optimize AI computations and accelerate inferencing at the edge.

For instance, In March 2022, Synaptics, a U.S.-based hardware company, released the Katana Edge AI Kit to accelerate the development of sensor fusion applications and AI vision for the Internet of Things (IoT). This kit is designed to integrate motion, vision, and sound detection software and hardware, along with both wireless and wired connectivity. By simplifying the design and development process, Synaptics aims to facilitate the adoption of edge AI technology in IoT applications.

Key Takeaways

- The Global Edge AI Hardware Market is projected to be valued at USD 43 Billion by 2033, rising from USD 8 Billion in 2023, and is anticipated to grow at a compound annual growth rate (CAGR) of 19.2% during the forecast period from 2024 to 2033.

- In 2023, the smartphones segment dominated the Edge AI hardware market, capturing over 36.5% of the market share.

- The CPU segment held a significant position in the Edge AI hardware landscape in 2023, accounting for more than 29.2% of the market share.

- The Consumer Electronics segment also maintained a leading position in the Edge AI hardware market in 2023, with a market share exceeding 21.3%.

- In 2023, North America was the dominant region in the Edge AI hardware market, holding over 37.5% of the market share and generating revenues of USD 3.0 billion.

Device Analysis

In 2023, the smartphones segment held a dominant market position within the Edge AI hardware market, capturing more than a 36.5% share. This leadership can be primarily attributed to the pervasive use of smartphones globally and the continuous advancements in mobile technology that incorporate AI capabilities directly into the device hardware.

Smartphones are increasingly equipped with AI-powered processors that enhance functionalities such as image and speech recognition, augmented reality, and user behavior prediction, which significantly improve user experience and device performance.

The demand for AI integration in smartphones is driven by consumer expectations for smarter, more intuitive devices that offer enhanced security features like facial recognition and personalized AI-driven services such as virtual assistants and customized feeds.

Additionally, the expansion of 5G technology has further propelled the smartphones segment by enabling faster data speeds and more reliable connections, which are essential for supporting sophisticated AI applications on mobile devices.

Moreover, manufacturers are continuously innovating to integrate powerful AI chips into smartphones, making them the central hub for personal data processing and connectivity. This innovation aligns with the growing trend of edge computing, where data is processed locally on the device, reducing latency and improving efficiency.

As a result, the smartphone segment not only leads in market share but also spearheads the development of edge AI technologies, setting trends that other device segments often follow. This segment’s robust growth signifies its critical role in shaping the future landscape of the Edge AI hardware market.

Processor Analysis

In 2023, the CPU segment held a dominant market position in the Edge AI hardware landscape, capturing more than a 29.2% share. This predominance is largely due to the versatility and ubiquity of CPUs in various computing devices, from smartphones to servers.

CPUs are integral in general-purpose computing and are well-suited for handling a wide range of AI tasks that require sequential data processing. Their ability to provide stable and reliable performance across diverse operating environments makes them a preferred choice for developers and manufacturers.

CPUs are particularly advantageous in edge AI applications due to their flexibility in executing complex algorithms that benefit from sequential processing capabilities. This is crucial in environments where tasks require rapid, real-time decision-making without the need to send data back to a centralized cloud server.

Additionally, CPUs have seen significant advancements in their architecture, with enhancements in power efficiency and processing speed, which further cements their utility in edge AI applications. Furthermore, the widespread familiarity among developers with CPU programming and optimization allows for easier and more efficient implementation of AI solutions at the edge.

This accessibility helps in speeding up the development cycle of AI applications, promoting innovation, and reducing time-to-market for new technologies. Thus, the CPU segment continues to lead the Edge AI hardware market, driven by its foundational role in computing and its adaptability to meet the growing demands of AI technologies.

End-use Industry Analysis

In 2023, the Consumer Electronics segment held a dominant market position in the Edge AI hardware market, capturing more than a 21.3% share. This leading position can be attributed to the widespread adoption of AI technologies in consumer devices such as smartphones, smart speakers, and wearables. These devices increasingly incorporate AI to enhance user interaction and automate device functionality, driving significant demand for Edge AI hardware that can process data locally and efficiently.

The proliferation of smart homes and the Internet of Things (IoT) has further boosted the demand for Edge AI hardware in consumer electronics. Devices in these ecosystems often require real-time processing for tasks like voice recognition, gesture control, and ambient intelligence, all of which are facilitated by edge computing solutions.

The need for seamless and immediate responses in these applications makes Edge AI hardware an essential component, thereby supporting the segment’s growth. Additionally, the Consumer Electronics segment benefits from continuous technological advancements and consumer demand for more sophisticated and interconnected devices.

Manufacturers are investing in innovative AI chips that can be embedded into consumer electronics, enhancing device capabilities and ensuring competitive differentiation in a crowded market. This ongoing innovation cycle not only sustains but also accelerates the segment’s dominance in the Edge AI hardware market, underlining its pivotal role in driving forward the applications of artificial intelligence at the edge.

Key Market Segments

By Device

- Smartphones

- Cameras

- Robots

- Wearables

- Smart Speaker

- Other Devices

By Processor

- CPU

- GPU

- FPGA

- ASIC

By End-use Industry

- Consumer Electronics

- Real Estate

- Automotive

- Transportation

- Healthcare

- Manufacturing

- Others

Driver

Increasing Demand for Real-Time Data Processing

The surge in demand for real-time data processing in various applications, including autonomous vehicles, industrial IoT, and consumer electronics, is a primary driver for the Edge AI hardware market. Real-time data processing capabilities are critical in these areas to enable rapid decision-making and responsiveness.

For instance, in autonomous vehicles, edge AI hardware allows for immediate processing of sensor data, crucial for safe navigation and obstacle avoidance. Similarly, in smart manufacturing, real-time data analysis can lead to more efficient operations, predictive maintenance, and reduced downtime. The ability to process data locally, without relying on cloud connectivity, reduces latency, enhances privacy, and improves system reliability, thereby propelling the adoption of edge AI hardware.

Restraint

High Costs and Complexity of Implementation

A significant restraint in the Edge AI hardware market is the high cost and complexity associated with implementing edge AI solutions. The development and deployment of edge AI hardware require substantial investment in specialized processors, sensors, and other components, which can be prohibitively expensive for small and medium-sized enterprises (SMEs).

Additionally, integrating advanced AI capabilities into edge devices often necessitates extensive modifications to existing infrastructure and systems, adding to the overall complexity and cost. This economic and technical barrier can slow down the adoption of edge AI technologies, particularly in sectors where cost constraints are a major consideration.

Opportunity

Expansion of 5G Technology

The rollout of 5G technology presents a significant opportunity for the Edge AI hardware market. 5G networks offer higher speeds and lower latency compared to previous generations, which enhances the capabilities of edge AI systems. With 5G, edge devices can communicate more efficiently and manage larger volumes of data, enabling more sophisticated AI applications at the edge.

This technology also facilitates the deployment of AI-driven services in areas such as telemedicine, smart cities, and augmented reality, all of which require robust, low-latency edge computing solutions. As 5G becomes more widespread, the demand for compatible edge AI hardware is expected to increase substantially.

Challenge

Security Concerns

Security remains a major challenge in the deployment of edge AI hardware. Edge devices, by virtue of their distributed nature and accessibility, are vulnerable to various security threats including data breaches and cyber attacks. Since these devices often process sensitive information, a security breach can have severe implications.

Furthermore, maintaining the integrity and confidentiality of data across numerous edge devices adds a layer of complexity to security management. Manufacturers and users must invest in robust security measures, which can increase costs and complicate deployments, potentially hindering the market growth.

Growth Factors

- IoT Integration: The proliferation of Internet of Things (IoT) devices across various sectors such as healthcare, automotive, and industrial automation significantly drives the growth of the Edge AI hardware market. These devices generate vast amounts of data that need real-time processing, pushing the demand for efficient edge AI solutions.

- Advancements in AI and Machine Learning: Continuous improvements in artificial intelligence (AI) and machine learning algorithms enhance the capabilities of edge AI hardware. These advancements allow for more sophisticated data analysis and decision-making at the device level, expanding the range of potential applications.

- Increased Focus on Data Privacy: With growing concerns over data privacy and stringent regulations like GDPR, there is a heightened demand for processing data locally on edge devices. This trend helps in minimizing data exposure and enhances consumer trust, thus boosting the adoption of edge AI hardware.

- Demand for Low-latency Processing: Applications requiring instant data processing, such as autonomous driving and real-time remote monitoring, need edge AI hardware to meet their low-latency requirements. This demand promotes the development and deployment of advanced edge AI systems.

- Government and Industry Initiatives: Various government and industry initiatives promoting digital transformation and smart infrastructure projects, like smart cities and smart grids, are pivotal in fostering the growth of the edge AI hardware market.

Emerging Trends

- Energy-efficient AI Chips: There is a growing trend towards developing energy-efficient AI chips that reduce power consumption while maintaining high performance. These chips are particularly crucial for battery-operated edge devices, enabling longer operational times without frequent recharges.

- Hybrid Edge-Cloud AI Models: To balance the load between edge and cloud computing, hybrid models are emerging as a trend. These models leverage both local processing and cloud capabilities, optimizing performance and scalability of AI applications.

- AI-enabled Edge Security: Enhancing security at the edge is becoming a trend, with more devices equipped with AI capabilities to detect and respond to threats autonomously. This development is crucial for protecting the integrity of data in distributed networks.

- Expansion of 5G: The expansion of 5G networks globally supports higher data transfer rates and lower latency, making it easier to deploy more complex AI applications on edge devices. This trend is crucial for real-time analytics and enhanced connectivity.

- Cross-industry Collaborations: There is an increasing trend of collaborations between technology providers, chipset manufacturers, and industry-specific enterprises to develop tailored edge AI solutions. These partnerships are aimed at creating highly specialized hardware that meets the unique needs of different sectors.

Regional Analysis

In 2023, North America held a dominant market position in the Edge AI hardware market, capturing more than a 37.5% share and generating revenues of USD 3.0 billion. This leadership can be attributed to the region’s advanced technological infrastructure, substantial investments in AI research and development, and the presence of leading technology companies.

The strong ecosystem of tech giants like NVIDIA, Intel, and Qualcomm, which are at the forefront of AI hardware innovation, significantly contributes to North America’s market dominance. Additionally, North America’s focus on enhancing industrial automation, smart cities, and autonomous vehicles has driven the demand for Edge AI hardware.

The integration of AI at the edge enables faster data processing and real-time analytics, which are crucial for applications requiring immediate decision-making capabilities. This regional emphasis on deploying AI solutions across various sectors, including healthcare, automotive, and consumer electronics, supports the substantial market share.

Moreover, government initiatives and funding to support AI development play a critical role. For example, the U.S. government has launched several initiatives to promote AI research, ensuring the region remains competitive in the global AI landscape. These policies not only foster innovation but also attract investments from both domestic and international stakeholders, further solidifying North America’s leading position in the Edge AI hardware market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Edge AI Hardware market features a robust roster of key players, each contributing significantly to the technological advancements and market expansion. Qualcomm Technologies Inc. stands out with its innovative chipsets that empower devices to perform AI tasks efficiently at the edge, reducing reliance on cloud-based operations. Huawei Technologies also plays a pivotal role, especially in developing markets, with its HiAI platform and AI-enabled chip solutions that cater to a diverse range of IoT and smart device applications.

MediaTek Inc. is renowned for its integrated circuits that support AI-driven functionalities in consumer electronics, enhancing the interface between users and devices through intelligent processing. Intel Corporation brings to the table its extensive expertise in AI hardware with processors that support high-speed, real-time AI computations, which are crucial for autonomous driving and industrial automation.

IBM Corporation, with its research prowess, focuses on developing AI systems that can operate in edge environments, pushing forward the boundaries of data privacy and security. Apple Inc., on the other hand, integrates AI capabilities directly into its consumer hardware products, creating a seamless user experience that is both intuitive and responsive.

Top Key Players in the Market

- Qualcomm Technologies Inc.

- Huawei Technologies

- MediaTek Inc.

- Intel Corporation

- IBM Corporation

- Apple Inc.

- NVIDIA Corporation

- Google LLC.

Recent Developments

- April 2024: Qualcomm announced a strategic collaboration with Advantech to revolutionize edge computing. This partnership aims to combine AI expertise, high-performance computing, and industry-leading connectivity to drive innovation in industrial computing.

- July 2024: Google expanded its AI hardware lineup with new edge AI modules designed for smart cameras and other edge devices, enhancing capabilities in image processing and real-time analytics.

- March 2024: Huawei launched the Ascend 910 AI processor, designed to support edge AI applications with high performance and energy efficiency, targeting sectors such as smart cities and autonomous driving.

- April 2023: MediaTek unveiled its Dimensity 9200 chipset, which integrates advanced AI processing capabilities for edge devices, focusing on enhancing mobile AI applications such as image recognition and voice assistance.

- August 2023: Intel launched the Movidius Myriad X VPU, a new AI processor for edge devices, offering improved performance for computer vision and deep learning applications.

- June 2023: Apple released the M2 chip, featuring enhanced AI capabilities for edge computing, optimized for applications in augmented reality and machine learning on mobile devices.

- February 2023: NVIDIA launched the Jetson Orin platform, a new edge AI hardware solution designed to power autonomous machines and AIoT applications with high efficiency.

Report Scope

Report Features Description Market Value (2023) USD 8.0 Bn Forecast Revenue (2033) USD 43 Bn CAGR (2024-2033) 19.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device (Smartphones, Cameras, Robots, Wearables, Smart Speaker, Other Devices), By Processor (CPU, GPU, FPGA, ASIC), By End-use Industry (Consumer Electronics, Real Estate, Automotive, Transportation, Healthcare, Manufacturing, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Qualcomm Technologies Inc., Huawei Technologies, MediaTek Inc., Intel Corporation, IBM Corporation, Apple Inc., NVIDIA Corporation, Google LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Edge AI hardware?Edge AI hardware refers to devices and components designed to perform artificial intelligence (AI) computations directly on the edge of the network, close to where data is generated, rather than in a centralized cloud server.

How big is Edge AI Hardware Market?The Global Edge AI Hardware Market size is expected to be worth around USD 43 Billion By 2033, from USD 8 Billion in 2023, growing at a CAGR of 19.2% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Edge AI Hardware market?Increasing demand for low-latency processing, growth in IoT devices, advancements in AI algorithms, and the need for data privacy and security are key drivers.

What are the current trends and advancements in Edge AI Hardware market?Trends include the integration of AI with edge devices, development of specialized AI chips, adoption of edge computing for real-time analytics, and advancements in power efficiency and miniaturization.

What are the major challenges and opportunities in the Edge AI Hardware market?Challenges include interoperability issues, managing vast amounts of data at the edge, and ensuring robust security. Opportunities lie in expanding applications across industries, improving edge device capabilities, and enhancing AI algorithms.

Who are the leading players in the Edge AI Hardware market?Key players in the Edge AI Hardware market include Qualcomm Technologies Inc., Huawei Technologies, MediaTek Inc., Intel Corporation, IBM Corporation, Apple Inc., NVIDIA Corporation, Google LLC.

-

-

- Qualcomm Technologies Inc.

- Huawei Technologies

- MediaTek Inc.

- Intel Corporation

- IBM Corporation

- Apple Inc.

- NVIDIA Corporation

- Google LLC.