Global Dump Truck Market By Trucks Type (Rear, Side, Roll-off), By Engine ( ICE (Diesel and Gasoline), Electric), By End Use (Construction, Mining, Agriculture and Forestry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 19096

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

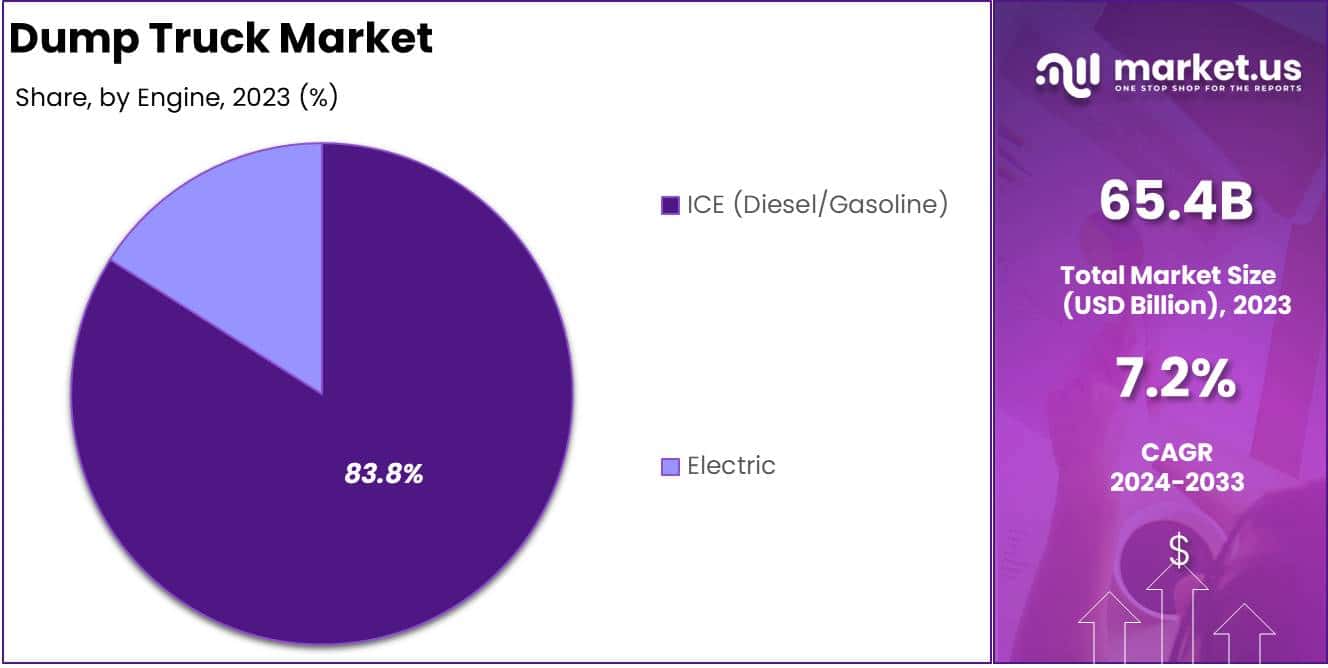

The Global Dump Truck Market size is expected to be worth around USD 131.1 Billion by 2033, from USD 65.4 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

A dump truck, also known as a tipper truck, is a heavy-duty vehicle primarily designed for transporting and unloading loose materials such as sand, gravel, demolition waste, and other bulk construction materials.

These vehicles are equipped with an open-box bed, which is hinged at the rear and equipped with hydraulic pistons to lift the front, allowing the contents to be deposited at the delivery site. Dump trucks are integral to industries like construction, mining, and waste management, where large-scale material handling is essential.

The market covers different types of dump trucks such as articulated, rigid, and off-road variants. Key end-users include construction companies, mining operators, infrastructure developers, and municipal bodies, reflecting the sector’s broad economic relevance.

The dump truck market is poised for growth due to several macroeconomic and industry-specific drivers. Increasing investments in infrastructure development, particularly in emerging economies, are a primary catalyst. Government initiatives aimed at building and upgrading roads, bridges, and urban infrastructure stimulate demand for construction equipment, including dump trucks.

Additionally, the expansion of the mining industry, driven by the rising demand for minerals and natural resources, significantly boosts the need for high-capacity dump trucks. Technological advancements, such as the integration of telematics and autonomous driving systems, are also enhancing the operational efficiency of these vehicles, contributing to market expansion.

Demand for dump trucks is closely tied to the health of the construction and mining industries. Urbanization trends, particularly in Asia-Pacific and Africa, are accelerating the construction of residential, commercial, and industrial facilities, driving consistent demand for material transportation solutions.

Furthermore, the global shift towards renewable energy and the associated construction of infrastructure like wind farms and solar power plants add to the sector’s momentum. In mining, as commodity prices stabilize and exploration activities resume, the need for durable, high-capacity dump trucks is expected to remain robust.

The dump truck market presents significant opportunities, particularly in developing regions. Rapid industrialization and the need for modern infrastructure in countries such as India, China, and Brazil offer a substantial growth runway.

In addition, the advent of electric and hybrid dump trucks aligns with global sustainability goals, providing manufacturers with a chance to diversify their portfolios and meet emerging regulatory standards.

The rise of smart cities and the increasing use of automation in construction and mining further open avenues for innovation, driving long-term growth prospects for market players.

According to Zippia, the U.S. dump truck market is characterized by a workforce of over 503,150 drivers, with notable demographic and wage trends shaping the industry. Women represent 9.4% of drivers, while 90.6% are men, and the average driver age is 47. Ethnic composition reveals 60.4% White, 16.8% Hispanic or Latino, and 13.3% Black or African American.

Notably, 4% of drivers identify as LGBT. Wage disparities persist, with women earning 92% of men’s salaries in 2022. Ponca City, OK, leads with an annual average wage of $61,647, highlighting regional wage variations within a sector vital to U.S. infrastructure.

According to Mobility Outlook, the SKT105E Electric Dump Truck redefines efficiency in open-cast mining, with a 70-tonne payload and a total weight capacity of 108,000 kg. Powered by dual 440 kW motors, it offers 60-70% better operating economics than conventional ICE models, marking a pivotal shift toward sustainable and cost-effective mining operations.

Key Takeaways

- The global dump truck market is projected to grow from USD 65.4 billion in 2023 to USD 131.1 billion by 2033, at a CAGR of 7.2%, driven by infrastructure development and mining expansion.

- Rear Dump Trucks dominate the market with a 53.2% share in 2023, owing to their superior load capacity and versatility in construction and mining.

- ICE (Diesel/Gasoline) engines lead with an 83.8% market share in 2023, favored for their power and reliability in demanding applications.

- The Construction sector commands a 46.5% share in 2023, fueled by rising global infrastructure projects.

- North America leads the dump truck market with a 38.3% share in 2023, benefiting from strong demand in construction and mining.

By Trucks Analysis

Rear Dump Trucks Dominating the Dump Truck Market with a 53.2% Share in 2023

In 2023, Rear Dump Trucks held a commanding position in the global dump truck market, capturing over 53.2% market share by truck type. Their dominance is attributed to their superior load-carrying capacity, ease of operation, and wide adoption across industries such as construction, mining, and infrastructure development.

Rear dump trucks are particularly favored for large-scale earthmoving projects, providing cost-effective and efficient transportation of materials. Side Dump Trucks accounted for a significant portion of the market, demonstrating their value in specialized applications.

Their ability to unload materials quickly and safely, particularly on uneven terrain, makes them a preferred choice in industries requiring high maneuverability and versatility. These features are especially beneficial in agriculture, forestry, and road construction.

Roll-Off Dump Trucks, while representing a smaller market share, are gaining traction due to their flexibility and adaptability in waste management and recycling sectors.

Their modular design, allowing for interchangeable containers, meets the rising demand for efficient waste handling in urban areas. With increasing environmental regulations and a focus on sustainability, this segment is poised for notable growth in the coming years.

By Engine Analysis

ICE (Diesel/Gasoline) Engines: Dominating the Dump Truck Market with an 83.8% Share in 2023

In 2023, Internal Combustion Engine (ICE) Dump Trucks, powered by diesel and gasoline, held a dominant position in the market, capturing over 83.8% of the total share by engine type.

The widespread use of ICE engines is driven by their robust performance, reliability, and ability to handle heavy loads in demanding environments such as construction, mining, and quarrying. Diesel engines, in particular, remain the industry standard due to their superior torque and fuel efficiency.

Although still in its nascent stages, Electric Dump Trucks are emerging as a promising alternative, driven by the push for sustainable and eco-friendly solutions. With advancements in battery technology and increasing regulatory pressures to reduce emissions, electric models are gaining interest, particularly in urban and environmentally sensitive areas.

While their market share remains modest, this segment is expected to grow significantly as infrastructure for electric vehicles improves and total cost of ownership decreases.

By End Use Analysis

Construction Dominating the Dump Truck Market with a 46.5% Share in 2023

In 2023, the Construction sector held a dominant position in the dump truck market, accounting for over 46.5% of the total share by end use. The sector’s leadership is underpinned by the growing demand for infrastructure development, including roads, bridges, and urban housing projects.

Dump trucks are indispensable in construction operations, offering efficient transport of materials like sand, gravel, and debris across project sites.

Mining emerged as another key end-use segment, driven by its reliance on heavy-duty dump trucks for the transportation of minerals, ores, and overburden. The industry’s focus on optimizing operational efficiency and safety continues to fuel demand for advanced dump truck solutions.

The Agriculture & Forestry segment accounted for a smaller but growing share, leveraging dump trucks for transporting bulk materials such as crops, soil, and timber. These trucks enhance productivity in sectors where large-scale material handling is crucial.

The Others category, including sectors like waste management and utility services, represents a diverse set of applications. Although its market share is comparatively limited, the segment benefits from the adaptability of dump trucks in specialized operations.

Key Market Segments

By Trucks Type

- Rear

- Side

- Roll-off

By Engine

- ICE (Diesel/Gasoline)

- Electric

By End Use

- Construction

- Mining

- Agriculture & Forestry

- Others

Driver

Infrastructure Development and Urbanization

The global surge in infrastructure development and rapid urbanization are pivotal drivers propelling the growth of the dump truck market. As nations invest heavily in constructing and upgrading transportation networks, residential complexes, and commercial facilities, the need for efficient material transportation becomes paramount.

Dump trucks, with their capacity to haul substantial loads of construction materials such as sand, gravel, and debris, are indispensable in these large-scale projects.

The expansion of urban areas necessitates the development of new roads, bridges, and public utilities, all of which require the movement of vast quantities of materials. This escalating demand for construction activities directly correlates with increased sales and utilization of dump trucks, thereby driving market growth.

Moreover, government initiatives aimed at boosting economic growth through infrastructure projects further amplify this demand. Policies promoting the development of smart cities and sustainable urban planning are leading to a proliferation of construction activities worldwide.

In emerging economies, rapid industrialization and urban migration are creating a surge in infrastructure needs, thereby escalating the requirement for dump trucks.

The construction industry’s reliance on these vehicles for efficient material handling underscores their critical role in meeting the logistical demands of modern infrastructure development. Consequently, the alignment of urbanization trends with infrastructure expansion serves as a significant driver for the global dump truck market.

Restraint

High Operational and Maintenance Costs

Despite the robust demand driven by infrastructure development, the dump truck market faces significant restraints due to high operational and maintenance costs. The substantial expenses associated with fuel consumption, regular maintenance, and parts replacement can deter potential buyers, particularly small and medium-sized enterprises operating on tight budgets.

The complexity of dump truck mechanisms necessitates specialized maintenance services, which can be costly and time-consuming.

Additionally, the volatility of fuel prices adds an element of financial unpredictability, further complicating budget planning for operators. These financial burdens can lead to extended equipment downtime and reduced operational efficiency, adversely affecting profitability and, consequently, market growth.

Furthermore, stringent environmental regulations aimed at reducing emissions have led to the development of more advanced, but often more expensive, dump truck models. The initial investment required for these environmentally compliant vehicles is higher, which can be a deterrent for many businesses.

The necessity for regular compliance checks and potential retrofitting of older models to meet new standards also contributes to increased operational costs. This financial strain can limit the adoption of new technologies and slow down fleet expansion, thereby restraining the overall growth of the dump truck market.

Opportunity

Technological Advancements and Electrification

The advent of technological innovations and the shift towards electrification present significant opportunities for growth in the dump truck market. The integration of advanced telematics systems enables real-time monitoring of vehicle performance, route optimization, and predictive maintenance, thereby enhancing operational efficiency and reducing downtime.

These technologies facilitate better fleet management and data-driven decision-making, leading to cost savings and improved productivity.

Moreover, the development of autonomous dump trucks, equipped with sophisticated sensors and artificial intelligence, is revolutionizing material transportation by increasing safety and operational efficiency, particularly in hazardous environments such as mining sites.

The global emphasis on sustainability and reducing carbon emissions has accelerated the adoption of electric dump trucks. These vehicles offer the dual benefits of lower operating costs and compliance with stringent environmental regulations.

Advancements in battery technology have extended the range and load capacity of electric dump trucks, making them a viable alternative to traditional diesel-powered models.

The growing availability of charging infrastructure and supportive government policies, including subsidies and incentives for electric vehicle adoption, further bolster this opportunity.

Companies investing in research and development to produce efficient and cost-effective electric dump trucks are well-positioned to capitalize on this emerging market trend, driving future growth.

Trends

Shift Towards Sustainable and Eco-Friendly Dump Trucks

A prominent trend shaping the dump truck market is the increasing shift towards sustainable and eco-friendly vehicles. Environmental concerns and stringent emission regulations are compelling manufacturers to innovate and develop dump trucks that minimize environmental impact.

The adoption of electric and hybrid dump trucks is gaining momentum, driven by advancements in battery technology that enhance performance and extend operational range.

These vehicles not only reduce greenhouse gas emissions but also offer lower operating costs due to decreased fuel consumption and maintenance requirements. The integration of renewable energy sources for charging further amplifies their environmental benefits, aligning with global sustainability goals.

In addition to electrification, there is a growing emphasis on utilizing lightweight materials and aerodynamic designs to improve fuel efficiency in traditional dump trucks. The incorporation of telematics and IoT technologies enables better route planning and load management, reducing unnecessary fuel consumption and emissions.

Manufacturers are also exploring the use of alternative fuels, such as hydrogen and biofuels, to power dump trucks, aiming to diversify energy sources and reduce reliance on fossil fuels.

This trend towards sustainability is not only driven by regulatory compliance but also by increasing consumer and stakeholder demand for environmentally responsible operations. Companies that proactively adopt these eco-friendly innovations are likely to gain a competitive advantage in the evolving dump truck market.

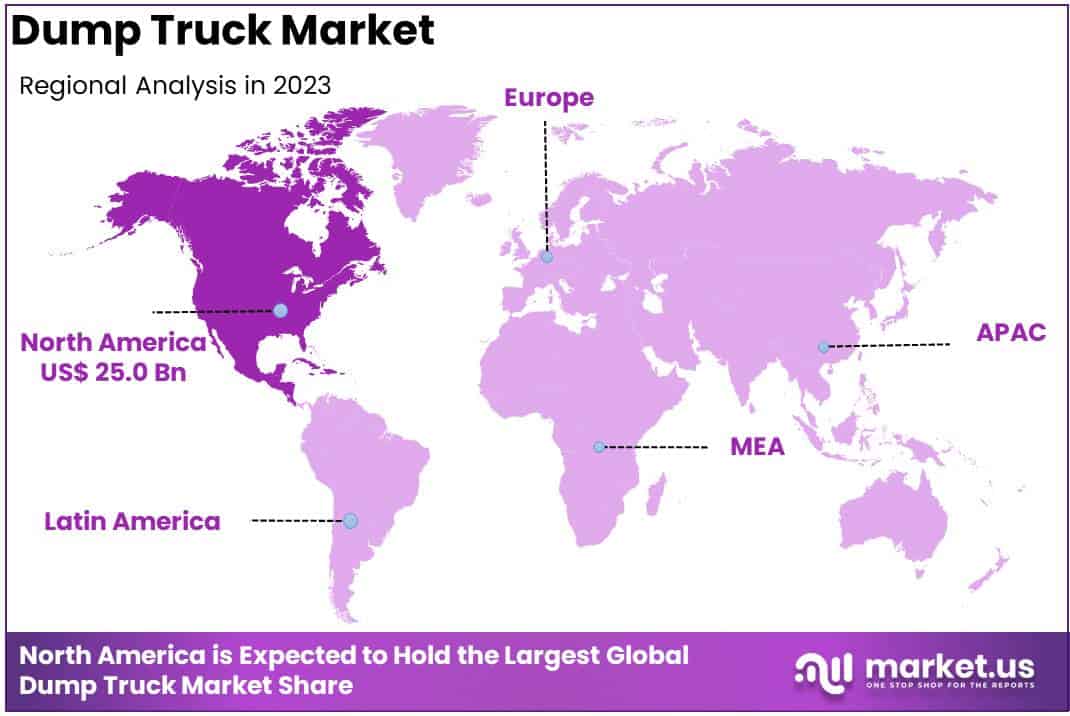

Regional Analysis

North America Leads Dump Truck Market with Largest Market Share of 38.3%

The global dump truck market exhibits diverse growth patterns across regions, with North America emerging as the leading market, capturing a dominant 38.3% share in 2023 and valued at USD 25.0 billion. This robust performance is driven by significant infrastructure investments, particularly in road construction and urban development.

The region’s strong mining sector further fuels demand for heavy-duty vehicles, while technological advancements in dump trucks enhance operational efficiency and safety, consolidating North America’s market position.

Europe follows as a key market, supported by stringent environmental regulations and the shift toward low-emission and electric dump trucks. The region’s well-established construction industry and focus on sustainability initiatives drive steady growth.

Asia Pacific represents a high-growth region, underpinned by rapid industrialization and urbanization, particularly in emerging economies such as China and India.

Government initiatives focused on infrastructure expansion, including road networks and large-scale commercial projects, propel demand for dump trucks. Asia Pacific is expected to exhibit strong growth potential in the coming years due to its massive population base and increasing construction activities.

The Middle East & Africa benefits from substantial investments in oil and gas exploration, as well as infrastructure projects aimed at diversifying economies beyond hydrocarbons. Similarly, Latin America experiences moderate growth, driven by the expansion of the mining and agriculture sectors, particularly in countries like Brazil and Chile.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global dump truck market is characterized by intense competition among established players, each leveraging their strengths to capture market share and drive innovation.

Caterpillar Inc. and Komatsu Ltd. remain dominant forces, renowned for their extensive product portfolios and cutting-edge technologies in heavy-duty construction and mining equipment.

OJSC BELAZ, with its specialized focus on ultra-large dump trucks, continues to command significant attention, particularly in the mining sector.

AB Volvo and Hitachi Construction Machinery Co., Ltd. are capitalizing on their advanced engineering capabilities and commitment to sustainability, introducing electric and hybrid models to meet stringent environmental regulations.

Deere & Company and Terex Trucks are expanding their footprint through strategic partnerships and diversification into emerging markets, while The Liebherr Group focuses on high-performance and reliable solutions tailored to complex construction projects.

Meanwhile, players like XCMG Group and KGHM Zanam SA are gaining traction in Asia and Europe, respectively, driven by robust demand for cost-effective yet high-quality machinery. DUX Machinery Corporation, with its niche in underground mining trucks, caters to specific industrial needs, enhancing its position in a competitive landscape.

This dynamic market environment pushes key players to innovate and adapt, responding to evolving customer requirements and global sustainability goals.

Companies that effectively integrate technological advancements, such as automation and telematics, while expanding their global presence, are poised to thrive in 2024 and beyond.

Top Key Players in the Market

- Caterpillar Inc.

- Komatsu Ltd.

- OJSC BELAZ

- Dheere & Company

- AB Volvo

- Hitachi Construction Machinery Co Ltd

- Terex Trucks

- The Liebherr Group

- KGHM Zanam SA

- DUX Machinery Corporation

- XCMG Group

Recent Developments

- In 2024 The Volvo Group acquired the battery business from Proterra and Proterra Operating Company for $210 million, excluding inventory adjustments. The acquisition includes a battery development center in California and an assembly facility in Greer, South Carolina.

- In 2023 Bosch and Plus formed a partnership to develop software-defined commercial trucks. PlusDrive, combined with Bosch’s steering systems, will deliver advanced driver assistance and partial automation. This collaboration was announced at the ACT Expo in Anaheim, California.

- In 2023 SANY Engineering Vehicles introduced a new range of energy-efficient dump trucks. These models focus on smarter features, higher performance, and lower environmental impact, aiming to transform the new energy vehicle sector.

- In 2023 Nikola Corp. started liquidating Romeo Power, which it had acquired for $144 million. The move supports Nikola’s focus on hydrogen fuel cell electric vehicles (FCEVs), which require fewer battery packs, sourced from Proterra’s South Carolina plant.

- In February 2024 Caterpillar Inc. posted Q4 2023 sales of $17.1 billion, a 3% rise from Q4 2022. Operating margins improved to 18.4%, with adjusted profit per share reaching $5.23, signaling strong financial growth.

Report Scope

Report Features Description Market Value (2023) USD 65.4 Bn Forecast Revenue (2033) USD 131.1 Bn CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Trucks Type (Rear, Side, Roll-off), By Engine ( ICE (Diesel and Gasoline), Electric), By End Use (Construction, Mining, Agriculture and Forestry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Caterpillar Inc., Komatsu Ltd., OJSC BELAZ, Dheere & Company, AB Volvo, Hitachi Construction Machinery Co Ltd, Terex Trucks, The Liebherr Group, KGHM Zanam SA, DUX Machinery Corporation, XCMG Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Caterpillar Inc.

- Komatsu Ltd.

- OJSC BELAZ

- Dheere & Company

- AB Volvo

- Hitachi Construction Machinery Co Ltd

- Terex Trucks

- The Liebherr Group

- KGHM Zanam SA

- DUX Machinery Corporation

- XCMG Group