Global Dual-Clutch Transmission Market By Product Type (Dry Clutch, Wet Clutch), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Motorsport Cars), By Gearshift (Manual, Automated), By Gearbox Type (Single Plate Clutch, Multi Plate Clutch), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132356

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

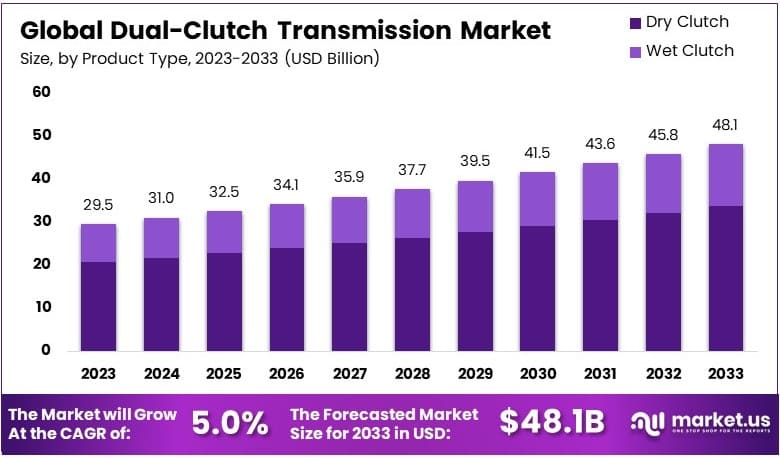

The Global Dual-Clutch Transmission Market size is expected to be worth around USD 48.1 Billion by 2033, from USD 29.5 Billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2024 to 2033.

A Dual-Clutch Transmission (DCT) is an advanced automatic gearbox. It uses two separate clutches for odd and even gears. This design ensures faster and smoother gear shifts. DCT combines the efficiency of a manual transmission with the convenience of an automatic. It is popular in sports and premium vehicles.

The Dual-Clutch Transmission Market includes the sale and development of DCT systems. It covers components, technology advancements, and related services. This market is driven by the growing demand for efficient and high-performance vehicles. Key players compete in innovation and price strategies to capture market share.

The demand for DCT is driven by its ability to enhance fuel efficiency by up to 15%. Opportunities exist in developing regions, where vehicle sales are growing rapidly. Increasing government regulations on carbon emissions further push manufacturers to adopt DCT technology. This creates a favorable market environment.

On a broader scale, DCT helps reduce global emissions. Locally, it supports the automotive sector by boosting technological advancements. In markets like China and India, the rising middle class demands better vehicle performance, increasing DCT adoption. Regional manufacturers are also integrating DCT to meet customer expectations.

The market is moderately saturated in developed regions but shows potential in emerging economies. Competitive pricing and product differentiation remain key strategies. Governments in Europe and North America invest in R&D for fuel-efficient technologies, indirectly benefiting DCT adoption.

Key Takeaways

- The Dual-Clutch Transmission Market was valued at USD 29.5 billion in 2023 and is projected to reach USD 48.1 billion by 2033, with a CAGR of 5.0%.

- In 2023, Dry Clutch is the leading product type, valued for its efficiency in passenger vehicles.

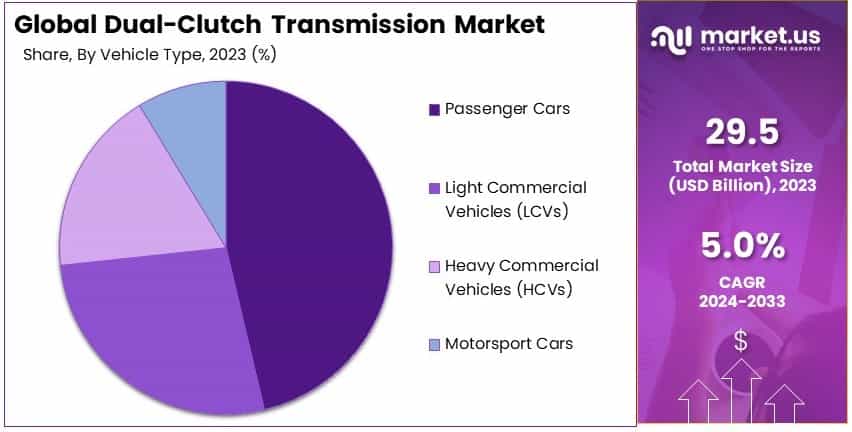

- In 2023, Passenger Vehicles dominate the vehicle type segment, reflecting high adoption in consumer markets.

- In 2023, Automated Gearshift system type leads, highlighting a shift toward driver convenience.

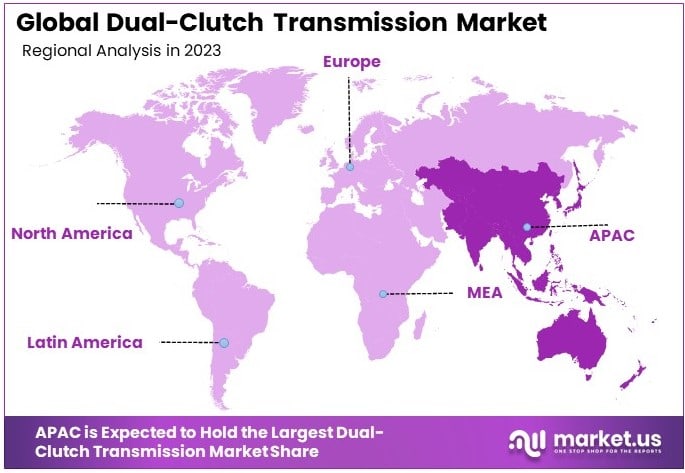

- In 2023, Asia-Pacific holds a substantial market share, driven by automotive industry growth in the region.

Product Type Analysis

Dry Clutch Dominates Due to Cost-Effectiveness and Lower Maintenance Needs

In the “Product Type” segment of the Dual-Clutch Transmission (DCT) Market, Dry Clutch systems hold the largest market share. This dominance is primarily due to their cost-effectiveness and reduced maintenance needs, which make them popular in vehicles where efficiency and economy are prioritized.

Dry clutch DCTs are lighter, resulting in better fuel efficiency, which is especially valuable in markets focused on fuel economy standards. Additionally, dry clutch systems perform well in moderate conditions, making them suitable for passenger vehicles that operate in regular driving environments.

On the other hand, Wet Clutch DCTs are preferred in high-performance and heavy-duty applications. They are more robust and can handle higher torque loads without overheating, which is essential in sports cars and heavy commercial vehicles.

Consequently, while wet clutches serve specific segments effectively, their higher cost and increased maintenance requirements make them less widespread than dry clutches. Both types of clutch systems contribute to the diverse needs of the DCT market, with each excelling in different driving conditions and vehicle demands.

Vehicle Type Analysis

Passenger Vehicles Lead Due to Demand for Efficient and Comfortable Driving

Within the “Vehicle Type” segment, Passenger Vehicles dominate the DCT market. This trend is largely driven by consumer demand for efficient, smooth, and comfortable driving experiences, which dual-clutch transmissions can deliver effectively.

Passenger vehicles benefit from the quick, seamless gear shifts offered by DCTs, which enhance acceleration and fuel efficiency. Consequently, automotive manufacturers are increasingly integrating DCTs into passenger car models to meet these consumer expectations and to remain competitive in an evolving market.

Light Commercial Vehicles (LCVs) are the next significant sub-segment. DCTs in commercial vehicles support fuel savings and performance efficiency, crucial for delivery and logistics industries where operational costs are high.

Heavy Commercial Vehicles (HCVs), though smaller in market share, are adopting DCTs to improve driving comfort and fuel economy. Motorsport Cars utilize DCTs to maximize speed and control, though this is a niche market due to the specialized requirements of motorsport transmissions.

Gearshift Analysis

Automated Gearshift Leads Due to Driver Convenience and Growing Market Demand

The “Gearshift” segment sees Automated Gearshift as the leading choice in the DCT market. This is due to the convenience it offers drivers by automating gear changes, thereby improving comfort and focus on the road.

Automated gearshift DCTs eliminate the need for manual input, making them especially appealing in urban settings where frequent gear changes are required. As a result, manufacturers are meeting market demand by incorporating automated DCTs, which align with trends toward ease of use and enhanced driving experiences.

Manual Gearshift DCTs, while less common, serve a segment of the market that prefers direct control over gear selection. These are often favored by driving enthusiasts and in specific performance-focused applications where control over the transmission is critical.

Consequently, manual gearshift DCTs contribute to market diversity by catering to consumers with unique preferences or performance needs, though automated gearshifts continue to lead overall due to their broad appeal.

Gearbox Type Analysis

Multi Plate Clutch Dominates Due to High Torque Handling and Durability

In the “Gearbox Type” segment, Multi Plate Clutch systems lead the market. This dominance is due to their ability to handle higher torque levels and offer increased durability, making them ideal for both high-performance and heavy-duty applications.

Multi plate clutches distribute torque across multiple friction surfaces, reducing wear and enhancing the longevity of the transmission system. Consequently, they are widely used in passenger vehicles and sports cars where performance and longevity are prioritized, meeting the demands of both consumers and manufacturers.

Single Plate Clutch systems, while simpler, are utilized in vehicles where high torque handling is not necessary. These clutches are cost-effective and lightweight, making them suitable for smaller, economy-focused vehicles.

In this way, single plate clutches provide a solution for specific market segments but are less dominant than multi plate systems, which offer a broader range of capabilities suited to the primary demands of the DCT market.

Key Market Segments

By Product Type

- Dry Clutch

- Wet Clutch

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Motorsport Cars

By Gearshift

- Manual

- Automated

By Gearbox Type

- Single Plate Clutch

- Multi Plate Clutch

Drivers

Demand for Fuel Efficiency Drives Market Growth

The increasing need for fuel efficiency is a crucial factor propelling the growth of the dual-clutch transmission (DCT) market. As fuel costs rise and environmental concerns intensify, automakers seek to offer fuel-efficient solutions to meet consumer demand.

The rise in performance-oriented vehicles also contributes to the growth of the DCT market. Dual-clutch transmissions provide rapid, smooth gear shifts, which are highly valued in sports and luxury cars. The technology’s ability to improve acceleration and overall driving dynamics appeals to consumers looking for a more engaging driving experience.

Additionally, DCT adoption is growing in both passenger and commercial vehicles. While passenger cars benefit from the technology’s efficiency and smoothness, commercial vehicles gain from the added power transfer and durability.

Technological advancements in transmission systems continue to push DCT development forward. Innovations in materials, electronic controls, and software optimization make modern DCTs more efficient and reliable.

Restraints

High Production Costs Restraint Market Growth

Manufacturing DCT systems requires specialized components and sophisticated assembly processes, which increase production expenses. These costs make DCTs more expensive than traditional transmissions, limiting their adoption among cost-sensitive consumers and automakers.

A shortage of skilled labor further restricts the DCT market. Building and maintaining DCT systems demands technical expertise that is not widely available. This labor shortage can lead to production delays and increased maintenance costs, creating obstacles for companies looking to expand DCT adoption.

The complexity of DCT maintenance also restrains market growth. Dual-clutch systems are intricate and require specialized tools and knowledge for repair and upkeep. Consumers may find DCT maintenance more complicated and costly than traditional transmission systems, reducing its appeal among those looking for low-maintenance options.

Competition from alternative transmission systems, such as continuously variable transmissions (CVTs) and automatic transmissions, further challenges DCT market growth. CVTs and automatic systems offer simpler maintenance and lower costs, making them attractive options for consumers and manufacturers alike.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Economic growth in regions such as Asia-Pacific, Latin America, and Africa has increased vehicle ownership, driving demand for modern automotive technologies. As consumers in these areas seek affordable, efficient vehicles, DCT manufacturers have an opportunity to expand their market reach and increase sales.

The integration of DCTs with electric and hybrid vehicles offers further growth potential. As the automotive industry shifts towards electrification, there is a need for efficient, responsive transmission systems compatible with electric powertrains.

DCTs are increasingly adapted for use in hybrid and electric vehicles, providing performance and efficiency benefits. This compatibility positions DCTs as valuable components for the growing electric vehicle (EV) market, expanding their applications beyond traditional vehicles.

Lightweight materials present another opportunity for DCT innovation. As automakers focus on reducing vehicle weight to improve fuel efficiency, there is a demand for lightweight transmission materials. Developing DCT systems using advanced materials such as aluminum and carbon fiber reduces vehicle weight, enhancing performance and energy efficiency. This focus on lightweight materials aligns with industry trends and provides a growth avenue for DCT manufacturers.

Challenges

Volatility in Raw Material Prices Challenges Market Growth

Metals and alloys used in DCT manufacturing are subject to price fluctuations, impacting production costs. When material prices rise, DCT manufacturers face increased expenses, which can lead to higher product prices and reduced demand. This price volatility makes it difficult for companies to maintain stable pricing, posing a challenge to long-term market growth.

Regulatory compliance requirements also challenge the DCT market. Stricter emissions and efficiency standards require manufacturers to innovate continually to meet legal requirements. Compliance adds costs and complexity, as companies must frequently upgrade designs and invest in research and development.

Retrofitting DCTs in older vehicle models presents additional challenges. Converting traditional transmission systems to DCTs is technically complex and costly, limiting the market for retrofitting solutions.

Dependence on a global supply chain also exposes the DCT market to risks. Supply chain disruptions, such as delays in raw material supply or geopolitical issues, can affect production schedules and costs. This reliance on international suppliers increases the market’s vulnerability to global uncertainties, complicating production planning and inventory management.

Growth Factors

Increasing Vehicle Production Worldwide Is a Growth Factor

As vehicle demand grows, manufacturers seek advanced transmission systems that improve efficiency and performance. DCTs provide a solution that meets both fuel efficiency and driving experience expectations, making them a preferred option for manufacturers globally.

Consumer preference for comfort and performance also contributes to DCT market growth. Drivers value smooth, responsive gear shifts, and DCTs deliver a driving experience that combines manual control with automatic convenience.

Technological innovations in automotive manufacturing also foster DCT market growth. Advanced manufacturing techniques reduce production costs and improve the quality of DCT systems, making them more accessible to a broader range of vehicle models.

Government incentives for fuel-efficient vehicles further drive the DCT market. Many governments offer tax breaks, subsidies, and incentives to manufacturers and consumers who choose fuel-efficient vehicles. These policies encourage automakers to include DCTs, which support fuel efficiency, in their models.

Emerging Trends

Shift Toward Electrification in Vehicles Is Latest Trending Factor

As more automakers prioritize electric vehicle production, the demand for efficient, compatible transmission systems like DCTs rises. DCTs enhance the performance and efficiency of hybrid and electric powertrains, making them a suitable choice for electrified models. This trend towards electrification drives innovation and expansion within the DCT market, aligning with broader automotive industry shifts.

Connected and autonomous vehicles represent another influential trend. DCTs can be integrated with connected vehicle systems to enhance automation and control, supporting the growth of autonomous driving technology.

The trend towards customizable transmission solutions is also gaining traction. Consumers increasingly seek performance and comfort in their driving experiences, creating demand for transmission systems tailored to specific vehicle models and driver preferences.

Lastly, the industry focus on lightweighting and fuel savings complements the demand for DCTs. Automakers aim to reduce vehicle weight to improve fuel economy, and DCTs contribute by providing efficient power transfer with minimal energy loss.

Regional Analysis

Asia-Pacific Dominates the Market Share

Asia-Pacific currently dominates in the Dual-Clutch Transmission (DCT) Market. The region is a critical player due to its robust automotive manufacturing sector. Countries like China, Japan, and South Korea lead in DCT adoption, driven by demand for fuel efficiency and high-performance vehicles.

Key factors driving potential market growth include the high demand for passenger cars and a strong presence of automotive manufacturers. The focus on fuel efficiency and smooth driving experiences aligns with consumer preferences, making DCT an attractive option in both domestic and export markets.

Regional market dynamics are shaped by Asia-Pacific’s extensive automotive infrastructure and continuous advancements in transmission technology. With increasing environmental regulations, manufacturers in the region are investing in DCT to meet emissions standards while enhancing vehicle performance, especially in premium and electric vehicle segments.

Regional Mentions:

- North America: North America sees moderate demand for DCT, primarily in high-performance and luxury vehicles. Environmental regulations and consumer interest in fuel efficiency drive steady adoption, particularly in the U.S. market.

- Europe: Europe has a strong presence in the DCT market, led by high demand in premium automotive segments. Stringent emissions standards and a focus on advanced automotive technology make DCT popular, especially in Germany and France.

- Middle East & Africa: The Middle East and Africa are emerging markets for DCT, with demand driven by luxury car imports. As the automotive market expands, interest in fuel-efficient and high-performance technologies is expected to rise gradually.

- Latin America: Latin America sees a growing interest in DCT, supported by rising demand for fuel-efficient vehicles. Countries like Brazil and Mexico focus on modernizing their automotive sectors, with an increasing emphasis on advanced transmission systems.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Dual-Clutch Transmission (DCT) Market is led by established automotive giants who focus on performance, efficiency, and technological advancements. The top players—ZF Friedrichshafen AG, Getrag (a subsidiary of Magna International), BorgWarner Inc., and Aisin Seiki Co., Ltd.—are recognized for their expertise in designing and manufacturing high-performance DCTs for global automotive markets.

ZF Friedrichshafen AG holds a dominant position in the DCT market, offering advanced transmission solutions known for their smooth shifting and fuel efficiency. ZF supplies major automakers worldwide, leveraging its strong engineering capabilities and commitment to innovation. The company’s expertise in high-performance DCTs makes it a preferred partner for premium and sports car manufacturers.

Getrag, part of Magna International, is a key player known for its extensive experience in transmission systems. Getrag focuses on providing DCTs that enhance both fuel economy and driving performance. Its partnerships with major automakers enable it to deliver tailored solutions, making Getrag a prominent name in the DCT market, particularly in Europe and Asia.

BorgWarner Inc. is a leader in DCT technology, especially for hybrid and electric vehicles. The company’s focus on efficiency and compact design has made its DCT systems popular among manufacturers prioritizing sustainable solutions. BorgWarner’s innovative approach to integrating DCTs into environmentally friendly vehicles sets it apart in this growing segment.

Aisin Seiki Co., Ltd., known for its precision engineering, has a strong presence in the DCT market with its high-quality transmission solutions. Aisin’s collaboration with Japanese and international automakers helps it deliver reliable and smooth-shifting DCTs. The company’s focus on enhancing vehicle performance and efficiency further strengthens its market position.

These key players shape the DCT market through their commitment to innovation, quality, and performance. By addressing the need for fuel efficiency and smooth driving experiences, they set industry standards, driving the market forward and meeting the demand for advanced transmission systems in a competitive landscape.

Top Key Players in the Market

- ZF Friedrichshafen AG

- Getrag (Magna International)

- BorgWarner Inc.

- Aisin Seiki Co., Ltd.

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Volkswagen Group

- Ford Motor Company

- General Motors

- Daimler AG (Mercedes-Benz)

- FCA US LLC (Stellantis)

- Schaeffler Group

- Jatco Ltd.

- Mitsubishi Motors

- Porsche AG

Recent Developments

- Tata Motors: On August 2024, Tata Motors is anticipated to introduce a seven-speed dual-clutch automatic (DCA) transmission for the diesel variant of its Nexon SUV. This update, revealed through a leaked image from Tata’s online vehicle configurator, indicates that the DCA option will be available for the top-tier Fearless+ S variant.

- Magna International: On October 2024 Magna International introduced its Dual Clutch Transmission Eco (DCT Eco) solution, securing a high-volume contract with a European original equipment manufacturer (OEM).

Report Scope

Report Features Description Market Value (2023) USD 29.5 Billion Forecast Revenue (2033) USD 48.1 Billion CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dry Clutch, Wet Clutch), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Motorsport Cars), By Gearshift (Manual, Automated), By Gearbox Type (Single Plate Clutch, Multi Plate Clutch) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ZF Friedrichshafen AG, Getrag (Magna International), BorgWarner Inc., Aisin Seiki Co., Ltd., Honda Motor Co., Ltd., Hyundai Motor Company, Volkswagen Group, Ford Motor Company, General Motors, Daimler AG (Mercedes-Benz), FCA US LLC (Stellantis), Schaeffler Group, Jatco Ltd., Mitsubishi Motors, Porsche AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dual-Clutch Transmission MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Dual-Clutch Transmission MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ZF Friedrichshafen AG

- Getrag (Magna International)

- BorgWarner Inc.

- Aisin Seiki Co., Ltd.

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Volkswagen Group

- Ford Motor Company

- General Motors

- Daimler AG (Mercedes-Benz)

- FCA US LLC (Stellantis)

- Schaeffler Group

- Jatco Ltd.

- Mitsubishi Motors

- Porsche AG