Global Driver Drowsiness Detection System Market By Product Type (Hardware devices, Software systems), By Vehicle Type (Passenger cars, Commercial vehicles), By System Type (Lane Departure warning, Driver fatigue monitoring, Driver distraction monitoring) By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 49318

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

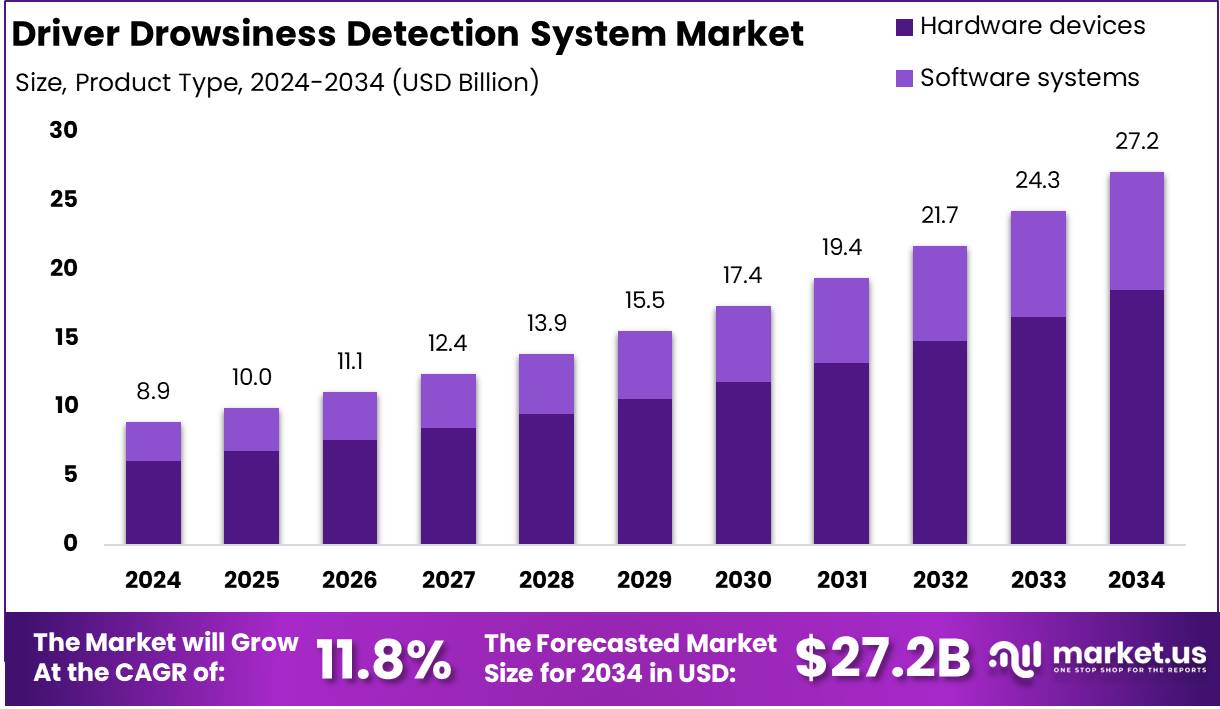

The Global Driver Drowsiness Detection System Market size is expected to be worth around USD 27.2 Billion by 2034 from USD 8.9 Billion in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034.

A Driver Drowsiness Detection System is an advanced automotive safety technology designed to monitor driver behavior and physiological indicators to detect signs of fatigue or inattention. Using sensors, cameras, and artificial intelligence, these systems analyze various parameters such as eye movement, head position, steering patterns, and blink frequency to assess the driver’s alertness level in real time.

When signs of drowsiness are detected, the system issues visual, auditory, or haptic alerts to prompt the driver to take corrective actions, such as taking a break. This technology plays a critical role in minimizing road accidents caused by driver fatigue and has become an integral component of modern advanced driver-assistance systems (ADAS).

The Driver Drowsiness Detection System Market encompasses the global industry involved in the development, production, and integration of fatigue-monitoring technologies across various vehicle types. This market includes hardware components such as cameras, sensors, and control modules, as well as software algorithms powered by machine learning and computer vision.

It spans across automotive segments including passenger vehicles, commercial fleets, and luxury cars, with increasing penetration in both OEM-fitted and aftermarket installations. The market is witnessing strong growth momentum due to heightened emphasis on road safety, government regulations mandating driver monitoring systems, and the rising adoption of semi-autonomous driving technologies.

The expansion of the Driver Drowsiness Detection System Market is primarily being driven by the increasing focus on vehicle and passenger safety. Governments and regulatory bodies in regions such as Europe and North America have implemented stringent norms that mandate the inclusion of driver monitoring systems in new vehicles.

Moreover, the rising number of road accidents attributed to driver fatigue has compelled automakers to prioritize the integration of such safety features. Additionally, the growing demand for ADAS and autonomous driving systems has accelerated the deployment of drowsiness detection technologies, which serve as foundational elements for driver vigilance monitoring.

The demand for driver drowsiness detection systems is experiencing a steady upward trajectory, particularly within the premium and commercial vehicle segments. Logistics companies and fleet operators are increasingly incorporating these systems to enhance driver accountability and reduce accident-related operational costs.

Simultaneously, consumer awareness around in-vehicle safety technologies is encouraging OEMs to offer these systems as standard or optional features in mid-range models. The increasing affordability of sensor technologies and the availability of integrated solutions are further boosting adoption across emerging markets, contributing to broader market growth.

Significant growth opportunities lie in the integration of driver drowsiness detection systems with AI-driven telematics and connected vehicle ecosystems. The convergence of data analytics, real-time monitoring, and cloud-based fleet management opens avenues for enhanced predictive safety mechanisms and performance optimization.

According to the National Sleep Foundation, drowsy driving contributes to thousands of crashes annually, while the AAA Foundation for Traffic Safety attributes 6,400 deaths each year in the U.S. to fatigue-related incidents. The National Highway Traffic Safety Administration estimates 100,000 crashes per year are caused primarily by drowsy driving, leading to over 71,000 injuries and $12.5 million in damages. Despite 85% of adults getting 7–9 hours of sleep nightly, only 4 in 10—40% are likely to find alternatives when sleep-deprived, and just 50% actively avoid driving without adequate rest.

90% of adults avoid driving after a few drinks, and 70% seek alternatives in such cases. This discrepancy highlights a significant behavioral gap in how individuals perceive drowsy driving risk versus alcohol impairment. The Driver Drowsiness Detection System market is expected to grow as demand for advanced in-vehicle safety systems increases. Supported by stringent regulations and rising awareness, these systems offer real-time fatigue monitoring through AI and biometric sensors, addressing the root causes of over 100,000 annual incidents and saving lives while reducing economic losses.

Key Takeaways

- The Global Driver Drowsiness Detection System market is projected to reach approximately USD 27.2 billion by 2034, up from USD 8.9 billion in 2024, expanding at a robust CAGR of 11.8% during the forecast period (2025–2034).

- Hardware devices continue to dominate the market by product type, accounting for over 68.2% of the global market share in 2024.

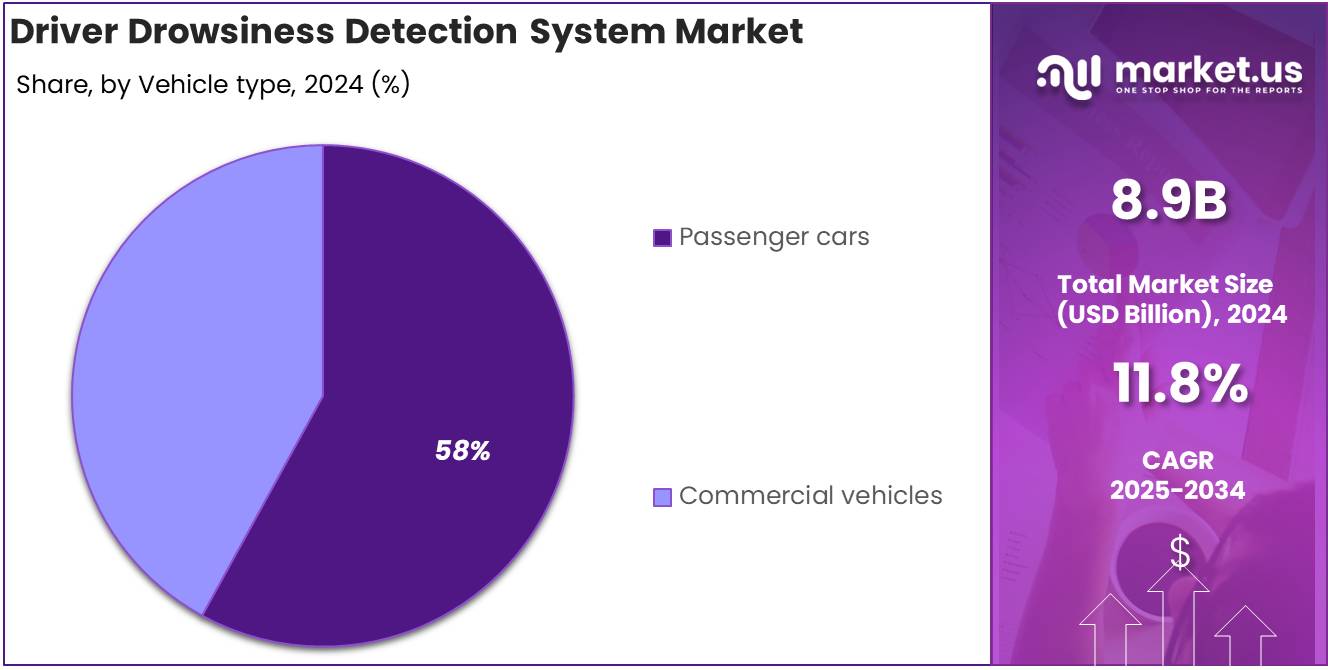

- Passenger cars represent the largest segment by vehicle type, holding more than 58% of the total market share in 2024.

- Lane departure warning systems held a dominant position by system type, capturing over 48.2% of the market in 2024.

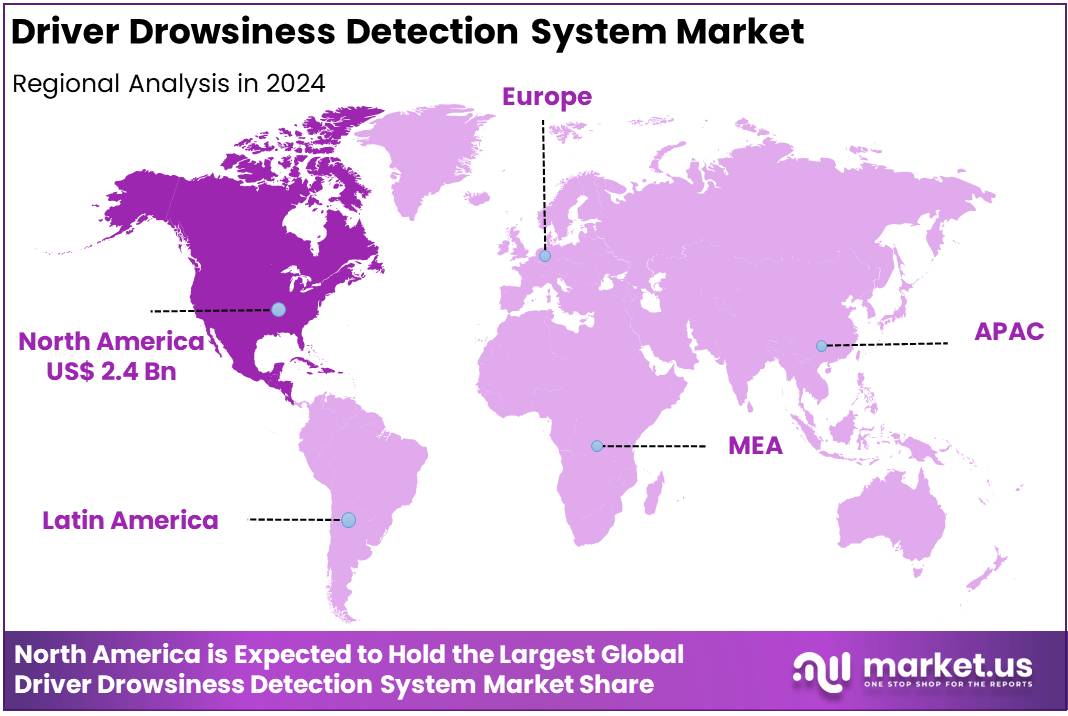

- North America emerged as the leading regional market in 2024, accounting for 27.6% of the global market share. The regional market is valued at approximately USD 2.4 billion, driven by stringent vehicle safety regulations and early adoption of advanced automotive technologies.

By Product Analysis

Hardware Devices Dominated the Driver Drowsiness Detection System Market with 68.2% Market Share in 2024

In 2024, hardware devices held a dominant market position in the By Product Type segment of the Driver Drowsiness Detection System Market, capturing more than 68.2% of the global market share. This significant share can be attributed to the widespread adoption of physical components such as facial recognition cameras, steering behavior sensors, eye-tracking systems, and seat pressure sensors integrated into vehicles for real-time fatigue monitoring.

Automakers are increasingly embedding these hardware-based detection units into both commercial and passenger vehicles to enhance driver safety and comply with evolving vehicle safety regulations across North America, Europe, and parts of Asia-Pacific.

The rising demand for reliable, real-time alert systems in high-risk driving environments, such as long-haul trucking and night-time driving, has further propelled the installation of hardware-based solutions.

software systems held a considerable share of the Driver Drowsiness Detection System Market in 2024. These solutions comprise fatigue-detection algorithms, machine learning frameworks, and real-time data analytics tools designed to interpret driver behavior and physiological signals.

The growing adoption of artificial intelligence and deep learning in automotive safety systems is accelerating the advancement of software-based detection capabilities. These systems are increasingly utilized in high-end and autonomous vehicle models where advanced driver-assistance features are deeply integrated into the vehicle’s electronic control architecture.

By Vehicle Type Analysis

Passenger Cars Dominated the Driver Drowsiness Detection System Market with 58% Market Share in 2024

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type segment of the Driver Drowsiness Detection System Market, capturing more than 58% of the total market share. This leading position was primarily driven by the growing integration of advanced driver-assistance systems (ADAS) in mid-range and high-end passenger vehicles.

Increasing consumer demand for in-vehicle safety features, along with rising awareness about fatigue-related accidents, has prompted automakers to equip cars with drowsiness detection technologies as a standard or optional feature. Additionally, regulatory support in key markets such as Europe and North America, which encourage or mandate safety systems, further strengthened the adoption of these solutions in the passenger car segment.

The expansion of the electric vehicle (EV) market has also contributed to the segment’s growth, as EV manufacturers increasingly focus on incorporating intelligent safety technologies to enhance driver experience and reduce accident risks.

Moreover, consumer preference for personal mobility and the rise in long-distance driving, especially post-pandemic, have created favorable conditions for the uptake of driver fatigue monitoring systems. As automakers continue to advance semi-autonomous and connected car capabilities, the role of drowsiness detection systems is expected to become more critical, thereby maintaining the growth momentum of this segment.

In 2024, commercial vehicles held a significant share in the Driver Drowsiness Detection System Market. This segment, comprising trucks, buses, and delivery vans, has seen increasing integration of fatigue monitoring systems, largely due to the elevated risk associated with extended driving hours and stringent road safety requirements.

Regulatory bodies and fleet operators are prioritizing investments in advanced safety technologies to reduce accident rates and manage liability risks. Within the logistics and transportation sectors, where driver alertness directly impacts operational efficiency and safety outcomes, drowsiness detection systems have become a critical tool.

The commercial vehicle segment is experiencing rising demand for comprehensive telematics and monitoring solutions, with driver fatigue detection functioning as a key component. These systems are being adopted within fleet management frameworks to facilitate real-time analysis of driver behavior and enable timely interventions to enhance road safety.

While uptake has been strong in regulated markets, adoption remains relatively slow in regions where financial barriers and weak regulatory enforcement persist. Nevertheless, the segment is expected to witness steady growth, driven by a growing emphasis on workforce safety, evolving vehicle compliance standards, and the broader trend toward digital transformation in fleet operations across global markets.

By System Type Analysis

Lane Departure Warning Systems Dominated the Driver Drowsiness Detection System Market with 48.2% Market Share in 2024

In 2024, lane departure warning systems held a dominant market position in the By System Type segment of the Driver Drowsiness Detection System Market, capturing more than 48.2% of the total market share. This significant share can be attributed to the widespread adoption of lane departure warning systems in modern vehicles as part of advanced driver-assistance systems (ADAS).

These systems are designed to alert drivers when they unintentionally drift out of their lane, a common sign of drowsiness or distraction. The growing focus on enhancing vehicle safety features and minimizing road accidents has driven the integration of lane departure warning systems, particularly in mid-range and high-end passenger cars.

Moreover, the rise in regulatory support for safety features, along with increasing consumer demand for vehicles equipped with these technologies, has further accelerated the adoption of lane departure warning systems. As the automotive industry increasingly shifts towards semi-autonomous vehicles, the role of these systems is expected to expand, providing an essential layer of protection for drivers in both traditional and emerging vehicle models.

Driver fatigue monitoring systems are specifically designed to track a driver’s physical condition and detect signs of fatigue, including changes in driving behavior, eye movements, and facial expressions. The growing prevalence of long-haul driving and the need for enhanced driver safety measures in both commercial and personal vehicles have fueled the demand for these systems. They are particularly essential in industries such as transportation and logistics, where maintaining driver alertness is critical for reducing the risk of accidents and ensuring safe operations.

These systems are increasingly integrated as part of advanced driver-assistance systems (ADAS) and are expected to see further adoption with the rise of electric and autonomous vehicles. While challenges such as sensor accuracy and calibration remain, the advancement of artificial intelligence and machine learning is improving the reliability and effectiveness of these systems.

As regulatory requirements strengthen and road safety continues to be a priority, the demand for driver fatigue monitoring systems is projected to grow, driven by both safety standards and technological innovation.

Driver distraction monitoring systems are designed to detect and alert drivers when their attention is diverted from the road due to non-driving activities, such as using a mobile phone. As distractions behind the wheel become an increasing concern globally, particularly with the growing use of in-vehicle technologies, the demand for these monitoring systems has risen significantly.

These systems are often integrated with other vehicle safety features, such as lane departure warning and collision avoidance systems, creating a comprehensive approach to ensuring driver safety.

The adoption of driver distraction monitoring is expected to continue to increase, particularly as stricter regulations and safety standards are enforced. Technological advancements in sensors, including eye-tracking and facial recognition, are making these systems more accurate and efficient.

The continued trend toward connected vehicles, along with the push for enhanced safety features in autonomous driving systems, is expected to further drive the demand for driver distraction monitoring solutions.

Key Market Segments

By Product Type

- Hardware devices

- Software systems

By Vehicle Type

- Passenger cars

- Commercial vehicles

By System Type

- Lane Departure warning

- Driver fatigue monitoring

- Driver distraction monitoring

Driver

Increasing Government Regulations Mandating Driver Safety Features

The implementation of stringent safety regulations by governments across major economies has emerged as a significant driver for the global Driver Drowsiness Detection System market. Regulatory authorities are increasingly mandating the inclusion of advanced driver-assistance systems (ADAS), particularly in commercial vehicles and passenger cars, to reduce the number of road accidents caused by fatigue-related errors.

According to recent industry assessments, driver fatigue accounts for approximately 20% of all serious road accidents globally. This has led to the adoption of proactive policies requiring automakers to integrate drowsiness detection technologies, especially in long-haul transport vehicles, public buses, and fleet management systems.

These mandates are accelerating the rate of technology integration in new vehicles, resulting in expanded product deployment and increased market penetration. The move toward making such systems compulsory in new vehicle models—particularly in Europe, North America, and parts of Asia—has significantly improved the growth trajectory of the market.

Furthermore, regional initiatives promoting zero-accident roads and Vision Zero campaigns are creating a favorable environment for the adoption of such systems. The legislative push is also encouraging manufacturers to innovate, leading to cost-effective sensor-based and camera-based solutions suitable for both high-end and economy vehicles, thereby expanding the addressable market base and enhancing growth prospects across all regions.

Restraint

High System Costs and Integration Complexity

Despite the growing demand and regulatory support, the high initial cost of Driver Drowsiness Detection Systems continues to act as a major restraint on market expansion. These systems often rely on complex technologies such as infrared sensors, facial recognition algorithms, steering pattern monitoring, and real-time data processing units.

The integration of such advanced components significantly increases vehicle production costs, especially for budget or entry-level models. As a result, original equipment manufacturers (OEMs) in cost-sensitive markets, particularly in emerging economies, are hesitant to include these systems as standard features. This cost barrier reduces the pace of widespread adoption, limiting the system’s reach to predominantly premium and luxury vehicle segments.

Additionally, the complexity of integrating drowsiness detection systems with existing vehicle electronics and user interfaces presents a technical challenge. Variability in driving behavior, lighting conditions, and road types can lead to inconsistent system accuracy and false alerts, causing trust issues among end-users.

These technical limitations impact consumer confidence and, consequently, market uptake. Retrofitting the technology into older vehicles is also expensive and not always compatible, further constraining potential market growth. Until manufacturers succeed in streamlining costs and enhancing the reliability of these systems, their adoption will remain restricted, particularly in developing regions where affordability is a critical purchasing criterion.

Opportunity

Expansion into Commercial Fleets and Logistics Operations

The growing emphasis on road safety and operational efficiency in the commercial transportation sector presents a significant growth opportunity for the Driver Drowsiness Detection System market. With the increasing number of road accidents involving long-haul trucks and delivery fleets, logistics companies are turning to technology-driven solutions to enhance driver safety and reduce liability.

Driver drowsiness detection systems are being adopted by fleet managers to ensure compliance with safety standards and minimize fatigue-related incidents. This is particularly relevant in regions where commercial vehicles account for a substantial share of roadway accidents, making such systems a key investment area for fleet operators.

Furthermore, these systems are being integrated with telematics and fleet management software to offer real-time alerts, performance monitoring, and fatigue analytics. This integration enhances overall fleet safety and operational planning, allowing companies to identify high-risk drivers and implement corrective actions such as mandatory rest breaks. Insurance providers are also offering premium discounts for vehicles equipped with such safety technologies, further incentivizing adoption.

As the demand for e-commerce logistics, ride-hailing, and last-mile delivery grows globally, the need for efficient and safe driver management is becoming critical, opening a scalable and long-term opportunity for the expansion of the driver drowsiness detection system market within commercial and fleet-based ecosystems.

Trends

Adoption of AI-Based Facial Monitoring Technologies

One of the most transformative trends in the Driver Drowsiness Detection System market is the integration of artificial intelligence (AI) into facial monitoring technologies. Advanced algorithms are now capable of analyzing subtle facial cues such as blinking rate, yawning frequency, and gaze direction to detect signs of fatigue in real-time.

Unlike traditional steering-based detection systems, AI-powered facial recognition offers greater accuracy and responsiveness, significantly improving system reliability. The increasing availability of high-resolution in-cabin cameras and processing chips has enabled automotive OEMs to embed these intelligent systems directly into dashboards, creating a seamless user experience and enhancing overall safety performance.

This trend is particularly relevant as vehicle manufacturers shift toward Level 2 and Level 3 autonomous driving, where human oversight remains essential. AI-driven drowsiness monitoring serves as a critical safety layer, alerting drivers to regain control when needed. Additionally, the use of machine learning allows these systems to adapt to individual driver behaviors over time, minimizing false positives and enhancing personalization.

As the automotive sector continues its digital transformation journey, the demand for intelligent, AI-enabled monitoring systems is expected to rise significantly. This trend not only enhances driver safety but also aligns with the broader move toward smart mobility and connected vehicles, reinforcing the market’s growth momentum.

Regional Analysis

North America Leads Driver Drowsiness Detection System Market with Largest Market Share of 27.6% in 2024

The global Driver Drowsiness Detection System market has witnessed steady regional segmentation, with North America emerging as the dominant region, accounting for the largest market share of 27.6% in 2024. The market in North America is valued at approximately USD 2.4 billion, driven by stringent road safety regulations, widespread adoption of advanced driver-assistance systems (ADAS), and strong automotive manufacturing capabilities.

The United States, in particular, plays a crucial role, supported by agencies such as the National Highway Traffic Safety Administration (NHTSA), which continue to push for the integration of fatigue monitoring technologies in both commercial and passenger vehicles. Increasing consumer awareness about road safety and rising demand for luxury vehicles embedded with driver monitoring systems have further fueled market penetration.

In Europe, the market is supported by proactive regulatory mandates and high emphasis on vehicle safety across countries such as Germany, France, and the United Kingdom. The European Union’s General Safety Regulation (GSR), which mandates the inclusion of driver drowsiness detection systems in new vehicles from 2022 onward, has significantly contributed to regional demand. The region also benefits from strong R&D capabilities and the presence of premium automotive manufacturers integrating these systems as standard features.

Meanwhile, the Asia Pacific region is expected to register the fastest growth rate during the forecast period, driven by increasing vehicle production, a growing middle-class population, and rising road accident rates in countries like China and India. Favorable government policies promoting road safety and the rapid development of automotive electronics are accelerating adoption in this region.

The Middle East & Africa market, though relatively smaller, is witnessing gradual adoption due to improving economic conditions and increasing vehicle imports with integrated safety features. Gulf Cooperation Council (GCC) countries are showing interest in intelligent transportation systems, which may spur further adoption.

In Latin America, market growth is primarily driven by Brazil and Mexico, where rising awareness of driver fatigue-related accidents and the entry of global automakers are pushing demand for drowsiness detection systems. However, limited regulatory enforcement and cost sensitivity pose challenges to large-scale implementation in both MEA and Latin America.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Driver Drowsiness Detection System market in 2024, several key players are demonstrating robust technological competencies and strategic market positioning. Continental AG continues to lead through its diversified portfolio of advanced driver-assistance systems (ADAS), leveraging sensor fusion and AI-driven fatigue monitoring solutions that have been widely adopted by European OEMs.

Delphi Automotive, now Aptiv PLC, has made substantial advancements in vehicle connectivity and autonomous driving technologies, contributing significantly to intelligent drowsiness detection modules integrated with broader ADAS platforms. Robert Bosch GmbH maintains a strong market foothold by offering highly reliable, camera-based driver monitoring systems supported by deep automotive sensor expertise and strong OEM collaborations across the globe.

Hella GmbH & Co. KGaA is increasingly investing in human-machine interface (HMI) technologies, using infrared sensors and dashboard-integrated solutions to support driver fatigue detection, particularly in mid-range vehicle segments. Autoliv Inc., known for its strong presence in automotive safety, is expanding its portfolio to include vision-based drowsiness solutions aligned with active safety systems.

Denso Corporation’s drowsiness detection technologies, particularly in the Asian markets, benefit from its strong partnerships with Japanese OEMs and focus on in-cabin thermal monitoring and facial recognition. Magna International Inc. is emphasizing the integration of behavioral algorithms into existing driver assistance platforms, offering modular, scalable solutions adaptable across multiple vehicle models.

Aisin Seiki Co., Ltd and TRW Automotive (now part of ZF Friedrichshafen AG) are utilizing their extensive automotive electronics expertise to co-develop embedded detection systems with tier-1 manufacturers. Valeo is focusing on AI-powered interior sensing technologies, enhancing its market proposition in premium vehicle segments.

Meanwhile, Seeing Machines Ltd and Smart Eye AB, as specialized vision technology firms, are setting industry benchmarks in eye-tracking and cognitive state analysis, securing partnerships with global OEMs aiming for L2 and L3 autonomy. Collectively, these players are driving innovation, safety compliance, and global adoption of drowsiness detection systems in vehicles.

Top Key Players in the Market

- Continental

- Delphi Automotive

- Robert Bosch

- Hella Gmbh and Co

- Autoliv Inc

- Denso Corporation

- Magna International Inc

- Aisin Seiki Co, ltd

- TRW Automotive

- Valco

- Seeing machines ltd

- Smart eye AB

Recent Developments

- In February 2025, Netradyne, a leading provider of AI and edge computing solutions, revealed that its innovative Driver Drowsiness with Driver Monitoring System (DMS) Sensor was selected as one of the HDT 2025 Top 20 Products. This recognition, awarded by the editors of Heavy Duty Trucking, highlights the DMS Sensor as a top new product in the trucking industry for 2024. The technology’s precise, real-time alerts empower drivers to avoid collisions and enhance road safety.

- In April 2025, Smart Eye, a renowned developer of DMS software, announced a significant achievement in securing its first design wins from a major Japanese original equipment manufacturer (OEM). This milestone marks a pivotal expansion of Smart Eye’s customer base, setting the stage for deeper collaboration with a prominent global automotive brand.

- In 2024, Rosmerta Technologies, an auto-tech company based in Delhi, showcased its cutting-edge AI-based Driver Monitoring & Alert System at the Bharat Mobility Global Expo. The system, designed for fleet operators, combines real-time vehicle tracking with AI-driven driver behavior analysis and in-cabin alerts, offering a comprehensive safety solution for commercial trucks.

Report Scope

Report Features Description Market Value (2024) USD 27.2 Billion Forecast Revenue (2034) USD 8.9 Billion CAGR (2025-2034) 11.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hardware devices, Software systems), By Vehicle Type (Passenger cars, Commercial vehicles), By System Type (Lane Departure warning, Driver fatigue monitoring, Driver distraction monitoring) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Continental, Delphi Automotive, Robert Bosch, Hella Gmbh and Co, Autoliv Inc, Denso Corporation, Magna International Inc, Aisin Seiki Co, ltd, TRW Automotive, Valco, Seeing machines ltd, Smart eye AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Driver Drowsiness Detection System MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Driver Drowsiness Detection System MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Continental

- Delphi Automotive

- Robert Bosch

- Hella Gmbh and Co

- Autoliv Inc

- Denso Corporation

- Magna International Inc

- Aisin Seiki Co, ltd

- TRW Automotive

- Valco

- Seeing machines ltd

- Smart eye AB