Global District Heating and Cooling Market Size, Share Analysis Report By Energy Source (District Heating, District Cooling), By Application (Industrial, Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160201

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

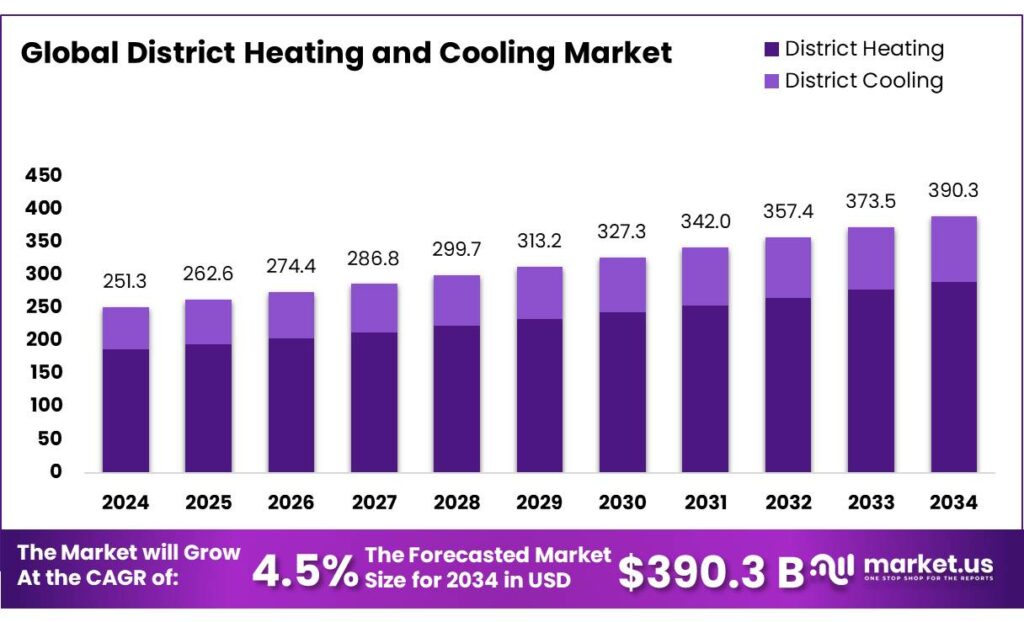

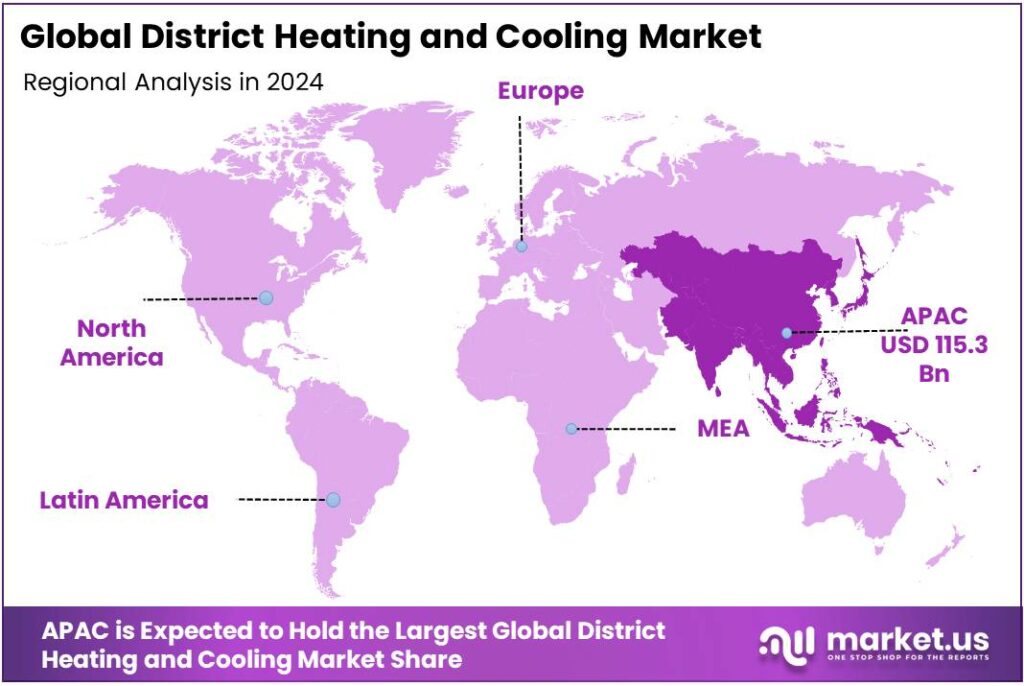

The Global District Heating and Cooling Market size is expected to be worth around USD 390.3 Billion by 2034, from USD 251.3 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 45.9% share, holding USD 115.3 Billion in revenue.

District heating and cooling (DHC) systems deliver thermal energy through centralized plants and insulated pipe networks to multiple buildings, improving efficiency and enabling fuel switching at scale. According to the International Energy Agency, district networks met roughly 9–10% of global final heating demand in 2022, underscoring both their current relevance and headroom for expansion in buildings and industry.

- In the European Union, heating dominates household energy use—space and water heating accounted for 77.6% of residential final energy in 2023—while “derived heat” contributed 8.5%, highlighting the role DHC can play in decarbonising a large, hard-to-abate load.

In the United States, district energy has been operating for over a century and today serves more than 4.3 billion square feet across universities, medical districts, military bases and city cores, often anchored by combined heat and power (CHP) for resilience and high utilisation. Policy momentum is accelerating: the EU’s revised Energy Efficiency Directive sets a binding additional 11.7% reduction in energy consumption by 2030 and strengthens provisions to expand renewable and waste heat in DHC, aligning local utilities, cities and industrial parks with decarbonisation targets.

Key driving factors include energy security, electrification readiness, and waste-heat recovery from data centres and industry. IEA analysis indicates modern renewable heat is set to increase materially this decade, and DHC is a prime vector to integrate large heat pumps, geothermal, solar thermal, and surplus industrial heat at system scale. On the cooling side, rapidly rising demand has pushed governments to commit to efficiency and emissions goals; the UN Environment Programme’s Global Cooling Pledge targets a 68% cut in cooling-related emissions by 2050, creating a policy tailwind for district cooling networks using efficient chillers, thermal storage and reclaimed heat.

Government initiatives play a crucial role in accelerating the adoption of DHC systems. For instance, in April 2023, the European Union allocated EUR 401 million to support the Czech Republic’s green district heating scheme. Such investments are indicative of a concerted effort to modernize heating infrastructure and promote the use of renewable energy sources. Additionally, the EU Heating and Cooling Strategy, slated for publication in early 2026, aims to further decarbonize the sector through integrated planning and the promotion of clean heating and cooling technologies.

- The transition towards renewable energy in DHC systems is further exemplified by the geothermal sector. In the European Union, geothermal district heating and cooling capacity reached 2.2 GWth in 2021, reflecting a 6% annual growth rate. This growth is indicative of the increasing viability and adoption of geothermal solutions in urban energy systems.

Key Takeaways

- District Heating and Cooling Market size is expected to be worth around USD 390.3 Billion by 2034, from USD 251.3 Billion in 2024, growing at a CAGR of 4.5%.

- District Heating held a dominant market position, capturing more than a 74.4% share of the overall District Heating and Cooling Market.

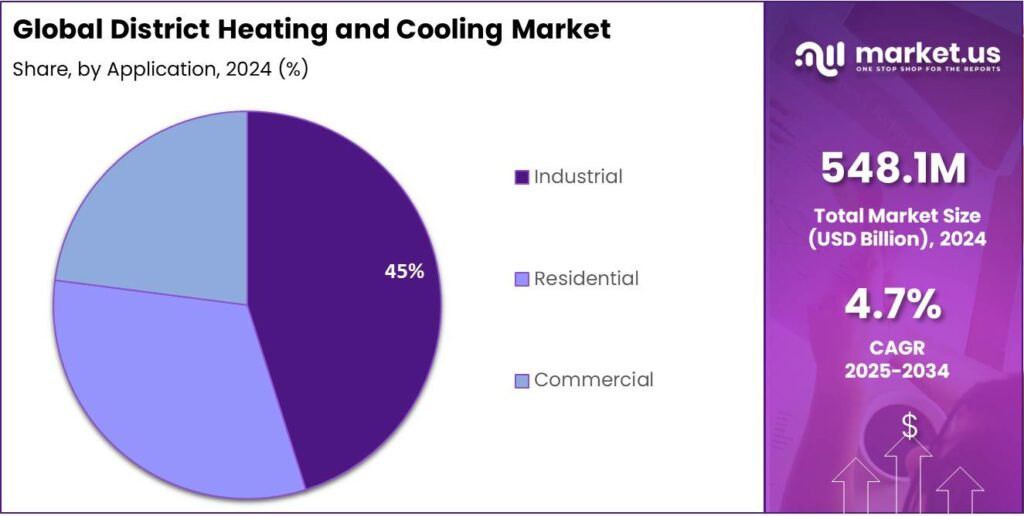

- Industrial held a dominant market position in the District Heating and Cooling Market, capturing more than a 45.2% share.

- Asia-Pacific (APAC) region emerged as the leading market for District Heating and Cooling, holding a dominant 45.9% share and accounting for approximately USD 115.3 billion.

By Energy Source Analysis

District Heating dominates with 74.4% share due to its established infrastructure and efficiency in large-scale energy distribution.

In 2024, District Heating held a dominant market position, capturing more than a 74.4% share of the overall District Heating and Cooling Market. The significant adoption of district heating systems can be attributed to their efficiency in supplying centralized thermal energy for residential, commercial, and industrial applications. These systems have been favored for their ability to reduce greenhouse gas emissions by integrating multiple energy sources, including renewable energy, natural gas, and waste heat recovery. In addition, urban areas with high population density have increasingly relied on district heating networks to meet energy demands in a cost-effective and environmentally sustainable manner.

The market continued to expand steadily, driven by government initiatives supporting low-carbon energy solutions and investments in modernizing existing district heating infrastructure. Cities in Europe and Asia have seen extensive deployment, with upgrades enhancing heat transfer efficiency and reducing operational costs. The rising focus on energy conservation and stringent environmental regulations has further reinforced the preference for district heating systems over decentralized alternatives. This trend is expected to maintain momentum as municipalities and private developers prioritize integrated energy solutions that balance reliability, affordability, and sustainability.

By Application Analysis

Industrial sector leads with 45.2% share due to high energy demand and process efficiency requirements.

In 2024, Industrial held a dominant market position in the District Heating and Cooling Market, capturing more than a 45.2% share. The industrial segment’s strong performance is largely driven by its high and continuous demand for thermal energy in processes such as manufacturing, chemical production, and food processing. Industries benefit from district heating systems as they provide a reliable and cost-effective source of heat, which enhances operational efficiency and reduces energy costs compared to individual heating solutions.

The industrial application segment continued to grow steadily, fueled by the expansion of manufacturing hubs and increasing emphasis on sustainable energy practices. Many industrial facilities have adopted district heating solutions to reduce carbon emissions and comply with stricter environmental regulations. Additionally, integration with waste heat recovery and renewable energy sources has further increased the attractiveness of these systems for industrial use.

Key Market Segments

By Energy Source

- District Heating

- CHP

- Geothermal

- Solar

- Heat Only Boilers

- Others

- District Cooling

- Free Cooling

- Absorption Cooling

- Heat Pumps

- Electric Chillers

- Others

By Application

- Industrial

- Residential

- Commercial

Emerging Trends

Shift to Low-Temperature, Flexible and Circular Heat Networks

One of the strongest recent trends in the district heating and cooling (DHC) world is the shift toward low-temperature, flexible, and circular heat networks — systems that operate at lower supply and return temperatures, adapt dynamically, and reuse local heat sources in a more “circular” way rather than in rigid, linear systems. This is not just engineering jargon — it reflects a more humane kind of energy infrastructure, one that listens to local conditions, evolves with demand, and respects resources.

Lowering the temperature of heat networks has many advantages: reduced distribution losses, easier integration of waste heat and renewable heat pumps, and safer operation. In older systems where supply water may run at 80–90 °C or more, a lot of energy is lost during transit. But new designs aim for supply temperatures of 40–60 °C or even lower, sometimes called “fourth- or fifth-generation” DHC. Alfa Laval highlights that a key trend is “low grid temperature” systems, and that newly built grids tend to aim for this.

Researchers estimate that about 30% of heat flows in food industry processes end up as waste heat at the end of production. That means a significant fraction of thermal energy is available, if systems adapt to accept it. In the UK’s food manufacturing sector alone, waste heat potential has been estimated at 1.4 TWh per year looking at process effluent heat recovery. In effect: low-temperature networks make it easier to integrate that kind of waste heat, which otherwise would be lost or vented.

Policy is pushing this trend too. In Europe, ambitions to decarbonize district heating and integrate renewable and waste heat are written into energy efficiency and heat planning frameworks. For example, the Euroheat DHC Market Outlook notes that expanding DHC to cover 20% of the EU’s heat demand by 2030 (up from ~13 % now) could save 24 Mt CO₂ annually. As part of that, member states are encouraged to identify waste heat sources in industrial zones, plan future low-temperature networks, and enforce heat network mapping in urban planning.

Drivers

Waste Heat Recovery and Industrial Heat Integration

One of the most compelling and human-centric drivers for accelerating district heating and cooling (DHC) is the opportunity to reclaim waste heat from industrial operations — turning what is today “waste” into a resource that warms homes, powers processes, and reduces emissions. Many industries produce vast heat loads they cannot fully use, and DHC gives that heat a second life.

Consider the magnitude of waste energy in industry. According to the U.S. Department of Energy, between 20% and 50% of industrial energy input is lost as waste heat — through hot exhaust gases, cooling water, or heat escaping into the environment. This means that in many factories, nearly half of the energy they consume flows out as unused thermal output.

In the European DHC landscape, this integration is already growing. As of 2025, renewable energy plus waste heat sources make up 44.1% of the energy mix in district heating and cooling networks — up 9.4 percentage points since 2022. That shift reflects a clear recognition that waste heat is not just a side note, but a core pillar of new systems.

Government policies also galvanize this integration. In the European Union, member states are required to increase the share of renewable heat by 1.6% per year until 2030 for the industrial sector, under the revised “Fit for 55” and related heat decarbonization frameworks. This requirement pushes industries to look at their thermal flows more carefully and consider supplying that heat into district networks.

At the national and municipal level, regulatory encouragement is rising. For example, in Scotland, the Heat Networks (Scotland) Act 2021 sets targets for connecting 650,000 dwellings to heat networks by 2030, and establishes a licensing regime to foster robust and safe heat supply markets. Under such laws, industrial plants become natural partners or nodes in broader thermal ecosystems.

Restraints

High Upfront Infrastructure Costs and Investment Risk

To bring this into perspective: installing insulated piping and laying networks underground is expensive. Many studies point to “high capital costs” as a central barrier. A 2025 review in Energy Policy and related literature names high installation cost, regulatory uncertainty, and weak integration policies among the top hurdles for DHC deployment. In other words, even when the long-term value is clear, the upfront burden scares off investors.

Another dimension is uncertain demand. If a district heating operator invests heavily but later consumption falls (because buildings become better insulated, or because individual heat pumps gain popularity), the financial payback can stretch much longer. In fact, some feasibility studies warn that reduced heat consumption is a threat to DHC viability — because if buildings demand less heat, then the fixed costs and network losses start to dominate.

While I did not find a public figure specifically from food industries about DHC, the pattern is analogous in other energy‐intensive sectors. Many industrial plants face high marginal costs for waste heat capture because the infrastructure to extract, clean, transport, and inject that heat is capital intensive. When projects involve tens of millions in capital, even a small shortfall in utilization (say 10–20 %) can lead to negative returns.

To mitigate this, governments sometimes step in with subsidies or guarantees. For example, the European Union’s Combined Heat and Power (CHP) Directive aims to promote cogeneration and integration of heat and power in a unified system — indirectly supporting DHC by encouraging high-efficiency heat generation. But even with supportive policy, individual local projects face risk. In many jurisdictions, there is no clear mechanism to share risk across stakeholders—city, utility, real estate owners, industries.

On the regulatory side, inconsistent permitting regimes, fragmented ownership (some parts municipal, some private), unclear cost allocation, and weak mandates for dense building zoning also contribute to risk. VTT, a European technical R&D organization, notes that multiple stakeholders—including building owners, property managers, utilities—must align for DHC to thrive, and misalignment adds friction and delays.

Opportunity

Deploying Waste-Heat from Food & Beverage and Industrial Sectors into DHC Networks

Inside food and beverage factories — think dairy, breweries, bakeries, meat processing — processes like drying, cooking, pasteurization, and refrigeration all produce large volumes of low- or medium-temperature waste heat. Research shows that some food processing facilities can recover up to 95% of waste heat from process air, steam, and flue gases under optimal conditions. That means a vast majority of the heat that currently gets vented into the atmosphere can be re-channeled. As the Food Industry Executive reports, deploying heat recovery can yield up to 25% annual energy savings in food and beverage plants by recovering ultra-low temperature waste heat as “free green energy.”

By linking these industrial waste heat flows into DHC systems, district networks can access a distributed and complementary heat supply. This reduces dependency on primary heating fuels and strengthens resilience. In practice, a brewery or dairy plant could act not just as a consumer of heat, but a supplier. For example, in the UK, a brewery is experimenting with an ultra-high temperature heat pump to recycle brewing vapors normally lost — aiming to replace its oil boiler and cut fuel costs by 40%. This illustrates how even in food production, thermal reuse is becoming both feasible and financially attractive.

From a scale perspective, the European Commission notes that as of 2021, district heating covered about 12% of final energy demand for space and water heating across the EU, and capacity is expected to rise by at least 80% by 2030. This expansion will require new heat supply sources — and waste heat from industrial zones is a natural candidate. In parallel, national and local governments are offering incentives and regulatory backing: in many countries, heat planning frameworks now require municipalities to map waste and surplus heat potentials and integrate them into city-wide heating strategies.

Modern innovations like large-scale heat pumps, thermal storage, and smart controls make it easier to adapt variable waste heat streams into stable supply for district systems. The more industrial participants cooperate, the more the DHC network becomes a shared backbone. Over time, that can strengthen the business case for new residential communities, business parks, and mixed-use developments to adopt DHC as their preferred option.

Regional Insights

APAC dominates with 45.9% share, valued at USD 115.3 billion, driven by rapid urbanization and industrial growth.

In 2024, the Asia-Pacific (APAC) region emerged as the leading market for District Heating and Cooling, holding a dominant 45.9% share and accounting for approximately USD 115.3 billion in market value. The substantial growth in this region can be attributed to rapid urbanization, increasing industrial activity, and the expansion of smart city initiatives across countries such as China, Japan, and South Korea. These factors have accelerated the adoption of district heating and cooling systems, which provide reliable, efficient, and environmentally sustainable energy solutions for densely populated urban centers and industrial clusters.

China, in particular, has invested heavily in modernizing its urban energy infrastructure, with large-scale district heating networks implemented to improve energy efficiency and reduce reliance on coal-based individual heating systems. Similarly, Japan and South Korea have focused on integrating renewable energy sources and waste heat recovery into their district energy systems, further driving the market. Government policies promoting low-carbon energy solutions and financial incentives for energy-efficient infrastructure have played a pivotal role in supporting regional adoption.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADC Energy Systems, established in 2005 and headquartered in Dubai, specializes in delivering turnkey EPC (Engineer, Procure, and Construct) solutions for industrial and commercial cooling, heating, refrigeration, and energy systems across the Gulf region. With a notable track record, the company has achieved a turnover of AED 1.7 billion, reflecting its robust presence in the market. ADC is recognized for executing large-scale district cooling projects, such as the Palm Jumeirah Crescent and Saadiyat Island district cooling plants, demonstrating its capability in handling complex infrastructure projects.

Emicool, a subsidiary of Dubai Investments PJSC, is a leading district cooling service provider in the UAE. Established in 2003, the company serves over 30,000 customers and operates with a cooling capacity of 355,000 tonnes of refrigeration (TR). Emicool’s district cooling systems are designed to reduce energy consumption by up to 35% compared to traditional air-conditioning systems, thereby lowering carbon footprints. The company’s commitment to sustainability and energy efficiency positions it as a key player in the region’s efforts to develop low-carbon urban infrastructure.

ENGIE is a multinational energy company operating over 320 district heating and cooling systems worldwide. With a strong presence in Europe, Asia, and North America, ENGIE focuses on providing sustainable and efficient heating and cooling solutions to urban areas. The company’s district energy systems utilize renewable energy sources, waste heat recovery, and cogeneration technologies to minimize environmental impact. ENGIE’s commitment to decarbonization and energy efficiency aligns with global efforts to reduce greenhouse gas emissions and promote sustainable urban development.

Top Key Players Outlook

- ADC Energy Systems

- Danfoss

- DC Pro Engineering

- Emicool

- ENGIE

- Fortum

- Göteborg Energi

- Helen Oy

- Keppel Corporation Limited

- Ørsted A/S

Recent Industry Developments

In 2024 Danfoss plays, they launched a modular data centre heat recovery system that can cut energy use by 20% and recover waste heat for nearby buildings, and achieve cooling efficiency gains up to 30% via Danfoss’s Turbocor compressors.

In 2024 ENGIE: District Heating Eco Energías, a Spanish firm specializing in biomass-based heat networks, giving ENGIE majority control at 70.74% ownership and enhancing its clean heating pipeline in Spain.

Report Scope

Report Features Description Market Value (2024) USD 251.3 Bn Forecast Revenue (2034) USD 390.3 Bn CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Energy Source (District Heating, District Cooling), By Application (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADC Energy Systems, Danfoss, DC Pro Engineering, Emicool, ENGIE, Fortum, Göteborg Energi, Helen Oy, Keppel Corporation Limited, Ørsted A/S Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  District Heating and Cooling MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

District Heating and Cooling MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADC Energy Systems

- Danfoss

- DC Pro Engineering

- Emicool

- ENGIE

- Fortum

- Göteborg Energi

- Helen Oy

- Keppel Corporation Limited

- Ørsted A/S