Global Disodium Succinate Market Size, Share Analysis Report By Purity (Up to 98% and Above 98%), By Type (Anhydrous and Hexahydrate), By Source (Synthetic and Bio-based), By Application (Food And Beverage, Pharmaceutical, Personal Care And Cosmetics, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160878

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

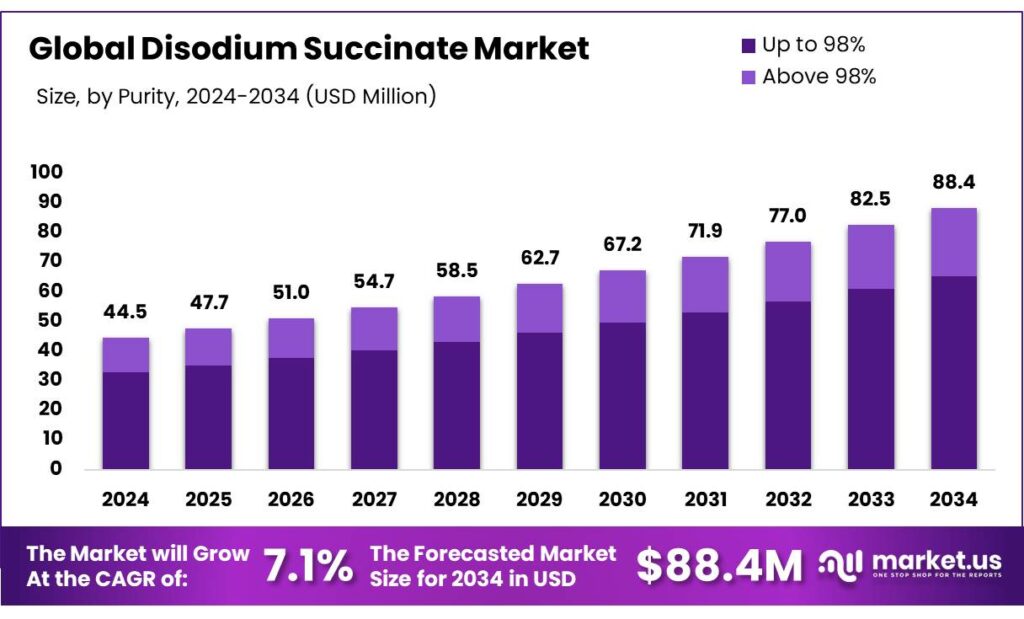

The Global Disodium Succinate Market size is expected to be worth around USD 88.4 Million by 2034, from USD 44.5 Million in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

Sodium succinate is the sodium salt of succinic acid, a naturally occurring metabolic intermediate and dicarboxylic acid. It’s a versatile compound found naturally in biological tissues and can be synthetically produced or generated through fermentation. One of the major drivers of the disodium succinate is its ability to enhance umami flavor, which makes it an important ingredient in the food and beverage industry.

Additionally, it is used as a pH adjuster, buffering agent, fragrance enhancer, and surfactant in the personal care and cosmetics industry. As there is a global shift towards sustainable products, there is an enhanced focus on bio-based disodium succinate. However, prolonged consumption of the compound might affect humans, leading to allergies and weakened liver and kidneys.

- According to the Flavor and Extract Manufacturers Association (FEMA), the average maximum use level of disodium succinate, on which the expert panel based its judgment that it is generally recognized as safe (GRAS), is 60 ppm in beverages, baked goods, dairy products, meat products, sauces, and soups.

Key Takeaways

- The global disodium succinate market was valued at USD 44.5 million in 2024.

- The global disodium succinate market is projected to grow at a CAGR of 7.1% and is estimated to reach USD 88.4 million by 2034.

- Based on the purity, disodium succinate, which is pure up to 98% dominated the market in 2024, comprising about 73.8% share of the total global market.

- In 2024, hexahydrate disodium succinate led the market with about 70.5% of the total global market share.

- On the basis of the sources, the synthetic segment dominated the market in 2024, accounting for 61.8% share of the total global market.

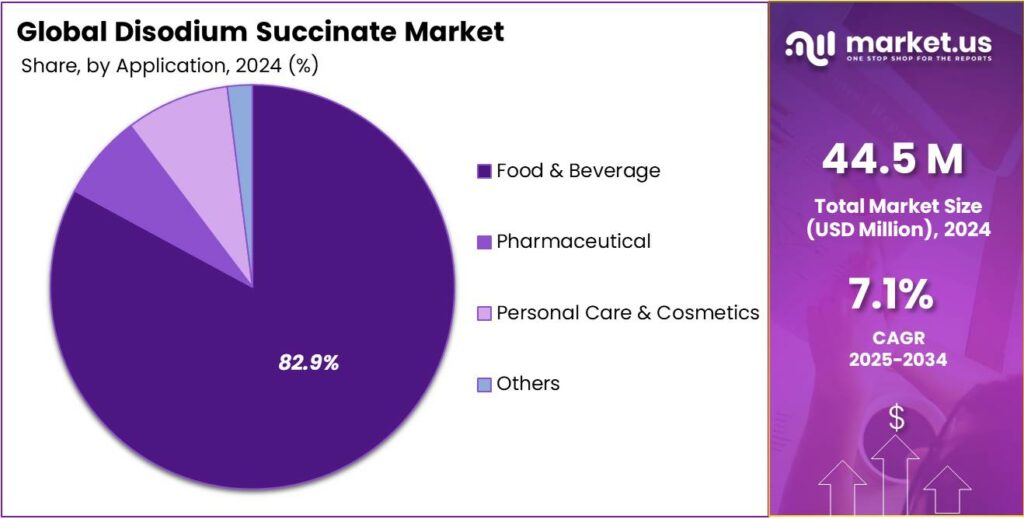

- Among the applications of disodium succinate, the food & beverage industry held share of 82.9% of the market share.

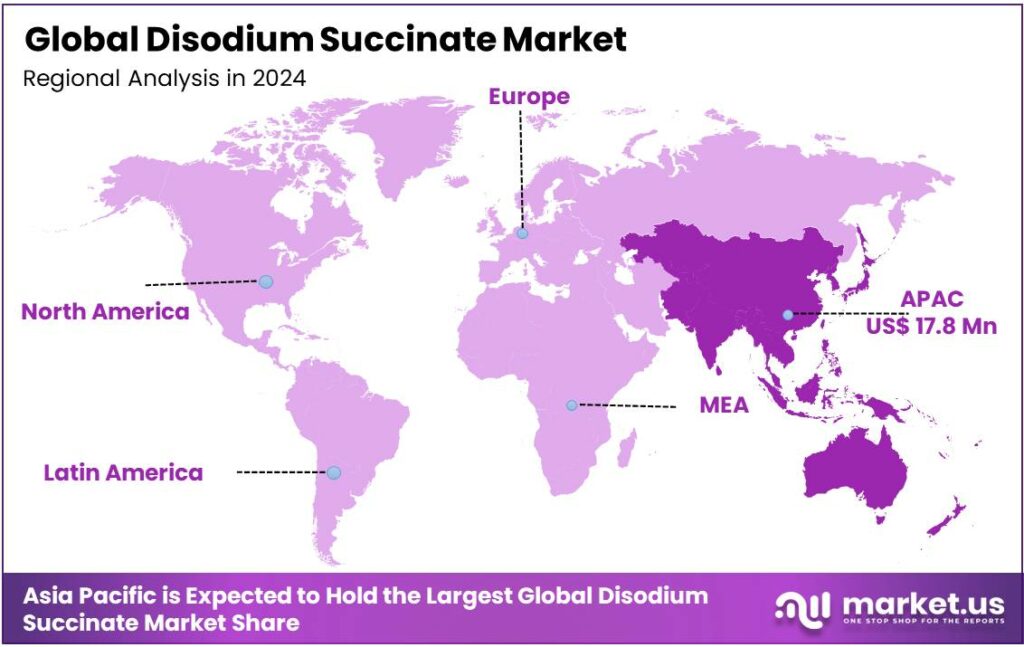

- Asia Pacific was the largest market for disodium succinate in 2024, accounting for around 39.9% of the total global consumption.

Purity Analysis

Disodium Succinate, which is up to 98% Pure, Dominated the Market.

On the basis of the purity, the market is segmented into up to 98% and above 98%. Disodium succinate, that is up to 98% pure, dominated the market in 2024 with a market share of 73.8%. It is more widely utilized than its higher-purity counterpart as it offers a practical balance between performance, cost, and application needs.

In most food, beverage, and industrial applications, 98% purity is sufficient to meet safety and functional standards, making it a cost-effective choice for mass production. Higher-purity disodium succinate, while available, is more expensive to produce due to the additional refinement processes, which may not yield significant benefits in typical usage scenarios.

For instance, in food seasoning or flavor enhancement, the small difference in purity does not noticeably affect taste or stability. The manufacturers prefer the 98% variant to optimize both quality and production efficiency.

Type Analysis

Hexahydrate Disodium Succinate was the Leading Segment in the Market.

Based on the types of disodium succinate, the market is segmented into anhydrous and hexahydrate. Hexahydrate disodium succinate dominated the market in 2024 with a market share of 70.5%. It is more commonly used than its anhydrous form due to its greater stability and ease of handling in various applications. The hexahydrate form contains water molecules that help maintain its crystalline structure, making it less prone to clumping and easier to dissolve in water-based formulations.

This characteristic is particularly important in food processing and cosmetics, where uniform mixing and consistent texture are crucial. Additionally, the hexahydrate version tends to be less hygroscopic than the anhydrous form, reducing the risk of moisture-related degradation during storage. These practical advantages make hexahydrate disodium succinate a preferred choice for manufacturers aiming for reliable performance and efficient processing.

Source Analysis

Synthetic Disodium Succinate Held the Largest Share of the Market.

On the basis of the source of disodium succinate, the market is divided into synthetic and bio-based. Synthetic disodium succinate dominated the market in 2024 with a market share of 61.8%. It is more utilized than bio-based variants primarily due to its consistent quality, cost-effectiveness, and established production processes. Synthetic methods allow manufacturers to produce large quantities with precise control over purity and composition, ensuring uniform performance across various applications.

In contrast, bio-based disodium succinate, produced through fermentation or other biological routes, can face variability in yield and purity depending on raw materials and process conditions. Additionally, synthetic production often requires less time and infrastructure investment, making it more scalable for large industrial demands. While bio-based options are gaining interest for sustainability reasons, synthetic disodium succinate remains the preferred choice for many industries due to its reliability, affordability, and widespread availability.

Application Analysis

Food & Beverage Industry Emerged as a Leading Segment in the Disodium Succinate Market.

Based on the applications of disodium succinate, the market is divided into food & beverage, pharmaceutical, personal care & cosmetics, and others. The food & beverage industry dominated the market in 2024 with a market share of 82.9%. Most disodium succinate is used in the food and beverage sector, as its primary function as a flavor enhancer directly improves the taste and savory quality of a wide range of consumable products. Its ability to intensify umami flavors makes it indispensable in soups, snacks, sauces, and processed foods, where flavor is a critical factor.

In contrast, the pharmaceutical, personal care, and cosmetics industries require ingredients that focus more on stability, skin compatibility, or therapeutic benefits rather than taste enhancement. While disodium succinate is used in these sectors, its role is more limited, as a fragrance enhancer or surfactant, resulting in lower overall consumption compared to the food sector, where demand is driven by mass production and high-volume use.

Key Market Segments

By Purity

- Up to 98%

- Above 98%

By Type

- Anhydrous

- Hexahydrate

By Source

- Synthetic

- Bio-based

By Application

- Food & Beverage

- Meat, Poultry & Seafood

- Instant Noodles & Soups

- Sauces, Dressings & Condiments

- Savory & Snacks

- Others

- Pharmaceutical

- Personal Care & Cosmetics

- Others

Drivers

Ability to Enhance the Umami Flavor Drives the Disodium Succinate Market.

Disodium succinate is gaining significant traction in the food industry due to its powerful ability to enhance umami flavor, often referred to as the fifth taste alongside sweet, sour, salty, and bitter. This compound, commonly used as a flavor enhancer in processed foods, soups, snacks, and instant noodles, works synergistically with monosodium glutamate (MSG) to create a richer, more savory taste profile. Its unique capability to intensify meaty and brothy flavors makes it particularly valuable in plant-based and vegetarian food products, where replicating the depth of animal-based umami is challenging.

For instance, in instant ramen seasoning or bouillon cubes, disodium succinate contributes to a more full-bodied flavor with as little as 0.03–0.05% concentration by weight. Additionally, it is thermostable and retains its flavor-enhancing properties even after high-heat processing, making it suitable for a wide range of culinary applications. This versatility and efficiency continue to drive its widespread adoption across the global food and beverage industry.

Restraints

Long-Term Consumption Effect on Human Health Might Hamper the Growth of the Disodium Succinate Market.

Concerns over the potential long-term health effects of disodium succinate consumption may pose a challenge to the growth of the disodium succinate market, particularly as the food and beverage industry accounts for over 80% of its total usage. While disodium succinate is generally recognized as safe (GRAS) by regulatory authorities, continuous consumption through a wide variety of processed foods, such as instant noodles, snacks, canned soups, and frozen meals, has a hazardous effect on the human body due to cumulative intake. It is suggested that disodium succinate is prone to cause allergic reactions. It could potentially contribute to metabolic imbalances, sodium-related health issues such as hypertension, or even gastrointestinal discomfort in sensitive individuals.

Additionally, long-term excessive consumption of foods containing disodium succinate may cause certain damage to the liver and kidneys, which may easily lead to excessive burden on the liver and kidneys and cause liver and kidney diseases. Furthermore, children and pregnant women have weak liver and kidney functions and are susceptible to disodium succinate. Growing consumer awareness and scrutiny of ingredient labels are encouraging a shift toward cleaner, additive-free food products, which could restrain the widespread use of disodium succinate in the long run.

Opportunity

Demand for Bio-Based Sodium Succinate Creates Opportunities in the Market.

The rising demand for bio-based sodium succinate is creating new opportunities in the disodium succinate market, driven by increasing consumer preference for sustainable and eco-friendly ingredients. Bio-based disodium succinate is produced through fermentation processes using renewable feedstocks such as glucose derived from corn or sugarcane, offering a greener alternative. This shift aligns with the broader trend toward cleaner-label and environmentally conscious food production.

For instance, food manufacturers are incorporating bio-based disodium succinate in plant-based meat alternatives and natural seasonings to meet the growing demand for clean-label products without compromising on flavor. Furthermore, its biodegradable nature and lower carbon footprint appeal to industries beyond food, such as pharmaceuticals and cosmetics, where sustainability is becoming a key decision-making factor. With regulatory bodies encouraging the reduction of fossil-derived additives, the adoption of bio-based disodium succinate is expected to rise, opening doors for innovation and product differentiation in various sectors.

Trends

Increased Demand for Disodium Succinate from the Cosmetics Industry.

An ongoing trend in the disodium succinate market is the growing demand from the cosmetics and personal care industry, where the compound is valued for its multifunctional properties. Disodium succinate serves as a pH adjuster, buffering agent, and skin-conditioning agent in a wide range of formulations, including creams, lotions, cleansers, and serums. Its mild, non-irritating nature makes it suitable for sensitive skin products, aligning with the rising consumer demand for gentle, skin-friendly ingredients. For instance, in facial moisturizers and anti-aging creams, disodium succinate helps stabilize the formulation while contributing to improved skin texture and tone. Additionally, the shift toward clean beauty and sustainable sourcing has encouraged cosmetic manufacturers to explore bio-based variants of disodium succinate, further fueling its adoption. As consumers become more ingredient-conscious, the inclusion of multifunctional and naturally derived compounds like disodium succinate is becoming a preferred choice, driving innovation and expansion within the cosmetics segment of the market.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Disodium Succinate Market.

Geopolitical tensions have had a notable impact on the disodium succinate market, affecting both the supply chain and international trade dynamics. Many of the raw materials required for producing disodium succinate, such as succinic acid and sodium carbonate, are sourced and processed in countries like China and other parts of Asia. Disruptions due to trade conflicts, tariffs, or export restrictions can hinder the smooth flow of these materials, leading to production delays and cost escalations. For instance, ongoing trade disputes between major economies like the U.S. and China have led to uncertainty around import-export regulations, directly affecting manufacturers dependent on cross-border sourcing.

Additionally, political instability in resource-rich regions can impact logistics and transport routes, further straining supply chains. For instance, the Russia-Ukraine conflict has led to increased energy prices and limited access to certain chemicals and commodities, influencing overall production costs. These uncertainties make it challenging for companies to maintain stable pricing and consistent product availability.

- For instance, in July 2022, Nippon Shokubai increased the selling price of the compound by JPY 25/kg or USD 0.25/kg.

Regional Analysis

Asia Pacific is the Largest Market for Disodium Succinate.

Asia Pacific held the major share of the global disodium succinate market, valued at around US$17.8 million, commanding an estimated 39.9% of the total revenue share. The region stands out as the largest market for disodium succinate, driven by its extensive use in regional cuisines and the booming processed food industry. Countries such as China, Japan, South Korea, and Southeast Asian nations widely incorporate umami-rich ingredients into their traditional and modern dishes, with disodium succinate playing a key role in enhancing savory flavors.

In Japan, for instance, it is commonly used in dashi-based soups and noodle broths, while in China, it’s frequently added to hot pots, sauces, and instant noodles to intensify taste. The region’s high consumption of convenience foods, including ready-to-eat meals and packaged snacks, further supports strong demand for this flavor enhancer. Additionally, Asia Pacific’s rapidly growing cosmetics and pharmaceutical industries also contribute to market expansion, utilizing disodium succinate in various formulations. Local production capabilities, abundant raw materials, and cost-effective manufacturing have enabled the region to not only meet domestic demand but also serve as a key exporter to global markets.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the disodium succinate market are Nippon Shokubai, Fengchen Group, Anhui Sunsing Chemicals, Aipu Food Industry, Fuso Chemical, Qingdao Jiutai Biotechnology, Qingdao Baotai Pure Food Technology, Dr. Paul Lohmann GmbH & Co. KGaA, Fujifilm Wako Pure Chemical Corporation, and Shanghai Talent Chemical. In recent years, these companies have been focusing on their R&D and expansion for product diversification and the development of bio-based sodium succinate.

The major players in the industry

- Nippon Shokubai Co., Ltd.

- Fengchen Group Co., Ltd.

- Anhui Sunsing Chemicals Co., Ltd.

- Aipu Food Industry

- Fuso Chemical Co., Ltd.

- Qingdao Jiutai Biotechnology Co., Ltd.

- Qingdao Baotai Pure Food Technology Co., Ltd.

- Paul Lohmann GmbH & Co. KGaA

- Fujifilm Wako Pure Chemical Corporation

- Shanghai Talent Chemical Co., Ltd.

- Other Players

Key Strategies

- Product Diversification: Manufacturers offer various grades and forms of disodium succinate, such as synthetic, bio-based, anhydrous, and hexahydrate variants, to cater to different industries like food, cosmetics, and pharmaceuticals. This broad product range helps them meet diverse customer needs and enter new market segments effectively.

- Sustainability Initiatives: Manufacturers invest in eco-friendly production methods and promote bio-based disodium succinate to appeal to environmentally conscious consumers. Highlighting sustainability helps differentiate their products, align with regulatory trends, and attract clients focused on clean-label and green ingredient sourcing.

Report Scope

Report Features Description Market Value (2024) USD 44.5 Mn Forecast Revenue (2034) USD 84.4 Mn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 98%, Above 98%), By Type (Anhydrous, Hexahydrate), By Source (Synthetic, Bio-based), By Application (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Nippon Shokubai, Fengchen Group, Anhui Sunsing Chemicals, Aipu Food Industry, Fuso Chemical, Qingdao Jiutai Biotechnology, Qingdao Baotai Pure Food Technology, Dr. Paul Lohmann GmbH & Co. KGaA, Fujifilm Wako Pure Chemical Corporation, Shanghai Talent Chemical, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nippon Shokubai Co., Ltd.

- Fengchen Group Co., Ltd.

- Anhui Sunsing Chemicals Co., Ltd.

- Aipu Food Industry

- Fuso Chemical Co., Ltd.

- Qingdao Jiutai Biotechnology Co., Ltd.

- Qingdao Baotai Pure Food Technology Co., Ltd.

- Paul Lohmann GmbH & Co. KGaA

- Fujifilm Wako Pure Chemical Corporation

- Shanghai Talent Chemical Co., Ltd.

- Other Players