Global Discount Department Stores Market Size, Share, Growth Analysis By Product Type (Clothing & Apparel, Beauty & Health, Electronics, Home & Living, Toys & Games, Others), By Payment Options (Contactless, Tender Types), By Operating Mode (Brick-And-Mortar, Online/E-Commerce), By Store Format (Omnichannel Discount Stores, Shopping Center, Standalone Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161171

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

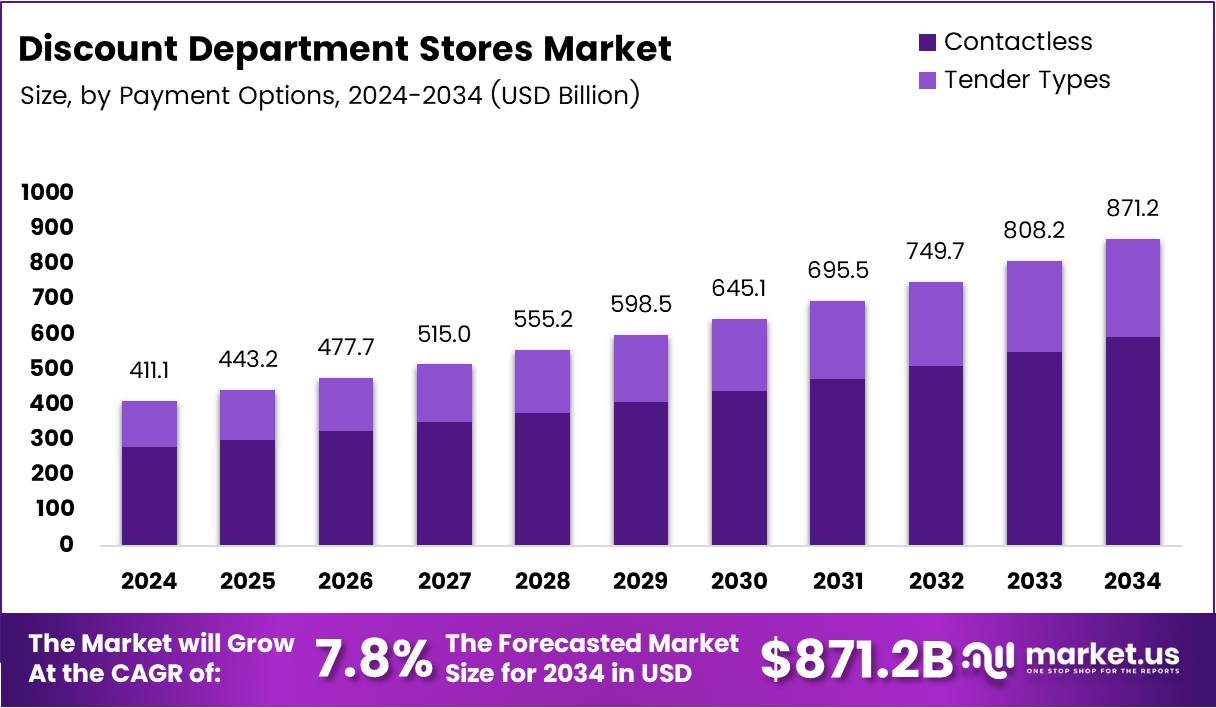

The Global Discount Department Stores Market size is expected to be worth around USD 871.2 Billion by 2034, from USD 411.1 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

The Discount Department Stores Market represents a major segment within the retail industry, offering branded and private-label merchandise at lower prices. These stores cater to value-conscious consumers seeking apparel, electronics, and household goods under one roof. The model thrives on high-volume sales, competitive pricing, and efficient supply chain management to maintain profitability.

The market has evolved due to rising inflation, changing shopping behaviors, and e-commerce integration. Consumers increasingly prefer stores that combine affordability and convenience, making discount retailers a preferred choice during economic uncertainty. Brands like Walmart, Target, and Kohl’s have expanded private-label portfolios and loyalty programs to retain cost-sensitive shoppers.

Government policies supporting consumer spending and local employment indirectly boost this market. Retail infrastructure investment in suburban and tier-2 regions further expands reach. Meanwhile, sustainability regulations push discount stores toward eco-friendly packaging and energy-efficient operations, reflecting compliance and brand differentiation across global retail markets.

Technological advancement plays a critical role. Integration of AI-driven inventory systems, omnichannel retailing, and mobile payment options enhances shopping convenience. Discount department stores increasingly rely on data analytics to forecast demand, personalize promotions, and optimize pricing strategies, creating growth opportunities in both developed and emerging markets.

Consumer behavior continues to shape this sector. According to the National Retail Federation, 63% of U.S. holiday shoppers said they would buy gifts at discount department stores, emphasizing their dominance in seasonal retail. Furthermore, Private Label Manufacturers Association reported private-label sales hit a record USD 271 billion in 2024, marking a 3.9% year-over-year rise, driven by affordability trends.

Additionally, industry reports indicate that 92% of consumers plan to shop in physical stores during the Holiday 2025 season, with discount department stores remaining the most-preferred destination. These statistics underline strong consumer confidence in in-store value shopping, ensuring steady growth momentum. As competition intensifies, strategic investment in omnichannel experiences and sustainability initiatives will define long-term success in the global Discount Department Stores Market.

Key Takeaways

- The Global Discount Department Stores Market is projected to reach USD 871.2 Billion by 2034, up from USD 411.1 Billion in 2024, growing at a CAGR of 7.8% (2025–2034).

- Clothing & Apparel dominated the By Product Type segment with a 34.8% share in 2024, driven by strong demand for affordable fashion and seasonal offerings.

- Contactless Payments led the By Payment Options segment with a 68.9% share in 2024, supported by the rapid rise of NFC cards, mobile wallets, and digital apps.

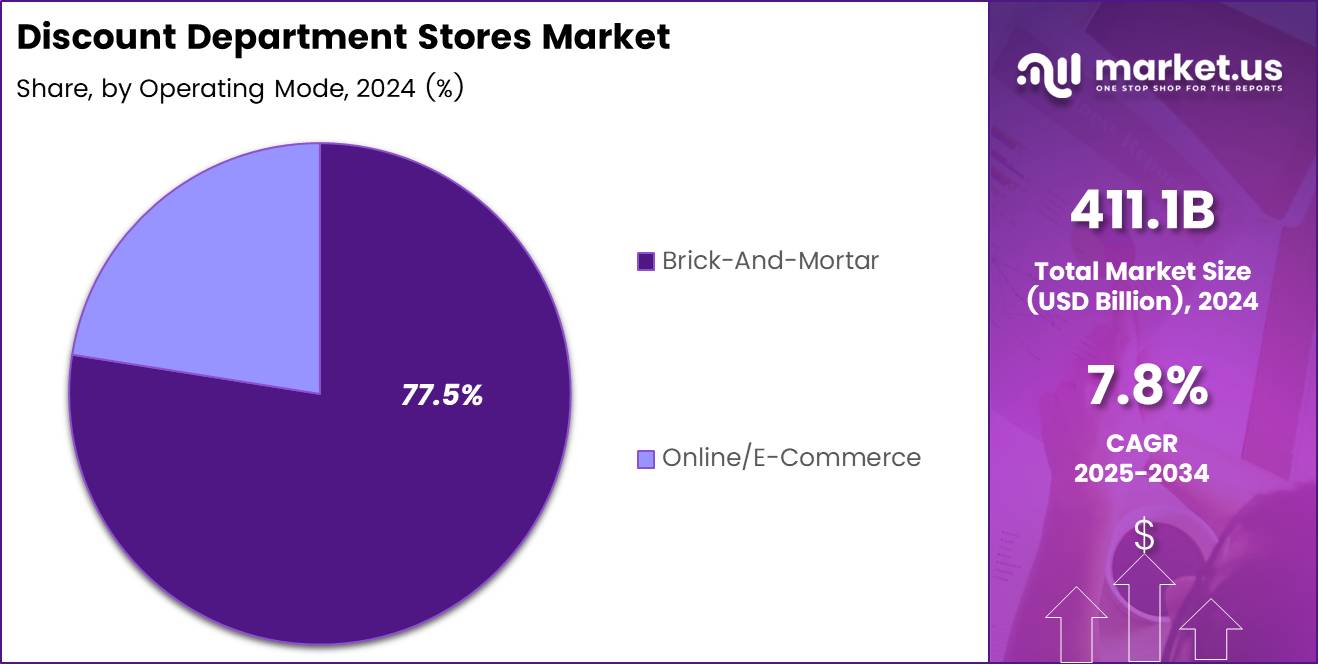

- Brick-And-Mortar Stores held a 77.5% share in 2024 under the By Operating Mode category, reflecting consumers’ preference for physical shopping and instant access.

- Omnichannel Discount Stores dominated the By Store Format segment with a 44.2% share in 2024, combining online and offline experiences for seamless consumer engagement.

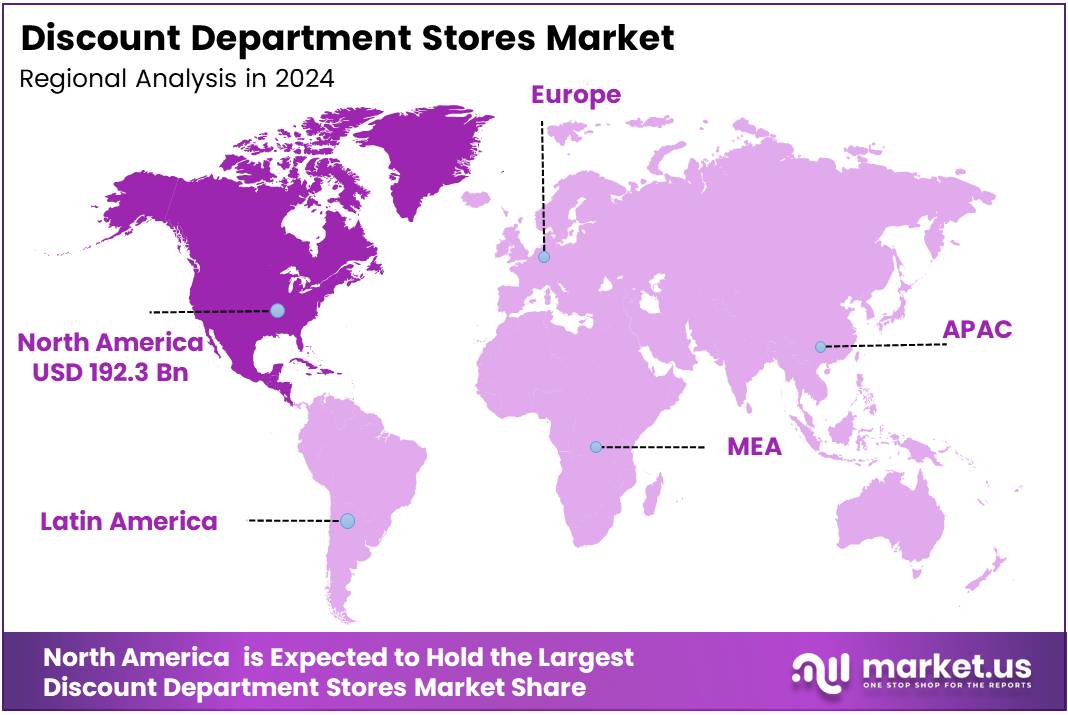

- North America remained the leading regional market, holding a 46.8% share and valued at USD 192.3 Billion in 2024, driven by strong consumer spending and advanced retail infrastructure.

By Product Type Analysis

Clothing & Apparel dominates with 34.8% due to its widespread appeal and consistent consumer demand.

In 2024, Clothing & Apparel held a dominant market position in the By Product Type segment of the Discount Department Stores Market, with a 34.8% share. The segment benefits from continuous consumer preference for affordable fashion and seasonal trends. Discount stores provide a variety of styles at lower prices, attracting value-conscious shoppers and strengthening this category’s leading role.

Beauty & Health products represent a significant portion of the market, driven by increasing interest in self-care and personal grooming. The affordability of skincare, cosmetics, and wellness products in discount department stores attracts a wide demographic. Moreover, the growing availability of branded products at lower prices further enhances market traction.

Electronics continue to perform steadily, as discount stores offer competitive pricing on essential gadgets. Consumers seeking budget-friendly alternatives for smartphones, tablets, and accessories prefer these outlets. Promotions and bundle deals further encourage higher footfall, positioning this segment as a consistent contributor to overall sales.

Home Electronics hold a notable share as consumers increasingly invest in cost-effective home appliances. Affordable televisions, kitchen appliances, and audio systems drive volume sales. Discount stores leverage partnerships with manufacturers to offer reliable yet budget-friendly electronic solutions for everyday household needs.

Personal Electronics attract tech-savvy consumers seeking economical gadgets. The segment benefits from rising demand for accessories such as headphones, smartwatches, and chargers. Discount retailers focus on affordability and quick turnover, ensuring a steady inflow of customers looking for practical and accessible tech solutions.

Home & Living products remain integral to household shopping lists. Discount stores offer diverse home décor, furniture, and utility items at accessible prices. The segment grows as consumers prioritize affordability without compromising quality, making it a key driver of repeat purchases within the market.

Toys & Games exhibit consistent growth, supported by seasonal demand and family-oriented promotions. Parents prefer discount stores for their competitive pricing and variety of educational and entertainment toys. Frequent product updates and holiday promotions boost customer engagement and sales momentum in this segment.

Others category includes various miscellaneous items that cater to consumer convenience. This segment benefits from impulse purchases and bulk discount offers. The diversity of products within this category ensures consistent sales contribution across multiple consumer demographics.

By Payment Options Analysis

Contactless dominates with 68.9% due to its convenience and growing adoption of digital payment systems.

In 2024, Contactless payments held a dominant market position in the By Payment Options segment of the Discount Department Stores Market, with a 68.9% share. The segment’s growth is propelled by the increasing adoption of NFC-enabled cards, mobile wallets, and digital payment apps. Customers prefer this option for its speed, hygiene, and security, making it the top choice for modern retail transactions.

Tender Types continue to play an essential role, catering to consumers who prefer traditional cash or card payments. This segment maintains relevance, especially among older demographics and regions with limited digital infrastructure. Despite the digital shift, many discount department stores retain tender payment options to ensure inclusivity for all customer groups.

By Operating Mode Analysis

Brick-And-Mortar dominates with 77.5% due to its physical presence and customer experience advantages.

In 2024, Brick-And-Mortar stores held a dominant market position in the By Operating Mode segment of the Discount Department Stores Market, with a 77.5% share. These stores remain the cornerstone of the industry, offering tangible shopping experiences and instant product access. Shoppers value the ability to physically inspect items and enjoy in-store promotions that enhance loyalty and sales performance.

Online/E-Commerce channels continue to expand as consumers increasingly value convenience and wider product selections. Discount department stores invest in digital platforms to reach tech-savvy customers, streamline ordering, and integrate flexible delivery options. The hybrid approach of in-store and online offerings further strengthens overall market competitiveness.

By Store Format Analysis

Omnichannel Discount Stores dominate with 44.2% due to their integrated retail experience and accessibility.

In 2024, Omnichannel Discount Stores held a dominant market position in the By Store Format segment of the Discount Department Stores Market, with a 44.2% share. Their ability to blend physical and digital channels provides a seamless shopping journey. Customers benefit from flexible purchasing options, click-and-collect services, and personalized promotions, driving this segment’s strong dominance.

Shopping Center stores benefit from high foot traffic and diversified customer bases. Their strategic locations within malls and commercial areas ensure consistent visibility and spontaneous purchases. These stores often host promotional events and seasonal discounts, further stimulating customer engagement and revenue generation.

Standalone Stores serve local communities with accessible and compact retail spaces. Their convenience and targeted product offerings attract regular customers. With efficient operations and lower overheads, these stores maintain profitability while catering to daily shopping needs within neighborhoods.

Others format includes emerging retail models such as pop-up outlets and temporary discount centers. These formats provide flexibility in capturing seasonal or location-specific demand. Their adaptability helps brands test markets, promote new collections, and reach untapped consumer segments efficiently.

Key Market Segments

By Product Type

- Clothing & Apparel

- Children’s Clothing

- Fashion Accessories

- Men’s Clothing

- Women’s Clothing

- Beauty & Health

- Electronics

- Home Electronics

- Personal Electronics

- Home & Living

- Toys & Games

- Others

By Payment Options

- Contactless

- Tender Types

By Operating Mode

- Brick-And-Mortar

- Online/E-Commerce

By Store Format

- Omnichannel Discount Stores

- Shopping Center

- Standalone Stores

- Others

Drivers

Rising Consumer Preference for Affordable Branded Merchandise Across Developed Markets

The discount department stores market is growing steadily as more consumers in developed regions prefer affordable branded products. Customers are increasingly looking for well-known brands at lower prices, making discount retailers an attractive shopping option. This shift in consumer behavior is driven by economic uncertainty and the desire for value-based spending without compromising on brand appeal.

Private label product expansion is another key factor driving the market. Retailers are launching in-house brands that offer similar quality to premium labels but at lower costs. This strategy not only boosts profit margins but also strengthens customer loyalty as shoppers begin to trust and repurchase store-exclusive items.

Omnichannel retailing is also shaping market growth. Discount stores are integrating online and offline platforms, offering click-and-collect options and digital payment systems to enhance convenience. This approach allows customers to shop easily across multiple channels, improving accessibility and engagement.

Additionally, the expanding urban middle class in many regions supports market demand. This demographic is highly price-sensitive yet brand-conscious, creating steady growth for discount retailers that balance affordability with quality. Together, these trends are fueling strong market expansion worldwide.

Restraints

Intense Competition from E-Commerce Giants Offering Deep Discount Models

The discount department stores market faces growing pressure from major e-commerce players that offer aggressive discounting and vast product selections. Online platforms like Amazon and Alibaba attract price-conscious shoppers with convenience and competitive pricing, drawing customers away from physical discount stores.

Shrinking profit margins also remain a major restraint. Volatile supply chain costs, rising labor expenses, and fluctuating raw material prices make it difficult for retailers to maintain profitability while offering low prices. This operational challenge often limits reinvestment and innovation.

Another key issue is limited differentiation among discount retailers. With many stores selling similar products, it becomes hard to build a unique brand identity. This leads to brand dilution and customer churn, as consumers switch easily between stores offering comparable deals.

Lastly, discount retailers are highly dependent on economic cycles. During economic slowdowns, consumers cut back on discretionary spending, directly affecting store revenues. These cyclical patterns make long-term financial stability challenging, particularly for smaller regional players.

Growth Factors

Adoption of AI-Driven Inventory and Demand Forecasting in Discount Retailing

The discount department stores market is witnessing strong growth opportunities through the adoption of AI and data analytics. Smart technologies are helping retailers predict demand, optimize inventory, and minimize overstock or shortages. This leads to better product availability and reduced operational costs, enhancing overall efficiency.

Expanding into emerging economies presents another promising avenue. Countries in Asia, Latin America, and Africa have large populations of cost-conscious consumers seeking branded goods at lower prices. Establishing stores in these regions can help global retailers tap into new customer bases and increase market share.

Collaborations with sustainable and ethical brands are also opening doors for growth. Younger consumers, especially Millennials and Gen Z, prefer shopping from responsible brands. Partnering with eco-friendly suppliers can help discount stores appeal to this audience and strengthen their brand image.

Furthermore, the development of digital loyalty programs is helping retain customers. Mobile apps and personalized reward systems encourage repeat purchases and build long-term engagement. These innovations collectively offer significant growth potential for the discount department store market.

Emerging Trends

Surge in Demand for Off-Price Luxury and Premium Product Segments

A major trend shaping the discount department stores market is the rising demand for off-price luxury and premium products. Consumers are increasingly interested in owning high-end items without paying full retail prices, creating strong opportunities for discount retailers offering such collections.

Retailers are also leveraging data analytics to personalize both online and in-store shopping experiences. By analyzing customer behavior, stores can tailor promotions, recommend products, and improve satisfaction, leading to higher sales conversions.

Sustainability is another trending factor. Many discount department stores are sourcing eco-friendly and recycled merchandise to attract environmentally conscious buyers. This approach not only aligns with global sustainability goals but also builds trust with modern consumers who value responsible shopping.

Lastly, pop-up and hybrid store formats are gaining popularity in urban centers. These temporary or mixed-format stores allow retailers to test markets, engage customers directly, and offer exclusive deals. Such innovative retail formats are redefining the way discount department stores connect with today’s shoppers.

Regional Analysis

North America Dominates the Discount Department Stores Market with a Market Share of 46.8%, Valued at USD 192.3 Billion

The North American discount department stores market holds the largest share globally, accounting for 46.8% of the total market and valued at USD 192.3 Billion. This dominance is driven by strong consumer demand for value-oriented products and a mature retail ecosystem that supports large-scale operations.

High purchasing power, advanced logistics networks, and the growing popularity of omnichannel retailing continue to propel market expansion in the U.S. and Canada. The region’s focus on convenience and affordability ensures steady growth across both urban and suburban markets.

Europe Discount Department Stores Market Trends

The European discount department stores market demonstrates strong resilience, supported by consumers’ preference for budget-friendly and sustainable shopping options. Although smaller in share compared to North America, the region continues to show steady growth across major economies such as Germany, the U.K., and France. The increasing emphasis on private labels, efficient supply chains, and digital transformation initiatives has strengthened the region’s competitive landscape. Additionally, the post-pandemic shift toward affordability has fueled the demand for discount retail formats.

Asia Pacific Discount Department Stores Market Trends

The Asia Pacific market is emerging as one of the fastest-growing regions, supported by rapid urbanization and the rising middle-class population. The region’s expanding retail infrastructure and increasing disposable incomes are encouraging the proliferation of discount department stores across countries such as China, India, and Japan. Growth is also fueled by digitalization, with e-commerce integration enhancing accessibility and customer reach. The focus on value-for-money offerings and modernized store formats continues to attract a wide consumer base in this dynamic market.

Middle East and Africa Discount Department Stores Market Trends

The Middle East and Africa discount department stores market is witnessing gradual growth due to expanding retail investments and evolving consumer preferences toward affordable shopping. With rising urban populations and increasing smartphone adoption, the region is experiencing greater interest in hybrid retail experiences combining physical stores and digital platforms. Countries in the Gulf Cooperation Council (GCC) and parts of Africa are seeing increased entry of international retail brands, supported by favorable demographic trends and improving infrastructure.

Latin America Discount Department Stores Market Trends

The Latin American market for discount department stores is expanding steadily, driven by consumers seeking affordable alternatives amid economic fluctuations. Countries such as Brazil and Mexico represent key growth areas, as rising inflation and currency pressures push shoppers toward value-based retail options. The region’s retail players are emphasizing localized product assortments, improved store experiences, and digital engagement strategies to maintain competitiveness. The steady rise in consumer awareness and affordability preference continues to strengthen the market’s foundation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Discount Department Stores Company Insights

In 2024, Walmart Inc. remained the leading force in the global discount department stores market, leveraging its vast omnichannel network and advanced supply chain automation. Its emphasis on low prices and private-label product expansion helped sustain customer loyalty amid inflationary pressures. The company’s investments in retail technology and curbside pickup further improved shopper convenience and traffic.

COSTCO Wholesale Corporation strengthened its membership-driven model with continued expansion across Asia and Europe. The company’s efficient inventory management and bulk-purchasing discounts attracted value-conscious consumers. In 2024, COSTCO enhanced its e-commerce integration, focusing on quick delivery and sustainability initiatives in packaging and supply operations.

Burlington Stores, Inc. expanded aggressively across North America, capitalizing on consumer shifts toward off-price retail. The company’s “treasure hunt” store experience and focus on apparel and home categories boosted foot traffic. Burlington’s lean inventory strategy and flexible pricing approach allowed it to adapt to changing consumer demand effectively.

Dollarama Inc. maintained its stronghold in the Canadian market with steady store network growth and an expanding product assortment. The company benefited from increased consumer visits seeking affordability during economic uncertainty. In 2024, Dollarama’s investment in distribution centers enhanced efficiency, ensuring consistent stock levels and pricing advantage over competitors.

Collectively, these players drove innovation in retail efficiency, omnichannel accessibility, and value-based merchandising. Their focus on expanding private-label offerings and adopting data-driven inventory management systems positioned them to capture sustained consumer demand for affordable, quality products worldwide.

Top Key Players in the Market

- Walmart Inc.

- COSTCO Wholesale Corporation

- Burlington Stores, Inc.

- Dollarama Inc.

- Kmart Corporation

- Lidl Stiftung & Co. KG

- Meijer, Inc.

- Ollie’s Bargain Outlet Holdings, Inc.

- Pan Pacific International Holdings Corp

- Pepco Group N.V.

- Ross Stores, Inc.

Recent Developments

- In July 2024, Neiman Marcus was acquired by Hudson’s Bay Company and integrated into Saks Global, creating a unified luxury retail group aimed at strengthening digital and in-store experiences across North America. This move combined two of the largest luxury department store chains under one umbrella to enhance global competitiveness.

- In December 2024, Nordstrom agreed to be acquired by the Nordstrom family and a Mexican retail group in a deal valuing the company at USD 6.25 billion (including debt). The transaction aimed to take the company private, ensuring greater strategic flexibility and long-term growth.

- In July 2025, Dollarama completed a takeover of The Reject Shop, an Australian discount variety retailer, for approximately AUD $259 million. Following the acquisition, The Reject Shop was delisted from the ASX, marking Dollarama’s first major international expansion move.

Report Scope

Report Features Description Market Value (2024) USD 411.1 Billion Forecast Revenue (2034) USD 871.2 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Clothing & Apparel, Beauty & Health, Electronics, Home & Living, Toys & Games, Others), By Payment Options (Contactless, Tender Types), By Operating Mode (Brick-And-Mortar, Online/E-Commerce), By Store Format (Omnichannel Discount Stores, Shopping Center, Standalone Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Walmart Inc., COSTCO Wholesale Corporation, Burlington Stores, Inc., Dollarama Inc., Kmart Corporation, Lidl Stiftung & Co. KG, Meijer, Inc., Ollie’s Bargain Outlet Holdings, Inc., Pan Pacific International Holdings Corp, Pepco Group N.V., Ross Stores, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Discount Department Stores MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Discount Department Stores MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Walmart Inc.

- COSTCO Wholesale Corporation

- Burlington Stores, Inc.

- Dollarama Inc.

- Kmart Corporation

- Lidl Stiftung & Co. KG

- Meijer, Inc.

- Ollie’s Bargain Outlet Holdings, Inc.

- Pan Pacific International Holdings Corp

- Pepco Group N.V.

- Ross Stores, Inc.