Global Directional Drilling Services Market Size, Share, And Growth Analysis Report By Service (Rotary Steerable System (RSS), Logging-While-Drilling(LWD), Measurement-While-Drilling (MWD) and Survey, Motors (MUD Motors), Others), By Technique (Horizontal, Extended Reach, Vertical), By Location (Onshore, Offshore), By End-Users (Oil and Gas, Construction, Mining, Water, Exploration, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144508

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

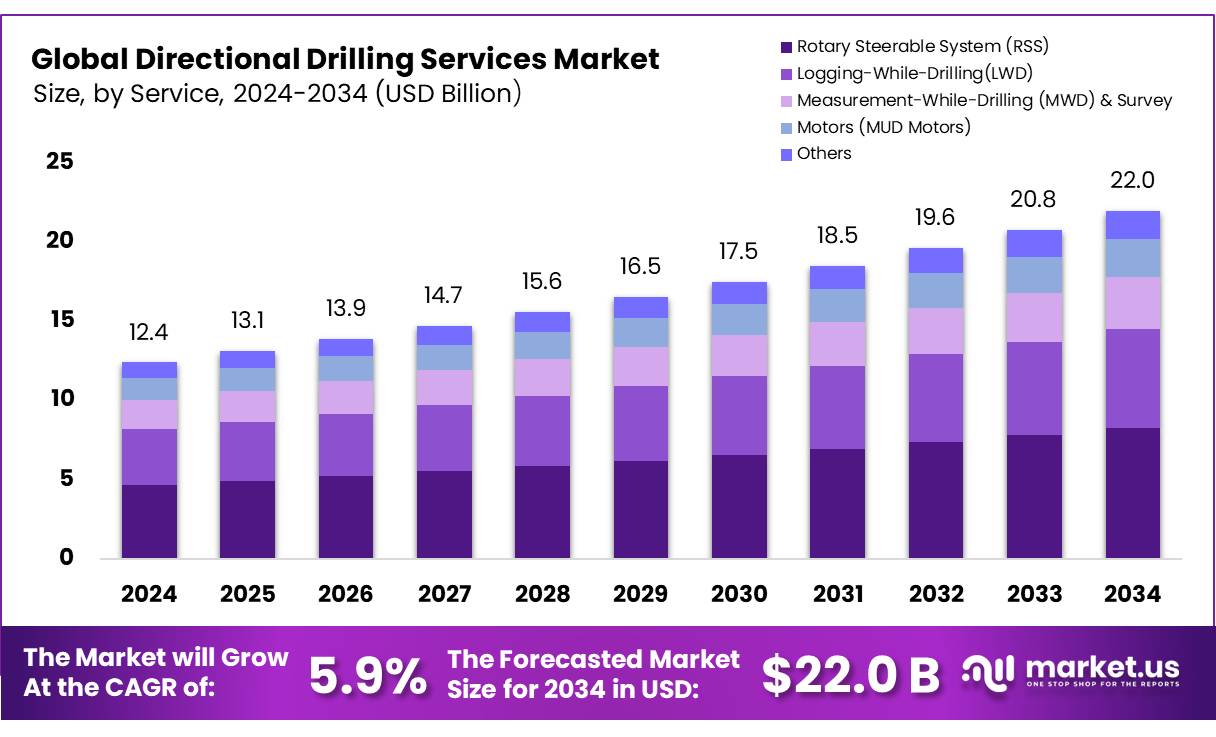

The Global Directional Drilling Services Market size is expected to be worth around USD 22.0 billion by 2034, from USD 12.4 billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Directional Drilling Services Market is pivotal in today’s energy sector, providing essential solutions for complex drilling challenges. This market is defined by the use of specialized drilling techniques that allow for directional or angled drilling, catering to specific geological conditions. These services are crucial for accessing oil and gas reserves that are unreachable by conventional vertical drilling methods.

The industry is characterized by a high level of technical expertise and significant investment in research and development. The market landscape is competitive, with key players constantly innovating to offer more efficient and cost-effective solutions. These services are employed extensively in oil and gas exploration, particularly in regions where drilling conditions are challenging or where precise well placement is critical to maximizing production.

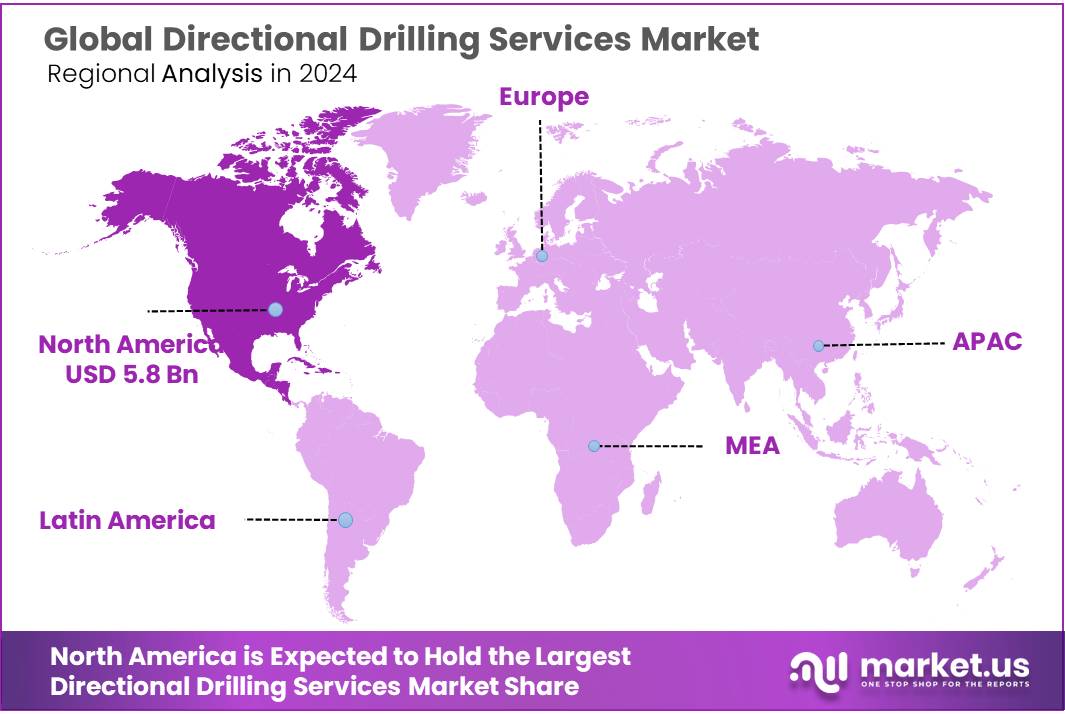

North America dominates the market, accounting for over 47% of the global share, fueled by extensive shale gas exploration in the United States and Canada. The offshore segment, contributing nearly 30% of global crude oil production, is witnessing significant growth due to declining operational costs in deepwater projects, particularly in regions like the Gulf of Mexico and the North Sea.

The rising global energy consumption, which grew by 4% in 2021, and the need to optimize production from maturing fields. Technological innovations, such as automated drilling systems, enhance precision and efficiency, further propelling market expansion. Growth opportunities lie in the exploration of unconventional resources, with shale gas and tight oil production expected to account for 25% of global crude oil output. The market is poised to benefit from an estimated 603 new projects in North America between 2021 and 2025.

Key Takeaways

- The global Directional Drilling Services Market is projected to grow from USD 12.4 billion in 2024 to USD 22.0 billion by 2034, at a CAGR of 5.9%.

- Rotary Steerable System (RSS) led the market in 2024 with over 37.5% share due to its drilling efficiency and accuracy.

- Horizontal drilling dominated with a 59.3% market share in 2024, driven by its use in shale and tight oil/gas reservoirs.

- Onshore drilling accounted for over 68.1% of the market in 2024, favored for optimizing resource extraction in oil and gas fields.

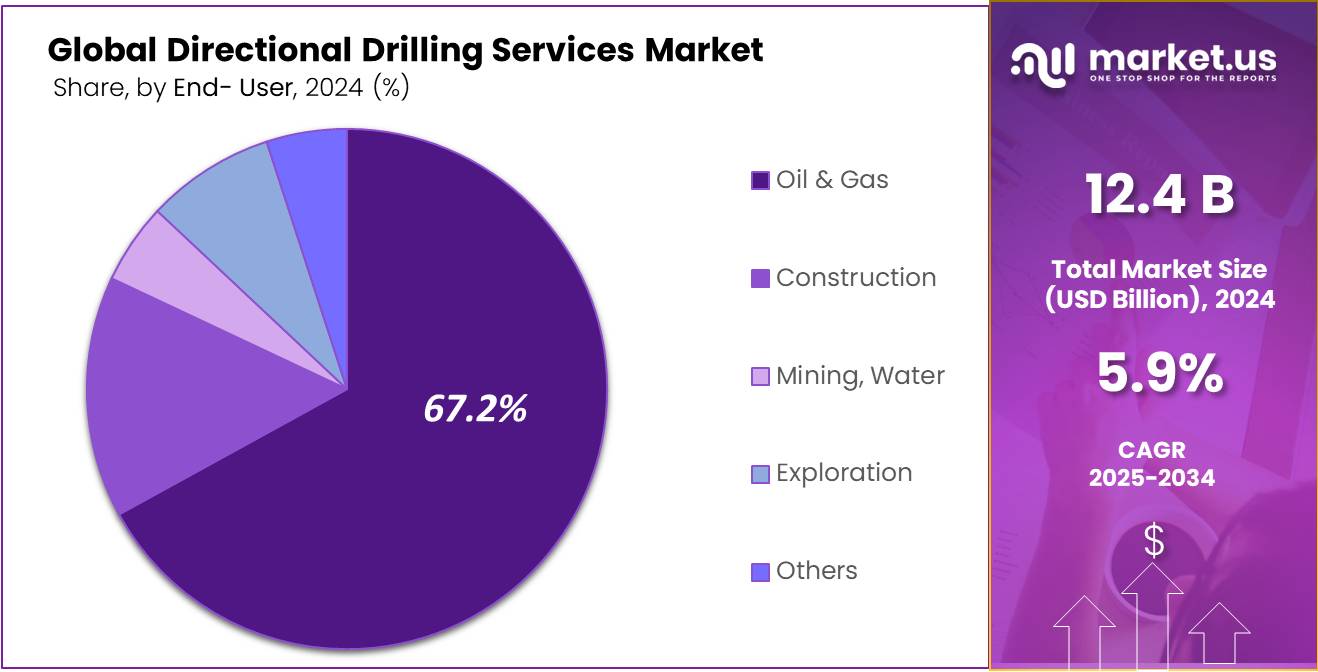

- The Oil and Gas sector held a 67.2% market share in 2024, leveraging directional drilling for efficient hydrocarbon recovery.

- North America led the market with a 47.4% share of USD 5.8 billion in 2024, fueled by shale gas and oil sands exploration.

By Service

In 2024, Rotary Steerable System (RSS) held a dominant market position, capturing more than a 37.5% share of the global directional drilling services market. This segment’s prominence is attributed to its significant contributions to enhancing drilling efficiency and accuracy in challenging geological formations.

RSS technology, which allows for precise directional control while drilling, is particularly valuable in environments where traditional methods fall short. This technology has proven especially crucial in maximizing hydrocarbon extraction from complex reservoirs, which are often characterized by tight turns and hard-to-reach zones.

The adoption of RSS has been spurred by its ability to reduce drilling time and mitigate risks associated with non-productive time. Operators favor RSS because it enhances the quality of the wellbore, which can significantly impact the overall production rates and the economic viability of drilling projects.

By Technique

In 2024, Horizontal drilling held a dominant market position, capturing more than a 59.3% share of the global directional drilling services market. This technique’s substantial market share stems from its critical role in the development of unconventional resource plays, particularly shale formations and tight oil and gas reservoirs.

Horizontal drilling enables the industry to maximize the exposure of the wellbore to the reservoir, significantly enhancing the extraction efficiency and, consequently, the production volumes compared to traditional vertical drilling. The preference for horizontal drilling is driven by its ability to access and economically produce resources from reservoirs that are otherwise challenging and costly to exploit.

This method is particularly effective in densely populated or environmentally sensitive areas, as it minimizes the surface footprint of drilling operations. The technique’s ability to drill along the lateral extensions of oil and gas layers translates into fewer wells needed for resource development, leading to lower overall project costs and reduced environmental impact.

By Location

In 2024, Onshore drilling held a dominant market position, capturing more than a 68.1% share of the global directional drilling services market. This segment’s strong foothold is primarily due to the extensive drilling activities in onshore oil and gas fields, where directional drilling techniques are increasingly employed to optimize resource extraction.

The preference for onshore locations is driven by the relative ease of access, lower operational costs, and reduced logistical challenges compared to offshore environments. The onshore sector benefits significantly from advancements in drilling technologies that allow for deeper and more complex trajectories.

These innovations make it feasible to exploit reservoirs that were previously considered uneconomical or too challenging to develop. Moreover, the integration of digital technologies in onshore drilling operations, such as real-time data monitoring and analysis, has enhanced the efficiency and safety of these operations, further solidifying the segment’s market share.

By End-Users

In 2024, the Oil and Gas sector held a dominant market position in the directional drilling services market, capturing more than a 67.2% share. This substantial market share reflects the sector’s heavy reliance on advanced drilling techniques to access and efficiently exploit both conventional and unconventional hydrocarbon resources.

Directional drilling is particularly crucial in the oil and gas industry because it allows for the precise targeting of oil and gas pockets, maximizing recovery while minimizing the environmental footprint and operational costs.

The continued preference for directional drilling in the oil and gas sector is driven by the need to enhance production rates and access reservoirs in geologically complex areas such as tight sands, shale formations, and other resource-rich but challenging environments. The ability of directional drilling to reach reservoirs horizontally and at multiple angles from a single vertical well site increases the productivity of each well and reduces the number of wells that need to be drilled.

Key Market Segments

By Service

- Rotary Steerable System (RSS)

- Logging-While-Drilling(LWD)

- Measurement-While-Drilling (MWD) & Survey

- Motors (MUD Motors)

- Others

By Technique

- Horizontal

- Extended Reach

- Vertical

By Location

- Onshore

- Offshore

By End-Users

- Oil and Gas

- Construction

- Mining, Water

- Exploration

- Others

Drivers

Driving Factor: Enhanced Recovery in Unconventional Reservoirs

One of the major driving factors for the directional drilling services market is the enhanced recovery techniques required in unconventional reservoirs. As traditional hydrocarbon sources deplete, the oil and gas industry is increasingly turning towards unconventional resources such as shale gas, tight oil, and coalbed methane.

These resources, often located in complex geological formations, necessitate advanced drilling techniques to effectively and efficiently access. According to the U.S. Energy Information Administration (EIA), shale gas production in the United States has seen a substantial increase, from accounting for just 2% of the country’s total natural gas production in 2000 to an estimated 70% by 2025.

This rapid growth in shale gas extraction underscores the critical role of directional drilling services in enabling the access and optimization of these challenging reservoirs. The precision and flexibility provided by directional drilling allow for maximizing contact with the oil and gas-bearing formations, significantly enhancing the output and productivity of these wells.

Restraints

Restraint Factor: High Cost of Directional Drilling Operations

A significant restraint in the directional drilling services market is the high cost associated with these operations. Directional drilling, while effective for accessing and increasing hydrocarbon recovery, involves sophisticated technology and specialized equipment that substantially elevate the initial investment and operational expenses.

This factor can particularly impact smaller or financially constrained oil and gas companies, limiting their ability to invest in advanced drilling technologies. The complexity of planning and executing directional wells also requires highly skilled personnel, further adding to the costs.

The use of Rotary Steerable Systems (RSS), essential for precise directional control, can increase drilling costs by up to 30% compared to conventional methods. These financial considerations can deter the adoption of directional drilling techniques, especially in regions where cost efficiency is paramount or where the economic viability of reserves is marginal.

Opportunity

Growth Factor: Technological Advancements in Drilling Equipment

A major growth factor for the directional drilling services market is the continuous technological advancement in drilling equipment. These innovations have significantly improved the efficiency and effectiveness of drilling operations, particularly in challenging environments such as deepwater or unconventional resource formations.

The development of high-precision tools like Rotary Steerable Systems (RSS) and advanced logging-while-drilling (LWD) technologies allows for more accurate wellbore placement, which is critical in maximizing hydrocarbon extraction and minimizing environmental impact.

For instance, the implementation of real-time data transmission technologies in directional drilling operations has revolutionized how drill sites are managed and operated. According to a report by the International Energy Agency (IEA), the use of digital technologies in oil and gas operations can enhance production efficiency by up to 20%.

Trends

Emerging Factor: Expansion into the Renewable Energy Sector

A significant emerging factor for the directional drilling services market is its expansion into the renewable energy sector, particularly geothermal energy. As the global focus shifts toward sustainable energy solutions, geothermal energy is gaining prominence due to its potential for providing reliable, low-carbon, and cost-effective power.

Directional drilling services, traditionally used in oil and gas exploration, are increasingly being adapted to enhance the development of geothermal resources. The precision and efficiency offered by directional drilling techniques are critical in geothermal operations, where drilling must navigate complex geological formations to tap into heat reservoirs deep beneath the earth’s surface.

According to the U.S. Department of Energy, geothermal power has the potential to increase its contribution to the U.S. energy portfolio tenfold, largely driven by advancements in drilling technologies that reduce costs and increase the feasibility of deeper and more complex geothermal wells.

Regional Analysis

North America’s Dominance in the Directional Drilling Services Market

North America holds a commanding position, capturing 47.4% of the global market share, which translates to a value of USD 5.8 billion. This dominance is primarily driven by the extensive drilling activities in the United States and Canada, where technological advancements and the exploration of unconventional resources like shale gas and oil sands are particularly prevalent.

The region’s leadership in innovative drilling technologies, such as hydraulic fracturing and horizontal drilling, further consolidates its market position. The U.S. leads within the region, spurred by its significant investments in oil and gas exploration, especially in major shale formations such as the Permian Basin, Eagle Ford, and Bakken.

These areas have seen a resurgence in drilling activity due to technological improvements that have reduced operational costs and enhanced production efficiencies. Canadian markets also contribute robustly, with Alberta’s oil sands and British Columbia’s shale resources driving demand for directional drilling services.

Government policies and regulatory frameworks in North America supporting energy independence and domestic production have been vital in sustaining the growth of the directional drilling market. Initiatives aimed at reducing environmental impacts and enhancing the efficiency of extraction processes encourage the adoption of advanced directional drilling techniques.

The commitment to reducing carbon footprints and the gradual shift towards renewable energy sources present new opportunities for directional drilling services, particularly in the geothermal sector, which is poised for growth. North America is expected to maintain its dominance due to ongoing technological innovations, favorable government policies, and an established infrastructure supporting the energy sector’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- AlMansoori Specialized Engineering stands out in the Middle Eastern markets as a leading provider of directional drilling services. Their reputation is bolstered by strong capabilities in offering tailored solutions that enhance drilling accuracy and efficiency, particularly in challenging geological settings. The company’s focus on safety and innovation in drilling operations underscores its commitment to maintaining high industry standards and client satisfaction.

- Baker Hughes Incorporated is a global leader in the directional drilling sector, known for pioneering some of the most advanced technologies in the industry. Their expertise spans across various complex environments, where they enhance resource extraction through innovative drilling solutions. Baker Hughes’ continued investment in research and development positions it at the forefront of the market, driving operational excellence and sustainability in energy production.

- Cathedral Energy Services Ltd. is recognized for its specialized directional drilling services primarily in North America. Their focus on cost-effective and reliable drilling solutions caters to both major and independent oil and gas companies. Cathedral’s commitment to integrating new technologies and continuous improvement in their service offerings has solidified their market position and client trust.

- China Oilfield Services Limited (COSL), a major state-owned enterprise, is instrumental in providing comprehensive oilfield services in China and internationally. Their directional drilling services are critical for exploiting offshore oil and gas fields, supported by a large fleet of drilling units and innovative technologies that ensure efficient and environmentally friendly operations.

- Gyrodata Incorporated specializes in advanced gyroscopic technology and services for directional drilling, enhancing wellbore placement accuracy and operational efficiency. Their cutting-edge solutions and global reach make them a key player in the industry, particularly valuable in environments where precise drilling is critical to maximizing hydrocarbon recovery and minimizing costs.

Top Key Players in the Market

- AlMansoori Specialized Engineering

- Baker Hughes Incorporated

- Cathedral Energy Services Ltd.

- China Oilfield Services Limited

- Gyrodata Incorporated

- Halliburton Company

- Integra

- Jindal Drilling & Industries Limited

- Gyrodata (Texas, United States)

- Leam Drilling Systems, LLC.

- Nabors Industries, Ltd.

- National Oilwell Varco, Inc.

- NewTech Services

- Phoenix Technology Services

- PHX Energy Services Corp.

- Schlumberger Limited

- Scientific Drilling International

- Weatherford International

Recent Developments

- In 2024, AlMansoori Specialized Engineering, a prominent oilfield services provider based in Abu Dhabi, UAE, continues to expand its directional drilling capabilities. A notable recent development includes its ongoing collaboration with Oil and Natural Gas Corporation Ltd. (ONGC) in India.

- In 2025, Baker Hughes, a global energy technology company, made significant strides in directional drilling services. The company announced a multi-year contract with Dubai Petroleum Establishment (DPE) for the Margham Gas Storage Project. This contract involves providing integrated coiled-tubing drilling services, leveraging Baker Hughes’s CoilTrak system and expertise in under-balanced drilling to enhance gas injection capabilities.

Report Scope

Report Features Description Market Value (2024) USD 12.4 Billion Forecast Revenue (2034) USD 22.0 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Rotary Steerable System (RSS), Logging-While-Drilling(LWD), Measurement-While-Drilling (MWD) & Survey, Motors (MUD Motors), Others), By Technique (Horizontal, Extended Reach, Vertical), By End- Users (Oil & Gas, Construction, Mining, Water, Exploration, Others), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AlMansoori Specialized Engineering, Baker Hughes Incorporated, Cathedral Energy Services Ltd., China Oilfield Services Limited, Gyrodata Incorporated, Halliburton Company, Integra, Jindal Drilling & Industries Limited, Gyrodata (Texas, United States), Leam Drilling Systems, LLC., Nabors Industries, Ltd., National Oilwell Varco, Inc., NewTech Services, Phoenix Technology Services, PHX Energy Services Corp., Schlumberger Limited, Scientific Drilling International, Weatherford International Customization Scope Customization for segments at, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Directional Drilling Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Directional Drilling Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AlMansoori Specialized Engineering

- Baker Hughes Incorporated

- Cathedral Energy Services Ltd.

- China Oilfield Services Limited

- Gyrodata Incorporated

- Halliburton Company

- Integra

- Jindal Drilling & Industries Limited

- Gyrodata (Texas, United States)

- Leam Drilling Systems, LLC.

- Nabors Industries, Ltd.

- National Oilwell Varco, Inc.

- NewTech Services

- Phoenix Technology Services

- PHX Energy Services Corp.

- Schlumberger Limited

- Scientific Drilling International

- Weatherford International