Global Digital Wound Care Management System Market By Product Type (Software and Hardware), By Application (Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Others) and Acute Wounds), By End-User (Hospitals and Wound Care Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152062

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

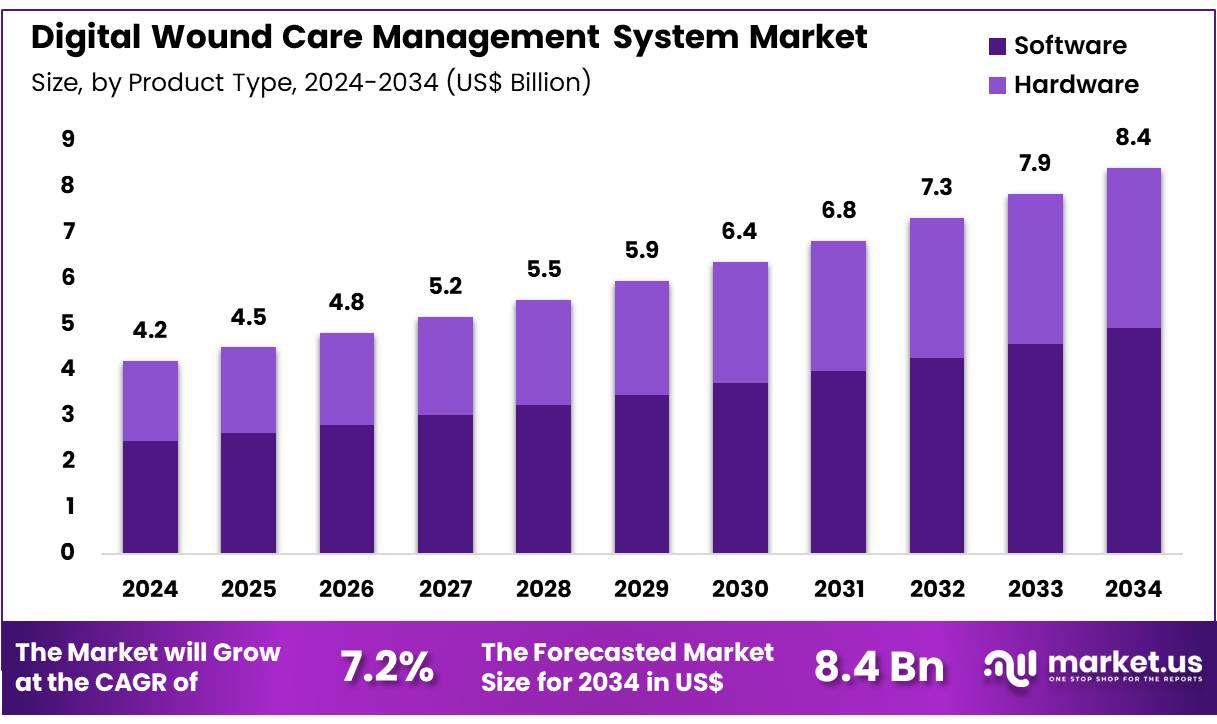

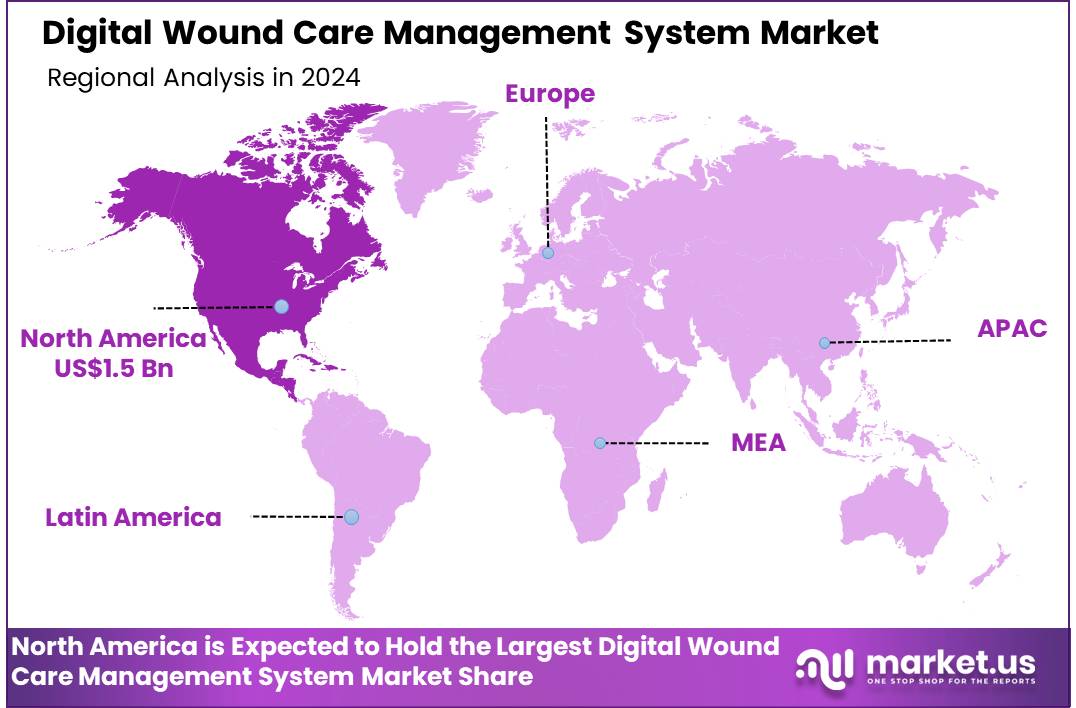

Global Digital Wound Care Management System Market size is expected to be worth around US$ 8.4 Billion by 2034 from US$ 4.2 Billion in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 34.6% share with a revenue of US$ 1.5 Billion.

Increasing demand for more efficient, precise, and cost-effective wound care solutions is driving the growth of the digital wound care management system market. These systems integrate advanced technologies, such as imaging, digital measurement tools, and data analytics, to provide healthcare professionals with real-time insights for accurate wound assessment and treatment planning. The adoption of digital wound care solutions helps streamline diagnosis, enhances patient outcomes, and reduces the risk of complications by enabling more precise monitoring of wound healing progress.

As chronic conditions like diabetes and obesity, which lead to non-healing wounds, continue to rise, the need for advanced wound care management systems grows. Moreover, the integration of artificial intelligence and machine learning into these platforms is unlocking new opportunities for personalized treatment and predictive analytics. In April 2023, MolecuLight Corp., known for its point-of-care fluorescence imaging to detect bacterial loads in wounds, formed a partnership with Perceptive Solutions.

This collaboration integrates MolecuLightDX bacterial imaging devices with Perceptive Solutions’ cloud-based WoundZoom platform, offering wound care professionals access to advanced imaging, digital wound measurement, and a comprehensive wound management system. This integration streamlines both diagnosis and treatment, reflecting a growing trend of combining digital tools with traditional wound care practices to improve clinical outcomes. The increasing focus on improving patient care efficiency and enhancing treatment protocols ensures the continued expansion of the digital wound care management system market.

Key Takeaways

- In 2024, the market for digital wound care management system generated a revenue of US$ 4.2 billion, with a CAGR of 7.2%, and is expected to reach US$ 8.4 billion by the year 2034.

- The product type segment is divided into software and hardware, with software taking the lead in 2023 with a market share of 58.4%.

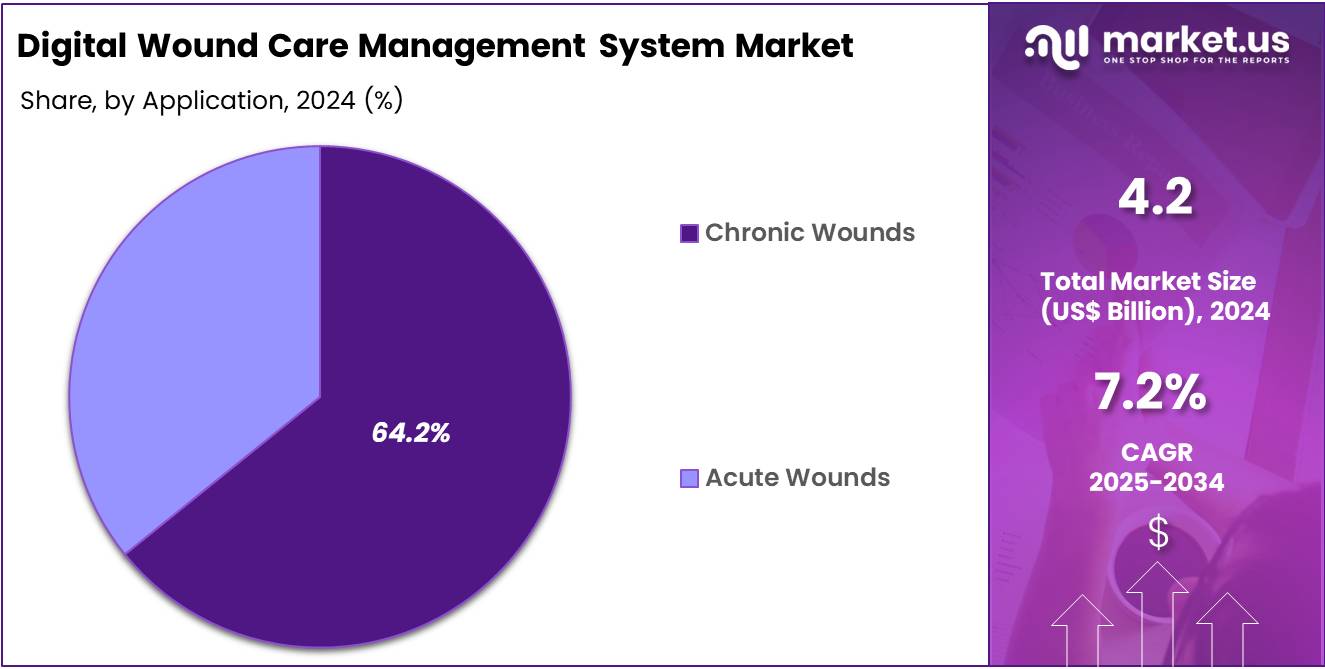

- Considering application, the market is divided into chronic wounds and acute wounds. Among these, chronic wounds held a significant share of 64.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals and wound care clinics. The hospitals sector stands out as the dominant player, holding the largest revenue share of 54.7% in the digital wound care management system market.

- North America led the market by securing a market share of 34.6% in 2023.

Product Type Analysis

Software is expected to be the dominant product type in the digital wound care management system market, holding 58.4% of the share. The growth of this segment is driven by the increasing demand for digital solutions to manage wound care more effectively. Software solutions provide healthcare professionals with the tools necessary for real-time monitoring, data collection, and decision-making, improving patient outcomes.

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in wound care management software is expected to enhance its capabilities, driving market expansion. The growing focus on improving healthcare efficiency and reducing treatment costs will also fuel the demand for software-based wound care management systems. As hospitals and wound care clinics increasingly adopt digital platforms for patient care, software will continue to play a critical role in transforming wound care management, ensuring its dominance in the market.

Application Analysis

Chronic wounds are projected to be the leading application in the digital wound care management system market, accounting for 64.2% of the share. The rising incidence of chronic conditions such as diabetes, obesity, and vascular diseases, which are major contributors to chronic wounds, is expected to drive the demand for specialized wound care management systems.

Chronic wounds require long-term care, and digital solutions can significantly improve the monitoring and management of these wounds, reducing complications and promoting faster healing. The increasing adoption of digital wound care management systems in both hospital settings and home care environments is likely to boost the growth of this segment.

Additionally, as healthcare providers focus on improving the quality of care and reducing costs associated with chronic wound management, the demand for digital solutions is expected to grow, solidifying chronic wounds as the dominant application in the market.

End-User Analysis

Hospitals are expected to remain the largest end-user segment in the digital wound care management system market, comprising 54.7% of the share. Hospitals are at the forefront of adopting advanced technologies to improve patient care, and wound care is no exception. Digital wound care management systems help hospitals streamline the treatment of patients with chronic and acute wounds by providing better monitoring, documentation, and treatment plans.

The growing prevalence of chronic wounds and an increasing emphasis on improving healthcare outcomes will drive hospitals to adopt digital wound care management solutions. Moreover, the integration of these systems into electronic health records (EHRs) and other hospital management systems is expected to further enhance their adoption. As hospitals continue to focus on improving efficiency, patient safety, and care quality, the demand for digital wound care management systems is anticipated to grow, maintaining hospitals as a key player in this market.

Key Market Segments

By Product Type

- Software

- Hardware

By Application

- Chronic Wounds

- Diabetic Foot Ulcers

- Pressure Ulcers

- Venous Leg Ulcers

- Others

- Acute Wounds

By End-User

- Hospitals

- Wound Care Clinics

Drivers

Increasing Prevalence of Chronic Wounds is Driving the Market

The rising global prevalence of chronic wounds, such as diabetic foot ulcers, pressure injuries, and venous leg ulcers, is a primary driver for the digital wound care management system market. These wounds often require prolonged, complex care, placing a significant burden on healthcare systems and patients. Digital solutions offer enhanced monitoring, streamlined documentation, and improved communication, leading to better outcomes.

The burden of chronic wounds is substantial; for instance, a 2022 compendium of estimates published in “Advances in Wound Care” noted that chronic wounds affect 10.5 million US Medicare beneficiaries alone, representing an increase of 2.3 million from a 2014 update. The increasing global aging population and the rising incidence of chronic diseases like diabetes contribute directly to the growing number of individuals suffering from these persistent wounds, thereby fueling the demand for advanced digital management tools.

Restraints

Lack of Interoperability and Data Integration is Restraining the Market

A significant restraint on the digital wound care management system market is the pervasive challenge of interoperability and seamless data integration across disparate healthcare information technology (IT) systems. Digital wound care solutions often need to communicate with electronic health records (EHRs), hospital management systems, and other clinical platforms to provide a holistic view of patient care.

However, varied software standards, proprietary systems, and complex data exchange protocols hinder smooth information flow, leading to fragmented patient data and additional administrative burdens for clinicians. AudioEye, in a September 2024 article on “Top 6 Challenges for Digital Healthcare in 2024,” explicitly identified interoperability as a major hurdle, explaining that the inability for different systems to seamlessly exchange and use data can compromise both care quality and the patient experience. This lack of cohesive integration limits the full potential and widespread adoption of digital solutions, despite their inherent benefits for wound management.

Opportunities

Growing Adoption of Telehealth in Wound Care Creates Growth Opportunities

The accelerated adoption and acceptance of telehealth services, significantly boosted by recent global health events, present a major growth opportunity for the digital wound care management system market. Telehealth enables remote wound assessment, monitoring, and virtual consultations, allowing healthcare providers to manage patients’ wounds from a distance. This reduces the need for frequent in-person clinic visits, enhances patient convenience, and improves access to specialized wound care, particularly for individuals in rural or underserved areas.

A BMC Health Services Research article published in April 2025 explored the implementation of telemedicine in wound care, highlighting its potential to enhance professional self-efficacy for wound care and foster feelings of security among patients over time. The continued expansion of reimbursement policies for telehealth services by payers, including government programs, further supports this trend, encouraging broader integration of digital solutions into routine wound care practice.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the digital wound care management system market, primarily through their impact on healthcare spending, government healthcare budgets, and private investment in digital health infrastructure. During periods of robust economic growth, healthcare systems often have greater financial capacity to invest in advanced digital technologies, including sophisticated wound care solutions that can improve efficiency and patient outcomes.

Conversely, economic downturns or high inflation rates can lead to budget constraints in public and private healthcare sectors, potentially delaying or limiting the adoption of new digital systems due to their initial capital outlay. The International Monetary Fund (IMF) projects global growth to remain stable at around 3.1% in 2024, which, while not a rapid acceleration, provides a generally steady economic backdrop for continued investment in healthcare digitalization.

Geopolitical factors, such as international trade policies affecting the import and export of digital health hardware and software, and the stability of global supply chains for specialized electronic components, also play a crucial role. Political instability or trade disputes can disrupt supply chains, increase manufacturing costs, and create uncertainty for global distribution, affecting the timely availability and pricing of digital wound care systems.

However, the undeniable long-term benefits of digital solutions in improving efficiency and patient care in chronic wound management ensure sustained focus and investment, allowing the market to adapt and grow even amidst broader economic and political fluctuations.

Current US tariff policies can directly impact the digital wound care management system market by altering the cost of imported hardware, such as specialized cameras for wound imaging, sensors for remote monitoring, and computing components for data processing. Given the globalized nature of electronics and medical device manufacturing, many critical parts or even complete digital wound care systems are sourced from various international suppliers.

The US Census Bureau’s foreign trade data for 2023 and 2024 indicates substantial US imports of medical, surgical, and optical instruments, as well as electronic components, highlighting the market’s reliance on global supply chains. Any new tariffs imposed on these technology categories could directly increase the operational costs for US-based manufacturers of digital wound care systems or healthcare providers utilizing them. This could translate to higher prices for digital solutions or reduced investment in developing new technologies, potentially impacting accessibility and innovation.

Conversely, these tariff policies can act as a powerful incentive for manufacturers to invest in expanding or establishing domestic production capabilities for digital wound care hardware and software components within the US. This strategic shift towards localized manufacturing aims to create a more secure and resilient supply chain for essential healthcare technologies, reducing dependence on potentially volatile international sources and enhancing national technological self-sufficiency, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Integration of Artificial Intelligence (AI) for Predictive Analytics is a Recent Trend

A prominent recent trend in the digital wound care management system market is the increasing integration of Artificial Intelligence (AI) and machine learning for predictive analytics and enhanced decision-making. AI algorithms can analyze vast datasets of wound images, patient demographics, and treatment histories to predict healing trajectories, identify at-risk wounds for complications, and recommend personalized interventions.

A “Wounds International” journal article published in March 2025, discussing “Promoting wound healing through artificial intelligence-powered dressing development,” highlighted that AI and sensor technologies are transforming wound care by improving automated wound monitoring capacities and treatment personalization options. This allows for more proactive and precise wound management, moving beyond traditional reactive approaches. AI-powered diagnostic tools and monitoring systems improve accuracy in wound assessment, potentially reducing healing times and preventing adverse events.

Regional Analysis

North America is leading the Digital Wound Care Management System Market

North America dominated the market with the highest revenue share of 34.6% owing to the increasing prevalence of chronic wounds, the rising adoption of telemedicine, and ongoing efforts to improve healthcare efficiency.

While specific government statistics on digital wound care systems are not readily available, the Centers for Disease Control and Prevention (CDC) continuously monitors chronic disease indicators, highlighting the persistent burden of conditions that lead to chronic wounds in the US In Canada, the digital transformation in healthcare is supported by government initiatives, with Health Canada emphasizing digital health and virtual care to improve access and data sharing, as noted in its 2023-24 Departmental Plan. This includes projects like Telewound Care Canada, which by 2024, saw Swift Medical provide care to one million patients in a single year, demonstrating substantial adoption of digital solutions.

Furthermore, major medical technology companies are contributing to this growth; Smith+Nephew’s Advanced Wound Management business unit reported underlying revenue growth of 12.2% in the fourth quarter of 2024, reflecting strong demand for advanced wound care solutions that often integrate digital components.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing elderly population, rising prevalence of chronic diseases like diabetes, and government efforts to modernize healthcare infrastructure through digital initiatives. Although detailed government statistics on chronic wound prevalence for 2022-2024 specifically for China are not publicly disclosed by their National Health Commission or related bodies, the overall burden of chronic diseases is substantial and increasing across the region, leading to a higher incidence of complex wounds.

Japan’s Ministry of Health, Labour and Welfare is actively promoting digital transformation in healthcare through its “Medical Digital Transformation (DX) Promotion Plan,” introduced in 2022, which focuses on accelerating the digitization of healthcare and expanding the use of cloud-based electronic medical records.

Similarly, India’s Ministry of Health and Family Welfare has launched broad digital health initiatives, including the Ayushman Bharat Digital Health Mission, facilitating teleconsultations and integrated health services which indirectly support the expansion of remote wound monitoring. These national efforts, coupled with the strategic focus of companies like Smith+Nephew on their Advanced Wound Management business unit in Asia Pacific, are projected to drive the adoption of innovative digital solutions for wound care across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the digital wound care management system market employ several strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies and research tools targeting wound healing. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for wound care solutions.

Swift Medical Inc. is a prominent player in the digital wound care management system market. Headquartered in Toronto, Canada, Swift Medical specializes in providing digital wound care solutions, including mobile applications and cloud-based platforms, to assist healthcare professionals in wound assessment and management. The company’s offerings enable clinicians to capture and analyze wound images, track healing progress, and collaborate with interdisciplinary teams, enhancing the quality of care and patient outcomes. Swift Medical’s commitment to innovation and quality has established it as a key contributor to the advancement of digital wound care technologies.

Top Key Players

- WoundZoom

- WoundMatrix, Inc

- Swift Medical Inc

- Smith+Nephew

- Net Health Systems, Inc

- Joerns Healthcare

- Essity Aktiebolag

- 3M

Recent Developments

- In March 2022, Swift Medical, a digital wound care startup, launched Swift Ray 1, a device that connects to a smartphone camera to capture subcutaneous clinical data. The technology ensures precise data collection across patients of different skin tones, enhancing wound care outcomes with accurate and consistent clinical insights.

- In July 2022, Smith+Nephew, a global medical technology leader, launched the WOUND COMPASS Clinical Support App. This application provides healthcare professionals with a valuable digital resource, aiding in wound evaluation and supporting informed decision-making, ultimately improving treatment accuracy and reducing inconsistencies in clinical practice.

Report Scope

Report Features Description Market Value (2024) US$ 4.2 Billion Forecast Revenue (2034) US$ 8.4 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software and Hardware), By Application (Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers, and Others) and Acute Wounds), By End-User (Hospitals and Wound Care Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape WoundZoom, WoundMatrix, Inc, Swift Medical Inc, Smith+Nephew, Net Health Systems, Inc, Joerns Healthcare, Essity Aktiebolag, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Wound Care Management System MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Digital Wound Care Management System MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- WoundZoom

- WoundMatrix, Inc

- Swift Medical Inc

- Smith+Nephew

- Net Health Systems, Inc

- Joerns Healthcare

- Essity Aktiebolag

- 3M