Global Diagnostic Exosome Biomarkers Market By Product Type (Reagents, Urine Kits, Software, Serum/Plasma Kits, and Kits), By Application (Oncology, Neurodegenerative Disorders, Metabolic Disorders, and Others), By End-user (Cancer Institute, Diagnostic Center, Hospital, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168375

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

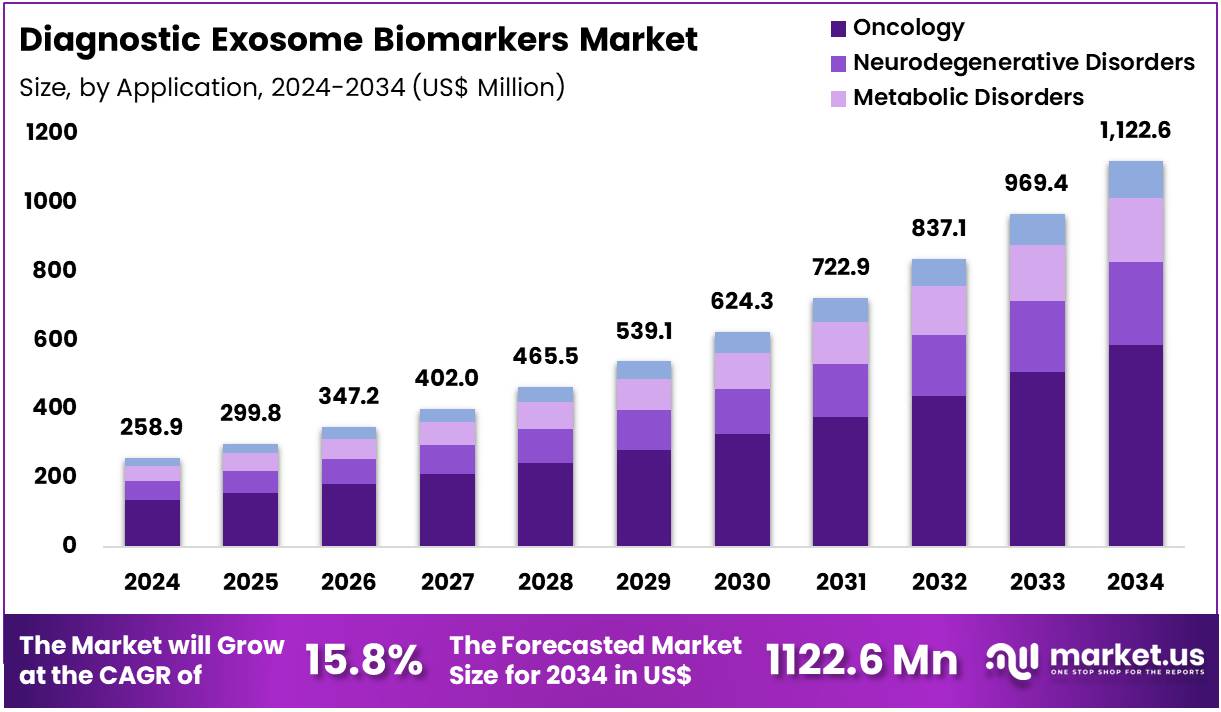

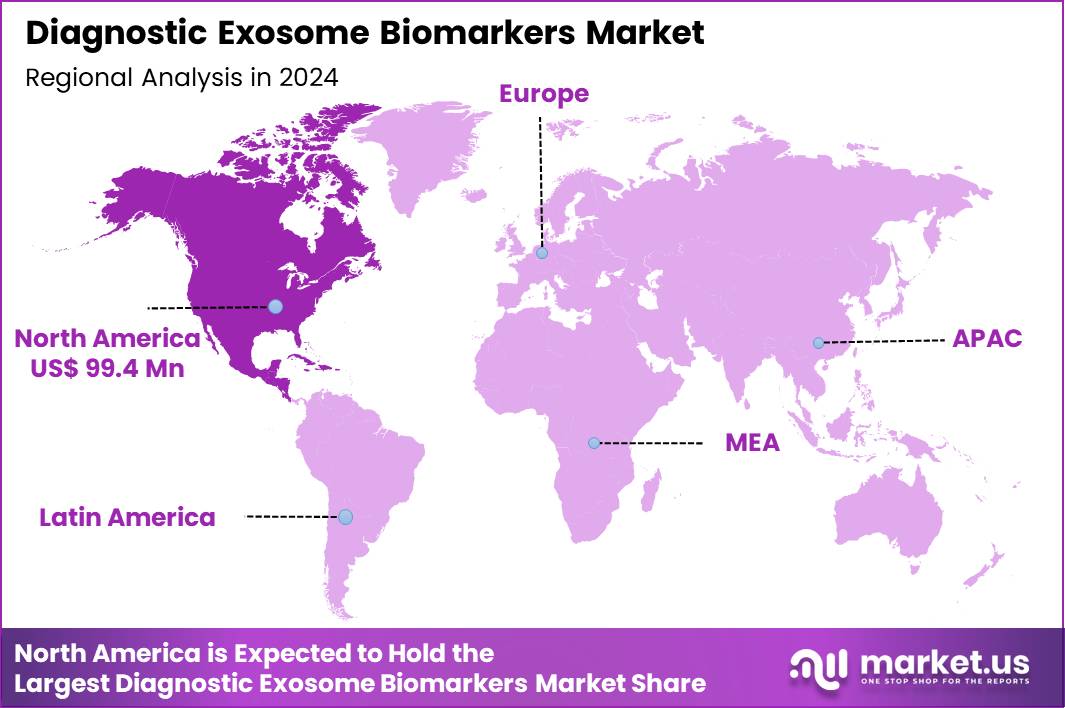

The Global Diagnostic Exosome Biomarkers Market size is expected to be worth around US$ 1122.6 Million by 2034 from US$ 258.9 Million in 2024, growing at a CAGR of 15.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.4% share with a revenue of US$ 99.4 Million.

Increasing clinical validation through reimbursement milestones propels the Diagnostic Exosome Biomarkers market, as payers recognize the value of vesicle-derived signals in guiding patient management decisions. Laboratories harness exosomal surface markers and cargo molecules to deliver actionable insights from blood, urine, and cerebrospinal fluid samples.

Clinicians apply these biomarkers for non-invasive lung cancer subtyping via PD-L1-positive exosomes, melanoma therapy selection through BRAF mutation detection, endometriosis diagnosis using miRNA signatures, and sepsis prognosis via endothelial-derived microvesicles.

National Government Services extended Medicare coverage for Bio-Techne’s ExoDx prostate test in February 2023, eliminating key financial obstacles and establishing exosome assays as reimbursable elements of standard urologic care. This pivotal ruling accelerates physician adoption and stimulates development of additional exosome-based clinical tests.

Growing adoption of minimally invasive monitoring tools accelerates the Diagnostic Exosome Biomarkers market, as oncologists and neurologists track dynamic disease states without repeated tissue biopsies. Biotechnology firms refine isolation platforms that enrich tumor-derived or neuron-derived exosomes for longitudinal profiling.

These assays support treatment response evaluation in immunotherapy via exosomal checkpoint protein levels, Parkinson’s disease staging through alpha-synuclein aggregates, hepatocellular carcinoma surveillance in cirrhosis patients, and preterm birth risk assessment using cervicovaginal exosomal markers.

Serial sampling capabilities create opportunities for companion diagnostics and real-time therapeutic adjustment protocols. Pharmaceutical sponsors increasingly incorporate exosomal endpoints into registrational trials to strengthen evidence packages.

Rising integration of multi-modal exosome analysis invigorates the Diagnostic Exosome Biomarkers market, as researchers combine nucleic acid, protein, and lipid profiles from individual vesicles to enhance diagnostic precision. Advanced characterization techniques enable simultaneous detection of oncogenic mutations, fusion transcripts, and immune-modulatory surface ligands.

Clinicians deploy these comprehensive panels for ovarian cancer early detection via FOLR1-positive exosomes, traumatic brain injury severity grading through glial markers, viral versus bacterial infection differentiation using host-response cargo, and graft-versus-host disease prediction in transplant recipients. Multi-modal approaches unlock opportunities for machine-learning-driven signature discovery and regulatory-grade assay standardization. Collaborative consortia actively validate exosome panels against conventional diagnostics to expedite clinical implementation.

Key Takeaways

- In 2024, the market generated a revenue of US$ 258.9 Million, with a CAGR of 15.8%, and is expected to reach US$ 1122.6 Million by the year 2034.

- The product type segment is divided into reagents, urine kits, software, serum/plasma kits, and kits, with reagents taking the lead in 2023 with a market share of 44.8%.

- Considering application, the market is divided into oncology, neurodegenerative disorders, metabolic disorders, and others. Among these, oncology held a significant share of 52.4%.

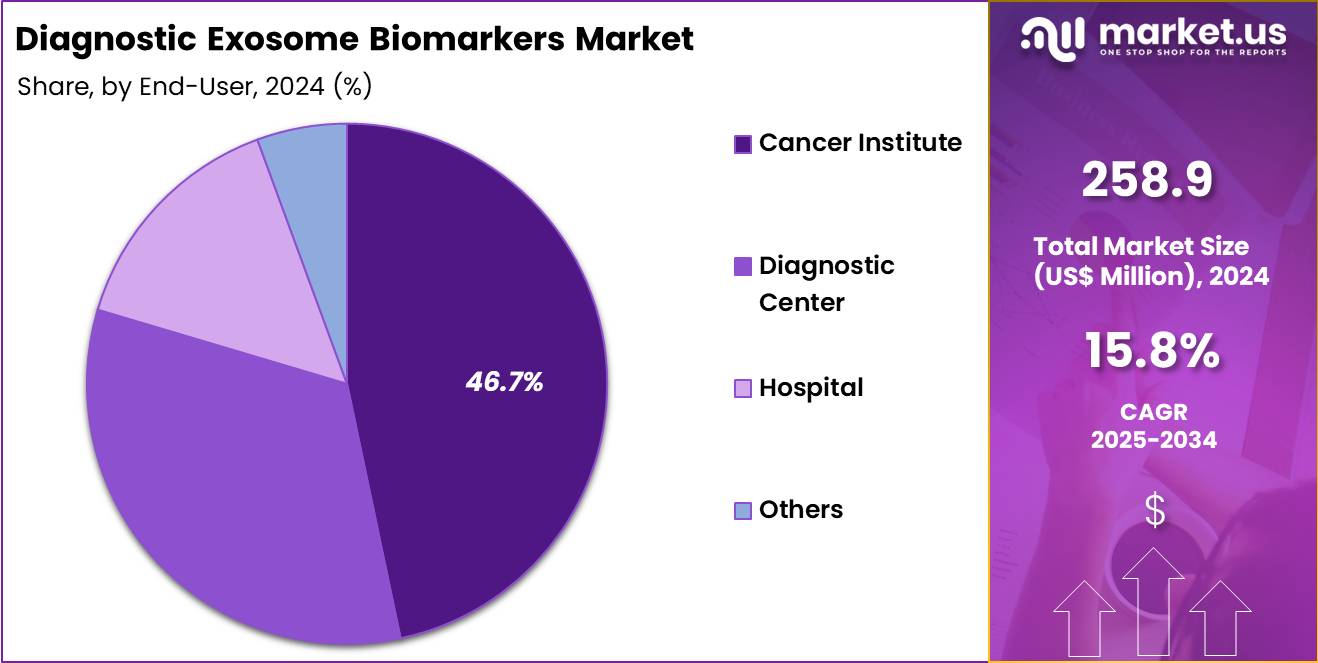

- Furthermore, concerning the end-user segment, the market is segregated into cancer institute, diagnostic center, hospital, and others. The cancer institute sector stands out as the dominant player, holding the largest revenue share of 46.7% in the market.

- North America led the market by securing a market share of 38.4% in 2023.

Product Type Analysis

Reagents, holding 44.8%, are expected to dominate as laboratories expand exosome-isolation and biomarker-characterization studies across oncology and neurology. Researchers depend on high-purity reagents to process complex biological fluids, and this dependency drives continuous consumption. Pharmaceutical teams use reagents to study exosomal RNA, DNA, proteins, and lipids linked to disease pathways.

Multiplex assays increase reagent demand as they target multiple biomarkers simultaneously. Growth in liquid-biopsy programs strengthens the requirement for standardized extraction and purification reagents. Academic centers invest in advanced exosome workflows, raising procurement volumes. Companies introduce optimized reagent chemistries that improve yield and sensitivity, attracting more research users.

Global funding for extracellular-vesicle biology supports regular reagent purchases. Expansion of precision-medicine initiatives increases reliance on reagents that support high-fidelity biomarker detection. These factors keep reagents anticipated to remain the dominant product type.

Application Analysis

Oncology, holding 52.4%, is anticipated to remain the leading application as cancer researchers focus on exosomal biomarkers for early detection, prognosis assessment, and therapy-response monitoring. Tumor-derived exosomes carry unique molecular signatures, and oncology teams rely on these signals for non-invasive testing. Growth in immuno-oncology accelerates demand for assays that track exosome-mediated immune modulation.

Liquid-biopsy programs expand across major cancer centers, increasing exosome-based testing volumes. Pharmaceutical companies incorporate exosome biomarkers into clinical-trial endpoints to evaluate treatment efficacy. Rising cancer incidence across North America, Europe, and Asia supports steady adoption.

Exosome biomarkers offer improved sensitivity compared with traditional markers, encouraging broader laboratory use. Genomic and proteomic profiling trends further strengthen cancer-focused applications. Increased investment in tumor-microenvironment research keeps oncology projected to dominate the application segment.

End-User Analysis

Cancer institutes, holding 46.7%, are expected to dominate end-user adoption due to their deep involvement in advanced biomarker research and clinical translation. Specialty cancer centers run high volumes of molecular testing focused on tumor-derived exosomes, increasing demand for kits and reagents. Research teams investigate exosomal RNA and protein signatures linked to early-stage cancers, supporting continuous assay utilization.

Institutes conduct large-scale clinical studies and require sensitive tools to validate exosome biomarkers. Partnerships between cancer institutes and diagnostic developers accelerate method optimization and adoption. Precision-oncology programs expand panels of exosome-based biomarkers for personalized treatment selection.

Institutes invest in advanced isolation and characterization systems, raising test throughput. Multidisciplinary teams integrate exosome data into genomic and imaging workflows. Strong research funding and a high clinical workload keep cancer institutes anticipated to remain the top end-user segment in the diagnostic exosome biomarkers market.

Key Market Segments

By Product Type

- Reagents

- Urine Kits

- Software

- Serum/Plasma Kits

- Kits

By Application

- Oncology

- Neurodegenerative Disorders

- Metabolic Disorders

- Others

By End-user

- Cancer Institute

- Diagnostic Center

- Hospital

- Others

Drivers

Increasing Global Cancer Incidence is Driving the Market

The rising number of cancer cases worldwide serves as a primary driver for the diagnostic exosome biomarkers market, as exosomes offer non-invasive liquid biopsy options for early tumor detection through circulating nucleic acids and proteins. This epidemiological trend heightens the need for sensitive assays that capture exosomal cargo reflective of tumor microenvironment changes.

Oncology centers are incorporating exosome profiling into routine workflows to complement imaging and tissue biopsies, improving diagnostic accuracy. Research institutions prioritize exosome-based panels for their potential in identifying minimal residual disease post-treatment. Regulatory bodies support the development of these biomarkers by streamlining validations for companion diagnostics in precision oncology.

Manufacturers are scaling production of isolation kits optimized for high-yield exosome recovery from plasma samples. Collaborative clinical studies demonstrate exosomal miRNAs as superior indicators of metastasis risk compared to traditional markers. Public health strategies emphasize scalable screening tools to address incidence disparities in underserved populations.

The driver accelerates investments in automation for exosome characterization, ensuring throughput for population-level applications. Educational initiatives for pathologists focus on interpreting exosomal signatures, fostering broader clinical adoption. The Centers for Disease Control and Prevention reported 1,851,238 new cancer cases in the United States in 2022. This substantial caseload underscores the urgency for innovative diagnostic modalities like exosome biomarkers.

Restraints

Lack of Standardized Isolation Protocols is Restraining the Market

Inconsistent protocols for exosome isolation and characterization represent a key restraint in the diagnostic exosome biomarkers market, leading to variability in biomarker yield and reproducibility across laboratories. Differential centrifugation methods often co-isolate contaminants, compromising downstream assay specificity for clinical use. This heterogeneity discourages regulatory submissions, as agencies demand robust validation data for diagnostic claims.

Smaller biotech firms struggle with the costs of developing proprietary standardization kits, limiting innovation. The restraint perpetuates reliance on invasive biopsies, delaying the shift to liquid-based alternatives. International consortia advocate for unified guidelines, but adoption remains slow due to entrenched practices. Manufacturers face challenges in scaling immunocapture techniques for diverse biofluids, affecting commercialization timelines.

The issue exacerbates inter-study discrepancies, hindering meta-analyses for biomarker discovery. Training gaps among technicians further amplify errors in sample handling, eroding trust in exosomal results. Policy recommendations call for reference materials, yet funding for such initiatives is limited.

Addressing this restraint requires harmonized frameworks to unlock reliable diagnostic applications. A National Institutes of Health review highlighted that comparing studies is highly challenging due to the lack of validated methodologies for exosome isolation.

Opportunities

Increased NIH Funding for Exosome Research is Creating Growth Opportunities

Heightened federal investments in exosome research through targeted grants are opening significant growth avenues for the diagnostic exosome biomarkers market, supporting the transition from bench to bedside applications. These funds enable large-scale cohort studies validating exosomal proteins as prognostic indicators in solid tumors. Opportunities arise in developing multiplex assays that profile exosomal lipids alongside RNA for comprehensive disease staging.

Academic-industry partnerships leverage grants to refine ultracentrifugation alternatives like microfluidics for cost-effective isolation. The funding facilitates biomarker discovery in underrepresented cancers, expanding market applicability beyond common histotypes. Regulatory pathways benefit from grant-supported pre-clinical data, expediting investigational device exemptions. This influx diversifies portfolios toward point-of-care exosome analyzers, appealing to ambulatory settings.

Global collaborations extend U.S.-funded insights to international validations, enhancing export potential. The opportunities promote equity by prioritizing biofluids accessible in low-resource environments. Long-term, they position exosomes as integral to multi-omics diagnostics, driving revenue from service-based testing.

The National Institutes of Health awarded a $2.4 million grant in 2023 for research into extracellular vesicle-based diagnosis of lung nodules. Such allocations exemplify the catalytic role of public funding in market maturation.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic tailwinds strongly support the Diagnostic Exosome Biomarkers market, as rising healthcare budgets worldwide and increasing commitment to precision medicine fuel investment in advanced diagnostic technologies. At the same time, persistent inflation squeezes smaller players, raises capital costs, and slows adoption in price-sensitive healthcare systems.

Geopolitical friction, especially between the United States and China, disrupts reliable supply of key reagents and instrumentation, forcing companies to redesign sourcing strategies and accept longer lead times. The current U.S. tariff regime adds direct cost pressure on imported components and finished diagnostic systems, pushing up prices and temporarily limiting market reach in competitive segments.

Companies nevertheless turn these constraints into advantages by accelerating domestic production, forging new North American manufacturing partnerships, and qualifying alternative suppliers in allied nations. These strategic shifts strengthen supply-chain resilience and position the industry for sustained leadership in non-invasive diagnostics. The market therefore emerges stronger, more self-reliant, and well-equipped to deliver the next generation of biomarker-based clinical solutions.

Latest Trends

Fast Track Designations for Exosome Diagnostics is a Recent Trend

The granting of fast track designations to exosome-based diagnostic tools has marked a notable trend in 2024, accelerating regulatory review for promising liquid biopsy innovations in oncology. These designations prioritize exosomal RNA signatures for non-invasive prostate and bladder cancer detection, reducing development timelines significantly.

Developers are focusing on engineered exosomes with enhanced stability for biomarker enrichment, aligning with trend-driven validations. This momentum integrates exosome profiling into adaptive trial designs, where real-time adjustments enhance therapeutic precision. Clinical sites adopt standardized workflows for exosome enumeration, supporting trend-fueled scalability.

The trend intersects with AI analytics to automate cargo classification, minimizing subjective interpretations. Pharmaceutical sponsors co-develop companion exosome assays, embedding them in label expansions for targeted agents. Ethical considerations emphasize diverse cohort representations to mitigate bias in exosomal datasets. Broader adoption previews exosome utility in infectious disease monitoring, adapting platforms for viral load assessments.

Regulatory dialogues evolve to incorporate post-designation surveillance for long-term performance. Two exosome-based diagnostics received fast track approval from the U.S. Food and Drug Administration in 2024. This progression signals a maturing ecosystem for biomarker-driven diagnostics.

Regional Analysis

North America is leading the Diagnostic Exosome Biomarkers Market

The percentage share of North America in the Diagnostic Exosome Biomarkers market stands at 38.4%, highlighting its leadership fueled by pioneering applications in liquid biopsy technologies during 2024. Researchers increasingly leverage exosomal cargo analysis for non-invasive cancer profiling, enabling earlier detection of colorectal and breast malignancies through miRNA and protein signatures.

Pharmaceutical alliances with diagnostic firms accelerated validation of nanoparticle-based isolation kits, streamlining integration into clinical workflows for neurodegenerative disorder monitoring. The Food and Drug Administration’s fast-track designations for exosome-derived assays spurred adoption in precision oncology trials, particularly for prostate cancer recurrence prediction.

Academic consortia in California and Massachusetts expanded high-resolution proteomics platforms, enhancing sensitivity for circulating exosomal markers in cardiovascular risk assessment. Venture investments targeted scalable microfluidic devices for exosome enrichment, addressing bottlenecks in sample processing for population-scale screening programs. Healthcare networks incorporated these biomarkers into guidelines for immunotherapy response evaluation, boosting demand amid rising chronic disease burdens.

Policy incentives from the Centers for Medicare & Medicaid Services covered exosome testing in high-risk cohorts, facilitating broader reimbursement and market accessibility. In support of this expansion, the National Institutes of Health awarded a $2.4 million grant in 2023 to develop extracellular vesicle-based diagnostics for lung nodules.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Biotech leaders project vigorous advancement for exosome-based diagnostic tools in Asia Pacific over the forecast period, driven by expanding genomic surveillance networks in emerging economies like Indonesia and Vietnam. National health agencies invest heavily in ultracentrifugation protocols for biomarker discovery, targeting tuberculosis and hepatitis through exosomal lipid profiling.

University partnerships anticipate widespread deployment of immunocapture arrays for viral load assessment, improving outbreak response in densely populated urban centers. Regulatory authorities estimate faster approvals for point-of-care exosome analyzers, integrating them into telemedicine platforms for remote diabetes management.

Industry innovators likely scale production of aptamer-conjugated beads, reducing costs for population-wide Alzheimer’s screening initiatives. Collaborative platforms in Malaysia foster data-sharing repositories, accelerating machine learning models for predictive exosomal proteomics in autoimmune conditions. Philanthropic organizations project equitable access via subsidized kits, prioritizing maternal-fetal health monitoring in rural districts.

Multilateral agreements facilitate knowledge exchange, elevating assay standardization across borders for infectious disease diagnostics. Governments channel resources into training hubs, empowering local scientists to pioneer fluorescence spectroscopy for exosomal surface marker enumeration. Bolstering this momentum, China’s National Bureau of Statistics reported fiscal expenditures on science and technology at 1,199.58 billion yuan in 2023.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Diagnostic Exosome Biomarkers market drive growth through strategic partnerships, licensing agreements, and heavy R&D investment to improve exosome isolation scalability and clinical validation. They accelerate commercialization via collaborations with diagnostic firms and pursue regulatory approvals for liquid biopsy tests targeting oncology and neurology.

Geographic expansion into Asia-Pacific and product portfolio diversification further strengthen market share. A prominent leader, Bio-Techne Corporation (Minneapolis, USA), offers advanced exosome research reagents and the ExoDx™ Prostate test—the only FDA-cleared exosome-based prostate cancer diagnostic supporting its dominant position in North America through continuous innovation and integrated workflow solutions.

Top Key Players

- Thermo Fisher Scientific Inc.

- System Biosciences LLC

- ReNeuron

- QIAGEN

- Hitachi Chemical Diagnostics Inc.

- Exosome Diagnostics

- Evox Therapeutics

- Capricor Therapeutics Inc.

- Capital Biosciences Inc.

- Bio-Techne

Recent Developments

- In May 2024, Capricor Therapeutics presented new findings on using exosomes to deliver treatments for arginase-1 deficiency. Although therapeutic in intent, the initiative raises the scientific profile of exosome biology by demonstrating its applicability in real disease settings. As more research validates exosome cargo as clinically meaningful, interest naturally extends to exosome-driven diagnostics. This scientific momentum strengthens the market by encouraging further biomarker discovery programs built around exosomal signatures.

- In April 2024, EXO Biologics attracted up to EUR 16 million in early-stage investment, giving the company the resources to expand its exosome research and production capabilities. This influx of capital strengthens the technical backbone required for discovering, validating, and supplying exosome-derived biomarkers. By enabling higher-quality manufacturing and more advanced analytical processes, the funding directly contributes to a more robust pipeline of exosome diagnostic tools, supporting long-term growth of the Diagnostic Exosome Biomarkers Market.

Report Scope

Report Features Description Market Value (2024) US$ 258.9 Million Forecast Revenue (2034) US$ 1122.6 Million CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Urine Kits, Software, Serum/Plasma Kits, and Kits), By Application (Oncology, Neurodegenerative Disorders, Metabolic Disorders, and Others), By End-user (Cancer Institute, Diagnostic Center, Hospital, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., System Biosciences LLC, ReNeuron, QIAGEN, Hitachi Chemical Diagnostics Inc., Exosome Diagnostics, Evox Therapeutics, Capricor Therapeutics Inc., Capital Biosciences Inc., Bio-Techne Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diagnostic Exosome Biomarkers MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Diagnostic Exosome Biomarkers MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- System Biosciences LLC

- ReNeuron

- QIAGEN

- Hitachi Chemical Diagnostics Inc.

- Exosome Diagnostics

- Evox Therapeutics

- Capricor Therapeutics Inc.

- Capital Biosciences Inc.

- Bio-Techne