Global Dental Laboratory Welders Market Analysis By Type (Manual, Automatic), By Application (Cast Repairs, Wrought Wire Single-Arm Clasping, New Clasp Assembly, Implant Restorations, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 84155

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

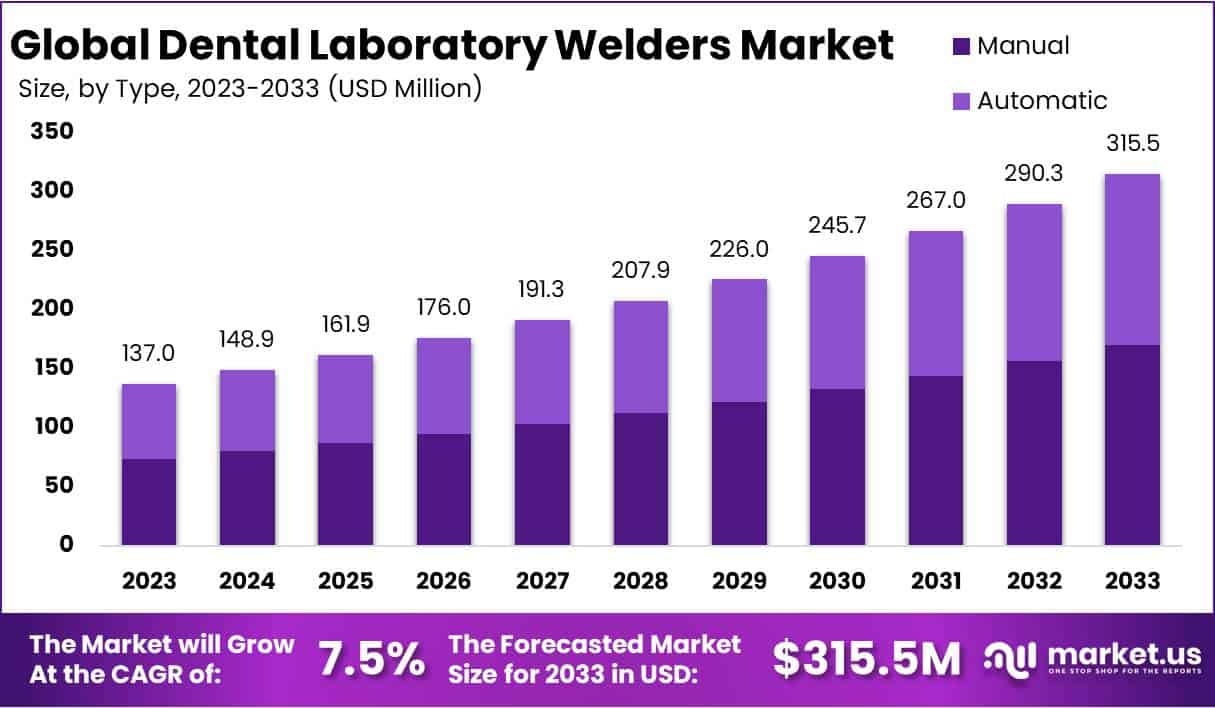

The Global Dental Laboratory Welders Market size is expected to be worth around USD 315.5 Million by 2033, from USD 137 Million in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

Dental laboratory welders play a crucial role in dental healthcare, specializing in the fabrication of prosthetic devices such as dentures, bridges, crowns, and other dental restorations. Utilizing advanced welding techniques, these professionals work with various metals to create appliances that are essential for patients’ oral health. The profession demands precision, a keen eye for detail, and often a specialized degree or certificate in welding technology.

The market for dental laboratory welders is witnessing a significant uptick, driven by the growing incidence of dental disorders globally. According to the Global Burden of Disease Study 2017, dental decay is prevalent among 60-90% of school-aged children and nearly all adults. This widespread issue, exacerbated by increased consumption of sugary foods, inadequate oral hygiene, and underutilization of healthcare services, underscores the escalating demand for dental restorative services and, by extension, for skilled dental laboratory welders.

Technological advancements in welding, particularly the emergence of laser welding techniques, are revolutionizing the field. As reported by the National Center for Biotechnology Information, laser welding offers numerous benefits over traditional methods, including enhanced biocompatibility, reduced contamination risk, and improved mechanical strength. These innovations not only promise to improve the quality of dental prostheses but also to expand the market for dental laboratory welding equipment and services.

However, the COVID-19 pandemic has posed significant challenges to the dental laboratory welders market. Disruptions in supply chains, particularly those dependent on China for raw materials and medical components, have impacted the production and delivery of dental welding equipment. The pandemic’s effect has led to operational halts and workforce reductions in some dental practices, highlighting the importance of skilled professionals in this sector and the need for robust training programs.

With the dental laboratory sector in the United States emerging as a lucrative business avenue, the demand for skilled welders with a background in dentistry is on the rise. This trend underscores the critical role of dental laboratory welders in ensuring the delivery of high-quality, affordable dental care to the public.

Key Takeaways

- Market Size: The market is projected to reach USD 315.5 million by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

- Dominant Type: Manual welders hold over 54% of the market share, valued at USD 74.1 million in 2023.

- Popular Applications: Manual welding techniques represent over 40% market share, with USD 54.8 million revenue in 2023.

- Cosmetic Dentistry Surge: Cosmetic dentistry market to grow at 14.2% CAGR, reaching USD 145.3 billion by 2033.

- Digital Dentistry Adoption: By 2023, nearly 60% of dental laboratories will adopt digital workflows and CAD/CAM technologies.

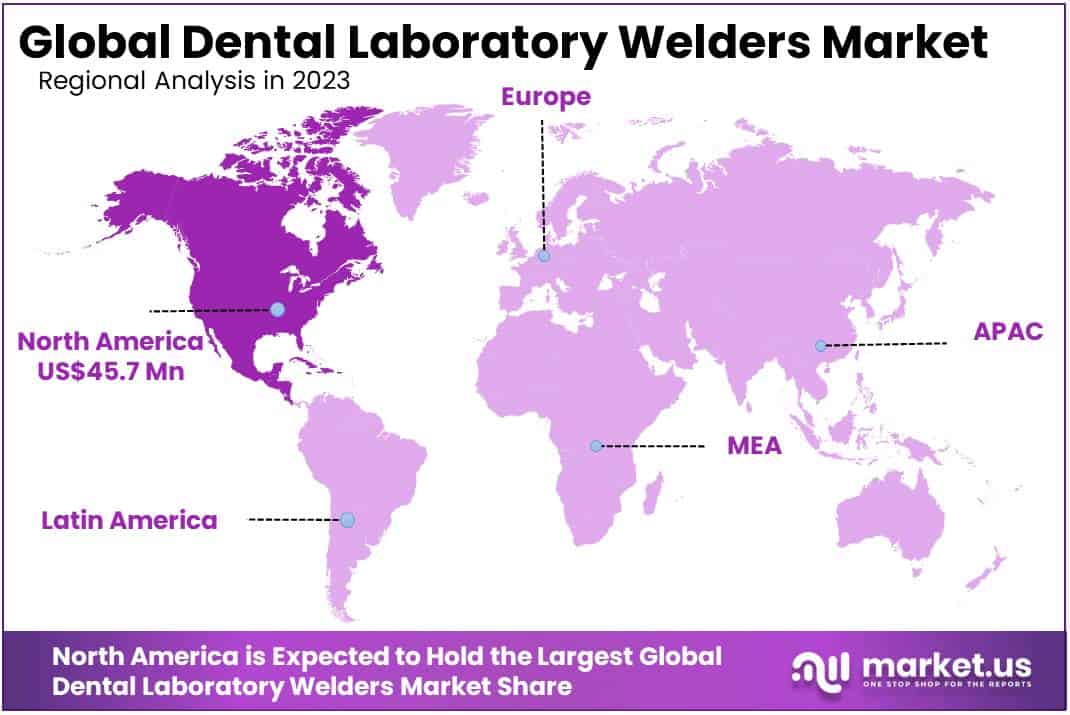

- Regional Dominance: North America commands 36% market share, valued at USD 45.7 million in 2023.

- Emerging Market Competition: Asia Pacific and Europe pose competition to North America due to advancements and investments.

Type Analysis

In 2023, an analysis of the Dental Laboratory Welders Market highlighted the strong presence of manual welders in the Type segment, holding a commanding share of over 54%. This preference for manual welders among dental laboratories can be attributed to their versatility, cost-effectiveness, and user-friendly operation.

Manual welders provide dental technicians with precise control over the welding process, allowing for meticulous adjustments and tailored customization to meet specific requirements. Moreover, their lower initial investment compared to automatic welders makes them an appealing choice for laboratories aiming to manage their budgets effectively without compromising on quality.

Although the automatic segment showed significant growth and captured a notable portion of the market, it trailed behind the manual segment in terms of market share. Automatic welders, known for their advanced features and automated functions, cater primarily to larger-scale laboratories focused on efficiency and high production volumes. However, their higher upfront costs may have hindered their adoption among smaller dental laboratories.

Looking forward, both manual and automatic welders are expected to experience continued growth, driven by technological advancements and increasing demand for dental prosthetics. Nevertheless, the manual segment is projected to maintain its dominance due to its affordability, adaptability, and widespread acceptance among dental technicians. As the dental industry evolves, further innovations in both manual and automatic welders can be anticipated, meeting the evolving needs of dental professionals worldwide.

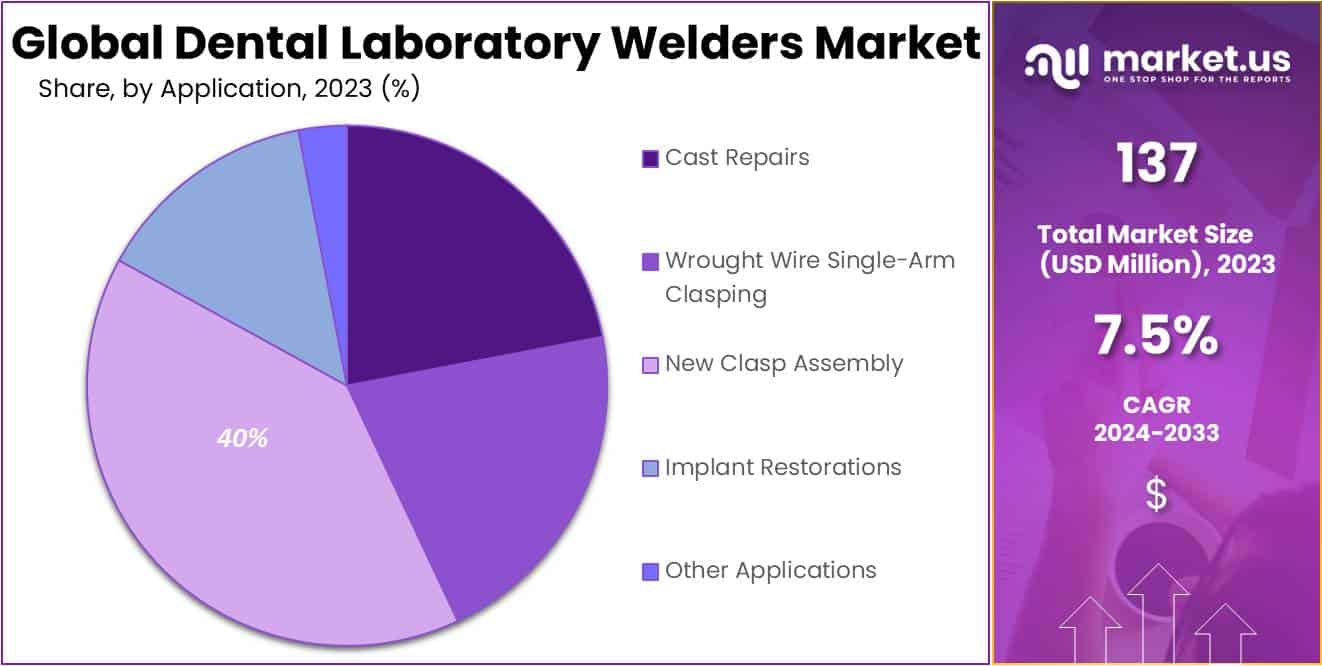

Application Analysis

In 2023, the analysis of the Dental Laboratory Welders Market showed that manual welding techniques held a strong position in the market, particularly in various applications like cast repairs, clasping, and implant restorations. These manual methods accounted for over 40% of the market share, indicating their significant presence and effectiveness in dental laboratory welding.

Manual welding has long been a staple in dental laboratories, offering technicians precise control and adaptability for intricate tasks. Its versatility allows for its widespread use across different applications, meeting the diverse needs of dental practitioners. This flexibility ensures that manual welding remains relevant in the dental laboratory landscape.

The enduring popularity of manual welding is due to its reliability and ability to consistently produce high-quality welds. Dental technicians appreciate the hands-on approach, which allows for meticulous attention to detail and customization according to patient specifications. Consequently, manual welding continues to be a preferred choice for various welding tasks in dental laboratories.

Looking forward, while automated welding technologies are gaining ground, manual welding is expected to maintain its leading position in the market. However, the landscape may gradually change as automated methods offer improved efficiency and precision in specific applications. Nevertheless, manual welding remains integral to the dental laboratory welding market, promising continued growth and innovation.

Key Market Segments

Type

- Manual

- Automatic

Application

- Cast Repairs

- Wrought Wire Single-Arm Clasping

- New Clasp Assembly

- Implant Restorations

- Other Applications

Drivers

Increasing Aging Population

The global rise in the aging population, especially in developed regions, serves as a significant driver for the Dental Laboratory Welders Market. As individuals age, they often experience dental issues such as tooth decay, loss, and deterioration, necessitating the use of dental prosthetics and restorative procedures.

According to the World Health Organization (WHO), the global population aged 60 years and older is expected to double by 2050, reaching over 2 billion people. This demographic shift fuels the demand for dental laboratory welders as indispensable tools in fabricating high-quality dental appliances and implants to address age-related dental challenges. With a larger elderly population requiring dental care, there is a corresponding increase in the need for precise and durable dental prosthetics, driving the adoption of advanced welding technologies in dental laboratories worldwide.

Restraints

Regulatory Compliance Challenges

Regulatory compliance challenges represent a significant restraint for the Dental Laboratory Welders Market, particularly for smaller manufacturers. Stringent regulations governing product safety, quality, and sterilization processes increase operational costs and create barriers to market entry and expansion.

According to a report by the American Dental Association (ADA), compliance with regulatory requirements accounts for a considerable portion of dental laboratory expenses, with an estimated average of 15% to 20% of total operating costs dedicated to regulatory compliance measures. For instance, adherence to the U.S. Food and Drug Administration’s (FDA) regulations on medical device manufacturing necessitates robust quality management systems and rigorous documentation, adding to the financial burden on manufacturers.

Moreover, compliance with international standards such as ISO 13485 further compounds regulatory challenges, requiring ongoing investments in staff training and infrastructure upgrades. Consequently, regulatory compliance constraints can impede innovation and market growth, disproportionately affecting smaller players in the dental laboratory welders market.

Opportunities

Rising Demand for Cosmetic Dentistry

The escalating demand for cosmetic dentistry procedures presents a significant growth avenue for the dental laboratory welders market. With an increasing emphasis on oral aesthetics and a burgeoning desire for enhanced appearance, the global cosmetic dentistry market is witnessing remarkable expansion. According to data from the American Academy of Cosmetic Dentistry, the demand for cosmetic dentistry procedures has surged in recent years, with an estimated 86% of patients seeking cosmetic treatments to improve their appearance.

Moreover, according to market.us, the global cosmetic dentistry market is expected to experience a compound annual growth rate (CAGR) of more than 14.2% from 2024 to 2033. By 2033, it is anticipated to surpass a market value of USD 145.3 billion. This growth trajectory underscores the substantial opportunity for dental laboratory welders, as they play a pivotal role in crafting various cosmetic dental prosthetics, including veneers, crowns, and bridges. As the pursuit of aesthetic enhancements continues to drive demand for cosmetic dentistry procedures, the dental laboratory welders market is poised for robust expansion to meet the evolving needs of patients worldwide.

Trends

Shift Towards Digital Dentistry

The dental laboratory welders market is undergoing a significant transformation due to the pervasive adoption of digital dentistry practices. Digitalization driving the development of integrated digital welding solutions tailored for dental laboratories. For instance, the International Data Corporation (IDC) forecasts that by 2023, nearly 60% of dental laboratories worldwide will have adopted digital workflows and CAD/CAM technologies.

This adoption rate underscores the industry’s rapid evolution toward digital dentistry, wherein dental laboratory welders play a pivotal role. These welders are being designed to seamlessly integrate with digital design software, offering enhanced precision and automation. As digital dentistry continues to gain momentum, the demand for such advanced welding solutions is expected to further escalate, reshaping the dental laboratory equipment landscape.

Regional Analysis

In 2023, North America stood out as a powerhouse in the Dental Laboratory Welders Market, seizing over 36% of the market share with a staggering value of USD 45.7 million. This dominance can be attributed to various factors, including the region’s advanced healthcare infrastructure, widespread adoption of dental technologies, and a surging demand for dental services driven by factors such as aging demographics and increased awareness of oral health.

The United States played a pivotal role in bolstering North America’s market supremacy, thanks to its large population, substantial healthcare spending, and cutting-edge dental laboratories. The presence of key industry players and research institutions further solidified the region’s leadership position in the dental laboratory welders market.

Moreover, regulatory frameworks that encouraged the adoption of innovative dental technologies, alongside well-established distribution channels, facilitated the widespread acceptance of dental laboratory welders across North America. Market dynamics such as mergers, collaborations, and product innovations also contributed significantly to maintaining the region’s market dominance.

Looking forward, while North America is anticipated to sustain its significant presence in the dental laboratory welders market, there might be a slight dip in market share due to heightened competition from emerging markets in Asia Pacific and Europe. However, continued technological advancements and increased investments in dental healthcare infrastructure are expected to fuel growth opportunities in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dental laboratory welders market, competition among key players is fierce, driven by advancements in technology and innovative product offerings. LaserStar holds a significant market share with its extensive range of laser welding systems, supported by robust research and development efforts. Sunstone Engineering LLC also commands a notable position, known for its precision micro welding solutions and global presence.

Similarly, Primotec distinguishes itself through diverse product offerings catering to various dental laboratory needs, while ElettroLaser emphasizes reliability and precision in its welding solutions. Each company demonstrates steady growth, with a focus on customer satisfaction and product excellence. LaserStar, Sunstone Engineering LLC, Primotec, and ElettroLaser strategically invest in research and development, forming key partnerships, and expanding their product lines to stay ahead in the competitive landscape.

Additionally, other significant players contribute to market dynamics, competing based on differentiation, quality, and customer service. Together, these companies shape the industry, driving innovation and meeting the evolving demands of dental laboratories worldwide.

Market Key Players

- LaserStar

- Sunstone Engineering LLC

- Primotec

- ElettroLaser

- IPG photonics

- Max Photonics

- Alpha Laser

- Orion

- Primotec

- Other Key Players

Recent Developments

- In January 2024, LaserStar unveiled its latest innovation in the dental industry with the introduction of the “LD-X2” series of dental laser welders. This new series boasts enhanced power and accelerated welding speeds, promising improved efficiency and precision for dental professionals.

- In October 2023, Sunstone Engineering LLC made waves with the launch of the “D2 Dental Laser Welder,” a compact and user-friendly option tailored for smaller dental labs. This addition to their product line aims to offer accessible and efficient welding solutions for a wider range of dental practitioners.

- In August 2023, Primotec forged a strategic partnership with “Ivoclar Vivadent,” a leading name in dental materials and technology. This collaboration aims to provide optimized welding solutions specifically tailored for Ivoclar Vivadent’s zirconia restorations, catering to the evolving needs of dental professionals.

- In June 2023, ElettroLaser showcased its cutting-edge technology at a major dental trade show, highlighting the features of the “Elyssa EVO” welder. Emphasizing advanced ergonomics and precise control capabilities, the Elyssa EVO aims to set new standards for efficiency and user experience in dental welding equipment.

Report Scope

Report Features Description Market Value (2023) USD 137 Million Forecast Revenue (2033) USD 315.5 Million CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Manual, Automatic), By Application (Cast Repairs, Wrought Wire Single-Arm Clasping, New Clasp Assembly, Implant Restorations, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape LaserStar, Sunstone Engineering LLC, Primotec, ElettroLaser, IPG photonics, Max Photonics, Alpha Laser, Orion, Primotec, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Dental Laboratory Welders market in 2023?The Dental Laboratory Welders market size is USD 137 million in 2023.

What is the projected CAGR at which the Dental Laboratory Welders market is expected to grow at?The Dental Laboratory Welders market is expected to grow at a CAGR of 7.5% (2024-2033).

List the segments encompassed in this report on the Dental Laboratory Welders market?Market.US has segmented the Dental Laboratory Welders market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Manual, Automatic. By Application the market has been segmented into Cast Repairs, Wrought Wire Single-Arm Clasping, New Clasp Assembly, Implant Restorations, Other Applications.

List the key industry players of the Dental Laboratory Welders market?LaserStar, Sunstone Engineering LLC, Primotec, ElettroLaser, IPG photonics, Max Photonics, Alpha Laser, Orion, Primotec, Other Key Players

Which region is more appealing for vendors employed in the Dental Laboratory Welders market?North America is expected to account for the highest revenue share of 36% and boasting an impressive market value of USD 45.7 million. Therefore, the Dental Laboratory Welders industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Dental Laboratory Welders?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Dental Laboratory Welders Market.

Dental Laboratory Welders MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Dental Laboratory Welders MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- LaserStar

- Sunstone Engineering LLC

- Primotec

- ElettroLaser

- IPG photonics

- Max Photonics

- Alpha Laser

- Orion

- Primotec

- Other Key Players