Global Decaffeinated Coffee Market By Type (Roasted, Raw), By Bean Type (Arabica, Robusta, Blends), By End-use (Residential, Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: March 2025

- Report ID: 84296

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

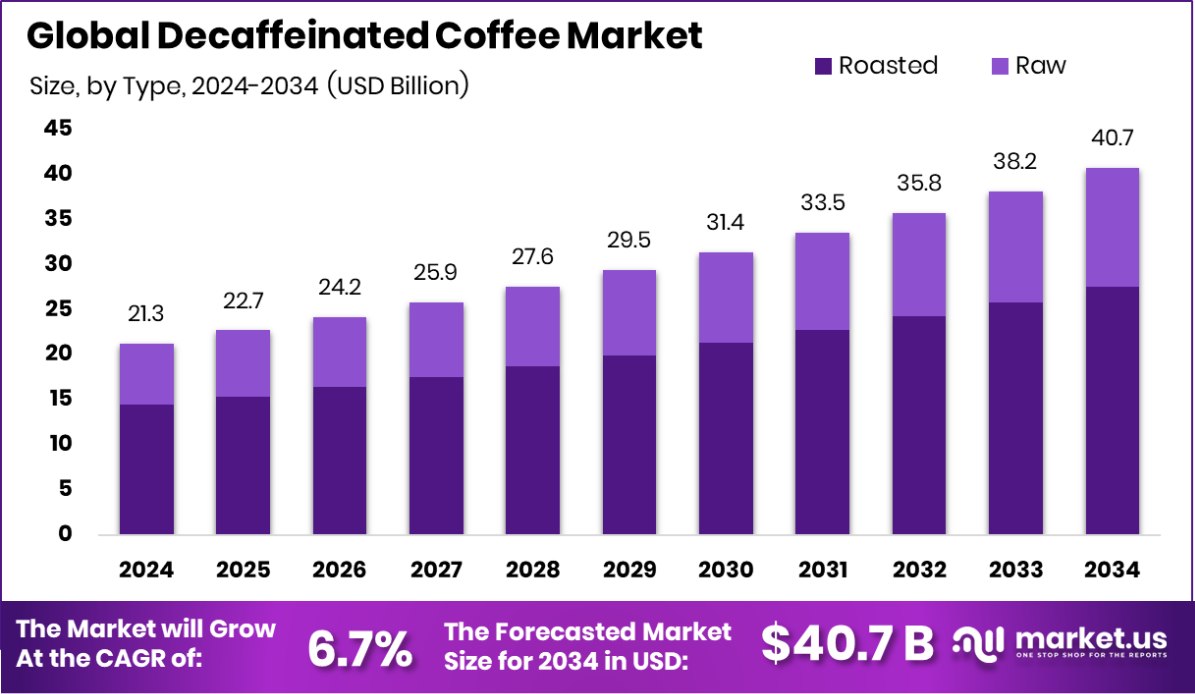

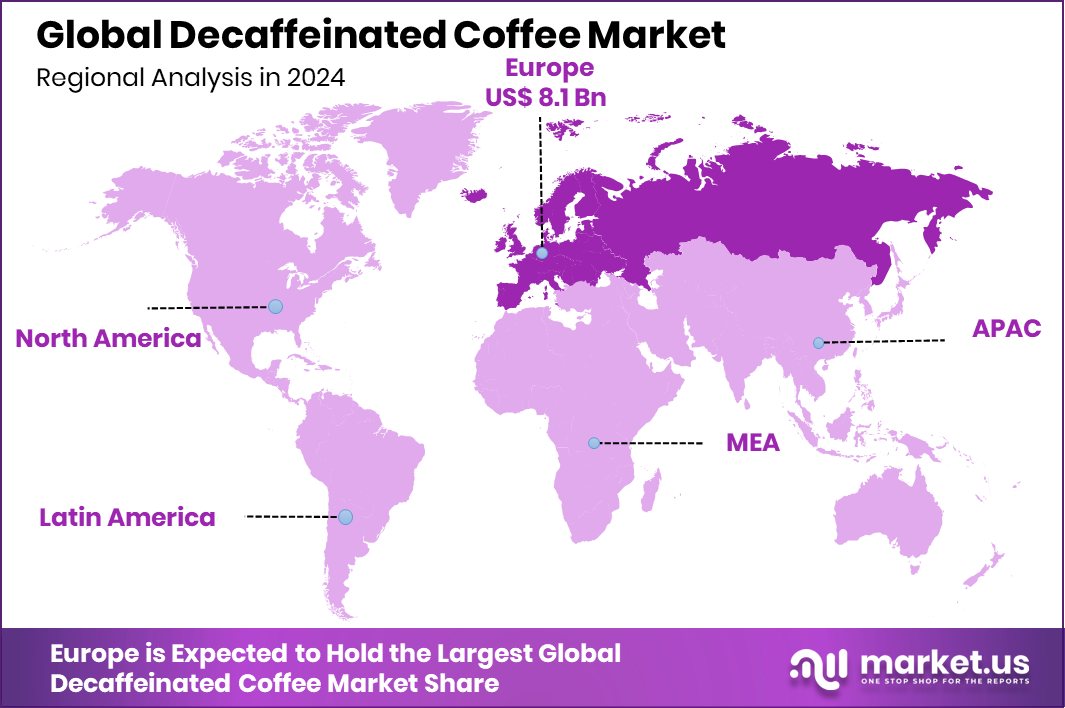

The Global Decaffeinated Coffee Market is expected to be worth around USD 40.7 billion by 2034, up from USD 21.3 billion in 2024, and grow at a CAGR of 6.7% from 2025 to 2034. High health awareness in Europe drives demand for decaf coffee worth USD 8.1 billion.

Decaffeinated Coffee is regular coffee that has had most of its caffeine content removed. This process usually involves water, organic solvents, or carbon dioxide to extract caffeine from the beans before they’re roasted. Despite the reduced caffeine, decaf coffee maintains a similar taste, aroma, and body to its caffeinated counterpart, making it a popular option for those who want to enjoy coffee without the jitters or sleep disruptions.

The Decaffeinated Coffee Market is growing steadily as consumers become more health-conscious and seek caffeine alternatives. This market includes a wide range of products, from instant mixes to specialty brews, catering to diverse preferences. Rising awareness about caffeine-related health concerns and lifestyle choices is encouraging more people to choose decaf options at home and in cafés.

One major growth factor is the increasing number of consumers looking to reduce caffeine due to anxiety, pregnancy, or sleep issues. Many are replacing their second or third cup of regular coffee with decaf, especially during the evening hours, which drives steady sales across age groups.

Demand is also fueled by a growing interest in wellness and natural food choices. As more people read labels and track their intake, decaf coffee is gaining popularity among those who still want the flavor and ritual of coffee without the buzz.

Key Takeaways

- The Global Decaffeinated Coffee Market is expected to be worth around USD 40.7 billion by 2034, up from USD 17.3 billion in 2024, and grow at a CAGR of 6.7% from 2025 to 2034.

- Roasted decaffeinated coffee holds a 67.80% share, reflecting strong consumer preference for traditional coffee flavors.

- Arabica beans dominate the decaffeinated coffee market with a 59.20% share due to their smoother, premium taste.

- Residential consumption drives 58.40% of the decaffeinated coffee market, driven by health-focused daily routines.

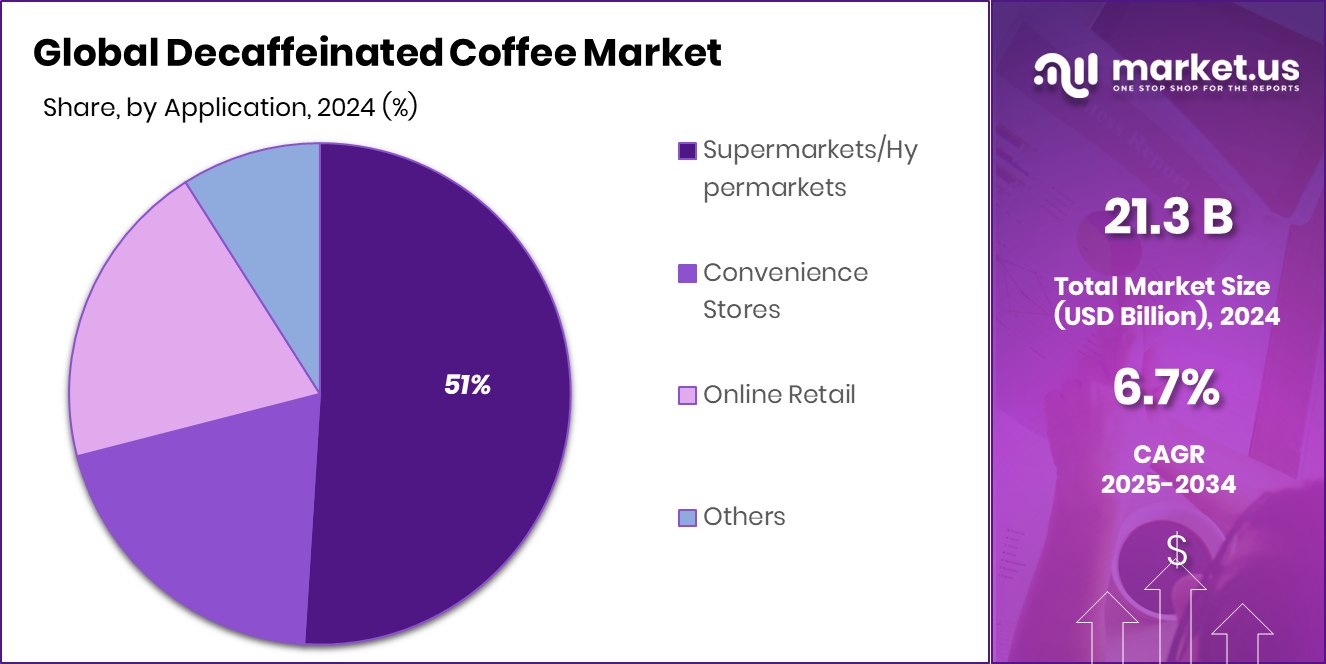

- Supermarkets and hypermarkets account for 51.20%, making them key distribution hubs for decaffeinated coffee products.

- The market value in Europe reached approximately USD 8.1 billion this year.

By Type Analysis

Roasted dominates the Decaffeinated Coffee Market with a 67.80% strong consumer preference.

In 2024, Roasted held a dominant market position in the By Type segment of the Decaffeinated Coffee Market, with a 67.80% share. This strong performance was largely attributed to consumer preference for traditional coffee formats that preserve aroma, depth of flavor, and overall freshness. Roasted decaf coffee, especially whole bean and ground variants, remains a staple in both household consumption and coffee shop offerings.

The dominance of roasted decaf also reflects shifting consumer habits toward at-home brewing, where roasted beans offer greater control over strength and preparation style. Additionally, the growing availability of premium roasted decaf in supermarkets and online platforms has expanded accessibility for a broader audience.

While instant and ready-to-drink decaf products are gaining popularity among convenience-driven consumers, the roasted category continues to lead due to its authentic experience and versatility.

This market position is further supported by the rise in specialty coffee culture, where roasted beans—decaf included—are favored for their quality and traceability. As awareness about caffeine sensitivity grows, roasted decaf is expected to maintain its lead, driven by both traditional preferences and evolving wellness trends.

By Bean Type Analysis

Arabica beans lead the Decaffeinated Coffee Market, accounting for 59.20% of the consumption share.

In 2024, Arabica held a dominant market position in the By Bean Type segment of the Decaffeinated Coffee Market, with a 59.20% share. This dominance was largely driven by Arabica’s mild flavor profile, lower bitterness, and smoother acidity, which align well with consumer expectations for high-quality decaffeinated coffee.

Arabica beans are widely regarded as superior in taste, and even after decaffeination, they retain their natural sweetness and aromatic complexity, making them the preferred choice for both home brewers and specialty cafés.

The significant share of Arabica also reflects growing consumer demand for premium and specialty decaf options. With more people shifting toward healthier lifestyles and reducing caffeine intake, the preference for Arabica-based decaf has increased due to its balanced taste and broader availability in whole bean, ground, and capsule formats. The expansion of decaf offerings within Arabica-based single-origin and organic lines has further supported its market hold.

Additionally, Arabica’s dominance is tied to its global cultivation and recognition, particularly from regions known for high-elevation farming, which adds depth to flavor even after the caffeine removal process. This strong market presence is expected to continue as taste-conscious consumers seek high-quality decaf alternatives without compromising on the coffee experience.

By End-use Analysis

The residential segment drives the Decaffeinated Coffee Market demand with a 58.40% usage rate.

In 2024, Residential held a dominant market position in the By End-use segment of the Decaffeinated Coffee Market, with a 58.40% share. This lead was primarily driven by the growing trend of at-home coffee consumption, fueled by convenience, cost-efficiency, and lifestyle shifts.

Consumers are increasingly preparing coffee at home due to hybrid work models, health-conscious routines, and a desire for personal control over beverage choices. Decaffeinated coffee, in particular, is gaining traction among individuals seeking to reduce caffeine without giving up the comfort of their daily coffee ritual.

Within the residential segment, the demand spans across roasted beans, ground coffee, and pods tailored for home machines. Households with caffeine-sensitive individuals or those seeking evening or late-night coffee options are opting for decaf varieties more often.

The segment also benefits from improved availability of decaf options in retail outlets and online platforms, making it easier for consumers to explore and purchase based on flavor preferences and brewing methods.

This strong market presence is also supported by increased consumer awareness around health and wellness, where decaf serves as a practical alternative. As more people embrace mindful consumption habits, the residential segment is expected to remain the primary driver of decaffeinated coffee demand.

By Distribution Channel Analysis

Supermarkets/Hypermarkets contribute 51.20% of sales in the Decaffeinated Coffee Market retail network.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Decaffeinated Coffee Market, with a 51.20% share. This channel’s lead stems from its widespread accessibility, extensive shelf space, and the ability to offer consumers a broad variety of decaffeinated coffee products under one roof.

Shoppers prefer supermarkets and hypermarkets for their convenience, in-person product comparison, promotional pricing, and immediate availability, making them the go-to choice for regular purchases.

These retail formats cater to a wide customer base, ranging from casual buyers to routine decaf coffee drinkers. The presence of both local and international brands on the shelves has boosted consumer trust and product visibility. Moreover, the growing health trend has prompted retailers to expand their decaf offerings across different bean types, roast levels, and packaging formats to meet evolving preferences.

In-store placement strategies, such as featured displays and health-focused sections, have also contributed to stronger consumer engagement with decaffeinated coffee products. The ability to combine coffee shopping with other household needs further adds to the appeal of this channel.

Key Market Segments

By Type

- Roasted

- Raw

By Bean Type

- Arabica

- Robusta

- Blends

By End-use

- Residential

- Commercial

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Driving Factors

Health-Conscious Lifestyle Driving Decaf Coffee Demand

One of the biggest reasons behind the growth of the decaffeinated coffee market is the rising shift toward healthier living. More people are cutting back on caffeine due to concerns like anxiety, insomnia, high blood pressure, and pregnancy-related issues. Decaf coffee offers a safer, more relaxed option for those who still want to enjoy the flavor and routine of drinking coffee without the side effects.

This is especially popular among older adults and younger people who follow wellness trends. As consumers become more mindful of what they consume, they are choosing products that support better sleep, calmness, and long-term health. This shift is helping decaf coffee become a regular part of daily routines, not just a specialty option.

Restraining Factors

High Processing Costs Limit Decaf Coffee Growth

One major factor holding back the growth of the decaffeinated coffee market is the high cost of processing. Removing caffeine from coffee beans requires special methods such as water-based extraction, CO₂ processing, or using solvents.

These techniques add to manufacturing costs and often make decaf products more expensive than regular coffee. As a result, some consumers are hesitant to pay more for a product that offers less stimulation.

Additionally, small producers may avoid entering the decaf segment due to the investment needed for decaffeination equipment or outsourcing. This limits product variety and slows down market expansion, especially in price-sensitive regions. Overall, high production costs remain a strong barrier to the wider adoption of decaffeinated coffee.

Growth Opportunity

Rising Demand For Specialty Decaf Coffee Blends

A big growth opportunity in the decaffeinated coffee market lies in specialty coffee. More people are now looking for premium decaf options that offer rich flavors, unique origins, and ethical sourcing.

Traditionally, decaf was seen as bland or low quality, but that perception is changing. As coffee lovers seek healthier choices without sacrificing taste, there is growing space for single-origin, organic, or artisan decaf blends.

This trend is especially strong among younger consumers and those who enjoy gourmet coffee experiences at home. Brands that focus on quality, transparency, and storytelling can tap into this niche. By offering high-end decaf options, the market can expand beyond basic consumption into a lifestyle-driven, premium coffee category.

Latest Trends

Cold Brew Decaf Gaining Popularity Among Consumers

One of the latest trends in the decaffeinated coffee market is the growing popularity of cold brew decaf. Consumers are increasingly choosing cold beverages, especially in warmer regions or during summer months. Cold brew is known for its smooth, less acidic taste, and when paired with decaffeinated beans, it offers a refreshing, health-friendly option.

This trend is catching on with younger audiences and working professionals who want a caffeine-free coffee experience without compromising on taste or style. Ready-to-drink (RTD) cold brew decaf is also gaining space on supermarket shelves and in cafes. As convenience and wellness continue to drive purchasing behavior, cold brew decaf is becoming a key product innovation in the expanding decaf coffee landscape.

Regional Analysis

In 2024, Europe dominated the decaffeinated coffee market with a 38.30% share.

In 2024, Europe emerged as the leading region in the decaffeinated coffee market, accounting for a 38.30% share and reaching a market value of USD 8.1 billion. This dominance is attributed to rising health awareness, a well-established coffee culture, and growing demand for caffeine-free alternatives across key countries like Germany, France, and the UK.

North America followed closely, driven by increasing consumption among health-conscious consumers, especially in the U.S., where decaf options are widely available in both retail and food service outlets. The Asia Pacific region is witnessing steady growth, supported by urbanization and a rising middle-class population showing interest in Western-style coffee beverages, including decaf variants.

Meanwhile, the Middle East & Africa region is experiencing gradual adoption, primarily in urban centers where premium coffee consumption is increasing. Latin America, though traditionally known as a coffee-producing region, is also seeing a slow yet noticeable shift toward decaffeinated consumption due to growing health trends and export-based production.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Nestlé S.A. continues to hold a strong position in the global decaffeinated coffee market, supported by its well-established brand recognition and wide product range. With its deep distribution network and popular offerings under its Nescafé line, Nestlé successfully caters to both premium and mass-market consumers. The company’s ability to combine convenience with evolving health preferences has helped it maintain a firm grip on global decaf demand, especially in Europe and Asia.

On the other hand, Starbucks Corporation remains a key player through its strong presence in the retail café segment and packaged products. The brand’s commitment to offering high-quality, ethically sourced decaf options aligns with changing consumer values around sustainability and health.

Starbucks’ seasonal decaf beverages and custom drink options keep it relevant among younger, health-conscious urban consumers. Its expansion of ready-to-drink (RTD) and cold brew decaf options in select markets also reflects a sharp alignment with modern consumption habits.

The J.M. Smucker Company, known for its Folgers and Dunkin’ branded coffee products, plays a significant role in the at-home decaf market. With strong household penetration in North America, the company capitalizes on convenience, affordability, and familiarity. It remains competitive by offering a wide selection of roast profiles and packaging formats, appealing to value-driven consumers who prioritize both taste and caffeine reduction.

Top Key Players in the Market

- Nestlé S.A.

- Starbucks Corporation

- The J.M. Smucker Company

- Keurig Dr Pepper

- Kraft Heinz Company

- Caribou Coffee Company

- Illycaffè S.p.A.

- Peet’s Coffee & Tea

- Tchibo GmbH

- Tim Hortons

- Dunkin

- Savorista Coffee

Recent Developments

- In December 2024, Danone’s STōK brand launched a new range of ready-to-drink decaffeinated cold brew coffees in the U.S., catering to consumers seeking convenient, caffeine-free options.

- In November 2024, The J.M. Smucker Company raised its annual profit forecast, driven by resilient demand and higher prices in its coffee segment, including decaffeinated offerings.

- In September 2024, Keurig Dr Pepper agreed to pay a $1.5 million fine to settle charges from the SEC alleging misleading statements about the recyclability of its single-use coffee pods.

Report Scope

Report Features Description Market Value (2024) USD 21.3 Billion Forecast Revenue (2034) USD 40.7 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Roasted, Raw), By Bean Type (Arabica, Robusta, Blends), By End-use (Residential, Commercial), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., Starbucks Corporation, The J.M. Smucker Company, Keurig Dr Pepper, Kraft Heinz Company, Caribou Coffee Company, Illycaffè S.p.A., Peet’s Coffee & Tea, Tchibo GmbH, Tim Hortons, Dunkin, Savorista Coffee Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Decaffeinated Coffee MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Decaffeinated Coffee MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- Starbucks Corporation

- The J.M. Smucker Company

- Keurig Dr Pepper

- Kraft Heinz Company

- Caribou Coffee Company

- Illycaffè S.p.A.

- Peet’s Coffee & Tea

- Tchibo GmbH

- Tim Hortons

- Dunkin

- Savorista Coffee