Global Cosmetics Market By Product (Skin Care, Hair Care, Makeup, Fragrance, Others), End-user (Men, Women, Unisex), Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Pharmacies, Online Sales Channel, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 60956

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

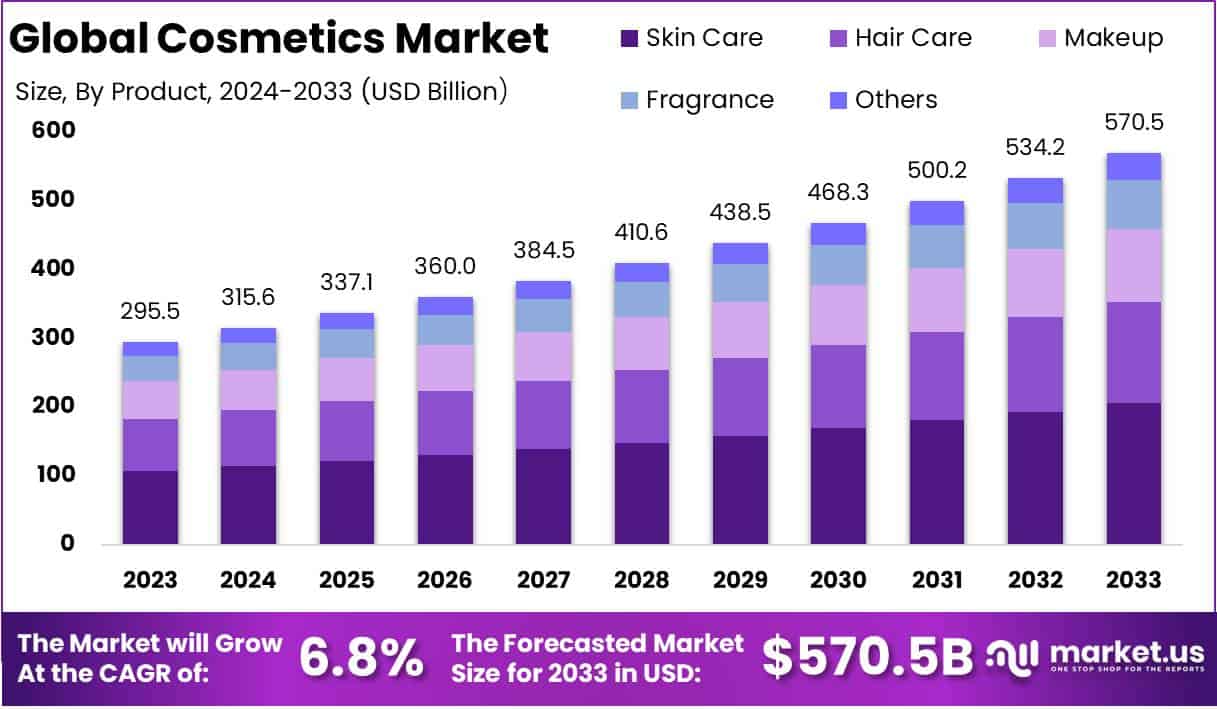

The Global Cosmetics Market size is expected to be worth around USD 570.5 Billion by 2033 from USD 295.5 Billion in 2023, growing at a CAGR of 6.8% during the forecast period from 2024 to 2033.

The cosmetics market encompasses a broad range of products designed for enhancing appearance, personal care, and skin health. This includes skincare, haircare, makeup, perfumes, and hygiene products for both men and women.

Companies in this market range from global giants like L’Oréal, Estée Lauder, and Procter & Gamble, to emerging indie brands that target niche consumer segments.

The market is highly dynamic, characterized by continuous product innovation and evolving consumer preferences. Its scope extends beyond mere aesthetics, encompassing health, wellness, and sustainability, making it a critical component of the broader beauty and personal care industry.

The cosmetics market is driven by several key growth factors, including rising disposable incomes, increasing urbanization, and a growing emphasis on self-care and appearance among consumers globally. Technological advancements and the rise of social media influencers have also significantly impacted the market, as consumers seek new and innovative products endorsed by beauty experts and celebrities.

Additionally, the increasing awareness of skincare, fueled by a focus on natural ingredients and anti-aging products, is propelling the growth of the skincare segment. Expanding e-commerce platforms and digital marketing strategies are further enhancing market reach, allowing brands to target diverse demographics and regions effectively.

The demand for cosmetics is undergoing a transformation as consumers increasingly prioritize products that align with health, wellness, and ethical considerations. Today’s consumers are more informed and discerning, seeking transparency in ingredient sourcing and production processes.

As a result, demand for organic, vegan, cruelty-free, and sustainable products has surged, with brands rapidly adapting to meet these preferences. The cosmetics market presents substantial opportunities for growth, especially in the realms of digital transformation and sustainability.

E-commerce and direct-to-consumer (DTC) models are revolutionizing how brands interact with customers, providing a personalized and engaging shopping experience. Leveraging technology such as artificial intelligence (AI) for product customization and augmented reality (AR) for virtual try-ons can further enhance customer engagement and satisfaction.

According to Zippia, the cosmetics industry is a dynamic and expansive sector, with the United States playing a pivotal role in shaping its global impact. In 2023, the U.S. cosmetics market was valued at approximately $91.4 billion, representing a significant portion of the global industry’s total value.

The market encompasses a diverse range of segments, including skincare, hair care, makeup, perfumes, and more, with skincare emerging as the most profitable, accounting for roughly 42% of the market. This trend is largely driven by an increasing consumer focus on health-oriented and anti-aging products, as evidenced by the global anti-aging market’s valuation of $38.62 billion.

Consumer spending patterns also demonstrate the strength of the U.S. market, with Americans spending an average of $244 to $313 per month on beauty products, reinforcing the nation’s status as a leading consumer base.

Digital engagement is a critical growth driver within the cosmetics industry. Social media platforms like Instagram and YouTube have become essential for brands to connect with consumers. Notably, 37% of American shoppers discover new cosmetic products through social media ads, while influencer-led content significantly shapes purchasing decisions over 60% of beauty-related content on YouTube is created by influencers rather than brands.

Furthermore, the increasing demand for gender-neutral and men’s cosmetics reflects evolving consumer preferences, with the men’s personal care segment projected to experience considerable growth, further expanding the market’s reach.

The cosmetics market is poised for substantial growth, driven by favorable regulatory changes and strategic government initiatives aimed at boosting consumer spending and supporting women-led businesses.

Notably, the reduction of the Goods and Services Tax (GST) on beauty products from 18% to 12% is expected to lower retail prices, stimulating demand and expanding sales volumes. This shift is particularly advantageous for startups, enhancing their competitiveness in a price-sensitive market.

Additionally, the Union Budget 2024-25, which allocated over ₹3 lakh crore to programs supporting women and girls, underscores a strong emphasis on women’s empowerment. This financial support is likely to increase female entrepreneurship in the beauty industry, thereby expanding the market and fostering innovation.

According to Demandsage, the cosmetics market is evolving rapidly, with skincare accounting for 42% of the global beauty market and 58% of shoppers spending $1 to $100 monthly on products. Social media ads influence 37% of consumer purchases, while e-commerce is growing at 12% annually, with U.S. online sales expected to reach $45 billion by 2027.

Consumers increasingly seek personalized experiences, with 75% willing to pay a premium and 50% favoring brands that promote diversity and inclusivity. Asia-Pacific and North America are set to remain dominant, with growth rates of 7% and 6% respectively, between 2022 and 2027.

Key Takeaways

- The global cosmetics market is projected to grow from USD 265.4 billion in 2023 to USD 449.1 billion by 2033, at a CAGR of 5.4%, driven by rising disposable incomes, self-care trends, and digital transformation..

- The Skin Care segment leads with a 36.2% share in 2023, driven by increasing demand for anti-aging and natural products.

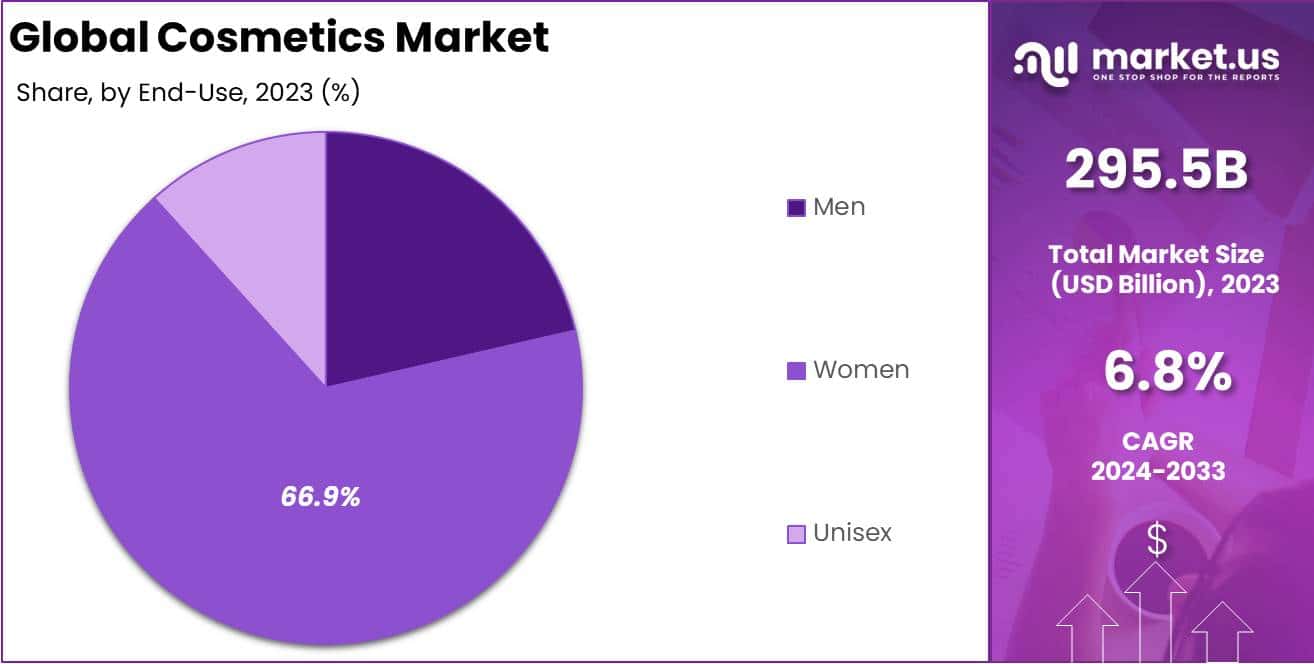

- The Women’s segment dominates with a 66.9% share, supported by a diverse range of products and a strong emphasis on personalized beauty solutions.

- Hypermarkets/Supermarkets held the largest distribution channel share in 2023 at 24.2%, favored for convenience and product variety.

- North America led the regional market with a 33.7% share in 2023, driven by high consumer spending and innovative product offerings.

By Product Analysis

Skin Care Leading the Cosmetics Market in 2023 with 36.2% Market Share

In 2023, Skin Care held a dominant market position within the Cosmetics sector, capturing more than 36.2% of the overall market share. This segment’s leadership is driven by increasing consumer focus on health-conscious beauty, demand for anti-aging products, and rising adoption of skincare routines across diverse age groups.

The Hair Care segment emerging as a key growth driver. Demand for specialized hair treatments, including anti-hair fall, scalp care, and color protection products, has been pivotal. The growing popularity of natural and sulfate-free hair care products is also enhancing this segment’s appeal among environmentally conscious consumers.

Makeup products reflecting strong growth fueled by rising social media influence and the growing trend of self-expression through cosmetics. The proliferation of inclusive and diverse product lines has made makeup more accessible and appealing to a broader consumer base.

The Fragrance segment driven by increasing consumer preference for premium and personalized scents. Growth in this segment is also supported by expanding e-commerce channels, which have made luxury and niche fragrances more accessible.

The Others category, comprising products such as nail care, personal hygiene, and cosmetic accessories. While smaller in share, these niche categories exhibit potential for growth, particularly as consumer interest in holistic beauty solutions continues to rise.

By End-Use Analysis

Women Leading the Cosmetics Market in 2023 with 66.9% Market Share

In 2023, Women held a dominant market position in the Cosmetics market by end-user, capturing more than 66.9% of the overall market share. This segment’s dominance is attributed to the high demand for a wide variety of products across skincare, makeup, and hair care categories.

Increasing awareness about personal grooming and beauty trends, along with the growing influence of social media, has significantly contributed to this segment’s strong performance.

The Men’s showcasing notable growth potential. This rise is fueled by increasing adoption of grooming products, such as beard care, skincare, and specialized hair care solutions. The shift in societal perceptions around male grooming and self-care is further driving demand in this segment.

Unisex products reflecting growing consumer preference for versatile and inclusive solutions. The rising appeal of gender-neutral branding and multi-functional products, such as unisex skincare and fragrances, has been a key factor in the segment’s steady growth.

By Distribution Channel Analysis

Hypermarkets/Supermarkets Leading the Cosmetics Market in 2023 with 24.2% Market Share

In 2023, Hypermarkets/Supermarkets held a dominant market position in the Cosmetics market by distribution channel, capturing more than 24.2% of the total share. These outlets remain a preferred choice for consumers due to their convenience, wide product variety, and frequent promotional offers. Additionally, the ability to physically evaluate products before purchase continues to drive strong sales in this channel.

Specialty stores attract consumers seeking expert advice, exclusive product lines, and a personalized shopping experience. Their focus on premium and niche products helps maintain a loyal customer base.

Pharmacies are supported by growing consumer demand for dermatologically-tested and medically-recommended cosmetics. The segment benefits from consumer trust in health-focused retail environments, particularly for skincare and hair care products.

The Online Sales Channel showcasing rapid growth driven by convenience, extensive product availability, and competitive pricing. The rise of e-commerce platforms, along with digital marketing strategies, has made this channel increasingly popular among tech-savvy and younger consumers.

The Others category, which includes convenience stores, beauty salons, and direct sales. These channels play a supporting role, catering to specific consumer needs and preferences for unique or location-based purchasing experiences.

Key Market Segments

By Product

- Skin Care

- Hair Care

- Makeup

- Fragrance

- Others

End-user

- Men

- Women

- Unisex

Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Pharmacies

- Online Sales Channel

- Others

Driver

Growing Demand for Natural and Organic Products

One of the key drivers propelling the cosmetics market is the rising consumer demand for natural and organic products. As health and wellness trends gain prominence globally, consumers are becoming more conscious of the ingredients in their skincare, makeup, and personal care products.

This shift is largely influenced by an increasing awareness of potential health risks associated with synthetic chemicals and artificial ingredients commonly found in traditional cosmetics. Consequently, there is a strong preference for products that are formulated with organic, cruelty-free, and sustainably sourced ingredients.

Brands are responding to this demand by expanding their portfolios to include clean beauty lines, eco-friendly packaging, and certification labels such as vegan and cruelty-free. Major players and niche brands alike are investing in R&D to create effective and safe products that appeal to this growing segment of conscious consumers.

The preference for natural and organic products is not limited to skincare alone it extends across the entire cosmetics spectrum, including hair care, makeup, and fragrances.

As this trend becomes mainstream, it is driving market growth by not only attracting new customers but also increasing brand loyalty among existing consumers who value transparency and sustainability in their purchasing decisions.

Restraint

Regulatory Challenges and Compliance Costs

One significant restraint impacting the cosmetics market is the complex and stringent regulatory landscape. The cosmetics industry is subject to diverse regulations and safety standards across different countries and regions.

Authorities like the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) in the EU enforce rigorous guidelines on product formulation, ingredient safety, labeling, and marketing claims.

Complying with these regulations is crucial but often becomes a barrier for companies, especially smaller and emerging brands, due to the high costs and complexity involved. For instance, brands must invest heavily in testing and certification processes to ensure that their products meet safety standards and avoid harmful or banned substances.

These procedures are time-consuming and expensive, impacting profit margins and slowing down the time-to-market for new products. Additionally, as the market shifts towards natural and organic formulations, companies must also navigate the certification processes for clean beauty labels, which further adds to compliance costs.

Opportunity

Integration of Technology and Personalization

The integration of technology and personalization in cosmetics is rapidly transforming the market, presenting a significant growth opportunity for brands looking to innovate and differentiate themselves. As consumers increasingly seek products tailored to their unique skin types, preferences, and lifestyle needs, the use of advanced technology like artificial intelligence (AI), augmented reality (AR), and data analytics is becoming essential for cosmetics companies.

Brands are leveraging AI to offer personalized skincare solutions, such as virtual skin assessments that analyze consumers’ skin conditions and recommend products suited to their specific needs.

Major players are also developing apps that allow consumers to create customized skincare routines, track their progress, and receive real-time recommendations based on environmental factors like weather or UV exposure.

This trend is not only enhancing customer satisfaction but also building long-term brand loyalty by providing highly tailored and effective solutions.

Additionally, AR technology is revolutionizing the online and in-store shopping experience through virtual try-on features, allowing customers to test makeup shades, hair colors, and other cosmetic products virtually before making a purchase.

For companies, investing in technology-driven solutions also means gaining access to valuable consumer data, which can be analyzed to better understand consumer behavior and preferences.

This data-driven approach enables brands to optimize their product development, marketing strategies, and inventory management, ultimately driving sales growth and operational efficiency.

By embracing technology and personalization, cosmetics brands have the opportunity to elevate their customer experience, cater to the growing demand for bespoke products, and stay ahead in an increasingly competitive market.

Trends

Sustainability and Eco-Friendly Practices

A major trend shaping the cosmetics market is the growing emphasis on sustainability and eco-friendly practices, which is increasingly becoming central to brand strategy and consumer choice.

As environmental awareness rises among consumers, there is a strong preference for cosmetics that align with eco-conscious values. This trend is driving brands to innovate with sustainable packaging solutions, environmentally friendly ingredients, and cruelty-free production methods.

Many consumers now actively seek products that minimize environmental impact, such as those packaged in recyclable, biodegradable, or refillable containers. In response, brands are investing in sustainable packaging technologies, like using plant-based or recycled materials, to reduce their carbon footprint and appeal to this environmentally-conscious demographic.

This sustainability trend is also influencing the retail experience, as more brands incorporate sustainable practices into their business models. For instance, some companies are partnering with retailers to create take-back or recycling programs, where consumers return empty containers for recycling or refilling, reducing waste and fostering brand loyalty through eco-friendly initiatives.

Adopting sustainability as a core value is no longer optional for brands but a necessary strategy to remain competitive and relevant. This trend reflects a broader shift in consumer behavior, where purchasing decisions are increasingly influenced by ethical considerations.

Cosmetics brands that proactively address these demands by embedding sustainability into their products and practices are likely to strengthen their market position and build a loyal consumer base.

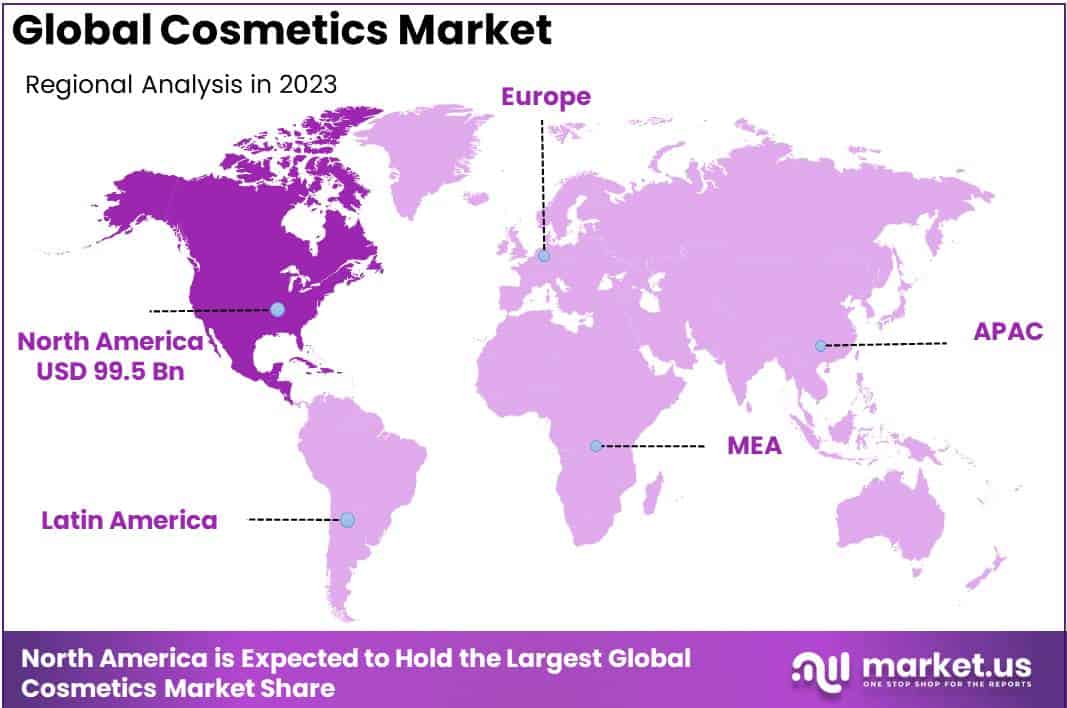

Regional Analysis

North America Dominates the Cosmetics Market with Largest Market Share of 33.7% in 2023

The global cosmetics market showcases significant regional diversity with contributions from North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2023, North America maintained its leading position, capturing 33.7% of the global market share, valued at USD 99.5 billion.

This dominance is largely due to the high consumer expenditure on beauty and personal care products, coupled with the innovative product offerings from established North American brands that continue to set trends globally.

Europe remains a vital player in the cosmetics industry, driven by an increasing demand for organic and eco-friendly beauty solutions.

This shift reflects the region’s heightened consumer awareness regarding sustainable practices and the environmental impact of cosmetics. Moreover, stringent EU regulations on cosmetic products ensure high-quality standards, supporting consumer trust and market growth.

Asia Pacific is witnessing rapid expansion in the cosmetics sector, spurred by rising disposable incomes and an expanding middle class. The region’s diverse consumer base and increasing urbanization are key factors propelling the demand for both premium and mass-market beauty products, positioning it as a potential leader in the coming years.

The Middle East & Africa region is experiencing a surge in demand for luxury cosmetic products, with the GCC countries acting as the main catalysts due to their high disposable incomes and a culturally ingrained penchant for luxury goods.

Latin America, led by Brazil, is noted for its growth in the cosmetics sector, driven by the rich local biodiversity which is often leveraged to develop unique cosmetic products that resonate well with both local and global consumers.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global cosmetics industry in 2024 is characterized by a dynamic landscape, with key players leveraging diverse strategies to maintain and enhance their market positions. Adidas AG, traditionally recognized for its athletic apparel, has been expanding its footprint in the personal care segment. By aligning its product offerings with its sports-centric brand identity, Adidas appeals to consumers seeking performance-oriented personal care solutions.

Coty Inc. continues to navigate its extensive portfolio of beauty brands, focusing on innovation and digital engagement to revitalize its market presence. Strategic partnerships and a renewed emphasis on sustainability are central to Coty’s efforts to resonate with modern consumers.

L’Oréal Group, a global leader in beauty, maintains its dominance through continuous investment in research and development. The company’s agility in adopting digital technologies and its commitment to sustainability initiatives underscore its forward-thinking approach.

Estée Lauder Companies, Inc. emphasizes luxury and premium skincare products, leveraging its strong brand heritage. The company is expanding its digital channels and focusing on personalized consumer experiences to drive growth.

Revlon Consumer Products LLC faces challenges in a competitive market but is striving to regain its foothold through product innovation and strategic marketing initiatives aimed at revitalizing its brand image.

Avon Products, Inc. continues to leverage its direct-selling model, integrating digital tools to enhance representative and customer engagement, thereby adapting to evolving consumer purchasing behaviors.

Unilever maintains a diverse portfolio of personal care brands, emphasizing sustainability and ethical sourcing. The company’s commitment to environmental and social governance resonates with increasingly conscious consumers.

Godrej Group, with its strong presence in emerging markets, focuses on affordable and accessible beauty products. The company’s deep understanding of local consumer preferences positions it well for sustained growth.

Procter & Gamble leverages its extensive distribution networks and strong brand equity to maintain a significant share in the cosmetics market. Continuous innovation and strategic acquisitions are central to its growth strategy.

Beiersdorf AG, known for its skincare expertise, invests heavily in research to develop products that meet specific consumer needs. The company’s focus on dermatological solutions strengthens its position in the skincare segment.

Henkel AG & Co KGaA combines its expertise in consumer goods with a focus on sustainability, developing products that cater to environmentally conscious consumers. Innovation in packaging and formulations is a key aspect of its strategy.

Kao Corporation emphasizes high-quality skincare and haircare products, leveraging advanced research and technology. The company’s commitment to sustainability and product safety enhances its brand reputation.

Hoyu Co., Ltd., specializing in hair color products, focuses on innovation to meet diverse consumer preferences. The company’s dedication to quality and safety standards solidifies its position in the haircare market.

Top Key Players in the Market

- Coty Inc.

- L’Oréal Group

- Estee Lauder Companies, Inc.

- Revlon Consumer Products LLC

- Avon Products, Inc.

- Unilever

- Company 7

- Godrej Group

- Procter & Gamble

- Beiersdorf AG

- Henkel AG & Co KGaA

- Kao Corporation

- Hoyu Co., Ltd.

Recent Developments

- In 2023, L’Oréal acquired the premium skincare brand Aesop from Natura & Co. for $2.525 billion. This acquisition represents a strategic move by L’Oréal to deepen its presence in the luxury skincare segment, leveraging Aesop’s reputation for high-quality, sustainably sourced products. It stands as one of the largest beauty industry deals of the year, highlighting L’Oréal’s continued focus on expanding its premium skincare portfolio to meet growing consumer demand for luxury and eco-conscious products.

- In September 2024, Euroitalia acquired the beauty and fragrance rights for Moschino from the Aeffe Group. The transaction involved an initial payment of 39.6 million euros, with additional payments scheduled for completion by the end of 2024. This acquisition aligns with Euroitalia’s strategy to expand its luxury fragrance offerings, capitalizing on Moschino’s brand appeal and international recognition. By adding Moschino to its portfolio, Euroitalia aims to strengthen its position within the high-end fragrance market.

- In August 2023, e.l.f. Beauty acquired Naturium, a high-performance skincare brand, for $355 million. This acquisition enhances e.l.f. Beauty’s product range by integrating Naturium’s science-backed skincare solutions, which appeal to millennial and male demographics. The move also aims to expand e.l.f. Beauty’s customer base and diversify its offerings beyond color cosmetics, positioning the company for continued growth in the broader skincare market.

Report Scope

Report Features Description Market Value (2023) US$ 295.5 Bn Forecast Revenue (2033) US$ 570.5 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Skin Care, Hair Care, Makeup, Fragrance, Others), End-user (Men, Women, Unisex), Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Pharmacies, Online Sales Channel, Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Coty Inc., L’Oréal Group, Estee Lauder Companies, Inc., Revlon Consumer Products LLC, Avon Products, Inc., Unilever, Company 7, Godrej Group, Procter & Gamble, Beiersdorf AG, Henkel AG & Co KGaA, Kao Corporation, Hoyu Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Coty Inc.

- L’Oréal Group

- Estee Lauder Companies, Inc.

- Revlon Consumer Products LLC

- Avon Products, Inc.

- Unilever

- Company 7

- Godrej Group

- Procter & Gamble

- Beiersdorf AG

- Henkel AG & Co KGaA

- Kao Corporation

- Hoyu Co., Ltd.