Global Carmine Market Report By Application (Dairy & Frozen Products, Food & Beverage, Cosmetics, Other Applications), By End-User (Food Processing, Beverage, Catering, Cosmetics & Pharmaceutical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 47677

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

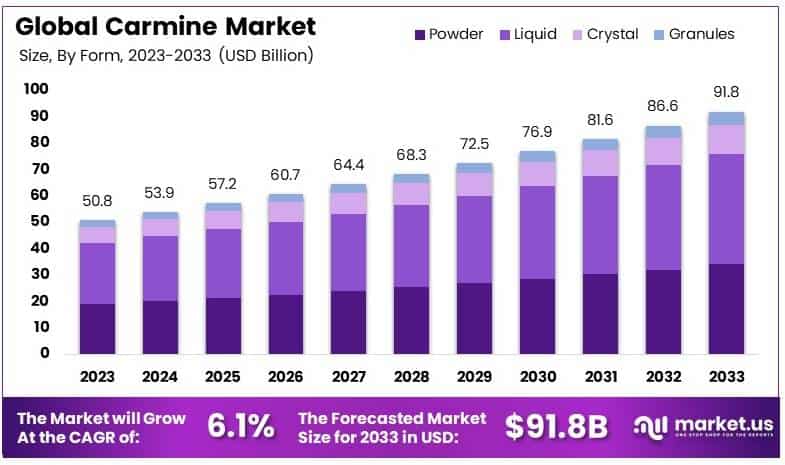

The Global Carmine Market size is expected to be worth around USD 91.8 Billion by 2033, from USD 50.8 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

Carmine is a natural red pigment derived from cochineal insects. It is widely used in the food and cosmetics industries as a coloring agent. It is known for its vibrant shade and stability under heat and light, making it a preferred choice for natural coloring.

The carmine market encompasses the production, processing, and sale of carmine pigment. It involves extracting carmine from cochineal insects and refining it for various applications, primarily in food, beverages, cosmetics, and pharmaceuticals. The market is shaped by consumer preferences for natural ingredients and regulations governing food safety.

Approximately 70,000 insects are needed to produce one pound of carmine, highlighting the labor-intensive and resource-dependent nature of this production process. Peru remains the largest producer, supplying the majority of the global market, followed by Mexico and Chile. The market’s reliance on these key regions makes it concentrated and vulnerable to local challenges such as climate and agricultural practices.

In the pharmaceutical sector, carmine is widely used as a coloring agent in tablets and capsules. The food and beverage industry also relies heavily on this pigment, especially in natural and organic products, as it is considered a safer alternative to synthetic dyes and other food colorants.

The market is not yet saturated but shows signs of high competition, especially among major producing countries like Peru, Mexico, and Chile. These nations dominate the global supply chain, making the market competitive and dependent on their production levels.

As global demand for carmine increases, smaller producers may find it difficult to compete unless they innovate or find niches within the market. Additionally, synthetic alternatives and other natural dyes & pigments pose a growing threat, particularly in regions where regulatory frameworks or cost factors make carmine less attractive.

Government regulations play a critical role in the carmine market. In the European Union and the United States, specific guidelines regulate the permissible levels of carmine in food and pharmaceutical products, ensuring safety and quality standards. These regulations are essential for consumer trust but also impose compliance costs on producers.

Countries like Peru, the leading carmine supplier, benefit from government support and investment in the agricultural sector, focusing on improving sustainable farming practices and ensuring compliance with international standards.

Investing in technology and sustainable farming methods can help producers stabilize their supply chains and maintain a competitive edge in the global market. By aligning with global regulatory frameworks, they can ensure consistent product quality and build stronger trade relationships.

Key Takeaways

- The Carmine Market was valued at USD 50.8 Billion in 2023 and is expected to reach USD 91.8 Billion by 2033, with a CAGR of 6.1%.

- In 2023, Liquids dominated the form segment with 45.7%, owing to their versatility and ease of application in various industries.

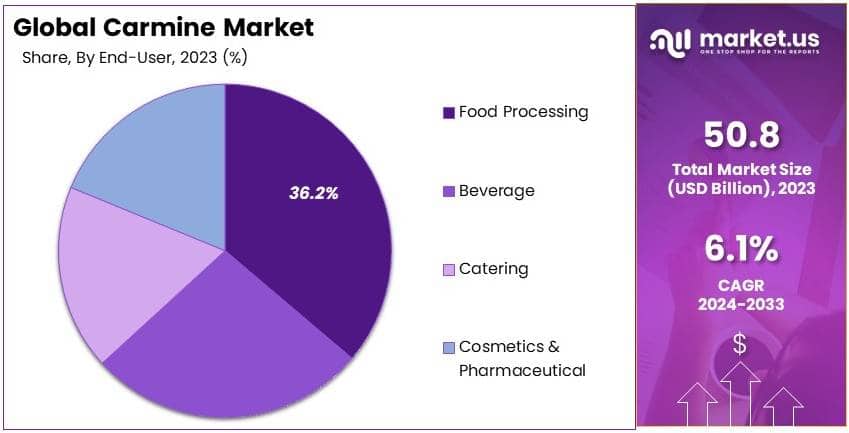

- In 2023, Food Processing led the end-use industry segment with 36.2%, due to high demand for natural colorants in processed foods.

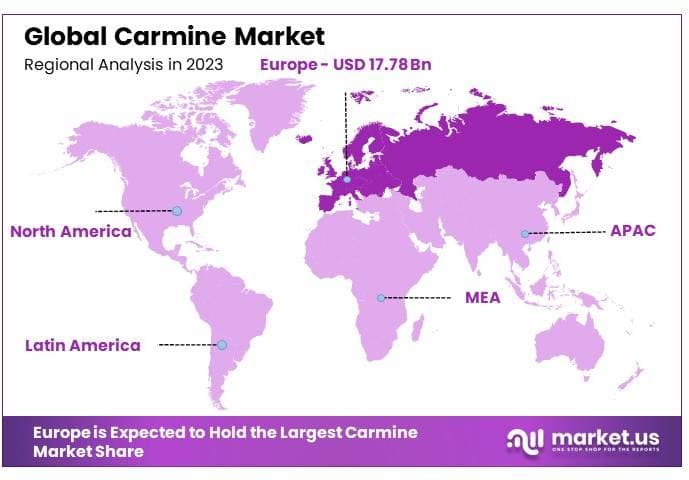

- In 2023, Europe dominated the market with a 35.0% share, valued at USD 17.78 Billion, due to strict regulations favoring natural additives.

Form Analysis

Liquids dominate with 45.7% due to ease of integration and efficient production processes.

The Carmine market, notable for its use in coloring food, cosmetic chemicals, and pharmaceuticals, is categorized into several forms: powder, liquid, crystal, and granules. Among these, the liquid form of Carmine holds the largest market share, dominating with 45.7%.

Liquid Carmine is highly favored in industrial applications where consistency and ease of mixing are critical. It offers uniform color dispersion and is preferred for its ability to blend smoothly without clumps, which is particularly valuable in liquid-based products like beverages and liquid cosmetics.

Powder Carmine, while also popular, is primarily utilized where precise measurement and gradual integration of color are required, such as in baking mixes or spice blends. Crystals and granules are less prevalent but serve niche markets where storage stability and gradual solubility are beneficial, such as in meat processing and certain types of confections.

Despite its smaller market share, the crystal and granule forms are anticipated to grow, driven by their specific advantages in food safety and extended shelf life. The versatility and adaptability of these forms to meet specific industrial requirements also indicate potential growth areas within the Carmine market.

End-User Industry Analysis

Food processing dominates with 36.2% due to Carmine’s essential role in food coloring and safety.

In the analysis of the Carmine market by end-user industry, food processing emerges as the dominant segment, accounting for 36.2% of the market. This sector relies heavily on Carmine for various applications, including meat products, baked products, and confections, where Carmine is valued not only for its vibrant red hue but also for its status as a natural food colorant as opposed to synthetic alternatives.

The preference for natural additives in food processing is driven by growing consumer awareness and regulatory support for healthier, more natural food products.

The substantial market share held by the food processing industry is attributed to the critical role of color in food appeal and marketing. Carmine’s ability to retain its color under heat and light exposure makes it particularly useful in processed foods that undergo extensive preparation and shelf storage.

Additionally, the increasing global demand for processed foods with extended shelf life and appealing appearances supports the continued use of Carmine in this industry.

Other significant segments include beverages, catering, and cosmetics & pharmaceuticals. In beverages, Carmine is used to enhance the visual appeal of flavored drinks and alcoholic beverages.

The catering industry utilizes Carmine to maintain color consistency in large-scale food production. In cosmetics and pharmaceuticals, Carmine finds application in coloring products such as lipsticks and pills, where natural ingredients are increasingly preferred.

Although food processing remains the cornerstone of Carmine’s market dominance, the other segments exhibit potential for growth. The beverage industry, in particular, is poised for expansion, driven by innovations in drink aesthetics and flavor enhancement.

Similarly, the demand in cosmetics for natural ingredients provides a lucrative avenue for Carmine’s expansion, reflecting broader market trends towards sustainability and natural composition in consumer products.

Key Market Segments

By Form

- Powder

- Liquid

- Crystal

- Granules

By End-User

- Food Processing

- Beverage

- Catering

- Cosmetics & Pharmaceutical

Drivers

Rising Demand and Clean Label Preferences Drive Market Growth

The Carmine Market is seeing growth driven by several key factors. Rising demand for natural food colorants is a major driver as consumers increasingly seek clean, safe, and natural ingredients in their food.

This trend aligns with the broader shift toward clean label products, where consumers are looking for simple, recognizable ingredients on product labels. These preferences create a strong demand for carmine as a trusted natural colorant.

Additionally, the expanding use of carmine in cosmetics and pharmaceuticals is supporting market growth. Carmine’s vibrant color and stability make it a preferred choice in the cosmetic industry, especially in lipsticks and blushes. The pharmaceutical sector also uses carmine for coloring medicines and supplements, enhancing its market penetration.

Increasing awareness of health and wellness further boosts the market. As consumers grow more conscious of their dietary and cosmetic choices, they lean towards products containing natural ingredients.

Restraints

Ethical and Cost Concerns Restrain Market Growth

Despite its growth potential, several factors are restraining the Carmine Market. One major restraint is the high production cost of carmine, which is derived from cochineal insects. This labor-intensive process raises the overall cost, limiting its appeal to price-sensitive manufacturers.

Ethical concerns also present a challenge. Carmine is derived from insects, which poses issues for consumers and companies committed to vegan or cruelty-free standards. This limits its adoption, particularly in sectors where ethical sourcing is critical.

In a blog post, Cliff Burrows, Starbucks president, stated that the company would use lycopene (a tomato-based ingredient) and stop using Carmine in strawberry products. Campari, an Italian liqueur that is used in popular Negroni, was made with carmine dye.

The availability of synthetic alternatives further restrains market growth. Synthetic colorants offer a cheaper, more easily scalable option, drawing away some potential carmine users. Lastly, the regulatory framework surrounding natural colorants is stringent, particularly in regions with strict food safety and labeling laws.

Opportunity

Emerging Markets and Innovation Provide Opportunities

The Carmine Market presents several growth opportunities for industry players. Expansion into emerging markets, where demand for processed foods and cosmetics is rapidly increasing, offers significant potential. As consumer awareness of natural ingredients grows in these regions, carmine is expected to see rising demand.

The development of plant-based alternatives to carmine offers another promising avenue for growth. As companies seek to align with vegan trends, innovations in plant-derived red pigments could provide an ethical alternative, meeting market demand while addressing concerns about animal-derived ingredients.

Increasing investment in research and development (R&D) for more sustainable extraction processes is another opportunity. Companies are focusing on reducing the environmental impact of carmine production, enhancing its appeal to eco-conscious consumers.

Lastly, strategic collaborations and partnerships between manufacturers, food producers, and cosmetic companies can unlock new market opportunities, expanding carmine’s applications across industries.

Challenges

Volatile Supply and Misinformation Challenge Market Growth

The Carmine Market faces several challenges that threaten its growth. One significant challenge is the volatile supply of raw materials. Carmine is derived from cochineal insects, and fluctuations in insect populations can lead to supply shortages or price increases, complicating production for manufacturers.

Competition from synthetic colorants and other natural alternatives also presents a challenge. With the availability of cheaper, synthetic colorants, as well as newer natural options like beet juice and annatto, carmine faces stiff competition in the market.

Consumer misinformation regarding carmine’s animal origin can also pose a barrier, especially as veganism gains popularity.

Supply chain management adds another layer of complexity. The multi-step process of sourcing and extracting carmine requires careful coordination, and any disruption can affect product availability. Addressing these challenges requires proactive strategies in supply chain management, clear consumer communication, and competitive positioning.

Growth Factors

Innovation and Consumer Preferences Are Growth Factors

Several growth factors are propelling the Carmine Market forward. Rising consumer demand for natural ingredients is a primary driver, particularly as health-conscious individuals prefer food and cosmetic products with minimal artificial additives.

The expansion of the processed foods and beverages industry further supports market growth. As more consumers turn to packaged and processed foods, the need for natural food colorants like carmine increases, strengthening the market.

The cosmetics industry’s increasing focus on organic and natural products is another growth factor. Consumers are shifting toward beauty products with clean labels, driving up demand for carmine as a trusted natural pigment. Lastly, innovation in extraction technologies is enhancing production efficiency, helping to meet the rising demand while ensuring sustainability.

Emerging Trends

Sustainability and Vegan Trends Are Latest Trending Factors

Several trending factors are currently shaping the Carmine Market. The rise in vegan and plant-based trends is a significant influence, with consumers seeking products free from animal-derived ingredients. This shift is driving the demand for vegan alternatives and pushing companies to innovate with plant-based colorants.

Increased focus on sustainability in production is also a key trend. As consumers demand eco-friendly practices, companies are adopting greener methods for carmine extraction and processing. This aligns with the broader sustainability movement across industries.

The growing popularity of clean beauty products is further shaping the market. Consumers prefer cosmetics with natural, transparent ingredients, boosting the use of carmine in this sector. Enhanced label transparency and traceability have become a focal point as consumers want to know the origin of the ingredients in their products.

Regional Analysis

Europe Dominates with 35.0% Market Share

Europe leads the Carmine Market with a 35.0% share, valued at USD 17.78 billion. This dominance is driven by the high demand for natural food colorants, especially in the food and beverage industry. The region’s focus on clean-label products and strict regulations on synthetic additives have increased the preference for carmine.

Europe’s strong regulatory framework encourages the use of natural and sustainable ingredients. The region also benefits from consumer awareness around health and wellness, driving demand for carmine in various applications like confectionery, dairy, and cosmetics. The presence of major players in the food processing industry further strengthens Europe’s position in the market.

Looking ahead, Europe’s leadership in the Carmine Market is expected to grow as the trend toward natural products intensifies. Innovation in sustainable extraction methods and the increasing popularity of plant-based diets could further boost demand in the region.

Regional Mentions:

- North America: North America holds a significant share in the Carmine Market due to growing consumer demand for natural ingredients in food and cosmetics. The region’s focus on health-conscious products and clean-label trends supports carmine usage.

- Asia Pacific: Asia Pacific is witnessing rapid growth in the Carmine Market, driven by rising consumer awareness and the growing food processing industry. Increased demand for natural colorants in developing economies like China and India is propelling the market.

- Middle East & Africa: The Middle East and Africa are emerging markets for carmine, with increasing adoption in the food and beverage sector. The focus on premium, natural products is driving demand in these regions, especially for confectionery and dairy applications.

- Latin America: Latin America shows steady growth in the Carmine Market due to its significant role in carmine production. The region benefits from the availability of raw materials and rising demand for natural colorants in the local food industry.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The carmine market consists of companies involved in the production of natural red colorants derived from cochineal insects. These colorants are widely used in food, beverages, cosmetics, and pharmaceuticals. The market is growing due to the rising demand for natural alternatives to synthetic dyes.

Key players offer a variety of carmine-based products, ranging from liquid to powdered forms. These products are primarily used as natural colorants in food and cosmetics. Some companies also offer custom formulations and solutions for specific industry needs.

Companies in the carmine market position themselves as providers of natural and clean-label ingredients. Many focus on the growing consumer demand for natural, non-GMO, and allergen-free products. Partnerships with food and beverage manufacturers help strengthen market presence.

Key players in the market have a global presence, with strong operations in regions such as North America, Europe, and Latin America, where cochineal insects are harvested. These companies serve a wide range of industries across the globe.

Innovation focuses on improving extraction processes, increasing yield, and developing more stable carmine formulations for broader applications. Companies are also working on sustainable sourcing and eco-friendly production methods.

The competitive edge of leading companies lies in their commitment to natural products, extensive industry partnerships, and continuous innovation in product quality and sustainability. Their global reach and ability to meet the growing demand for clean-label solutions further strengthen their market position.

Top Key Players in the Market

- Amerilure

- The Hershey Company

- DDW The Color House

- Sensient Colors LLC

- Proquimac

- Chr. Hansen Holding A/S

- Naturex

- colorMaker Inc.

- Biocon

- Roha

- Danone

- Other Key Players

Recent Developments

- In August 2022, Danone acquired a majority stake in Happy Family, an organic baby food producer, further extending its portfolio of clean-label products. This acquisition supports the growing market trend towards organic and natural food products, which often utilize carmine for color

- Fermentalg and DDW, part of Givaudan, have reached the final milestone for the Galdieria Blue Extract, an acid-stable natural blue color for food and beverages, initiating pre-commercialization as of June 2022.

Report Scope

Report Features Description Market Value (2023) USD 50.8 Billion Forecast Revenue (2033) USD 91.8 Billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Dairy & Frozen Products, Food & Beverage, Cosmetics, Other Applications), By End-User (Food Processing, Beverage, Catering, Cosmetics & Pharmaceutical) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amerilure, The Hershey Company, DDW The Color House, Sensient Colors LLC, Proquimac, Chr. Hansen Holding A/S, Naturex, colorMaker Inc., Biocon, Roha, Danone, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amerilure

- The Hershey Company

- DDW The Color House

- Sensient Colors LLC

- Proquimac

- Chr. Hansen Holding A/S

- Naturex

- colorMaker Inc.

- Biocon

- Roha

- Danone

- Other Key Players