Global Cosmetic Antioxidants Market By Type (Vitamins, Polyphenols, Enzymes, Carotenoids, Other), By Source (Synthetic, Natural), By Application (Skin Care, Hair Care, Injectables, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140118

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

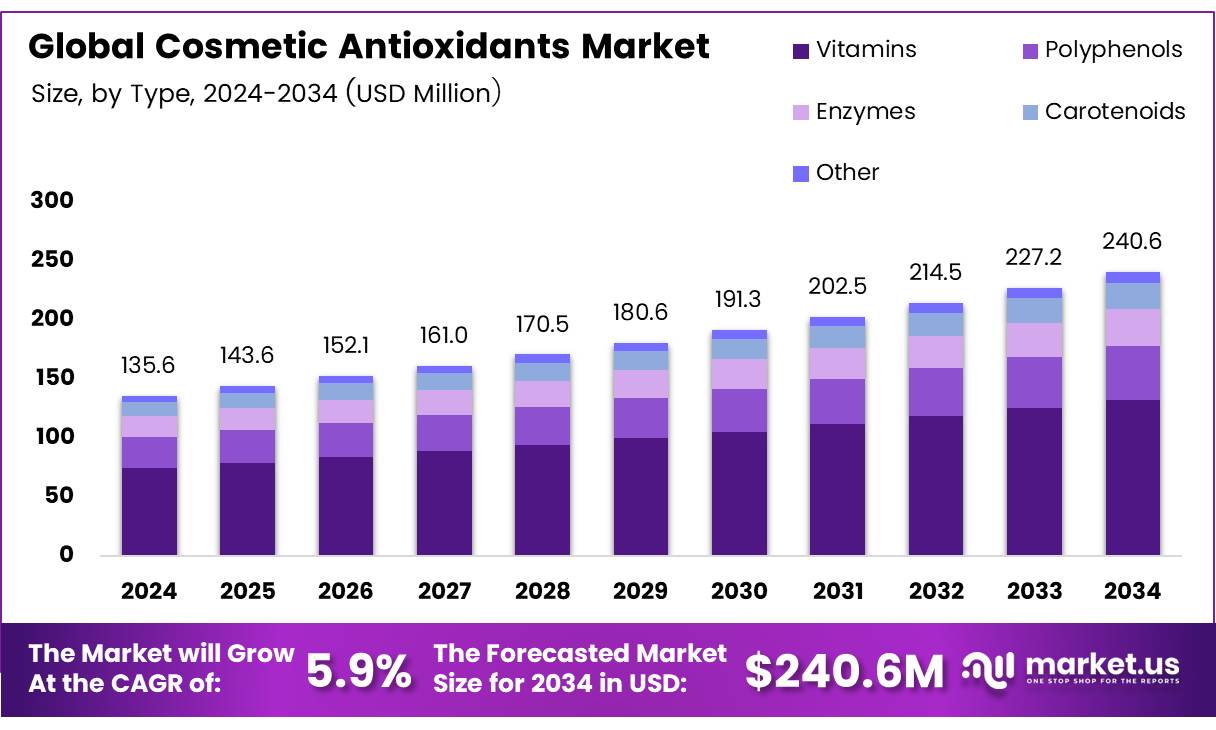

The Global Cosmetic Antioxidants Market size is expected to be worth around USD 240.6 Million by 2034, from USD 135.6 Million in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Cosmetic antioxidants are compounds used in skincare and cosmetic formulations to combat oxidative stress, which can lead to skin aging and damage. These antioxidants neutralize free radicals, which are unstable molecules generated by exposure to UV radiation, pollution, and environmental stressors.

They play a crucial role in enhancing the stability and efficacy of cosmetic products, thus increasing their demand in the beauty industry. Key antioxidants such as vitamin C, vitamin E, and various botanical extracts are commonly incorporated into skincare products to protect the skin from premature aging, reduce inflammation, and promote healthier skin.

In recent years, there has been a significant increase in consumer awareness about the importance of antioxidants in skincare. This has led to a rise in demand for antioxidant-enriched products such as serums, moisturizers, sunscreens, and anti-aging formulations.

According to a survey conducted in March 2024, 57.8% of the respondents in China preferred sunscreen cosmetics with moisturizing benefits, underlining the growing consumer inclination toward multifunctional products.

The global beauty market is also seeing a surge in younger consumer segments, with Millennials and Gen Z accounting for 60% of the market, as per Cropink data. This younger demographic is highly conscious about skincare, propelling the demand for antioxidant-based cosmetics.

The cosmetic antioxidants market has been experiencing robust growth, driven by several factors such as increasing consumer demand for anti-aging and skin protection solutions, along with rising awareness of skin health. As consumers become more aware of the long-term effects of environmental factors on their skin, they are gravitating toward products that offer protective benefits.

The market’s expansion is further supported by a shift in consumer preferences toward natural and organic ingredients, with antioxidants such as green tea extract, pomegranate, and coenzyme Q10 gaining popularity. Moreover, the surge in skincare-focused innovations, such as antioxidant-infused sunscreens and moisturizers, is pushing the market forward.

There are also significant opportunities for growth in emerging markets. The global market is witnessing a rise in skincare product demand, particularly in regions like Asia-Pacific, where skincare is deeply embedded in cultural routines. Government investment in cosmetic regulations and skin health initiatives will also play a pivotal role in market expansion.

For example, regulations ensuring the safety and efficacy of cosmetic products will bolster consumer trust and stimulate market growth. Additionally, the increase in the number of cosmetic companies, which rose by 76% compared to 2022 (according to GUS data), indicates a healthy competitive environment, fostering innovation and driving market dynamics.

Moreover, the rising incidence of skin diseases is another factor fueling the demand for antioxidant-infused products. According to WorldSkinDay, over 3,000 skin diseases affect more than 1.8 billion people globally at any given time, highlighting the growing global concern for skin health. With antioxidants playing a critical role in reducing skin damage and enhancing skin repair, their incorporation into skincare products is expected to continue to rise.

Key Takeaways

- The Global Cosmetic Antioxidants Market is expected to reach USD 240.6 million by 2034, growing at a CAGR of 5.9% from 2025 to 2034.

- Vitamins dominate the By Type Analysis segment, holding 54.6% market share in 2024 due to anti-aging and skin health benefits.

- The Synthetic segment leads the market with 61.2% share in 2024, driven by cost-effectiveness and stable performance.

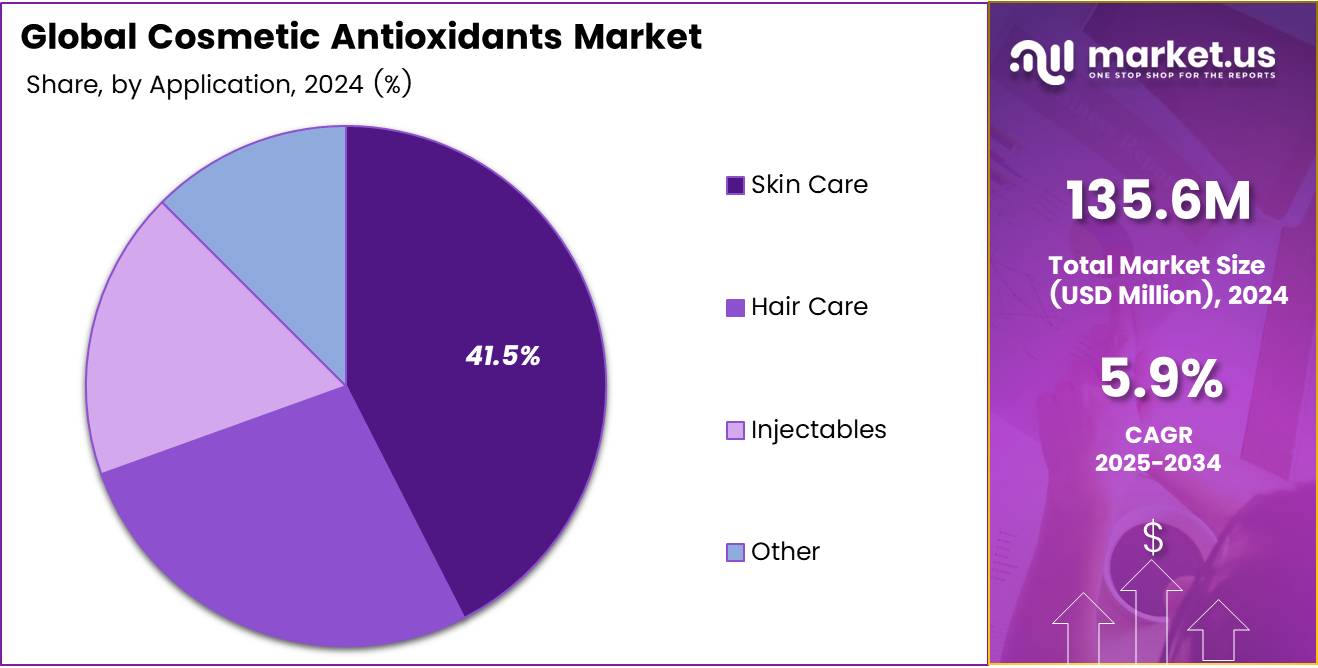

- Skin Care holds the largest share (41.5%) in the By Application Analysis segment in 2024, fueled by demand for anti-aging products.

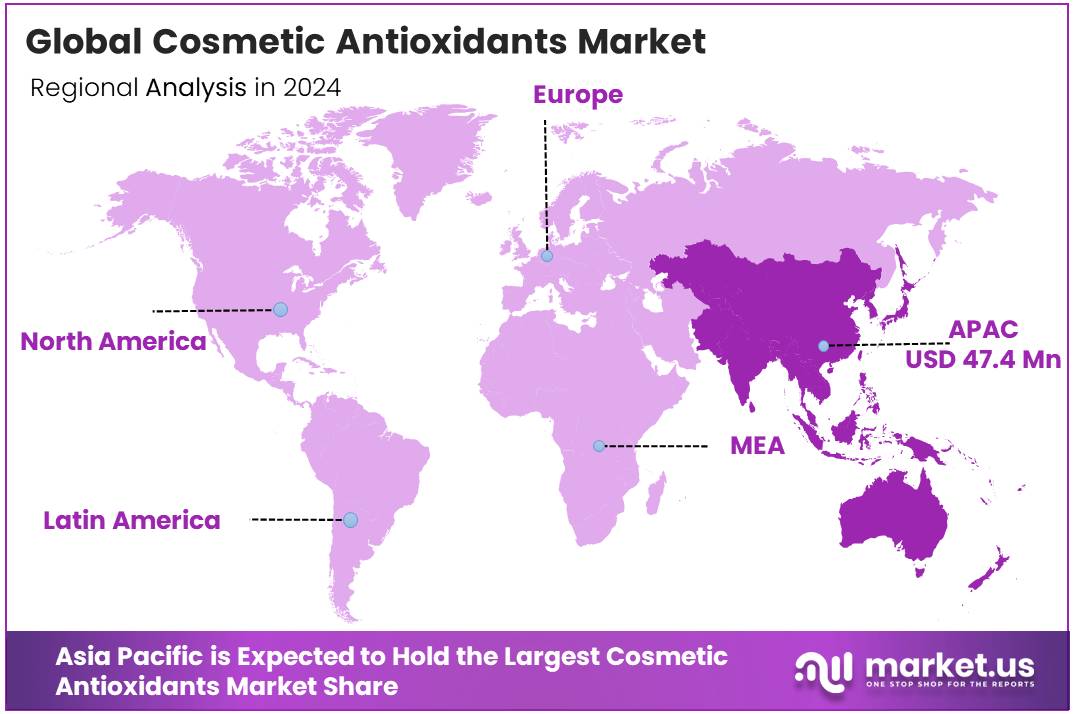

- The Asia Pacific region holds the largest market share at 35.2%, valued at USD 47.4 million in 2024.

Type Analysis

Vitamins Lead the Cosmetic Antioxidants Market with 54.6% Share in 2024, Driven by Skin Health Benefits

In 2024, Vitamins held a dominant market position in the By Type Analysis segment of the Cosmetic Antioxidants Market, capturing a substantial 54.6% share. This dominance can be attributed to the growing consumer awareness of the anti-aging and skin health benefits provided by vitamins such as Vitamin C, Vitamin E, and Vitamin A.

These vitamins are widely recognized for their ability to neutralize free radicals, enhance skin elasticity, and reduce the appearance of fine lines and wrinkles, making them essential ingredients in a variety of cosmetic formulations.

Polyphenols, coming in second, are gaining momentum, contributing significantly to the market’s growth. Their antioxidant properties, derived from plant-based sources like tea, grapes, and berries, have made them popular in formulations targeting skin protection and rejuvenation. Enzymes, although a smaller segment, are valued for their gentle exfoliating properties, which support skin renewal.

Carotenoids, such as beta-carotene, continue to find favor in products aimed at providing sun protection and maintaining skin vitality. The Other category, encompassing additional antioxidant compounds, also plays a role but with comparatively lower market share. As consumer demand for clean, natural ingredients grows, the overall use of antioxidants in cosmetics is expected to expand further.

Source Analysis

Synthetic dominates the Cosmetic Antioxidants Market with a 61.2% share due to its cost-effectiveness and stability

In 2024, the Synthetic segment held a dominant market share of 61.2% in the Cosmetic Antioxidants Market, driven by its cost-effectiveness and stable performance.

Synthetic antioxidants are widely preferred by manufacturers due to their consistent quality, longer shelf life, and ease of formulation. These antioxidants offer superior protection against oxidative stress, making them ideal for skincare and beauty products designed to prevent aging and deterioration from environmental factors.

On the other hand, the Natural segment is gaining traction due to rising consumer demand for clean beauty products and a shift towards natural ingredients. Although natural antioxidants provide benefits like superior skin nourishment and lower irritation, they typically come at a higher cost, which limits their widespread adoption. Nonetheless, with increasing awareness about sustainability and eco-consciousness, the Natural segment is expected to experience significant growth in the coming years, capturing a larger share of the market.

Overall, while the Synthetic segment continues to dominate, the Natural segment’s steady growth reflects an evolving preference toward organic and sustainable alternatives in the cosmetic industry.

Application Analysis

Skin Care Leads Cosmetic Antioxidants Market with 41.5% Share in 2024, Driven by Growing Consumer Demand for Anti-Aging Solutions

In 2024, the Skin Care segment held a dominant market position in the By Application Analysis segment of the Cosmetic Antioxidants Market, commanding a 41.5% share. This growth can be attributed to an increasing consumer preference for anti-aging products and a heightened awareness of skin protection against environmental damage.

As antioxidants play a critical role in neutralizing free radicals, which contribute to premature skin aging, their inclusion in skincare products such as serums, moisturizers, and sunscreens is growing. Consumers are increasingly turning to antioxidants like vitamin C, E, and green tea extract, fueling market demand.

Following closely are Hair Care products, which represent a significant portion of the market, thanks to consumers’ rising focus on maintaining healthy, nourished hair. Injectables, such as anti-aging botox and dermal fillers, continue to gain momentum, leveraging antioxidant properties for skin rejuvenation.

The Other category encompasses a variety of specialized products, from eye creams to body lotions, contributing to the overall diversification of the cosmetic antioxidants market. As the beauty and personal care industry continues to innovate, the inclusion of antioxidants in all application categories is expected to drive further market growth.

Key Market Segments

By Type

- Vitamins

- Polyphenols

- Enzymes

- Carotenoids

- Other

By Source

- Synthetic

- Natural

By Application

- Skin Care

- Hair Care

- Injectables

- Other

Drivers

Rising Consumer Awareness Fuels Demand for Cosmetic Antioxidants

The cosmetic antioxidants market is experiencing robust growth, driven by several key factors. One of the main drivers is the rising consumer awareness surrounding personal grooming, appearance, and self-care.

As people become more conscious about the health and appearance of their skin, they are increasingly seeking products that offer protective benefits, such as antioxidants, which are known for their ability to fight skin aging and damage from environmental stressors.

Alongside this, the growth in disposable income is making premium cosmetic products more accessible to a wider audience, allowing consumers to invest in higher-quality items that include antioxidant-rich formulations.

Another important factor is the shift towards organic and natural beauty products. As consumers demand cleaner, cruelty-free, and sustainable options, brands are responding by developing products with antioxidants sourced from natural ingredients like vitamins, green tea, and berries.

Additionally, the aging population is significantly contributing to the demand for anti-aging solutions, as older consumers seek out products that help reduce the visible signs of aging, such as wrinkles and fine lines.

This creates substantial growth opportunities for cosmetic antioxidants, as they are seen as key ingredients in combating skin aging and improving overall skin health. All these factors combined make the antioxidant-infused cosmetic market a highly attractive space for both new and established brands.

Restraints

Environmental Concerns Limit Growth of Cosmetic Antioxidants Market

While the cosmetic antioxidants market is expanding, there are some significant challenges that could hinder its growth. One major restraint is the increasing concern among consumers about the environmental impact of packaging waste and ingredient sourcing. Many consumers are now prioritizing eco-friendly, sustainable products, and brands that fail to meet these expectations may struggle to attract a loyal customer base.

This is especially true for brands that rely on non-sustainable practices or packaging materials that contribute to environmental harm. Another challenge facing the market is the rising cost of raw materials, particularly natural oils, minerals, and plant-based ingredients commonly used in antioxidant formulations.

As these key ingredients become more expensive due to factors like climate change, supply chain disruptions, and increased demand, the overall cost of production rises. This, in turn, leads to higher prices for consumers, which could limit the affordability and accessibility of antioxidant-based cosmetic products.

For brands operating in this space, balancing quality with cost-effective production while addressing environmental concerns will be crucial to maintaining growth and meeting evolving consumer expectations. Therefore, these factors pose real risks to the expansion of the market if not managed carefully.

Growth Factors

Men’s Grooming Sector Opens New Growth Avenues for Cosmetic Antioxidants

The cosmetic antioxidants market has several exciting growth opportunities on the horizon. One promising area is the expanding men’s grooming and skincare segment. With more men becoming conscious of their skin health and grooming routines, there is a growing demand for antioxidant-rich skincare products targeted specifically at men. This opens up untapped potential for brands to develop new products that cater to this demographic.

Additionally, there is a significant rise in the popularity of vegan, cruelty-free, and eco-friendly beauty products. Consumers are increasingly seeking products that align with their ethical values, and brands that offer antioxidants in formulations that are vegan and sustainably sourced stand to capture a larger share of this market. Subscription models are also providing opportunities for growth.

Beauty box subscriptions and personalized product delivery services are gaining traction as consumers look for convenience and the chance to discover new, high-quality products. This trend creates a direct path to market growth by offering products in a more personalized and convenient manner.

Finally, expanding into emerging markets, particularly in regions like Asia-Pacific, Latin America, and Africa, presents a huge opportunity. These regions are experiencing rapid urbanization, rising incomes, and a growing interest in personal care, all of which provide fertile ground for antioxidant-based cosmetics. As these markets continue to develop, they represent a massive growth opportunity for brands looking to tap into new consumer bases.

Emerging Trends

Clean Beauty Movement Shapes Cosmetic Antioxidants Market Trends

One of the key trends in the cosmetic antioxidants market is the rise of the clean beauty movement. More consumers are now seeking products that are free from harmful chemicals, preservatives, and artificial fragrances, which has prompted brands to innovate with cleaner, safer ingredients.

This shift is particularly relevant for antioxidant-based products, as consumers look for natural and effective solutions that nourish the skin without exposing it to harmful substances. Additionally, sustainable packaging has become an essential priority for both consumers and brands.

Eco-friendly and recyclable packaging is in high demand as people become more conscious of environmental impact. Brands that offer products in sustainable packaging are gaining favor, especially as consumers align their beauty choices with their environmental values. Another growing trend is the increasing focus on holistic and wellness beauty.

Consumers are no longer just looking for skincare products but are also prioritizing products that promote overall well-being, often incorporating elements of aromatherapy, mindfulness, and holistic health. Antioxidant-rich products are well-positioned to meet this trend, as they are often seen as part of a broader wellness routine that nurtures both skin health and mental well-being.

These trends, combined with the growing desire for transparency and ethical products, are shaping the future of the cosmetic antioxidants market, pushing brands to adapt and offer solutions that align with consumer values in health, sustainability, and overall well-being.

Regional Analysis

Asia Pacific Leads Cosmetic Antioxidants Market with 35.2% Share and USD 47.4 Million

The global cosmetic antioxidants market is experiencing significant growth across various regions, driven by increasing consumer awareness of skin health, aging concerns, and the rising demand for natural and organic products. In Asia Pacific, the market holds the largest share, accounting for 35.2% of the global market, valued at USD 47.4 million.

This dominance is fueled by the rapidly expanding beauty and personal care industry, particularly in countries like China, Japan, and South Korea, where consumer preference is shifting towards antioxidants due to their proven benefits in combating environmental stressors and aging. The growth in Asia Pacific is further supported by the rise in disposable income and the growing awareness of skin protection against pollution and UV damage.

Regional Mentions:

In North America, the market is poised for steady growth, with the U.S. being a key contributor due to the increasing demand for anti-aging products and natural skincare. The North American market is expected to continue expanding, driven by the rising trend of clean beauty products and the growing popularity of antioxidants like Vitamin C and E, which are widely used in formulations.

Europe also exhibits strong growth, with countries such as Germany, the UK, and France leading the charge. The European market benefits from a well-established cosmetics industry, coupled with rising demand for sustainable, green formulations, and the adoption of antioxidants in skincare solutions.

The Middle East and Africa region presents a promising opportunity, with growing demand for high-end cosmetics and anti-aging products, though it still represents a smaller portion of the overall market. Latin America is seeing increasing interest, particularly in Brazil and Mexico, as the region adopts global beauty trends, including those focused on antioxidant-rich skincare.

While Asia Pacific remains the dominating region, the global cosmetic antioxidants market is witnessing robust growth across all regions as consumers become more conscious of skin health and the role antioxidants play in protecting against environmental damage and aging.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, key players in the global cosmetic antioxidants market, including Ashland Global Holdings, BASF SE, Evonik Industries AG, and Koninklijke DSM N.V., continue to dominate due to their innovative product portfolios and strategic market positioning. These companies are leveraging their strong R&D capabilities to introduce advanced antioxidant solutions that cater to the rising consumer demand for anti-aging, skin protection, and sustainable beauty products.

Ashland Global Holdings remains a frontrunner, offering a wide range of functional antioxidant ingredients, especially in the natural and clean beauty space. The company’s emphasis on bio-based antioxidants aligns well with the growing trend towards sustainability and eco-conscious consumerism.

BASF SE and Evonik Industries, both renowned for their extensive chemical expertise, provide potent antioxidant solutions to protect skin from oxidative stress caused by environmental factors like pollution and UV rays. Their focus on research-driven innovation and global distribution networks enhances their competitive edge in this sector.

Koninklijke DSM N.V. stands out for its commitment to sustainability, offering plant-based antioxidants in alignment with the clean beauty movement. The company’s strategic collaborations with skincare brands further solidify its market presence. Other players like Croda International PLC and Kemin Industries are also noteworthy, as they focus on incorporating natural and plant-derived ingredients into their formulations, catering to the growing demand for cruelty-free and sustainable products.

The market is also seeing increasing consolidation and partnerships, particularly with smaller firms like BTSA Biotecnologias and Provital Group, which bring unique, regionally-focused products that appeal to niche markets. These players will continue to shape the global cosmetic antioxidants market by meeting the evolving consumer demands for effective, ethical, and innovative beauty solutions.

Top Key Players in the Market

- Ashland Global Holdings

- BTSA Biotecnologias Aplicadas S.L.

- Eastman Chemical Company

- Koninklijke DSM N.V.

- Evonik Industries AG

- BASF SE

- SEPPIC

- Wacker Chemie AG

- Barentz International BV

- Kemin Industries, Inc.

- Jan Dekker International

- Nexira

- Archer Daniels Midland Company

- Croda International PLC

- Provital Group

- Yasho Industries

Recent Developments

- In June 2024, skincare startup CHOSEN raised $1.2 million in seed funding to accelerate its product development and expand its reach in the competitive skincare market. The funding will support the brand’s mission to create personalized skincare solutions for diverse consumer needs.

- In June 2024, RENÉE Cosmetics secured ₹100 crore in Series B funding, aiming to enhance its product portfolio and expand its presence across Indian and international markets. The investment will enable RENÉE to further innovate in the beauty and skincare sectors with a focus on sustainable and cruelty-free products.

- In January 2025, Unilever Ventures led a $5 million funding round for India’s RAS Luxury Skincare, signaling strong investor confidence in the brand’s potential to scale in the premium skincare segment. The funding will help RAS expand its offerings and enhance its digital presence globally.

- In December 2024, Sugar Cosmetics raised US$4.5 million in a funding round to expand its market share and strengthen its position in the rapidly growing beauty and cosmetics industry. This new investment will allow Sugar Cosmetics to enhance product development and boost its marketing efforts.

Report Scope

Report Features Description Market Value (2024) USD 135.6 Million Forecast Revenue (2034) USD 240.6 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Vitamins, Polyphenols, Enzymes, Carotenoids, Other), By Source (Synthetic, Natural), By Application (Skin Care, Hair Care, Injectables, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ashland Global Holdings, BTSA Biotecnologias Aplicadas S.L., Eastman Chemical Company, Koninklijke DSM N.V., Evonik Industries AG, BASF SE, SEPPIC, Wacker Chemie AG, Barentz International BV, Kemin Industries, Inc., Jan Dekker International, Nexira, Archer Daniels Midland Company, Croda International PLC, Provital Group, Yasho Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cosmetic Antioxidants MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Cosmetic Antioxidants MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ashland Global Holdings

- BTSA Biotecnologias Aplicadas S.L.

- Eastman Chemical Company

- Koninklijke DSM N.V.

- Evonik Industries AG

- BASF SE

- SEPPIC

- Wacker Chemie AG

- Barentz International BV

- Kemin Industries, Inc.

- Jan Dekker International

- Nexira

- Archer Daniels Midland Company

- Croda International PLC

- Provital Group

- Yasho Industries