Global Computational Biology Market By Service (Software Platform, Infrastructure & Hardware, and Databases), By Application (Drug Discovery & Disease Modelling (Target Validation, Target Identification, Lead optimization, and Lead Discovery), Preclinical Drug Development (Pharmacokinetics and Pharmacodynamics), Clinical Trial (Phase IV, Phase III, Phase II, and Phase I), Computational Genomics, Computational Proteomics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138194

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

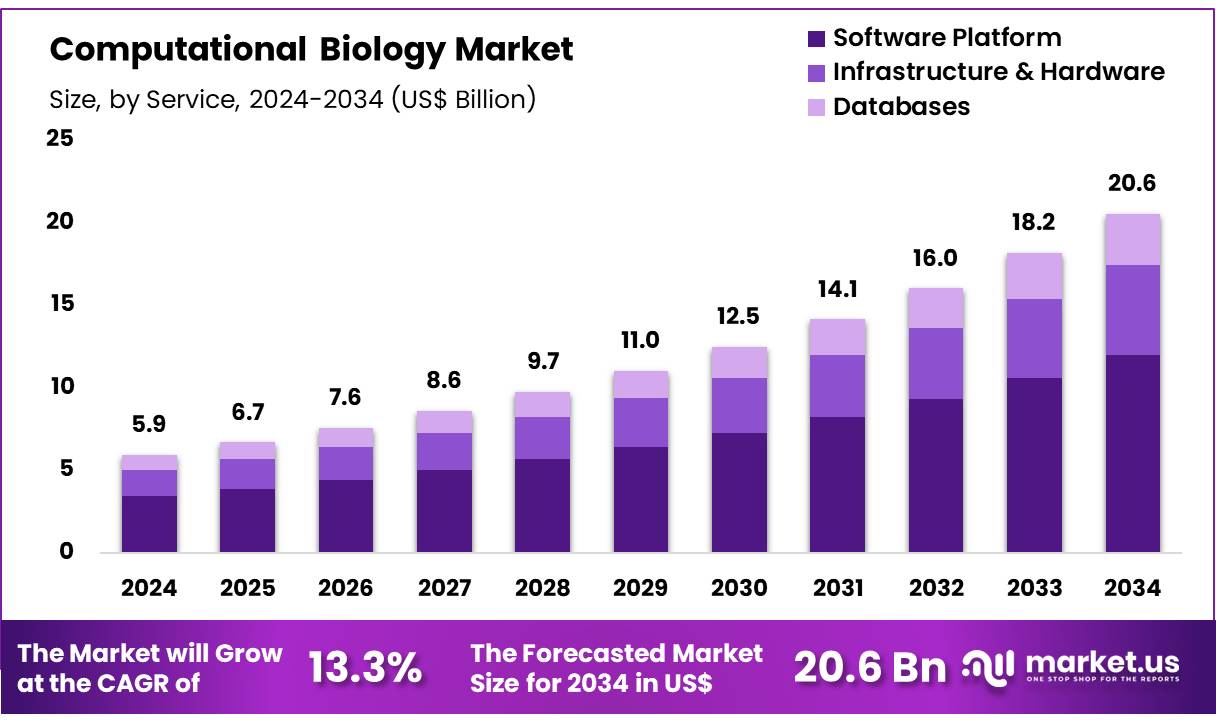

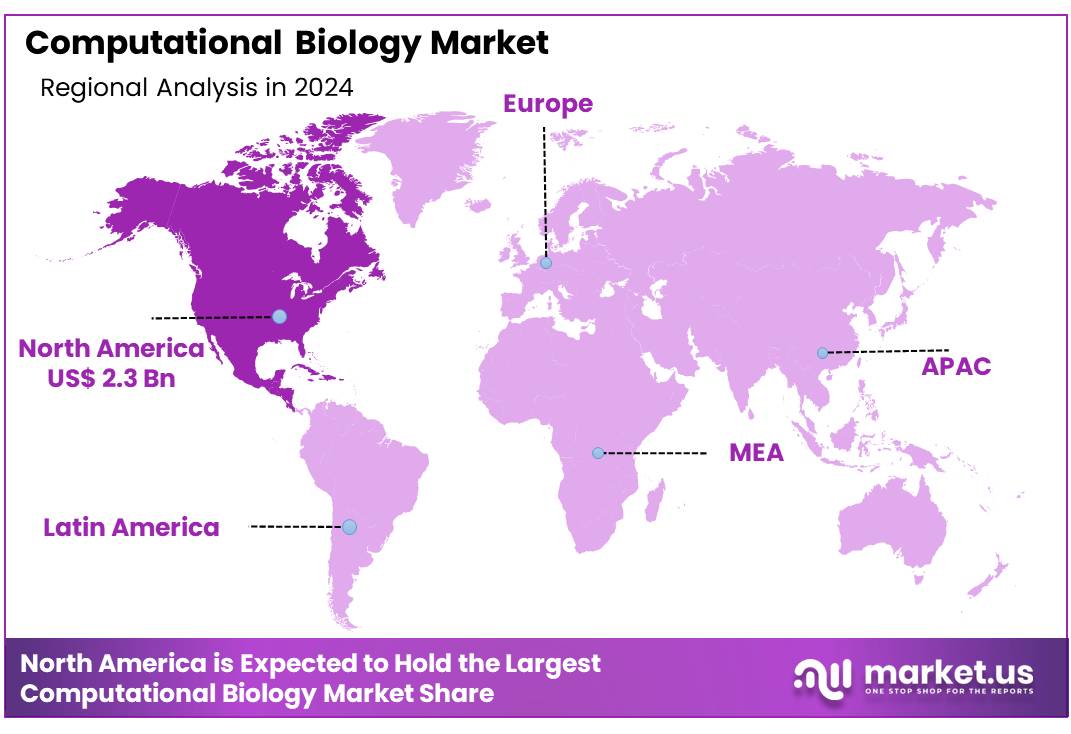

Global Computational Biology Market size is expected to be worth around US$ 20.6 billion by 2034 from US$ 5.9 billion in 2024, growing at a CAGR of 13.3% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 38.9% share with a revenue of US$ 2.3 Billion.

Increasing demand for data-driven insights in life sciences research is driving the growth of the computational biology market. Computational biology applies advanced computational techniques to understand biological systems, enabling applications in drug discovery, genomics, disease modeling, and personalized medicine. As the complexity of biological data expands, there is a growing need for innovative technologies to process, analyze, and interpret large-scale biological information.

The integration of artificial intelligence (AI) and machine learning into computational biology is one of the key drivers, as these technologies help optimize processes such as drug discovery, biomarker identification, and gene editing. A news article published in January 2023 reported that the average cost of drug discovery and development is approximately US$ 1.3 billion, underscoring a substantial opportunity for AI-based technologies to optimize and accelerate this process.

The rising trend of personalized medicine further enhances the demand for computational biology tools, as they enable the development of tailored treatments based on an individual’s genetic profile. Additionally, advancements in cloud computing and big data analytics provide new opportunities to manage and analyze the vast amounts of biological data generated from research. The increasing use of computational models in understanding complex diseases such as cancer, neurological disorders, and autoimmune diseases also presents substantial growth potential in the market.

Key Takeaways

- In 2024, the market for Computational Biology generated a revenue of US$ 5.9 billion, with a CAGR of 13.3%, and is expected to reach US$ 20.6 billion by the year 2033.

- The service segment is divided into software platform, infrastructure & hardware, and databases, with software platform taking the lead in 2023 with a market share of 58.2%.

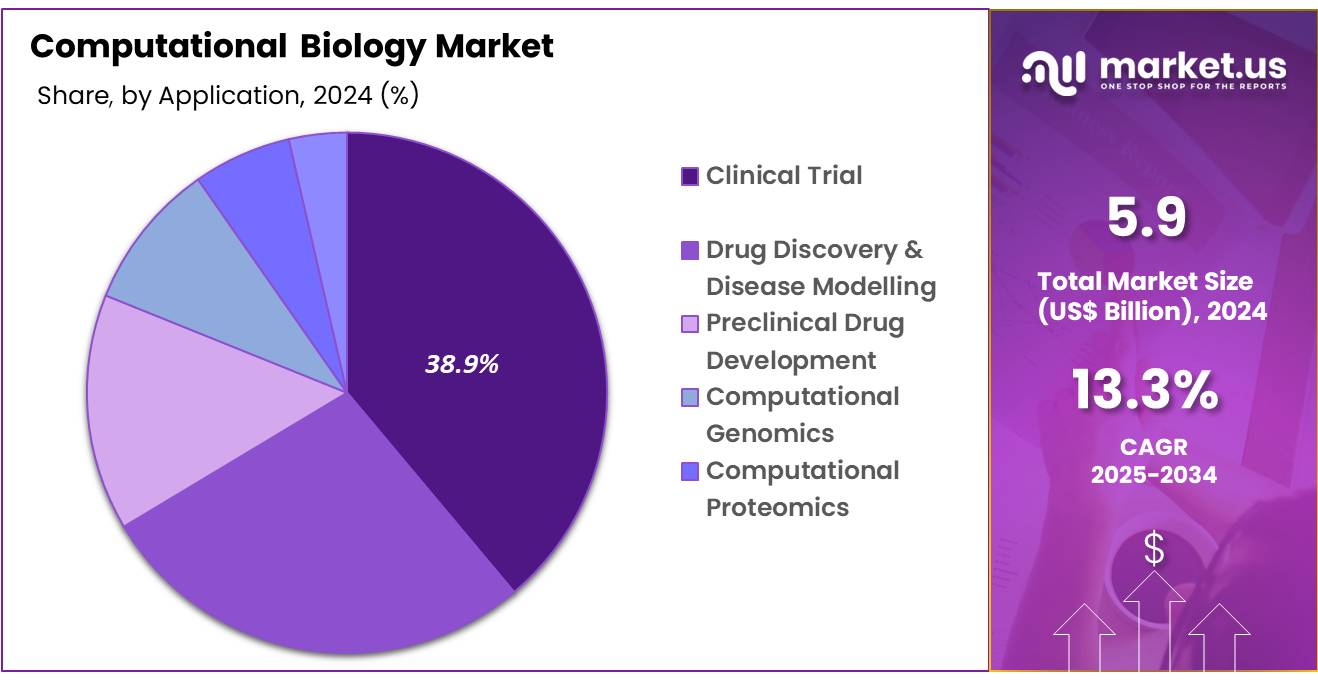

- Considering application, the market is divided into drug discovery & disease modelling, preclinical drug development, clinical trial, computational genomics, computational proteomics, and others. Among these, clinical trial held a significant share of 38.9%.

- North America led the market by securing a market share of 38. 9% in 2023.

Service Analysis

The software platform segment led in 2023, claiming a market share of 58.2% owing to the increasing demand for advanced tools that can process, analyze, and visualize large biological data sets. As the field of computational biology grows more complex, software platforms are likely to become essential for researchers and healthcare professionals looking to model biological systems, simulate experiments, and predict molecular behaviors.

The rapid advancements in artificial intelligence (AI) and machine learning are anticipated to drive further development of sophisticated software solutions. These platforms will likely play a critical role in genomics, drug discovery, and personalized medicine by improving accuracy and efficiency in data processing.

Additionally, the need for scalable and user-friendly software that can integrate data from diverse sources, such as omics data and clinical trials, is expected to fuel demand in the coming years. As more research organizations and pharmaceutical companies adopt computational biology solutions, the software platform segment is projected to grow steadily.

Application Analysis

The clinical trial held a significant share of 38.9% due to as pharmaceutical companies increasingly rely on computational models to enhance the efficiency and accuracy of drug development. The use of computational biology in clinical trials is expected to revolutionize the way drug candidates are tested by offering more precise predictions about their efficacy and safety. This approach will likely reduce the time and cost of clinical trials, especially in early-stage testing.

The growing complexity of diseases and the need for more personalized treatments are anticipated to drive the adoption of computational models to predict patient responses, optimize dosing, and identify biomarkers. The rise in chronic diseases and the increasing demand for biologics and precision medicine are likely to fuel this segment’s growth. Additionally, advancements in data integration from clinical and genomic studies are expected to improve clinical trial designs, further supporting the expansion of this application within computational biology.

Key Market Segments

By Service

- Software Platform

- Infrastructure & Hardware

- Databases

By Application

- Drug Discovery & Disease Modelling

- Target Validation

- Target Identification

- Lead optimization

- Lead Discovery

- Preclinical Drug Development

- Pharmacokinetics

- Pharmacodynamics

- Clinical Trial

- Phase IV

- Phase III

- Phase II

- Phase I

- Computational Genomics

- Computational Proteomics

- Others

Drivers

Increasing popularity of mRNA immunotherapies is driving the computational biology market

Growing popularity of mRNA immunotherapies significantly drives the computational biology market by enhancing the ability to design and optimize targeted treatments. In May 2022, CureVac, a Germany-based company, partnered with Belgium’s myNEO to focus on identifying and developing mRNA immunotherapies targeting specific cancer antigens. myNEO utilized its extensive biological databases and bioinformatics tools, integrated with machine learning algorithms, to pinpoint and validate precise target areas that elicit strong immune responses.

This collaboration highlights the essential role of computational models in understanding complex biological interactions and accelerating the development of effective therapies. As mRNA immunotherapies gain traction in treating various cancers, the demand for advanced computational solutions grows to support data analysis, simulation, and predictive modeling.

Furthermore, the integration of machine learning with bioinformatics facilitates the discovery of novel therapeutic targets and the personalization of treatment protocols, driving further investment in computational technologies. The rise in clinical trials and research initiatives focused on mRNA-based treatments also boosts the need for robust data management and analytical platforms. Consequently, companies specializing in computational biology are expected to expand their offerings and innovate new tools to meet the evolving needs of the biotech industry.

The increasing reliance on computational approaches for drug discovery and development ensures sustained growth and dynamic advancements within the computational biology market. This trend not only fosters scientific breakthroughs but also enhances the efficiency and accuracy of therapeutic innovations, positioning the computational biology sector as a critical enabler in the fight against cancer.

Restraints

Growing concerns over data privacy are restraining the computational biology market

A significant restraint in the computational biology market is the growing concerns over data privacy, which create barriers to consumer trust and market adoption. As computational biology relies heavily on the analysis of vast amounts of sensitive genetic and clinical data, ensuring the security and confidentiality of this information becomes paramount. High-profile data breaches and misuse of genetic information have heightened awareness and anxiety among individuals and organizations about the potential risks involved.

Regulatory frameworks like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose strict guidelines on data handling, increasing compliance costs and operational complexities for companies in the market. Additionally, the ethical implications of data sharing and ownership further complicate the landscape, as stakeholders demand greater transparency and control over their genetic information.

Smaller firms and startups may find it particularly challenging to navigate these stringent regulations, limiting their ability to innovate and compete. The fear of legal repercussions and loss of reputation due to data breaches can deter investments and slow down the adoption of computational biology solutions.

Moreover, the technical challenges associated with implementing robust data security measures require significant resources and expertise, which can strain budgets and divert focus from core business activities. Consequently, these growing data privacy concerns act as a substantial barrier to the widespread acceptance and growth of the computational biology market, hindering its potential to fully capitalize on emerging opportunities.

Opportunities

Growing use of AI is creating opportunities for the computational biology market

Growing use of artificial intelligence (AI) creates substantial opportunities for the computational biology market by revolutionizing the way biological data is analyzed and interpreted. A research paper published by Nature in February 2022 revealed that integrating AI into drug discovery and development has increased the drug pipeline by nearly 40% annually, showcasing the transformative impact of AI on the pharmaceutical industry.

AI-powered algorithms enhance the ability to process and analyze large-scale genomic data, identifying patterns and correlations that traditional methods may overlook. This capability accelerates the discovery of new drug targets and the optimization of therapeutic compounds, driving the demand for sophisticated computational tools.

Additionally, machine learning models facilitate predictive analytics, enabling researchers to forecast the efficacy and safety of potential treatments with greater accuracy. The automation of repetitive tasks through AI also increases operational efficiency, allowing scientists to focus on more complex and innovative aspects of research. Furthermore, the integration of AI with bioinformatics and systems biology enables the development of comprehensive models that simulate biological processes, providing deeper insights into disease mechanisms and treatment responses.

The rise of personalized medicine, which relies heavily on precise data analysis and interpretation, further amplifies the need for AI-driven computational solutions. As the pharmaceutical and biotech sectors continue to embrace AI technologies, the computational biology market is expected to experience significant growth, driven by the continuous innovation and enhanced capabilities that AI brings to biological research and drug development. This synergy between AI and computational biology not only accelerates scientific discovery but also improves the overall efficiency and effectiveness of healthcare innovations.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the computational biology market. On the positive side, the increasing investment in healthcare, biotechnology, and pharmaceutical research drives the demand for computational methods to analyze complex biological data. The growing focus on precision medicine, personalized therapies, and drug discovery further boosts the market.

However, economic slowdowns may limit research funding and slow the adoption of advanced computational technologies. Geopolitical tensions and trade restrictions may disrupt access to critical computing infrastructure, data, or research partnerships, affecting innovation. Additionally, regulatory differences between countries may complicate the development and deployment of computational solutions. Despite these challenges, the ongoing advancements in AI, machine learning, and data analytics, coupled with an expanding biotechnology sector, are expected to propel long-term growth in computational biology.

Latest Trends

Surge in Collaborations and Partnerships Driving the Computational Biology Market:

Rising collaborations and partnerships are driving growth in the computational biology market. High levels of cooperation between technology companies, research institutions, and pharmaceutical firms are expected to foster innovation and accelerate the development of cutting-edge computational tools. These alliances enhance the integration of AI, big data, and computational modeling into drug discovery, genomics, and systems biology.

In April 2023, IBM and Moderna announced a collaboration to leverage generative AI and quantum computing in advancing mRNA technology. This partnership aims to accelerate the discovery and development of vaccines through innovative computational methods. As more industry leaders recognize the potential of computational biology, the increasing number of strategic partnerships is anticipated to significantly contribute to the market’s expansion.

Regional Analysis

North America is leading the Computational Biology Market

North America dominated the market with the highest revenue share of 38.9% owing to the increasing demand for advanced data analysis in genomics, drug discovery, and personalized medicine. The growing complexity of biological data has led to the increasing need for computational models that can efficiently analyze vast amounts of genetic and molecular information. This demand has been further fueled by the rapid advancements in biotechnology and the rise of precision medicine, where computational biology plays a key role in developing personalized treatment plans.

A notable development in this space occurred in February 2021 when Rescale, a California-based startup specializing in scientific and engineering simulations, raised US$ 50 million to support its platform and hardware infrastructure. The company’s focus on enhancing computational capabilities has contributed to the broader growth of the computational biology sector by providing the tools necessary for more efficient data analysis.

Additionally, the rise in artificial intelligence (AI) and machine learning technologies has provided new opportunities for innovation, driving the integration of computational biology in drug discovery and clinical research. As biotechnology companies continue to harness these technologies, the computational biology market in North America is expected to continue its upward trajectory.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing investments in biotechnology and healthcare research. Countries like China, India, and Japan are anticipated to see rapid advancements in computational tools for biological data analysis, driven by the increasing focus on genomics, drug development, and personalized therapies.

In April 2022, Algorithmic Biologics, an AI-driven startup based in India, announced plans to develop a molecular computing algorithm to analyze biological data, including DNA, RNA, and proteins. This innovation highlights the growing interest in computational biology within the region, where the demand for advanced data analytics in life sciences is expected to rise.

Additionally, as the region’s pharmaceutical and biotechnology industries expand, the need for computational biology solutions to accelerate drug discovery and improve treatment efficacy will likely grow. The growing number of AI-driven biotech companies and research initiatives, alongside government support for innovation, is estimated to fuel market growth in Asia Pacific in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the computational biology market focus on developing advanced algorithms and software platforms to accelerate research in genomics, drug discovery, and systems biology. Companies expand their offerings by integrating AI and machine learning to enhance predictive modeling and simulation capabilities.

Collaborations with pharmaceutical companies and academic institutions drive innovation and broaden application areas. Geographic expansion into regions with increasing biotechnology investments helps reach new customers. Many players also prioritize cloud-based solutions, enabling efficient data sharing and scalability for large-scale research projects.

Illumina, Inc. is a leading company in this market, providing powerful tools for genomic data analysis and interpretation. The company combines state-of-the-art sequencing technology with advanced bioinformatics software to support researchers and healthcare professionals. Illumina’s global presence and focus on innovation solidify its position as a key contributor to advancements in computational biology.

Top Key Players

- Xaira Therapeutics

- QIAGEN

- Illumina, Inc.

- Genedata AG

- Fios Genomics

- Evaxion Biotech

- Compugen

- Aganitha AI Inc.

- Accenture

Recent Developments

- In January 2023, Evaxion Biotech’s personalized cancer vaccine, developed in combination with Keytruda, received Fast Track Designation (FTD) from the FDA for treating individuals with metastatic melanoma (MM).

- In February 2023, Accenture announced an investment in Ocean Genomics, a US-based technology and AI company specializing in advanced computational platforms. This investment aims to support biotechnology companies in the discovery and development of personalized medicines.

Report Scope

Report Features Description Market Value (2024) US$ 5.9 billion Forecast Revenue (2034) US$ 20.6 billion CAGR (2025-2034) 13.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Software Platform, Infrastructure & Hardware, and Databases), By Application (Drug Discovery & Disease Modelling (Target Validation, Target Identification, Lead optimization, and Lead Discovery), Preclinical Drug Development (Pharmacokinetics and Pharmacodynamics), Clinical Trial (Phase IV, Phase III, Phase II, and Phase I), Computational Genomics, Computational Proteomics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Xaira Therapeutics, QIAGEN, Illumina, Inc., Genedata AG, Fios Genomics, Evaxion Biotech, Compugen, Aganitha AI Inc., and Accenture. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Computational Biology MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Computational Biology MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Xaira Therapeutics

- QIAGEN

- Illumina, Inc.

- Genedata AG

- Fios Genomics

- Evaxion Biotech

- Compugen

- Aganitha AI Inc.

- Accenture