Global Controlled-Release Fertilizers Market By Product Type (Slow Release, Coated & Encapsulated, N-Stabilizers, and Other Product Types) By Form (Liquid, Granule, and Powder), By Crop Type (Cereal & Grains, Fruits & Vegetables, Oilseeds & Pulses, Forage & Turf, and Other Crop Types) By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 106019

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

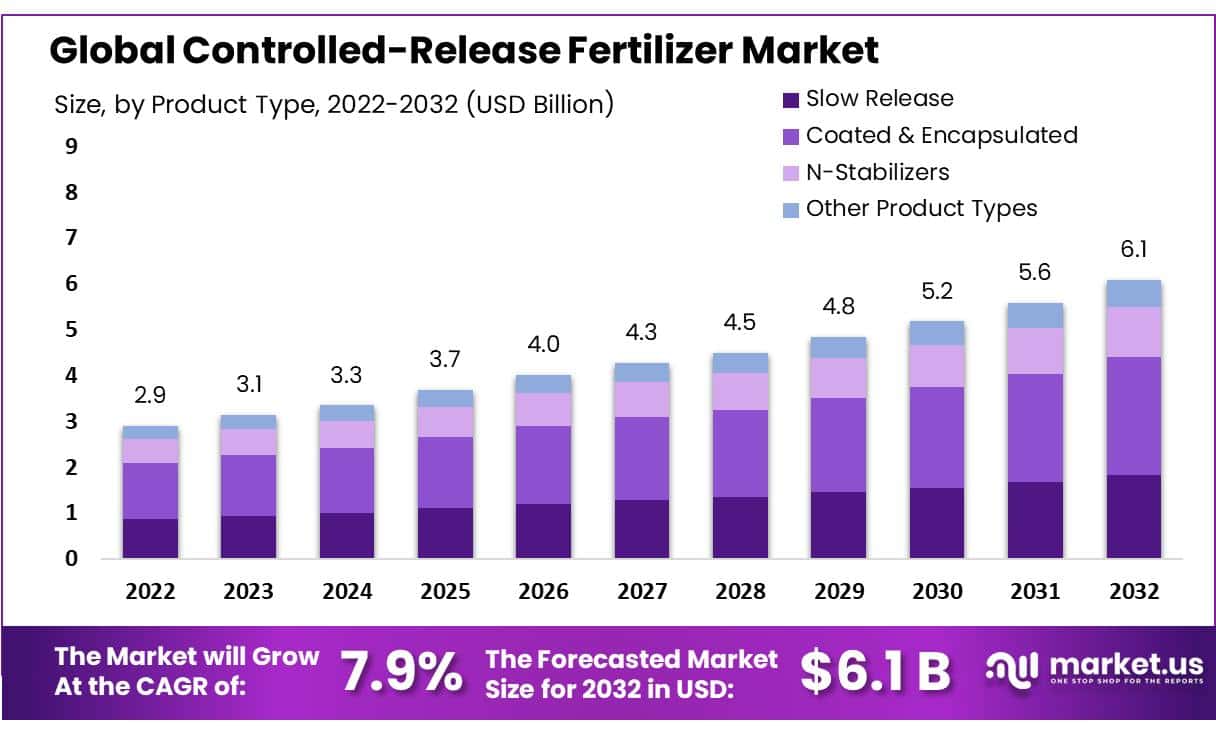

In 2022, the Global Controlled-Release Fertilizers Market was valued at USD 2.9 Billion, It is expected to reach USD 6.1 billion by 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 7.9%.

Controlled-release fertilizers (CRFs) are specialized fertilizers that gradually release nutrients over time, ensuring a more efficient and sustained supply to plants. Unlike traditional fertilizers, CRFs provide a controlled and predictable nutrient release, reducing application frequency and environmental impacts.

They are encapsulated or coated with materials that control the rate of nutrient release, influenced by factors like temperature, moisture, and soil microbial activity. This technology improves nutrient use efficiency and crop yield while mitigating nutrient runoff into water bodies. Controlled-release fertilizers are gaining popularity due to their ability to enhance nutrient utilization efficiency and minimize environmental impact.

The International Fertilizer Association estimates they can increase nutrient use efficiency by 30% compared to conventional fertilizers and reduce nutrient losses by 20-30%, safeguarding soil fertility and mitigating the negative effects of nutrient pollution on ecosystems.

Actual Numbers Might Vary in the Final Report

Key Takeaways

Market Size: The global controlled-release fertilizers market is anticipated to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2032.

Market Trend: Controlled-release fertilizers have gained notable traction, especially in response to the increasing demand for efficient and sustainable agricultural practices.

Product Type Analysis: Among these, the coated & encapsulated segment shines as the top earner in the Controlled-Release Fertilizers market, commanding a substantial 42.2% market share in 2022.

Form Analysis: Among these, the granule segment led the market with a 58.6% share in 2022 and is projected to grow at 8.1% CAGR during the forecast period.

Crop Type Analysis: Among these, the fruits & vegetables segment emerged as the most profitable in the Controlled-release fertilizer market, boasting a significant market share of 46.2% in 2022.

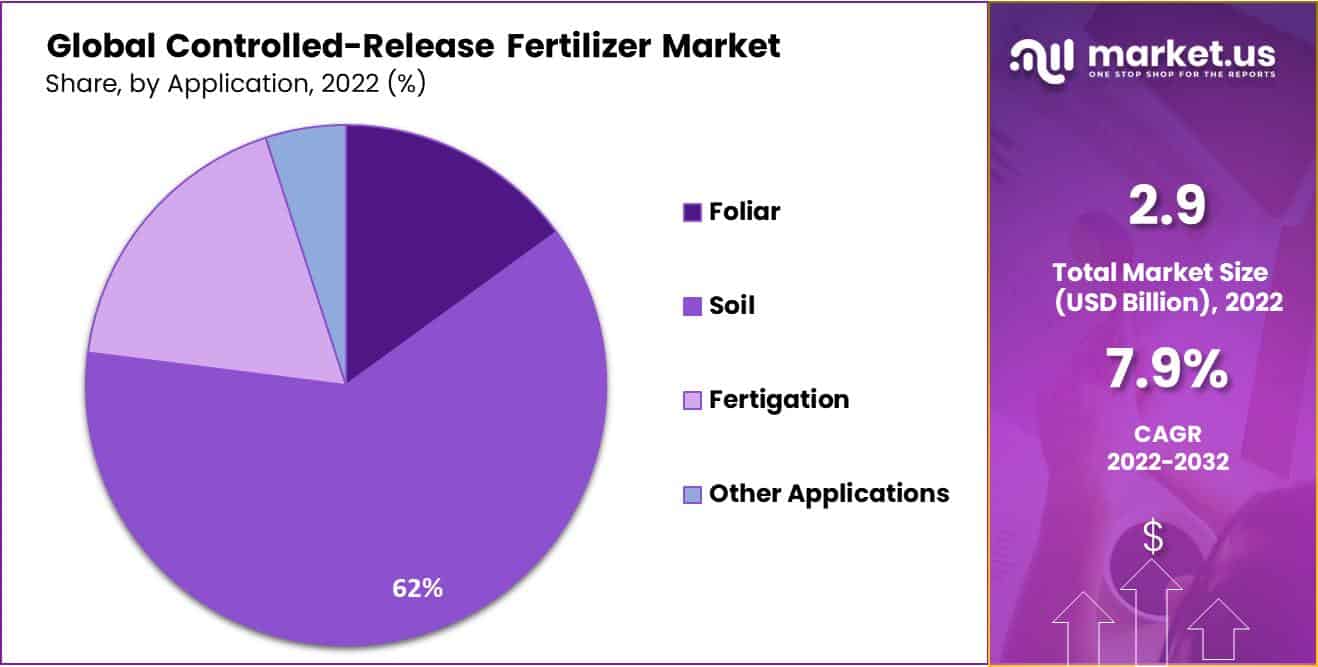

Application Analysis: Among these, the soil application secured a notable market share in 2022, dominating with a commanding 62% share.

Drivers: Growing global population and increasing need for enhanced agricultural productivity, coupled with rising awareness about balanced nutrient management.

Restraints: Initial higher costs of controlled-release fertilizers compared to conventional ones, and the need for precise application.

Opportunities: Expansion of precision farming techniques, focus on sustainable agriculture, and research for innovative formulations.

Challenges: Striking the right balance between cost and efficiency, regulatory compliance, and educating farmers about the benefits of controlled-release fertilizers.

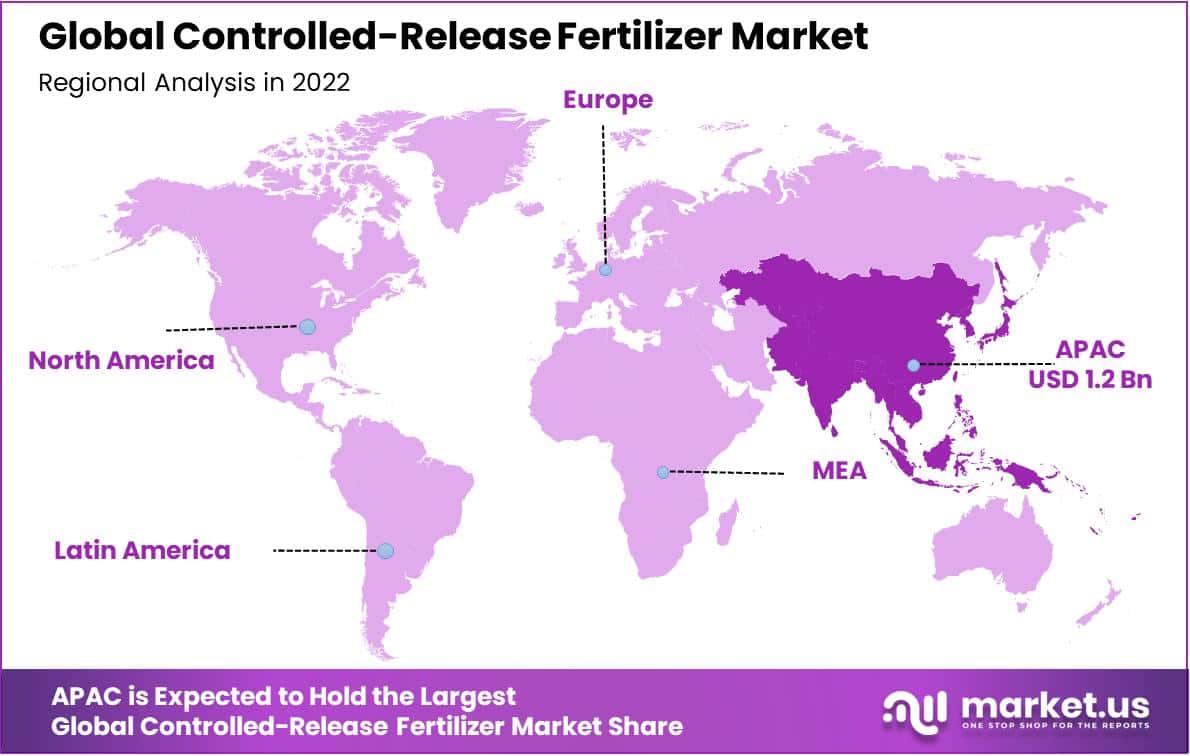

Regional Analysis: In 2022, APAC stood out as the dominant region in the market, capturing a substantial 40% market share of the total revenue.

Key Players Analysis: Major players in the controlled-release fertilizers market include Yara International ASA, The Scotts Miracle-Gro Company, ICL Specialty Fertilizers, Nutrien Ltd., Kingenta Ecological Engineering Group Co., Ltd, Haifa Group, R. Simplot Company, Koch Industries, Sociedad Química y Minera, Aglucone Fertilizers GmbH & Co. KG, Other Key Players.

Driving Factors

Mitigating Environmental Impact and Rising Demand for Food Drive the Global Controlled-Release Fertilizers Market

Environmental sustainability is a priority for governments, organizations, and consumers. Conventional fertilizers cause nutrient runoff, leading to water pollution and ecosystem imbalances. Controlled-release fertilizers (CRF) address this by gradually releasing nutrients, reducing over-fertilization and environmental impact.

The Food and Agriculture Organization (FAO) reports that nutrient runoff from agriculture contributes to 70% of global water pollution, prompting more agricultural stakeholders to adopt CRF solutions. Furthermore, the controlled-released fertilizer market is driven by the increasing demand for food. As the global population expands, there is increasing pressure to enhance agricultural productivity to ensure food security.

According to the International Fertilizer Association (IFA), farmers must produce 50% more food by 2050 to meet this demand. Controlled-release Fertilizers offer the advantage of sustained nutrient supply to crops, ensuring steady growth and optimal yield, thus mitigating food security concerns.

- According to the Food and Agriculture Organization (FAO), the global demand for food is projected to rise by 70% by 2050, placing immense pressure on agricultural systems.

Restraining Factors

Higher Costs and Lack of Awareness Are Hindering The Growth of the Global Controlled-Release Fertilizers Market

Controlled-release fertilizers require advanced technologies and manufacturing processes, leading to higher production costs than traditional fertilizers. This cost differential often discourages and can be a deterrent for small-scale farmers with limited financial resources.

Despite the advantages of controlled-release fertilizers, several farmers are still unfamiliar with their benefits and proper usage. A lack of awareness and education on the advantages of these fertilizers and their appropriate application methods hampers their adoption and utilization.

Market Scope

By Product Type Analysis

Based on product type, the market for Controlled-Release Fertilizers is segmented into slow-release, coated & encapsulated, n-stabilizers, and other product types. Among these, the coated & encapsulated segment is the most lucrative in the Controlled-Release Fertilizers market. In 2022, the coated & encapsulated segment accounted for a market share of 42.2%.

The dominance of coated & encapsulated fertilizers is attributed to their distinct advantages in modern agricultural practices. These fertilizers release nutrients gradually, matching crop growth stages and minimizing wastage. They shield nutrients from environmental factors, ensuring availability when needed.

This leads to improved nutrient uptake, enhanced yield potential, and reduced environmental impacts. These innovative fertilizers also contribute to labor efficiency, making them increasingly preferred in modern farming systems.

By Form Analysis

By application, the market for controlled-release fertilizers is further divided into liquid, granule, and powder. Among these, the granule segment dominated the market with a market share of 58.6% in 2022, and it is projected to grow at a CAGR of 8.1% during the forecasted period. This is due to farmers commonly prefer using granular forms of fertilizers.

The granular form ensures a consistent distribution of nutrients across the field, promoting even plant development and minimizing the need for frequent applications. This approach also reduces labor and operational costs associated with frequent fertilization. Moreover, granular controlled-release fertilizers contribute to environmental sustainability by minimizing the potential for nutrient pollution in water bodies.

By Crop Type Analysis

By crop type, the market is further divided into cereal & grains, fruits & vegetables, oilseeds & pulses, forage & turf, and other crop types. Among these, with a market share of 46.2% in 2022, the fruits & vegetables segment is most lucrative in the Controlled-released fertilizer market. Controlled-release fertilizers are preferred for fruits and vegetables due to their unique nutrient requirements throughout their growth stages.

These fertilizers provide gradual and steady nutrient release, catering to the crops’ needs. This approach fosters robust development and enhances yield quality. Controlled-release fertilizers also enhance nutrient efficiency and reduce environmental impact by minimizing nutrient runoff and leaching. Farmers choose these fertilizers for optimal growth and environmental mitigation.

By Application Analysis

The market for controlled-released fertilizer is further segmented by application into foliar, soil, fertigation, and other applications. Among these, the soil application held a significant market share in 2022. With a 62% market share, the soil segment dominated the market.

When CRF is incorporated into the soil, it provides a consistent nutrient supply to the root zone, promoting balanced growth and reducing the risk of over-fertilization or nutrient runoff. This method allows for efficient nutrient utilization by plants while minimizing wastage. Additionally, CRF applied to the soil can be strategically placed near the root zone, enhancing plant nutrient uptake.

Key Market Segments

Based on Product Type

- Slow Release

- Coated & Encapsulated

- N-Stabilizers

- Other Product Types

Based on Form

- Liquid

- Granule

- Powder

Based on Crop Type

- Cereal & Grains

- Fruits & Vegetables

- Oilseeds & Pulses

- Forage & Turf

- Other Crop Types

Based on Application

- Foliar

- Soil

- Fertigation

- Other Applications

Growth Opportunities

Global Population Growth, Precision Agriculture, and Sustainable Farming are the Growth Opportunities in The Controlled-Release Fertilizers Market

The world’s population is continually increasing, leading to greater demand for food production. Controlled-release fertilizers ensure optimal crop yields without overloading the soil with nutrients. As a result, the growing global population presents a substantial opportunity for the Controlled-release fertilizer market to expand.

Many governments worldwide are implementing regulations and incentives to promote sustainable agriculture. These policies often encourage the adoption of Controlled-release fertilizers due to their positive environmental impact. This support creates a conducive environment for market growth.

Ongoing research and development efforts have led to innovations in Controlled-release fertilizer formulations. New technologies enable precise nutrient release, matching plant requirements throughout the growing season. These advancements improve crop yields and reduce wastage, making Controlled-release fertilizers more attractive to farmers.

Latest Trends

Sustainable Agriculture and Customization are the Key Trends in Recent Years in Controlled-release Fertilizer Market

One of the most prominent trends in the Controlled-release fertilizer market is the increasing emphasis on sustainable agriculture practices. As concerns about environmental sustainability and resource efficiency continue to rise, farmers and agricultural producers are turning to Controlled-release fertilizers.

These fertilizers offer several benefits, such as reduced nutrient runoff and minimized environmental impact. They also help to improve crop yield and quality over time, making them a preferred choice for modern agriculture.

Another key trend in the Controlled-release fertilizer market is the increasing demand for customized and blended fertilizer products. Farmers are seeking tailored solutions that meet the specific nutrient requirements of their crops and soil conditions. This has led to the development of blended Controlled-release fertilizers that combine various nutrient sources and release rates in a single product.

Customization is also achieved through precision application technologies that allow farmers to adjust the release rates according to their unique needs. This trend reflects the evolving nature of modern agriculture, which prioritizes efficiency and sustainability.

Regional Analysis

The Asia-Pacific Region Emerged as The Dominant Region in The Global Controlled-Release Fertilizers Market

In 2022, APAC was the most dominant region in the market, with a 40% market share of the total revenue. This results from the region’s vast and diverse agricultural landscape, encompassing countries such as China and India, which presents a significant market for controlled-release fertilizers.

The need for sustainable agriculture practices to meet the food demands of a growing population has led to an increased adoption of these fertilizers in this region. North America is the fastest-growing region in the Controlled-released fertilizer market, with a CAGR of 8.2% during the forecasted period.

This high growth rate is attributed to the region’s well-developed agricultural infrastructure and access to advanced agricultural technologies has facilitated the widespread implementation of these innovative fertilizers.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the global controlled-release fertilizer market include Yara International ASA, The Scotts Miracle-Gro Company, ICL Specialty Fertilizers, Nutrien Ltd., Kingenta Ecological Engineering Group Co., Ltd, Haifa Group, J.R. Simplot Company, Koch Industries, Sociedad Química y Minera, Aglucone Fertilizers GmbH & Co. KG, and several others.

These companies contribute significantly to the industry’s growth, offering various innovative and sustainable fertilizer solutions for agriculture.

Market Key Players

- Yara International ASA

- The Scotts Miracle-Gro Company

- ICL Specialty Fertilizers

- Nutrien Ltd.

- Kingenta Ecological Engineering Group Co., Ltd

- Haifa Group

- R. Simplot Company

- Koch Industries

- Sociedad Química y Minera

- Aglucone Fertilizers GmbH & Co. KG

- Other Key Players

Recent Developments

In September 2023, ICL launched groundbreaking Biodegradable CRF Technology, eqo. x, designed for open-field agriculture. Eqo. x release technology is the first offering to provide a controlled-release fertilizer (CRF) coating for urea.

Report Scope

Report Features Description Market Value (2022) USD 2.9 Bn Forecast Revenue (2032) USD 6.1 Bn CAGR (2023-2032) 7.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Slow Release, Coated & Encapsulated, N-Stabilizers, and Other Product Types) By Form (Liquid, Granule, and Powder), By Crop Type (Cereal & Grains, Fruits & Vegetables, Oilseeds & Pulses, Forage & Turf, and Other Crop Types) By Application (Foliar, Soil, Fertigation, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Yara International ASA, The Scotts Miracle-Gro Company, ICL Specialty Fertilizers, Nutrien Ltd., Kingenta Ecological Engineering Group Co., Ltd, Haifa Group, J.R. Simplot Company, Koch Industries, Sociedad Química y Minera, Aglucone Fertilizers GmbH & Co. KG, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Controlled-Release Fertilizers Market Size?Controlled-Release Fertilizers Market was valued at USD 2.9 Billion, It is expected to reach USD 6.1 billion by 2032 Between 2023 and 2032

What is the CAGR for the Controlled-Release Fertilizers Market?The Controlled-Release Fertilizers Market is registered to grow at a CAGR of 7.9% during 2023-2032.Which region is more attractive for vendors in the Controlled-Release Fertilizers Market?Asia-Pacific accounted for the largest market share of 40% among the other regions. Therefore, the Controlled-Release Fertilizers Market in Asia-Pacific is expected to garner significant business opportunities for the vendors during the forecast period. Controlled-Release Fertilizers MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample

Controlled-Release Fertilizers MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Yara International ASA

- The Scotts Miracle-Gro Company

- ICL Specialty Fertilizers

- Nutrien Ltd.

- Kingenta Ecological Engineering Group Co., Ltd

- Haifa Group

- R. Simplot Company

- Koch Industries

- Sociedad Química y Minera

- Aglucone Fertilizers GmbH & Co. KG

- Other Key Players